Automotive Sunroof Market Synopsis:

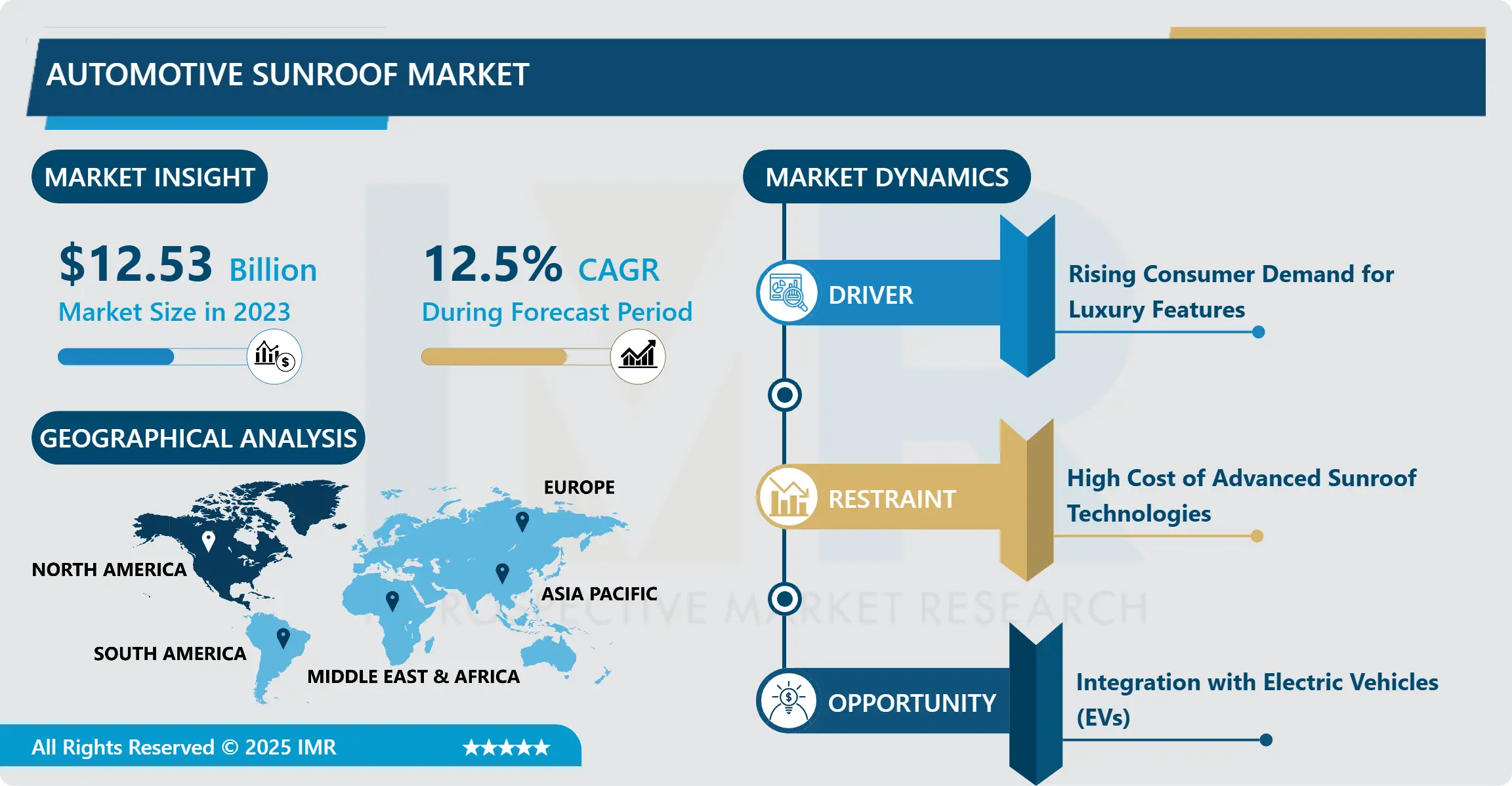

Automotive Sunroof Market Size Was Valued at USD 12.53 Billion in 2023, and is Projected to Reach USD 36.17 Billion by 2032, Growing at a CAGR of 12.5% From 2024-2032.

Automotive sunroof market can be defined as a segment of the automobile industry that is responsible for the production, development and distribution of sunroof – detachable or folding roof panel situated in the car roof which provides natural light and ventilation into the automobile passenger compartment. These are some of the major emotions that are associated with passenger vehicles sunroof as it is well know today as the bees knees that gives passenger vehicles a flavour of natural light anikan ventilations and good looks.

Automotive sunroof industry has shown a remarkable growth in the past few years primarily due to rising consumer concerns and preference for comfort and luxury mobility solutions. Currently, sunroofs are very popular and, depending on the vehicle’s class, become standard equipment for mid-and high-price segments of cars. It is further growing as more automobile manufacturers use enhanced sunroof features that in addition to providing ventilation and comfort, create style statements. Rising technological features of electric sunroof systems, sunroof having automatic controls and features of panoramic designs are tending to make this sunroof market more and more technical and customer friendly.

Whilst the automotive industry shifts to electric vehicles, smart features, sunroofs are emerging part of such trends. Besides the aesthetic and practical value, sunroofs are being incorporated to complement energy use of electric cars needed for their operation. As a result, some of the sunroofs are now designed to work hand in hand with the solar panels help in charging of batteries of the vehicle making sunroof an added advantage to vehicles. The ever rising need for stylistic and sophisticated car interiors and also the consideration of cars with lavish features are also driving the market forward.

Market is also increasing with the increase in disposable income especially in the emerging markets thereby growing the consumer preference for manufactured added options like the sunroof. In developed countries, manufacturers are now including sunroofs on many of the cars on the road while in developing countries, manufacturers are adding them on the mid-level cars. The ever-increasing trends in the usage of vehicles required to provide comfort, style, and convenience are the major trends that will continue to force the automotive sunroof market players to push for better and superior form and design of sunroofs.

Automotive Sunroof Market Trend Analysis:

Increasing Popularity of Panoramic Sunroofs

-

Panoramic sunroof trend is now changing the nature of automotive sunroof market. Sunroof is large, expansive glass panel, running from front to rear of the vehicles, that offers an open top feel to the car. This design targets those consumers who would like to have more light penetrating into the cabin and more space on the inside of a car. This has especially been influenced by the upsurge of the usage of SUVS and crossovers most of which come with installed sunroof systems.

- In addition, increased development of glass technologies is making the panoramic sunroof stronger, lighter and safer which has increased its demand. This capability of incorporating features like sunshades, UV filters, and even solar charging features to these extended size sunroof openings is improving them. Consumers remain focused on comfort, luxury and appearance of vehicles and panoramic sunroofs are increasingly important elements of car designs.

Integration with Electric Vehicles (EVs)

-

Therefore, the emerging trend of electric automobiles is considered as a major advantage to the automotive sunroof market. There are electric vehicles that are used to optimize energy and therefore can be benefited from solar powered sun roof that can charge the vehicle battery. Many car makers are already using solar panels as an integral part of the sunroof system of their electric cars to make sustainable as well as aesthetic change in the design of the car. This is right in line with the trend of getting newer car varieties to possess characteristics of green technologies and thus make EVs appealing to environmentally sensitive people.

- Globally, the usage of electric cars is increasing at a constant rate and along with the electric cars market, more attractions like solar sunroof will have a constant hike in demand. Integration of solar panel to sunroof is beneficial in cutting the carbon emissions in automobiles thus favoring the international effort towards conservation of the environment. Companies are looking at this chance through innovations in the sunroof systems that can facilitate solar power integration and this segment is going to extend as more people embrace the use of electric cars.

Automotive Sunroof Market Segment Analysis:

Automotive Sunroof Market is Segmented on the basis of Type, Material, Vehicle Type, Opening Mechanism, Sales Channel, and Region.

By Type, Pop-up Sunroof segment is expected to dominate the market during the forecast period

-

The automotive sunroof market has classification based on types such as pop-up sunroof, inbuilt sunroof, sunroof spoiler and large opening panoramic sunroof. Convertible soft tops are rudimentary constructs which can be opened/closed mechanically by tilting or sliding a panel up or down and offers minimal provisions for ventilation / sun exposure. They are widely used in the low-cost vehicles because of their basic structure and hence low costs of installation. Built-in sunroof, however, are the types that form part of the roof of the vehicle and, therefore, they are more aestonically pleasing than pop-up sunroof. These are commonly fitted in mid range cars and more often than not, are powered electrically for ease of use.

- Brand new fabric sunroof has also been fashionable in the market especially in branded and luxurious vehicles. They have a wider flared option and give the car a more pronounced interior feel. These are usually produced from tempered glass and incorporate factors such as the sun shade and ultraviolet inhibiting. Spoiler sunroof as seen in most sports cars as they give the car a sporty feel and at the same time allows light into the car interior. These various types of sunroof designs provide the consumers with designs, benefits, and prices of sunroof of their choice leading to growth of the automotive sunroof market.

By Opening Mechanism, Electric segment expected to held the largest share

-

The sunroof opening system is a profound aspect in the functionality and ergonomics of the car they are installed in. Convertible roof – this type of sunroof has to be operated mechanically by the user either with the help of a lever or a crank. These sunroofs are cheaper, and the models come in entry-level vehicles. Nevertheless, they offer natural flow of air and light and are adopted in relatively cheap vehicles. But there is a disadvantage with such systems in that their operation is manual, not as seamless as electric systems.

- These are sunroof systems operated mechanically through the use of motors whereby the sunroof can be opened or closed by a simple press of a button and are typical of mid to hi- end class cars. These sunroofs are most convenient and easier to operate than their traditional counterparts, making a drive more enjoyable. The electric mechanism also means better controls for positioning the sunroof with some having buttons that allow for one touch or automatic controls. Due to the rising customer expectation of convenience and need for luxury, electric sunroof is being preferred by consumers hence; its steadily rising market share.

Automotive Sunroof Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

At present, the automotive sunroof market is dominated by North America due to the numberOf key players in the automotivedemand for premium and luxury vehicles. Currently, there are many automobile giants in the region for instance General Motors, Ford and Tesla many of which are transferring higher sunroof patterns to their automobiles. Also, the new tendency of consumers’ towards new big cars especially SUV’s and cross over cars which most involves sunroof services is a driver to the market.

- Furthermore, the North American automotive manufacturing industry has moreover vigour and is more inclined toward innovation and designing. Consumers in this region have particularly favored comfort and luxury, with new sunroof technologies being warmly welcomed into the market. Therefore, it is considered that North America will continue to remain the major consumer of automotive sunroof in the future.

Active Key Players in the Automotive Sunroof Market:

- Aisin Seiki Co., Ltd. (Japan)

- BOS GmbH & Co. KG (Germany)

- CIE Automotive (Spain)

- Delphi Automotive LLP (UK)

- Donghee Industrial Co., Ltd. (South Korea)

- Hyundai Mobis (South Korea)

- Inalfa Roof Systems (Netherlands)

- Magna International Inc. (Canada)

- Pininfarina (Italy)

- Sumitomo Electric Industries, Ltd. (Japan)

- Webasto Group (Germany)

- Yachiyo Industry Co., Ltd. (Japan)

- Other Active Players

Key Industry Developments in the Automotive Sunroof Market:

-

In June 2024, Hyundai, headquartered in Seoul, announced the launch of the Inster EV, an electric version of Casper ICE vehicle. The EV boosts a single-pane sunroof.

- May 2023, Webasto Group opened a second automotive sunroof production facility in India. The company is investing in the rapidly growing India market and opening another plant for panoramic roof production in Chennai. The new plant offers an initial capacity of 250,000 units per annum and a production and storage area extending over approximately 9,500 square meters. The plant will be responsible for the roof’s production and shipping to customers in Southern India.

- May 2023, Gabrial India signed a contract with Inalfa Roof Systems to manufacture SUVs and sedans. The company planned to invest USD 20.72 million to set up a greenfield facility in Chennai and Tamil Nadu. The facility, which will become operational in the first quarter of 2024, can produce 200,000 sunroofs per annum in the first phase.

|

Automotive Sunroof Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.53 Billion |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 36.17 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Opening Mechanism |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Sunroof Market by Type

4.1 Automotive Sunroof Market Snapshot and Growth Engine

4.2 Automotive Sunroof Market Overview

4.3 Pop-up Sunroof

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Pop-up Sunroof: Geographic Segmentation Analysis

4.4 Inbuilt Sunroof

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Inbuilt Sunroof: Geographic Segmentation Analysis

4.5 Spoiler Sunroof

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Spoiler Sunroof: Geographic Segmentation Analysis

4.6 Panoramic Sunroof

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Panoramic Sunroof: Geographic Segmentation Analysis

Chapter 5: Automotive Sunroof Market by Material

5.1 Automotive Sunroof Market Snapshot and Growth Engine

5.2 Automotive Sunroof Market Overview

5.3 Glass

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Glass: Geographic Segmentation Analysis

5.4 Fabric

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fabric: Geographic Segmentation Analysis

Chapter 6: Automotive Sunroof Market by Opening Mechanism

6.1 Automotive Sunroof Market Snapshot and Growth Engine

6.2 Automotive Sunroof Market Overview

6.3 Manual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Manual: Geographic Segmentation Analysis

6.4 Electric

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Electric: Geographic Segmentation Analysis

Chapter 7: Automotive Sunroof Market by Vehicle Type

7.1 Automotive Sunroof Market Snapshot and Growth Engine

7.2 Automotive Sunroof Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Cars: Geographic Segmentation Analysis

7.4 Commercial Vehiclea

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial Vehiclea: Geographic Segmentation Analysis

Chapter 8: Automotive Sunroof Market by Sales Channel

8.1 Automotive Sunroof Market Snapshot and Growth Engine

8.2 Automotive Sunroof Market Overview

8.3 Original Equipment Manufacturer (OEM

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Original Equipment Manufacturer (OEM: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Sunroof Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 WEBASTO GROUP (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 INALFA ROOF SYSTEMS (NETHERLANDS)

9.4 CIE AUTOMOTIVE (SPAIN)

9.5 YACHIYO INDUSTRY CO. LTD. (JAPAN)

9.6 AISIN SEIKI CO. LTD. (JAPAN)

9.7 BOS GMBH & CO. KG (GERMANY)

9.8 MAGNA INTERNATIONAL INC. (CANADA)

9.9 DONGHEE INDUSTRIAL CO. LTD. (SOUTH KOREA)

9.10 DELPHI AUTOMOTIVE LLP (UK)

9.11 SUMITOMO ELECTRIC INDUSTRIES

9.12 LTD. (JAPAN)

9.13 HYUNDAI MOBIS (SOUTH KOREA)

9.14 PININFARINA (ITALY)

9.15 OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Sunroof Market By Region

10.1 Overview

10.2. North America Automotive Sunroof Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Type

10.2.4.1 Pop-up Sunroof

10.2.4.2 Inbuilt Sunroof

10.2.4.3 Spoiler Sunroof

10.2.4.4 Panoramic Sunroof

10.2.5 Historic and Forecasted Market Size By Material

10.2.5.1 Glass

10.2.5.2 Fabric

10.2.6 Historic and Forecasted Market Size By Opening Mechanism

10.2.6.1 Manual

10.2.6.2 Electric

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Cars

10.2.7.2 Commercial Vehiclea

10.2.8 Historic and Forecasted Market Size By Sales Channel

10.2.8.1 Original Equipment Manufacturer (OEM

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Sunroof Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Type

10.3.4.1 Pop-up Sunroof

10.3.4.2 Inbuilt Sunroof

10.3.4.3 Spoiler Sunroof

10.3.4.4 Panoramic Sunroof

10.3.5 Historic and Forecasted Market Size By Material

10.3.5.1 Glass

10.3.5.2 Fabric

10.3.6 Historic and Forecasted Market Size By Opening Mechanism

10.3.6.1 Manual

10.3.6.2 Electric

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Cars

10.3.7.2 Commercial Vehiclea

10.3.8 Historic and Forecasted Market Size By Sales Channel

10.3.8.1 Original Equipment Manufacturer (OEM

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Sunroof Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Type

10.4.4.1 Pop-up Sunroof

10.4.4.2 Inbuilt Sunroof

10.4.4.3 Spoiler Sunroof

10.4.4.4 Panoramic Sunroof

10.4.5 Historic and Forecasted Market Size By Material

10.4.5.1 Glass

10.4.5.2 Fabric

10.4.6 Historic and Forecasted Market Size By Opening Mechanism

10.4.6.1 Manual

10.4.6.2 Electric

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Cars

10.4.7.2 Commercial Vehiclea

10.4.8 Historic and Forecasted Market Size By Sales Channel

10.4.8.1 Original Equipment Manufacturer (OEM

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Sunroof Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Type

10.5.4.1 Pop-up Sunroof

10.5.4.2 Inbuilt Sunroof

10.5.4.3 Spoiler Sunroof

10.5.4.4 Panoramic Sunroof

10.5.5 Historic and Forecasted Market Size By Material

10.5.5.1 Glass

10.5.5.2 Fabric

10.5.6 Historic and Forecasted Market Size By Opening Mechanism

10.5.6.1 Manual

10.5.6.2 Electric

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Cars

10.5.7.2 Commercial Vehiclea

10.5.8 Historic and Forecasted Market Size By Sales Channel

10.5.8.1 Original Equipment Manufacturer (OEM

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Sunroof Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Type

10.6.4.1 Pop-up Sunroof

10.6.4.2 Inbuilt Sunroof

10.6.4.3 Spoiler Sunroof

10.6.4.4 Panoramic Sunroof

10.6.5 Historic and Forecasted Market Size By Material

10.6.5.1 Glass

10.6.5.2 Fabric

10.6.6 Historic and Forecasted Market Size By Opening Mechanism

10.6.6.1 Manual

10.6.6.2 Electric

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Cars

10.6.7.2 Commercial Vehiclea

10.6.8 Historic and Forecasted Market Size By Sales Channel

10.6.8.1 Original Equipment Manufacturer (OEM

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Sunroof Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Type

10.7.4.1 Pop-up Sunroof

10.7.4.2 Inbuilt Sunroof

10.7.4.3 Spoiler Sunroof

10.7.4.4 Panoramic Sunroof

10.7.5 Historic and Forecasted Market Size By Material

10.7.5.1 Glass

10.7.5.2 Fabric

10.7.6 Historic and Forecasted Market Size By Opening Mechanism

10.7.6.1 Manual

10.7.6.2 Electric

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Cars

10.7.7.2 Commercial Vehiclea

10.7.8 Historic and Forecasted Market Size By Sales Channel

10.7.8.1 Original Equipment Manufacturer (OEM

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Automotive Sunroof Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.53 Billion |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 36.17 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Opening Mechanism |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||