Automotive Smart Display Market Synopsis:

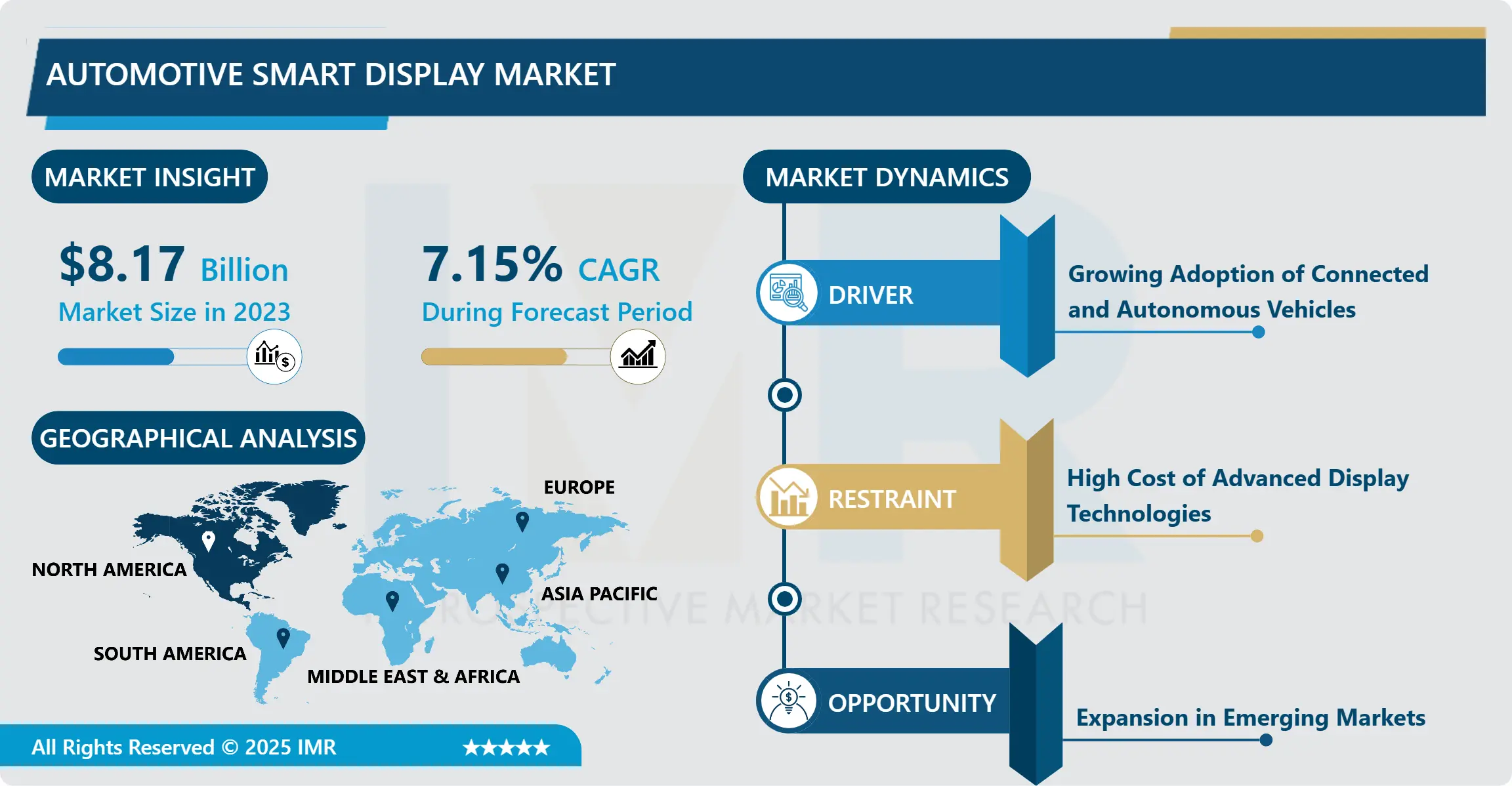

Automotive Smart Display Market Size Was Valued at USD 8.17 Billion in 2023, and is Projected to Reach USD 15.21 Billion by 2032, Growing at a CAGR of 7.15% From 2024-2032.

The Automotive Smart Display Market has been defined as encompassing smart display solutions that can be incorporated into automobiles to improve the interaction with car users as well as other onboard solutions including infotainment, navigation and safety provisions. These include LCD’s, TFT-LCD’s and other next generation technologies which serve infotainment, real time information and connectivity needs thereby defining the future of the in-car experience.

The Automotive Smart Display Market has become a revolutionary division of the auto industry due to growing trends of Customer Experience Management Integrated Interface and Navigation System. Smart displays are considered to be fully integrated, easy to operate, and deliver high-quality graphics and images to answer the current demands of various car users. Such facilities as touch screens, augmented reality displays, and voice recognition are slowly finding their way into automobiles.

This growth is occasioned by the growing industry of electric and autonomous vehicle industries, which rely on advanced display systems for functionality. Today’s automobile makers are utilizing smart displays for enhancing customer interactions, incorporating the safety features and enabling the V2X facilities. In addition, government safety standards considerating road safety as well as integrated advanced driver assistant systems (ADAS) have helped to adopt these displays in mid range and economy class of car models. This constant state of growth for automotive technology brings the display functional shifts assuring that there are always new chances to advanced manufacturing as well as supplying companies.

Automotive Smart Display Market Trend Analysis:

Integration of Augmented Reality (AR) in Smart Displays

-

Augmented Reality in smart automotive displays is revolutionizing how car owners and drivers experience their automobiles. AR units including the head-up displays (HUDs), also refers to as windshields displays since they project navigation routes, speed, and other alerting information on the windshield. These systems facilitate the provision of information which enables the driver glance through relevant information without having to immediately stop or cause an accident.

- This trend is supported by enhanced real time 3D mapping and Boolean operations together with enhanced sensor fusion. Large automotive makers are in partnership with tech firms to design Augmented Reality-based presentations supporting the increasing trend towards adoption of self-driving vehicles. The need for interactive and context-sensitive interfaces increases the importance of AR as a key element of future smart display systems.

Expansion in Emerging Markets

-

Another contingent for growth emerges from the increased adoption of the automotive smart display market in the progressing economies. With the increase of car owning society in countries like India, Brazil and Indonesia, the market of intelligent technologies in automotive such as smart displays is projected to grow. These regions are experiencing fast growth in industry, better standard living, and tendency towards connected vehicles.

- These markets are now being served directly by both local and overseas car makers with appropriate, affordable and smarter display technologies in their respective locales. Furthermore, the rise in safety legislation and the drive towards electric and self-driving cars within the regions should continue to drive smart display demand. Those firms that operate localized production facilities and distribution centres will probably seize these opportunities.

Automotive Smart Display Market Segment Analysis:

Automotive Smart Display Market is Segmented on the basis of Technology, Size, Vehicle Type, Level, Sales Channel, and Region.

By Technology, Liquid Crystal Display (LCD) segment is expected to dominate the market during the forecast period

-

By key type, the Automotive Smart Display Market is divided further into Liquid Crystal Display (LCD), Thin-film Transistor Liquid Crystal Display (TFT-LCD) and Other. LCDs are still prominent as a result of its low cost and many applications because of the reception to cheaper automotive devices. It provides consistent use benefit and corresponds to entry level infotainment and navigation demand.

- TFT-LCDs, in turn, is gradually gaining preference for premium vehicles due to the availability of improved image quality, faster response time, and significantly better viewing angles. But today as more and more users are looking for high definitions and touch response, TFT-LCD is dominating the market. Other new age technologies like OLEDs are also finding their way into devices because of the bright images and the possibility of flexibility that they offer, even though they are as of now only implemented in high-end laptops because of costs.

By Size, Up to 5” segment expected to held the largest share

-

By size, the market is classified into up to 5”, 5-10”, and above 10”. Gantry type displays with the viewing area measuring up to 5 inches are applied to rudimentary measurement and information and entertaining systems of B and C class vehicles. Such displays lack special features and are designed for cost-sensitive buyers.

- The 5”-10” segment holds the greatest market share, supporting effectiveness and many additional features. These displays are particularly suitable for infotainment, navigation and safety systems. Sizes above 10 inches are on the rise in luxury and electric models while offering great features such as the split screen and better graphics for navigation and media.

Automotive Smart Display Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Among the regions, North America controls the largest share in the automotive smart display market due to the well-established automobile sector in the region, along with the public’s increasing fondness of intelligent technologies for automobiles and the significant encouragement of the authorities for safety features. Being one of the pioneers in implementing connected and autonomous vehicles, the region generates high demand for smart displays.

- That for instance, automotive and technology giants in the United States and Canada exist adding on the innovation and increased markets. Furthermore, government concerns and policies related to road security and the electric modernization of vehicles provide a strong support to the advanced display systems market. Healing of North American car market lies in maintaining individual and technological orientation of the driving which will keep this market ahead.

Active Key Players in the Automotive Smart Display Market:

-

Continental AG (Germany)

- Denso Corporation (Japan)

- Harman International Industries, Inc. (USA)

- Kyocera Corporation (Japan)

- LG Display Co., Ltd. (South Korea)

- Magna International Inc. (Canada)

- Nippon Seiki Co., Ltd. (Japan)

- Panasonic Corporation (Japan)

- Pioneer Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Visteon Corporation (USA)

- Yazaki Corporation (Japan)

- Other Active Players

Key Industry Developments in the Automotive Smart Display Market:

-

In January 2024, LG Display unveiled a set of game-changing automobile displays at the Consumer Electronics Show (CES) 2024. Displays include a 57-inch pillar-to-pillar (P2P) LCD, which covers the dashboard from the left on the driver's side all the way to the right side of the front passenger seat and is the largest existing display, according to the company.

- In January 2024 - AUO, a global leader in display technology, made its CES debut in Las Vegas in this year by exhibiting advanced display technologies and solutions, including revolutionary Micro LED. It will highlight a range of in-vehicle display HMI solutions and extended mobility applications, envisioning the future of smart mobility.

- In July 2023 - LG Display Co. announced the supply of its organic light-emitting diode (OLED) automotive display to Hyundai Motor Co.'s premium brand Genesis for its new GV80 model’s integrated dashboard infotainment system. The 2024 GV80 facelift model will be fitted with LG’s 27-inch OLED screen for the luxury SUV’s panoramic display, combining screens for the dashboard, navigation, and the SUV's infotainment system.

|

Automotive Smart Display Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.17 Billion |

|

Forecast Period 2024-32 CAGR: |

7.15% |

Market Size in 2032: |

USD 15.21 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Level |

|

||

|

By Size |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Smart Display Market by Technology

4.1 Automotive Smart Display Market Snapshot and Growth Engine

4.2 Automotive Smart Display Market Overview

4.3 Liquid Crystal Display (LCD)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Liquid Crystal Display (LCD): Geographic Segmentation Analysis

4.4 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Thin-film Transistor Liquid Crystal Display (TFT-LCD): Geographic Segmentation Analysis

4.5 Others

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Others: Geographic Segmentation Analysis

Chapter 5: Automotive Smart Display Market by Driving Level

5.1 Automotive Smart Display Market Snapshot and Growth Engine

5.2 Automotive Smart Display Market Overview

5.3 Semi-Autonomous

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Semi-Autonomous: Geographic Segmentation Analysis

5.4 Conventional

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Conventional: Geographic Segmentation Analysis

Chapter 6: Automotive Smart Display Market by Size

6.1 Automotive Smart Display Market Snapshot and Growth Engine

6.2 Automotive Smart Display Market Overview

6.3 Up to 5”

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Up to 5”: Geographic Segmentation Analysis

6.4 5’-10”

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 5’-10”: Geographic Segmentation Analysis

6.5 Above 10

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Above 10: Geographic Segmentation Analysis

Chapter 7: Automotive Smart Display Market by Vehicle Type

7.1 Automotive Smart Display Market Snapshot and Growth Engine

7.2 Automotive Smart Display Market Overview

7.3 Passenger Car

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Passenger Car: Geographic Segmentation Analysis

7.4 Commercial Vehicle

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial Vehicle: Geographic Segmentation Analysis

Chapter 8: Automotive Smart Display Market by Sales Channel

8.1 Automotive Smart Display Market Snapshot and Growth Engine

8.2 Automotive Smart Display Market Overview

8.3 OEM

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 OEM: Geographic Segmentation Analysis

8.4 After

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 After: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Smart Display Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ROBERT BOSCH GMBH (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 CONTINENTAL AG (GERMANY)

9.4 DENSO CORPORATION (JAPAN)

9.5 MAGNA INTERNATIONAL INC. (CANADA)

9.6 VISTEON CORPORATION (USA)

9.7 PANASONIC CORPORATION (JAPAN)

9.8 HARMAN INTERNATIONAL INDUSTRIES INC. (USA)

9.9 LG DISPLAY CO. LTD. (SOUTH KOREA)

9.10 YAZAKI CORPORATION (JAPAN)

9.11 NIPPON SEIKI CO. LTD. (JAPAN)

9.12 PIONEER CORPORATION (JAPAN)

9.13 KYOCERA CORPORATION (JAPAN)

9.14 OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Smart Display Market By Region

10.1 Overview

10.2. North America Automotive Smart Display Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Technology

10.2.4.1 Liquid Crystal Display (LCD)

10.2.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.2.4.3 Others

10.2.5 Historic and Forecasted Market Size By Driving Level

10.2.5.1 Semi-Autonomous

10.2.5.2 Conventional

10.2.6 Historic and Forecasted Market Size By Size

10.2.6.1 Up to 5”

10.2.6.2 5’-10”

10.2.6.3 Above 10

10.2.7 Historic and Forecasted Market Size By Vehicle Type

10.2.7.1 Passenger Car

10.2.7.2 Commercial Vehicle

10.2.8 Historic and Forecasted Market Size By Sales Channel

10.2.8.1 OEM

10.2.8.2 After

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Smart Display Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Technology

10.3.4.1 Liquid Crystal Display (LCD)

10.3.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.3.4.3 Others

10.3.5 Historic and Forecasted Market Size By Driving Level

10.3.5.1 Semi-Autonomous

10.3.5.2 Conventional

10.3.6 Historic and Forecasted Market Size By Size

10.3.6.1 Up to 5”

10.3.6.2 5’-10”

10.3.6.3 Above 10

10.3.7 Historic and Forecasted Market Size By Vehicle Type

10.3.7.1 Passenger Car

10.3.7.2 Commercial Vehicle

10.3.8 Historic and Forecasted Market Size By Sales Channel

10.3.8.1 OEM

10.3.8.2 After

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Smart Display Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Technology

10.4.4.1 Liquid Crystal Display (LCD)

10.4.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.4.4.3 Others

10.4.5 Historic and Forecasted Market Size By Driving Level

10.4.5.1 Semi-Autonomous

10.4.5.2 Conventional

10.4.6 Historic and Forecasted Market Size By Size

10.4.6.1 Up to 5”

10.4.6.2 5’-10”

10.4.6.3 Above 10

10.4.7 Historic and Forecasted Market Size By Vehicle Type

10.4.7.1 Passenger Car

10.4.7.2 Commercial Vehicle

10.4.8 Historic and Forecasted Market Size By Sales Channel

10.4.8.1 OEM

10.4.8.2 After

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Smart Display Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Technology

10.5.4.1 Liquid Crystal Display (LCD)

10.5.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.5.4.3 Others

10.5.5 Historic and Forecasted Market Size By Driving Level

10.5.5.1 Semi-Autonomous

10.5.5.2 Conventional

10.5.6 Historic and Forecasted Market Size By Size

10.5.6.1 Up to 5”

10.5.6.2 5’-10”

10.5.6.3 Above 10

10.5.7 Historic and Forecasted Market Size By Vehicle Type

10.5.7.1 Passenger Car

10.5.7.2 Commercial Vehicle

10.5.8 Historic and Forecasted Market Size By Sales Channel

10.5.8.1 OEM

10.5.8.2 After

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Smart Display Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Technology

10.6.4.1 Liquid Crystal Display (LCD)

10.6.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.6.4.3 Others

10.6.5 Historic and Forecasted Market Size By Driving Level

10.6.5.1 Semi-Autonomous

10.6.5.2 Conventional

10.6.6 Historic and Forecasted Market Size By Size

10.6.6.1 Up to 5”

10.6.6.2 5’-10”

10.6.6.3 Above 10

10.6.7 Historic and Forecasted Market Size By Vehicle Type

10.6.7.1 Passenger Car

10.6.7.2 Commercial Vehicle

10.6.8 Historic and Forecasted Market Size By Sales Channel

10.6.8.1 OEM

10.6.8.2 After

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Smart Display Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Technology

10.7.4.1 Liquid Crystal Display (LCD)

10.7.4.2 Thin-film Transistor Liquid Crystal Display (TFT-LCD)

10.7.4.3 Others

10.7.5 Historic and Forecasted Market Size By Driving Level

10.7.5.1 Semi-Autonomous

10.7.5.2 Conventional

10.7.6 Historic and Forecasted Market Size By Size

10.7.6.1 Up to 5”

10.7.6.2 5’-10”

10.7.6.3 Above 10

10.7.7 Historic and Forecasted Market Size By Vehicle Type

10.7.7.1 Passenger Car

10.7.7.2 Commercial Vehicle

10.7.8 Historic and Forecasted Market Size By Sales Channel

10.7.8.1 OEM

10.7.8.2 After

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Automotive Smart Display Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.17 Billion |

|

Forecast Period 2024-32 CAGR: |

7.15% |

Market Size in 2032: |

USD 15.21 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Level |

|

||

|

By Size |

|

||

|

By Vehicle Type |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||