Automotive Heat Exchanger Market Synopsis:

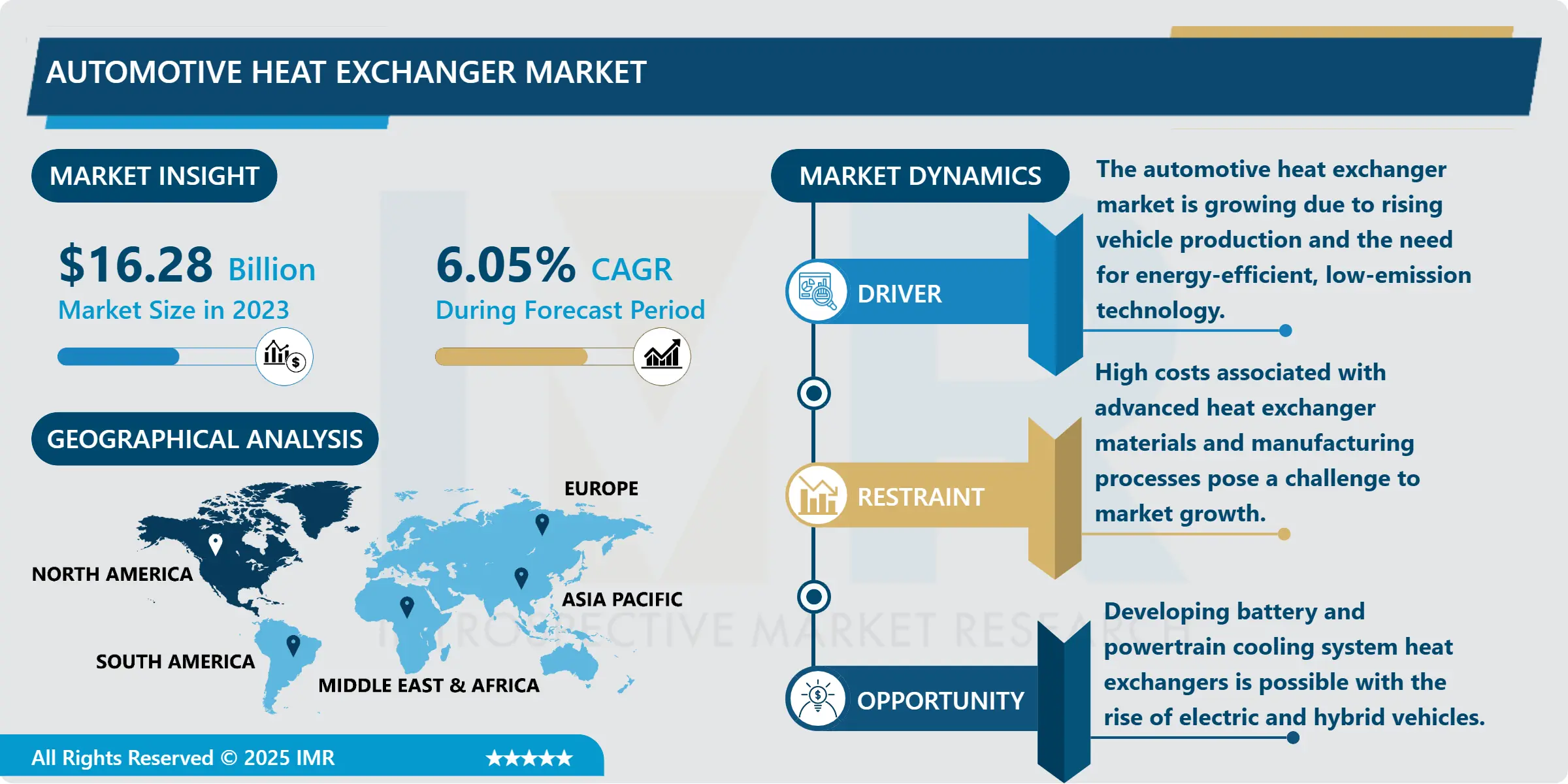

Automotive Heat Exchanger Market Size Was Valued at USD 16.28 Billion in 2023, and is Projected to Reach USD 27.55 Billion by 2032, Growing at a CAGR of 6.05% From 2024-2032.

The Automotive Heat Exchanger Market geared towards vehicles are highly significant since these components are inherent aspects of temperature control by transferring heat in different systems of the car, such as the engine, air conditioning, and transmission. Heat exchangers play a useful role in controlling the operating temperatures, enhancing the fuel economy and lowering the amount of pollution. As people now turn towards fuel-efficient vehicles and environmentally friendly products, the heat exchangers market is gradually expanding across the global market especially in the highly regulated areas of North America, Europe, and Asia-Pacific.

Other trends in the automotive area, like Electric Vehicles or hybrid power plants, also envoke developments in heat exchanger constructions. For example, thermal management of EVs, especially batteries and powertrains involved in the transport of electricity or conversion of it, is considerably high. As a result, we have seen manufacturers come up with improved smaller, lighter, and more efficient heat exchangers for use with the emerging thermal system technologies. Moreover, in aluminum and other light metal alloys, improvements in material have made it possible to build more reliable and effective heat exchangers.

The Asia-Pacific has been forecasted to be the leading market mainly due to the increasing automotive output within the developing countries such as China, Japan and India. Fortune 1000 automotive companies are to benefit a lot through increase in consumer demand of better fuel efficiency vehicles and enhanced climate control systems causing growth of the market especially in emergent economies. Third, the market gets constant innovation, as car manufacturers pay attention to creating heat exchangers suited for the existing and emergent standards and requirements. Because of the development of types of vehicles, key by EVs and hybrid automobiles, the living space of automotive heat exchanger market will last perpetually.

Automotive Heat Exchanger Market Trend Analysis:

Shift Toward Lightweight and Compact Heat Exchangers

- The market for small and light weight heat exchangers is increasing due to the automobile industry’s attempt to increase the fuel efficiency along with reducing the vehicle’s weight. Advanced automotive heat exchangers are being built from light materials like aluminum and advanced composites that contribute to the small overall weight of vehicles being produced today. This trend is particularly important in electric vehicles (EVs) as effective thermal management of battery and powertrain is important for extending range and improving performance. New generations of heat exchangers are characterized by ever greater compactness and ever greater efficiency for meeting the requirements of modern low-emission cars.

Focus on Lightweight and Compact Heat Exchangers

- The third major trend that speaks to the future of automotive heat exchangers is that making systems lighter and more compact is a top priority for other reasons including fuel efficiency and emissions. The automobile manufacturers are always coming up with heat exchangers that not only enhance the thermal efficiency but also the lightweight heat exchangers. Better, lighter, more durable and efficient heat exchanging materials such as aluminum and advanced composites are being used in developing heat exchanging parts, in an effort to satisfy the need for fuel efficient and green automobiles. This trend is set to accelerate the market growth in the future due to increasing standard of restrictions to fuel economy and emissions.

Automotive Heat Exchanger Market Segment Analysis:

Automotive Heat Exchanger Market Segmented on the basis of Application, Design Type, Material, Propulsion Type, Vehicle Type, and Region.

By Application, Intercooler segment is expected to dominate the market during the forecast period

- By application, the market for automotive heat exchanger has been categorized into intercooler, radiator, air conditioning, oil cooler and other. Intercoolers are now used to cool compressed air for charged engines that stabilize performance of supercharged/turbo charged engines. Large,horizontal radiators are indispensable to cool engine coolant, to avoid extremely high temperature within the engine chamber. HVAC heat exchangers are responsible for conditioning the passenger cabin so as to provide comfort while in the vehicle. Intercooler coolers are devices that are fitted to the engine to help in conditioning of engine oil hence need to be in good state to prevent damaging of the engine. The others segment comprises a number of heat exchangers applied to different applications including transmission cooling, HVAC/R, and battery thermal management in electric vehicles. The increasing need for effective thermal management mechanisms across the mentioned applications is boosting market expansion.

Automotive Heat Exchanger Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the Automotive Heat Exchanger Market over the forecast period, driven by the region's strong automotive manufacturing base, particularly in the United States and Canada, which are key hubs for both traditional and electric vehicle production. The increasing demand for fuel-efficient, low-emission vehicles, coupled with stringent environmental regulations, is pushing automakers to adopt advanced heat exchanger technologies for thermal management. Additionally, the rapid growth of electric and hybrid vehicles in the region is further boosting the demand for specialized heat exchangers designed for EV batteries and powertrains. The presence of leading market players and ongoing investments in automotive innovation also contribute to North America's dominant market position.

Active Key Players in the Automotive Heat Exchanger Market:

- Aisin Seiki Co., Ltd. (Japan)

- BorgWarner Inc. (United States)

- Calsonic Kansei (Japan)

- Delphi Technologies (United Kingdom)

- Denso Corporation (Japan)

- Hanon Systems (South Korea)

- Hitachi Automotive Systems, Ltd. (Japan)

- Keihin Corporation (Japan)

- MAHLE GmbH (Germany)

- Mannigel (Germany)

- Mitsubishi Heavy Industries Automotive Thermal Systems Co., Ltd. (Japan)

- Modine Manufacturing Company (United States)

- Sanden Holdings Corporation (Japan)

- T.RAD (Japan)

- Valeo (France)

- Other Active Players

|

Automotive Heat Exchanger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.28 Billion |

|

Forecast Period 2024-32 CAGR: |

6.05% |

Market Size in 2032: |

USD 27.55 Billion |

|

Segments Covered: |

By Application |

|

|

|

By Design Type |

|

||

|

By Material |

|

||

|

By Propulsion Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Heat Exchanger Market by Application

4.1 Automotive Heat Exchanger Market Snapshot and Growth Engine

4.2 Automotive Heat Exchanger Market Overview

4.3 Intercooler

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Intercooler: Geographic Segmentation Analysis

4.4 Radiator

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Radiator: Geographic Segmentation Analysis

4.5 Air Conditioning

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Air Conditioning: Geographic Segmentation Analysis

4.6 Oil Cooler

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Oil Cooler: Geographic Segmentation Analysis

4.7 and Others

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Others: Geographic Segmentation Analysis

Chapter 5: Automotive Heat Exchanger Market by Design Type

5.1 Automotive Heat Exchanger Market Snapshot and Growth Engine

5.2 Automotive Heat Exchanger Market Overview

5.3 Tube Fin

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Tube Fin: Geographic Segmentation Analysis

5.4 Plate Bar

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Plate Bar: Geographic Segmentation Analysis

5.5 and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Others: Geographic Segmentation Analysis

Chapter 6: Automotive Heat Exchanger Market by Material

6.1 Automotive Heat Exchanger Market Snapshot and Growth Engine

6.2 Automotive Heat Exchanger Market Overview

6.3 Aluminium

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Aluminium: Geographic Segmentation Analysis

6.4 Copper

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Copper: Geographic Segmentation Analysis

6.5 and Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Others: Geographic Segmentation Analysis

Chapter 7: Automotive Heat Exchanger Market by Propulsion Type

7.1 Automotive Heat Exchanger Market Snapshot and Growth Engine

7.2 Automotive Heat Exchanger Market Overview

7.3 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Internal Combustion Engine (ICE) and Electric Vehicle (EV): Geographic Segmentation Analysis

Chapter 8: Automotive Heat Exchanger Market by Vehicle Type

8.1 Automotive Heat Exchanger Market Snapshot and Growth Engine

8.2 Automotive Heat Exchanger Market Overview

8.3 Passenger Car

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Passenger Car: Geographic Segmentation Analysis

8.4 Light Commercial Vehicle

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Light Commercial Vehicle: Geographic Segmentation Analysis

8.5 and Heavy Commercial Vehicle

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 and Heavy Commercial Vehicle: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Automotive Heat Exchanger Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CALSONIC KANSEI (JAPAN)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AISIN SEIKI CO. LTD. (JAPAN)

9.4 DELPHI TECHNOLOGIES (UNITED KINGDOM)

9.5 MANNIGEL (GERMANY)

9.6 SANDEN HOLDINGS CORPORATION (JAPAN)

9.7 HITACHI AUTOMOTIVE SYSTEMS

9.8 LTD. (JAPAN)

9.9 MODINE MANUFACTURING COMPANY (UNITED STATES)

9.10 MITSUBISHI HEAVY INDUSTRIES AUTOMOTIVE THERMAL SYSTEMS CO. LTD. (JAPAN)

9.11 HANON SYSTEMS (SOUTH KOREA)

9.12 DENSO CORPORATION (JAPAN)

9.13 BORGWARNER INC. (UNITED STATES)

9.14 T.RAD (JAPAN)

9.15 VALEO (FRANCE)

9.16 MAHLE GMBH (GERMANY)

9.17 KEIHIN CORPORATION (JAPAN)

9.18 OTHER ACTIVE PLAYERS

Chapter 10: Global Automotive Heat Exchanger Market By Region

10.1 Overview

10.2. North America Automotive Heat Exchanger Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Application

10.2.4.1 Intercooler

10.2.4.2 Radiator

10.2.4.3 Air Conditioning

10.2.4.4 Oil Cooler

10.2.4.5 and Others

10.2.5 Historic and Forecasted Market Size By Design Type

10.2.5.1 Tube Fin

10.2.5.2 Plate Bar

10.2.5.3 and Others

10.2.6 Historic and Forecasted Market Size By Material

10.2.6.1 Aluminium

10.2.6.2 Copper

10.2.6.3 and Others

10.2.7 Historic and Forecasted Market Size By Propulsion Type

10.2.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.2.8 Historic and Forecasted Market Size By Vehicle Type

10.2.8.1 Passenger Car

10.2.8.2 Light Commercial Vehicle

10.2.8.3 and Heavy Commercial Vehicle

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Automotive Heat Exchanger Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Application

10.3.4.1 Intercooler

10.3.4.2 Radiator

10.3.4.3 Air Conditioning

10.3.4.4 Oil Cooler

10.3.4.5 and Others

10.3.5 Historic and Forecasted Market Size By Design Type

10.3.5.1 Tube Fin

10.3.5.2 Plate Bar

10.3.5.3 and Others

10.3.6 Historic and Forecasted Market Size By Material

10.3.6.1 Aluminium

10.3.6.2 Copper

10.3.6.3 and Others

10.3.7 Historic and Forecasted Market Size By Propulsion Type

10.3.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.3.8 Historic and Forecasted Market Size By Vehicle Type

10.3.8.1 Passenger Car

10.3.8.2 Light Commercial Vehicle

10.3.8.3 and Heavy Commercial Vehicle

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Automotive Heat Exchanger Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Application

10.4.4.1 Intercooler

10.4.4.2 Radiator

10.4.4.3 Air Conditioning

10.4.4.4 Oil Cooler

10.4.4.5 and Others

10.4.5 Historic and Forecasted Market Size By Design Type

10.4.5.1 Tube Fin

10.4.5.2 Plate Bar

10.4.5.3 and Others

10.4.6 Historic and Forecasted Market Size By Material

10.4.6.1 Aluminium

10.4.6.2 Copper

10.4.6.3 and Others

10.4.7 Historic and Forecasted Market Size By Propulsion Type

10.4.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.4.8 Historic and Forecasted Market Size By Vehicle Type

10.4.8.1 Passenger Car

10.4.8.2 Light Commercial Vehicle

10.4.8.3 and Heavy Commercial Vehicle

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Automotive Heat Exchanger Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Application

10.5.4.1 Intercooler

10.5.4.2 Radiator

10.5.4.3 Air Conditioning

10.5.4.4 Oil Cooler

10.5.4.5 and Others

10.5.5 Historic and Forecasted Market Size By Design Type

10.5.5.1 Tube Fin

10.5.5.2 Plate Bar

10.5.5.3 and Others

10.5.6 Historic and Forecasted Market Size By Material

10.5.6.1 Aluminium

10.5.6.2 Copper

10.5.6.3 and Others

10.5.7 Historic and Forecasted Market Size By Propulsion Type

10.5.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.5.8 Historic and Forecasted Market Size By Vehicle Type

10.5.8.1 Passenger Car

10.5.8.2 Light Commercial Vehicle

10.5.8.3 and Heavy Commercial Vehicle

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Automotive Heat Exchanger Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Application

10.6.4.1 Intercooler

10.6.4.2 Radiator

10.6.4.3 Air Conditioning

10.6.4.4 Oil Cooler

10.6.4.5 and Others

10.6.5 Historic and Forecasted Market Size By Design Type

10.6.5.1 Tube Fin

10.6.5.2 Plate Bar

10.6.5.3 and Others

10.6.6 Historic and Forecasted Market Size By Material

10.6.6.1 Aluminium

10.6.6.2 Copper

10.6.6.3 and Others

10.6.7 Historic and Forecasted Market Size By Propulsion Type

10.6.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.6.8 Historic and Forecasted Market Size By Vehicle Type

10.6.8.1 Passenger Car

10.6.8.2 Light Commercial Vehicle

10.6.8.3 and Heavy Commercial Vehicle

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Automotive Heat Exchanger Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Application

10.7.4.1 Intercooler

10.7.4.2 Radiator

10.7.4.3 Air Conditioning

10.7.4.4 Oil Cooler

10.7.4.5 and Others

10.7.5 Historic and Forecasted Market Size By Design Type

10.7.5.1 Tube Fin

10.7.5.2 Plate Bar

10.7.5.3 and Others

10.7.6 Historic and Forecasted Market Size By Material

10.7.6.1 Aluminium

10.7.6.2 Copper

10.7.6.3 and Others

10.7.7 Historic and Forecasted Market Size By Propulsion Type

10.7.7.1 Internal Combustion Engine (ICE) and Electric Vehicle (EV)

10.7.8 Historic and Forecasted Market Size By Vehicle Type

10.7.8.1 Passenger Car

10.7.8.2 Light Commercial Vehicle

10.7.8.3 and Heavy Commercial Vehicle

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Automotive Heat Exchanger Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.28 Billion |

|

Forecast Period 2024-32 CAGR: |

6.05% |

Market Size in 2032: |

USD 27.55 Billion |

|

Segments Covered: |

By Application |

|

|

|

By Design Type |

|

||

|

By Material |

|

||

|

By Propulsion Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||