Automotive Display Market Synopsis

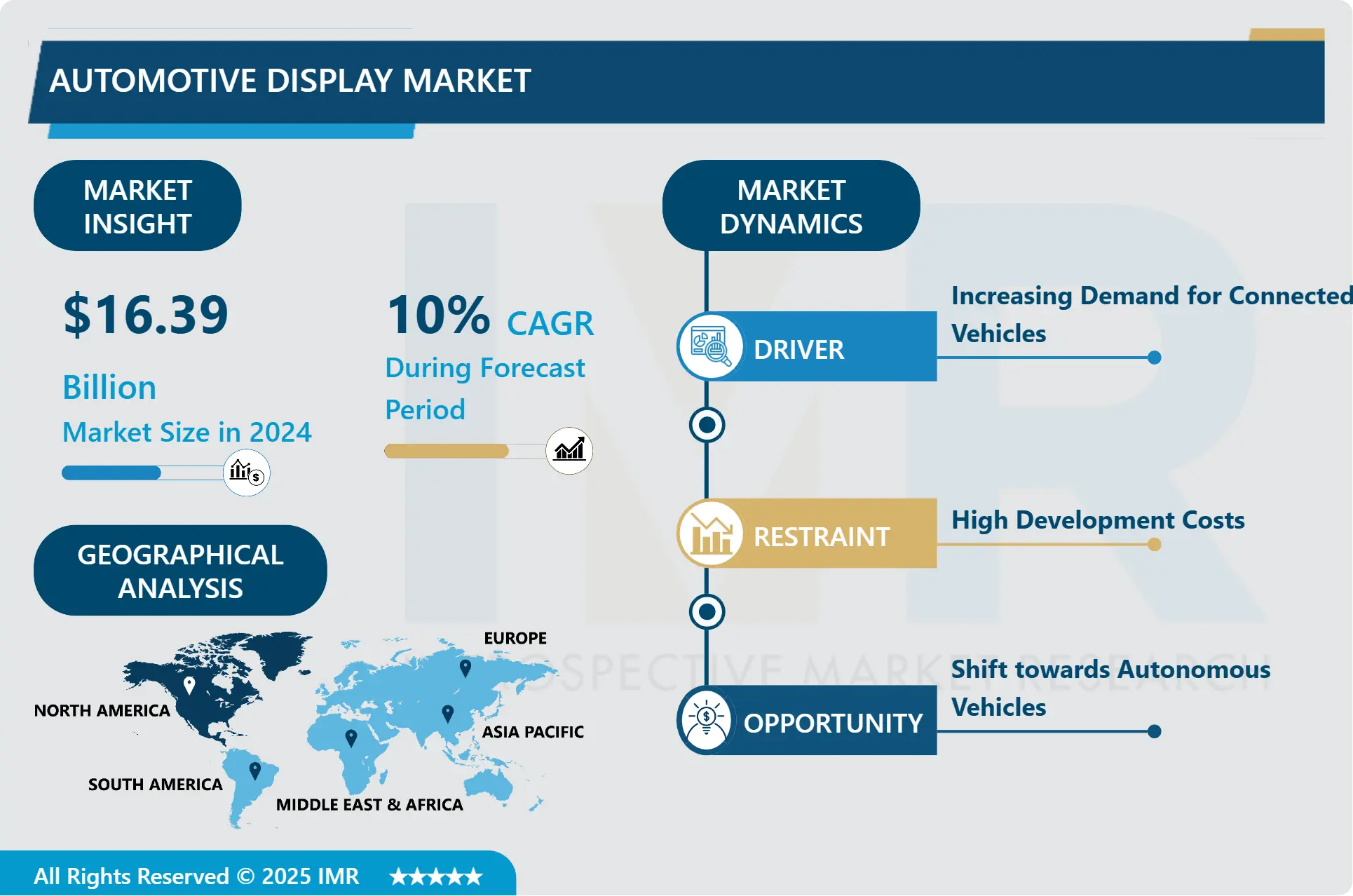

Automotive Display Market Size Was Valued at USD 16.39 Billion in 2024 and is Projected to Reach USD 35.13 Billion by 2032, Growing at a CAGR of 10% From 2025-2032.

The automotive display market refers to the industry segment focused on the development, production, and integration of visual display technologies within vehicles. These displays include instrument clusters, head-up displays (HUDs), infotainment systems, and rear-seat entertainment systems. They provide critical information and entertainment to drivers and passengers, enhancing the driving experience through features like navigation, vehicle diagnostics, connectivity, and multimedia access. The market encompasses a variety of display technologies such as LCD, OLED, and TFT, and caters to the growing demand for advanced, user-friendly, and interactive interfaces in modern vehicles.

The global automotive display market is witnessing significant growth, driven by the increasing demand for advanced vehicle infotainment systems and the rising adoption of connected car technologies. As vehicles become more integrated with digital interfaces, the need for sophisticated display systems that enhance user experience and safety has surged. The market is characterized by the rapid technological advancements in display technologies, including OLED, LCD, and AMOLED, which offer better resolution, brightness, and energy efficiency.

The proliferation of electric and autonomous vehicles is a major catalyst for the automotive display market. These vehicles rely heavily on advanced display systems for navigation, vehicle control, and entertainment, thereby driving the demand for high-quality displays. Additionally, the growing consumer preference for enhanced in-car experiences, including touchscreens, heads-up displays, and digital instrument clusters, is propelling market growth. Automakers are increasingly incorporating these displays to differentiate their products and offer a premium driving experience.

Regionally, the Asia Pacific dominates the automotive display market, attributed to the high production and sales of automobiles in countries like China, Japan, and South Korea. The region's strong technological infrastructure and the presence of major automotive manufacturers further bolster market growth. North America and Europe are also significant markets, driven by the high adoption of advanced automotive technologies and the presence of key industry players.

Despite the positive outlook, the market faces challenges such as high costs associated with advanced display technologies and concerns over driver distraction. Manufacturers are addressing these issues by developing cost-effective solutions and enhancing the safety features of display systems. The integration of augmented reality (AR) and artificial intelligence (AI) in automotive displays is expected to create new growth opportunities, enabling more interactive and intelligent vehicle interfaces.

Overall, the automotive display market is poised for substantial growth, supported by technological advancements and the evolving preferences of consumers for smarter and safer vehicles. As the automotive industry continues to innovate, the demand for sophisticated display systems will remain a key driver of market expansion.

Automotive Display Market Trend Analysis

The Rising Demand for Advanced Driver Assistance and In-Car Infotainment Systems

- The burgeoning demand for advanced driver assistance systems (ADAS) and in-car infotainment systems is reshaping the automotive landscape. Modern consumers prioritize safety, convenience, and an enriched driving experience, fueling the adoption of sophisticated display technologies in vehicles. ADAS, which includes features such as lane departure warnings, adaptive cruise control, and automated parking, relies heavily on high-resolution screens and head-up displays (HUDs) to deliver real-time data to drivers. These displays provide critical information, such as speed, navigation directions, and potential hazards, directly in the driver's line of sight, minimizing distraction and enhancing safety. Additionally, digital instrument clusters, replacing traditional analog gauges, offer customizable and intuitive interfaces that can adapt to various driving conditions and user preferences.

- In-car infotainment systems further contribute to the integration of advanced display technologies. These systems provide an immersive experience through large touchscreens and high-definition displays, offering seamless connectivity, entertainment, and navigation services. Consumers now expect their vehicles to function as extensions of their digital lives, with features like voice control, smartphone integration, and access to a wide range of apps and services. The convergence of these technologies not only enhances the driving experience but also sets new standards for convenience and luxury in the automotive industry. As a result, automakers are investing heavily in developing and incorporating cutting-edge display solutions, recognizing their role in meeting consumer expectations and staying competitive in a rapidly evolving market.

The Impact of Electric and Autonomous Vehicles on the Automotive Display Market

- The automotive display market is experiencing significant growth due to the shift towards electric and autonomous vehicles. Electric vehicles (EVs) require sophisticated displays to monitor and present critical information such as battery life, energy consumption, and charging status. These advanced displays ensure drivers have real-time access to essential data, enhancing the overall driving experience and vehicle efficiency. As EVs become more prevalent, the demand for high-quality, interactive, and user-friendly displays is expected to increase, driving innovation and competition among manufacturers. The integration of touchscreens, heads-up displays, and customizable digital dashboards is becoming standard, catering to the specific needs of EV users who prioritize sustainability, efficiency, and advanced technology.

- Similarly, autonomous vehicles are heavily reliant on complex display systems to provide both drivers and passengers with necessary information and controls. These vehicles require advanced human-machine interfaces (HMIs) to navigate and interpret real-time data from various sensors and systems. Displays in autonomous vehicles need to offer seamless interaction, intuitive controls, and clear visualization of navigation, safety alerts, and entertainment options. As autonomy levels increase, the role of displays extends beyond traditional dashboards to include augmented reality (AR) and virtual reality (VR) interfaces, offering immersive experiences and enhanced situational awareness. The evolution of autonomous vehicle technology is thus driving the development of cutting-edge display solutions, making them a pivotal component in the future of automotive design and functionality.

Automotive Display Market Segment Analysis:

Automotive Display Market Segmented based on By Product, By Screen Size and By Display Technology.

By Product, Center stack display segment is expected to dominate the market during the forecast period

- The center stack display segment in automotive technology plays a pivotal role in modern vehicle interiors, serving as the central interface for controlling infotainment systems, climate settings, and other vehicle functionalities. These displays are strategically positioned within the dashboard, offering drivers and passengers convenient access to a wide range of features and controls while driving.

- TFT-LCD (Thin Film Transistor Liquid Crystal Display) technology has emerged as the dominant choice for center stack displays due to several key advantages. Firstly, TFT-LCD displays are renowned for their reliability and durability, making them well-suited for the demanding automotive environment where they must operate effectively in varying temperatures and conditions. This reliability ensures consistent performance over the lifespan of the vehicle, contributing to a positive user experience.

- In addition to reliability, TFT-LCD displays offer excellent visibility under different lighting conditions, including bright sunlight and nighttime driving. This visibility is crucial for ensuring that drivers can easily read information displayed on the screen without distraction or discomfort. The size range of 5 to 10 inches is particularly popular because it strikes a balance between usability and space efficiency within the dashboard design. These sizes allow manufacturers to integrate sufficient screen real estate for displaying information and controls while still fitting seamlessly into the overall aesthetic and ergonomic layout of the vehicle's interior.

- Moreover, TFT-LCD technology supports a wide range of resolutions, ensuring that center stack displays can deliver sharp, clear graphics and text necessary for interacting with complex infotainment systems and navigation interfaces. This versatility in resolution helps enhance user interaction by providing a visually appealing and informative interface that complements the overall driving experience.

- Overall, TFT-LCD displays sized between 5 to 10 inches continue to dominate the center stack display segment in automotive design, driven by their reliability, visibility, and adaptability to meet both functional and design requirements within modern vehicle interiors. As automotive technology advances, these displays are expected to further evolve with enhancements in resolution, touch sensitivity, and integration with advanced vehicle connectivity features, maintaining their integral role in enhancing driver convenience and vehicle functionality.

By Display Technology, TFT-LCD segment held the largest share in 2023

- TFT-LCD (Thin Film Transistor Liquid Crystal Display) technology holds a prominent position in the automotive display market, largely due to its established manufacturing processes, affordability, and adaptability to the demanding conditions within vehicles. This technology relies on thin film transistors to control individual pixels, offering advantages such as precise color reproduction, high contrast ratios, and low power consumption. These attributes are crucial for automotive applications where displays must operate reliably over extended periods and under diverse environmental conditions.

- One of the key factors driving the dominance of TFT-LCD displays in automotive settings is their maturity in manufacturing. Manufacturers have refined the production processes for TFT-LCD panels, enabling economies of scale that contribute to their affordability compared to newer display technologies. This cost-effectiveness is particularly beneficial for automotive OEMs looking to integrate advanced display systems without significantly inflating vehicle production costs. Furthermore, TFT-LCD displays are available in a wide range of sizes and resolutions, catering to various display requirements across different vehicle models and segments.

- Another compelling aspect of TFT-LCD technology is its suitability for varied lighting conditions encountered inside vehicles. Whether it's bright sunlight or dimly lit interiors, TFT-LCD displays offer good visibility and readability. They can achieve high brightness levels when necessary to combat glare and maintain legibility under direct sunlight, crucial for ensuring that drivers can access critical information without distraction. Additionally, TFT-LCD displays typically incorporate anti-glare and anti-reflective coatings, further enhancing their performance in challenging lighting environments commonly encountered during driving.

Automotive Display Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North America, the automotive display market benefits significantly from a robust automotive industry that continually pushes the boundaries of technology and innovation. Major automakers in the region, such as General Motors, Ford, and Tesla, are at the forefront of integrating advanced digital displays into their vehicles. These displays serve not only for navigation and infotainment purposes but also as crucial interfaces for driver assistance systems (ADAS), enhancing both convenience and safety on the road.

- The region's emphasis on digital displays is closely tied to consumer preferences for connected vehicles. North American drivers increasingly expect seamless integration of smartphones and other smart devices with their vehicles, driving demand for intuitive touchscreen interfaces and high-definition displays. This trend is supported by the growing availability of high-speed internet connectivity and the expansion of 5G networks, which facilitate real-time data streaming and updates to in-car entertainment and navigation systems.

- Moreover, stringent safety regulations in North America play a pivotal role in shaping the automotive display market. Regulations such as those mandated by the National Highway Traffic Safety Administration (NHTSA) push automakers to incorporate advanced display technologies that enhance driver awareness and reduce distractions. As automakers strive to meet these regulatory requirements while delivering superior user experiences, the market for automotive displays in North America continues to evolve, with a focus on innovation and safety at its core.

Active Key Players in the Automotive Display Market

- Alps Alpine Co., Ltd.

- Continental AG

- Denso Corporation

- Hyundai Mobis

- Nippon Seiki Co., Ltd.

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- SAMSUNG (HARMAN International)

- Visteon Corporation

- Other Active Players

Key Industry Developments in the Automotive Display Market:

- In January 2024, Continental AG launched Crystal Center Display. Based on the most recent microLED technology, the 10- inch display offers previously unheard-of brightness and contrast levels. It appears as though the content on display is floating because the image-generating microLED panel is suspended within a beautifully designed crystal body.

Automotive Display Market Scope:

|

Global Automotive Display Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.39 Bn. |

|

Forecast Period 2025-32 CAGR: |

10% |

Market Size in 2032: |

USD 35.13 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Screen Size |

|

||

|

By Display Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Display Market by Product (2018-2032)

4.1 Automotive Display Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Center stack display

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Instrument cluster display

4.5 Head-up display

4.6 Rear-seat entertainment display

Chapter 5: Automotive Display Market by Screen Size (2018-2032)

5.1 Automotive Display Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Less than 5â€

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 5†to 10â€

5.5 Above 10â€

Chapter 6: Automotive Display Market by Display Technology (2018-2032)

6.1 Automotive Display Market Snapshot and Growth Engine

6.2 Market Overview

6.3 TFT-LCD

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 OLED

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Display Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALPS ALPINE CO LTD

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONTINENTAL AG

7.4 DENSO CORPORATION

7.5 HYUNDAI MOBIS

7.6 NIPPON SEIKI CO LTD

7.7 PANASONIC CORPORATION

7.8 PIONEER CORPORATION

7.9 ROBERT BOSCH GMBH

7.10 SAMSUNG (HARMAN INTERNATIONAL)

7.11 VISTEON CORPORATION

7.12 OTHER KEY PLAYERS

Chapter 8: Global Automotive Display Market By Region

8.1 Overview

8.2. North America Automotive Display Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Center stack display

8.2.4.2 Instrument cluster display

8.2.4.3 Head-up display

8.2.4.4 Rear-seat entertainment display

8.2.5 Historic and Forecasted Market Size by Screen Size

8.2.5.1 Less than 5â€

8.2.5.2 5†to 10â€

8.2.5.3 Above 10â€

8.2.6 Historic and Forecasted Market Size by Display Technology

8.2.6.1 TFT-LCD

8.2.6.2 OLED

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Display Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Center stack display

8.3.4.2 Instrument cluster display

8.3.4.3 Head-up display

8.3.4.4 Rear-seat entertainment display

8.3.5 Historic and Forecasted Market Size by Screen Size

8.3.5.1 Less than 5â€

8.3.5.2 5†to 10â€

8.3.5.3 Above 10â€

8.3.6 Historic and Forecasted Market Size by Display Technology

8.3.6.1 TFT-LCD

8.3.6.2 OLED

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Display Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Center stack display

8.4.4.2 Instrument cluster display

8.4.4.3 Head-up display

8.4.4.4 Rear-seat entertainment display

8.4.5 Historic and Forecasted Market Size by Screen Size

8.4.5.1 Less than 5â€

8.4.5.2 5†to 10â€

8.4.5.3 Above 10â€

8.4.6 Historic and Forecasted Market Size by Display Technology

8.4.6.1 TFT-LCD

8.4.6.2 OLED

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Display Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Center stack display

8.5.4.2 Instrument cluster display

8.5.4.3 Head-up display

8.5.4.4 Rear-seat entertainment display

8.5.5 Historic and Forecasted Market Size by Screen Size

8.5.5.1 Less than 5â€

8.5.5.2 5†to 10â€

8.5.5.3 Above 10â€

8.5.6 Historic and Forecasted Market Size by Display Technology

8.5.6.1 TFT-LCD

8.5.6.2 OLED

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Display Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Center stack display

8.6.4.2 Instrument cluster display

8.6.4.3 Head-up display

8.6.4.4 Rear-seat entertainment display

8.6.5 Historic and Forecasted Market Size by Screen Size

8.6.5.1 Less than 5â€

8.6.5.2 5†to 10â€

8.6.5.3 Above 10â€

8.6.6 Historic and Forecasted Market Size by Display Technology

8.6.6.1 TFT-LCD

8.6.6.2 OLED

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Display Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Center stack display

8.7.4.2 Instrument cluster display

8.7.4.3 Head-up display

8.7.4.4 Rear-seat entertainment display

8.7.5 Historic and Forecasted Market Size by Screen Size

8.7.5.1 Less than 5â€

8.7.5.2 5†to 10â€

8.7.5.3 Above 10â€

8.7.6 Historic and Forecasted Market Size by Display Technology

8.7.6.1 TFT-LCD

8.7.6.2 OLED

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Automotive Display Market Scope:

|

Global Automotive Display Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.39 Bn. |

|

Forecast Period 2025-32 CAGR: |

10% |

Market Size in 2032: |

USD 35.13 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Screen Size |

|

||

|

By Display Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||