Automotive Assembly Market Synopsis:

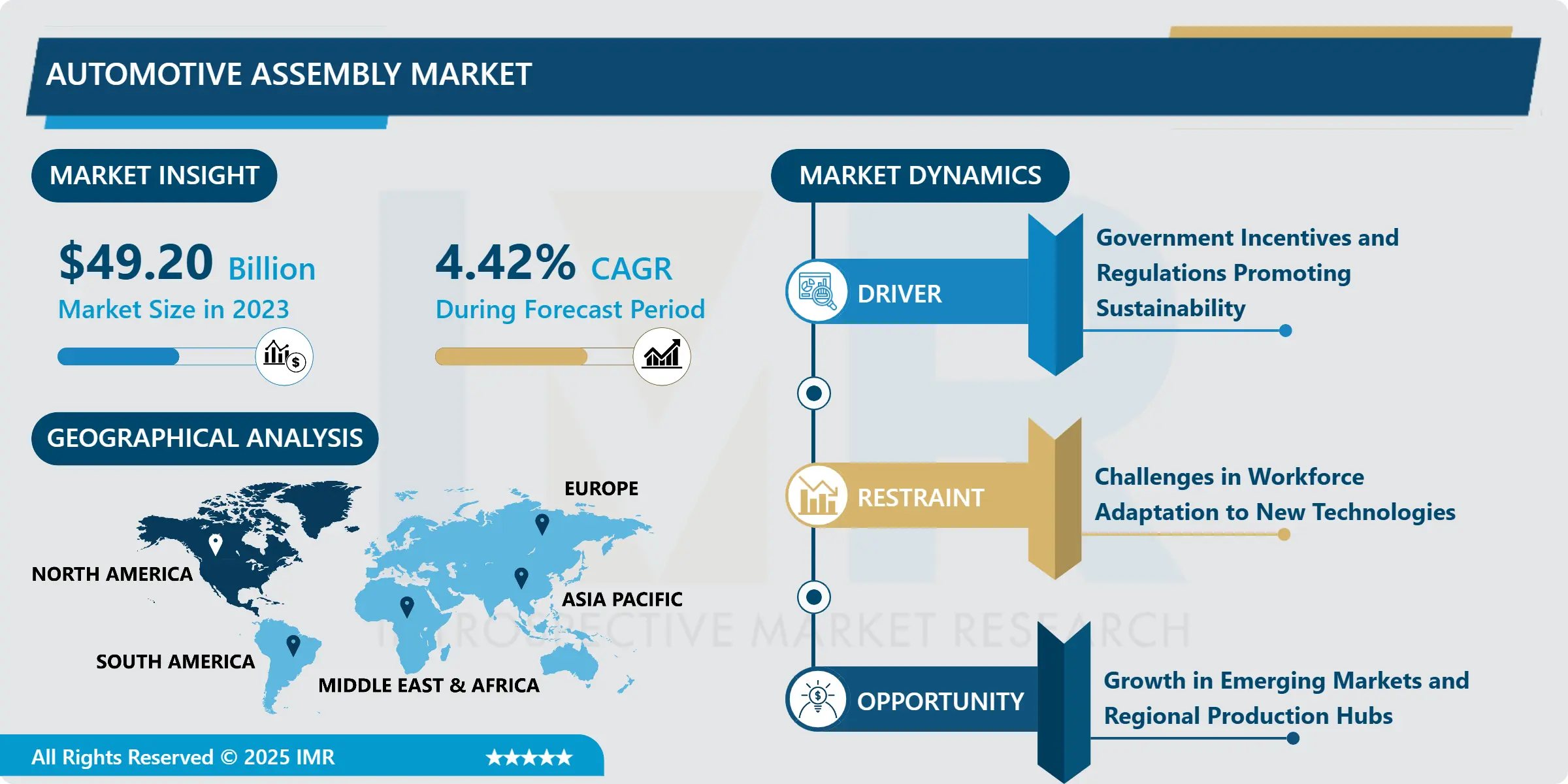

Automotive Assembly Market Size Was Valued at USD 49.20 Billion in 2023, and is Projected to Reach USD 72.16 Billion by 2032, Growing at a CAGR of 4.42% From 2024-2032.

Automotive Assembly Market refers to the industry of joining various vehicle parts including the body, the engine, interior and electrical systems, among others, to form a car. The assembly can be manual, automated, or semi-automated assembly for manufacturing as passengers’ automobiles, commercial automobiles, and EVs. Global players in the automobile industry dictate this market through the search for better ways to assemble automobiles, which is informed by consumers demand for better quality but cheaper automobiles.

Plug-in electric vehicles will be the main force in the automotive assembly market, as numerous car manufacturers must introduce higher technologies and efficiency in manufacturing assembly lines. Widespread use of economical and fuel-efficient automobiles fueled by government subsidies and international guidelines promoting the generation of lesser carbon footprints has encouraged automakers to boost production of EVs. Furthermore, AI and automation have been adopted in the lines of production to improve on precision, and lessen the expenses needed to produce high quality vehicles.

Another key driver is the greater need for more features such as infotainment, autonomous driving, and safety features like assist, and auto-brake. To reference these innovations, assembly processes have pulled up more complex components and entire systems to satisfy the incremental integration of such technologies into automotive manufacturing. Furthermore, existing and future advances in the scope of eco-design have been driving the continuous attention and need for improvements in manufacturing processes.

Automotive Assembly Market Trend Analysis:

The integration of the assembly lines with automation and robotic systems

- The major trend that prevails in the automotive assembly market is the integration of the assembly lines with automation and robotic systems. They ensure more production rates, bring minimum chances of human interconnection and also maintain safety and hygiene in factories. Across production plants, IoT and cloud technologies of Industry 4.0 also increased the way manufacturers control production processes, monitor assembly line quality, and reduce downtime using preventive measures. These technologies are especially relevant for the production of EVs because the technology and manufacturing processes are different than those used in internal combustion engine vehicles.

- Second is what pertains to product design characterized by increased application of a modular assembly systems. This has the advantage of allowing car manufacturers to build different types of car models from the same cut and on the same production line, factors that enable the company to cut costs while at the same time being flexible. Since there is an increasing market for electric and hybrids, modularity within assembly lines enables the industry to address these changes much quicker especially as manufacturers strive to meet legal requirements of clean energy vehicles. This trend is particularly observable in regions, such as South-East Asia and North America where manufacturers gradually shift attention towards EV production.

High growth area for the automotive assembly market

- Electric vehicles are one of the largest developments in the automotive sector that offers a high growth area for the automotive assembly market. While automakers look towards designing more EVs in light of the sustainability goals from various stakeholders like governments, they are going all out to modify production line to adopt EVs. This produces the possibility to penetrate the automotive supply chain either for the suppliers of the components of electric vehicles, or for the companies that produce batteries, electric motors, and difference specific components? Moreover, subsidies and tax incentives for vehicle manufactures compelled by governments globally to incorporate green manufacturing practices also make such opportunities more profitable.

- The second emerging opportunity is therefore in the Southeast Asia and Latin America markets, which are experiencing growth in automotive markets due to better disposable income and demand for automobiles. Manufacturing facilities are being established in these areas to escape the high labor expenses and to enjoy the benefits of beneficial business relations. This is particularly relevant given the current major shifts in strategies as carmakers strive to drive down manufacturing costs to hopefully take advantage of the increasing market demand for vehicles in these regions both with conventional gasoline engine vehicles as well as those powered by electricity.

Automotive Assembly Market Segment Analysis:

Automotive Assembly Market is Segmented on the basis of Assembly type, Vehicle Type, Assembly Line Type, and Region.

By Assembly Type, Manual Assembly segment is expected to dominate the market during the forecast period

- The automotive assembly market is divided into three main categories: manual, automated, and semi-automated assembly. Manual assembly is primarily utilized in scenarios where high precision and low volume production are required, with human labor performing the task of assembling various parts. This approach is ideal for custom or intricate work that demands a skilled touch.

-

On the other hand, automated assembly involves the use of robots and advanced machinery to handle large-scale production efficiently. This method is beneficial for manufacturers focusing on mass production, as it reduces labor costs and increases speed. Semi-automated assembly combines the strengths of both human labor and robotic systems, offering a balance of flexibility and efficiency. It is particularly advantageous in the production of electric vehicles (EVs), which involve complex systems requiring high levels of precision and accuracy. The integration of robots with human intervention ensures quality while maintaining production flexibility.

By Vehicle Type, Passenger Cars segment expected to held the largest share

- Automotive assembly market can be divided into two categories – passenger cars and commercial vehicles, and electric vehicles (EVs). Passenger car is most popular segment throughout the world with little contribution from others with reference to consumers’ demands and due to cheap availability of standardized models.

- Lorries and pickups and other utility vehicles therefore remain a major market contributor and are expected to exhibit increasing usage in the upcoming commercial, distribution and civil construction applications. One of the rapidly growing segments is electric vehicles or EVs, because more and more people strive for environmentally friendly transportation, governments support that trend by providing subsidies and incentives, and ongoing advances in battery technologies reduced manufacturing costs for EVs.

Automotive Assembly Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest share of automotive assembly market mainly due to the presence of premiere automobile manufacturing companies known globally like GM, Ford and Toyota. The United States to a greater extent continues to be a leading car manufacturing nation and there is demand for both, cars for individuals, and for business. Excellent advancement in technology concerning vehicles and automobile manufacturing has strengthened the market in the region through infusion of capital in electricon vehicles, autonomous systems and other modern manufacturing processes. Due to an increasing demand for EVs and government policies targeting environmental conservation, there is increasing adoption of EV production. Therefore, North America is witnessing more related capital investments like retooling assembly lines to suit additional requirements across the EV manufacturing industry.

- The U.S. and Canada present a strong operating environment, such as sound policies, skilled workforce and technological foundations that create suitable conditions for automotive production. Other advantages contributing to the regional strengths include the nearness to the key suppliers and markets coupled with greater emphasis on research and development that are key highlights of the automotive assembly market. The automotive assembly market in North America is also expected to rise despite challenge like the volatility of the price of raw materials and the uncertainties of trade. It is expected that the further shift towards electric and autonomous vehicles, as well as constant customer interest, will define the market in the region in the future.

Active Key Players in the Automotive Assembly Market:

- BMW Group (Germany)

- Daimler AG (Germany)

- Ford Motor Company (USA)

- General Motors (USA)

- Honda Motor Co. Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- Magna International Inc. (Canada)

- Nissan Motor Co. Ltd. (Japan)

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany), and Other Active Players

|

Automotive Assembly Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 49.20 Billion |

|

Forecast Period 2024-32 CAGR: |

4.42% |

Market Size in 2032: |

USD 72.16 Billion |

|

Segments Covered: |

By Assembly Type |

|

|

|

By Vehicle Type |

|

||

|

By Assembly Line Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Assembly Market by Assembly Type

4.1 Automotive Assembly Market Snapshot and Growth Engine

4.2 Automotive Assembly Market Overview

4.3 Manual Assembly

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Manual Assembly: Geographic Segmentation Analysis

4.4 Automated Assembly

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Automated Assembly: Geographic Segmentation Analysis

4.5 Semi-Automated Assembly

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Semi-Automated Assembly: Geographic Segmentation Analysis

Chapter 5: Automotive Assembly Market by Vehicle Type

5.1 Automotive Assembly Market Snapshot and Growth Engine

5.2 Automotive Assembly Market Overview

5.3 Passenger Cars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Cars: Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Geographic Segmentation Analysis

5.5 Electric Vehicles (EVs)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Electric Vehicles (EVs): Geographic Segmentation Analysis

Chapter 6: Automotive Assembly Market by Assembly Line Type

6.1 Automotive Assembly Market Snapshot and Growth Engine

6.2 Automotive Assembly Market Overview

6.3 Flexible Assembly Line

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Flexible Assembly Line: Geographic Segmentation Analysis

6.4 Dedicated Assembly Line

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Dedicated Assembly Line: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Assembly Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MAGNA INTERNATIONAL INC. (CANADA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 TOYOTA MOTOR CORPORATION (JAPAN)

7.4 GENERAL MOTORS (USA)

7.5 FORD MOTOR COMPANY (USA)

7.6 HONDA MOTOR CO. LTD. (JAPAN)

7.7 BMW GROUP (GERMANY)

7.8 VOLKSWAGEN AG (GERMANY)

7.9 DAIMLER AG (GERMANY)

7.10 NISSAN MOTOR CO. LTD. (JAPAN)

7.11 HYUNDAI MOTOR COMPANY (SOUTH KOREA)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Automotive Assembly Market By Region

8.1 Overview

8.2. North America Automotive Assembly Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Assembly Type

8.2.4.1 Manual Assembly

8.2.4.2 Automated Assembly

8.2.4.3 Semi-Automated Assembly

8.2.5 Historic and Forecasted Market Size By Vehicle Type

8.2.5.1 Passenger Cars

8.2.5.2 Commercial Vehicles

8.2.5.3 Electric Vehicles (EVs)

8.2.6 Historic and Forecasted Market Size By Assembly Line Type

8.2.6.1 Flexible Assembly Line

8.2.6.2 Dedicated Assembly Line

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Assembly Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Assembly Type

8.3.4.1 Manual Assembly

8.3.4.2 Automated Assembly

8.3.4.3 Semi-Automated Assembly

8.3.5 Historic and Forecasted Market Size By Vehicle Type

8.3.5.1 Passenger Cars

8.3.5.2 Commercial Vehicles

8.3.5.3 Electric Vehicles (EVs)

8.3.6 Historic and Forecasted Market Size By Assembly Line Type

8.3.6.1 Flexible Assembly Line

8.3.6.2 Dedicated Assembly Line

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Automotive Assembly Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Assembly Type

8.4.4.1 Manual Assembly

8.4.4.2 Automated Assembly

8.4.4.3 Semi-Automated Assembly

8.4.5 Historic and Forecasted Market Size By Vehicle Type

8.4.5.1 Passenger Cars

8.4.5.2 Commercial Vehicles

8.4.5.3 Electric Vehicles (EVs)

8.4.6 Historic and Forecasted Market Size By Assembly Line Type

8.4.6.1 Flexible Assembly Line

8.4.6.2 Dedicated Assembly Line

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Automotive Assembly Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Assembly Type

8.5.4.1 Manual Assembly

8.5.4.2 Automated Assembly

8.5.4.3 Semi-Automated Assembly

8.5.5 Historic and Forecasted Market Size By Vehicle Type

8.5.5.1 Passenger Cars

8.5.5.2 Commercial Vehicles

8.5.5.3 Electric Vehicles (EVs)

8.5.6 Historic and Forecasted Market Size By Assembly Line Type

8.5.6.1 Flexible Assembly Line

8.5.6.2 Dedicated Assembly Line

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Assembly Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Assembly Type

8.6.4.1 Manual Assembly

8.6.4.2 Automated Assembly

8.6.4.3 Semi-Automated Assembly

8.6.5 Historic and Forecasted Market Size By Vehicle Type

8.6.5.1 Passenger Cars

8.6.5.2 Commercial Vehicles

8.6.5.3 Electric Vehicles (EVs)

8.6.6 Historic and Forecasted Market Size By Assembly Line Type

8.6.6.1 Flexible Assembly Line

8.6.6.2 Dedicated Assembly Line

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Assembly Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Assembly Type

8.7.4.1 Manual Assembly

8.7.4.2 Automated Assembly

8.7.4.3 Semi-Automated Assembly

8.7.5 Historic and Forecasted Market Size By Vehicle Type

8.7.5.1 Passenger Cars

8.7.5.2 Commercial Vehicles

8.7.5.3 Electric Vehicles (EVs)

8.7.6 Historic and Forecasted Market Size By Assembly Line Type

8.7.6.1 Flexible Assembly Line

8.7.6.2 Dedicated Assembly Line

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Automotive Assembly Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 49.20 Billion |

|

Forecast Period 2024-32 CAGR: |

4.42% |

Market Size in 2032: |

USD 72.16 Billion |

|

Segments Covered: |

By Assembly Type |

|

|

|

By Vehicle Type |

|

||

|

By Assembly Line Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||