Astaxanthin Market Synopsis

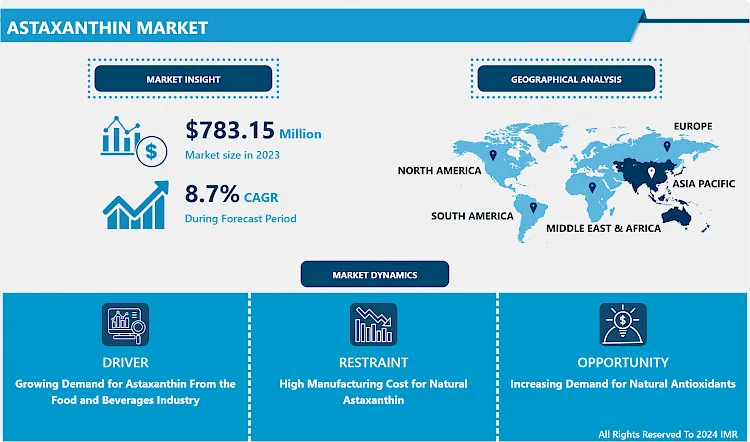

The Global Astaxanthin Market was estimated at USD 851.28 Million in 2024, and is anticipated to reach USD 1659.24 Million by 2032, growing at a CAGR of 8.7% over the analysis period 2025-2032.

Astaxanthin refers to that a reddish-brown pigment, belonging to a group of chemicals known as the xanthophyll category of carotenoids. It generally occurs naturally in some algae and lends the red or pink color in trout, salmon, shrimps, lobsters, and other seafood. A short while ago, yeast/fungi-based and synthetic astaxanthin have also received remarkably fame. Moreover, Astaxanthin stability was evaluated in different carriers and storage environments. Astaxanthin was obtained from Haematococcus and its stability in different edible oils was governed. Astaxanthin was immovable or secure at 70–90 °C in rice bran, gingelly, and palm oils with 84%–90% of retention of astaxanthin content which can be utilized in food and beverages, aquaculture and animal feed, pharmaceutical and nutraceutical applications, whereas astaxanthin content was brought down at 120 and 150 °C. Furthermore, astaxanthin is generally consumed orally and helps cure various chronic ailments. It has been highly employed to treat Alzheimer's disease, Parkinson's disease, liver malfunctions, high cholesterol, and macular degeneration. Numerous astaxanthin drugs have immense the market in recent years. Apart from this astaxanthin has also been widely utilized to treat heart diseases, strokes, and male infertility.

In addition, it protects the skin against sunburn and overcomes wrinkles. The application of astaxanthin products in dietary supplements is due to their easy availability coupled with cardiovascular benefits. Also, the product is inspected to be over 500 times healthier than vitamin E and is much more beneficial than other carotenoids such as lutein and lycopene. Such various applications are probably boosting the astaxanthin market during the forecast period.

.webp)

Astaxanthin Market Growth and Trend Analysis

Drivers:

Growing Demand for Astaxanthin From the Food and Beverages Industry

- The growing demand for astaxanthin from the food and beverages industry is increasingly being used as a food-coloring ingredient, an antioxidant to maintain the taste, color, freshness, and quality of food products. Traditionally, astaxanthin was mostly used to maintain the nutrients of the food from damage, improve sensory aspects, and boosting the overall appeal of food products. In the region of Europe, astaxanthin has received acceptance as an essential raw material to produce dietary nutrition.

- The aquaculture and animal feed sector are majorly dependent on feed additives for rich nutritive benefits for animals. Astaxanthin is used to increase nutritional value and pigmentation in animal feed. Hence, the development of poultry and aquaculture businesses has turned the market for astaxanthin since the increased usages of animal feed for health concerns. The remarkable growth in fisheries and aquaculture production has resulted in the raised consumption of different nutritious food products. Growing global consumption of seafood due to the increasing consumer consciousness about the health benefits of consuming fish and other aquaculture species.

- Key players working in the astaxanthin market landscape are also anticipated to introduce the latest and eco-friendly bio-astaxanthin to acquire an edge over competitors. Many key players are anticipated to invest in R&D for new astaxanthin that is anticipated to find utilizations in the aquaculture space. For example, in December 2019, Japanese scientists disclosed that they have found a novel way to synthesize natural astaxanthin by using marine algae.

Restraints:

High Manufacturing Cost For Natural Astaxanthin

- Astaxanthin can be incorporated naturally as well as synthetically. Synthetic astaxanthin is produced by various chemical formulations from petrochemicals products and is available at comparatively lower rates in the market. Additionally, natural astaxanthin is made through fermentation and extraction methods involving several microorganisms such as bacteria, fungi, yeast, marine animals, and algae. This natural astaxanthin is comparatively tough to manufacture and is costlier than synthetic astaxanthin.

Opportunities:

Increasing Demand For Natural Antioxidants

- There is a rising demand for natural carotenoids in their pure with compared to synthetic carotenoids, especially in the dietary supplements industry, owing to their high effectiveness and quality. The current process used for natural means of manufacture of carotenoids is limited and subject to contamination. These processes are costly, and hence, the costs of natural carotenoids such as beta-carotene and lycopene are almost three times higher than those of synthetic carotenoids.

Challenges:

Strict Government Policies In Developed Economies

- The regulatory issues for application areas of astaxanthin are witnessed to be different in all regions. FDA controls nutraceuticals under different norms and regulations in the United States. According to the Dietary Supplement Health and Education Act, 1994 (DSHEA), the producer must ensure that a nutraceutical-based product or ingredient is safe before it is a sale. Furthermore, the FDA is sanctioned to take action against any harmful product only after it reaches the market. Thus, producers are required to make sure the product label and be transparent about information.

Astaxanthin Market Segment Analysis

Based on Source, the synthetic segment is projected to account for the largest share in 2024

- Based on Source, the synthetic segment is projected to account for the largest share in the market owing to mostly usage of synthetic astaxanthin in the aquaculture, poultry, pet food applications. It is manufactured by a highly complex method from petrochemicals and is feed to fishes to offer coloration. The application of synthetic astaxanthin in aquaculture for catering pigmentation to these species and cost-effectiveness may further support market development.

Based on Production Technology, microalgae cultivation dominates the market over the forecast period.

-

The microalga H. Pluvialis is the highest source of astaxanthin. It holds 5% of dried H. Pluvialis biomass, of which 90% incorporate astaxanthin. The production technology includes two stages such as the green stage and the red stage. In the green stage, a single-cell colony of microalgae is recognized to grow unstressed by normal cell division. An optimal growth environment is provided to the "green" algal cells for high growth. In the second stage, cells are placed through different stress conditions, such as high radiation intensity and switching in growth media. These environments result in the yield and accumulation of natural astaxanthin in the cells in the esterified form.

Regional Insights

The Asia Pacific region is projected to dominate the market during the forecast period

- The Asia Pacific region is projected to dominate the market during the forecast period owing to growth in urbanization and rapid industrialization. Therefore, the consumption levels of astaxanthin vary from country to country and region to region. The rising preference among consumers for healthy food and the high demand for meat and seafood are some of the key factors for the development of animal feed usages of astaxanthin in the region. The Asia Pacific provides lucrative opportunities to producers and suppliers of astaxanthin, due to the cost advantage and high demand in this region. Additionally, rising financial assistance by the governments for the aquaculture industry with higher seafood consumption is anticipated to drive the market in the region. Furthermore, the rapid growth of the pharmaceuticals, cosmetics, and aquaculture industries in India, China, Japan, and South Korea is expected to propel the product adoption rate.

Players Covered in Astaxanthin Market are:

- BASF SE

- BGG

- Cyanotech Corporation

- DSM

- Fenchem

- Lycored

- Piveg

- Algae to Omega

- Wellgreen Technology

- Cardax

- INNOBIO

- ALGA Technologies

- Algix

- EID-Parry Ltd

- IGENE Biotechnology

- MicroA AS

- JX Nippon Oil

- Energy Corporation

- Astareal Inc.

- Kunming biogenic

- Divis Laboratories ltd.

- Otsuka Pharmaceuticals

- Others Active Players

Key Industry Developments In Astaxanthin Market

- In March 2024, Kuehnle AgroSystems (KAS) announced it had secured a $3 million investment led by S2G Ventures to advance its innovative method for producing natural astaxanthin from microalgae. This breakthrough supports sustainable solutions for aquaculture and human health by offering a natural alternative to synthetic options. The funding will enable KAS to scale its operations and expand the reach of its environmentally friendly and health-focused biotechnology.

- In Mar 2024, Nutrex Hawaii introduced a vegan, sugar-free gummy version of its popular BioAstin dietary supplement. Each serving delivers 12mg of Hawaiian astaxanthin, boasting 6000 times the antioxidant power of vitamin C. The gummies were designed to cater to health-conscious consumers seeking plant-based and convenient supplement options. This innovation marked a significant expansion of Nutrex Hawaii's product line, known for its expertise in astaxanthin supplements. The launch reinforced the brand’s commitment to providing high-quality, natural wellness solutions to a broader audience.

|

Astaxanthin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 851.28 Million |

|

Forecast Period 2025-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1659.24 Million |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Astaxanthin Market by Type (2018-2032)

4.1 Astaxanthin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Synthetic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Natural

Chapter 5: Astaxanthin Market by Form (2018-2032)

5.1 Astaxanthin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Powder

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Liquid

Chapter 6: Astaxanthin Market by Application (2018-2032)

6.1 Astaxanthin Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Feed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supplements

6.5 Food

6.6 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Astaxanthin Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AIDP INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AXIOM FOODS INC.

7.4 BIOWAY (XI'AN) ORGANIC INGREDIENTS CO. LTD.

7.5 GOLDEN GRAIN GROUP LIMITED

7.6 NORTH COAST NATURALS

7.7 NUTRIBIOTIC

7.8 RICEBRAN TECHNOLOGIES

7.9 ROLLINS INTERNATIONAL PVT. LTD.

7.10 (RHA HOLDINGS PRIVATE LTD.)

7.11 SHAFI GLUCO CHEM PVT. LTD.

7.12 THE GREEN LABS LLC

7.13 TOP HEALTH INGREDIENTS INC

7.14 OTHER MAJOR PLAYERS.

Chapter 8: Global Astaxanthin Market By Region

8.1 Overview

8.2. North America Astaxanthin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Synthetic

8.2.4.2 Natural

8.2.5 Historic and Forecasted Market Size by Form

8.2.5.1 Powder

8.2.5.2 Liquid

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Feed

8.2.6.2 Supplements

8.2.6.3 Food

8.2.6.4 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Astaxanthin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Synthetic

8.3.4.2 Natural

8.3.5 Historic and Forecasted Market Size by Form

8.3.5.1 Powder

8.3.5.2 Liquid

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Feed

8.3.6.2 Supplements

8.3.6.3 Food

8.3.6.4 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Astaxanthin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Synthetic

8.4.4.2 Natural

8.4.5 Historic and Forecasted Market Size by Form

8.4.5.1 Powder

8.4.5.2 Liquid

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Feed

8.4.6.2 Supplements

8.4.6.3 Food

8.4.6.4 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Astaxanthin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Synthetic

8.5.4.2 Natural

8.5.5 Historic and Forecasted Market Size by Form

8.5.5.1 Powder

8.5.5.2 Liquid

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Feed

8.5.6.2 Supplements

8.5.6.3 Food

8.5.6.4 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Astaxanthin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Synthetic

8.6.4.2 Natural

8.6.5 Historic and Forecasted Market Size by Form

8.6.5.1 Powder

8.6.5.2 Liquid

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Feed

8.6.6.2 Supplements

8.6.6.3 Food

8.6.6.4 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Astaxanthin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Synthetic

8.7.4.2 Natural

8.7.5 Historic and Forecasted Market Size by Form

8.7.5.1 Powder

8.7.5.2 Liquid

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Feed

8.7.6.2 Supplements

8.7.6.3 Food

8.7.6.4 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Astaxanthin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 851.28 Million |

|

Forecast Period 2025-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1659.24 Million |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||