Global Animal Feed Enzymes Market Overview

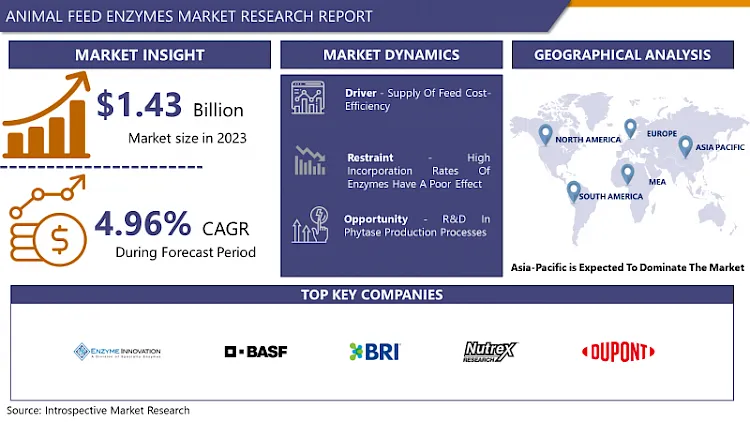

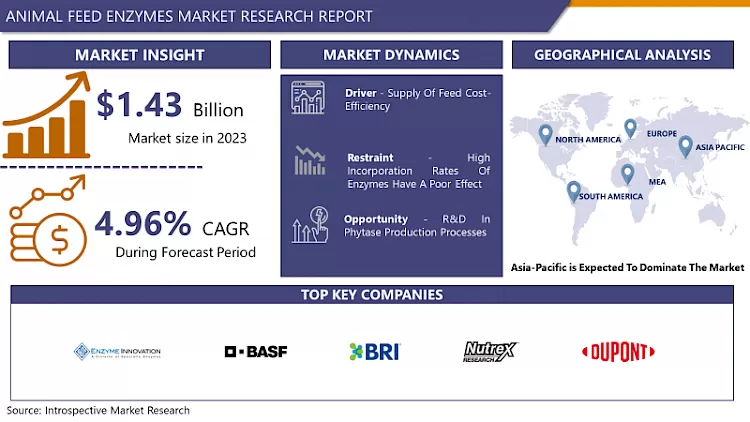

The Global Animal Feed Enzymes market was estimated at USD 1.43 billion in 2023 and is anticipated to reach USD 2.21 billion by 2032, growing at a CAGR of 4.96%.

Enzymes are proteins that aids in the breakdown, and absorption of naturally occurring elements like fiber and phytate in various feed ingredients. Due to the excessive use of synthetic and inorganic fertilizers, the crops are losing their nutritional qualities and some harmful by-products are formed once they are ingested by the livestock. Due to the ongoing crisis, livestock keepers are facing economic challenges because of which the livestock is fed with incompetent fodder. Moreover, this fodder contains harmful elements which hinder the digestion process of the livestock so to compensate certain important enzymes are used which aids the livestock indigestion and this would help the animal feed market to flourish during the forecast period. The cellulase enzyme helps in the digestion of the cellulose polysaccharide and breakdowns the fiber, glucan’s acts on non-starch polysaccharides and breaks down the fiber. Proteases act on the protein components and help in the degradation of the proteins into amino acids which are the essential building blocks for livestock. The rapidly growing livestock sector and the decrease in the productivity of competent fodder are expected to give a boost to the sector.

Furthermore, the enzymes enhance the energy level as well as the rate of metabolism in the livestock which significantly boots the livestock's resistance to diseases. Animal feed is expensive Moreover, only 25% of feed is absorbed by the livestock rest is excreted in the form of waste so to lower the expenditure feed enzymes will play a vital role as it will enhance the uptake of nutrients as well as enhance the nutritional attributes of feed. All these efforts are made to elevate the nutrition quality and to reduce the expenditure on animal feed.

Market Dynamic Factors of The Animal Feed Enzymes Market

Drivers:

Supply Of Feed Cost-Efficiency

Animal feed manufacturing accounts for a major operational cost, which involves 50%–60% of the total cost in animal feed production. Hence, decreasing feed costs per livestock remains a priority for every livestock rearer. The potential to enhance the digestibility of feed depends largely on the nutritional value of the diet itself. It has been shown that feed can record up to 90% of the variance in response to enzyme addition. By boosting digestibility, the nutrient density of diets and production costs can be minimized. Based on the evaluation overall effect of enzymes on the indigestible dietary fraction, feed enzymes are applied to maintain livestock performance, while decreasing feed costs.

Restraints:

High Incorporation Rates Of Enzymes Have A Poor Effect

Even though animal feed enzymes considerably influence the growth of the livestock industry, there are physiological limits foisted by the conditions to enzyme responses in the digestive tract of livestock. High levels of feed enzymes could impact the levels of endogenous enzymes in the gastrointestinal tract, with a poor impact on health. Differentiations in the segments of this effect depend on many factors, such as type of diet, age, and enzyme inclusion rates in feed products. Feed enzymes may set off various side effects, such as diarrhea, vomiting, gas, and swelling of the legs and feet. Additionally, some animals may occurrence allergic reactions to digestive enzymes. For example, Bromelain, the enzyme from pineapple, has anti-platelet properties. If this enzyme is offered to livestock in high quantities along with feed, it could raise the risk of bleeding as play as a blood thinner.

Opportunities:

R&D In Phytase Production Processes

According to the primary research, it is known that some fungi can grow in POME (palm oil mill effluent) and have the capability to manufacture phytase enzymes. The applications of phytase enzymes containing feed products for monogastric and digastric livestock could raise the efficiency of nutrient uptake and livestock resistance to disease attacks. Palm oil mill effluent (POME) is one type of waste that has not been used extensively in enzyme production. Some fungi that grow on POME indicate their capability of manufacturing phytase. The POME is disposed of and contaminates the environment. Apart from this, POME is one of the wastes that hold large concentrations of carbohydrates, proteins, nitrogen compounds, lipids, and minerals. Hence, they also play as remarkable raw material for bioconversion by biotechnological techniques.

Market Segmentation

Segmentation for the Animal Feed Enzymes Market

Based on the Livestock, the swine segment is projected to dominate the market over the forecast period. After poultry, the swine segment holds the maximum share in the market during the forecast period. After all swine livestock is unfit to utilize all components of its diet fully, specific enzymes can be added to the feed to help break down complex carbohydrates, protein, and phytate, through carbohydrase, protease, and phytase. Carbohydrates are the most successful in the feed of starters. The main carbohydrate in the swine diet is glucose, supplied by starch in corn. About 95% of the starch in corn can be digested. Therefore, not all carbohydrates in corn are starch. The more complex carbohydrates are known as fibers and are not well-utilized by pigs.

Based on the Source, the microorganism segment is expected to hold maximum share in the market over the forecast period, due to the higher usage of these sources to extract feed enzymes. Microorganisms remain highly important and suitable hosts to manufacture stable and industrially important feed enzymes. Enzymes obtained from microorganisms are of great importance in the production of animal feed.

Based on Product Type, carbohydrase dominates the market during the projected period. Carbohydrase’s are chosen by most animal feed-produced and livestock producers to be utilized as an enzyme. Hence, the segment is approximated to be the fastest-growing feed enzymes market over the projected period. The incorporation of carbohydrates in the feed caters to many advantages to the livestock. Monogastric animals are typically able to digest around 90% of accessible starch, but carbohydrates support them to boost this percentage. Carbohydrase enzymes are also very effective in growing the amount of energy made available from feed ingredients.

Based on the Form, the dry segment is projected to account for the largest share in the animal feed enzymes market during the forecast period. These products are highly preferred across liquid-based additives due to factors such as ease of handling, good thermal stability during fodder processing operations, and advanced enzyme activity. Dry formulations are accessible in powdered and pellet grades in the global market. This segment is expected to have significant penetration in ruminant and poultry applications over the years ahead.

Regional Analysis for Animal Feed Enzymes Market:

Asia Pacific region is projected to observe the most significant growth for the animal feed enzymes market owing to key socio-economic factors including growing meat consumption in China, India, and other economies in Southeast Asia. Moreover, increasing awareness about livestock diseases has led to the acceptance of safe animal nutrition practices. This factor, in turn, is probably to play a vital role in driving the demand for animal feed additives in the region.

Europe region is expected to witness the highest growth of the animal feed enzymes market after APAC. The major economies such as Spain and Russia are expected to witness significant industry growth during the projected period. Currently, Germany and Spain hold the maximum livestock production sector over the entire of Europe. The presence of a strong customers industry coupled with a properly working distribution network is the major growth supporter. Economies in the eastern part of Europe, including Russia, are expected to portray the fastest reach due to rising livestock production and growing pork consumption.

Players Covered in Animal Feed Enzymes Market are:

- Enzyme Innovation (US)

- BASF SE(Germany)

- Bioresource International Inc. (US)

- Eukaryotic Biologicals Pvt Ltd (India)

- Nutrex BE (Central Florida)

- AB Enzymes GmbH (Germany)

- Koninklijke DSM (Netherlands)

- DuPont (US)

- Chr. Hansen Holding a/s (Denmark)

- Novozymes (Denmark)

- Aum enzymes (India)

- Caprienzymes (India) and Others Major players

Key Industry Development in Animal Feed Enzymes Market

- In January 2023, Novus International completed the acquisition of Agrivida, a biotech company, intending to create new feed additives.

- In March 2024, Novus International was set to bolster its innovation pipeline through the acquisition of US enzyme company BioResource International, BRI's existing product portfolio, Novus, a prominent methionine manufacturer, will assume control of the company's facilities in North Carolina.

|

Global Animal Feed Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.96% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Animal Feed Enzymes Market by Type (2018-2032)

4.1 Animal Feed Enzymes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cellulase

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Proteases

4.5 Phytases

4.6 Alpha-Amylase

4.7 Carbohydrase

4.8 Non-Starch Polysaccharides

4.9 Others

Chapter 5: Animal Feed Enzymes Market by Source (2018-2032)

5.1 Animal Feed Enzymes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Animal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Microorganisms

5.5 Plant

Chapter 6: Animal Feed Enzymes Market by Form (2018-2032)

6.1 Animal Feed Enzymes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Dry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Liquid

Chapter 7: Animal Feed Enzymes Market by Livestock (2018-2032)

7.1 Animal Feed Enzymes Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Swine

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Poultry

7.5 Aquaculture

7.6 Sheep's

7.7 Goats

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Animal Feed Enzymes Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ARCHER DANIELS MIDLAND COMPANY (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CARGILL INC. (THE US)

8.4 BREMIL GROUP (BRAZIL)

8.5 SHANDONG YUXIN BIO-TECH (CHINA)

8.6 DOWDUPONT INC(US)

8.7 SONIC BIOCHEM EXTRACTION PVT.LTD (INDIA)

8.8 VICTORIA GROUP A. D. (SERBIA)

8.9 DPS/DUTCH PROTEIN & SERVICES B.V. (NETHERLANDS)

8.10 LINYI SHANSONG BIOLOGICAL PRODUCTS CO.LTD. (CHINA)

8.11 WILMAR INTERNATIONAL LTD (SINGAPORE)

8.12 CROWN SOYA PROTEIN GROUP (CHINA)

8.13 SONIC BIOCHEM (INDIA)

8.14 HUNG YANG FOODS CO.LTD. (NETHERLANDS)

Chapter 9: Global Animal Feed Enzymes Market By Region

9.1 Overview

9.2. North America Animal Feed Enzymes Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Cellulase

9.2.4.2 Proteases

9.2.4.3 Phytases

9.2.4.4 Alpha-Amylase

9.2.4.5 Carbohydrase

9.2.4.6 Non-Starch Polysaccharides

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size by Source

9.2.5.1 Animal

9.2.5.2 Microorganisms

9.2.5.3 Plant

9.2.6 Historic and Forecasted Market Size by Form

9.2.6.1 Dry

9.2.6.2 Liquid

9.2.7 Historic and Forecasted Market Size by Livestock

9.2.7.1 Swine

9.2.7.2 Poultry

9.2.7.3 Aquaculture

9.2.7.4 Sheep's

9.2.7.5 Goats

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Animal Feed Enzymes Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Cellulase

9.3.4.2 Proteases

9.3.4.3 Phytases

9.3.4.4 Alpha-Amylase

9.3.4.5 Carbohydrase

9.3.4.6 Non-Starch Polysaccharides

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size by Source

9.3.5.1 Animal

9.3.5.2 Microorganisms

9.3.5.3 Plant

9.3.6 Historic and Forecasted Market Size by Form

9.3.6.1 Dry

9.3.6.2 Liquid

9.3.7 Historic and Forecasted Market Size by Livestock

9.3.7.1 Swine

9.3.7.2 Poultry

9.3.7.3 Aquaculture

9.3.7.4 Sheep's

9.3.7.5 Goats

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Animal Feed Enzymes Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Cellulase

9.4.4.2 Proteases

9.4.4.3 Phytases

9.4.4.4 Alpha-Amylase

9.4.4.5 Carbohydrase

9.4.4.6 Non-Starch Polysaccharides

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size by Source

9.4.5.1 Animal

9.4.5.2 Microorganisms

9.4.5.3 Plant

9.4.6 Historic and Forecasted Market Size by Form

9.4.6.1 Dry

9.4.6.2 Liquid

9.4.7 Historic and Forecasted Market Size by Livestock

9.4.7.1 Swine

9.4.7.2 Poultry

9.4.7.3 Aquaculture

9.4.7.4 Sheep's

9.4.7.5 Goats

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Animal Feed Enzymes Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Cellulase

9.5.4.2 Proteases

9.5.4.3 Phytases

9.5.4.4 Alpha-Amylase

9.5.4.5 Carbohydrase

9.5.4.6 Non-Starch Polysaccharides

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size by Source

9.5.5.1 Animal

9.5.5.2 Microorganisms

9.5.5.3 Plant

9.5.6 Historic and Forecasted Market Size by Form

9.5.6.1 Dry

9.5.6.2 Liquid

9.5.7 Historic and Forecasted Market Size by Livestock

9.5.7.1 Swine

9.5.7.2 Poultry

9.5.7.3 Aquaculture

9.5.7.4 Sheep's

9.5.7.5 Goats

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Animal Feed Enzymes Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Cellulase

9.6.4.2 Proteases

9.6.4.3 Phytases

9.6.4.4 Alpha-Amylase

9.6.4.5 Carbohydrase

9.6.4.6 Non-Starch Polysaccharides

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size by Source

9.6.5.1 Animal

9.6.5.2 Microorganisms

9.6.5.3 Plant

9.6.6 Historic and Forecasted Market Size by Form

9.6.6.1 Dry

9.6.6.2 Liquid

9.6.7 Historic and Forecasted Market Size by Livestock

9.6.7.1 Swine

9.6.7.2 Poultry

9.6.7.3 Aquaculture

9.6.7.4 Sheep's

9.6.7.5 Goats

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Animal Feed Enzymes Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Cellulase

9.7.4.2 Proteases

9.7.4.3 Phytases

9.7.4.4 Alpha-Amylase

9.7.4.5 Carbohydrase

9.7.4.6 Non-Starch Polysaccharides

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size by Source

9.7.5.1 Animal

9.7.5.2 Microorganisms

9.7.5.3 Plant

9.7.6 Historic and Forecasted Market Size by Form

9.7.6.1 Dry

9.7.6.2 Liquid

9.7.7 Historic and Forecasted Market Size by Livestock

9.7.7.1 Swine

9.7.7.2 Poultry

9.7.7.3 Aquaculture

9.7.7.4 Sheep's

9.7.7.5 Goats

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Animal Feed Enzymes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.96% |

Market Size in 2032: |

USD 2.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Form |

|

||

|

By Livestock |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Animal Feed Enzymes Market research report is 2024-2032.

Koninklijke DSM N.V., Novozymes, BASF SE, DuPont, Enzyme Innovation, AB Enzymes GmbH, and Other Major Players.

The Animal Feed Enzymes Market is segmented into Type, Source, Form, Livestock, and Region. By Type, the market is categorized into Cellulase, Proteases, Phytases, Alpha-Amylase, Carbohydrase, Non-Starch Polysaccharides, and Others. By Source the market is categorized into Animal, Microorganisms, and Plant. By Form, the market is categorized into Dry, and Liquid. By Livestock, the market is categorized into Swine, Poultry, Aquaculture, Sheep's, Goats, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Enzymes are proteins that aids in the breakdown, and absorption of naturally occurring elements like fiber and phytate in various feed ingredients. Due to the excessive use of synthetic and inorganic fertilizers, the crops are losing their nutritional qualities and some harmful by-products are formed once they are ingested by the livestock. Enzymes enhance the energy level as well as the rate of metabolism in the livestock which significantly boots the livestock's resistance to diseases.

The Global Animal Feed Enzymes market was estimated at USD 1.43 billion in 2023 and is anticipated to reach USD 2.21 billion by 2032, growing at a CAGR of 4.96%.