Global Amniotic Products Market Overview

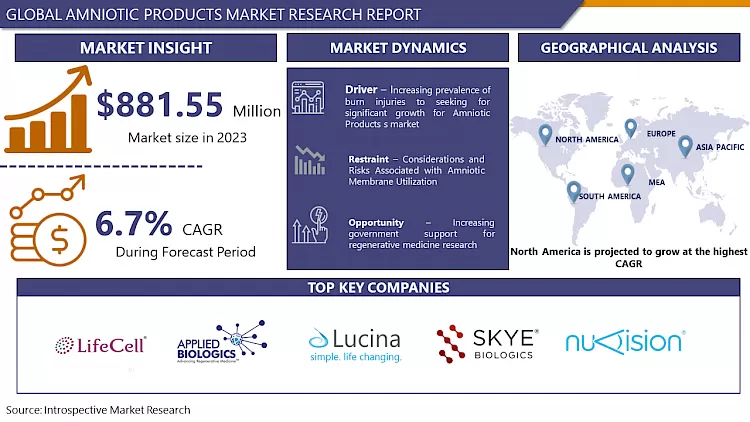

Global Amniotic Products Market was valued at USD 881.55 Million in 2023 and is expected to reach USD 1580.25 Million by the year 2032, at a CAGR of 6.7%.

The amniotic products market is located in regenerative medicine and utilizes the special characteristics of amniotic membranes, which are stored in cryopreserved or dehydrated form for different medical uses. Most commonly used in wound care, ophthalmology, and orthopedics, these membranes demonstrate anti-inflammatory and wound-healing capabilities. Hospitals and surgical centers are currently at the forefront in their utilization, but an increase appears to be on the horizon. Causes driving market expansion include the need for cutting-edge wound healing options, the discovery of fresh ophthalmic uses, and the increasing incidence of long-term illnesses. Supportive regulatory environments, particularly in areas such as China and India, also contribute to promoting innovation and expanding markets. Staying updated on advancements by monitoring new application research, tracking clinical trials, and following industry publications is crucial.

The studies on the advantages and potency of amniotic tissue in wounds date back over 100 years. Therefore, these characteristics make amniotic allografts an attractive wound biomaterial. Amniotic fluid allograft is a product that contained human amniotic membrane and amniotic fluid components obtained from the placental tissue of consenting mothers at the time of a live, full-term elective Cesarean birth. In recent years, Amniotic Products s research has developed treatments for a myriad of orthopedic conditions, incorporating osteoarthritis and plantar fasciitis. Moreover, it is being analyzed as a treatment for several other musculoskeletal conditions. The growing number of traumatic wounds and the growth in ophthalmology, orthopedic, and cosmetic surgeries will have an extreme impact on the growth of the market of Amniotic Products.

Market Dynamics And Factors For The Amniotic Products Market

Drivers:

An increasing prevalence of burn injuries to seeking for significant growth for Amniotic Products s market. Cases related to burn wounds and injuries have increased highly over the years. As the World Health Organization (WHO) states that nearly 180000 deaths are caused owing to burns every year. The statistics by the WHO further highlight that more than 1000000 people are moderately or adversely burnt every year. These statistics shed light on the requirement for treatment to decline the effect of the wounds. As Amniotic Products s are used for healing such wounds, the demand is anticipated to increase.

Additionally, as per the WHO, a majority of burn cases arise in low- and middle-income countries, and almost two-thirds occur in the WHO African and Southeast Asian regions. For example, in India, 1 million people bear moderate and adverse burns every year (Source: WHO). The prevalence of burns is also high in other Southeast Asian countries such as Bangladesh and Nepal. Furthermore, the execution of acts and various government initiatives to stimulate regenerative medicine research brings significant Amniotic Products market growth opportunities. Many economies are targeting improving research in regenerative medicine. This aspect may have a great impact on the expansion of the Amniotic Products market during the forecast period. Fast-track approvals for novel regenerative medicine products and other factors are also looked upon by launching various acts and initiatives. Therefore, these factors will bring major Amniotic Products market growth prospects.

Restraints:

Amniotic membranes are not to be utilized arbitrarily since there could be an occasional risk of complications. The patient or the recipient of an amniotic membrane could transmit bacterial, viral, or fungal infections if the donors are not acceptably screened for communicable diseases. Other risks to the patient/recipient may also occur if the membrane is not processed under sterile conditions, or if the membrane is inappropriately stored. Incidence rates of 1.6% to 8.0% have been recorded post amniotic membrane transplantation, with gram-positive isolates being registered most frequently. Also, premature degradation of an amniotic membrane and cheese wiring may further lead to frequent and repetitive transplantations, which in itself is a risk.

Opportunities:

Increasing government support for regenerative medicine research

Increased government support for regenerative medicine research presents a significant opportunity for the amniotic products market. This funding boost will accelerate research into the therapeutic applications of amniotic tissues. Government grants can fund clinical trials that explore the effectiveness of amniotic membrane products in treating a wider range of conditions. This could include anything from chronic wounds and burns to neurological disorders and organ failure. Positive results from these trials will build stronger scientific evidence for the use of amniotic products, leading to wider adoption by healthcare professionals.

Increased government investment can streamline regulations and create a more favorable environment for the development and commercialization of amniotic products. This could involve simplifying the approval process for new amniotic-based therapies or providing financial incentives for companies to invest in research and manufacturing. With smoother regulations and potential tax breaks, companies will be more likely to enter the amniotic products market, leading to a wider variety of products and potentially lower costs for patients. This overall growth in the regenerative medicine field, fueled by government support, will directly translate to a larger and more lucrative market for amniotic products.

Scope of the Amniotic Products Market

The main goal of this report is to help users understand the Amniotic Products market in terms of its definition, segmentation, market potential, influential trends, and challenges facing the market. In-depth research and analysis took place while preparing the report. Readers will find this report very helpful to in-depth understanding of the market.

Market Segmentation

Segmentation Analysis of Amniotic Products Market:

Based on the Type, the amniotic membrane segment is expected to register the highest Amniotic Products s market share over the forecast period. The maximum share of this segment can be attributed to its increased usage in several procedures and amniotic membranes are more effective than amniotic suspensions. Amniotic membrane has different antimicrobial and biological properties in corneal surgery, as it improves epithelialization, reinforces adhesion of basal epithelial cells, maintains epithelial phenotype, and modulates the proliferation of normal corneal, conjunctival, and limbal fibroblast. These membranes are also a defense against apoptosis, as well as inflammation, inhibit scarring, and neovascularization.

Based on Application, the wound care segment is expected to dominate the market of Amniotic Products s over the forecast period. Owing to the rising incidence of ulcers, traumatic and surgical wounds, and burns, and the requirement for advanced technologies for treatment. Amniotic Products s may be utilized for wounds that are chronic and non-healing. Furthermore, the human amniotic membrane has been utilized to treat different types of wounds for over 100 years. Research has shown that placental tissues can promote angiogenesis and new tissue formation, overcome scar tissue formation, modulate inflammation and pain, and may have anti-microbial effects.

Based on End-Users, the ambulatory surgery centers (ASCs) segment is expected to hold a larger Amniotic Products s market share in the forecast period. The growth of the market of Amniotic Products s is attributed to the rising demand for wound care biologics such as amniotic tissue products in hospitals and ASCs. In addition, rising incidence of hospital-acquired pressure ulcers, the growing number of adverse burn cases and rising consciousness regarding advanced burn care treatment, and the availability of reimbursement.

Regional Analysis of Amniotic Products Market:

North America dominates the global amniotic products market, driven by its advanced healthcare infrastructure, favorable reimbursement policies, high adoption of advanced therapies, and growing demand for specialized care due to an aging population. With well-established hospitals, clinics, and research institutions, the region facilitates the development and implementation of amniotic product technologies. Government and private insurance programs often cover costs, enhancing accessibility. The region's healthcare providers are early adopters of cutting-edge medical technologies, making amniotic products, with their potential for wound healing and tissue regeneration, particularly appealing. Looking ahead, researchers are exploring new frontiers in regenerative medicine, envisioning applications in tissue regeneration, skin grafts, burn repair, organ regeneration, and stem cell therapy, leveraging the rich source of stem cells found in amniotic fluid.

Players Covered in Amniotic Products Market are :

- LifeCell International Pvt. Ltd. (India)

- Applied Biologics (US)

- Lucina BioSciences (US)

- Skye Biologics Holdings

- LLC (US)

- Nuvision Biotherapies Limited (UK)

- AlloSource (US)

- MiMedx (US)

- Surgilogix (US)

- Smith & Nephew (UK)

- Organogenesis Inc. (US)

- Integra Lifesciences Corporation (US)

- Stryker (US)

- Next Biosciences (South Africa)

- Celularity

- Inc. (the US)

- NuVision Biotherapies Ltd. (UK)

- Katena Products

- Inc. (US)

- Surgenex (US)

- TissueTech

- Inc. (the US)

- Ventris Medical

- LLC (US)

- StimLabs LLC (US)

- VIVEX Biologics

- Inc. (the US)

- Genesis Biologics (US)

- Tides Medical (US)

- Orthofix Medical Inc. (US)

- Merakris Therapeutics (US)

- MTF Biologics (US) and others major players.

Key Industry Developments In The Amniotic Products Market

- In 2021, MiMedx (US) obtained approval from the Japanese Ministry of Health, Labour, and Welfare for the commercialization of EPIFIX in Japan.

- In 2021, Organogenesis Inc. (US) introduced ReNu an amniotic suspension, the company also obtained approval from the US FDA by granting the Regenerative Medicine Advanced Therapy designation for application in knee osteoarthritis.

- In February 2022, Amnio Technology unveiled two groundbreaking additions to its lineup of amniotic tissue allografts, PalinGen® Dual-Layer Membrane and Dual Layer PalinGen® X-Membrane. These FDA-recognized products boast minimal manipulation, homologous use, and chorion-free composition. With their unique dual-layered design, these allografts offer enhanced durability and slower resorption, making them well-suited for diverse applications in wound management and surgical procedures. Senior Director of New Product Development, Robert Diller, PhD, highlighted the strategic focus on improving efficacy in complex surgical settings.

- In April 2022, Sanara MedTech Inc. revealed its acquisition of Precision Healing Inc., marking a significant move in the competitive landscape of the amniotic products market. Sanara's merger with Precision Healing, a pioneer in chronic wound diagnosis technologies, is poised to revolutionize patient care. Ron Nixon, Sanara's Executive Chairman, expressed optimism about Precision Healing's multispectral imager and biomarker assay, anticipating improved diagnosis and treatment outcomes for chronic wounds, aligning with the growing demand for advanced wound care solutions.

|

Global Amniotic Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 881.55 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 1580.25 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Amniotic Products Market by Type (2018-2032)

4.1 Amniotic Products Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Amniotic Membranes {Cryopreserved

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dehydrated}

4.5 Amniotic Suspensions

Chapter 5: Amniotic Products Market by Application (2018-2032)

5.1 Amniotic Products Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wound Care

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ophthalmology

5.5 Orthopedics

5.6 Other

Chapter 6: Amniotic Products Market by End-User (2018-2032)

6.1 Amniotic Products Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 ASCs

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Amniotic Products Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 STERIS CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GETINGE AB

7.4 3M COMPANY

7.5 BELIMED AG

7.6 MATACHANA GROUP

7.7 MMM GROUP

7.8 CANTEL MEDICAL CORPADVANCED STERILIZATION PRODUCTS (ASP)

7.9 STERIZON LLC

7.10 JOHNSON & JOHNSON

7.11 SOTERA HEALTH

7.12 TUTTNAUER

7.13 MELAG MEDIZINTECHNIK GMBH & CO. KG

7.14 STERIGENICS INTERNATIONAL LLC

7.15 B. BRAUN MELSUNGEN AG

7.16 BETA STAR LIFE SCIENCE EQUIPMENT

7.17 ANDERSON PRODUCTS INCE-BEAM SERVICES INCCISA GROUP

7.18 CONSOLIDATED STERILIZER SYSTEMS

7.19 OTHERS

Chapter 8: Global Amniotic Products Market By Region

8.1 Overview

8.2. North America Amniotic Products Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Amniotic Membranes {Cryopreserved

8.2.4.2 Dehydrated}

8.2.4.3 Amniotic Suspensions

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Wound Care

8.2.5.2 Ophthalmology

8.2.5.3 Orthopedics

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Hospitals

8.2.6.2 ASCs

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Amniotic Products Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Amniotic Membranes {Cryopreserved

8.3.4.2 Dehydrated}

8.3.4.3 Amniotic Suspensions

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Wound Care

8.3.5.2 Ophthalmology

8.3.5.3 Orthopedics

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Hospitals

8.3.6.2 ASCs

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Amniotic Products Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Amniotic Membranes {Cryopreserved

8.4.4.2 Dehydrated}

8.4.4.3 Amniotic Suspensions

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Wound Care

8.4.5.2 Ophthalmology

8.4.5.3 Orthopedics

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Hospitals

8.4.6.2 ASCs

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Amniotic Products Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Amniotic Membranes {Cryopreserved

8.5.4.2 Dehydrated}

8.5.4.3 Amniotic Suspensions

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Wound Care

8.5.5.2 Ophthalmology

8.5.5.3 Orthopedics

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Hospitals

8.5.6.2 ASCs

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Amniotic Products Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Amniotic Membranes {Cryopreserved

8.6.4.2 Dehydrated}

8.6.4.3 Amniotic Suspensions

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Wound Care

8.6.5.2 Ophthalmology

8.6.5.3 Orthopedics

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Hospitals

8.6.6.2 ASCs

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Amniotic Products Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Amniotic Membranes {Cryopreserved

8.7.4.2 Dehydrated}

8.7.4.3 Amniotic Suspensions

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Wound Care

8.7.5.2 Ophthalmology

8.7.5.3 Orthopedics

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Hospitals

8.7.6.2 ASCs

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Amniotic Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 881.55 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.7% |

Market Size in 2032: |

USD 1580.25 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Amniotic Products Market research report is 2024-2032.

LifeCell International Pvt. Ltd. (India), Applied Biologics (US), Lucina BioSciences (US), Skye Biologics Holdings, LLC (US), Nuvision Biotherapies Limited (UK), AlloSource (US), MiMedx (US), Surgilogix (US), Smith & Nephew (UK), Organogenesis Inc. (US), Integra Lifesciences Corporation (US), Stryker (US), Next Biosciences (South Africa), Celularity, Inc. (the US), NuVision Biotherapies Ltd. (UK), Katena Products, Inc. (US), Surgenex (US), TissueTech, Inc. (the US), Ventris Medical, LLC (US), StimLabs LLC (US), VIVEX Biologics, Inc. (the US), Genesis Biologics (US), Tides Medical (US), Orthofix Medical Inc. (US), Merakris Therapeutics (US), MTF Biologics (US), and Other Major Players.

Amniotic Products Market is segmented into Type, Application, End-User and region. By Type, the market is categorized into Amniotic Membranes {Cryopreserved, Dehydrated}, Amniotic Suspensions. By Application, the market is categorized into Wound Care, Ophthalmology, Orthopedics, Other. By End-User, the market is categorized into Hospitals, ASCs, Others. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Advancement in regenerative medicine, the Amnio Technology line of products is manufactured from human amniotic membrane and fluid. These amniotic tissues, or allografts, are transplanted to offer protection and support for native tissues in the body.

Global Amniotic Products Market was valued at USD 881.55 Million in 2023 and is expected to reach USD 1580.25 Million by the year 2032, at a CAGR of 6.7%.