Amaranth Oil Market Synopsis

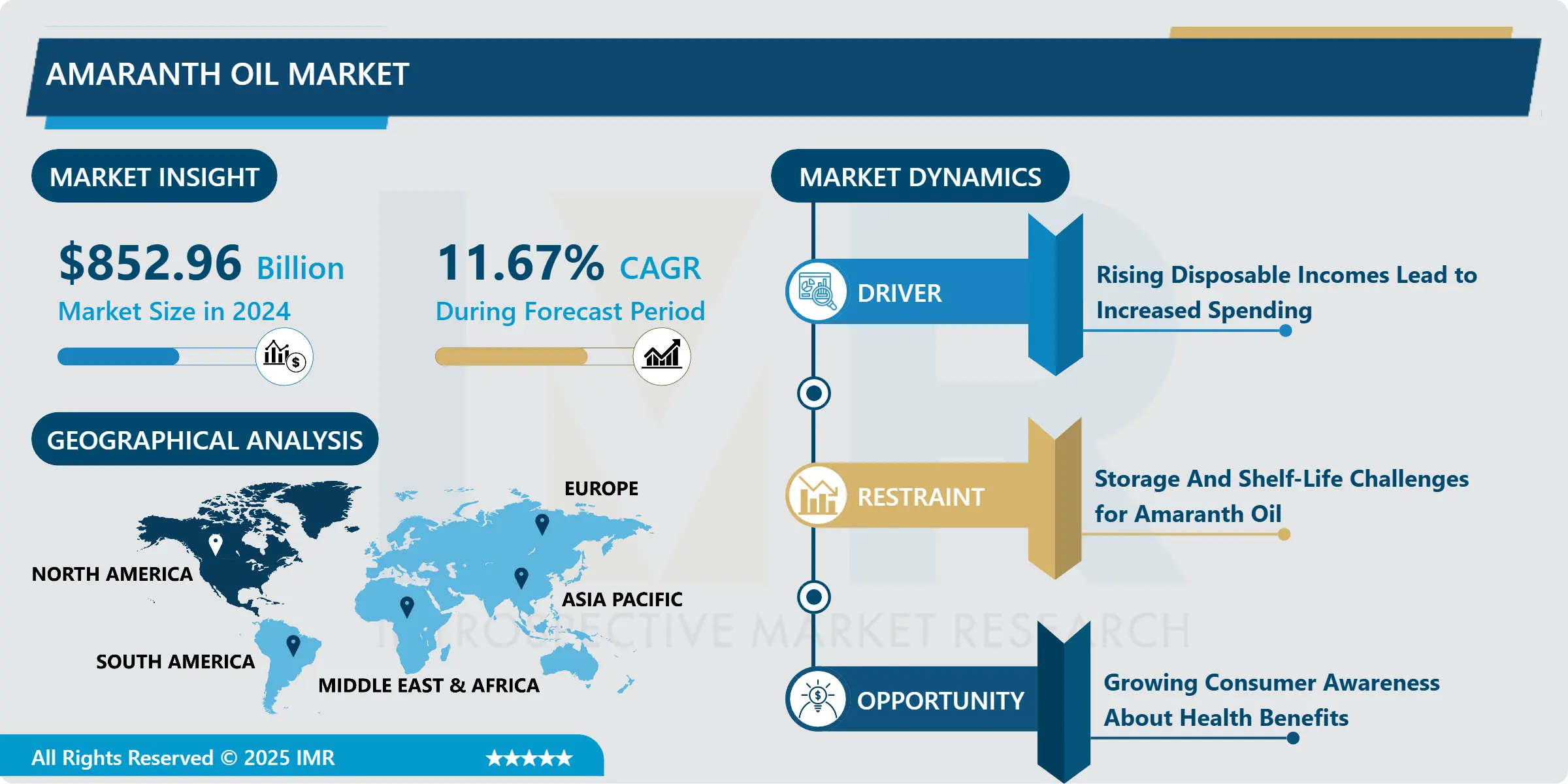

Amaranth Oil Market Size Was Valued at USD 852.96 Billion in 2024 and is Projected to Reach USD 2872.3 Billion by 2035, Growing at a CAGR of 11.67% From 2025-2035.

Amaranth oil is a type of oil which is obtained from amaranth seeds. Amaranth oil is one of the types that is rich in vitamin E, which is present in amaranth oil in a very rare tocotrienol form, which makes its antioxidant properties almost 40-50 times more than in the tocopherol form of the same vitamin. Amaranth oil consumption can help to reduce the risk of cancer.

The components that drive the development of the amaranth seed oil showcase incorporate the useful properties of amaranth oil such as tall squalene substance, tall sustenance esteem, its skin-identical nature, and temperature flexibility. The variables that demonstrate prevention in the development of the showcase are the tall fetched of generation, negligible to nil administrative bolster, and need for crude fabric availability

Amaranth seed oil has squalene that confers anti-aging, anti-inflammatory, and anti-oxidation properties separated from being a common skin-identical chemical that is promptly ingested by the skin. These properties have found numerous applications for amaranth seed oil in the beauty care products and individual care industry. The increment in requests for restorative and individual care items made from common fixings has assist expanded the request for amaranth oil from this industry

Squalene too demonstrates advantages for therapeutic purposes with its cell restoration anti-oxidation, and resistant framework: reinforcing properties. Amaranth seed oil is progressively being joined in pharmaceutical details to decrease the medication measurement and the related side impacts. Amaranth oil, as a wealthy source of squalene, has moreover found application in cancer therapies.

Amaranth Oil Market Trend Analysis

Amaranth Oil Market Growth Drivers- Rising Disposable Incomes Lead to Increased Spending

- As the day-by-day income level rises, consumers have more purchasing power, leading to a rise in spending on health and wellness products such as amaranth oil. Amaranth, being rich in protein, Fiber, and micronutrients, fits into this trend of health-conscious consumption. Increased disposable income may lead to a higher demand for premium or organic amaranth products, driving growth in the market with a growing awareness of its nutritional benefits and therapeutic properties, consumers are willing to invest in premium-quality oils. This trend drives demand within the amaranth oil market, fuelling growth and innovation.

- Consequently, as disposable incomes continue to increase, they serve as a significant driver propelling the expansion of the market. With higher income, consumers may be willing to explore a wider range of amaranth-based products beyond just the grain itself. This could include value-added products such as amaranth flour, snacks, breakfast cereals, or even beverages. Manufacturers may respond to this demand by diversifying their product lines and offering innovative options to cater to different consumer preferences.

Amaranth Oil Market Opportunity- Growing Consumer Awareness About Health Benefits

- As consumers become more health-conscious, there's a growing interest in natural and functional foods that offer specific health benefits. Amaranth oil is rich in unsaturated fatty acids, including omega-6 and omega-9, as well as vitamin E and other antioxidants. Positioning amaranth oil as a functional ingredient that supports heart health, skin health, and overall well-being can appeal to health-conscious consumers. The growing nutraceutical market offers opportunities for amaranth oil as a dietary supplement. Amaranth oil capsules or soft gels can be marketed as a source of essential fatty acids and antioxidants, targeting consumers seeking to support cardiovascular health, cognitive function, and immune system health.

- While the use of amaranth oil is relatively niche compared to other vegetable oils, there's potential for expansion into new markets and regions. Targeting regions with growing health and wellness trends or a preference for natural and traditional ingredients can help broaden the market for amaranth oil beyond its current niche. The amaranth oil market presents significant opportunities for growth and innovation across various industries, including health and wellness, beauty and personal care, nutraceuticals, functional foods, and supplements. By leveraging its nutritional properties and functional benefits, companies can capitalize on the growing demand for natural, healthy ingredients in the market.

Amaranth Oil Market Segmentation

Amaranth Oil Market is Segmented based on extraction type, packaging type, and application

By Type, Cold Pressing Process Segment is Expected to Dominate the Market During the Forecast Period

- Cold-pressed extraction method involves mechanically pressing the amaranth seeds to extract the oil without using heat or chemical solvents. This gentle process helps retain the oil's natural flavour, aroma, colour, and nutritional components such as essential fatty acids, vitamins, and antioxidants. As a result, cold-pressed amaranth oil is often perceived as superior in quality and nutritional value compared to oils extracted using solvent-based methods.

- Consumer Preferences for Natural Products and minimally processed products, there is a growing preference for oils extracted using cold-press methods. Consumers are more inclined to choose products that are perceived as pure, authentic, and free from chemical residues. Cold-pressed amaranth oil aligns with these consumer preferences and may command a premium price in the market due to its natural extraction process.

By Application, Cosmetics and Personal Care, Segment Held the Largest Share of in 2024

- Amaranth oil has gained popularity in the cosmetics and personal care industry due to its purported benefits for skin and hair. Amaranth oil is rich in antioxidants, particularly vitamin E and squalene, which are known for their moisturizing and anti-aging properties. These properties make it a sought-after ingredient in skincare products such as moisturizers, serums, and anti-aging creams. Furthermore, amaranth oil contains high levels of omega-3 and omega-6 fatty acids, which are beneficial for maintaining healthy hair and scalp. It is often used in hair care products like shampoos, conditioners, and hair oils to nourish and strengthen hair follicles.

- The increasing consumer preference for natural and organic ingredients in cosmetics and personal care products has further fuelled the demand for amaranth oil in this segment. As a result, it's not surprising that the cosmetics and personal care segment has become a significant driver of growth in the amaranth oil market. However, it's worth noting that amaranth oil also finds applications in other sectors such as food and pharmaceuticals, where it is valued for its nutritional and medicinal properties. Therefore, while the cosmetics and personal care segment may dominate the market, other sectors also contribute to the overall demand for amaranth oil.

Amaranth Oil Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

- North America has a well-established market for natural and organic products, driven by increasing consumer awareness of health and wellness. The demand for functional foods, dietary supplements, and natural skin care products is growing in the region, creating opportunities for amaranth oil manufacturers and suppliers. Additionally, the presence of key players and a favourable regulatory environment further support market growth in North America.

- North American companies often lead the way in product innovation and development, catering to evolving consumer preferences and demands. With a focus on clean-label, organic, and sustainable products, North American manufacturers are likely to introduce innovative formulations and applications of amaranth oil, further fuelling its dominance in the market.

- In 2023, the production index of the oil extraction industry in the United States stood at an estimated 140. This was a considerable increase from 2020, when the oil extraction industry's production index in the North American country was 110.

Top Key Players in Amaranth Oil Market

- Flavex Naturextrakte GmbH (Germany)

- AMR Amaranth a.s. (Czech Republic)

- Rusolin (Russia)

- AMR Amaranth, LLC(USA)

- Amaranth Bio Company (Ukraine)

- Amaranth Bio (India)

- Amaranth GmbH (Germany)

- Nans Products (India)

- AOS Products Private Limited (India)

- Jiyan Food Ingredients (India)

- Herbs and Crops Overseas (India)

- Nexira (France)

- Braham & Murry (United Kingdom)

- Sannysis (China)

- Hinterland Organic Herbs (Canada)

- All Organic Treasures GmbH (Germany)

- La Tourangelle (France)

- Shanghai Huanhai Health Technology Co., Ltd. (China)

- Parchem fine & specialty chemicals (USA)

- Nature's Brands, Inc. (USA)

- Vysehrad (Czech Republic)

- Mountain Rose Herbs (USA)

- Carrington Farms (USA)

- Rejuv Elixir (USA) (USA)

- Other Active Players

Key Industry Developments in The Amaranth Oil Market

- In Aug 2024, the New Wellness Brand Wellamar include supplements and Topicals Wellamar uses premium Amaranth Oil extracted from organically grown Amaranth plants for its topical and ingestible oils, both in dropper bottles

- In Oct 2023, Evonik launches GMP-quality plant-based squalene Launched last year, PhytoSquene is the first GMP amaranth oil-derived squalene on the market for use in adjuvants in parenteral dosage forms.

|

Global Amaranth Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 852.96 Billion |

|

Forecast Period 2024-35 CAGR: |

11.67% |

Market Size in 2035: |

USD 2872.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Amaranth Oil Market by Type (2018-2035)

4.1 Amaranth Oil Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Supercritical fluid Co2 extraction

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cold pressing

4.5 Organic solvent

Chapter 5: Amaranth Oil Market by Application (2018-2035)

5.1 Amaranth Oil Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cosmetics and personal care

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dietary supplements

5.5 Aromatics

5.6 Pharmaceuticals

5.7 Food and Beverages

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Amaranth Oil Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 FLAVEX NATUREXTRAKTE GMBH (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 AMR AMARANTH A.S. (CZECH REPUBLIC)

6.4 RUSOLIN (RUSSIA)

6.5 AMR AMARANTH

6.6 LLC(USA)

6.7 AMARANTH BIO COMPANY (UKRAINE)

6.8 AMARANTH BIO (INDIA)

6.9 AMARANTH GMBH (GERMANY)

6.10 NANS PRODUCTS (INDIA)

6.11 AOS PRODUCTS PRIVATE LIMITED (INDIA)

6.12 JIYAN FOOD INGREDIENTS (INDIA)

6.13 HERBS AND CROPS OVERSEAS (INDIA)

6.14 NEXIRA (FRANCE)

6.15 BRAHAM & MURRY (UNITED KINGDOM)

6.16 SANNYSIS (CHINA)

6.17 HINTERLAND ORGANIC HERBS (CANADA)

6.18 ALL ORGANIC TREASURES GMBH (GERMANY)

6.19 LA TOURANGELLE (FRANCE)

6.20 SHANGHAI HUANHAI HEALTH TECHNOLOGY COLTD. (CHINA)

6.21 PARCHEM FINE & SPECIALTY CHEMICALS (USA)

6.22 NATURE'S BRANDS INC. (USA)

6.23 VYSEHRAD (CZECH REPUBLIC)

6.24 MOUNTAIN ROSE HERBS (USA)

6.25 CARRINGTON FARMS (USA)

6.26 REJUV ELIXIR (USA) (USA)

Chapter 7: Global Amaranth Oil Market By Region

7.1 Overview

7.2. North America Amaranth Oil Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Supercritical fluid Co2 extraction

7.2.4.2 Cold pressing

7.2.4.3 Organic solvent

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Cosmetics and personal care

7.2.5.2 Dietary supplements

7.2.5.3 Aromatics

7.2.5.4 Pharmaceuticals

7.2.5.5 Food and Beverages

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Amaranth Oil Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Supercritical fluid Co2 extraction

7.3.4.2 Cold pressing

7.3.4.3 Organic solvent

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Cosmetics and personal care

7.3.5.2 Dietary supplements

7.3.5.3 Aromatics

7.3.5.4 Pharmaceuticals

7.3.5.5 Food and Beverages

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Amaranth Oil Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Supercritical fluid Co2 extraction

7.4.4.2 Cold pressing

7.4.4.3 Organic solvent

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Cosmetics and personal care

7.4.5.2 Dietary supplements

7.4.5.3 Aromatics

7.4.5.4 Pharmaceuticals

7.4.5.5 Food and Beverages

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Amaranth Oil Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Supercritical fluid Co2 extraction

7.5.4.2 Cold pressing

7.5.4.3 Organic solvent

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Cosmetics and personal care

7.5.5.2 Dietary supplements

7.5.5.3 Aromatics

7.5.5.4 Pharmaceuticals

7.5.5.5 Food and Beverages

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Amaranth Oil Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Supercritical fluid Co2 extraction

7.6.4.2 Cold pressing

7.6.4.3 Organic solvent

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Cosmetics and personal care

7.6.5.2 Dietary supplements

7.6.5.3 Aromatics

7.6.5.4 Pharmaceuticals

7.6.5.5 Food and Beverages

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Amaranth Oil Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Supercritical fluid Co2 extraction

7.7.4.2 Cold pressing

7.7.4.3 Organic solvent

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Cosmetics and personal care

7.7.5.2 Dietary supplements

7.7.5.3 Aromatics

7.7.5.4 Pharmaceuticals

7.7.5.5 Food and Beverages

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Amaranth Oil Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 852.96 Billion |

|

Forecast Period 2024-35 CAGR: |

11.67% |

Market Size in 2035: |

USD 2872.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||