Active Data Warehousing Market Synopsis

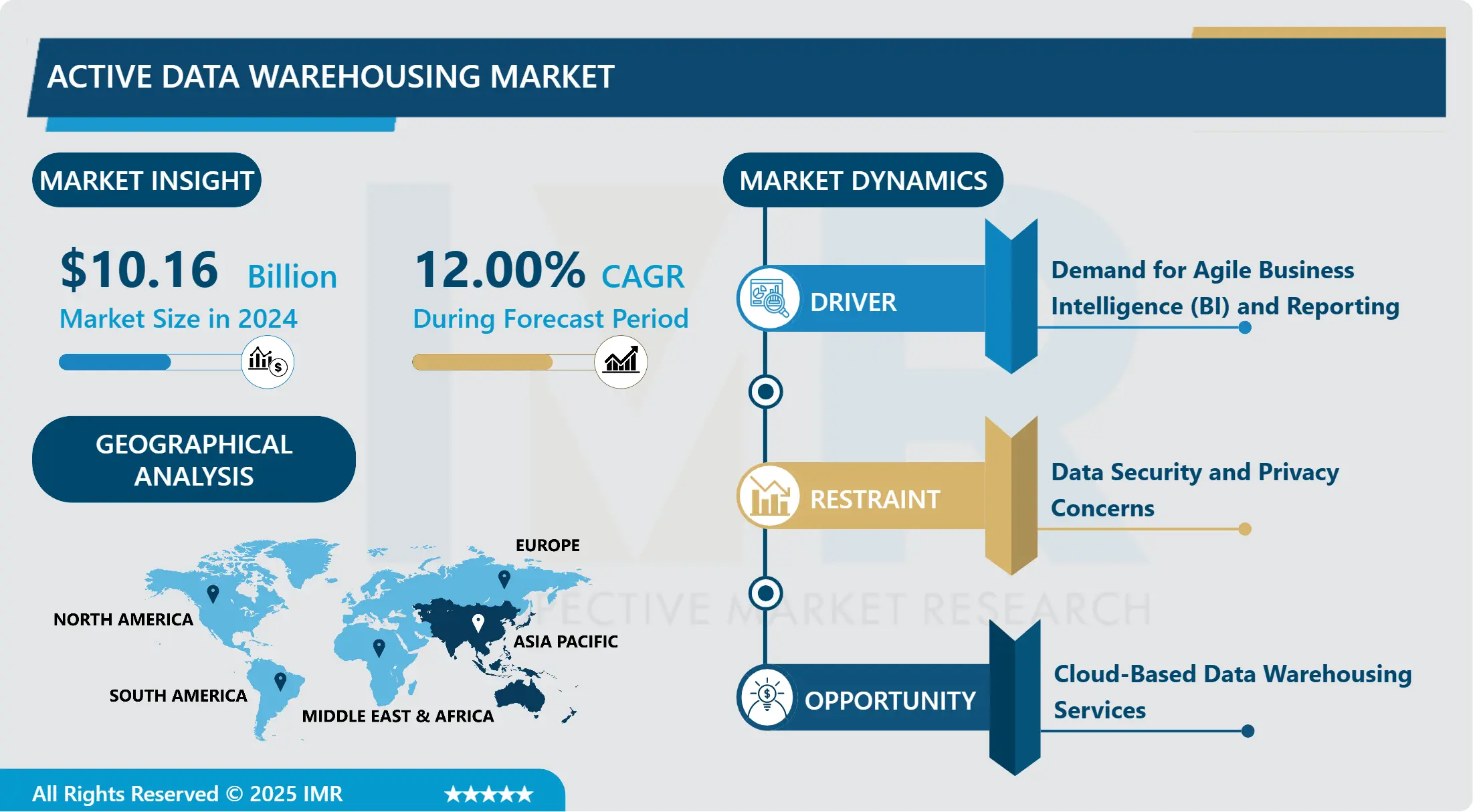

Active Data Warehousing Market Size Was Valued at USD 10.16 Billion in 2024, and is Projected to Reach USD 25.16 Billion by 2032, Growing at a CAGR of 12.00% From 2025-2032.

Active Data Warehousing is an extension of the DW architecture that includes not only passive storage of data for basic analytical purposes after it has been utilized for the transactional processing in operational systems, but also allows for near real-time processing of the data for subsequent analytical usage. This makes it possible for business to arrive at concrete decisions with the most recent information available on the markets. ADW platforms may include connections to executive systems, real-time data generators and analyzers, as well as other applications geared toward delivering real-time information and facilitating decision making. This dynamic approach gives added value to the data warehouse on targeted summaries by constantly updating the data to make it current for strategic uses.

The market for active data warehousing has also shown considerable growth and even some transformation by following the modern trends due to the growing demand for immediate data analysis in various organizations and companies. Real-time data warehousing means a type of data architecture that processes data gathered from different sources by the methods of extraction, transformation, and loading to deal with data immediately and respond to it speedily.

The rapid availability and increasing number of source of data and data types, formats and speed at which data organisations have advanced are some of the factors that has led to the growth of active data warehousing market. In IoT and new age business applications such as social media, communicating devices such as mobiles, and sensors, businesses are now flooded with data whether structured or unstructured, from different sources. And active data warehousing quickly and efficiently stors, processes and distributes this enormous amount of data, providing the opportunity for realization in real time important information and competitiveness of organisations in the modern fast growing business world.

Additionally, more cloud based environment and big data technologies have closely contributed in the growth of the active data warehousing market. The current advancements in cloud-based data warehousing systems have several advantages in terms of scalability, flexibility, and cost rationale, making it appealing to enterprises seeking ways to bolster their data environments. Furthermore, several newer technologies like in-memory computing, column-orientation databases, and stream processing, of the given technologies have made it possible to be more mobile, respond, and do complex analyzation of sea of data in real-time, this is has driven organizations to seek active data-warehousing ways.

Other driver that is keeping this active data warehousing market growing is the increase in the need for more complex ad business intelligence tools. In the contemporary world where major companies are focusing on the analysis of big data, decision-makers are incorporating analytics extensively. Current data warehouse and data warehousing can act as the basis of the innovative analytics aplication that enable instant decision system in organizations.

Furthermore, compliance regulation and legal necessities have also been the driving force behind active data warehouse solutions due to the various industries which are incorporating it including the finance industry, the health care industry and the retail industry. These industries have stringent rules around stewards, data control, protection, and privacy; active data housing solutions provide the features and functionalities needed to support compliance while offering real-time information scrutinization and information expostulation.

In the future, the active data warehousing market will experience increased development and advancement as it gains more attention for organizations to adapt to new technologies in making full utilization of data resources. Some of the trends that are likely to define the future of the market include the striving for incorporating artificial intelligence and machine learning features into data warehousing solutions into the limelight, the development of the edge computing concept that will enable users to perform real-time analytics at the edge of the network and the further advancement of the option of feasible cloud data warehousing services. All in all, the active data warehousing market has its utilities that benefit vendors and organizations to embrace the active data warehousing services in the modern digital world for their organization growth.

Active Data Warehousing Market Trend Analysis

Hybrid and Multi-cloud Data Warehousing

- Modern enterprises are contemplating transitioning to hybrid and multi-cloud data warehousing as more and more organizations embrace cloud technologies and look for adaptability in storing large volumes of valuable information. Operational data marts, a method of data storing and processing rather distinct from traditional data warehousing, are gaining popularity amongst companies that need real-time processing and analysis. This particular market niche cannot be defined as one that belongs to either of the categories above alone; instead, it focuses on the combination of on-premises infrastructure with cloud solutions, which enables organizations to benefit from both approaches.

- Many enterprises seek optimum and cost-effective solutions through hybrid and multi-cloud solutions and adapting to the diversified need of performance and data governance. Additionally, active data warehousing solutions feature enhanced processing capabilities, making them well-suited for a growth in data volume and variety required for decision-making and gaining competitive advantages in the contemporary world.

Cloud-Based Data Warehousing Services

- Currently, cloud-based data services in data warehousing have been on the rise, which goes to show that the active data warehousing market has undergone a change. Businesses select the opportunity to use cloud technologies for the purpose of data management because of their ability to scale and adapt while still being cost-efficient. Modern third-party solutions such as AWS, GCP, or Azure provide businesses with solid platforms to store and analyze huge amounts of data and gain insights in real-time.

- This move is towards cloud-centered solutions is further evidence that organizations are moving away from older on-premise data warehouses, since flexibility is valued and it is critical to respond to the market’s demands quickly. The trends in active data warehousing market are set to advance further into the context of technological advancement in the cloud computing, the revolutionized data processing techniques and the rising demand for real time information to support business decisions.

Active Data Warehousing Market Segment Analysis:

Active Data Warehousing Market is Segmented based on Deployment Mode, Enterprise Size, End-Use Industry, and Region.

By Deployment Mode, Cloud segment is expected to dominate the market during the forecast period

- Looking at the current dynamics of active data warehousing, the concept of deployment mode plays a very key role in determining the manner in which organisations will organise and use data architecture. On-premise deployment has been the go-to strategy for many organizations due to the comfort based on ownership, where data are stored within the physical business premises. This option is especially preferred by industries that have to follow restrictive laws regarding their activities or by companies dealing with confidential information. On the other hand, cloud is seen as the new paradigm whereby it offers scalability, accessibility and economical model. Cloud-based HR solutions offer rapid deployment, scalability, and integration opportunities with other cloud applications, which helps achieve higher levels of flexibility and creativity.

- The integrated model that is a mix of the on-premise and cloud models has been widely adopted since it can flexibly use the benefits of both while focusing on certain organization requirements and restrictions, such as, for instance, those imposed by the legislation. It is possible because this approach provides a wonderful opportunity for businesses to design the proper strategies for using data managing tools and to achieve the best combination of performance, safety, and cost-effectiveness. As organizations grapple with the ongoing advanced active data warehousing market challenges, choosing the right deployment mode serves as a critical factor in enhancing competitiveness, robustness, and overall performance in the current age of digitization.

By End Use Sector , IT & Telecommunication segment held the largest share in 2024

- The active data warehousing market is also growing rapidly and is being mainly used in aerospace industries or banking, financial sectors, insurance, healthcare, IT and telecom industries, government and public sector organizations, and it has other applications too. Telerobotics application involves the usage of active data management from the data generated based on the operations of the aerospace field, maintenance of airplanes, and implementation of safety measures. Institutions under the BFSI tag create active data warehousing to perform real-time analysis, risk management, and meeting up with the regulations.

- These solutions apply in the provision of patient care through the analysis of data, allowing for ideal patient treatment and optimizing of all the activities of the healthcare organizations. In a like manner, the IT & telecommunication industry has many applications of active data warehousing in managing network performance and customer experience as well as embracing service optimization. These solutions are used for collecting information and analysis for policy making, managing fiscal and monetary systems and the delivery of public services to the citizens by various government organizations. The guidelines and the example of their application in these industries show that active data warehousing is a crucial approach to promoting the development, effectiveness, and sustainability of businesses in the modern information-intensive environment.

Active Data Warehousing Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific region is recognized as set to take the lead in the active data warehousing market through the forecast year. Several reasons having led to this dominance can be explained as follows. First, many developing nations around the Asian continent and beyond, including China, India, and those in Southeast Asia, are experiencing fast economic growth, which in turn is making them require refined data sourcing services. This is especially true as companies grow and transform their ways of working; the solutions that active data warehousing offers for data management and analysis drive the solution’s adoption even further.

- Third, more organizations are integrating digital technologies into their operations, while the availability of new data-generating gadgets and the growth of the internet increases the amounts of data collected in diverse domains. Due to this highly large volumes, high band data, and applications requiring processing and analysis of real-time or near-real-time data need an efficient data warehousing infrastructure. Hence active data warehousing solution, through its capacity to integrate dynamic data integration, real-time analytical capabilities and analytically significant insight are becoming increasingly crucial to any organization that intends to create competitive advantage in the current data centric business world.

- Besides, sustained governmental policies towards adopting concepts such as digitalization and incorporation of innovations, along with the infrastructure investments provided, are collectively fostering the active data warehousing market in the Asia-Pacific region. Also, there is a mass and growing population of consumers who are not only possessing but also who are highly inclined in technology which is compelling technology companies to embrace analytics for improving the customer experience and profitability.

- Thus, it is proving to be a favorable environment for the vendors in the Asia-Pacific active data warehousing market to seek opportunities for growth and establish themselves firmly in the market. Both the maturing and enhancing technological advancements in Asia-Pacific region along with the pressing need of making accurate business decision on the basis of data analysis and with the help of favourable government policies Asia-Pacific is expected to entrench itself as an active data warehousing market in the coming years over the forecast period.

Active Key Players in the Active Data Warehousing Market

- Amazon Web Services Inc. (US)

- Hewlett Packard Enterprise Development LP (HPE) (US)

- Huawei Technologies Co. Ltd. (China)

- IBM Corporation (US)

- Cloudera Inc. (US)

- Microsoft Corporation (US)

- Oracle Corporation (US)

- SAP SE (Germany)

- Firebolt (Israel)

- Snowflake Computing Inc. (US)

- Pivotal Software Inc. (US)

- Kognitio Ltd (UK)

- Teradata Corporation (US)

- Tresure Data Inc. (US)

- Other Active Players

Key Industry Developments in the Active Data Warehousing Market

- In September 2024, HPE proudly announced the acquisition of Morpheus Data, a software platform that unified the management of multicloud and hybrid IT while empowering DevOps teams with self-service provisioning. This acquisition was expected to enhance the capabilities of HPE GreenLake cloud in simplifying IT complexity.

- In July 2024, IBM announced it has completed its acquisition of StreamSets and webMethods from Software AG after receiving all required regulatory approvals. The acquisition brings together leading capabilities in integration, API management and data ingestion. The acquisition builds on IBM's extensive software portfolio, with StreamSets adding new data ingestion capabilities to IBM's AI and data platform, and webMethods bringing Integration Platform as a Service (iPaas) capabilities to IBM's Automation solutions. IBM's clients and partners will now have access to one of the most modern and comprehensive application and data integration platforms in the industry to drive innovation and prepare business for AI.

|

Global Active Data Warehousing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.16 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.00% |

Market Size in 2032: |

USD 25.16 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Enterprise Size |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Active Data Warehousing Market by Deployment Mode (2018-2032)

4.1 Active Data Warehousing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-premise

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud

4.5 Hybrid

Chapter 5: Active Data Warehousing Market by Enterprise Size (2018-2032)

5.1 Active Data Warehousing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium Enterprises (SMEs)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Active Data Warehousing Market by End-Use Industry (2018-2032)

6.1 Active Data Warehousing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aerospace

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 BFSI

6.5 Healthcare

6.6 IT & Telecommunication

6.7 Government & Public Sector

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Active Data Warehousing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 B. BRAUN AG (GERMANY)

7.4 OLYMPUS CORPORATION (JAPAN)

7.5 BOSTON SCIENTIFIC CORPORATION (U.S)

7.6 KARL STORZ GMBH & CO. KG. (GERMANY)

7.7 ACUTRONIC MEDICAL SYSTEMS AG(SWITZERLAND)

7.8 COGENTIX MEDICAL (U.S)

7.9 OPTOMIC

7.10 FUJIFILM CORPORATION (JAPAN)

7.11 STRYKER CONMED CORPORATION (U.S)

7.12 HOLOGIC INC. (U.S.)

7.13 SMITH & NEPHEW PLC (U.K.)

7.14 GE HEALTHCARE (U.S.)

7.15 PHILIPS HEALTHCARE (NETHERLANDS)

7.16 SIEMENS HEALTHINEERS (GERMANY)

7.17 MEDIVATORS INC. (U.S.)

7.18 ENDOCHOICE HOLDINGS INC. (U.S.)

7.19 ZIMMER BIOMET HOLDINGS INC. (U.S.)

7.20 ALLERGAN PLC (U.S.)

7.21 LUMENIS LTD. (ISRAEL)

7.22 HAPPERS BERGER OTOPRONT GMBH. (GERMANY)

7.23 AND OTHER KEY PLAYERS

Chapter 8: Global Active Data Warehousing Market By Region

8.1 Overview

8.2. North America Active Data Warehousing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment Mode

8.2.4.1 On-premise

8.2.4.2 Cloud

8.2.4.3 Hybrid

8.2.5 Historic and Forecasted Market Size by Enterprise Size

8.2.5.1 Small and Medium Enterprises (SMEs)

8.2.5.2 Large Enterprises

8.2.6 Historic and Forecasted Market Size by End-Use Industry

8.2.6.1 Aerospace

8.2.6.2 BFSI

8.2.6.3 Healthcare

8.2.6.4 IT & Telecommunication

8.2.6.5 Government & Public Sector

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Active Data Warehousing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment Mode

8.3.4.1 On-premise

8.3.4.2 Cloud

8.3.4.3 Hybrid

8.3.5 Historic and Forecasted Market Size by Enterprise Size

8.3.5.1 Small and Medium Enterprises (SMEs)

8.3.5.2 Large Enterprises

8.3.6 Historic and Forecasted Market Size by End-Use Industry

8.3.6.1 Aerospace

8.3.6.2 BFSI

8.3.6.3 Healthcare

8.3.6.4 IT & Telecommunication

8.3.6.5 Government & Public Sector

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Active Data Warehousing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment Mode

8.4.4.1 On-premise

8.4.4.2 Cloud

8.4.4.3 Hybrid

8.4.5 Historic and Forecasted Market Size by Enterprise Size

8.4.5.1 Small and Medium Enterprises (SMEs)

8.4.5.2 Large Enterprises

8.4.6 Historic and Forecasted Market Size by End-Use Industry

8.4.6.1 Aerospace

8.4.6.2 BFSI

8.4.6.3 Healthcare

8.4.6.4 IT & Telecommunication

8.4.6.5 Government & Public Sector

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Active Data Warehousing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment Mode

8.5.4.1 On-premise

8.5.4.2 Cloud

8.5.4.3 Hybrid

8.5.5 Historic and Forecasted Market Size by Enterprise Size

8.5.5.1 Small and Medium Enterprises (SMEs)

8.5.5.2 Large Enterprises

8.5.6 Historic and Forecasted Market Size by End-Use Industry

8.5.6.1 Aerospace

8.5.6.2 BFSI

8.5.6.3 Healthcare

8.5.6.4 IT & Telecommunication

8.5.6.5 Government & Public Sector

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Active Data Warehousing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment Mode

8.6.4.1 On-premise

8.6.4.2 Cloud

8.6.4.3 Hybrid

8.6.5 Historic and Forecasted Market Size by Enterprise Size

8.6.5.1 Small and Medium Enterprises (SMEs)

8.6.5.2 Large Enterprises

8.6.6 Historic and Forecasted Market Size by End-Use Industry

8.6.6.1 Aerospace

8.6.6.2 BFSI

8.6.6.3 Healthcare

8.6.6.4 IT & Telecommunication

8.6.6.5 Government & Public Sector

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Active Data Warehousing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment Mode

8.7.4.1 On-premise

8.7.4.2 Cloud

8.7.4.3 Hybrid

8.7.5 Historic and Forecasted Market Size by Enterprise Size

8.7.5.1 Small and Medium Enterprises (SMEs)

8.7.5.2 Large Enterprises

8.7.6 Historic and Forecasted Market Size by End-Use Industry

8.7.6.1 Aerospace

8.7.6.2 BFSI

8.7.6.3 Healthcare

8.7.6.4 IT & Telecommunication

8.7.6.5 Government & Public Sector

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Active Data Warehousing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 10.16 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.00% |

Market Size in 2032: |

USD 25.16 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Enterprise Size |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||