3D Ic Market Synopsis

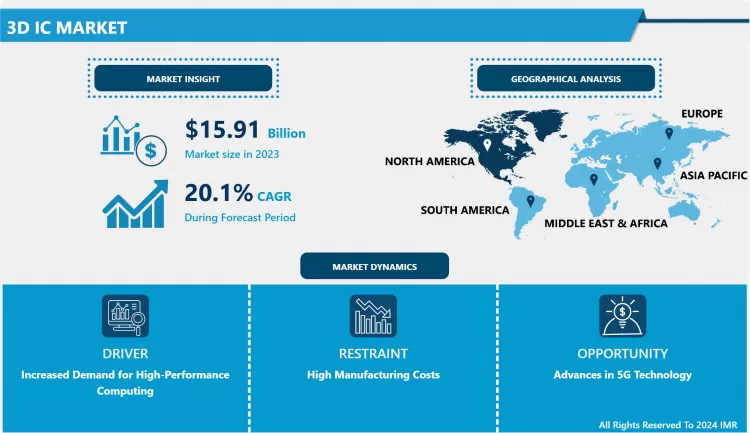

3D Ic Market Size Was Valued at USD 15.91 Billion in 2023, and is Projected to Reach USD 82.73 Billion by 2032, Growing at a CAGR of 20.10% From 2024-2032.

The 3D IC (Integrated Circuit) market refers to the sector focused on the design, development, and manufacturing of integrated circuits that utilize three-dimensional stacking technology to enhance performance and reduce the physical footprint of electronic devices. This technology allows for the vertical integration of multiple IC layers, improving speed, efficiency, and functionality while minimizing power consumption and space requirements. The 3D IC market includes a range of applications such as high-performance computing, mobile devices, and advanced consumer electronics, driving innovation in areas like data processing and memory storage.

- The global electric fuse market has witnessed significant growth in recent years, driven by the increasing demand for reliable and efficient electrical safety devices across various industries. An electric fuse is an essential component designed to protect electrical circuits from excessive currents that could cause damage or fires. As urbanization and industrialization continue to rise, the need for advanced electrical infrastructure and safety mechanisms has become more pronounced, further propelling the market forward. In 2023, the market size reached approximately USD 3.2 billion, reflecting a robust growth trajectory that is expected to continue over the forecast period.

- Several factors contribute to the expanding market size of electric fuses. The growing adoption of renewable energy sources, such as solar and wind power, has necessitated the integration of protective devices to ensure the stability and safety of electrical grids. Moreover, the rising prevalence of electrical equipment in residential, commercial, and industrial settings has heightened the demand for effective circuit protection solutions. Technological advancements have also played a pivotal role, with modern electric fuses offering enhanced features such as higher interrupting ratings and improved response times, thereby boosting their adoption across diverse applications.

- Regionally, the Asia-Pacific region has emerged as a dominant player in the electric fuse market, driven by rapid urbanization, infrastructure development, and the expansion of the manufacturing sector. Countries like China and India are at the forefront of this growth, supported by substantial investments in smart grid projects and renewable energy initiatives. North America and Europe also hold significant market shares, fueled by the ongoing modernization of electrical networks and stringent regulatory standards aimed at ensuring electrical safety.

- Despite the positive outlook, the electric fuse market faces certain challenges that could impede its growth. The high cost of advanced fuses and the availability of alternative protective devices, such as circuit breakers, present potential restraints. However, continuous research and development efforts aimed at reducing costs and enhancing the performance of electric fuses are expected to mitigate these challenges.

- In conclusion, the electric fuse market is poised for substantial growth, driven by increasing demand for electrical safety, the integration of renewable energy sources, and ongoing technological advancements. With significant opportunities emerging in the Asia-Pacific region and continuous efforts to overcome existing challenges, the market is expected to maintain its upward trajectory, offering lucrative prospects for industry participants and stakeholders.

3D Ic Market Trend Analysis

Technological Advancements in Semiconductor Fabrication and the Miniaturization Trend in 3D ICs

- Technological advancements in semiconductor fabrication processes, notably through-silicon vias (TSVs) and wafer-level packaging, are revolutionizing the 3D IC market. TSVs allow for the vertical stacking of integrated circuits by creating vertical electrical connections through the silicon wafer, drastically reducing the interconnect length and thus improving performance and power efficiency. This vertical integration reduces signal delay and power consumption, which is critical for high-performance computing applications. Wafer-level packaging, on the other hand, involves packaging the integrated circuits at the wafer level rather than after they have been cut into individual chips. This method not only enhances the performance and reliability of the chips but also reduces manufacturing costs and time. These innovations collectively contribute to the enhanced functionality of 3D ICs, making them an ideal choice for advanced consumer electronics, automotive systems, and telecommunications equipment.

- The trend towards miniaturization in electronics is a significant driving force behind the adoption of 3D ICs. As devices become smaller and more compact, the demand for higher bandwidth and lower latency continues to grow. 3D ICs, with their stacked architecture, offer a solution to these requirements by providing increased circuit density and improved data transfer rates. This is particularly important in applications such as smartphones, tablets, and IoT devices, where space is at a premium, and performance cannot be compromised. Additionally, the automotive industry is increasingly adopting 3D ICs to meet the demands of advanced driver-assistance systems (ADAS) and in-car entertainment systems, which require high processing power and efficient energy use. The telecommunications sector also benefits from 3D ICs, as they enable the development of high-speed communication networks essential for supporting the ever-increasing data traffic. Thus, the technological advancements in semiconductor fabrication are not only enhancing the capabilities of 3D ICs but are also broadening their application across various high-demand industries.

Vertical Stacking and Market Drivers of 3D IC Technology

- This technology allows for the stacking of multiple integrated circuits vertically, leading to a significantly reduced footprint and enhanced functionality. By stacking ICs vertically, manufacturers can create more complex and powerful chips without increasing the surface area, which is particularly beneficial for devices where space is a critical constraint. This vertical integration also allows for shorter interconnects between circuits, reducing signal delay and improving overall performance. The compact nature of 3D ICs makes them ideal for a wide range of applications, from smartphones and tablets to high-performance computing systems. This reduction in footprint not only supports the trend toward miniaturization in electronics but also facilitates the integration of more features and functionalities within a single device, enhancing user experience and device capabilities.

- The primary drivers for the 3D IC market include the growing need for advanced computing capabilities in cutting-edge applications such as artificial intelligence (AI), machine learning, and data centers. These applications require substantial processing power and efficiency, which 3D ICs can provide due to their high-density integration and superior performance characteristics. Additionally, the proliferation of Internet of Things (IoT) devices and wearable technology is significantly boosting the demand for 3D ICs. These devices require high processing power within a compact form factor to function effectively, making 3D ICs an ideal solution. Wearable technology, such as smartwatches and fitness trackers, benefits from the enhanced performance and reduced size of 3D ICs, allowing for more advanced features and longer battery life. The ability of 3D ICs to meet the stringent requirements of these advanced applications is driving their adoption and propelling the market forward.

3D Ic Market Segment Analysis:

3D Ic Market Segmented based on By Type, By Component, By Application, By End User.

By Application, Memory segment is expected to dominate the market during the forecast period

- Memory applications, such as DRAM (Dynamic Random-Access Memory) and NAND flash, play a pivotal role in the 3D packaging market due to their critical function in modern electronics. As electronic devices become increasingly advanced, the demand for higher memory density and performance has surged. DRAM is essential for providing fast, temporary storage that facilitates quick data access and processing, while NAND flash offers non-volatile storage that retains data even when power is off. Both types of memory are integral to the functionality of smartphones, tablets, laptops, and servers, where large amounts of data need to be processed rapidly and stored reliably. The continuous drive for improved performance and compact design in these devices amplifies the need for advanced 3D packaging solutions, which allow for higher memory integration and better efficiency in a smaller footprint.

- The dominance of memory applications in the 3D packaging market is further underscored by the relentless advancement in technology. With each new generation of devices, there is an increasing emphasis on enhancing memory capabilities to support more complex and data-intensive applications, from high-resolution multimedia to real-time analytics and artificial intelligence. The ability of 3D packaging to stack memory chips vertically, thus increasing capacity while maintaining a compact size, aligns perfectly with these evolving requirements. Consequently, memory applications capture the largest share of the 3D packaging market, driven by their fundamental role in the performance and functionality of a wide array of consumer and enterprise electronic devices.

By End User, Consumer Electronics segment held the largest share in 2023

- Consumer electronics, encompassing smartphones, tablets, wearables, and other personal gadgets, command the largest share in the end-user market for 3D packaging due to their massive production volumes and the relentless pace of innovation. This sector benefits from high consumer demand for increasingly sophisticated devices that offer enhanced features and performance. As devices become more compact and multifunctional, there is a corresponding need for advanced packaging solutions that can integrate more functionality into smaller spaces. 3D packaging technologies, such as stacked chips and interposers, enable manufacturers to meet these demands by allowing for higher density integration and improved performance without increasing the device's size. This trend is driven by the need to pack more computing power, memory, and connectivity into smaller and sleeker designs.

- Moreover, the rapid evolution of consumer electronics is characterized by frequent product releases and technological advancements, which perpetuates a cycle of innovation and demand for the latest packaging technologies. Each new generation of devices often requires cutting-edge solutions to handle increased processing power, improved graphics, and enhanced connectivity features. As a result, the consumer electronics sector continually drives the development and adoption of new 3D packaging methods that can support these advancements. The high volume of devices produced and the intense competition among manufacturers to deliver the latest innovations contribute to the sector's dominance in the end-user market, solidifying its position as the largest segment in the 3D packaging industry.

3D Ic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America plays a pivotal role in the global 3D IC market, largely due to its advanced technological ecosystem and the concentration of influential semiconductor companies. The United States, as a major hub for semiconductor innovation, hosts numerous leading firms that are at the forefront of 3D IC development. These companies leverage their substantial research and development (R&D) capabilities to push the boundaries of 3D integration technology, driving advancements that are critical to various high-tech applications. The country’s investment in cutting-edge technologies and its emphasis on staying ahead in the competitive semiconductor industry ensure a continuous stream of innovation, which propels the growth of the 3D IC market.

- Moreover, North America's well-established infrastructure and efficient supply chain further solidify its prominent position in the 3D IC market. The region benefits from a highly developed manufacturing base, advanced logistics networks, and a skilled workforce, all of which contribute to its competitive edge. The synergy between academic research institutions, technology companies, and manufacturing facilities creates a robust environment for developing and commercializing 3D IC technologies. As consumer electronics, automotive systems, and telecommunications continue to evolve, the North American market remains a key player, driving global trends and shaping the future of 3D IC applications.

Active Key Players in the 3D Ic Market

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED,

- Samsung Electronics Co. Ltd.,

- STMicroelectronics N.V.,

- Micron Technology, Inc.,

- AMKOR TECHNOLOGY,

- Xilinx Inc.,

- United Microelectronics Corporation.,

- INTEL CORPORATION,

- ASE GROUP,

- Toshiba Corporation

- Other Active Players

|

Global 3D Ic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.10% |

Market Size in 2032: |

USD 82.73 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 3D Ic Market by Type (2018-2032)

4.1 3D Ic Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stacked 3D

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Monolithic 3D

Chapter 5: 3D Ic Market by Component (2018-2032)

5.1 3D Ic Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Through-Silicon Via (TSV)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Through Glass Via (TGV)

5.5 Silicon Interposer

Chapter 6: 3D Ic Market by Application (2018-2032)

6.1 3D Ic Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Logic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Imaging & optoelectronics

6.5 Memory

6.6 MEMS/Sensors

6.7 LED

6.8 Others

Chapter 7: 3D Ic Market by End User (2018-2032)

7.1 3D Ic Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Consumer Electronics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Telecommunication

7.5 Automotive

7.6 Military & Aerospace

7.7 Medical Devices

7.8 Industrial

7.9 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 3D Ic Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED SAMSUNG ELECTRONICS CO. LTD. STMICROELECTRONICS N.V. MICRON TECHNOLOGY INC. AMKOR TECHNOLOGY XILINX INC. UNITED MICROELECTRONICS CORPORATION. INTEL CORPORATION ASE GROUP TOSHIBA CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3

Chapter 9: Global 3D Ic Market By Region

9.1 Overview

9.2. North America 3D Ic Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Stacked 3D

9.2.4.2 Monolithic 3D

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Through-Silicon Via (TSV)

9.2.5.2 Through Glass Via (TGV)

9.2.5.3 Silicon Interposer

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Logic

9.2.6.2 Imaging & optoelectronics

9.2.6.3 Memory

9.2.6.4 MEMS/Sensors

9.2.6.5 LED

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Consumer Electronics

9.2.7.2 Telecommunication

9.2.7.3 Automotive

9.2.7.4 Military & Aerospace

9.2.7.5 Medical Devices

9.2.7.6 Industrial

9.2.7.7 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe 3D Ic Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Stacked 3D

9.3.4.2 Monolithic 3D

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Through-Silicon Via (TSV)

9.3.5.2 Through Glass Via (TGV)

9.3.5.3 Silicon Interposer

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Logic

9.3.6.2 Imaging & optoelectronics

9.3.6.3 Memory

9.3.6.4 MEMS/Sensors

9.3.6.5 LED

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Consumer Electronics

9.3.7.2 Telecommunication

9.3.7.3 Automotive

9.3.7.4 Military & Aerospace

9.3.7.5 Medical Devices

9.3.7.6 Industrial

9.3.7.7 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe 3D Ic Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Stacked 3D

9.4.4.2 Monolithic 3D

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Through-Silicon Via (TSV)

9.4.5.2 Through Glass Via (TGV)

9.4.5.3 Silicon Interposer

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Logic

9.4.6.2 Imaging & optoelectronics

9.4.6.3 Memory

9.4.6.4 MEMS/Sensors

9.4.6.5 LED

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Consumer Electronics

9.4.7.2 Telecommunication

9.4.7.3 Automotive

9.4.7.4 Military & Aerospace

9.4.7.5 Medical Devices

9.4.7.6 Industrial

9.4.7.7 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific 3D Ic Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Stacked 3D

9.5.4.2 Monolithic 3D

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Through-Silicon Via (TSV)

9.5.5.2 Through Glass Via (TGV)

9.5.5.3 Silicon Interposer

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Logic

9.5.6.2 Imaging & optoelectronics

9.5.6.3 Memory

9.5.6.4 MEMS/Sensors

9.5.6.5 LED

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Consumer Electronics

9.5.7.2 Telecommunication

9.5.7.3 Automotive

9.5.7.4 Military & Aerospace

9.5.7.5 Medical Devices

9.5.7.6 Industrial

9.5.7.7 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa 3D Ic Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Stacked 3D

9.6.4.2 Monolithic 3D

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Through-Silicon Via (TSV)

9.6.5.2 Through Glass Via (TGV)

9.6.5.3 Silicon Interposer

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Logic

9.6.6.2 Imaging & optoelectronics

9.6.6.3 Memory

9.6.6.4 MEMS/Sensors

9.6.6.5 LED

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Consumer Electronics

9.6.7.2 Telecommunication

9.6.7.3 Automotive

9.6.7.4 Military & Aerospace

9.6.7.5 Medical Devices

9.6.7.6 Industrial

9.6.7.7 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America 3D Ic Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Stacked 3D

9.7.4.2 Monolithic 3D

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Through-Silicon Via (TSV)

9.7.5.2 Through Glass Via (TGV)

9.7.5.3 Silicon Interposer

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Logic

9.7.6.2 Imaging & optoelectronics

9.7.6.3 Memory

9.7.6.4 MEMS/Sensors

9.7.6.5 LED

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Consumer Electronics

9.7.7.2 Telecommunication

9.7.7.3 Automotive

9.7.7.4 Military & Aerospace

9.7.7.5 Medical Devices

9.7.7.6 Industrial

9.7.7.7 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global 3D Ic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.91 Bn. |

|

Forecast Period 2024-32 CAGR: |

20.10% |

Market Size in 2032: |

USD 82.73 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the 3D Ic Market research report is 2024-2032.

TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED, Samsung Electronics Co. Ltd., STMicroelectronics N.V., Micron Technology, Inc., AMKOR TECHNOLOGY, Xilinx Inc., United Microelectronics Corporation., INTEL CORPORATION, ASE GROUP, Toshiba Corporationand Other Major Players.

The 3D Ic Market is segmented into By Type, By Component, By Application, By End User and region. By Type, the market is categorized into Stacked 3D and Monolithic 3D. By Component, the market is categorized into Through-Silicon Via (TSV), Through Glass Via (TGV) and Silicon Interposer.By Application, the market is categorized into Logic, Imaging & optoelectronics, Memory, MEMS/Sensors, LED and Others.By End User, the market is categorized into Consumer Electronics, Telecommunication, Automotive, Military & Aerospace, Medical Devices, Industrial and OthersBy region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The 3D IC (Integrated Circuit) market refers to the sector focused on the design, development, and manufacturing of integrated circuits that utilize three-dimensional stacking technology to enhance performance and reduce the physical footprint of electronic devices. This technology allows for the vertical integration of multiple IC layers, improving speed, efficiency, and functionality while minimizing power consumption and space requirements. The 3D IC market includes a range of applications such as high-performance computing, mobile devices, and advanced consumer electronics, driving innovation in areas like data processing and memory storage.

3D Ic Market Size Was Valued at USD 15.91 Billion in 2023, and is Projected to Reach USD 82.73 Billion by 2032, Growing at a CAGR of 20.10% From 2024-2032.