2 4-Dichloro Toluene Market Synopsis

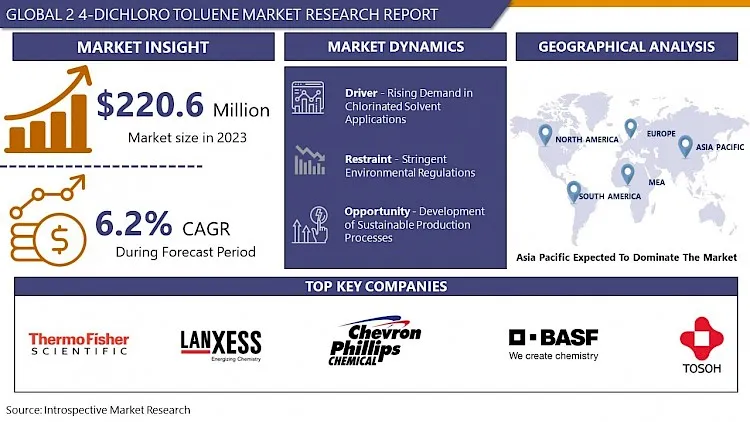

Global 2 4-Dichloro Toluene Market Size Was Valued at USD 234.58 Million in 2024 and is Projected to Reach USD 459.36 Million by 2035, Growing at a CAGR of 6.3 % From 2025-2035

2,4-Dichloro Toluene, also known as dichlorotoluene or DCT, is a chemical compound with the molecular formula C7H6Cl2. It is characterized by its two chlorine atoms attached to a toluene ring structure. This compound is commonly used in industrial applications as a solvent, in the production of herbicides and pesticides, and as an intermediate in the synthesis of various chemicals and compounds.

2,4-Dichloro Toluene (DCT) finds widespread application across various industries due to its versatile properties and chemical composition. One of its primary applications is in the manufacturing of herbicides and pesticides, where it serves as a key ingredient for effective weed and pest control in agriculture and landscaping. Additionally, DCT is utilized as a solvent in industrial processes such as paint thinners, adhesives, and cleaning agents, owing to its ability to dissolve a wide range of substances.

2,4-Dichloro Toluene lies in its efficacy as a pesticide and herbicide component, providing efficient and targeted control over unwanted vegetation and pests. Its solvent properties also make it valuable in the formulation of various industrial products, contributing to the functionality and performance of cleaning solutions, paints and coatings. As industries continue to prioritize effective pest management, efficient cleaning processes, and high-performance materials, the demand for 2,4-Dichloro Toluene is expected to witness steady growth.

2,4-Dichloro Toluene is projected to be driven by factors such as expanding agricultural activities, increasing industrialization, and the rising need for specialized chemicals and solvents. With ongoing advancements in chemical synthesis and formulation technologies, there are opportunities to further enhance the applications and benefits of DCT in various sectors. As regulatory standards evolve and industries seek sustainable solutions, the demand for environmentally friendly alternatives to traditional chemicals may also influence the growth trajectory of the 2,4-Dichloro Toluene market.

2 4-Dichloro Toluene Market Trend Analysis:

Rising Demand in Chlorinated Solvent Applications

- The rising demand for chlorinated solvent applications serves as a major driver for the growth of the 2,4-Dichloro Toluene (DCT) market. Chlorinated solvents, including DCT, are widely used in various industrial processes such as cleaning, degreasing, and extraction due to their effective solvency properties. DCT, specifically, is valued for its ability to dissolve and remove contaminants, oils, and greases from surfaces and materials, making it indispensable in industries such as manufacturing, automotive, and electronics.

- 2,4-Dichloro Toluene in chlorinated solvent applications is its effectiveness in providing efficient cleaning and degreasing solutions. Its chemical composition and solubility make it suitable for tackling stubborn residues and contaminants, thereby improving overall cleanliness and production efficiency in industrial settings. As industries continue to prioritize cleanliness, safety, and regulatory compliance, the demand for chlorinated solvents like DCT is expected to rise significantly.

- The growth in chlorinated solvent applications is further driven by the expansion of sectors such as aerospace, metalworking, and pharmaceuticals, where stringent cleanliness standards and precision manufacturing processes are essential. Additionally, advancements in DCT production technologies and formulations contribute to its enhanced performance and applicability in diverse industrial applications, paving the way for sustained growth in the 2,4-Dichloro Toluene market.

Development of Sustainable Production Processes

- The development of sustainable production processes presents a significant opportunity for driving the growth of the 2,4-Dichloro Toluene (DCT) market. Sustainable production practices aim to minimize environmental impact, reduce waste generation, and enhance resource efficiency throughout the manufacturing process. In the context of DCT production, sustainable practices may include the adoption of green chemistry principles, waste reduction strategies, and the use of renewable energy sources.

- Sustainable production processes for 2,4-Dichloro Toluene is the potential to address environmental concerns and regulatory requirements. By implementing eco-friendly practices such as solvent recycling, energy optimization, and waste management, manufacturers can reduce the ecological footprint associated with DCT production. This not only improves environmental stewardship but also enhances the market acceptance of DCT-based products among environmentally conscious consumers and industries.

- Furthermore, the growing focus on sustainability across industries creates market opportunities for DCT manufacturers that prioritize sustainable production methods. Companies investing in research and development to develop cleaner, more efficient processes for DCT synthesis and purification are well-positioned to meet the increasing demand for environmentally friendly chemicals. As sustainability continues to drive decision-making in the chemical industry, the adoption of sustainable production processes for 2,4-Dichloro Toluene is expected to contribute significantly to market growth and competitiveness.

2 4-Dichloro Toluene Market Segment Analysis:

2 4-Dichloro Toluene Market Segmented on the basis of Type and Application

By Type, Chemical Grade segment is expected to dominate the market during the forecast period

- The chemical grade segment is poised to dominate the growth of the 2,4-Dichloro Toluene (DCT) market. This dominance is attributed to the extensive use of high-purity DCT in various chemical processes and applications. Chemical-grade DCT is characterized by its purity and consistency, making it a preferred choice for manufacturing pharmaceuticals, agrochemicals, and specialty chemicals where stringent quality standards are paramount.

- Moreover, the chemical grade segment benefits from the demand for reliable and high-performance chemicals in industries such as healthcare, agriculture, and manufacturing. Chemical-grade DCT plays a vital role as a key intermediate in the synthesis of pharmaceutical ingredients, pesticides, herbicides, and other specialty chemicals. Its purity and quality attributes ensure the effectiveness and safety of the end products, driving the preference for chemical-grade DCT among manufacturers and consumers alike. Manufacturers focusing on producing high-purity DCT and meeting industry-specific standards are well-positioned to capitalize on the increasing demand for chemical-grade DCT across diverse industrial sectors.

By Application, the Pesticide segment held the largest share of 64.38% in 2024

- The pesticide segment is the dominant force driving the growth of the 2,4-Dichloro Toluene (DCT) market, holding the largest share. This segment's prominence is due to the extensive utilization of DCT as a vital component in the production of pesticides. DCT serves as a key intermediate in the synthesis of various pesticide formulations used in agriculture and pest management. Its effectiveness in controlling pests, weeds, and diseases in crops makes it indispensable for agricultural activities worldwide.

- Furthermore, the pesticide segment's growth is fueled by the increasing demand for pest control solutions in agriculture to ensure crop yield and quality. With agriculture being a critical sector for food production and security, the reliance on pesticides, including those containing DCT, remains high. Manufacturers catering to the pesticide segment of the 2,4-Dichloro Toluene market are well-positioned to capitalize on the ongoing demand for effective and sustainable pest management solutions, driving the segment's dominance in the market.

2 4-Dichloro Toluene Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to dominate the market growth of 2,4-Dichloro Toluene, driven by various factors contributing to its robust industrial and agricultural sectors. This dominance is propelled by countries like China, India, and Japan, which play significant roles in the production and consumption of 2,4-Dichloro Toluene due to their large-scale agricultural activities and growing chemical manufacturing industries. Additionally, the region benefits from favorable government policies, increasing investments in agrochemicals, and a rising demand for specialty chemicals, further boosting the market's expansion.

- The rapid urbanization and economic development in Asia Pacific contribute to the escalating demand for 2,4-Dichloro Toluene in diverse applications such as pesticide production, pharmaceuticals, and chemical synthesis. With a focus on technological advancements and sustainability initiatives, Asia Pacific is expected to maintain its dominance in the 2,4-Dichloro Toluene market, offering lucrative opportunities for market players to capitalize on the region's growing demand and evolving industrial landscape.

2 4-Dichloro Toluene Market Top Key Players:

- VWR International, LLC (U.S.)

- Chevron Phillips Chemical Company LLC. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Tosoh USA, Inc. (U.S.)

- BASF SE (Germany)

- Lanxess (Germany)

- HPC Standards GmbH (Germany)

- Royal Society of Chemistry (UK)

- Toray Industries, Inc. (Japan)

- Kumiai Chemical Industry Co., Ltd (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Hongxing Chemical Co. Ltd. (China)

- Benzo Chem Industries Pvt. Ltd. (India)

- SimSon Pharma Limited (India)

- TCI Chemicals (India) Pvt. Ltd. (India), and Other Major Players.

Key Industry Developments in the 2 4-Dichloro Toluene Market

- In December 2023 - Thermo Fisher Scientific Inc. a global leader in serving science, proudly announces the successful completion of its acquisition of PPD, Inc. (Nasdaq: PPD), a renowned provider of clinical research services to the biopharma and biotech industry. The acquisition, valued at $17.4 billion, marks a significant milestone in Thermo Fisher Scientific's commitment to advancing healthcare through cutting-edge solutions and services.

- In February 2023 - Mitsubishi Chemical Group is delighted to announce its decision to absorb its esteemed group company, Mitsubishi Chemical Systems, Inc. (MCSY), effective April 1, 2023. This strategic move reflects our group's commitment to enhancing operational efficiency, driving synergies, and fostering innovation across our diverse portfolio of services.

|

2 4-Dichloro Toluene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 234.58 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.3% |

Market Size in 2035: |

USD 459.36 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 2 4-Dichloro Toluene Market by Type (2018-2035)

4.1 2 4-Dichloro Toluene Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chemical Grade

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pharmaceutical Grade

Chapter 5: 2 4-Dichloro Toluene Market by Application (2018-2035)

5.1 2 4-Dichloro Toluene Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Medicine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pesticide

5.5 Dyes

5.6 Pigments

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 2 4-Dichloro Toluene Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 QORVO INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SKYWORKS SOLUTIONS INC. (UNITED STATES)

6.4 TEXAS INSTRUMENTS INCORPORATED (UNITED STATES)

6.5 STMICROELECTRONICS N.V. (SWITZERLAND)

6.6 ON SEMICONDUCTOR CORPORATION (UNITED STATES)

6.7 ANALOG DEVICES INC. (UNITED STATES)

6.8 ERICSSON (SWEDEN)

6.9 BROADCOM INC. (UNITED STATES)

6.10 QUALCOMM INCORPORATED (UNITED STATES)

6.11 NXP SEMICONDUCTORS (NETHERLANDS)

6.12 OTHER KEY PLAYERS

Chapter 7: Global 2 4-Dichloro Toluene Market By Region

7.1 Overview

7.2. North America 2 4-Dichloro Toluene Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Chemical Grade

7.2.4.2 Pharmaceutical Grade

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Medicine

7.2.5.2 Pesticide

7.2.5.3 Dyes

7.2.5.4 Pigments

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe 2 4-Dichloro Toluene Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Chemical Grade

7.3.4.2 Pharmaceutical Grade

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Medicine

7.3.5.2 Pesticide

7.3.5.3 Dyes

7.3.5.4 Pigments

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe 2 4-Dichloro Toluene Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Chemical Grade

7.4.4.2 Pharmaceutical Grade

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Medicine

7.4.5.2 Pesticide

7.4.5.3 Dyes

7.4.5.4 Pigments

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific 2 4-Dichloro Toluene Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Chemical Grade

7.5.4.2 Pharmaceutical Grade

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Medicine

7.5.5.2 Pesticide

7.5.5.3 Dyes

7.5.5.4 Pigments

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa 2 4-Dichloro Toluene Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Chemical Grade

7.6.4.2 Pharmaceutical Grade

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Medicine

7.6.5.2 Pesticide

7.6.5.3 Dyes

7.6.5.4 Pigments

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America 2 4-Dichloro Toluene Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Chemical Grade

7.7.4.2 Pharmaceutical Grade

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Medicine

7.7.5.2 Pesticide

7.7.5.3 Dyes

7.7.5.4 Pigments

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

2 4-Dichloro Toluene Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 234.58 Mn. |

|

Forecast Period 2025-35 CAGR: |

6.3% |

Market Size in 2035: |

USD 459.36 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||