Vulnerability Management as a Service (VMaaS) Market Synopsis

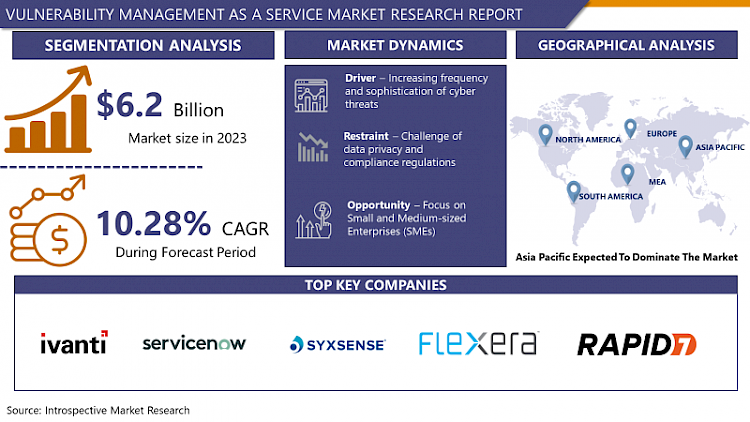

Vulnerability Management as a Service (VMaaS) Market Size Was Valued at USD 6.2 Billion in 2023, and is Projected to Reach USD 14.96 Billion by 2032, Growing at a CAGR of 10.28 % From 2024-2032.

VMaaS or Vulnerability Management as a Service is a specialized and fully managed service that aims at the disclosure, evaluation, and control of security exposures in the network environment of an organization. This service uses sophisticated systems for constant assessment, Samp;p; surveillance, and analysis of systems, applications, and networks to identify vulnerabilities that may be exploited by attackers. The VMaaS providers are several in providing proper priority to these vulnerabilities depending on the risk factors involved and proper time to work for their solutions, as well as various standards and acts that need to be followed in the organization. IT leaders looking to VMaaS also gain advantages in security postures, threat risk, and delegation of vulnerability management to dedicated experts to keep their businesses focused.

- The Vulnerability Management as a Service (VMaaS) market is fast growing due to the rising awareness that in the current world, being proactively secure is vital amidst hackers and crackers. Built-out services in this market are rather vast and span from continuous vulnerability scanning and threat assessment to prioritization of risks and generation of remediation strategies. VMaaS providers make use of emerging innovative technologies namely, machine learning, and artificial intelligence as well as automated processes that offer real-time VMs and exceptional vulnerability management. The main drivers that shape the growth of the market include the increasing need for communications services, the rising use of clouds, and linked devices, and the need for enhanced security measures due to strict rules that regulatory bodies set. The VMaaS solution is being adopted by small and medium-size enterprises or SMEs for the benefit of demanding enterprise-level security solutions but with less investment and trained resources available.

- Based on the information gathered, the competition among participants offering VMaaS is formed by both traditional cybersecurity companies and new market entrants that can offer complex and scalable solutions that meet certain industry demands. Small and big VMaaS providers are striving to update what they offer especially due to the dynamic nature of the threat landscape and new, more complex threats and threat vectors. Trends show the tendency towards combining vulnerability management with other-oriented security activities; thereby integrating those end-to-end oriented platforms.

- Furthermore, new trends around automation and artificial intelligence should provide increased improvements to VMaaS capabilities which in turn should help to identify and respond to threats much quicker and with increased efficiency. In any case, the market of VMaaS services is promising and is expected to experience fast development shortly due to the rising need for proper and comprehensive vulnerability assessment solutions in the modern business environment.

Vulnerability Management as a Service (VMaaS) Market Trend Analysis

Increasing integration of artificial intelligence (AI) and machine learning (ML) technologies

- They are being used to streamline vulnerability identification, risk management, and exposure or mitigation as well as to boost the speed and quality of the practice. AI and ML provide the capabilities to examine vast data sets to look for similar patterns with potential weaknesses and also open doors for VMaaS providers that provide advanced and more preventative security solutions. Thus, the a need to address the increasing challenge and volume of cyber threats manage fake positives, and improve efficiency and organizational excellence in vulnerability management workflows. The developments in AI and ML technologies show them being the primary strategic option for determining the future of VMaaS with increasingly improved security measures against growing threats.

Focus on Small and Medium-sized Enterprises (SMEs)

- A compelling argument for embracing VMaaS can therefore be made concerning the opportunities that exist in the SME market segment. It is quite common for SMEs not to have personnel and/or financial capabilities to support a more systematic and professional approach to vulnerability management and this makes many of them potential adopters of outsourcing solutions. By adopting the concept of VMaaS, the security solutions offered by VMaaS providers can be cost-effective to adopt by small businesses owing to their relatively low cost compared to traditional security solutions that would have been quite expensive for SMEs. Thus, the VMaaS providers need to come up with focused market segmentation initiatives and unique positioning claims that will give promising respect to ROI, simplicity, and robustness to novel market segments that may be easily reached out to.

Vulnerability Management as a Service (VMaaS) Market Segment Analysis:

Vulnerability Management as a Service (VMaaS) Market is segmented based on type and application.

By Type, Software segment is expected to dominate the market during the forecast period

- At the type level, the global Vulnerability Management as a Service (VMaaS) market has been divided into software and services; from where the software type segment is predicted to have the largest market share during the predicted period. It was found that several potential reasons made these countries. First, let us discuss that software solutions provide a more extensive and varied range of features being able to continually scan, monitor, and report on vulnerabilities in multiple IT systems. These solutions mostly use artificial intelligence, machine learning, and automation features to improve their effectiveness and effectiveness and therefore cannot be considered tools for shallow vulnerabilities insurance.

- Moreover, the expansion and diversions in the IT frameworks imply that they integrate an extensive range of services such as cloud services, IoT devices, and even the new work-from-home service, all of which require sound and flexible software solutions to operate efficiently. In the case of VMaaS solutions, the software tools are intended to give instant feedback about the current threat situation and the ability to respond promptly in order to maintain a good security stance. Furthermore, the possibilities to adjust and expand their use in meeting the needs of various enterprises are the primary benefits of these software solutions that attract the attention of a wide spectrum of industries. In line with diverse types of threats emerging in the market, there is an increasing need for more complex and enhanced vulnerability management software that all in all is an important factor fueling the growth and dominance of the segment in the VMaaS market.

By Application, the Bank segment is expected to hold the largest share

- The VMaaS market Segmentation by Vertical: Among all the verticals in the VMaaS market, the banking vertical holds the largest market share. This dominance is attributed to the fact that currently, security measures in banking industries have to meet strict regulatory measures and data security is usually threatened with high frequency for which complex security measures are required. Secure and efficient management of money: Banks control vast amounts of sensitive financial information and personal identification data that remain attractive for a cyberattack. Therefore, vulnerability management has become more sophisticated and requires the capability to monitor and detect threats in real time as well as offer reminders on resolving vulnerabilities.

- Also there are certain imposed compliance requirements that institutions must adhere to from regulatory bodies inclusive of the PCI DSS and other regional/national/ international data protection legislation. They entail proper vulnerability management approach to try and minimize incidences of data leakage and to follow the law. Banks are thus in a process of embracing VMaaS in order to bolster their security status, address the risk issues more effectively as well as meet the desired legal requirements. This heavy demand from the banking sector is what gives a substantial contribution to its share in the VMaaS market, underlining the importance of vulnerability management to safeguard the financial sector against ever-growing threats.

Vulnerability Management as a Service (VMaaS) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to control the growth of world’s Vulnerability Management as a Service (VMaaS) market through the projection period thanks to a number of cannons. The trends and growth of using digital technologies have soared high in almost all industries such as finance, healthcare, manufacturing industries, etc has paved way for the usage of cloud services, IoT devices and systems, complex IT structures etc,. The current trend of embracing the digital platform increases the risk of cybersecurity attacks, and therefore an efficient vulnerability management system is also critical. Also, economic growth in the region and its huge population expands the demand for VMaaS products since the company receives more customers. The governments across the globe especially in developing countries like China, India and Japan have also established regulations regarding cybersecurity that mount pressure on organizations to adopt sophisticated security mechanisms to converge to the laid down standards and safeguard the vital information.

Active Key Players in the Vulnerability Management as a Service (VMaaS) Market

- Buchanan Technologies (United States)

- CGI UK (United Kingdom)

- Citadel (United States)

- CSW (United States)

- Datashield (United States)

- Dimension Data (South Africa)

- GoSecure (Canada)

- GuidePoint Security (United States)

- IBM (United States)

- Ingram Micro (United States)

- Ivanti (United States)

- Kontex Security (Ireland)

- NTT (Japan)

- Optiv (United States)

- Rapid7 (United States)

- SecurityHQ (United Kingdom), and Other key Players

|

Global Vulnerability Management as a Service (VMaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.28 % |

Market Size in 2032: |

USD 14.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

Challenge of data privacy and compliance regulations |

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Vulnerability Management as a Service (VMaaS) Market by Type

5.1 Vulnerability Management as a Service (VMaaS) Market Overview Snapshot and Growth Engine

5.2 Vulnerability Management as a Service (VMaaS) Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Software: Geographic Segmentation

5.4 Solution

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solution: Geographic Segmentation

Chapter 6: Vulnerability Management as a Service (VMaaS) Market by End-User

6.1 Vulnerability Management as a Service (VMaaS) Market Overview Snapshot and Growth Engine

6.2 Vulnerability Management as a Service (VMaaS) Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BFSI: Geographic Segmentation

6.4 IT & Telecommunication

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 IT & Telecommunication: Geographic Segmentation

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Vulnerability Management as a Service (VMaaS) Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Vulnerability Management as a Service (VMaaS) Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Vulnerability Management as a Service (VMaaS) Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 IVANTI VMAAS

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 SERVICENOW

7.4 SYXSENSE ACTIVE SECURE

7.5 FLEXERA SOFTWARE VULNERABILITY MANAGEMENT

7.6 ASIMILY INSIGHT

7.7 RAPID7 MVM

7.8 QUALYS VMDR

7.9 CROWDSTRIKE FALCON SPOTLIGHT

7.10 BUCHANAN TECHNOLOGIES

7.11 CGI UK

7.12 CITADEL

7.13 CSW

7.14 DATASHIELD

7.15 DIMENSION DATA

7.16 GOSECURE

7.17 GUIDEPOINT SECURITY

7.18 IBM

7.19 INGRAM MICRO

7.20 KONTEX SECURITY

7.21 NTT

7.22 OPTIV

7.23 SECURITYHQ

7.24 STRATEJM

7.25 OTHER MAJOR PLAYERS

Chapter 8: Global Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Software

8.2.2 Solution

8.3 Historic and Forecasted Market Size By End-User

8.3.1 BFSI

8.3.2 IT & Telecommunication

8.3.3 Healthcare

8.3.4 Others

Chapter 9: North America Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Software

9.4.2 Solution

9.5 Historic and Forecasted Market Size By End-User

9.5.1 BFSI

9.5.2 IT & Telecommunication

9.5.3 Healthcare

9.5.4 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Software

10.4.2 Solution

10.5 Historic and Forecasted Market Size By End-User

10.5.1 BFSI

10.5.2 IT & Telecommunication

10.5.3 Healthcare

10.5.4 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Software

11.4.2 Solution

11.5 Historic and Forecasted Market Size By End-User

11.5.1 BFSI

11.5.2 IT & Telecommunication

11.5.3 Healthcare

11.5.4 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Software

12.4.2 Solution

12.5 Historic and Forecasted Market Size By End-User

12.5.1 BFSI

12.5.2 IT & Telecommunication

12.5.3 Healthcare

12.5.4 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Vulnerability Management as a Service (VMaaS) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Software

13.4.2 Solution

13.5 Historic and Forecasted Market Size By End-User

13.5.1 BFSI

13.5.2 IT & Telecommunication

13.5.3 Healthcare

13.5.4 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Vulnerability Management as a Service (VMaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.2 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.28 % |

Market Size in 2032: |

USD 14.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

Challenge of data privacy and compliance regulations |

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET COMPETITIVE RIVALRY

TABLE 005. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET THREAT OF SUBSTITUTES

TABLE 007. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET BY TYPE

TABLE 008. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOLUTION MARKET OVERVIEW (2016-2028)

TABLE 010. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET BY END-USER

TABLE 011. BFSI MARKET OVERVIEW (2016-2028)

TABLE 012. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 013. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY END-USER (2016-2028)

TABLE 017. N VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY END-USER (2016-2028)

TABLE 020. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY END-USER (2016-2028)

TABLE 023. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY END-USER (2016-2028)

TABLE 026. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY END-USER (2016-2028)

TABLE 029. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 030. IVANTI VMAAS: SNAPSHOT

TABLE 031. IVANTI VMAAS: BUSINESS PERFORMANCE

TABLE 032. IVANTI VMAAS: PRODUCT PORTFOLIO

TABLE 033. IVANTI VMAAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. SERVICENOW: SNAPSHOT

TABLE 034. SERVICENOW: BUSINESS PERFORMANCE

TABLE 035. SERVICENOW: PRODUCT PORTFOLIO

TABLE 036. SERVICENOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. SYXSENSE ACTIVE SECURE: SNAPSHOT

TABLE 037. SYXSENSE ACTIVE SECURE: BUSINESS PERFORMANCE

TABLE 038. SYXSENSE ACTIVE SECURE: PRODUCT PORTFOLIO

TABLE 039. SYXSENSE ACTIVE SECURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. FLEXERA SOFTWARE VULNERABILITY MANAGEMENT: SNAPSHOT

TABLE 040. FLEXERA SOFTWARE VULNERABILITY MANAGEMENT: BUSINESS PERFORMANCE

TABLE 041. FLEXERA SOFTWARE VULNERABILITY MANAGEMENT: PRODUCT PORTFOLIO

TABLE 042. FLEXERA SOFTWARE VULNERABILITY MANAGEMENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ASIMILY INSIGHT: SNAPSHOT

TABLE 043. ASIMILY INSIGHT: BUSINESS PERFORMANCE

TABLE 044. ASIMILY INSIGHT: PRODUCT PORTFOLIO

TABLE 045. ASIMILY INSIGHT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. RAPID7 MVM: SNAPSHOT

TABLE 046. RAPID7 MVM: BUSINESS PERFORMANCE

TABLE 047. RAPID7 MVM: PRODUCT PORTFOLIO

TABLE 048. RAPID7 MVM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. QUALYS VMDR: SNAPSHOT

TABLE 049. QUALYS VMDR: BUSINESS PERFORMANCE

TABLE 050. QUALYS VMDR: PRODUCT PORTFOLIO

TABLE 051. QUALYS VMDR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CROWDSTRIKE FALCON SPOTLIGHT: SNAPSHOT

TABLE 052. CROWDSTRIKE FALCON SPOTLIGHT: BUSINESS PERFORMANCE

TABLE 053. CROWDSTRIKE FALCON SPOTLIGHT: PRODUCT PORTFOLIO

TABLE 054. CROWDSTRIKE FALCON SPOTLIGHT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BUCHANAN TECHNOLOGIES: SNAPSHOT

TABLE 055. BUCHANAN TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 056. BUCHANAN TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 057. BUCHANAN TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. CGI UK: SNAPSHOT

TABLE 058. CGI UK: BUSINESS PERFORMANCE

TABLE 059. CGI UK: PRODUCT PORTFOLIO

TABLE 060. CGI UK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CITADEL: SNAPSHOT

TABLE 061. CITADEL: BUSINESS PERFORMANCE

TABLE 062. CITADEL: PRODUCT PORTFOLIO

TABLE 063. CITADEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CSW: SNAPSHOT

TABLE 064. CSW: BUSINESS PERFORMANCE

TABLE 065. CSW: PRODUCT PORTFOLIO

TABLE 066. CSW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. DATASHIELD: SNAPSHOT

TABLE 067. DATASHIELD: BUSINESS PERFORMANCE

TABLE 068. DATASHIELD: PRODUCT PORTFOLIO

TABLE 069. DATASHIELD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. DIMENSION DATA: SNAPSHOT

TABLE 070. DIMENSION DATA: BUSINESS PERFORMANCE

TABLE 071. DIMENSION DATA: PRODUCT PORTFOLIO

TABLE 072. DIMENSION DATA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. GOSECURE: SNAPSHOT

TABLE 073. GOSECURE: BUSINESS PERFORMANCE

TABLE 074. GOSECURE: PRODUCT PORTFOLIO

TABLE 075. GOSECURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GUIDEPOINT SECURITY: SNAPSHOT

TABLE 076. GUIDEPOINT SECURITY: BUSINESS PERFORMANCE

TABLE 077. GUIDEPOINT SECURITY: PRODUCT PORTFOLIO

TABLE 078. GUIDEPOINT SECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. IBM: SNAPSHOT

TABLE 079. IBM: BUSINESS PERFORMANCE

TABLE 080. IBM: PRODUCT PORTFOLIO

TABLE 081. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. INGRAM MICRO: SNAPSHOT

TABLE 082. INGRAM MICRO: BUSINESS PERFORMANCE

TABLE 083. INGRAM MICRO: PRODUCT PORTFOLIO

TABLE 084. INGRAM MICRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. KONTEX SECURITY: SNAPSHOT

TABLE 085. KONTEX SECURITY: BUSINESS PERFORMANCE

TABLE 086. KONTEX SECURITY: PRODUCT PORTFOLIO

TABLE 087. KONTEX SECURITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. NTT: SNAPSHOT

TABLE 088. NTT: BUSINESS PERFORMANCE

TABLE 089. NTT: PRODUCT PORTFOLIO

TABLE 090. NTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OPTIV: SNAPSHOT

TABLE 091. OPTIV: BUSINESS PERFORMANCE

TABLE 092. OPTIV: PRODUCT PORTFOLIO

TABLE 093. OPTIV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. SECURITYHQ: SNAPSHOT

TABLE 094. SECURITYHQ: BUSINESS PERFORMANCE

TABLE 095. SECURITYHQ: PRODUCT PORTFOLIO

TABLE 096. SECURITYHQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. STRATEJM: SNAPSHOT

TABLE 097. STRATEJM: BUSINESS PERFORMANCE

TABLE 098. STRATEJM: PRODUCT PORTFOLIO

TABLE 099. STRATEJM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY TYPE

FIGURE 012. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOLUTION MARKET OVERVIEW (2016-2028)

FIGURE 014. VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY END-USER

FIGURE 015. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 016. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 017. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA VULNERABILITY MANAGEMENT AS A SERVICE (VMAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Vulnerability Management as a Service (VMaaS) Market research report is 2024-2032.

Buchanan Technologies, CGI UK, Citadel, CSW, Datashield, Dimension Data, GoSecure, GuidePoint Security, IBM, Ingram Micro, and Other Major Players.

The Vulnerability Management as a Service (VMaaS) Market is segmented into Type, Application, and region. By Type, the market is categorized into Software, Solution. By Application, the market is categorized into Finance, Bank, Medical, Telecommunications, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

VMaaS or the Vulnerability Management as a Service is a specialized and fully-managed service which aims at the disclosure, evaluation, and control of security exposures in the network environment of an organization. This service uses sophisticated systems for constant assessing, Samp;p;veillance, and analyzing of systems, applications and networks to identify vulnerabilities that may be exploited by attackers. The VMaaS providers are several in providing proper priority to these vulnerabilities depending on the risk factors involved and proper time to work for their solutions, as well as various standards and acts that need to be followed in the organization. IT leaders looking to VMaaS also gain advantages in security postures, threat risk, and delegation of vulnerability management to dedicated experts to keep their business focuses.

Vulnerability Management as a Service (VMaaS) Market Size Was Valued at USD 6.2 Billion in 2023, and is Projected to Reach USD 14.96 Billion by 2032, Growing at a CAGR of 10.28 % From 2024-2032.