Farming as a Service Market Synopsis

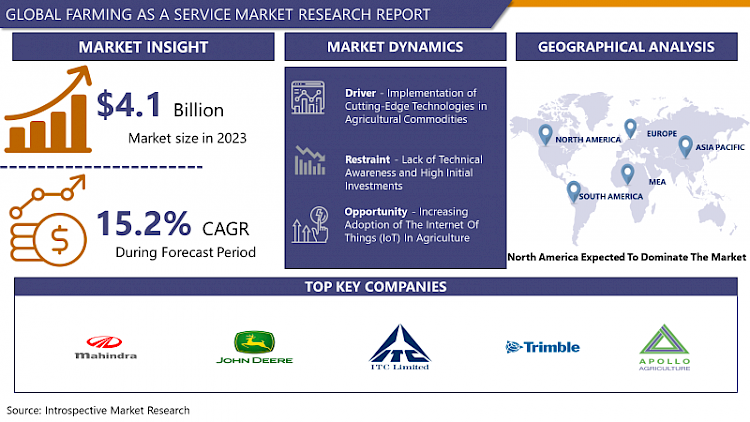

Farming as a Service Market Size Was Valued at USD 4.1 Billion in 2023 and is Projected to Reach USD 14.7 Billion by 2032, Growing at a CAGR of 15.2% From 2024-2032.

Farming as a Service (FaaS) is a business model where a farmer can demand for a service on demand, on a usage or a subscription basis that provides sophisticated, professional and easy to use solutions for farmers. It is a structure of professional services that provide a range of expert agrarian management services. It also offers the farmers the various services like precision farming tools, analytics, utility & labor services, equipment rentals and access to markets & broader audience among others. In addition, through FaaS, farmers get convenient access to crop production inputs, timely availabilities of labor, desired machinery and equipment hiring options and utility facilities such as irrigation services & electricity.

- FAAS market is under the increased legal interest, particularly in terms of data protection and clarity of contractual relationships. Since farming is a service, the essence of which is the gathering and processing of substantial amounts of data on yields, climate, and ground conditions, the topic of data protection and cybersecurity is critical. Protection of farmers’ and other stakeholders’ data is important to foster trust and compliance with the law. Additionally, maintaining clarity of subscription terms, service level agreements, and any legal implications that may be linked to the farming as a service become fundamental determinants of compliance in the context. This concern with regulatory compliance is crucial to long-term development and in an ever-shifting environment in the agricultural technology industry

- Technological expansion especially in categories like agricultural products is the main reason behind the farming as a service market. Automated data management software, GPS, Yield mapping software (YMS), variable rate technology (VRT), and the mapping software play a crucial role in increasing profit levels and the fertility of the soil besides reducing the cost of farming and encouraging sustainable farming.

- Further, it has also seen the increased adoption of internet of things (IoT) in agriculture and a decrease in energy usage as well as the cost. As such, the following factors contribute to the growth of the farming as a service market size. But high initial investments coupled with low technical awareness is a real concern that is restraining the farming as a service market. However, there will be more opportunities for agritech start-ups in the future and this will contribute to the major growth opportunities in the farming as a service market.

- Hence, it can be observed that precision and resource investment in software development lead to better farm management approaches that decrease energy consumption and make the entire process more cost effective. Due to the time constraint and effectiveness of smart farming solutions over the conventional methods, the smart farming market is poised to grow.

Farming as a Service Market Trend Analysis

Implementation of Cutting-Edge Technologies in Agricultural Commodities

- If adopted to the maximum, smart agriculture enables farmers to combat the impact of climate change on crops by collating geospatial data on planting, soil, livestock, and other inter- and intra-field information. Additionally, smart agriculture also offers knowledge on the amount of pesticide, herbicide, liquid fertilizer, and irrigation required to be used, minimizing wastage. Computer aided data management, GPS, yield mapping software (YMS), variable rate technology (VRT), and mapping software assist in increasing profit growth and soil fertility, decreasing the relative costs in farming and encouraging sustainable farming.

- Another notable feature of smart agricultural technologies is increased business productivity through the use of automation and improved product quality at lower farming expenses. For this reason, most farming entrepreneurs are already using the following innovative and effective agricultural tools to increase productivity and profits. In addition, smart agriculture techniques were designed to ensure that agribusiness becomes more lucrative than it has ever been.

Increasing Adoption Of The Internet Of Things (Iot) In Agriculture

- There is an increased use of Internet of Things (IoT) in agriculture and farmers get real time assistance through the use of loT application. The plan of loT applications in traditional agriculture leads to more efficient use of time and resources, such as a land, energy or water for farming and thus farmers can concentrate on delivering food of good quality to the consumers. Furthermore, farmers are also able lo address significant changes in the air efficiency, humidity, and weather due to the aggressive adaption of loT technology by the agricultural industry. It incorporates various management tools and technologies, visualization, and data analytics to perform the tasks that are typically accomplished in farming activities. By initiating smart sustainable solutions of energy and water resource at loT technology in agriculture, the farm production is Increased, while emissions are reduced. Further, the farmers may be enlightened on how to apply information and communication technologies to full earnings and promote sustainable utilization of resources based on different climatic conditions when internet grows in the agricultural sector. Therefore, the farming as a service Industry over the forecast period will have its growth driven by the higher usage of the Internet of Things (IoT) in the agriculture sector within the aforementioned years.

Farming as a Service Market Segment Analysis:

Farming as a Service Market is Segmented based on Service, Delivery Model, and End User.

By Service, farm management solutions segment is expected to dominate the market during the forecast period

- Depending on the type of provided service, farming as a service market includes farm management solutions, production assistance, and access to markets.

- Among all these segments the farm management solutions segment had the largest market share of about 76%. 83% in 2023. Some of the key services offered in farm management are as follows: Government, farmer, corporates, and other final advisory firms are given insights.

- Farm management services also involve precision farming services which have been rapidly expanding in recentyears due to the increasing adoption of precision farming to meet the increasing global market demand for better quality food products. Hyperspectral imaging technology, sensors for collecting weather information and soil samples, auto-guidance equipment, precision irrigation systems, etc. , which can enhance agricultural outcomes.

- In addition to increase demand for precision farming and accelerating the growth of the market, there is deterioration of the water problem, as well as the need to save the Earth’s resources. The particular sub-segmentation of production assistance is equipment rental, labour, utility service, and agriculture marketing. Equipment rental for example, includes renting of farming machinery such as tractors, combines, etc.

By End User, Farmers segment held the largest share in 2023

- Segmented on the basis of end-users they include farmers, government bodies, corporations, financial institutions and advisory bodies. Farmers continued to dominate the farming as a service industry due to the segment’s revenue share of over 30% among all end-users. 41% in 2023. Furthermore, the farmer end-user segment is expected to grow at a considerably high CAGR of 15% over the projected duration. There is expectation that by the end of the forecast period, this figure will drop to only 4%. Farming as a service is used mainly by farmers who require the services to boost their farming activities.

- All service types are used by farmers, including services related to farm management, production, or access to market. Farmers apply farm management solutions in order to make sound decision instead of assuming things blindly. Others include production assistance services, these are the services in relation to renting out equipment, hiring labor, providing utility services or even helping farmers to market their produce.

Farming as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America held the largest share of the market, generating 45 % of the total sales. 41% in 2023. North America is one of the leading agricultural regions globally and encompasses some of the largest average farmlands globally. Currently there is about 897,400,000 acres of land under cultivation in North America, while the U. S. farmer works on an averagely sized farm of about 445 acres.

- With relatively large average farm size and a vast amount of cultivated land, North America emerged as the largest region in the farming as a service market. This market share has been attributed to the fact that the use of automation and control systems are common in most countries in the region due to the adoption of more progressive smart farming approaches that has seen an uptake of agriculture farming-as-a-service.

Active Key Players in the Farming as a Service Market

- Mahindra and Mahindra

- John Deere

- ITC

- Trimble

- EM3

- Apollo Agriculture

- Accenture

- Taranis

- Precision Hawk

- IBM

- BigHaat

- Ninja Kart

- Other Key Players

Key Industry Developments in the Farming as a Service Market:

- Taranis announced in January 2023 the commercial release of AcreForward that aims to help ag retailers bring greater value to the acres of land across the world. The solution was conceived to deliver the most detailed and frequent, at the leaf level, information about growers’ crops in the season and to capitalize on each acre’s Smart agriculture possibilities enhanced by new findings related to carbon capture and soil health.

- In July 2022, ITC Ltd. decided to found a brand new full-stack agritech app named ITCMAARS (Meta Market for Advanced Agricultural Rural Access to Markets) that will extend the company’s agri-business arm even further. The company was get ready to help farmers using Farming As A Service- based, and individual crop recommendations based on ML.

Global Farming as a Service Market Scope:

|

Global Farming as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.2% |

Market Size in 2032: |

USD 14.7 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Delivery Model |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FARMING AS A SERVICE MARKET BY SERVICE (2017-2032)

- FARMING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FARM MANAGEMENT SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCTION ASSISTANCE

- ACCESS TO MARKETS

- FARMING AS A SERVICE MARKET BY DELIVERY MODEL (2017-2032)

- FARMING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUBSCRIPTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAY-PER-USE

- FARMING AS A SERVICE MARKET BY END-USER (2017-2032)

- FARMING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FARMERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- CORPORATE

- FINANCIAL INSTITUTIONS

- ADVISORY BODIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Farming as a Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MAHINDRA AND MAHINDRA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- JOHN DEERE

- ITC

- TRIMBLE

- EM3

- APOLLO AGRICULTURE

- ACCENTURE

- TARANIS

- PRECISION HAWK

- IBM

- BIGHAAT

- NINJA KART

- COMPETITIVE LANDSCAPE

- GLOBAL FARMING AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Delivery Model

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Farming as a Service Market Scope:

|

Global Farming as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.2% |

Market Size in 2032: |

USD 14.7 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Delivery Model |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FARMING AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FARMING AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FARMING AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. FARMING AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. FARMING AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. FARMING AS A SERVICE MARKET BY SOLUTIONS

TABLE 008. FARM MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 009. PRODUCTION ASSISTANCE MARKET OVERVIEW (2016-2028)

TABLE 010. ACCESS TO MARKET MARKET OVERVIEW (2016-2028)

TABLE 011. FARMING AS A SERVICE MARKET BY DELIVERY MODEL

TABLE 012. PAY-PER-USE MARKET OVERVIEW (2016-2028)

TABLE 013. SUBSCRIPTION MARKET OVERVIEW (2016-2028)

TABLE 014. FARMING AS A SERVICE MARKET BY END USER

TABLE 015. CORPORATES MARKET OVERVIEW (2016-2028)

TABLE 016. FINANCIAL INSTITUTION MARKET OVERVIEW (2016-2028)

TABLE 017. FARMER MARKET OVERVIEW (2016-2028)

TABLE 018. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 019. ADVISORY BODIES MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA FARMING AS A SERVICE MARKET, BY SOLUTIONS (2016-2028)

TABLE 021. NORTH AMERICA FARMING AS A SERVICE MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 022. NORTH AMERICA FARMING AS A SERVICE MARKET, BY END USER (2016-2028)

TABLE 023. N FARMING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE FARMING AS A SERVICE MARKET, BY SOLUTIONS (2016-2028)

TABLE 025. EUROPE FARMING AS A SERVICE MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 026. EUROPE FARMING AS A SERVICE MARKET, BY END USER (2016-2028)

TABLE 027. FARMING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC FARMING AS A SERVICE MARKET, BY SOLUTIONS (2016-2028)

TABLE 029. ASIA PACIFIC FARMING AS A SERVICE MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 030. ASIA PACIFIC FARMING AS A SERVICE MARKET, BY END USER (2016-2028)

TABLE 031. FARMING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA FARMING AS A SERVICE MARKET, BY SOLUTIONS (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA FARMING AS A SERVICE MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA FARMING AS A SERVICE MARKET, BY END USER (2016-2028)

TABLE 035. FARMING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA FARMING AS A SERVICE MARKET, BY SOLUTIONS (2016-2028)

TABLE 037. SOUTH AMERICA FARMING AS A SERVICE MARKET, BY DELIVERY MODEL (2016-2028)

TABLE 038. SOUTH AMERICA FARMING AS A SERVICE MARKET, BY END USER (2016-2028)

TABLE 039. FARMING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 040. AGRIBOLO: SNAPSHOT

TABLE 041. AGRIBOLO: BUSINESS PERFORMANCE

TABLE 042. AGRIBOLO: PRODUCT PORTFOLIO

TABLE 043. AGRIBOLO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NINJACART: SNAPSHOT

TABLE 044. NINJACART: BUSINESS PERFORMANCE

TABLE 045. NINJACART: PRODUCT PORTFOLIO

TABLE 046. NINJACART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MAHINDRA & MAHINDRA LTD: SNAPSHOT

TABLE 047. MAHINDRA & MAHINDRA LTD: BUSINESS PERFORMANCE

TABLE 048. MAHINDRA & MAHINDRA LTD: PRODUCT PORTFOLIO

TABLE 049. MAHINDRA & MAHINDRA LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. JOHN DEERE: SNAPSHOT

TABLE 050. JOHN DEERE: BUSINESS PERFORMANCE

TABLE 051. JOHN DEERE: PRODUCT PORTFOLIO

TABLE 052. JOHN DEERE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. APOLLO AGRICULTURE: SNAPSHOT

TABLE 053. APOLLO AGRICULTURE: BUSINESS PERFORMANCE

TABLE 054. APOLLO AGRICULTURE: PRODUCT PORTFOLIO

TABLE 055. APOLLO AGRICULTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. IBM: SNAPSHOT

TABLE 056. IBM: BUSINESS PERFORMANCE

TABLE 057. IBM: PRODUCT PORTFOLIO

TABLE 058. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. EKYLIBRE: SNAPSHOT

TABLE 059. EKYLIBRE: BUSINESS PERFORMANCE

TABLE 060. EKYLIBRE: PRODUCT PORTFOLIO

TABLE 061. EKYLIBRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. IDRONE SERVICES: SNAPSHOT

TABLE 062. IDRONE SERVICES: BUSINESS PERFORMANCE

TABLE 063. IDRONE SERVICES: PRODUCT PORTFOLIO

TABLE 064. IDRONE SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. FARMLYPLACE: SNAPSHOT

TABLE 065. FARMLYPLACE: BUSINESS PERFORMANCE

TABLE 066. FARMLYPLACE: PRODUCT PORTFOLIO

TABLE 067. FARMLYPLACE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BIGHAAT: SNAPSHOT

TABLE 068. BIGHAAT: BUSINESS PERFORMANCE

TABLE 069. BIGHAAT: PRODUCT PORTFOLIO

TABLE 070. BIGHAAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ACCENTURE: SNAPSHOT

TABLE 071. ACCENTURE: BUSINESS PERFORMANCE

TABLE 072. ACCENTURE: PRODUCT PORTFOLIO

TABLE 073. ACCENTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. TRIMBLE: SNAPSHOT

TABLE 074. TRIMBLE: BUSINESS PERFORMANCE

TABLE 075. TRIMBLE: PRODUCT PORTFOLIO

TABLE 076. TRIMBLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. TARANIS: SNAPSHOT

TABLE 077. TARANIS: BUSINESS PERFORMANCE

TABLE 078. TARANIS: PRODUCT PORTFOLIO

TABLE 079. TARANIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 080. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 081. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 082. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FARMING AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FARMING AS A SERVICE MARKET OVERVIEW BY SOLUTIONS

FIGURE 012. FARM MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 013. PRODUCTION ASSISTANCE MARKET OVERVIEW (2016-2028)

FIGURE 014. ACCESS TO MARKET MARKET OVERVIEW (2016-2028)

FIGURE 015. FARMING AS A SERVICE MARKET OVERVIEW BY DELIVERY MODEL

FIGURE 016. PAY-PER-USE MARKET OVERVIEW (2016-2028)

FIGURE 017. SUBSCRIPTION MARKET OVERVIEW (2016-2028)

FIGURE 018. FARMING AS A SERVICE MARKET OVERVIEW BY END USER

FIGURE 019. CORPORATES MARKET OVERVIEW (2016-2028)

FIGURE 020. FINANCIAL INSTITUTION MARKET OVERVIEW (2016-2028)

FIGURE 021. FARMER MARKET OVERVIEW (2016-2028)

FIGURE 022. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 023. ADVISORY BODIES MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA FARMING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE FARMING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC FARMING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA FARMING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA FARMING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Farming as a Service Market research report is 2024-2032.

Mahindra and Mahindra, John Deere, ITC, Trimble, EM3, Apollo Agriculture, Accenture, Taranis, Precision Hawk, IBM, BigHaat, Ninja Kart, and Other Major Players..

The Farming as a Service Market is segmented into service, delivery model, end user, and region. By service, the market is categorized into farm management solutions, production assistance, access to markets. By delivery model, the market is categorized into subscription, pay-per-use. By end user, the market is categorized into farmers, government, corporate, financial institutions, and advisory bodies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Farming as a Service (FaaS) is a business model of farming services that makes it easier for farmers to access those services they require on either a subscription or usage basis. Some of these services may comprise equipment hire, hi-tech farming tools and equipment, consultancy, and logistics. Through the use of technology and data, FaaS can improve efficiency and sustainability in farming, thus making other farming methods possible for young farmers and small and medium-scale farmers.

Farming as a Service Market Size Was Valued at USD 4.1 Billion in 2023 and is Projected to Reach USD 14.7 Billion by 2032, Growing at a CAGR of 15.2% From 2024-2032.