Big data as a Service Market Synopsis

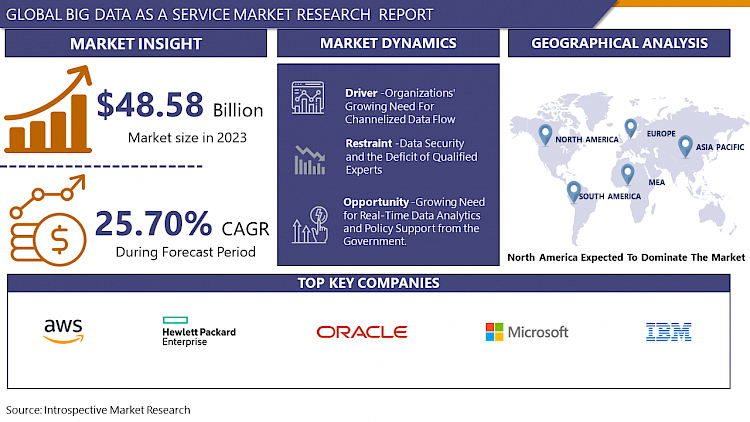

Big data as a Service Market Size is Valued at USD 48.48 Billion in 2024, and is Projected to Reach USD 380.62 Billion by 2032, Growing at a CAGR of 25.70% From 2024-2032.

BDaaS market can be described as the market of Big Data solutions that are provided through the cloud-computing platform with the main focus on the aspects of scalability and cost-efficiency on analysis and storage. BDaaS providers offer data management, processing, and analysis services which do not require enterprises to invest in related hardware or software; helping enterprises fulfil their flexible data needs. This market is being boosted by the rising data traffic, need for faster analysis, and a new trend of integrating cloud computing to improve operations and gain more insights.

- Currently, the BDaaS market is growing fast due to the rising need for comprehensive and inexpensive solutions for Big Data handling. One of the significant actors of this segment is Driver, which provides versatile BDaaS services considering the specific features of various industries. Built on the cloud, Driver offers the enterprises efficient technologies to integrate, store, process and analyse massive data. Their services are for structured and unstructured data processing in an effort to allow the business to make valuable decisions within the shortest time possible.

- Within the BDaaS space, dRiver’s services include real-time analysis, forecasting, and machine learning. Therefore, by tapping on dRiver’s deep understanding of the implementation of scalable infrastructure and protection of data and information, dDriver delivers solutions that meet the industry’s rules and requirements. As the requirements for the operational agility involving the data rises, Driver persists in developing the BDaaS solutions that provide organizations with customizable approaches to manage their data resources and turn them into the sources of competitive advantages in the modern digital environment.

Big data as a Service Market Trend Analysis

Driving Innovation through BDaaS, Trends and Future Outlook

- The future of the BDaaS market is vivid as the amount of data being produced in diverse industries keeps growing, and there is a need to manage such data effectively and at a reasonable cost. BDaaS allows the companies to handle petabytes of data and analyse them at the same time with no need to invest in hardware like in case of on-premises solutions. Such scalability is especially appealing to entities that use data analytics for planning, strategic, and management purposes.

- BDaaS market comprises key players that are introducing new services by focusing on such aspects as real-time analytics, AI-based data analysis, and advanced solutions in the sphere of data protection. The use of the cloud-based BDaaS solutions continues to grow around the world because the need for the innovative and flexible data management solutions for the digital business across the healthcare, finical/ banking, retail, and telecommunication industries among others is increasing steadily. Due to the current trend of organizations focusing on metrics and analytics to make informed decisions the BDaaS market has the potential to grow at a faster rate in future with predictions showing progressive growth and development in relation to data analytics services.

The Next Frontier, Exploring the Untapped Potential of BDaaS

- The market segment of Big Data as a Service (BDaaS) has a huge opportunity arising from the rising volumes, velocity, and variety of data produced across the business sectors. BDaaS solutions are designed at a large scale to provide an organization with a way to deal with large amounts of data without having to build up the same amount of internal hardware. Besides, it cuts the number of operations which in addition to saving operational costs it increases the flexibility of deals to better utilize the data gathered.

- Some factors explaining the BDaaS market development include the increased usage of the cloud services that provide any business with an opportunity to implement data services without high investments, such as the ones that are made by small enterprises. Also, incorporating intelligent technologies such as Artificial Intelligence and Machine Learning have increased the efficiency of BDaaS in developing innovative analytics mechanisms for organizations to drive more insights from their data. The growing importance of big data for the decision-making process in today’s companies ensures that the BDaaS market will have numerous opportunities for development in the future, covering the USA as well as other states, fields such as healthcare, finance, retail, and manufacturing. This constantly changing environment presents a lot of opportunities for BDaaS providers to develop and adapt to the changing customer needs as well as increase the market’s competitiveness.

Big data as a Service Market Segment Analysis:

Big data as a Service Market is Segmented on the basis of Solution type, Deployment Model, and end-users.

By Solution Type, Hadoop-As-A-Service segment is expected to dominate the market during the forecast period

- The Big Data as a Service (BDaaS) market comprises several solutions for various consumption types required by different organizations. Some are Hadoop as a Service which is another way of cost effective management of Hadoop clusters to dealing with large data sets. Today, a number of vendors have developed Data Analytics-as-a-Service platforms that provide enhanced, business-friendly analytical solutions. Moreover, Data-as-a-Service solutions give an opportunity to obtain the datasets and information that were chosen according to certain criteria and improve the rate of decision-making and organizational performance in various sectors. Altogether, all these BDaaS solutions will address the need for efficient and flexible data management and analytic solutions in today’s highly competitive environment.

By Deployment Model, Public Cloud segment held the largest share in 2024

- The Big Data as a Service (BDaaS) market deployment option are the Public Cloud that entails large data availability and shareable access to the infrastructure provided by third-party vendors based on large infrastructure. Private Cloud solutions ensure that the private corporation has exclusive use of the Cloud infrastructure and can safeguards the data being used in such organizations that strictly adheres to compliance regulations. Hybrid Cloud plays the role of keeping the necessary data in both the public and the private Cloud zones; at the same time, it allows choosing when the data transfer occurs based on the load or sensitivity. These deployment types allow the BDaaS solutions to be customized according to operational requirements and delivered on a scalable cloud architecture that reduces costs and can easily integrate with organizations’ existing IT environments.

Big data as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North American BDaaS market has a great potential due to the excessive development of technological industries and the growing demand for advanced analytics in the region. Strengthened by a strong and quite saturated IT market, high connectivity, and continuing investments in cloud computing, North America is still one of the main markets worldwide. They are key to the faster growth of BDaaS, helping corporations find efficient and affordable methods of managing big data.

- While large enterprises such as IBM, Microsoft, and HP held substantial stakes in BDaaS in North America, several startups were intensively vying for the market with highly specific BDaaS solutions. When considering the core industries that rely on BDaaS to drive changes in operations, decision-making, and competitive advantage, key sectors include healthcare, finance, retail and telecommunication. Such market trends are only spurred further by new developments in artificial intelligence, machine learning, and data security, which will continue to support BDaaS innovation and growth in North America as a crucial regional market.

Active Key Players in the Big data as a Service Market

- Amazon Web Services Inc. (United States)

- Hewlett Packard Enterprise (United States)

- IBM Corporation (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- SAS Institute Inc. (United States)

- Teradata Corporation (United States)

- Google Inc. (United States)

- Accenture (Ireland)

- Salesforce (United States)

- Hitachi Vantara (United States)

- CenturyLink Inc. (United States)

- Wipro Limited (India)

- Snowflake Inc. (United States)

- Others

|

Global Big data as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.70 % |

Market Size in 2032: |

USD 380.62 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Type |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIG DATA AS A SERVICE MARKET BY SOLUTION TYPE (2017-2032)

- BIG DATA AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HADOOP-AS-A-SERVICE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- DATA ANALYTICS-AS-A-SERVICE

- DATA-AS-A-SERVICE

- BIG DATA AS A SERVICE MARKET BY DEPLOYMENT MODEL (2017-2032)

- BIG DATA AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PUBLIC CLOUD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYBRID CLOUD

- PRIVATE CLOUD

- BIG DATA AS A SERVICE MARKET BY END USERS (2017-2032)

- BIG DATA AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT & TELECOM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD & BEVERAGE

- BFSI LOGISTICS

- HEALTHCARE

- DÉFENSE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Big data as a Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMAZON WEB SERVICES INC. (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HEWLETT PACKARD ENTERPRISE (UNITED STATES)

- IBM CORPORATION (UNITED STATES)

- MICROSOFT CORPORATION (UNITED STATES)

- ORACLE CORPORATION (UNITED STATES)

- SAP SE (GERMANY)

- SAS INSTITUTE INC. (UNITED STATES)

- TERADATA CORPORATION (UNITED STATES)

- GOOGLE INC. (UNITED STATES)

- ACCENTURE (IRELAND)

- SALESFORCE (UNITED STATES)

- HITACHI VANTARA (UNITED STATES)

- CENTURYLINK INC. (UNITED STATES)

- WIPRO LIMITED (INDIA)

- SNOWFLAKE INC. (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL BIG DATA AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Solution Type

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Big data as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 48.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

25.70 % |

Market Size in 2032: |

USD 380.62 Bn. |

|

Segments Covered: |

By Solution Type |

|

|

|

By Deployment Type |

|

||

|

End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIG DATA AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIG DATA AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIG DATA AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. BIG DATA AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIG DATA AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. BIG DATA AS A SERVICE MARKET BY SOLUTION TYPE

TABLE 008. HADOOP-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 009. DATA ANALYTICS-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. DATA-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 011. BIG DATA AS A SERVICE MARKET BY DEPLOYMENT MODEL

TABLE 012. PUBLIC CLOUD MARKET OVERVIEW (2016-2028)

TABLE 013. HYBRID CLOUD MARKET OVERVIEW (2016-2028)

TABLE 014. PRIVATE CLOUD MARKET OVERVIEW (2016-2028)

TABLE 015. BIG DATA AS A SERVICE MARKET BY END USE INDUSTRY

TABLE 016. IT & TELECOM MARKET OVERVIEW (2016-2028)

TABLE 017. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 018. BFSI MARKET OVERVIEW (2016-2028)

TABLE 019. LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 020. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 021. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA BIG DATA AS A SERVICE MARKET, BY SOLUTION TYPE (2016-2028)

TABLE 024. NORTH AMERICA BIG DATA AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 025. NORTH AMERICA BIG DATA AS A SERVICE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 026. N BIG DATA AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE BIG DATA AS A SERVICE MARKET, BY SOLUTION TYPE (2016-2028)

TABLE 028. EUROPE BIG DATA AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 029. EUROPE BIG DATA AS A SERVICE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 030. BIG DATA AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC BIG DATA AS A SERVICE MARKET, BY SOLUTION TYPE (2016-2028)

TABLE 032. ASIA PACIFIC BIG DATA AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 033. ASIA PACIFIC BIG DATA AS A SERVICE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 034. BIG DATA AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BIG DATA AS A SERVICE MARKET, BY SOLUTION TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BIG DATA AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA BIG DATA AS A SERVICE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 038. BIG DATA AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA BIG DATA AS A SERVICE MARKET, BY SOLUTION TYPE (2016-2028)

TABLE 040. SOUTH AMERICA BIG DATA AS A SERVICE MARKET, BY DEPLOYMENT MODEL (2016-2028)

TABLE 041. SOUTH AMERICA BIG DATA AS A SERVICE MARKET, BY END USE INDUSTRY (2016-2028)

TABLE 042. BIG DATA AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 043. AMAZON WEB SERVICES INC.: SNAPSHOT

TABLE 044. AMAZON WEB SERVICES INC.: BUSINESS PERFORMANCE

TABLE 045. AMAZON WEB SERVICES INC.: PRODUCT PORTFOLIO

TABLE 046. AMAZON WEB SERVICES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. HEWLETT PACKARD ENTERPRISE: SNAPSHOT

TABLE 047. HEWLETT PACKARD ENTERPRISE: BUSINESS PERFORMANCE

TABLE 048. HEWLETT PACKARD ENTERPRISE: PRODUCT PORTFOLIO

TABLE 049. HEWLETT PACKARD ENTERPRISE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. IBM CORPORATION: SNAPSHOT

TABLE 050. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 051. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 052. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MICROSOFT CORPORATION: SNAPSHOT

TABLE 053. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 054. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 055. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ORACLE CORPORATION: SNAPSHOT

TABLE 056. ORACLE CORPORATION: BUSINESS PERFORMANCE

TABLE 057. ORACLE CORPORATION: PRODUCT PORTFOLIO

TABLE 058. ORACLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SAP SE: SNAPSHOT

TABLE 059. SAP SE: BUSINESS PERFORMANCE

TABLE 060. SAP SE: PRODUCT PORTFOLIO

TABLE 061. SAP SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SAS INSTITUTE INC.: SNAPSHOT

TABLE 062. SAS INSTITUTE INC.: BUSINESS PERFORMANCE

TABLE 063. SAS INSTITUTE INC.: PRODUCT PORTFOLIO

TABLE 064. SAS INSTITUTE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. TERADATA CORPORATION: SNAPSHOT

TABLE 065. TERADATA CORPORATION: BUSINESS PERFORMANCE

TABLE 066. TERADATA CORPORATION: PRODUCT PORTFOLIO

TABLE 067. TERADATA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. GOOGLE INC.: SNAPSHOT

TABLE 068. GOOGLE INC.: BUSINESS PERFORMANCE

TABLE 069. GOOGLE INC.: PRODUCT PORTFOLIO

TABLE 070. GOOGLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ACCENTURE: SNAPSHOT

TABLE 071. ACCENTURE: BUSINESS PERFORMANCE

TABLE 072. ACCENTURE: PRODUCT PORTFOLIO

TABLE 073. ACCENTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SALESFORCE: SNAPSHOT

TABLE 074. SALESFORCE: BUSINESS PERFORMANCE

TABLE 075. SALESFORCE: PRODUCT PORTFOLIO

TABLE 076. SALESFORCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. HITACHI VANTARA: SNAPSHOT

TABLE 077. HITACHI VANTARA: BUSINESS PERFORMANCE

TABLE 078. HITACHI VANTARA: PRODUCT PORTFOLIO

TABLE 079. HITACHI VANTARA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CENTURYLINK INC.: SNAPSHOT

TABLE 080. CENTURYLINK INC.: BUSINESS PERFORMANCE

TABLE 081. CENTURYLINK INC.: PRODUCT PORTFOLIO

TABLE 082. CENTURYLINK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. WIPRO LIMITED: SNAPSHOT

TABLE 083. WIPRO LIMITED: BUSINESS PERFORMANCE

TABLE 084. WIPRO LIMITED: PRODUCT PORTFOLIO

TABLE 085. WIPRO LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SNOWFLAKE INC.: SNAPSHOT

TABLE 086. SNOWFLAKE INC.: BUSINESS PERFORMANCE

TABLE 087. SNOWFLAKE INC.: PRODUCT PORTFOLIO

TABLE 088. SNOWFLAKE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 089. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 090. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 091. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIG DATA AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIG DATA AS A SERVICE MARKET OVERVIEW BY SOLUTION TYPE

FIGURE 012. HADOOP-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. DATA ANALYTICS-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. DATA-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 015. BIG DATA AS A SERVICE MARKET OVERVIEW BY DEPLOYMENT MODEL

FIGURE 016. PUBLIC CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 017. HYBRID CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 018. PRIVATE CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 019. BIG DATA AS A SERVICE MARKET OVERVIEW BY END USE INDUSTRY

FIGURE 020. IT & TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 021. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 022. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 023. LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 024. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 025. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA BIG DATA AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE BIG DATA AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC BIG DATA AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA BIG DATA AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA BIG DATA AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the big data as a Service Market research report is 2024-2032.

Amazon Web Services Inc. (United States), Hewlett Packard Enterprise (United States), IBM Corporation (United States), Microsoft Corporation (United States), Oracle Corporation (United States), SAP SE (Germany), SAS Institute Inc. (United States), Teradata Corporation (United States), Google Inc. (United States), Accenture (Ireland), Salesforce (United States), Hitachi Vantara (United States), CenturyLink Inc. (United States), Wipro Limited (India), Snowflake Inc. (United States) and Other Major Players.

The Big data as a Service Market is segmented into By Solution Type (Hadoop-As-A-Service, Data Analytics-As-A-Service, Data-As-A-Service), Deployment Model (Public Cloud, Hybrid Cloud, Private Cloud), End Use Industry (IT & Telecom, Food & Beverage, BFSI, Logistics, Healthcare, Defense, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

BDaaS market can be described as the market of Big Data solutions that are provided through the cloud-computing platform with the main focus on the aspects of scalability and cost-efficiency on analysis and storage. BDaaS providers offer data management, processing, and analysis services which do not require enterprises to invest in related hardware or software; helping enterprises fulfil their flexible data needs. This market is being boosted by the rising data traffic, need for faster analysis, and a new trend of integrating cloud computing to improve operations and gain more insights.

Big data as a Service Market Size is Valued at USD 48.58 Billion in 2024, and is Projected to Reach USD 380.62 Billion by 2032, Growing at a CAGR of 25.70% From 2024-2032.