Compliance as a Service Market Synopsis

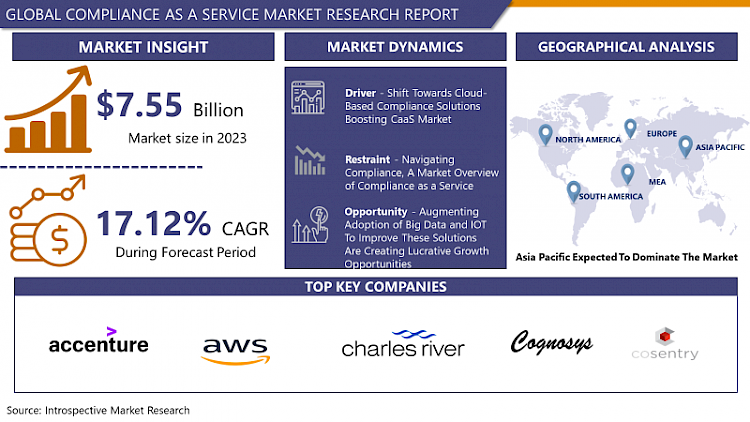

Compliance as a Service Market Size is Valued at USD 7.55 Billion in 2023 and is Projected to Reach USD 26.75 Billion by 2032, Growing at a CAGR of 17.12% From 2024-2032.

A cloud-based utility known as Compliance as a utility (CaaS) assists organizations in the administration and upkeep of regulatory compliance obligations. It furnishes organizations with the means and means to guarantee adherence to industry and legal benchmarks, including financial regulations and data protection laws. Frequently, CaaS offerings include capabilities for risk assessment, policy management, auditing, and reporting. The expanding intricacy of regulatory landscapes and the imperative for organizations to effectively oversee compliance obligations while mitigating expenses and vulnerabilities propel this market.

- CaaS is currently considered as a rapidly growing and popular solution for various reasons. First, the growth in the level of regulation for various industries is the primary driver of organizations to find better and cheaper solutions for compliance. CaaS provides end-to-end solutions for compliance management, as it helps organizations to address issues related to compliance with the requirements of different regulatory systems.

- Secondly, the increased usage of digital transformation and cloud solutions is the driving force behind CaaS. Today, as business processes are shifting online, and data is becoming the crucial factor of success, compliance with data protection regulations and standards is essential. Due to this, CaaS providers can easily deliver solutions that are elastic in nature to meet the changing compliance requirements of an organization and therefore can suit small, medium and large enterprises.

- Also, the need to secure data and privacy is also a major factor that is fueling the demand for CaaS. As governments across the world tighten the noose on the data handling and protection through laws such as GDPR and CCPA, companies are seeking the services of CaaS providers. CaaS is beneficial in as much as it provides organizations with a way of being ready for compliance, thus avoiding the expensive fines and penalties of non-compliance.

Compliance as a Service Market Trend Analysis

Increasing Applications in the Automotive Industry

- The market for Compliance as a Service (CaaS) is growing rapidly due to the growing concerns of compliance across industries and the need for a solution that can manage the compliance process efficiently. CaaS is being implemented in organizations to enhance the way organizations handle compliance to ensure that they are in line with the set legal requirements, cut on costs, and minimize on the risks that emanate from non-compliance. It is also experiencing an increased use of cloud technology solutions since it is flexible, scalable and cheaper.

- Another trend is adopting of new technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) as the means of compliance processes improvement in the CaaS market. These technologies allow for efficiency in compliance functions, streamlining of compliance processes, and better decision making in compliance matters. Moreover, the market is also experiencing growing trends of compliance solutions for specific industries in accordance with the specific regulation in respective segments, which is also influencing the market growth positively.

Simplifying Compliance, The CaaS Solution

- The Compliance as a Service (CaaS) market is growing rapidly owing to the growth in the regulatory environment and the need for organizations to address these compliance requirements effectively. The CaaS providers present the business with various solutions that enable the business to easily handle compliance related activities including monitoring, reporting, and auditing.

- It is also evident from the market trends that the market is experiencing a shift towards the adoption of cloud computing as well as the need for solutions that are flexible and cost efficient in terms of compliance. This is especially true for SMEs who are seeking for CaaS providers to address their compliance requirements since they do not have the capacity to establish and sustain sophisticated compliance solutions on their own. In conclusion, CaaS market is poised to grow further as organizations look for ways to better deal with compliance challenges in the age of growing regulation.

Compliance as a Service Market Segment Analysis:

Compliance as a Service Market is segmented on the basis of type, and Vertical.

By Type, Software segment is expected to dominate the market during the forecast period

- CaaS encompasses a variety of software solutions that are aimed at addressing compliance challenges and optimizing the related processes. This may encompass system that offer regulatory oversight, risk evaluation, audit control, and reporting solutions.

- On the other hand, the services offered in the CaaS market are service-based that are consultation and advisory services that assist organizations in dealing with intricate compliance laws. Such services may include compliance audits, compliance audits and recommendation, the formulation of policies and guidelines, and the conduct of training to ensure that the organizations adhere to the set laws.

- Altogether this software and service-based solution enable any organization to have the right tools and support to manage compliance smoothly and successfully.

By Vertical, IT & ITES segment held the largest share in 2023

- In the current CaaS market, solutions are designed and developed to provide compliance solutions for a range of industry sectors. Some of the prominent verticals are Banking, Financial Services and Insurance (BFSI), Information Technology (IT) & ITES, Government & Public sector, Healthcare & Life sciences, Retail & E-commerce and others.

- The BFSI sector particularly depends on compliance solutions to meet the regulatory standards of the financial market and protect the customer’s information. Some of the reasons why IT & ITES companies are interested in CaaS include managing data security and privacy regulations. The public sector uses CaaS to maintain legal and regulatory compliance of the operations of the government. To avoid violating the laws that regulate the provision of healthcare services and to ensure that the patient data is secure, many healthcare organizations implement CaaS.

- CaaS helps the retail and E-commerce industries in addressing compliance with the laws and rules of consumer protection. Other industries like manufacturing, energy and telecommunication industry also have access to variety of CaaS solutions as per their respective regulatory requirements. This industry-specific approach is helpful in making sure that CaaS providers are in a position of being able to meet the specific compliance needs of various verticals.

Compliance as a Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is experiencing a growing demand for Compliance as a Service (CaaS) due to the rising regulatory pressures, the use of new technologies, and the prevalence of compliance challenges that need to be addressed at low cost. China, India, and Japan are currently dominating the market due to factors, such as large population and technological advancement. For instance, owing to the strict regulatory measures in the Chinese market, especially for the financial and healthcare sectors, the demand for CaaS has recently been on the rise.

- Further, the market is well-positioned to experience an influx of significant CaaS providers, boosting their operations in the region. All these providers are now offering various services such as risk assessment, data protection and reporting to ensure that companies are in compliance with laws within their respective countries and those of the international market. The growing understanding among the companies regarding the value of outsourcing compliance operations is further propelling the market growth in the Asia Pacific region.

Active Key Players in the Compliance as a Service Market

- Accenture Plc (Ireland)

- Amazon Web Services Inc (United States)

- Charles River Systems Inc (United States)

- Cognosys Technologies (India)

- Cosentry Inc (United States)

- Datapipe Inc (United States)

- Dell SecureWorks Inc (United States)

- FireHost Inc (United States)

- Linedata (France)

- Peak 10 Inc (United States)

- ScaleMatrix Inc (United States)

- Trustwave Holdings Inc (United States)

- Others Active Key Players

Key Industry Developments in the Compliance as a Service Market:

- In March 2022, Trustero, a pioneer in Compliance as a Service for emerging enterprises, has raised $8 million in seed funding and emerged from covert mode, the company announced. The round was led by Zetta Venture Partners, with Engineering Capital and Vertex Ventures also participating.

- In March 2022, Flexera, an IT management software company, and IBM Turbonomic Application Resource Management (ARM) have introduced new solutions designed to assist organizations in streamlining IT asset management through automation. The newly developed solutions are designed to assist organizations in reducing expenses while automating the progressively intricate processes of software license optimization and compliance.

|

Global Compliance as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.12% |

Market Size in 2032: |

USD 26.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- COMPLIANCE AS A SERVICE MARKET BY TYPE (2017-2032)

- COMPLIANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICE

- COMPLIANCE AS A SERVICE MARKET BY VERTICAL (2017-2032)

- COMPLIANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IT & ITES

- GOVERNMENT

- HEALTHCARE

- RETAIL

- E-COMMERCE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Compliance as a Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ACCENTURE PLC (IRELAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AMAZON WEB SERVICES INC (UNITED STATES)

- CHARLES RIVER SYSTEMS INC (UNITED STATES)

- COGNOSYS TECHNOLOGIES (INDIA)

- COSENTRY INC (UNITED STATES)

- DATAPIPE INC (UNITED STATES)

- DELL SECUREWORKS INC (UNITED STATES)

- FIREHOST INC (UNITED STATES)

- LINEDATA (FRANCE)

- PEAK 10 INC (UNITED STATES)

- SCALEMATRIX INC (UNITED STATES)

- TRUSTWAVE HOLDINGS INC (UNITED STATES)

- COMPETITIVE LANDSCAPE

- GLOBAL COMPLIANCE AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Compliance as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.12% |

Market Size in 2032: |

USD 26.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. COMPLIANCES AS SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. COMPLIANCES AS SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. COMPLIANCES AS SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. COMPLIANCES AS SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. COMPLIANCES AS SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. COMPLIANCES AS SERVICE MARKET BY TYPE

TABLE 008. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. COMPLIANCES AS SERVICE MARKET BY VERTICAL

TABLE 011. HBFSI MARKET OVERVIEW (2016-2028)

TABLE 012. IT & ITES MARKET OVERVIEW (2016-2028)

TABLE 013. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 014. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 015. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA COMPLIANCES AS SERVICE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA COMPLIANCES AS SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 019. N COMPLIANCES AS SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE COMPLIANCES AS SERVICE MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE COMPLIANCES AS SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 022. COMPLIANCES AS SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC COMPLIANCES AS SERVICE MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC COMPLIANCES AS SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 025. COMPLIANCES AS SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA COMPLIANCES AS SERVICE MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA COMPLIANCES AS SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 028. COMPLIANCES AS SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA COMPLIANCES AS SERVICE MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA COMPLIANCES AS SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 031. COMPLIANCES AS SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 032. APPLE (US): SNAPSHOT

TABLE 033. APPLE (US): BUSINESS PERFORMANCE

TABLE 034. APPLE (US): PRODUCT PORTFOLIO

TABLE 035. APPLE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. HEWLETT PACKARD (US): SNAPSHOT

TABLE 036. HEWLETT PACKARD (US): BUSINESS PERFORMANCE

TABLE 037. HEWLETT PACKARD (US): PRODUCT PORTFOLIO

TABLE 038. HEWLETT PACKARD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LENOVO (CHINA): SNAPSHOT

TABLE 039. LENOVO (CHINA): BUSINESS PERFORMANCE

TABLE 040. LENOVO (CHINA): PRODUCT PORTFOLIO

TABLE 041. LENOVO (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. DELL TECHNOLOGIES (US): SNAPSHOT

TABLE 042. DELL TECHNOLOGIES (US): BUSINESS PERFORMANCE

TABLE 043. DELL TECHNOLOGIES (US): PRODUCT PORTFOLIO

TABLE 044. DELL TECHNOLOGIES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. COMPUTACENTER (UK): SNAPSHOT

TABLE 045. COMPUTACENTER (UK): BUSINESS PERFORMANCE

TABLE 046. COMPUTACENTER (UK): PRODUCT PORTFOLIO

TABLE 047. COMPUTACENTER (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MICROSOFT (US): SNAPSHOT

TABLE 048. MICROSOFT (US): BUSINESS PERFORMANCE

TABLE 049. MICROSOFT (US): PRODUCT PORTFOLIO

TABLE 050. MICROSOFT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CISCO (US): SNAPSHOT

TABLE 051. CISCO (US): BUSINESS PERFORMANCE

TABLE 052. CISCO (US): PRODUCT PORTFOLIO

TABLE 053. CISCO (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. COMPUCOM (US): SNAPSHOT

TABLE 054. COMPUCOM (US): BUSINESS PERFORMANCE

TABLE 055. COMPUCOM (US): PRODUCT PORTFOLIO

TABLE 056. COMPUCOM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. 3STEPIT (FINLAND): SNAPSHOT

TABLE 057. 3STEPIT (FINLAND): BUSINESS PERFORMANCE

TABLE 058. 3STEPIT (FINLAND): PRODUCT PORTFOLIO

TABLE 059. 3STEPIT (FINLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TELIA COMPANY (SWEDEN): SNAPSHOT

TABLE 060. TELIA COMPANY (SWEDEN): BUSINESS PERFORMANCE

TABLE 061. TELIA COMPANY (SWEDEN): PRODUCT PORTFOLIO

TABLE 062. TELIA COMPANY (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. CHG MERIDIAN (GERMANY): SNAPSHOT

TABLE 063. CHG MERIDIAN (GERMANY): BUSINESS PERFORMANCE

TABLE 064. CHG MERIDIAN (GERMANY): PRODUCT PORTFOLIO

TABLE 065. CHG MERIDIAN (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ATEA GLOBAL SERVICES (LATVIA): SNAPSHOT

TABLE 066. ATEA GLOBAL SERVICES (LATVIA): BUSINESS PERFORMANCE

TABLE 067. ATEA GLOBAL SERVICES (LATVIA): PRODUCT PORTFOLIO

TABLE 068. ATEA GLOBAL SERVICES (LATVIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. CSI LEASING (US): SNAPSHOT

TABLE 069. CSI LEASING (US): BUSINESS PERFORMANCE

TABLE 070. CSI LEASING (US): PRODUCT PORTFOLIO

TABLE 071. CSI LEASING (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ECONOCOM (FRANCE): SNAPSHOT

TABLE 072. ECONOCOM (FRANCE): BUSINESS PERFORMANCE

TABLE 073. ECONOCOM (FRANCE): PRODUCT PORTFOLIO

TABLE 074. ECONOCOM (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. GREENFLEX (FRANCE): SNAPSHOT

TABLE 075. GREENFLEX (FRANCE): BUSINESS PERFORMANCE

TABLE 076. GREENFLEX (FRANCE): PRODUCT PORTFOLIO

TABLE 077. GREENFLEX (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. GRENKE (GERMANY): SNAPSHOT

TABLE 078. GRENKE (GERMANY): BUSINESS PERFORMANCE

TABLE 079. GRENKE (GERMANY): PRODUCT PORTFOLIO

TABLE 080. GRENKE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. EXCELLENCE IT (UK): SNAPSHOT

TABLE 081. EXCELLENCE IT (UK): BUSINESS PERFORMANCE

TABLE 082. EXCELLENCE IT (UK): PRODUCT PORTFOLIO

TABLE 083. EXCELLENCE IT (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. FOXWAY (SWEDEN): SNAPSHOT

TABLE 084. FOXWAY (SWEDEN): BUSINESS PERFORMANCE

TABLE 085. FOXWAY (SWEDEN): PRODUCT PORTFOLIO

TABLE 086. FOXWAY (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. COMPLIANCES AS SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. COMPLIANCES AS SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. COMPLIANCES AS SERVICE MARKET OVERVIEW BY VERTICAL

FIGURE 015. HBFSI MARKET OVERVIEW (2016-2028)

FIGURE 016. IT & ITES MARKET OVERVIEW (2016-2028)

FIGURE 017. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 018. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 019. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA COMPLIANCES AS SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE COMPLIANCES AS SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC COMPLIANCES AS SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA COMPLIANCES AS SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA COMPLIANCES AS SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Compliance as a Service Market research report is 2024-2032.

Accenture Plc (Ireland), Amazon Web Services Inc (United States), Charles River Systems Inc (United States), Cognosys Technologies (India), Cosentry Inc (United States), Datapipe Inc (United States), Dell SecureWorks Inc (United States), FireHost Inc (United States), Linedata (France), Peak 10 Inc (United States), ScaleMatrix Inc (United States), Trustwave Holdings Inc (United States) and Other Major Players.

The Compliance as a Service Market is segmented By Type (Software, Service), Vertical (BFSI, IT & ITeS, Government, Healthcare, Retail & eCommerce, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A cloud-based utility known as Compliance as a utility (CaaS) assists organizations in the administration and upkeep of regulatory compliance obligations. It furnishes organizations with the means and means to guarantee adherence to industry and legal benchmarks, including financial regulations and data protection laws. Frequently, CaaS offerings include capabilities for risk assessment, policy management, auditing, and reporting. The expanding intricacy of regulatory landscapes and the imperative for organizations to effectively oversee compliance obligations while mitigating expenses and vulnerabilities propel this market.

Compliance as a Service Market Size is Valued at USD 7.55 Billion in 2023 and is Projected to Reach USD 26.75 Billion by 2032, Growing at a CAGR of 17.12% From 2024-2032.