Video Surveillance as a Service Market Synopsis

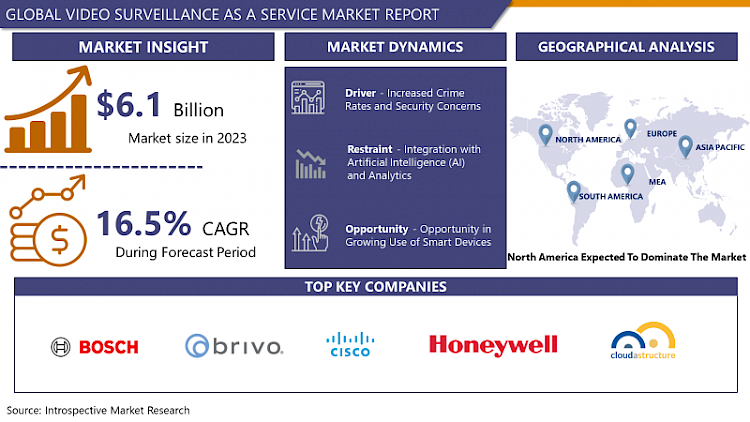

Video Surveillance as a Service Market Size Was Valued at USD 6.1 Billion in 2023, and is Projected to Reach USD 24.1 Billion by 2032, Growing at a CAGR of 16.5% From 2024-2032.

VSaaS is a managed video surveillance service model that involves storing, monitoring and managing video surveillance data remotely. It enables the viewing of live and recorded video footage through any device with internet access, including features like video analysis, instant notifications, and expandable storage. VSaaS is therefore an effective and efficient solution to the conventional on-premise video surveillance systems.

VSaaS can be described as a cloud-based service that enables security officers to watch over a number of premises through cameras that sends video footage over the Internet to a data center where it is stored. The various driving forces that are currently contributing to the market’s expansion include heightened security threats in industries like retail, healthcare, and transportation. VSaaS therefore is a more efficient and cheaper solution than having to invest in costly on premise infrastructure.

- The advantage of video surveillance-as-a-service is that it enables organizations to expand or reduce the scale of surveillance systems. Remote access, cloud-based VSaaS makes it easier to access and view surveillance footage from a distance, enhancing the monitoring process. The various VSaaS solutions that are based on analytics & AI include features like facial recognition, object detection, and others.

- VSaaS is emerging as one of the fastest growing segments in the video surveillance market. Technology is an ever-evolving field, threats are on the rise, and people are in search of efficient and affordable video surveillance systems. Some of the key trends driving the growth of the global video surveillance as a service market are the Cloud VSaaS, which is one of the fastest growing cloud-based software as a service solutions. This can be attributed to the fact that cloud-based solutions are easily scalable, can be easily accessed remotely and do not require much investment in physical infrastructure. Cloud-based software as a service (SaaS) is a complete solution that can be easily integrated and used by any organization.

- The use of AI in video surveillance as a service can be used to enhance the performance of the analytics. The integration of AI and machine learning can enable video data analysis for tasks such as object identification, anomalies detection, predictive maintenance and other functions. This trend is altering the way of video surveillance as it automates the monitoring and alerting functions. Connecting VSaaS to IoT: The combination of VSaaS and IoT makes it possible to derive new valuable insights from the data. The IoT sensors, cameras, and other analytical platforms foster improved security and monitoring systems.

Video Surveillance as a Service Market Trend Analysis

Government Sector Investments in the Improvement of Public Safety Infrastructure

- Due to the installation of many public safety and transportation infrastructure cameras, VSaaS has become a very important factor in public safety. For example, in the UK, and in France, among other countries, a lot of money has been put into CCTV cameras. On the other hand, other United States cities, including Chicago, have been reported to have up to 24,000 cameras spread all over the city. In particular, some factors like increased focus on security issues, the rising government investment in security, especially in the context of smart cities, and the growing digitization of society will lead to the potential growth of VSaaS in the government segment.

- In addition, the government sector is also likely to be one of the largest consumers of VSaaS solutions since more large cities areImplementing VSaaS technologies such as surveillance video cameras to combat crime given that police departments are being forced to work with reduced budgets and shrinking staff. Furthermore, the growing adoption of video surveillance systems and the increased focus on advanced technologies in the private sector are also contributing factors to the market’s growth.

Price Reductions and Enhanced Technological Performance

- The VSaaS system is virtually unconstrained when it comes to scalability and you can choose a number of architectures. The video surveillance services provided by Cisco contain servers that encode up to 64 video channels and contains up to 12 TB of storage capacity. The live video can be accessed from any device with an internet connection and a web browser. However, VSaaS systems such as this one are quite flexible and are compatible with a large number of third-party IP cameras, making the transition from a physical DVR to a cloud-based solution easy.

- The cost of Monthly VSaaS varies between $2 and $8 per camera. This comprises of surveillance as well as data management. It does not include the cost of the IP cameras since they are priced between USD 140 and USD 2,300 every depending on the specifications. Also, another important aspect of most IP camera solutions is the compatibility with mobile devices, irrespective of the cost. This makes the consumers able to manage and regulate the cameras with ease and also from a distance. Likewise, the growth in the use of smart phones and tablets has made it possible for the common man to incorporate video surveillance in his day to day activities which in turn has enhanced the demand for VSaaS especially among small businesses.

Video Surveillance as a Service Market Segment Analysis:

Video Surveillance as a Service Market is segmented based on Type, Application, and Component.

By Type, hosted segment is expected to dominate the market during the forecast period

- The hosted segment accounts for the largest market share and is expected to continue to do so, growing at a CAGR of 15. Is expected to see a CAGR of 66% over the forecast period. Given the technological growth, more and more organizations are looking to adopt hosted video surveillance solutions. The shift towards hosted video and other business applications in the cloud has made hosted surveillance more viable. Cloud hosted video record means that the video footage is stored directly in the cloud instead of a DVR or a memory device on the same premises as the camera. Although the cloud-hosted cameras are available in the market with different features and functionalities, the common feature that is seen among them is the ability to access them directly over a network connection. In full VSaaS models, the video is not stored at the location where it is captured by the user’s cameras. It is either sent to a video service provider or a third party provider for storage and distribution.

- Hybrid VSaaS is a type of video surveillance system that is a combination of managed and hosted video surveillance. This solution often involves keeping all the video surveillance data on site and backup of the data in full or part at a remote location. Hybrid video surveillance as a service refers to a system whereby analog video inputs as well as IP video inputs are fed into the same unit. It enables users to integrate all the current cameras and they must be allowed to integrate IP cameras where sensible. In hybrid VSaaS, the actual recording and storage of videos take place at the business premises of the clients. However, the management of the video is done by a video manufacturer/provider who provides the central video server that controls the devices. Many providers also provide the option of storing copies of certain videos of the user in backup storage. The Hybrid VSaaS is able to offer flexibility and scalability through an open platform as well as future proof the investment as much as possible.

By Application, commercial segment held the largest share in 2023

- The commercial segment is also the largest and predicted to have the highest CAGR of 15% over the forecast period. It is expected to account for 60% of the total sales during the forecast period. Video surveillance or closed circuit television is particularly useful in the protection of industrial and commercial property. Besides the basic functions of protection, such as protecting the perimeter and the outer shell against damage, theft, and espionage, video systems are also used to control and enhance various business processes and to provide for the health and safety of employees. There are immediate business requirements for smart video surveillance systems that can leverage the installed base of cameras to provide a more sophisticated security system and offer greater value in other areas besides strictly security. This paper presents a new taxonomy to categorize video surveillance as a service based on the commercial functions it serves. Through facial recognition VSaaS assists in identifying criminals who may be perpetrating the crime. Video cameras give a general view of the division while they can also be plugin into systems to watch over processes as they occur.

- VSaaS system records activities during an event and identifies violence, theft, or an accident that is likely to occur. Art theft is growing in museums, gallery openings, or exhibition spaces, and this can be combated by using VSaaS. However, if cameras are placed, potential thieves, vandals or curious visitors know they are expected to act properly. Video surveillance has several uses in the area of road safety, including video cameras on buses and trains, video surveillance in multi-story car parks. Many people are afraid of getting attacked in underground garages and parking decks, and video surveillance makes them feel safe. Video surveillance at public places is for everyone’s advantage and promotes the safety of people. Video surveillance can enhance the security of car parks, transport systems, cultural events, and other public areas, including hospitals, schools, universities, churches, and other institutions.

Video Surveillance as a Service Market Regional Insights:

Notrth America is Expected to Dominate the Market Over the Forecast period

- North America has been the largest regional market for VSaaS and is expected to continue the growth rate of 14.8%. Currently, North America dominates the market owing to the contribution made by the United States and Canada towards the overall revenue. These countries are technological leaders and start using new technologies as soon as possible. Technological advancement in North America was relatively high as compared to the other regions; this increases the market for a hybrid system, megapixel camera, and analytics. In North America, the growth of communication networks has also played a significant role in the growth of VSaaS systems. Technological advancements, instantaneous access, integration of wireless technologies, video analytics, the cost-effectiveness of IP surveillance systems, and government support have positively impacted the uptake of IP surveillance technology in North America. However, the United States alone has placed around 70 million surveillance cameras, up to 4. Each camera is to be fitted with six people. The cameras are widely used in the United States especially in the retail and commercial sectors for instance, hotels, restaurants and offices among other private sectors boosting the market demand.

Active Key Players in the Video Surveillance as a Service Market

- ADT

- Johnson Controls

- Axis Communications AB

- Avigilon

- A Motorola Solutions Company

- Alarm.com

- Eagle Eye Networks, Inc.

- Honeywell International Inc.

- Securitas AB

- Genetec Inc.

- Other Key Players

Key Industry Developments in the Video Surveillance as a Service Market:

- April 2023- The Broadband Service Provider revealed that Converge ICT and KT Corp of South Korea signed a Memorandum of Understanding to enter into a business cooperation in the future. Some of the planned deals between Converge and KT Corp, formerly known as Korea Telecom, include the Video Surveillance as a Service (VSaaS), which is a cloud-based video surveillance solution, and Mobility as a Service (MaaS), a transport management technology.

- September 2022- The global provider of IP surveillance solutions, VIVOTEK, officially presented its long-awaited cloud-based video surveillance as a service (VSaaS) – VORTEX in the United States market, which not only marks the company’s entry into the subscription market but also proves that VIVOTEK can combine camera, web, app, cloud, and deep learning in one powerful AI-based video surveillance service.

|

Global Video Surveillance as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.5 % |

Market Size in 2032: |

USD 24.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- VIDEO SURVEILLANCE AS A SERVICE MARKET BY TYPE (2017-2032)

- VIDEO SURVEILLANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSTED SERVICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANAGED SERVICES

- HYBRID SERVICES

- VIDEO SURVEILLANCE AS A SERVICE MARKET BY DEPLOYMENT MODEL (2017-2032)

- VIDEO SURVEILLANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- HYBRID DEPLOYMENT

- VIDEO SURVEILLANCE AS A SERVICE MARKET BY APPLICATION (2017-2032)

- VIDEO SURVEILLANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COMMERCIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INFRASTRUCTURE

- RESIDENTIAL

- PUBLIC FACILITIES

- MILITARY & DEFENSE

- INDUSTRIAL

- VIDEO SURVEILLANCE AS A SERVICE MARKET BY END-USER (2017-2032)

- VIDEO SURVEILLANCE AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- RESIDENTIAL USER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Video Surveillance as a Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CISCO SYSTEMS, INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HONEYWELL INTERNATIONAL INC. (US)

- ADT INC. (US)

- VERKADA INC. (US)

- BRIVO SYSTEMS LLC (US)

- CLOUDASTRUCTURE INC. (US)

- EAGLE EYE NETWORKS, INC. (US)

- ARCULES INC. (US)

- ALARM.COM HOLDINGS, INC. (US)

- OV LOOP, INC. (US)

- RHOMBUS SYSTEMS, INC. (US)

- CAMCLOUD INC. (CANADA)

- GENETEC INC. (CANADA)

- SOLINK CORPORATION (CANADA)

- AVIGILON CORPORATION (CANADA)

- BOSCH SECURITY SYSTEMS (GERMANY)

- CLOUDVIEW LTD. (UK)

- AXIS COMMUNICATIONS AB (SWEDEN)

- NETWATCH GROUP (IRELAND)

- JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

- IVIDEON (RUSSIA)

- PANASONIC CORPORATION (JAPAN)

- DAHUA TECHNOLOGY CO., LTD. (CHINA)

- HIKVISION DIGITAL TECHNOLOGY CO., LTD. (CHINA)

- HANWHA TECHWIN CO., LTD. (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL VIDEO SURVEILLANCE AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Video Surveillance as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.5 % |

Market Size in 2032: |

USD 24.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET COMPETITIVE RIVALRY

TABLE 005. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET THREAT OF NEW ENTRANTS

TABLE 006. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET THREAT OF SUBSTITUTES

TABLE 007. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET BY TYPE

TABLE 008. HOSTED MARKET OVERVIEW (2016-2028)

TABLE 009. MANAGED MARKET OVERVIEW (2016-2028)

TABLE 010. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 011. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET BY VERTICAL

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. MILITARY & DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 014. INSTITUTIONAL MARKET OVERVIEW (2016-2028)

TABLE 015. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY VERTICAL (2016-2028)

TABLE 019. N VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY VERTICAL (2016-2028)

TABLE 022. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY VERTICAL (2016-2028)

TABLE 025. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY VERTICAL (2016-2028)

TABLE 028. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY VERTICAL (2016-2028)

TABLE 031. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET, BY COUNTRY (2016-2028)

TABLE 032. BOSCH SECURITY SYSTEMS: SNAPSHOT

TABLE 033. BOSCH SECURITY SYSTEMS: BUSINESS PERFORMANCE

TABLE 034. BOSCH SECURITY SYSTEMS: PRODUCT PORTFOLIO

TABLE 035. BOSCH SECURITY SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BRIVO INC.: SNAPSHOT

TABLE 036. BRIVO INC.: BUSINESS PERFORMANCE

TABLE 037. BRIVO INC.: PRODUCT PORTFOLIO

TABLE 038. BRIVO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD: SNAPSHOT

TABLE 039. HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD: BUSINESS PERFORMANCE

TABLE 040. HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD: PRODUCT PORTFOLIO

TABLE 041. HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CISCO SYSTEMS INC.: SNAPSHOT

TABLE 042. CISCO SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 043. CISCO SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 044. CISCO SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 045. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 046. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 047. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CLOUDASTRUCTURE INC: SNAPSHOT

TABLE 048. CLOUDASTRUCTURE INC: BUSINESS PERFORMANCE

TABLE 049. CLOUDASTRUCTURE INC: PRODUCT PORTFOLIO

TABLE 050. CLOUDASTRUCTURE INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. GENETEC: SNAPSHOT

TABLE 051. GENETEC: BUSINESS PERFORMANCE

TABLE 052. GENETEC: PRODUCT PORTFOLIO

TABLE 053. GENETEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. NEO SOLUTIONS INC.: SNAPSHOT

TABLE 054. NEO SOLUTIONS INC.: BUSINESS PERFORMANCE

TABLE 055. NEO SOLUTIONS INC.: PRODUCT PORTFOLIO

TABLE 056. NEO SOLUTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 057. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 058. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 059. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY TYPE

FIGURE 012. HOSTED MARKET OVERVIEW (2016-2028)

FIGURE 013. MANAGED MARKET OVERVIEW (2016-2028)

FIGURE 014. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 015. VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY VERTICAL

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. MILITARY & DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 018. INSTITUTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 019. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA VIDEO SURVEILLANCE AS A SERVICE MARKET MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Video Surveillance as a Service Market research report is 2024-2032.

ADT; Johnson Controls; Axis Communications AB; Avigilon; A Motorola Solutions Company; Alarm.com; Eagle Eye Networks, Inc.; Honeywell International Inc.; Securitas AB; Genetec Inc., and Other Major Players..

The Video Surveillance as a Service Market is segmented into type, application, component, and region. By type, the market is categorized into hosted, managed, hybrid. By application, the market is categorized into commercial, infrastructure, residential, military and defense, others. By component, the market is categorized into hardware, software, and services. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

VSaaS is a cloud-based model for storing and managing surveillance footage and video recordings that is delivered via subscription service. Through cloud technology, VSaaS enable users to access live and recorded video streams from any location using an internet connection and an appropriate device. This service often offers features like video analysis, real-time alerting, and storage capacity to accommodate videos, which makes it a more economical and adaptable choice compared to on-premises video surveillance systems.

Video Surveillance as a Service Market Size Was Valued at USD 6.1 Billion in 2023, and is Projected to Reach USD 24.1 Billion by 2032, Growing at a CAGR of 16.5% From 2024-2032.