Vegetable Snacks Market Synopsis

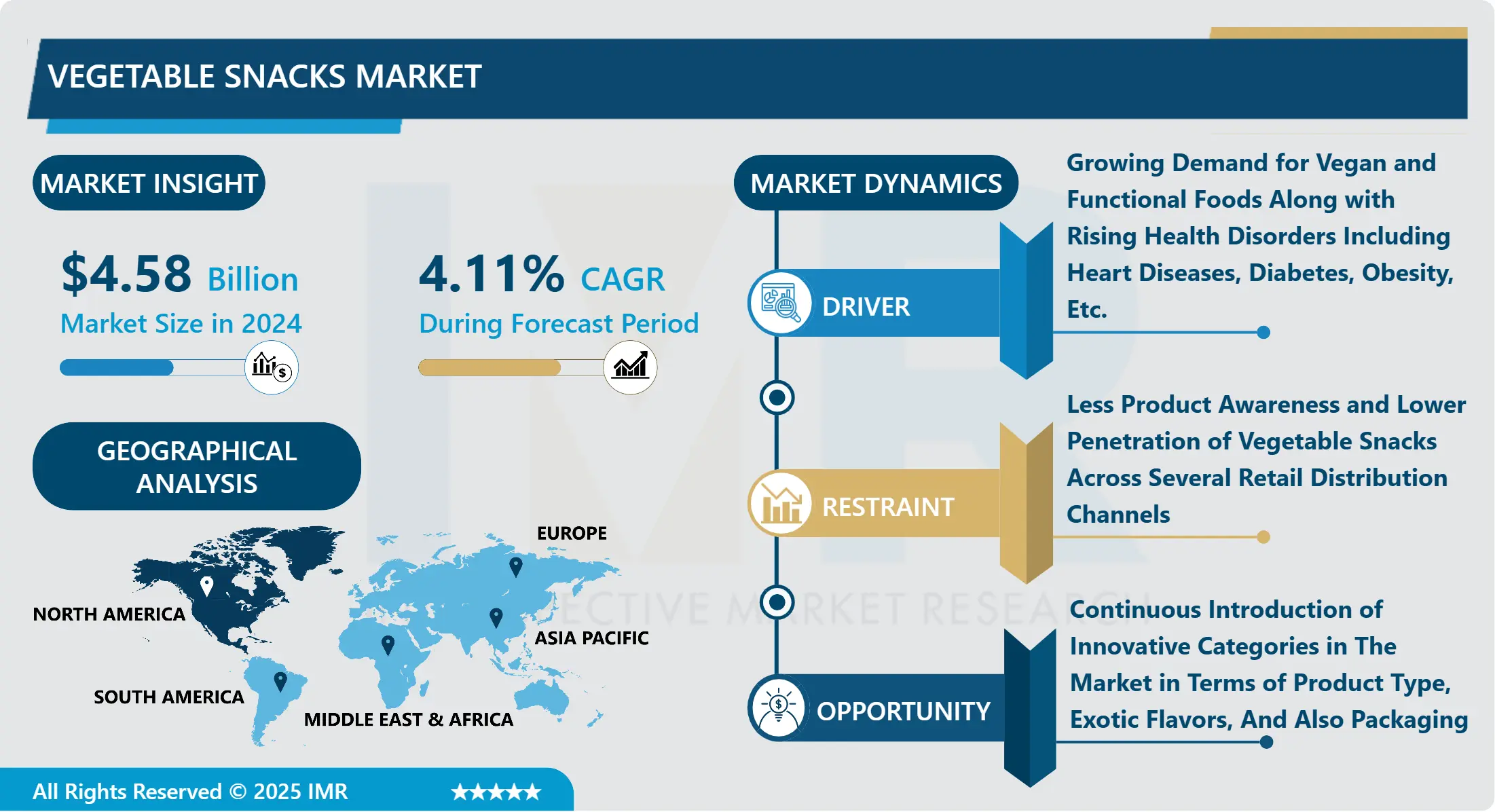

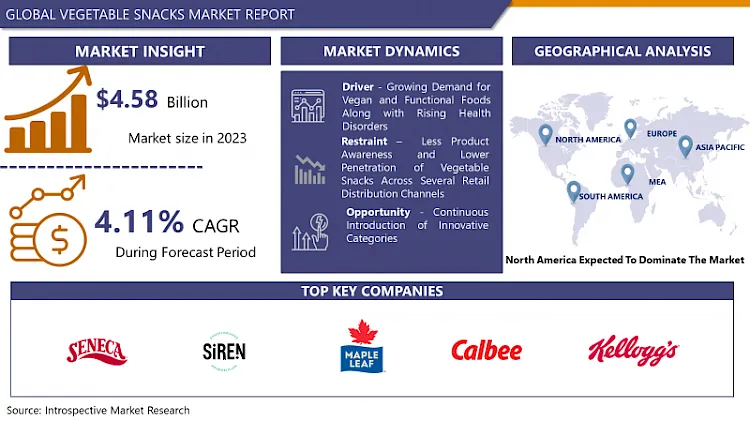

The Global Vegetable Snacks Market size is expected to grow from USD 4.58 billion in 2024 to USD 6.58 billion by 2032, at a CAGR of 4.11% during the forecast period (2025-2032).

Vegetable snacks are plant-based snacks containing raw, dried, or less processed vegetables in pre-packaged form. Vegetable Snacks are available with a lot of options ranging from chips or flakes to vegetable dip as a condiment, these kinds of snacking options are a great change to traditional vegetables, they’re a delicious, guilt-free way to pack more veggies into people’s diets. Vegetable snacks come in a variety of new flavors and they are higher in fiber, vitamins, and minerals, and when paired with the right accompaniments, vegetable snacks can be very filling and satisfying.

Vegetable Snacks and Savory past year was recorded to have a market value of $4.2 billion which was a 9% growth as compared to its consecutively previous year. The producers of vegetable snacks are also thriving by combining vegetables, whether snap peas, beets, or sweet potatoes, with nuts and legumes, such as black beans and chickpeas in order to offer innovative products in the market, due to which the use of chickpeas in snack foods is up 35%, while the use of beans is up 25%.

Recent studies from the CDC noted that less than 10% of adults today eat their daily recommended amount of vegetables. Which is due to the dislike of eating vegetables. But, now there are very great vegetable-based snacking options as the market has started to see that healthy vegetarian snacks don’t have to be dull and flavorless. This is really a shift in vegetable sales as people are consuming more vegetables may it be in a modified form.

Furthermore, snacking on unhealthy foods for many people has resulted in steady weight gain over years, even if they eat nutritious foods during their meal time during snacks it is mostly mindless eating which is usually on foods that are highly processed and provide excess energy, fat, sugar and salt. And hence vegetable snacks are becoming the best choice that allows one to snack and still stay healthy.

The Vegetable Snacks Market Trend Analysis

Growing Demand for Vegan and Functional Foods Along with Rising Health Disorders Including Heart Diseases, Diabetes, Obesity, Etc.

- Snacking and even meal replacement with snacks is a growing trend among consumers especially young consumers who have health-conscious views on functionality with their food choices. People are asking for more than just fun in eating snacks which is driving the demand for more functional and plant-based foods. The young physique-oriented generation is opting for plant-based foods to achieve their macros and nutritional goals alongside their busy schedules by choosing snacking options that would serve their nutritional needs.

- According to statistics, in the next 5 years the macro-snacking category can grow upto USD 16 billion and further in that category, fruit-, vegetable- and legume-based snacks are among the fastest growing.

- Furthermore, the worldwide prevalence of obesity and related diseases has seen a great increase over the last few decades. In 2016, more than 1.9 billion adults, 18 years and older, were overweight of which more than 650 million were obese and the situation is even getting worse as over 340 million children and adolescents aged 5-19 were seen to be overweight or obese in 2016.

- Today, most of the world's population lives in developed and developing countries where overweight and obesity derived from snacking or mindless overeating is the main reason behind more serious health conditions like cancer, diabetes, and stroke. About 90% of type 2 diabetes is attributable to excess weight and approximately 197 million people worldwide have impaired glucose tolerance, most commonly because of obesity and the associated metabolic syndrome.

- Owning to such grave outcomes of unhealthy snacking, people are getting aware of their health and are now asking for more healthy alternatives to processed snack products which has led to the emergence of vegetable-based snacks in the market

Continuous Introduction of Innovative Categories in The Market in Terms of Product Type, Exotic Flavors, And Also Packaging

- The global market of Vegetable Snacks is estimated to make huge profits in upcoming times with the help of product innovations and by offering a wide variety of options to target more and more people. Presently the market players are coming up with new products that can be enjoyed by consumers along with maintaining healthy eating. Products like Nuts and seeds including almonds, sunflower seeds, and pumpkin seeds are gaining popularity among health-conscious consumers as additive-free snacks which provide them with some much-needed protein.

- Other products like dried fruits, chips, crisps (air-fried), vegetable slices, and Greek yogurt cups and cheese sticks are some that are gaining a lot of demand from consumers as these foods ensure that one’s daily meals get nutritionally balanced. They’re also the perfect afternoon pick.

- There are a lot of new and innovative products hitting the shelves each month. For instance, A new healthy vegetable snack was launched by drawing on innovation from Australia’s national science agency CSIRO together with start-up Nutri V, the product contains broccoli, pumpkin, and cauliflower, which can’t be sold and would otherwise have gone to waste, often as landfill or animal feed.

- Such, product innovations to make snacks more functional supported by the increasing prevalence of health disorders among consumers are expected to boost the market growth even further in the upcoming period.

Segmentation Analysis Of The Vegetable Snacks Market

Vegetable Snacks market segments cover the Type, Distribution Channel, and Region.

By Type, the Chips and Crisps, and nuts and seeds segments are expected to Dominate the Market during the upcoming period.

- The popularity of these segments is attributed to wide flavors, options and low prices. Today, savory snacks are most loved and have a global market value of over UDS 250 billion, and speaking further the biggest product in the savory market is chips. Recently, vegetable slices and dried fruits have also gained traction among many people worldwide.

- For example, according to a Statista study based on the U.S. Census data and Simmons National Consumer Survey (NHCS), around 284.37 million Americans consumed potato chips in 2020, this number indicates how convenience and availability favors chips and other crispy pre-packaged snacks to gain huge sales.

- Not only do consumers prefer chips and slices for snacks but they also spend a lot of money on them which in turn is leading to higher revenue generation through these specific segments.

- Other Segment that can be expected to dominate the Vegetable Snacks Market with high share is packaged nuts and seeds which are available in different flavors. Trail mix a type of snack that is a mix of various types of nuts such as cashews, almonds, pecans, walnuts, dried fruit, etc. is one of the most loved snacking options to gain health benefits as these nuts are particularly rich in Omega-3 fatty acids Also, they may contain breakfast cereals, granola, chocolate chips, pretzels, shredded coconut, carob chips, and seeds. These kinds of snacks are more loved by students and working professionals. Further, it’s affordable, easy-to-store, and eat-on-the-go features are aiding the growth of the segment

Regional Analysis of The Vegetable Snacks Market

North America Dominates the Market, While the Asia Pacific Along with North America Is Expected to Grow at A Rapid Pace During the Forecast Period.

- North American region in the past few years has witnessed a major market share of the Vegetable Snacks Market. This Growth is attributed to the growing awareness regarding health among consumers and the shift of consumers from a meat-based to a more vegetarian diet. Furthermore, the developed countries of North America like the US and Canada have experienced a considerable increase in plant-based retail sales which is also helping the Vegetable Snacks Manufacturers with business expansion.

- In 2021, according to the Plant-based Foods Association and the Good Food Institute, the overall retail sales of plant-based foods in the United States were about 7.4 billion which was around a 6.2% increase as compared to the previous year.

- The Rising prevalence of chronic diseases among the population of these countries is an obvious result of overeating and frequent and unhealthy snacking which is driving the demand for foods that bring about health benefits along with the same taste. For instance, Snacking is inevitable part of Americans and Canadians, among Canadians snacking contributed to nearly 23% of total daily energy intake, which was highest among younger children (27%) and lowest among older adults (20.8%).

- Hence, as snacking considerably contributes to total nutrient and energy intake of people living in such developed countries of North America, promoting vegetable-based and nutrient-dense snacks provides an opportunity to achieve greater sales.

Top Key Players Covered in The Vegetable Snacks Market

- Seneca Foods Corp. (US)

- Siren Snacks (US)

- Maple Leaf Foods Inc. (Canada)

- Calbee Inc. (Japan)

- The Kellogg Company (US)

- General Mills Inc. (US)

- Upton’s Natural (US)

- Nestle S.A. (Switzerland)

- Conagra Brands, Inc. (US)

- Louisville Vegan Jerky Co (US)

- Eat Real (US)

- Oumph (UK)

- Vegan Rob's (US)

- Quorn (UK)

- Luke's Organic (US)

- Other Active Players

Key Industry Developments in the Vegetable Snacks Market

- In February 2024, Once Upon a Farm has introduced three new organic, non-GMO kids' snacks with zero added sugar. The new Fruit & Veggie Puffs are designed for toddlers aged ten months and older. Made with avocado oil and sorghum, these unsweetened, unsalted puffs are free from rice and corn. Available in flavors like strawberry, sweet potato & coconut; apple, sweet potato & coconut; and mango, carrot & coconut, they support fine motor skill development and encourage self-feeding.

|

Global Vegetable Snacks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.11 % |

Market Size in 2032: |

USD 6.58 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vegetable Snacks Market by Type (2018-2032)

4.1 Vegetable Snacks Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chips & Crisps

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nuts & Seeds

4.5 Dried Veggies

4.6 Biscuits & Cookies

4.7 Others

Chapter 5: Vegetable Snacks Market by Distribution Channel (2018-2032)

5.1 Vegetable Snacks Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Supermarkets & Hypermarkets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Convenience Stores

5.5 Online Stores

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Vegetable Snacks Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 PFIZER INC. (US)

6.4 MERCK & COINC. (US)

6.5 SANOFI (US)

6.6 GLAXOSMITHKLINE PLC (UK)

6.7 NOVARTIS INTERNATIONAL AG (SWITZERLAND)

6.8 TORRENT PHARMACEUTICALS LTD. (INDIA)

6.9 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

6.10 ALKEM LABORATORIES LTD. (INDIA)

6.11 CADILA HEALTHCARE LTD. (INDIA)

6.12 DSM (NETHERLANDS)

6.13 BASF SE (GERMANY)

6.14 FERMENTA BIOTECH LIMITED (INDIA)

6.15 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH COLTD (CHINA)

6.16 DISHMAN GROUP (INDIA)

6.17 TAIZHOU HAISHENG PHARMACEUTICAL COLTD. (CHINA)

6.18 ZHEJIANG MEDICINE COLTD. (CHINA)

6.19 PHW GROUP (GERMANY)

6.20 BIO-TECH PHARMACAL (US)

6.21 DIVI'S NUTRACEUTICALS (INDIA)

6.22

Chapter 7: Global Vegetable Snacks Market By Region

7.1 Overview

7.2. North America Vegetable Snacks Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Chips & Crisps

7.2.4.2 Nuts & Seeds

7.2.4.3 Dried Veggies

7.2.4.4 Biscuits & Cookies

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 Supermarkets & Hypermarkets

7.2.5.2 Convenience Stores

7.2.5.3 Online Stores

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Vegetable Snacks Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Chips & Crisps

7.3.4.2 Nuts & Seeds

7.3.4.3 Dried Veggies

7.3.4.4 Biscuits & Cookies

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 Supermarkets & Hypermarkets

7.3.5.2 Convenience Stores

7.3.5.3 Online Stores

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Vegetable Snacks Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Chips & Crisps

7.4.4.2 Nuts & Seeds

7.4.4.3 Dried Veggies

7.4.4.4 Biscuits & Cookies

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 Supermarkets & Hypermarkets

7.4.5.2 Convenience Stores

7.4.5.3 Online Stores

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Vegetable Snacks Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Chips & Crisps

7.5.4.2 Nuts & Seeds

7.5.4.3 Dried Veggies

7.5.4.4 Biscuits & Cookies

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 Supermarkets & Hypermarkets

7.5.5.2 Convenience Stores

7.5.5.3 Online Stores

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Vegetable Snacks Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Chips & Crisps

7.6.4.2 Nuts & Seeds

7.6.4.3 Dried Veggies

7.6.4.4 Biscuits & Cookies

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 Supermarkets & Hypermarkets

7.6.5.2 Convenience Stores

7.6.5.3 Online Stores

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Vegetable Snacks Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Chips & Crisps

7.7.4.2 Nuts & Seeds

7.7.4.3 Dried Veggies

7.7.4.4 Biscuits & Cookies

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 Supermarkets & Hypermarkets

7.7.5.2 Convenience Stores

7.7.5.3 Online Stores

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Vegetable Snacks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.58 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.11 % |

Market Size in 2032: |

USD 6.58 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||