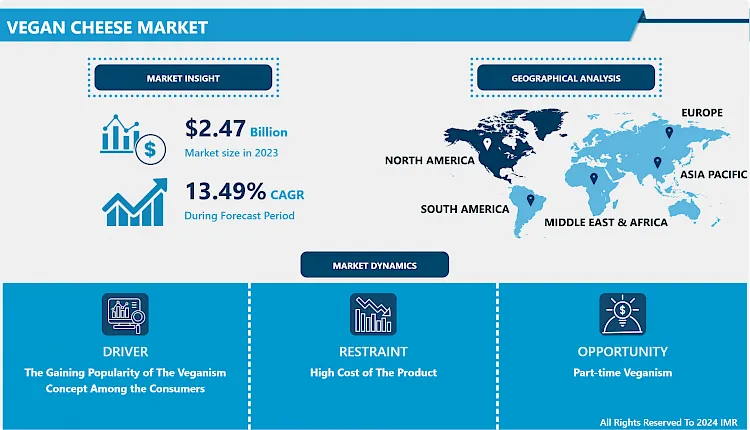

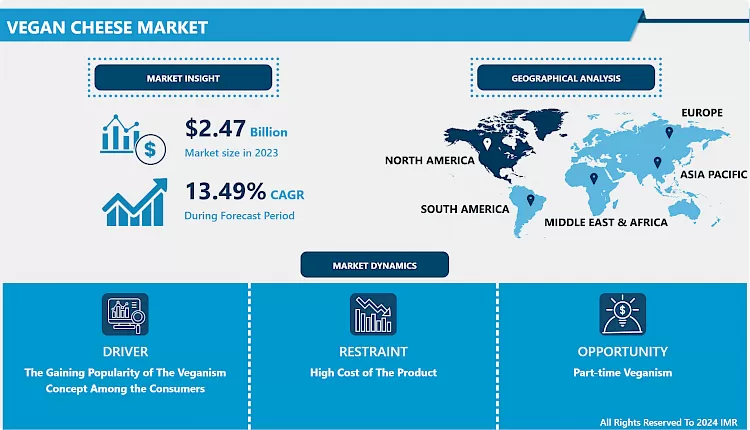

Vegan Cheese Market Overview

The Vegan Cheese market estimated at USD 2.47 Billion in the year 2023, is projected to reach a revised size of USD 7.71 Billion by 2032, growing at a CAGR of 13.49% over the analysis period 2024-2032.

- Veganism is referred to as the refusal from the utilizations of animal-based products, especially in food and beverage products. Vegan cheese is the substitute for dairy cheese that is derived from plant-based sources such as almond milk, coconut milk, cashew milk, soy milk, pine nuts, hazelnut, others. Moreover, with the switching consumer tastes and preferences and shifting consumer lifestyle, producers are developing with the flavors of vegan cheese such as herbs, spice, and blends. In addition, vegan cheese is the least in fat and gluten-free which helps to growth of the vegan cheese market.

- Furthermore, increased interest in plant-based foods has been raised owing to awareness associated with health, sustainability, and animal welfare. Regarding conventional production of dairy, there are three key areas of concern environment impact (pollution of soil and water, emissions of greenhouse gases, and land use), human health (increased antibiotic resistance and exposure to zoonotic diseases), and animal welfare (treatment of farmed animals, including disease, injury, and mental/emotional well-being). Hence, plant-based products provide a more sustainable and ethical option to consumers that are significantly growing in popularity among consumers.

Market Dynamics and Factors for the Vegan Cheese Market:

Drivers:

- Growing consciousness regarding health issues about the utilization of dairy products is further affecting consumers to switch to vegan products. Recent researches have suspected the application of antibiotics, hormones, and allergens on cattle for rising cattle production producing a negative outlook of the dairy industry. Moreover, rising consciousness regarding the environmental pollution caused owing to dairy farming practices are turning the shift towards dairy alternatives

- The gaining popularity of the veganism concept among the consumers has prompted food productions units to incorporate dairy-free substitutes in the production of a different variety of food products. Vegan cheese is generating widespread adoption in bakeries and fast-food joints. To capitalize on the rising demand for vegan cheese, leading fast-food ventures such as Domino's and MacDonald's have already started catering vegan burgers, pizzas, and other vegan fast-food products. Moreover, a growing number of grocery and retail stores are starting to sell different varieties of vegan cheese. In addition, the accessibility of vegan cheese in different flavors such as cranberry, caramel, blueberry, and many other flavors is supplying the consumers a chance to experience new tastes. Additionally, vegan cheese is cholesterol-free and a great source of protein making it a healthy substitute for obese and lactose intolerant individuals. The market is gradually gaining rising penetration as producers continue to boost the texture and mouthfeel of vegan cheese to match the qualities of its dairy counterpart.

Restraints:

- Within the plant-based product market, vegan cheese is a developing segment that has yet to gain traction or interest from a diversified consumer base. Even though vegan cheese sales continue to grow, the category remains in its rising compared to other plant-based analog categories (i.e., dairy and meat) as vegan cheese only accounts for less than 1% of all total dollar sales of retail cheese. Concerning the growing acceptance of these products, sensory methods can be applied to better understand sensory and quality attributes and whether they offer the desirable qualities of a conventional dairy-based product.

Opportunities:

Part-time Veganism

- When you consider a part-time vegan lifestyle, it can occur in a few different ways, but it means you stay away from junk food and eat vegan food most of the time, only eating non-vegan one day a week or for a couple of hours at the end of every day. Many people who eat a flexitarian diet follow these basic guidelines such as eating vegetables and fruit in abundance, eating fewer animal products, staying away from junk food, don't eat out; cooking at home as much as you can, eat high-quality foods.

- Furthermore, part-time veganism is a growing sector, which is grabbing the attention of stakeholders in the North American vegan cheese market. Veganuary is another trend, which is translating into sales opportunities for plant-based cheese choices in the market. Manufacturers are developing products that are fortified with probiotics, calcium, protein, and vitamin D to help consumers choose a dairy-free lifestyle. Apart from nutritional advantages, delivering an appealing texture and taste is of prime importance for its use in pizza and other dishes.

Market Segmentation

- Based on the product type, the Mozzarella segment is expected to account for the largest vegan cheese market share over the forecast period. Mozzarella is widely used in Italian dishes, such as pasta, pizzas, croquettes, and Caprese salad, and is available in the form of slices, cubes, shredded, and spreads. The demand for mozzarella is significantly high in countries where Italian cuisine is popular.

- Based on the source, the almond milk segment is expected to dominate the vegan cheese market during the forecast period. Almond milk cheese is one of the widely used sources in vegan cheese preparation. The naturally higher fat content of the almond milk gives the cheese a smoother texture without an astringent taste. Almond milk has been known for its high nutritional profile that has further fueled its demand for vegan cheese preparation. Almond milk is low in calories that have garnered attention from health-conscious consumers all over the world. Thus, the high nutritional profile of almond milk has been one of the major contributing factors for its source base in vegan cheese production.

- Based on the end-use, the household/retail segment is expected to register the maximum vegan cheese market share over the forecast period. Growing consumer disposable income levels and preference to spend on premium products have helped to an increase in demand for vegan cheese in the household segment. Additionally, easy product accessibility in supermarkets and convenience stores has improved the growth of this segment.

- Based on the nature, the organic segment is anticipated to record the maximum market share during the forecast period. Owing to the gaining popularity for plant-based food as well as an organic product among the consumers. Also, with this trend key players are offering the product accordingly to the consumers which helps to growth of the market over the forecast period. For instance, US-based company Follow Your Heart offers numerous varieties of vegan cheese containing certified organic ingredients such as Mozzarella – 81 percent organic, Nacho – 70 percent organic, Monterey Jack – 80 percent organic, Cheddar – 74 percent organic, Cream Cheese – 70 percent organic. Moreover, Follow Your Heart provides vegan goods online and in wholefood shops in the U.S., Mexico, the U.K., and Germany. Some other types include provolone, American, garden herb, Parmesan, pepper jack, and smoked Gouda.

- Based on distribution channels, the vegan cheese market is segmented into direct sales, indirect sales, specialty retail stores, traditional grocery stores, hypermarkets/supermarkets, convenience stores, online retailers. The hypermarkets/supermarkets segment led the vegan cheese market during the forecast period. Vegan cheese is majorly sold in hypermarkets/supermarkets. Consumers opted to purchase vegan cheese from supermarkets and hypermarkets due to the trust of high-quality products, various attractive offers, and a one-stop shopping experience. Furthermore, online retailers' segment is gaining popularity after the leading segment supermarket owing to home delivery service, highly emergence of the smartphones, laptops, and availability of the high speed of internet activity which is triggering the segment growth and is expected to growth of the vegan cheese market over the forecast period.

Regional Analysis for the Vegan Cheese Market:

- North America region is expected to dominate the vegan cheese market during the forecast period. This is mainly owing to strong consciousness of animal inhumanity owing to vigorous vegan outreaches in the region coupled with the rising consciousness of veganism as a healthy lifestyle. Furthermore, the presence of a large number of key players such as Follow Your Heart, UPrise Foods, Daiya Foods, Miyoko's Kitchen Company, and others allows the product to be sold at a cheap cost and is easily available in other regions over the world.

- In the European region, customers are increasingly choosing more eco-friendly and vegan products due to the growing consciousness regarding animal inhumanity and rising carbon footprint owing to the utilization of food products obtained from animals such as milk, meat, honey, eggs, pork, and seafood.

- Asia-Pacific is the fastest-growing vegan cheese market and is anticipated to continue its growth during the forecast period. This is majorly attributed to rising spending on nutritional and plant-based products. An increase in urbanization, rising spending on health products, and consciousness about the medicinal benefits of plants based dairy products are anticipated to turn the vegan cheese market growth in Asia-Pacific during the forecast period. Moreover, change in lifestyle and growth in trend of eating out and drastic changes in the food preference is after influencing the growth of the vegan cheese market.

Players Covered in Vegan Cheese Market are :

- UPrise Foods

- Daiya Foods

- Parmela Creamery

- Tyne Cheese Limited

- Good Planet Foods

- Vtopian Artisan Cheese Company

- Kite Hill

- Feel Foods Ltd.

- Tesco

- Miyoko's Kitchen Company

- Vermont Farmstead Company

- Follow Your Heart

- Galaxy Nutritional Foods Inc.

- Violife Foods

- Mad Millie

- Field Roast Grain Meat Co.

- Nush

- Go Veggie and other major players.

Key Industry Developments in Vegan Cheese Market

- In March 2024, Daiya, the brand that cracked the code on dairy-free cheese, announced the launch of their new Dairy-Free Cheese Shreds tailored specifically for food service operators. Leveraging the success of its new proprietary ingredient, the Daiya Oat Cream blend, these innovative shreds promise a dairy-like melt that browns just like cheese - perfect for food service operators and restaurateurs looking to level up their plant-based offerings.

- In February 2024, Swedish vegan dairy start-up Stockeld Dreamery announced the launch of its innovative fermented Cheddar slice, crafted from fermented legume milk. This plant-based cheese aimed to redefine the dairy-free cheese experience, marking a significant milestone in the industry. Touted as a pioneer of the “third wave” of vegan cheese, it promised an elevated taste and texture for plant-based cheese enthusiasts.

- In April 2024, The Compleat Food Group re-entered the M&A industry with the acquisition of Palace Culture, a UK-based dairy-free cheese business. This strategic move enhanced the group’s plant-based product portfolio, distinguishing itself by focusing on dairy-free cheese rather than meat alternatives. The acquisition aligns with The Compleat Food Group’s commitment to diversifying its offerings in the plant-based food sector and meeting growing consumer demand.

|

Vegan Cheese Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.47 Billion |

|

Forecast Period 2024-32 CAGR: |

13.49% |

Market Size in 2032: |

USD 7.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vegan Cheese Market by Type (2018-2032)

4.1 Vegan Cheese Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mozzarella

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gouda

4.5 Parmesan

4.6 Cheddar

4.7 Cream Cheese

4.8 Ricotta

4.9 Others

Chapter 5: Vegan Cheese Market by Source (2018-2032)

5.1 Vegan Cheese Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Almond Milk

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Coconut Milk

5.5 Cashew Milk

5.6 Soy Milk

5.7 Pine Nuts

5.8 Hazelnut

5.9 Others

Chapter 6: Vegan Cheese Market by End-Use (2018-2032)

6.1 Vegan Cheese Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Food Service Industry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Household/Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Vegan Cheese Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ACI WORLDWIDE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADYEN

7.4 AURUS

7.5 ALIANT PAYMENTS

7.6 ALIPAY

7.7 APPLE PAY

7.8 DUE

7.9 DWOLLA

7.10 FATTMERCHANT

7.11 FIS

7.12 FISERV

7.13 GLOBAL PAYMENTS

7.14 INTUIT

7.15 JPMORGAN CHASE

7.16 MASTERCARD

7.17 PAYPAL

7.18 PAYSAFE

7.19 PAYTRACE

7.20 PAYU

7.21 SPREEDLY

7.22 SQUARE

7.23 STRIPE

7.24 VISA

7.25 WEX

7.26 WORLDLINE

7.27 2CHECKOUT

Chapter 8: Global Vegan Cheese Market By Region

8.1 Overview

8.2. North America Vegan Cheese Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Mozzarella

8.2.4.2 Gouda

8.2.4.3 Parmesan

8.2.4.4 Cheddar

8.2.4.5 Cream Cheese

8.2.4.6 Ricotta

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Almond Milk

8.2.5.2 Coconut Milk

8.2.5.3 Cashew Milk

8.2.5.4 Soy Milk

8.2.5.5 Pine Nuts

8.2.5.6 Hazelnut

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size by End-Use

8.2.6.1 Food Service Industry

8.2.6.2 Household/Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Vegan Cheese Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Mozzarella

8.3.4.2 Gouda

8.3.4.3 Parmesan

8.3.4.4 Cheddar

8.3.4.5 Cream Cheese

8.3.4.6 Ricotta

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Almond Milk

8.3.5.2 Coconut Milk

8.3.5.3 Cashew Milk

8.3.5.4 Soy Milk

8.3.5.5 Pine Nuts

8.3.5.6 Hazelnut

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size by End-Use

8.3.6.1 Food Service Industry

8.3.6.2 Household/Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Vegan Cheese Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Mozzarella

8.4.4.2 Gouda

8.4.4.3 Parmesan

8.4.4.4 Cheddar

8.4.4.5 Cream Cheese

8.4.4.6 Ricotta

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Almond Milk

8.4.5.2 Coconut Milk

8.4.5.3 Cashew Milk

8.4.5.4 Soy Milk

8.4.5.5 Pine Nuts

8.4.5.6 Hazelnut

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size by End-Use

8.4.6.1 Food Service Industry

8.4.6.2 Household/Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Vegan Cheese Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Mozzarella

8.5.4.2 Gouda

8.5.4.3 Parmesan

8.5.4.4 Cheddar

8.5.4.5 Cream Cheese

8.5.4.6 Ricotta

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Almond Milk

8.5.5.2 Coconut Milk

8.5.5.3 Cashew Milk

8.5.5.4 Soy Milk

8.5.5.5 Pine Nuts

8.5.5.6 Hazelnut

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size by End-Use

8.5.6.1 Food Service Industry

8.5.6.2 Household/Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Vegan Cheese Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Mozzarella

8.6.4.2 Gouda

8.6.4.3 Parmesan

8.6.4.4 Cheddar

8.6.4.5 Cream Cheese

8.6.4.6 Ricotta

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Almond Milk

8.6.5.2 Coconut Milk

8.6.5.3 Cashew Milk

8.6.5.4 Soy Milk

8.6.5.5 Pine Nuts

8.6.5.6 Hazelnut

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size by End-Use

8.6.6.1 Food Service Industry

8.6.6.2 Household/Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Vegan Cheese Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Mozzarella

8.7.4.2 Gouda

8.7.4.3 Parmesan

8.7.4.4 Cheddar

8.7.4.5 Cream Cheese

8.7.4.6 Ricotta

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Almond Milk

8.7.5.2 Coconut Milk

8.7.5.3 Cashew Milk

8.7.5.4 Soy Milk

8.7.5.5 Pine Nuts

8.7.5.6 Hazelnut

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size by End-Use

8.7.6.1 Food Service Industry

8.7.6.2 Household/Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Vegan Cheese Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.47 Billion |

|

Forecast Period 2024-32 CAGR: |

13.49% |

Market Size in 2032: |

USD 7.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Vegan Cheese Market research report is 2024-2032.

UPrise Foods, Daiya Foods, Parmela Creamery, Tyne Cheese Limited, Good Planet Foods, Vtopian Artisan Cheese Company, Kite Hill, Feel Foods Ltd., Tesco, Miyoko's Kitchen Company, Vermont Farmstead Company, Follow Your Heart, Galaxy Nutritional Foods Inc., Violife Foods, Mad Millie, Field Roast Grain Meat Co., Nush, Go Veggie and other major players.

The Vegan Cheese Market is segmented into Type, Source, End-Use, and region. By Type, the market is categorized into Mozzarella, Gouda, Parmesan, Cheddar, Cream Cheese, Ricotta, Others. By Source, the market is categorized into Almond Milk, Coconut Milk, Cashew Milk, Soy Milk, Pine Nuts, Hazelnut, Others. By End-Use, the market is categorized into Food Service Industry, Household/Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Veganism is referred to as the refusal from the utilizations of animal-based products, especially in food and beverage products. Vegan cheese is the substitute for dairy cheese that is derived from plant-based sources such as almond milk, coconut milk, cashew milk, soy milk, pine nuts, hazelnut, others.

The Vegan Cheese market estimated at USD 2.47 Billion in the year 2023, is projected to reach a revised size of USD 7.71 Billion by 2032, growing at a CAGR of 13.49% over the analysis period 2024-2032.