Urinary Tract Infection Therapeutic Market Synopsis:

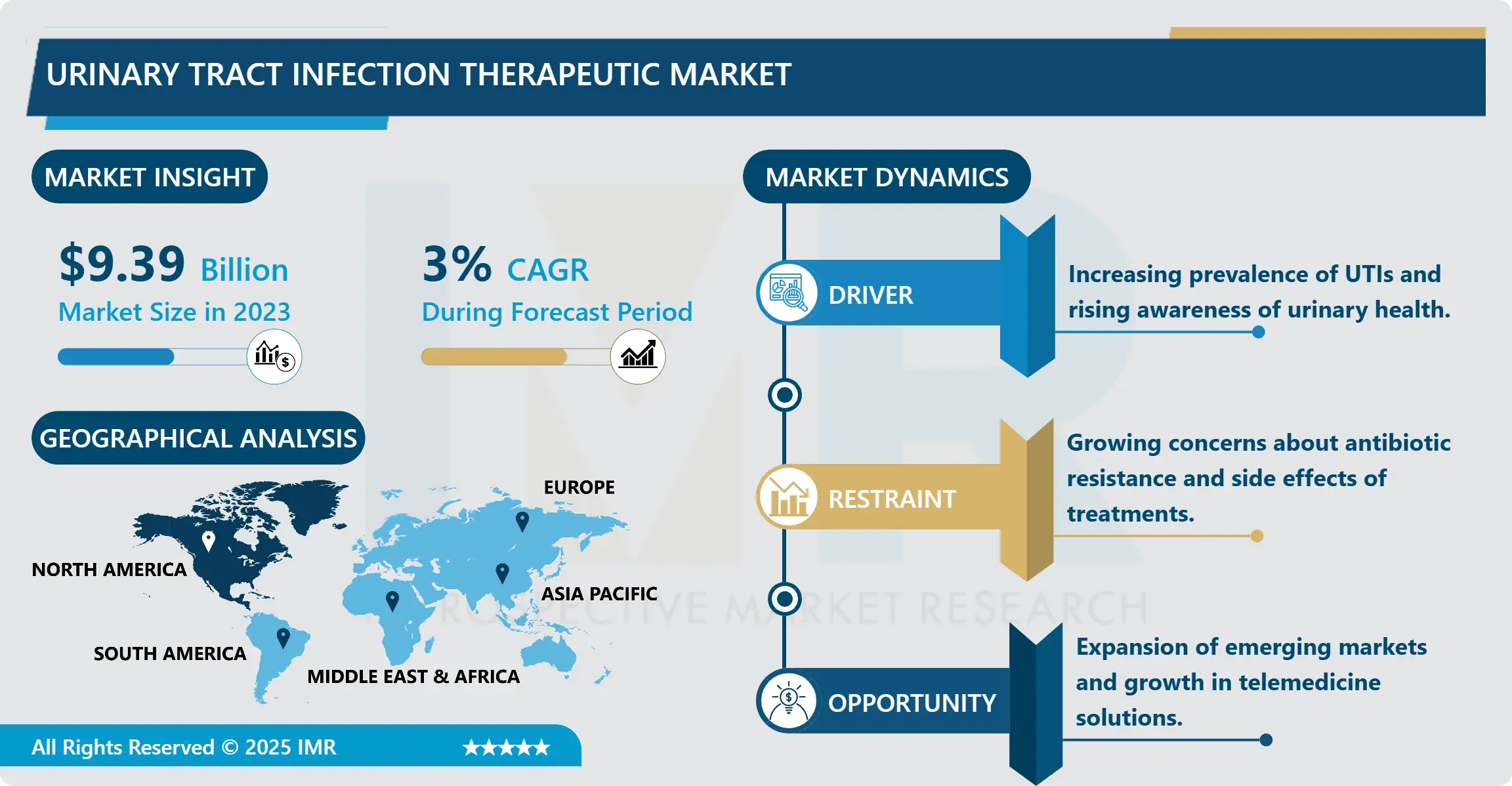

Urinary Tract Infection Therapeutic Market Size Was Valued at USD 9.39 Billion in 2023, and is Projected to Reach USD 11.8 Billion by 2032, Growing at a CAGR of 3% From 2024-2032.

The therapeutic market for the UTI means all kinds of medicinal products aimed at a primary prevention of UTIs and at a treatment of pyelonephritis, cystitis, urethritis, and other bacterial infections that affect the urinary system. These infections can occur in different organs within the urinary system, for instance, bladders; urethras and kidneys. The market of these products in OCA comprises bacterial antibiotics, pain killers, and supportive measures aimed at relieving pain and eliminating the cause of infection. As evidenced by the increase in prevalence rates especially amongst women and the elderly, there exists growing innovation in the management strategies of user associated infection.

The current market for urinary tract infection therapeutic products is steadily growing steadily due to the growing concern with urinary health, rising incidences to UTI and the advancement in the research of pharmaceutical products. UTIs are a common bacterial infection whose prevalence is rapidly rising globally thereby necessitating efficient treatment approaches. These include the adoption of a sedentary lifestyle, growth of the elderly population, and continually rising cost of health care, which have made the rates of UTIs to rise steadily. It Decentralised treatment options include the common ones such as antibiotics that are normally used by different patients to the new ones that are in the market.

Further, on the landscape, there have been shifts in market development due to the introduction of remote healthcare services and health-related application software that increases patients’ satisfaction and improves the administration of care plans. The current outbreak of coronavirus also influences changes in the utilization of teleconsultations along with altering the patient approach to UTIs. Pharmaceutical companies also invest onto research in introducing enhanced efficacy and low resistance drugs. This situation is perfect for investment in business because there are new opportunities for market participants.

Urinary Tract Infection Therapeutic Market Trend Analysis

Rise of Antibiotic Resistance

-

Another critical development observed in the UTI therapeutic market is that of antibiotic resistance. Due to increased bacterial resistance to most of the recommended antibiotics, standard treatment regimens reduce in efficacy leading to prolonged infections and complications. This trend has forced other healthcare professionals to look for other therapeutic options such as newer antibiotic classes, combination therapies and non-antibiotic. The growing knowledge of antibiotic overuse, coupled with appropriate use necessity, is pushing new therapy investigations, including bacteriophage treatment and immunomodulation.

- Further, there are indications toward molecular and/or individualized medicine for developing the next generation of UTI therapy. Thanks to improvements in genetics and diagnostics it is now possible to adapt antibiotic treatments indicated for certain pathogens to particular patients. This measure doesn’t only improve the impact of treatment, but it also eliminated or reduced the chances of resistance formation. Further as the market faces these challenges, solutions for effective UTIs will be important in the market.

Innovation in Treatment Approaches

-

Moreover, some trends refer to molecular and/or individualized medicine for perspective generation of UTI treatment construction. Due to further enhancement in the field of genetics and diagnostics one can now prescribe a certain antibiotic that is effective against specific pathogens, for a specific individual. This measure doesn’t only enhance the effectiveness of treatment but also in some way forms ways of eradicating or demeaning the probability of resistance formation. Besides as the market is headed with such challenges, measures to efficient UTIs will be crucial in the market.

Urinary Tract Infection Therapeutic Market Segment Analysis:

Urinary Tract Infection Therapeutic Market is Segmented on the basis of Drug Class, Indication, and Region.

By Drug, Penicillin and Combinations segment is expected to dominate the market during the forecast period

-

Penicillin and Combinations segment should remain the largest in the UTI therapeutic market throughout the forecast period given the bacteriostatic and bactericidal properties of the drug for UTI. Penicillin with other combination drugs that improve the efficacy against retarded strains makes it a viable recommendation for first and second-line UTITIS’ treatment. This segment is experiencing new product development in an effort to develop better formulations for penicillin and other agents. Also, the rising knowledge of healthcare practitioners about the right use of antibiotics as a result of the pressing worries about antibiotic resistance is expected to enhance the use of these therapies and cement the position of the therapies further in the market. As health organizations remain concern in providing quality and safe measures of fighting UTIs, the Penicillin and Combinations segment is poised to experience rapid expansion.

By Indication, Complicated UTI segment expected to held the largest share

-

UTI segment is predicted to cover the largest percentage of the UTI therapeutic market because of increasing incidences of factors that put the patients at risk of developing complicated infection such as diabetes, structural abnormalities in the urinary tract and immunocompromising diseases. Complex UTIs are more likely to require less benign management strategies and longer treatment durations resulting in greater healthcare consumption. This has led to increased awareness of the need for exclusive treatment strategies for such conditions, pushing the demand for more sophisticated modalities of treatment that specifically target the non-susceptible microbe and alleviate the presenting complains. Strategic growth and developments in medical sectors for reiterative complicated UTIs and innovations in effective treatments from healthcare services are believed to add growth to this segment as such segments look for better recurrence rates.

Urinary Tract Infection Therapeutic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America leads the market of UTI therapeutic with nearly 40% of its global share. This large market share could be attributed to increased incidences of UTI, a well-developed healthcare market, and significant growth in the research and development market of the pharmaceutical division. The region is well developed in relation to healthcare and this means quicker embraces of novelties in this domain. Also, better knowledge of the disease among doctors and patients, high level of treatment and early diagnosis, also stimulate the markets development.

Active Key Players in the Urinary Tract Infection Therapeutic Market

- Astellas Pharma (Japan)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Cipla (India)

- Gilead Sciences (USA)

- GlaxoSmithKline (UK)

- Hikma Pharmaceuticals (UK)

- Johnson & Johnson (USA)

- Merck & Co. (USA)

- Mylan N.V. (USA)

- Novartis (Switzerland)

- Pfizer (USA)

- Roche (Switzerland)

- Sanofi (France)

- Teva Pharmaceutical Industries (Israel)

- Other Active Players.

Key Industry Developments in the Urinary Tract Infection Therapeutic Market:

-

In April 2023, Gepotidacin, an investigational, first-in-class oral antibiotic with a novel mechanism of action for uncomplicated urinary tract infections (UTI) in female adults and adolescents, has shown promising results in the pivotal EAGLE-2 and EAGLE-3 phase Ill trials, according to GSK plc, a multinational pharmaceutical and biotechnology company. In Copenhagen, Denmark, the results were given orally at the European Congress of Clinical Microbiology and Infectious Diseases (ECCMID).

|

Urinary Tract Infection Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.39 Billion |

|

Forecast Period 2024-32 CAGR: |

3% |

Market Size in 2032: |

USD 11.8 Billion |

|

Segments Covered: |

By Drug |

|

|

|

By Indication |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Urinary Tract Infection Therapeutic Market by Drug Class

4.1 Urinary Tract Infection Therapeutic Market Snapshot and Growth Engine

4.2 Urinary Tract Infection Therapeutic Market Overview

4.3 Penicillin and Combinations

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Penicillin and Combinations: Geographic Segmentation Analysis

4.4 Quinolones

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Quinolones: Geographic Segmentation Analysis

4.5 Cephalosporin

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Cephalosporin: Geographic Segmentation Analysis

4.6 Aminoglycoside Antibiotics

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Aminoglycoside Antibiotics: Geographic Segmentation Analysis

4.7 Sulphonamides

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Sulphonamides: Geographic Segmentation Analysis

Chapter 5: Urinary Tract Infection Therapeutic Market by Indication

5.1 Urinary Tract Infection Therapeutic Market Snapshot and Growth Engine

5.2 Urinary Tract Infection Therapeutic Market Overview

5.3 Complicated UTI

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Complicated UTI: Geographic Segmentation Analysis

5.4 Uncomplicated UTI

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Uncomplicated UTI: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Urinary Tract Infection Therapeutic Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PFIZER (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 JOHNSON & JOHNSON (USA)

6.4 MERCK & CO. (USA)

6.5 GLAXOSMITHKLINE (UK)

6.6 OTHER ACTIVE PLAYERS

Chapter 7: Global Urinary Tract Infection Therapeutic Market By Region

7.1 Overview

7.2. North America Urinary Tract Infection Therapeutic Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Drug Class

7.2.4.1 Penicillin and Combinations

7.2.4.2 Quinolones

7.2.4.3 Cephalosporin

7.2.4.4 Aminoglycoside Antibiotics

7.2.4.5 Sulphonamides

7.2.5 Historic and Forecasted Market Size By Indication

7.2.5.1 Complicated UTI

7.2.5.2 Uncomplicated UTI

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Urinary Tract Infection Therapeutic Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Drug Class

7.3.4.1 Penicillin and Combinations

7.3.4.2 Quinolones

7.3.4.3 Cephalosporin

7.3.4.4 Aminoglycoside Antibiotics

7.3.4.5 Sulphonamides

7.3.5 Historic and Forecasted Market Size By Indication

7.3.5.1 Complicated UTI

7.3.5.2 Uncomplicated UTI

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Urinary Tract Infection Therapeutic Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Drug Class

7.4.4.1 Penicillin and Combinations

7.4.4.2 Quinolones

7.4.4.3 Cephalosporin

7.4.4.4 Aminoglycoside Antibiotics

7.4.4.5 Sulphonamides

7.4.5 Historic and Forecasted Market Size By Indication

7.4.5.1 Complicated UTI

7.4.5.2 Uncomplicated UTI

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Urinary Tract Infection Therapeutic Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Drug Class

7.5.4.1 Penicillin and Combinations

7.5.4.2 Quinolones

7.5.4.3 Cephalosporin

7.5.4.4 Aminoglycoside Antibiotics

7.5.4.5 Sulphonamides

7.5.5 Historic and Forecasted Market Size By Indication

7.5.5.1 Complicated UTI

7.5.5.2 Uncomplicated UTI

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Urinary Tract Infection Therapeutic Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Drug Class

7.6.4.1 Penicillin and Combinations

7.6.4.2 Quinolones

7.6.4.3 Cephalosporin

7.6.4.4 Aminoglycoside Antibiotics

7.6.4.5 Sulphonamides

7.6.5 Historic and Forecasted Market Size By Indication

7.6.5.1 Complicated UTI

7.6.5.2 Uncomplicated UTI

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Urinary Tract Infection Therapeutic Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Drug Class

7.7.4.1 Penicillin and Combinations

7.7.4.2 Quinolones

7.7.4.3 Cephalosporin

7.7.4.4 Aminoglycoside Antibiotics

7.7.4.5 Sulphonamides

7.7.5 Historic and Forecasted Market Size By Indication

7.7.5.1 Complicated UTI

7.7.5.2 Uncomplicated UTI

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Urinary Tract Infection Therapeutic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.39 Billion |

|

Forecast Period 2024-32 CAGR: |

3% |

Market Size in 2032: |

USD 11.8 Billion |

|

Segments Covered: |

By Drug |

|

|

|

By Indication |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||