UHD Surgical Display Market Synopsis

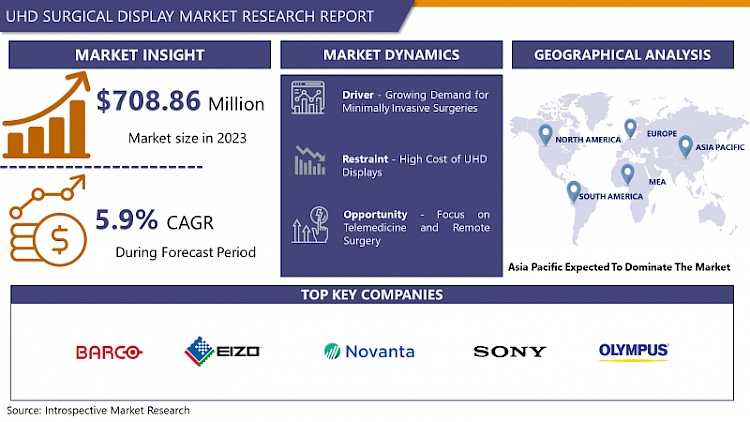

UHD Surgical Display Market Size Was Valued at USD 708.86 Million in 2023 and is Projected to Reach USD 1187.47 Million by 2032, Growing at a CAGR of 5.9% From 2024-2032

The UHD Surgical Display Market category relates to the sector of the medical technology industry that deals with the manufacture of trade and distribution of Ultra High Definition (UHD) displays which are specially designed for use in surgeries. Highlighted by significant features of high screen resolution which can be as high as 3840 x 2160 pixels these displays provide detailed on-site visualisation of operations to surgeons and members of medical teams in and out of operating rooms. UHD surgical displays can be regarded as essential elements of today’s operating theaters; they provide surgeons with crucial pieces of information that enable fast and accurate decisions as well as overall improved outcome of the surgery. The UHD surgical display trends in the future will remain a focus on higher technologies, such as the 3D interface, touches screens, and working with other equipment to optimize the efficiency of surgeries and the quality of care about patients.

- Major factors that are driving the UHD surgical display market are the development of the medical industry and rising prevalence of surgeries which require better visualization and images output. As more and more people go for surgeries that require minute details, there is always the need to have the best image in the operating theater, it is for this reason that there has been a rise in the demand for the ultra-high definition (UHD) surgical displays. These displays provide better image sharpness, colors, and details which lead to better performance, especially when working on highly sensitive surgeries and procedures that require high precision and accuracy in order to positively impact the lives of patients involved.

- Some of the more important drivers influencing the market for UHD surgical displays include the current, and in many regions, rising incidences of chronic ailments such as cardiovascular diseases and cancer subsequently requiring enhanced surgical procedures. Similarly, the growing global population of geriatrics and the overall increase in the number of surgeries conducted across the world are bolstering the need for enhanced medical imaging systems. UHD surgical displays are crucial in improving visibility for surgeons since they form a critical component in defining the efficiency and results of product delivery.

- The trends seen for the present and the future revolve around the need for screens larger in diagonal and denser in pixels necessary to provide detailed imaging while performing surgeries. Hence, manufacturers are engaging in the research and development of advanced display technologies like OLED and MicroLED in a bid to garner higher image quality and sturdiness which is essential within surgical settings. In addition, the inclusion of additional features such as 3D and image enhancement are also boosting the usage of UHD surgical displays across all disciplines of medicine.

- The UHD surgical display market is today being driven by North America, owing to the presence of large device manufacturers, advanced healthcare systems, and high health care spending. Nevertheless, Asia-Pacific is projected to present higher growth as a result of the continually rising healthcare spending, increasing per capita income together with the standard application of progressive healthcare technologies in key markets including the United States of China, Japan and India.

- However, there is a number of challenges intrinsic to the UHD surgical display market including: high costs of UHD surgical displays; compatibility of these displays with the existing surgical equipment; and data privacy and security considerations which are inevitable when implementing new technologies. However, some limitations and threats include continued restrictions due to the COVI9D-19 outbreak that affect the supply chain and postpone elective surgeries, thus affecting the market to some degree.

- In sum, the market for the UHD surgical display is experiencing a steady growth due to drive by successive advancements in technology, higher clients inflow in surgeries, and global escalating standard of visualization in today’s health care systems. There are several factors that will continue to guide the behaviors of market players over the medium term: Strategic partnerships, product development and market penetration, and diversification are some of the strategies that will be espoused by market players in regard to the new opportunities and health care market environment.

UHD Surgical Display Market Trend Analysis

Advancements in UHD Surgical Display Technology

- This movement noticeable on the general trend towards up-scaling and resolution oriented market in UHD surgical display is notable as a paradigm change that emerged in response to the existing market demands of OR. Operating room staffs understand that detail and fine imagery in specially relevant, especially in operations where clear definition is of substantial importance. Consequently, manufacturers went ahead and released UHD displays with the resolutions of 4K and more, researching innovative technologies to create images of the utmost quality.

- In addition to achieving improved picture quality in UHD, these modern monitors offer better clarity and depth of focus, which allows the surgeon to see even the smallest details of anatomical features or the instruments used. Continued advancement of this level of visual detail during surgery ensures decisions made are accurate thus improving patient outcomes and decreasing risks during surgery. Additionally, an increased screen size is integrated to enable interaction between members of the surgical staff; several personnel can perform visualization of various high resolution images at once, which proves useful in improving organized work flow in the operating theater. In conclusion, the increase in the size of the operative field and the resolution of UHD surgical displays can be seen as a continuation of a process of development and an attempt to provide even better solutions for the needs of new generations of surgeons and healthcare workers and pursue the goal of increasing the quality of surgical operations and, therefore, the quality of life and survival rate of patients around the world.

Innovative Features Driving Enhanced Functionality in UHD Surgical Displays

- The next and fourth trend is the incorporation of improved attributes and attributes in the UHD surgical display market dictated by the need to improve operations, features, and functionality in surgeries. Manufacturers understand the need to support surgeons and other health care workers by offering tools to help implement processes that enhance the rate of working within the laps. Hence they are into touch screen, where they are able to conduct all the operations with imaging data and with surgical controls on the display itself. Not only does it minimise the dependence of the surgeon on external input devices but it also can greatly improve the surgeons’ ability to manipulate images together with navigating through vast and intricate data sets with great accuracy.

- Further, by integrating multi-modality support and general compatibility with different imaging techniques including endoscopies, laparoscopies, and microscopies, UHD surgical displays’ applicability is further enhanced into numerous surgical operations as universal tools. This means the surgeons can access the required modality without having to potential multiple displays to work from this can be time consuming and also congest operations in the operating room. This integration enhances the communication between surgical subteams as well as helps in making more informed decisions with greater efficiency by offering an unhampered overview of anatomical features and all necessary operational specifics. These advanced innovative features and technologies prove that in addition to uplift the usability and functionality of UHD surgical displays, these can also lead to better service delivery, increased productivity, and therefore increased patient’s satisfaction and health outcomes in surgical rooms.

UHD Surgical Display Market Segment Analysis:

UHD Surgical Display Market is segmented based on Product, Application and End-User

By Application, surgical imaging segment is expected to dominate the market during the forecast period

- The surgical imaging segment holds the dominant share in the medical displays market, driven primarily by the increasing adoption of minimally invasive surgeries (MIS). These procedures rely heavily on high-quality imaging to ensure precision and accuracy during operations. The demand for superior imaging technology is fueled by the necessity for clear, detailed visuals that enable surgeons to navigate complex anatomical structures without large incisions. As minimally invasive techniques continue to advance, the requirement for high-resolution displays becomes more critical. LED UHD displays, known for their exceptional color accuracy and resolution, are particularly favored in surgical settings, providing surgeons with the necessary clarity to perform intricate procedures. The shift towards MIS is not only driven by technological advancements but also by the benefits it offers, such as reduced recovery times, lower risk of complications, and shorter hospital stays, all of which contribute to its growing adoption and, consequently, the dominance of the surgical imaging segment.

- Furthermore, the integration of sophisticated imaging systems within operating rooms is becoming increasingly common, enhancing the overall efficiency and outcomes of surgeries. The trend towards hybrid operating rooms, which combine traditional surgical environments with advanced imaging capabilities, underscores the importance of high-quality displays. These hybrid settings allow for real-time imaging during surgeries, facilitating immediate adjustments and better decision-making. Additionally, the continuous development of surgical robotics and navigation systems, which depend heavily on precise imaging, further drives the demand for top-tier medical displays in the surgical imaging segment. Hospitals and surgical centers are investing significantly in upgrading their imaging technologies to stay at the forefront of medical innovation, ensuring optimal patient care and surgical success. This substantial investment underscores the dominant position of surgical imaging in the medical displays market.

By End-User, Diagnostic imaging centers segment held the largest share in 2023

- Diagnostic imaging centers emerge as the largest end-user segment within the medical displays market, primarily due to their specialization in providing comprehensive imaging services. These standalone facilities are equipped with the latest advanced imaging technologies, such as MRI, CT scans, and ultrasound machines, which are essential for accurate diagnosis and patient management. By focusing exclusively on imaging, these centers can allocate substantial resources to acquiring high-quality display systems that enhance their diagnostic capabilities. The specialization allows them to maintain a high standard of service, attracting a broad patient base that includes referrals from a wide range of healthcare providers. The ability to offer precise, detailed, and reliable imaging is critical, and advanced LCD and LED UHD displays play a vital role in ensuring that diagnostic images are clear and accurate, facilitating better interpretation by radiologists.

- The rise in outpatient services significantly contributes to the prominence of diagnostic imaging centers in the medical displays market. Patients increasingly prefer the convenience of accessing diagnostic services outside of traditional hospital settings. This trend is driven by the need for faster service, reduced wait times, and a more patient-friendly environment. Diagnostic imaging centers are well-positioned to meet these demands, offering flexible scheduling and often quicker turnaround times for results. Additionally, the growing emphasis on preventive healthcare and early diagnosis further drives the demand for imaging services. As healthcare systems worldwide focus on reducing the burden on hospitals and providing more community-based care, diagnostic imaging centers are expanding their capabilities and reach. This expansion ensures they capture a substantial share of the market, supported by their ability to deliver high-quality, timely imaging services that are crucial for effective medical diagnosis and treatment planning.

UHD Surgical Display Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to be the fastest growing for UHD surgical display market in the throughout the world due to China, Japan and India. China is an emerging economy with increasing investment in medical technology given its HEWC and strategic focus on improving on the minimum standards of the healthcare system. The increasing populace in the country in association with the constantly increasing healthcare spending develops a conducive environment for the assimilation of excellent UHD surgical displays in numerous healthcare facilities. Likewise, Japan, which is recognized for excellent technology, demonstrates a high need for modern machine instruments such as UHD displays for the country’s sophisticated medical sector. Also, the advanced and enlarging healthcare sector of India – both for indigenous people and medical tourists – is the great opportunity for the companies that operate in the sphere of UHD surgical display. More hospitals and specialty clinics in the Asia pacific countries are likely to establish themselves in a position where they could need better quality surgical displays over the next few years and hence dominate the world market.

- In addition, the rise in the medical tourism business in the Asia Pacific region, which significantly strengthens the market place for UHD surgical displays. India, Thailand and Singapore are among the most preferred medical tourism destinations, as more and more individuals look for quality health care services that are relatively cheap. While facilities in these countries are constantly trying to meet the internationally recognized standards and target patients from different parts of the world, it is crucial to implement the state-of-the-art equipment like UHD displays in surgical procedures. Due to the increased adoption of medical procedures among medical tourists and the resultant burgeoning domestic market in the Asia Pacific region for superior healthcare and UHD surgical displays, the market is indeed predicted to rise significantly. There are many reasons as to why the region would continue to dominate the global UHD surgical display market in the near future and these include growth in the economy, enhancement of the healthcare system and fully prepared pool of patients.

Active Key Players in the UHD Surgical Display Market

- Barco

- Eizo

- FSN Medical Technologies

- LG Display

- Novanta

- Siemens Healthineers

- Sony

- Steris

- Quest International

- Advantech

- Stryker

- Olympus

- Winmate

- Joimax GmbH

- Panasonic

- Integritech

- Other Major Players

|

Global UHD Surgical Display Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 708.86 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 1187.47 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- UHD SURGICAL DISPLAY MARKET BY PRODUCT (2017-2032)

- UHD SURGICAL DISPLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LED UHD DISPLAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LCD UHD DISPLAY

- UHD SURGICAL DISPLAY MARKET BY APPLICATION (2017-2032)

- UHD SURGICAL DISPLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SURGICAL IMAGING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIAGNOSTIC IMAGING

- DENTAL IMAGING

- MEDICAL EDUCATION

- TELE-MEDICINE

- UHD SURGICAL DISPLAY MARKET BY END-USER (2017-2032)

- UHD SURGICAL DISPLAY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIAGNOSTIC IMAGING CENTERS

- ACADEMIC AND RESEARCH CENTERS

- AMBULATORY SURGICAL CENTERS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- UHD Surgical Display Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BARCO

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- FSN MEDICAL TECHNOLOGIES

- LG DISPLAY

- NOVANTA

- SIEMENS HEALTHINEERS

- SONY

- STERIS

- QUEST INTERNATIONAL

- ADVANTECH

- STRYKER

- OLYMPUS

- WINMATE

- JOIMAX GMBH

- PANASONIC

- INTEGRITECH

- COMPETITIVE LANDSCAPE

- GLOBAL UHD SURGICAL DISPLAY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global UHD Surgical Display Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 708.86 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.9% |

Market Size in 2032: |

USD 1187.47 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. UHD SURGICAL DISPLAY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. UHD SURGICAL DISPLAY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. UHD SURGICAL DISPLAY MARKET COMPETITIVE RIVALRY

TABLE 005. UHD SURGICAL DISPLAY MARKET THREAT OF NEW ENTRANTS

TABLE 006. UHD SURGICAL DISPLAY MARKET THREAT OF SUBSTITUTES

TABLE 007. UHD SURGICAL DISPLAY MARKET BY PRODUCT

TABLE 008. LED UHD DISPLAY MARKET OVERVIEW (2016-2028)

TABLE 009. LCD UHD DISPLAY MARKET OVERVIEW (2016-2028)

TABLE 010. UHD SURGICAL DISPLAY MARKET BY APPLICATION

TABLE 011. SURGICAL IMAGING MARKET OVERVIEW (2016-2028)

TABLE 012. DIAGNOSTIC IMAGING MARKET OVERVIEW (2016-2028)

TABLE 013. DENTAL IMAGING MARKET OVERVIEW (2016-2028)

TABLE 014. MEDICAL EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 015. TELE-MEDICINE MARKET OVERVIEW (2016-2028)

TABLE 016. UHD SURGICAL DISPLAY MARKET BY END-USER

TABLE 017. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 018. DIAGNOSTIC IMAGING CENTERS MARKET OVERVIEW (2016-2028)

TABLE 019. ACADEMIC & RESEARCH CENTERS MARKET OVERVIEW (2016-2028)

TABLE 020. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA UHD SURGICAL DISPLAY MARKET, BY PRODUCT (2016-2028)

TABLE 023. NORTH AMERICA UHD SURGICAL DISPLAY MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA UHD SURGICAL DISPLAY MARKET, BY END-USER (2016-2028)

TABLE 025. N UHD SURGICAL DISPLAY MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE UHD SURGICAL DISPLAY MARKET, BY PRODUCT (2016-2028)

TABLE 027. EUROPE UHD SURGICAL DISPLAY MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE UHD SURGICAL DISPLAY MARKET, BY END-USER (2016-2028)

TABLE 029. UHD SURGICAL DISPLAY MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC UHD SURGICAL DISPLAY MARKET, BY PRODUCT (2016-2028)

TABLE 031. ASIA PACIFIC UHD SURGICAL DISPLAY MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC UHD SURGICAL DISPLAY MARKET, BY END-USER (2016-2028)

TABLE 033. UHD SURGICAL DISPLAY MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA UHD SURGICAL DISPLAY MARKET, BY PRODUCT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA UHD SURGICAL DISPLAY MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA UHD SURGICAL DISPLAY MARKET, BY END-USER (2016-2028)

TABLE 037. UHD SURGICAL DISPLAY MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA UHD SURGICAL DISPLAY MARKET, BY PRODUCT (2016-2028)

TABLE 039. SOUTH AMERICA UHD SURGICAL DISPLAY MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA UHD SURGICAL DISPLAY MARKET, BY END-USER (2016-2028)

TABLE 041. UHD SURGICAL DISPLAY MARKET, BY COUNTRY (2016-2028)

TABLE 042. CONMED CORPORATION (UNITED STATES): SNAPSHOT

TABLE 043. CONMED CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 044. CONMED CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 045. CONMED CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. HILIEX (UNITED STATES): SNAPSHOT

TABLE 046. HILIEX (UNITED STATES): BUSINESS PERFORMANCE

TABLE 047. HILIEX (UNITED STATES): PRODUCT PORTFOLIO

TABLE 048. HILIEX (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. EIZO (JAPAN): SNAPSHOT

TABLE 049. EIZO (JAPAN): BUSINESS PERFORMANCE

TABLE 050. EIZO (JAPAN): PRODUCT PORTFOLIO

TABLE 051. EIZO (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BARCO (EUROPE): SNAPSHOT

TABLE 052. BARCO (EUROPE): BUSINESS PERFORMANCE

TABLE 053. BARCO (EUROPE): PRODUCT PORTFOLIO

TABLE 054. BARCO (EUROPE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SIEMENS (GERMANY): SNAPSHOT

TABLE 055. SIEMENS (GERMANY): BUSINESS PERFORMANCE

TABLE 056. SIEMENS (GERMANY): PRODUCT PORTFOLIO

TABLE 057. SIEMENS (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SONY (JAPAN): SNAPSHOT

TABLE 058. SONY (JAPAN): BUSINESS PERFORMANCE

TABLE 059. SONY (JAPAN): PRODUCT PORTFOLIO

TABLE 060. SONY (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SYNERGY MEDICAL INC. (UNITED SATES): SNAPSHOT

TABLE 061. SYNERGY MEDICAL INC. (UNITED SATES): BUSINESS PERFORMANCE

TABLE 062. SYNERGY MEDICAL INC. (UNITED SATES): PRODUCT PORTFOLIO

TABLE 063. SYNERGY MEDICAL INC. (UNITED SATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SHENZHEN JLD DISPLAY EXPERT CO. LTD (CHINA): SNAPSHOT

TABLE 064. SHENZHEN JLD DISPLAY EXPERT CO. LTD (CHINA): BUSINESS PERFORMANCE

TABLE 065. SHENZHEN JLD DISPLAY EXPERT CO. LTD (CHINA): PRODUCT PORTFOLIO

TABLE 066. SHENZHEN JLD DISPLAY EXPERT CO. LTD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. FSN MEDICAL TECHNOLOGIES (UNITED STATES): SNAPSHOT

TABLE 067. FSN MEDICAL TECHNOLOGIES (UNITED STATES): BUSINESS PERFORMANCE

TABLE 068. FSN MEDICAL TECHNOLOGIES (UNITED STATES): PRODUCT PORTFOLIO

TABLE 069. FSN MEDICAL TECHNOLOGIES (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. RICHARDSON ELECTRONICS LTD (UNITED STATES): SNAPSHOT

TABLE 070. RICHARDSON ELECTRONICS LTD (UNITED STATES): BUSINESS PERFORMANCE

TABLE 071. RICHARDSON ELECTRONICS LTD (UNITED STATES): PRODUCT PORTFOLIO

TABLE 072. RICHARDSON ELECTRONICS LTD (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. UHD SURGICAL DISPLAY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. UHD SURGICAL DISPLAY MARKET OVERVIEW BY PRODUCT

FIGURE 012. LED UHD DISPLAY MARKET OVERVIEW (2016-2028)

FIGURE 013. LCD UHD DISPLAY MARKET OVERVIEW (2016-2028)

FIGURE 014. UHD SURGICAL DISPLAY MARKET OVERVIEW BY APPLICATION

FIGURE 015. SURGICAL IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 016. DIAGNOSTIC IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 017. DENTAL IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 018. MEDICAL EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 019. TELE-MEDICINE MARKET OVERVIEW (2016-2028)

FIGURE 020. UHD SURGICAL DISPLAY MARKET OVERVIEW BY END-USER

FIGURE 021. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 022. DIAGNOSTIC IMAGING CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 023. ACADEMIC & RESEARCH CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 024. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA UHD SURGICAL DISPLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE UHD SURGICAL DISPLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC UHD SURGICAL DISPLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA UHD SURGICAL DISPLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA UHD SURGICAL DISPLAY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the UHD Surgical Display Market research report is 2024-2032.

Barco, Eizo, FSN Medical Technologies, LG Display, Novanta, Siemens Healthineers, Sony, Steris, Quest International, Advantech, Stryker, Olympus, Winmate, Joimax GmbH, Panasonic, Integritech and Other Major Players.

The UHD Surgical Display Market is segmented into By Product, By Application, By End-User, and region. By Product, the market is categorized into LED UHD Display and LCD UHD Display. By Application, the market is categorized into Surgical Imaging, Diagnostic Imaging, Dental Imaging, Medical Education and Tele-medicine. By End-User, the market is categorized into Hospitals , Diagnostic Imaging Centers, Academic and Research Centers, Ambulatory Surgical Centers and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The UHD Surgical Display Market category relates to the sector of the medical technology industry that deals with the manufacture of trade and distribution of Ultra High Definition (UHD) displays which are specially designed for use in surgeries. Highlighted by significant features of high screen resolution which can be as high as 3840 x 2160 pixels these displays provide detailed on-site visualisation of operations to surgeons and members of medical teams in and out of operating rooms. UHD surgical displays can be regarded as essential elements of today’s operating theaters; they provide surgeons with crucial pieces of information that enable fast and accurate decisions as well as overall improved outcome of the surgery. The UHD surgical display trends in the future will remain a focus on higher technologies, such as the 3D interface, touches screens, and working with other equipment to optimize the efficiency of surgeries and the quality of care about patients.

UHD Surgical Display Market Size Was Valued at USD 708.86 Million in 2023 and is Projected to Reach USD 1187.47 Million by 2032, Growing at a CAGR of 5.9% From 2024-2032.