Neurosurgery Surgical Power Tools Market Synopsis

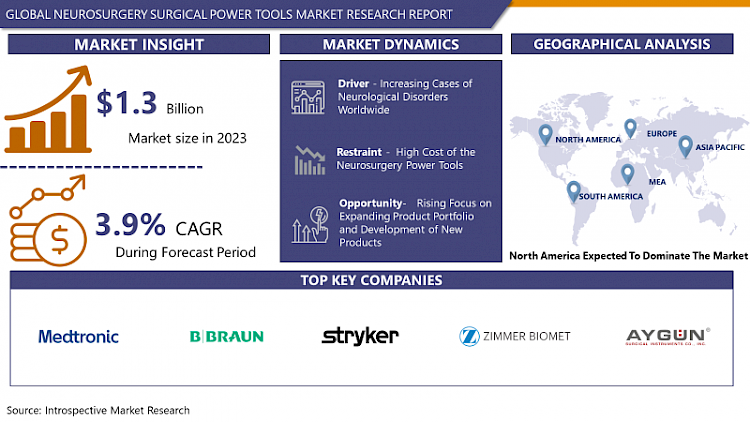

Neurosurgery Surgical Power Tools Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 1.8 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

The pneumatic and electric neurosurgical drills are the instruments that surgeons utilize in treating brain and skull ailments. Electric drills mainly operate through power while the pneumatic drill system is a surgical instrument system that is operated hydraulically.

Nevertheless, the electric-operated power sources are cheaper as compared to pneumatic neurosurgery surgical power tools. These neurosurgery surgical power tools devices of use in drilling at the skull as well as in the removal of hard and soft tissues and bones in general neurosurgery operations or in open and endoscopic spine surgery.

- The segments in neurosurgery surgical power tools market on the basis of tool and power type have been defined. Tool type segment involves drills, reamers, saws and all other related medical equipment. Power type segment encompasses pneumatic, electric and battery operated medical equipments. Here are those medical instruments that assist neurosurgeons in operations commonly known as skull base surgeries and craniotomies. There is an increased usage of neuro surgical power tools since they possess benefits like enhanced dependability and productivity over conventional tools.

- The market is currently being driven by the increasing usage of minimally invasive neurosurgeries today. Minimally invasive treatments are gaining popularity among surgeons for a certain set of activities, such as operations for tumors in the brain. Patients also prefer minimally invasive neurosurgeries as they entail shorter periods of time than traditional surgeries, short exposure and trauma to the patient, and less tissue damage overall and therefore reduced morbidity.

- As the number of neurosurgeries, including skull base surgeries and craniotomies is increasing around the world, the market for such systems is experiencing a similar trend. These are surgeries that are conducted in an effort to excise distortions in the layers of the brain’s skull. Another factor that has enhanced accessibility of neurosurgical procedures is technological factors, power equipment.

- The common surgical procedure known as craniotomy, which entails the use of a crane to remove a bone flap from the skull to address hematomas, tumors, traumatic brain injury or swelling, and to also remove a foreign object can also be performed using better neurosurgery power instruments. Therefore, the utilization of powered equipment in order to reduce risks during the conduct of these complex neurosurgical operations has been instrumental in the advancement of growth.

Neurosurgery Surgical Power Tools Market Trend Analysis

Rise in neurological illnesses and Government initiatives

- The market is being supported by factors such as availability of devices in the end user market places like hospitals and neurosurgical centers , it usefulness in operations like craniotomies and skull based surgeries and due to the rising incidence neurological disorders in the ageing population.

- As sourced from the administration for community living, geriatric population (65 years and above) in the U. S. was 46. 2 million in 2014. A number of diseases and disorders affect people as they age. It is however factual that majority of elderly individuals experience neurological disorders. Hence, increase in the aging population is expected to have a positive impact on global neurosurgery surgical power tools market during 2022–2029.

Growing cases of neurological disorders and increasing geriatric population

- The growing cases of neurological disorders, the increasing geriatric population, and changing trends on the number of surgeries conducted and on the use of neurosurgery surgical power tools drive the growth of market. In addition, the strapping growth in the volume of less invasive neurosurgical procedures and the improving hospital buying capacity that can propel the worldwide neurosurgery surgical power tools market within the forecast period.

Neurosurgery Surgical Power Tools Market Segment Analysis:

Neurosurgery Surgical Power Tools Market Segmented based on Tools Type, and Tools Type.

By Tools Type, Drills segment is expected to dominate the market during the forecast period

- The drills segment was the largest in the market, due to an increased adoption of the product in minimally invasive surgical procedures. This segment consists of the cranial drill, which is used in operations and craniotomies to make larger holes in the skull. There are several categories and classifications of drills depending on their application and features. One such classification is the electrical drill which is operated by rechargeable batteries.

- The reamers segment is anticipated to be the fastest growing segment over the forecast period due to the improved specifications in terms of power torque for surgery. The demand for reamers is rising given features like the magnetic coil design, which provides high peak torque for surgeons to operate on the skull.

By Power Type, Electric segment held the largest share in 2023

- The electric segment remained the largest in the market due to factors like higher speeds being incorporated in the manufacturing of the bikes. For instance, it is possible to have a surgical drill known as Medtronic Midas Rex Legend Stylus that has a high torque capacity despite its small size making it appropriate for different kinds of operations. Power surgical instruments are conceived with an idea of the most challenging operations. They are designed to provide consistent efficiency and low levels of vibration, heat and noise hence contributing to the enhancement of the preference for the products which in turn boosts the growth of the market.

Neurosurgery Surgical Power Tools Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The North America region accounted for the largest share in this market due to the latest trends of brain-related injuries and disorders and the availability of neurosurgeons. However, increasing demands for neurosurgery procedures, FDA approved products and subsequently released products by market players are the other factors that remains strong. This possibilities associated with minimally invasive neurosurgical procedures and application of sophisticated power tools may further promote the market during the years to come.

Active Key Players in the Neurosurgery Surgical Power Tools Market

- Medtronic

- B. Braun Melsungen AG

- Stryker

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- Olympus Corporation

- Richard Wolf GmbH

- Conmed Corporation

- Mizuho OSI

- Smith & Nephew

- Medline Industries, Inc.

- Karl Storz SE & Co. KG

- Hoya Corporation (Pentax Medical)

- KLS Martin Group

- Bovie Medical Corporation

- NICO Corporation

- Brainlab AG

- Integra LifeSciences Corporation

- Alphatec Spine

- Aygun Surgical Instruments and Other Key Players

Key Industry Developments in the Neurosurgery Surgical Power Tools Market:

- In April 2024, Integra LifeSciences announced that it had completed its acquisition of Acclarent, Inc., a leader in ear, nose, and throat (ENT) surgical interventions. By incorporating Acclarent’s innovative product portfolio, Integra expanded its range of market-leading brands and achieved immediate scale and accretive growth through a specialized sales channel. The acquisition increased the Company’s total addressable market by $1 billion and opened new opportunities in the appealing ENT device segment.

- In April 2024, FUJIFILM Healthcare Americas Corporation, a prominent provider of diagnostic and enterprise imaging solutions, and Brainlab, a leading digital medical technology company, announced that Brainlab became the exclusive U.S. distributor of the ARIETTA Precision Ultrasound forss neurosurgery applications. This ultrasound was integrated with Brainlab’s surgical navigation systems to create a powerful intraoperative neurosurgery solution. The ARIETTA Precision, paired with Brainlab’s navigation systems, delivered advanced guidance and image quality for critical surgical decisions.

|

Global Neurosurgery Surgical Power Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 1.8 Bn. |

|

Segments Covered: |

By Tools Type |

|

|

|

By Power Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NEUROSURGERY SURGICAL POWER TOOLS MARKET BY TOOLS (2017-2032)

- NEUROSURGERY SURGICAL POWER TOOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRILL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REAMER

- SAW

- OTHERS

- NEUROSURGERY SURGICAL POWER TOOLS MARKET BY POWER (2017-2032)

- NEUROSURGERY SURGICAL POWER TOOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PNEUMATIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTRIC

- BATTERY-POWERED

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Neurosurgery Surgical Power Tools Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MEDTRONIC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- B. BRAUN MELSUNGEN AG

- STRYKER

- ZIMMER BIOMET

- AYGUN SURGICAL INSTRUMENTS

- COMPETITIVE LANDSCAPE

- GLOBAL NEUROSURGERY SURGICAL POWER TOOLS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Tool Type

- Historic And Forecasted Market Size By Power Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Neurosurgery Surgical Power Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 1.8 Bn. |

|

Segments Covered: |

By Tools Type |

|

|

|

By Power Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NEUROSURGERY SURGICAL POWER TOOLS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NEUROSURGERY SURGICAL POWER TOOLS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NEUROSURGERY SURGICAL POWER TOOLS MARKET COMPETITIVE RIVALRY

TABLE 005. NEUROSURGERY SURGICAL POWER TOOLS MARKET THREAT OF NEW ENTRANTS

TABLE 006. NEUROSURGERY SURGICAL POWER TOOLS MARKET THREAT OF SUBSTITUTES

TABLE 007. NEUROSURGERY SURGICAL POWER TOOLS MARKET BY PRODUCT

TABLE 008. DRILL MARKET OVERVIEW (2016-2028)

TABLE 009. REAMER MARKET OVERVIEW (2016-2028)

TABLE 010. SAW MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. NEUROSURGERY SURGICAL POWER TOOLS MARKET BY POWER TYPE

TABLE 013. PNEUMATIC MARKET OVERVIEW (2016-2028)

TABLE 014. ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 015. BATTERY-POWERED MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY PRODUCT (2016-2028)

TABLE 017. NORTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY POWER TYPE (2016-2028)

TABLE 018. N NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY PRODUCT (2016-2028)

TABLE 020. EUROPE NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY POWER TYPE (2016-2028)

TABLE 021. NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY PRODUCT (2016-2028)

TABLE 023. ASIA PACIFIC NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY POWER TYPE (2016-2028)

TABLE 024. NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY PRODUCT (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY POWER TYPE (2016-2028)

TABLE 027. NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY PRODUCT (2016-2028)

TABLE 029. SOUTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY POWER TYPE (2016-2028)

TABLE 030. NEUROSURGERY SURGICAL POWER TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 031. MEDTRONIC (IRELAND): SNAPSHOT

TABLE 032. MEDTRONIC (IRELAND): BUSINESS PERFORMANCE

TABLE 033. MEDTRONIC (IRELAND): PRODUCT PORTFOLIO

TABLE 034. MEDTRONIC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. B. BRAUN MELSUNGEN AG (GERMANY): SNAPSHOT

TABLE 035. B. BRAUN MELSUNGEN AG (GERMANY): BUSINESS PERFORMANCE

TABLE 036. B. BRAUN MELSUNGEN AG (GERMANY): PRODUCT PORTFOLIO

TABLE 037. B. BRAUN MELSUNGEN AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. STRYKER (UNITED STATES): SNAPSHOT

TABLE 038. STRYKER (UNITED STATES): BUSINESS PERFORMANCE

TABLE 039. STRYKER (UNITED STATES): PRODUCT PORTFOLIO

TABLE 040. STRYKER (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. BRAINLAB AG (GERMANY): SNAPSHOT

TABLE 041. BRAINLAB AG (GERMANY): BUSINESS PERFORMANCE

TABLE 042. BRAINLAB AG (GERMANY): PRODUCT PORTFOLIO

TABLE 043. BRAINLAB AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. INTEGRA LIFESCIENCES (UNITED STATES): SNAPSHOT

TABLE 044. INTEGRA LIFESCIENCES (UNITED STATES): BUSINESS PERFORMANCE

TABLE 045. INTEGRA LIFESCIENCES (UNITED STATES): PRODUCT PORTFOLIO

TABLE 046. INTEGRA LIFESCIENCES (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SCOPIS GMBH (GERMANY): SNAPSHOT

TABLE 047. SCOPIS GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 048. SCOPIS GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 049. SCOPIS GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. BOSTON SCIENTIFIC CORPORATION (UNITED STATES): SNAPSHOT

TABLE 050. BOSTON SCIENTIFIC CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 051. BOSTON SCIENTIFIC CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 052. BOSTON SCIENTIFIC CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ELEKTA (SWEDEN): SNAPSHOT

TABLE 053. ELEKTA (SWEDEN): BUSINESS PERFORMANCE

TABLE 054. ELEKTA (SWEDEN): PRODUCT PORTFOLIO

TABLE 055. ELEKTA (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. CYBERONICS INC. (UNITED STATES): SNAPSHOT

TABLE 056. CYBERONICS INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 057. CYBERONICS INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 058. CYBERONICS INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MICROMAR IND. E COM. LTDA (SPAIN): SNAPSHOT

TABLE 059. MICROMAR IND. E COM. LTDA (SPAIN): BUSINESS PERFORMANCE

TABLE 060. MICROMAR IND. E COM. LTDA (SPAIN): PRODUCT PORTFOLIO

TABLE 061. MICROMAR IND. E COM. LTDA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. NEUROS MEDICAL (UNITED STATES): SNAPSHOT

TABLE 062. NEUROS MEDICAL (UNITED STATES): BUSINESS PERFORMANCE

TABLE 063. NEUROS MEDICAL (UNITED STATES): PRODUCT PORTFOLIO

TABLE 064. NEUROS MEDICAL (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SPR THERAPEUTICS (UNITED STATES): SNAPSHOT

TABLE 065. SPR THERAPEUTICS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 066. SPR THERAPEUTICS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 067. SPR THERAPEUTICS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SYNAPSE BIOMEDICAL INC. (UNITED STATES): SNAPSHOT

TABLE 068. SYNAPSE BIOMEDICAL INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 069. SYNAPSE BIOMEDICAL INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 070. SYNAPSE BIOMEDICAL INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. KARL STORZ (GERMANY): SNAPSHOT

TABLE 071. KARL STORZ (GERMANY): BUSINESS PERFORMANCE

TABLE 072. KARL STORZ (GERMANY): PRODUCT PORTFOLIO

TABLE 073. KARL STORZ (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ABBOTT (UNITED STATES): SNAPSHOT

TABLE 074. ABBOTT (UNITED STATES): BUSINESS PERFORMANCE

TABLE 075. ABBOTT (UNITED STATES): PRODUCT PORTFOLIO

TABLE 076. ABBOTT (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY PRODUCT

FIGURE 012. DRILL MARKET OVERVIEW (2016-2028)

FIGURE 013. REAMER MARKET OVERVIEW (2016-2028)

FIGURE 014. SAW MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY POWER TYPE

FIGURE 017. PNEUMATIC MARKET OVERVIEW (2016-2028)

FIGURE 018. ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 019. BATTERY-POWERED MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA NEUROSURGERY SURGICAL POWER TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Neurosurgery Surgical Power Tools Market research report is 2024-2032.

Medtronic,B. Braun Melsungen AG,Stryker,Zimmer Biomet,DePuy Synthes (Johnson & Johnson),Olympus Corporation,Richard Wolf GmbH,Conmed Corporation,Mizuho OSI,Smith & Nephew,Medline Industries, Inc.,Karl Storz SE & Co. KG,Hoya Corporation (Pentax Medical),KLS Martin Group,Bovie Medical Corporation,NICO Corporation,Brainlab AG,Integra LifeSciences Corporation,Alphatec Spine,Aygun Surgical Instruments and Other Key Players

The Neurosurgery Surgical Power Tools Market is segmented into tools type, power type, and region. By tools type, the market is categorized into drill, reamer, saw, others. By power type, the market is categorized into pneumatic, electric, battery-powered. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Neurosurgeries and minimally invasive neurosurgeries are done with the help of surgical power tools. These include drills, saws, reamers, and among others These tools consist of drills, saws, reamers, among others. Neurosurgery can be used to diagnose and treat many neurological disorders such as aneurysms, stroke, Alzheimer’s disease, Parkinson’s disease, degenerative diseases, Spinal Cord and Brain Injuries, and many others.

Neurosurgery Surgical Power Tools Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 1.8 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.