Surgical Stapling Device Market Synopsis

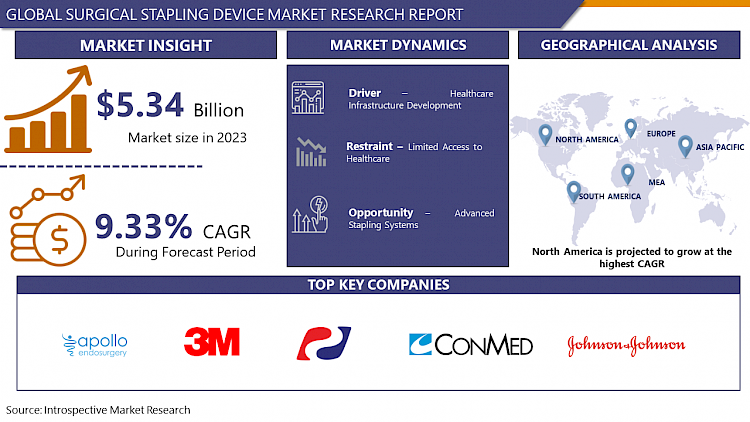

Surgical Stapling Device Market Size Was Valued at USD 5.34 Billion in 2023 and is Projected to Reach USD 11.91 Billion by 2032, Growing at a CAGR of 9.33% From 2024-2032.

A surgical stapling device is a medical instrument used in surgical procedures to close wounds, incisions, or surgical incisions quickly and securely. It works by inserting surgical staples into tissue to close or seal it, similar to how a stapler is used on paper. Surgical stapling devices are commonly used in a wide range of surgical procedures, including gastrointestinal surgeries, thoracic surgeries, and gynecological surgeries, among others. They offer several advantages over traditional sutures, including faster closure times, reduced tissue trauma, and improved wound healing.

- Surgical stapling devices are used in various surgical procedures, including gastrointestinal surgeries, bariatric surgery, thoracic surgeries, cardiac surgeries, obstetric and gynecological surgeries, orthopedic surgeries, and skin closure. They facilitate the creation of anastomoses, allowing surgeons to remove diseased or damaged tissue and reconnect healthy segments. In bariatric surgery, they create smaller stomach pouches or reroute the digestive tract, reducing stomach size and promoting weight loss.

- In thoracic surgeries, they seal lung tissue, close bronchial stumps, and repair chest wall incisions. In cardiac surgeries, they create secure connections between blood vessels and repair cardiac structures with minimal tissue trauma. In orthopedic surgeries, they secure soft tissues, ligaments, and tendons, promoting stability and support during healing. Lastly, surgical staplers are used for skin closure in various surgical specialties, reducing operating time and improving cosmetic outcomes.

- The surgical stapler is commonly used during surgical procedures and, at the same time, is in an almost constant state of developmental evolution. Although these devices are highly versatile and efficient, there have been well-documented incidences of staple line leaks leading to postoperative complications that often result from issues not attributable to ischemia.

- Surgical stapling devices are crucial in minimally invasive surgeries due to their benefits such as reduced pain, shorter recovery times, and lower risk of complications. The demand for these devices is increasing due to factors like aging populations, chronic diseases, and increasing healthcare access in developing countries. Technological advancements in surgical stapling devices have improved safety, precision, and ease of use, leading to increased adoption.

- Surgical stapling offers advantages over traditional suturing techniques, such as faster procedure times, consistent staple formation, reduced risk of leaks and bleeding, and improved wound healing. The growing healthcare expenditure and investments in healthcare infrastructure support the growth of the surgical stapling device market.

- The aging population drives demand for surgical interventions to address age-related health conditions and surgical stapling devices are widely used in procedures like cardiac surgery, oncological resections, and joint replacements. Regulatory approvals and standards ensure the safety, efficacy, and quality of surgical stapling devices, instilling confidence among healthcare providers and patients.

Surgical Stapling Device Market Trend Analysis

Healthcare Infrastructure Development

- Healthcare infrastructure development is a key driver of the adoption and utilization of surgical stapling devices. This development is driven by the expansion of healthcare facilities, increasing surgical procedures, and investments in advanced surgical technologies.

- Surgical stapling devices offer advantages over traditional suturing techniques, such as faster procedure times and reduced blood loss. Healthcare infrastructure development also includes investments in advanced surgical technologies to improve patient care and surgical outcomes.

- Surgical stapling devices are essential tools in various surgical specialties, such as general surgery, gastrointestinal surgery, thoracic surgery, and gynecology. Regional healthcare initiatives aim to improve access to quality healthcare services, particularly in underserved areas.

- Healthcare infrastructure development supports these initiatives and ensures equitable access to surgical care across regions. Technological advancements in surgical stapling technology, such as robotic-assisted systems and disposable staplers with integrated safety features, also contribute to the demand for these devices in modern healthcare settings.

Restraints

Limited Access to Healthcare

- Limited access to healthcare can significantly restrain the market for surgical stapling devices. Geographical barriers, healthcare disparities, underdeveloped healthcare systems, regulatory challenges, and cost barriers are some of the factors that can impact the availability of these devices.

- Geographical barriers, particularly in rural or remote areas, can lead to long travel distances, lack of transportation infrastructure, and limited availability of healthcare facilities. Socioeconomic factors, such as financial constraints, lack of health insurance coverage, and limited availability of healthcare providers, can also contribute to disparities in access to surgical care.

- Underdeveloped healthcare systems may also have inadequate infrastructure, a shortage of trained medical personnel, and insufficient medical supplies and equipment, further limiting the availability of surgical stapling devices.

- Regulatory challenges and approval processes can also impact the availability of surgical stapling devices in certain markets. Cost barriers, such as the high cost of surgical procedures, can also pose a significant barrier to access for patients in regions with limited financial resources or inadequate health insurance coverage.

Opportunity

Advanced Stapling Systems

- Integrated stapling systems are surgical devices that combine staplers with advanced imaging, navigation, and feedback technologies. These systems offer several advantages, including enhanced precision, real-time feedback, improved navigation, customized treatment approaches, and efficiency.

- Advanced imaging technologies like high-definition cameras and image processing software provide surgeons with a clear view of the surgical site, enabling precise placement of staples and reducing post-operative complications. Feedback technologies help surgeons make informed decisions during surgery, such as adjusting stapler settings or repositioning the device for optimal outcomes.

- Navigation tools like GPS-like tracking systems or electromagnetic sensors assist in navigating complex anatomical structures, ensuring accurate positioning and tissue alignment.

- Integrated stapling systems also streamline the surgical workflow by combining multiple functions into a single device, reducing the need for additional instrumentation and enhancing overall productivity.

Challenges

Requires Specialized Training

- Surgical stapling devices pose a significant challenge due to their complexity and diverse applications. Surgeons and operating room staff must be trained in the proper handling, operation, and maintenance of these devices. The devices are sophisticated and require precise operation, including understanding the firing mechanism, staple cartridge loading, and safety features.

- Surgical stapling devices are also used in various surgical specialties, necessitating specialized training programs for each. Improper use can lead to complications like tissue trauma, bleeding, staple line leaks, and device malfunction. Surgeons must be trained to recognize and mitigate these risks through proper technique, patient selection, and intraoperative decision-making. Training programs should emphasize evidence-based guidelines and best practices to minimize adverse events.

- Maintenance and troubleshooting of surgical stapling devices is also crucial, including routine inspection, cleaning, and sterilization procedures. As surgical stapling technology evolves, surgeons and staff must engage in continuing education and skill maintenance to stay updated on the latest advancements and best practices.

Surgical Stapling Device Market Segment Analysis:

Surgical Stapling Device Market Segmented based on product, type, application, and end-users.

By Product, Powered Surgical Staplers segment is expected to dominate the market during the forecast period

- Powered surgical staplers are advanced medical devices that incorporate advanced technology, ergonomic designs, and features like articulation, rotation, and precise tissue sensing. These advancements lead to improved surgical outcomes, reduced operative time, and enhanced patient safety. They are easier to use than manual staplers, reducing surgeon fatigue and offering more consistent staple formation.

- Powered staplers also reduce the risk of complications like tissue trauma, bleeding, and leaks at the staple line. They are versatile tools suitable for various surgical procedures, making them indispensable in modern operating rooms. As healthcare systems worldwide strive to improve patient outcomes, reduce costs, and enhance operational efficiency, there is a growing demand for innovative medical devices.

- Medical device companies are investing in research and development to further enhance the capabilities of powered surgical staplers, with continued innovation in staple design, feedback systems, and integration with digital health technologies expected to drive market growth.

By Type, Reusable Surgical Staplers segment held the largest share of 62.45% in 2023

- Reusable surgical staplers are a cost-effective alternative to disposable staplers, offering multiple uses and reduced costs over time. They are environmentally friendly, reducing single-use disposable waste from surgical procedures. They are built with durable materials and undergo rigorous testing to ensure longevity and reliability. This may lead to higher adoption rates and market share.

- Reusable staplers must meet stringent regulatory requirements for reprocessing and sterilization, ensuring patient safety. Manufacturers invest in ensuring their products meet these standards, boosting their market share. Surgeons and institutions may have specific preferences for specific brands or models based on performance, reliability, and compatibility with existing equipment.

- Long-term cost savings from reusable staplers can drive higher adoption rates and market share. Overall, reusable surgical staplers are a promising solution for healthcare facilities looking to optimize their budgets without compromising on quality.

Surgical Stapling Device Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the United States and Canada, has a robust healthcare infrastructure, enabling the adoption of advanced surgical techniques and technologies, including surgical stapling devices. The region's high surgical procedure volumes, including general, colorectal, thoracic, and bariatric surgeries, make surgical stapling devices essential.

- The region is also a hub for medical device innovation, with leading companies investing in research and development to improve performance, safety, and efficacy. The FDA-supervised regulatory environment ensures that surgical stapling devices meet rigorous safety and efficacy standards, instilling confidence among healthcare providers.

- Favorable reimbursement policies in North America also support the adoption of surgical stapling devices. North America's high healthcare expenditure, driven by high per capita income, advanced medical technologies, and an aging population, supports the procurement of surgical stapling devices and other medical equipment.

Surgical Stapling Device Market Top Key Players:

- Johnson & Johnson (US)

- Conmed Corporation (US)

- Reach Surgical, Inc. (US)

- Microline Surgical (US)

- Stryker Corporation (US)

- 3M Healthcare (formerly Covidien) (US)

- Teleflex Incorporated (US)

- Apollo Endosurgery, Inc. (US)

- Grena Ltd. (Poland)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew plc (UK)

- Purple Surgical (UK)

- Grena Think Medical (UK)

- Eon Surgical Ltd. (UK)

- Gastrostapler SAS (France)

- DACH Medical Group Holding AG (Switzerland)

- Medtronic plc (Ireland)

- Welfare Medical Ltd. (China)

- Victor Medical Instruments Co., Ltd. (China)

- TSI Healthcare Co., Ltd. (China)

- XNY Medical (China)

- Meril Life Sciences Pvt. Ltd. (India), and other major players

Key Industry Developments in the Surgical Stapling Device Market:

- In August 2023, Teleflex Incorporated a leading global provider of medical technologies announced a definitive agreement to acquire Standard Bariatrics, Inc. which commercialized an innovative powered stapling technology for bariatric surgery. The Titan SGS® from Standard Bariatrics addresses unmet needs in sleeve gastrectomy by offering surgeons the longest continuous staple cutline of 23 centimeters1,2. The first-of-its-kind stapler may help users achieve more consistent and symmetrical sleeve pouch anatomy, setting their patients up for optimized outcomes.

- In January 2023, The Johnson & Johnson Medical Devices Companies (JJMDC)* today announced that it will collaborate with Microsoft to further enable and expand JJMDC’s secure and compliant digital surgery ecosystem. The Microsoft Cloud will help JJMDC realize its vision of driving innovation that advances skills, improves workflow, and enhances surgical decision-making for a better overall customer experience and improved patient and economic outcomes.

-

In May 2024, Ethicon, a Johnson & Johnson MedTech company, announced the U.S. launch of the ECHELON LINEAR™ Cutter, a surgical stapler with 3D-Stapling Technology and Gripping Surface Technology, delivering 47% fewer leaks at the staple line. This innovation aimed to reduce surgical risks and improve patient outcomes in colorectal surgeries.

|

Global Surgical Stapling Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

5.34 Bn |

|

Forecast Period 2024-32 CAGR: |

9.33% |

Market Size in 2032: |

11.91 Bn |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL STAPLING DEVICE MARKET BY PRODUCT (2017-2032)

- SURGICAL STAPLING DEVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POWERED SURGICAL STAPLERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUAL SURGICAL STAPLERS

- SURGICAL STAPLING DEVICE MARKET BY TYPE (2017-2032)

- SURGICAL STAPLING DEVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISPOSABLE SURGICAL STAPLERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE SURGICAL STAPLERS

- SURGICAL STAPLING DEVICE MARKET BY APPLICATION (2017-2032)

- SURGICAL STAPLING DEVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- THORACIC SURGERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ORTHOPEDIC SURGERY

- CARDIAC SURGERY

- ABDOMINAL SURGERY

- PELVIC SURGERY

- OTHERS

- SURGICAL STAPLING DEVICE MARKET BY END USER (2017-2032)

- SURGICAL STAPLING DEVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AMBULATORY SURGICAL CENTERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOSPITALS & CLINICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surgical Stapling Device Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JOHNSON & JOHNSON (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CONMED CORPORATION (US)

- REACH SURGICAL, INC. (US)

- DEXTERA SURGICAL INC. (APTUS ENDOSYSTEMS INC.) (US)

- MICROLINE SURGICAL (US)

- STRYKER CORPORATION (US)

- 3M HEALTHCARE (FORMERLY COVIDIEN) (US)

- TELEFLEX INCORPORATED (US)

- APOLLO ENDOSURGERY, INC. (US)

- GRENA LTD. (POLAND)

- B. BRAUN MELSUNGEN AG (GERMANY)

- SMITH & NEPHEW PLC (UK)

- PURPLE SURGICAL (UK)

- GRENA THINK MEDICAL (UK)

- EON SURGICAL LTD. (UK)

- GASTROSTAPLER SAS (FRANCE)

- DACH MEDICAL GROUP HOLDING AG (SWITZERLAND)

- MEDTRONIC PLC (IRELAND)

- WELFARE MEDICAL LTD. (CHINA)

- VICTOR MEDICAL INSTRUMENTS CO., LTD. (CHINA)

- TSI HEALTHCARE CO., LTD. (CHINA)

- XNY MEDICAL (CHINA)

- MERIL LIFE SCIENCES PVT. LTD. (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL STAPLING DEVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Stapling Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

5.34 Bn |

|

Forecast Period 2024-32 CAGR: |

9.33% |

Market Size in 2032: |

11.91 Bn |

|

Segments Covered: |

By Product |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL STAPLING DEVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL STAPLING DEVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL STAPLING DEVICE MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL STAPLING DEVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL STAPLING DEVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL STAPLING DEVICE MARKET BY PRODUCT

TABLE 008. MANUAL SURGICAL STAPLERS MARKET OVERVIEW (2016-2028)

TABLE 009. POWERED SURGICAL STAPLERS MARKET OVERVIEW (2016-2028)

TABLE 010. SURGICAL STAPLING DEVICE MARKET BY TYPE

TABLE 011. REUSABLE MARKET OVERVIEW (2016-2028)

TABLE 012. DISPOSABLE MARKET OVERVIEW (2016-2028)

TABLE 013. SURGICAL STAPLING DEVICE MARKET BY APPLICATION

TABLE 014. GYNECOLOGIC SURGERY MARKET OVERVIEW (2016-2028)

TABLE 015. COSMETIC SURGERY MARKET OVERVIEW (2016-2028)

TABLE 016. UROLOGIC SURGERY MARKET OVERVIEW (2016-2028)

TABLE 017. GENERAL SURGERY MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. SURGICAL STAPLING DEVICE MARKET BY END USER

TABLE 020. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 021. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHER MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY PRODUCT (2016-2028)

TABLE 024. NORTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY END USER (2016-2028)

TABLE 027. N SURGICAL STAPLING DEVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE SURGICAL STAPLING DEVICE MARKET, BY PRODUCT (2016-2028)

TABLE 029. EUROPE SURGICAL STAPLING DEVICE MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE SURGICAL STAPLING DEVICE MARKET, BY APPLICATION (2016-2028)

TABLE 031. EUROPE SURGICAL STAPLING DEVICE MARKET, BY END USER (2016-2028)

TABLE 032. SURGICAL STAPLING DEVICE MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC SURGICAL STAPLING DEVICE MARKET, BY PRODUCT (2016-2028)

TABLE 034. ASIA PACIFIC SURGICAL STAPLING DEVICE MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC SURGICAL STAPLING DEVICE MARKET, BY APPLICATION (2016-2028)

TABLE 036. ASIA PACIFIC SURGICAL STAPLING DEVICE MARKET, BY END USER (2016-2028)

TABLE 037. SURGICAL STAPLING DEVICE MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICE MARKET, BY PRODUCT (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICE MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICE MARKET, BY APPLICATION (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICE MARKET, BY END USER (2016-2028)

TABLE 042. SURGICAL STAPLING DEVICE MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY PRODUCT (2016-2028)

TABLE 044. SOUTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY APPLICATION (2016-2028)

TABLE 046. SOUTH AMERICA SURGICAL STAPLING DEVICE MARKET, BY END USER (2016-2028)

TABLE 047. SURGICAL STAPLING DEVICE MARKET, BY COUNTRY (2016-2028)

TABLE 048. ETHICON INC.: SNAPSHOT

TABLE 049. ETHICON INC.: BUSINESS PERFORMANCE

TABLE 050. ETHICON INC.: PRODUCT PORTFOLIO

TABLE 051. ETHICON INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. B. BRAUN MELSUNGEN AG: SNAPSHOT

TABLE 052. B. BRAUN MELSUNGEN AG: BUSINESS PERFORMANCE

TABLE 053. B. BRAUN MELSUNGEN AG: PRODUCT PORTFOLIO

TABLE 054. B. BRAUN MELSUNGEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. STRYKER: SNAPSHOT

TABLE 055. STRYKER: BUSINESS PERFORMANCE

TABLE 056. STRYKER: PRODUCT PORTFOLIO

TABLE 057. STRYKER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SMITH+ NEPHEW: SNAPSHOT

TABLE 058. SMITH+ NEPHEW: BUSINESS PERFORMANCE

TABLE 059. SMITH+ NEPHEW: PRODUCT PORTFOLIO

TABLE 060. SMITH+ NEPHEW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. MEDTRONIC: SNAPSHOT

TABLE 061. MEDTRONIC: BUSINESS PERFORMANCE

TABLE 062. MEDTRONIC: PRODUCT PORTFOLIO

TABLE 063. MEDTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CONMED CORPORATION: SNAPSHOT

TABLE 064. CONMED CORPORATION: BUSINESS PERFORMANCE

TABLE 065. CONMED CORPORATION: PRODUCT PORTFOLIO

TABLE 066. CONMED CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. INTUITIVE SURGICAL: SNAPSHOT

TABLE 067. INTUITIVE SURGICAL: BUSINESS PERFORMANCE

TABLE 068. INTUITIVE SURGICAL: PRODUCT PORTFOLIO

TABLE 069. INTUITIVE SURGICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. CARDICA INC: SNAPSHOT

TABLE 070. CARDICA INC: BUSINESS PERFORMANCE

TABLE 071. CARDICA INC: PRODUCT PORTFOLIO

TABLE 072. CARDICA INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. MERIL LIFE SCIENCES PVT. LTD: SNAPSHOT

TABLE 073. MERIL LIFE SCIENCES PVT. LTD: BUSINESS PERFORMANCE

TABLE 074. MERIL LIFE SCIENCES PVT. LTD: PRODUCT PORTFOLIO

TABLE 075. MERIL LIFE SCIENCES PVT. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. PURPLE SURGICAL: SNAPSHOT

TABLE 076. PURPLE SURGICAL: BUSINESS PERFORMANCE

TABLE 077. PURPLE SURGICAL: PRODUCT PORTFOLIO

TABLE 078. PURPLE SURGICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ZIMMER BIOMET: SNAPSHOT

TABLE 079. ZIMMER BIOMET: BUSINESS PERFORMANCE

TABLE 080. ZIMMER BIOMET: PRODUCT PORTFOLIO

TABLE 081. ZIMMER BIOMET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. GOLDEN STAPLER SURGICAL CO. LTD.: SNAPSHOT

TABLE 082. GOLDEN STAPLER SURGICAL CO. LTD.: BUSINESS PERFORMANCE

TABLE 083. GOLDEN STAPLER SURGICAL CO. LTD.: PRODUCT PORTFOLIO

TABLE 084. GOLDEN STAPLER SURGICAL CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. JOHNSON & JOHNSON: SNAPSHOT

TABLE 085. JOHNSON & JOHNSON: BUSINESS PERFORMANCE

TABLE 086. JOHNSON & JOHNSON: PRODUCT PORTFOLIO

TABLE 087. JOHNSON & JOHNSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. CAREFUSION CORPORATION: SNAPSHOT

TABLE 088. CAREFUSION CORPORATION: BUSINESS PERFORMANCE

TABLE 089. CAREFUSION CORPORATION: PRODUCT PORTFOLIO

TABLE 090. CAREFUSION CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. COVIDIEN PLC: SNAPSHOT

TABLE 091. COVIDIEN PLC: BUSINESS PERFORMANCE

TABLE 092. COVIDIEN PLC: PRODUCT PORTFOLIO

TABLE 093. COVIDIEN PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 094. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 095. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 096. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL STAPLING DEVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL STAPLING DEVICE MARKET OVERVIEW BY PRODUCT

FIGURE 012. MANUAL SURGICAL STAPLERS MARKET OVERVIEW (2016-2028)

FIGURE 013. POWERED SURGICAL STAPLERS MARKET OVERVIEW (2016-2028)

FIGURE 014. SURGICAL STAPLING DEVICE MARKET OVERVIEW BY TYPE

FIGURE 015. REUSABLE MARKET OVERVIEW (2016-2028)

FIGURE 016. DISPOSABLE MARKET OVERVIEW (2016-2028)

FIGURE 017. SURGICAL STAPLING DEVICE MARKET OVERVIEW BY APPLICATION

FIGURE 018. GYNECOLOGIC SURGERY MARKET OVERVIEW (2016-2028)

FIGURE 019. COSMETIC SURGERY MARKET OVERVIEW (2016-2028)

FIGURE 020. UROLOGIC SURGERY MARKET OVERVIEW (2016-2028)

FIGURE 021. GENERAL SURGERY MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. SURGICAL STAPLING DEVICE MARKET OVERVIEW BY END USER

FIGURE 024. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 025. AMBULATORY SURGICAL CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA SURGICAL STAPLING DEVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE SURGICAL STAPLING DEVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC SURGICAL STAPLING DEVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA SURGICAL STAPLING DEVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Stapling Device Market research report is 2024-2032.

Johnson & Johnson (US), Conmed Corporation (US), Reach Surgical, Inc. (US), Dextera Surgical Inc. (Aptus Endosystems Inc.) (US), Microline Surgical (US), Stryker Corporation (US),3M Healthcare (formerly Covidien) (US), Teleflex Incorporated (US), Apollo Endosurgery, Inc. (US), Grena Ltd. (Poland), B. Braun Melsungen AG (Germany), Smith & Nephew plc (UK), Purple Surgical (UK), Grena Think Medical (UK), Eon Surgical Ltd. (UK), Gastrostapler SAS (France), DACH Medical Group Holding AG (Switzerland), Medtronic plc (Ireland), Welfare Medical Ltd. (China), Victor Medical Instruments Co., Ltd. (China), TSI Healthcare Co., Ltd. (China), XNY Medical (China), Meril Life Sciences Pvt. Ltd. (India), and Other Major Players.

The Surgical Stapling Device Market is segmented into Product, Type, Application, End User, and region. By Product, the market is categorized into Powered Surgical Staplers, and Manual Surgical Staplers. By Type, the market is categorized into Disposable Surgical Staplers and reusable Surgical Staplers. By Application, the market is categorized into Thoracic Surgery, Orthopedic Surgery, Cardiac Surgery, Abdominal Surgery, Pelvic Surgery, and Others. By End User, the market is categorized into Ambulatory Surgical Centers, Hospitals, and clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

In short, the surgical stapling device market refers to the sector of the medical device industry that focuses on the design, manufacture, and distribution of tools used for surgical stapling procedures. These devices are commonly employed in various surgical specialties to facilitate the closure of incisions, resections, and anastomoses. The market encompasses a wide range of products, including disposable and reusable staplers, as well as accessories such as staples and cartridges. Key factors driving the market include technological advancements, increasing surgical volumes, demand for minimally invasive procedures, and emphasis on improving patient outcomes and surgical efficiency.

Surgical Stapling Device Market Size Was Valued at USD 5.34 Billion in 2023 and is Projected to Reach USD 11.91 Billion by 2032, Growing at a CAGR of 9.33% From 2024-2032.