Type 2 Diabetes Market Synopsis:

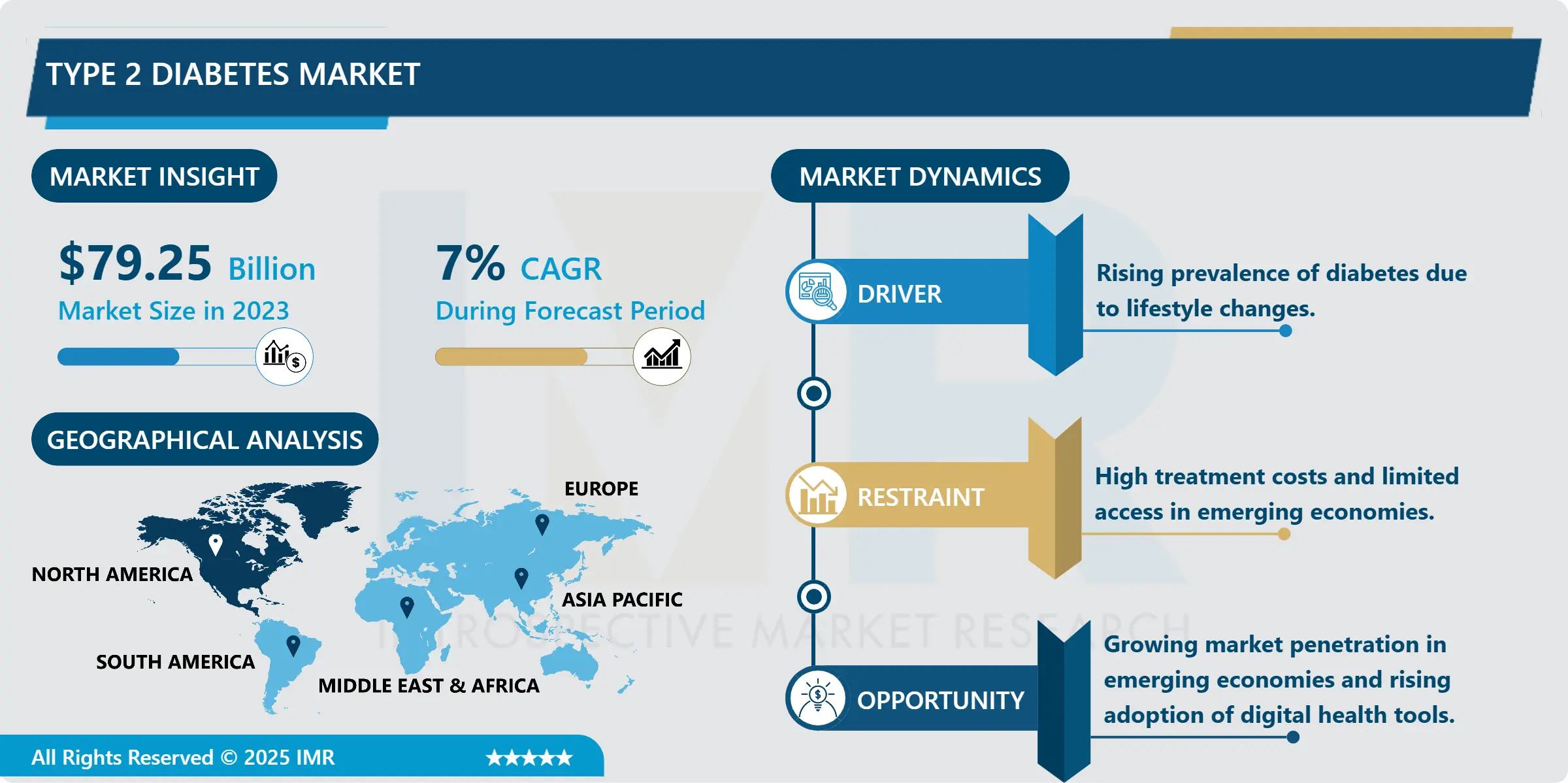

Market Size Was Valued at USD 79.25 Billion in 2023, and is Projected to Reach USD 153.98 Billion by 2032, Growing at a CAGR of 7.0% From 2024-2032.

The Type 2 diabetes market therefore consists of drugs, treatments, devices, and services to treat or support people living with Type 2 diabetes, a chronic condition in which the body does not use insulin effectively and sugars accumulate in the blood. The market caters to the patient mentioned above needs through prescription products, diagnostic devices, disease management solutions, including insulin therapy, GLP-1 receptor agonist, and SGLT2 inhibitor. As an example of the market for reducing diabetes complications, the increased incidence of diabetes worldwide due to improper diets, increased life expectancy, and the increasing obesity rate has urged the market forward.

Market for Type 2 diabetes has expanded significantly in the recent past mainly because of increased prevalence of obesity, inadequate physical activity, and un desirable eating habits that are associated with the disease. Thanks to the increasing need for proper treatment and management solutions, there has been an emergence of different novel therapies and devices. Both the pharmaceutical companies and the healthcare providers have not relent in their search for better treatment for Type 2 diabetes, hence developing better solutions for patients. However, alongside drugs, the applications of digital health and wearable technology are fast becoming standards of diabetes care where patients can check or adjust their blood sugar levels.

It is relatively an `open’ market with many large MNCs who hold a big stake but still, many new entrants including many startups and small firms are also providing targeted solutions in this market. Worldwide, governments and health care organizations are also involved in raising awareness about diabetes care and prevention among the public and through (campaigns. Favourable government policies or grants for the management of diabetes especially in the developed countries are facilitating market growth. Necessary changes in the types of therapy, together with the rising interest in precision medicine, seems to perpetuate the growth of Type 2 diabetes market in the next years.

Type 2 Diabetes Market Trend Analysis

Focus on Combination Therapies

-

A main factor that has emerged and continues to significantly impact the market of Type 2 diabetes therapies is the trend towards multi-therapy. Use of multimodal therapies, which entails the use of two or more drug products is becoming popular since it holds higher effectiveness in regulating blood glucose. As compared to focusing on single large classes of drugs these therapies work on different facets of Type 2 diabetes pathophysiology and hence are holistic that yield better result in comparison to single agent therapies. This trend is uniquely apparent with the use of GLP-1 receptor agonism alongside SGLT2 inhibition with the development of a cardioprotective glucose-lowering regimen in T2DM. Thus, since there is constant R & D spending, there is significant ongoing investment in new combination therapy by pharmaceutical companies, which creates a huge opportunity and growth expectation in this category.

- Furthermore, classical inv_Connections and kn_newrelations_9_30 research on fixed dose combination also shows that patients prefer the products as they require fewer doses per day thus practicing convenience. As more clinic data acts as a testimony to the efficacy of these therapies, approvals and consumer acceptance have trickled in leading to more capital investment. They forecast this trend as a revolutionary in Type 2 diabetes treatment that will consistently propel growth for organizations offering unique solutions.

Expansion in Emerging Markets

-

A large growth of the Type 2 diabetes market in developing countries is a major attractive to the stakeholders. Third world countries such as India, China and Brazil are experiencing high incidence of diabetes because of urbanization, change of diet, and lack of access to health facilities. As these economies expand the health care amenities and access, the need for diabetes therapies and management products is expected to spike massively. These markets are emerging as the new opportunities in the growth of pharma industries; many of these firms are entering into local joint-ventures and networks for distribution with the growing market demand.

Type 2 Diabetes Market Segment Analysis:

Type 2 Diabetes Market is Segmented on the basis of dDug, Diabetes Type, Route of Administration, Distribution channel, and region.

By Drug, Insulin segment is expected to dominate the market during the forecast period

-

The insulin segment holds the largest Market share in the Type 2 diabetes market throughout the forecast period due to its importance in the management of patients with an advanced form of the disease or patients who cannot manage their disease through oral anti-diabetic drugs. It plays an essential role for treatment and especially now that stage 2 diabetes shows a trend of increasing and those patients requiring insulin injection stage. Advances made in insulin delivery include pens, pumps, smart deliveries, and have offered better efficiencies in delivering precise doses thus increase patient compliance and results. In addition, increasing usage of analogy insulins offering better control at the same time freer from side effects than conventional ones are also fuelling the demand. These advancements coupled with increasing global consciousness about intensive diabetes management is predicted to further strengthen the position of insulin in the market over the forecast period.

By Diabetes Type, type 1 segment expected to held the largest share

-

The largest segment is the Type 1 diabetes segment, largely because of the chronic, lifelong insulin dependency and extensive disease management required among patients who are diagnosed with this condition. Type 1 diabetes is associated with the auto immune destruction of beta cells, and so freeing the patient would imply a cessation of Insulin administration which can be fatal. This continual need has led to improvements on insulin products, CGM and the insulin pumps targeting mainly this type of diabetes. Furthermore, enhanced sensitisation, better diagnostic tools and techniques for DM, and enhanced paediatric DM care have raised the expectation for superior therapeutic techniques. The ever-increasing need for enhanced, sustainable approaches to managing blood sugar levels will continue to support the steady market share within the Type 1 diabetes segment amongst healthcare providers and consumers.

Type 2 Diabetes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

\ North America is predicted to be prominent in 2023 with a high market share due to the well-developed and sophisticated healthcare systems, high-diabetes incidence rates, and better healthcare facilities. Currently, it has been estimated that this region owns approximately 35% of the market share, and due to increased R&D and high usage of innovative therapies, the dominance remains unstoppable. The primary market for this market is geographically located in America due to the large number of health care centers and high literacy level about the diseases. On the same note, comprehensive insurance policies and availability of patient support plans widen the Type 2 diabetes care reach, and thereby traces North America as the world’s most profitable market for diabetes.

Active Key Players in the Type 2 Diabetes Market

-

Astellas Pharma Inc. (Japan)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Boehringer Ingelheim (Germany)

- Bristol-Myers Squibb (USA)

- Eli Lilly and Company (USA)

- GlaxoSmithKline plc (UK)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Switzerland)

- Novo Nordisk (Denmark)

- Pfizer Inc. (USA)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Takeda Pharmaceutical Company (Japan)

- Other Active Players.

Key Industry Developments in the Type 2 Diabetes Market:

-

In January 2024, Lariat, a copycat of the diabetes drug Liraglutide, was released in India by Glenmark Pharmaceuticals Ltd. The price of this drug for a daily amount of 1.2 mg is about USD 1.21.

- In June 2023, the pharmaceutical company Pfizer Inc. said that it was continuing to test its oral GLP-1-RA option as a way to help people with type 2 diabetes and obesity.

- In March 2023, The Central Drugs Standard Control Organization (CDSCO) in India granted Sanofi (India) marketing license for their diabetic medication Soliqua (in a pre-filled pen).

|

Global Type 2 Diabetes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 79.25 Billion |

|

Forecast Period 2024-32 CAGR: |

7.0 % |

Market Size in 2032: |

USD 153.98 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Diabetes Type |

|

||

|

By Route Of Administration |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Type 2 Diabetes Market by Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

4.1 Type 2 Diabetes Market Snapshot and Growth Engine

4.2 Type 2 Diabetes Market Overview

4.3 Type 1

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Type 1: Geographic Segmentation Analysis

4.4 and Type 2)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 and Type 2): Geographic Segmentation Analysis

4.5 Route of Administration (Oral

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Route of Administration (Oral: Geographic Segmentation Analysis

4.6 Subcutaneous

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Subcutaneous: Geographic Segmentation Analysis

4.7 and Intravenous)

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 and Intravenous): Geographic Segmentation Analysis

4.8

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 : Geographic Segmentation Analysis

Chapter 5: Type 2 Diabetes Market by Distribution Channel

5.1 Type 2 Diabetes Market Snapshot and Growth Engine

5.2 Type 2 Diabetes Market Overview

5.3 Online pharmacies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Online pharmacies: Geographic Segmentation Analysis

5.4 Hospital Pharmacies

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Hospital Pharmacies: Geographic Segmentation Analysis

5.5 and Retail Pharmacies)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Retail Pharmacies) : Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Type 2 Diabetes Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 NOVO NORDISK (DENMARK)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SANOFI (FRANCE)

6.4 ELI LILLY AND COMPANY (USA)

6.5 ASTRAZENECA (UK)

6.6 MERCK & CO. INC. (USA)

6.7 OTHER ACTIVE PLAYERS

Chapter 7: Global Type 2 Diabetes Market By Region

7.1 Overview

7.2. North America Type 2 Diabetes Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.2.4.1 Type 1

7.2.4.2 and Type 2)

7.2.4.3 Route of Administration (Oral

7.2.4.4 Subcutaneous

7.2.4.5 and Intravenous)

7.2.4.6

7.2.5 Historic and Forecasted Market Size By Distribution Channel

7.2.5.1 Online pharmacies

7.2.5.2 Hospital Pharmacies

7.2.5.3 and Retail Pharmacies)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Type 2 Diabetes Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.3.4.1 Type 1

7.3.4.2 and Type 2)

7.3.4.3 Route of Administration (Oral

7.3.4.4 Subcutaneous

7.3.4.5 and Intravenous)

7.3.4.6

7.3.5 Historic and Forecasted Market Size By Distribution Channel

7.3.5.1 Online pharmacies

7.3.5.2 Hospital Pharmacies

7.3.5.3 and Retail Pharmacies)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Type 2 Diabetes Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.4.4.1 Type 1

7.4.4.2 and Type 2)

7.4.4.3 Route of Administration (Oral

7.4.4.4 Subcutaneous

7.4.4.5 and Intravenous)

7.4.4.6

7.4.5 Historic and Forecasted Market Size By Distribution Channel

7.4.5.1 Online pharmacies

7.4.5.2 Hospital Pharmacies

7.4.5.3 and Retail Pharmacies)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Type 2 Diabetes Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.5.4.1 Type 1

7.5.4.2 and Type 2)

7.5.4.3 Route of Administration (Oral

7.5.4.4 Subcutaneous

7.5.4.5 and Intravenous)

7.5.4.6

7.5.5 Historic and Forecasted Market Size By Distribution Channel

7.5.5.1 Online pharmacies

7.5.5.2 Hospital Pharmacies

7.5.5.3 and Retail Pharmacies)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Type 2 Diabetes Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.6.4.1 Type 1

7.6.4.2 and Type 2)

7.6.4.3 Route of Administration (Oral

7.6.4.4 Subcutaneous

7.6.4.5 and Intravenous)

7.6.4.6

7.6.5 Historic and Forecasted Market Size By Distribution Channel

7.6.5.1 Online pharmacies

7.6.5.2 Hospital Pharmacies

7.6.5.3 and Retail Pharmacies)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Type 2 Diabetes Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), Diabetes Type

7.7.4.1 Type 1

7.7.4.2 and Type 2)

7.7.4.3 Route of Administration (Oral

7.7.4.4 Subcutaneous

7.7.4.5 and Intravenous)

7.7.4.6

7.7.5 Historic and Forecasted Market Size By Distribution Channel

7.7.5.1 Online pharmacies

7.7.5.2 Hospital Pharmacies

7.7.5.3 and Retail Pharmacies)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Type 2 Diabetes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 79.25 Billion |

|

Forecast Period 2024-32 CAGR: |

7.0 % |

Market Size in 2032: |

USD 153.98 Billion |

|

Segments Covered: |

By Drug Class |

|

|

|

By Diabetes Type |

|

||

|

By Route Of Administration |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||