Track Geometry Measurement System (TGMS) Market Synopsis

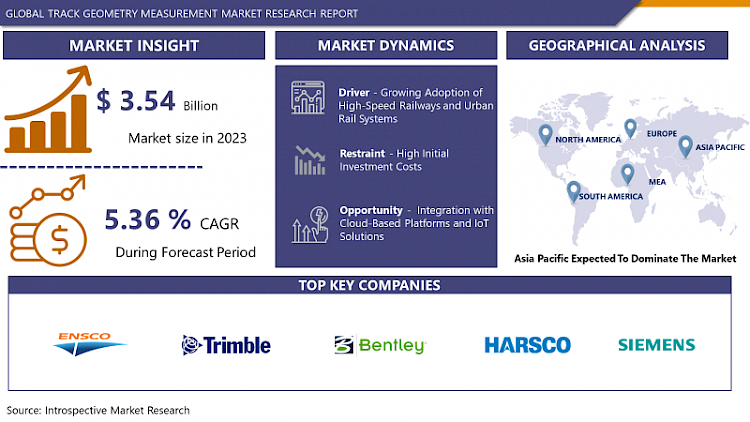

Global Track Geometry Measurement System (TGMS) Market Size Was Valued at USD 3.54 Billion in 2023 and is Projected to Reach USD 5.38 Billion by 2030, Growing at a CAGR of 5.36 % From 2024-2032.

A Track Geometry Measurement System (TGMS) is utilized in rail infrastructure management for evaluating the geometric attributes of railway tracks. It utilizes a range of sensors and measurement tools to precisely gather information on parameters like track gauge, alignment, curvature, and cross-level.

- The Track Geometry Measurement System (TGMS) finds application in railway infrastructure maintenance and management, offering numerous advantages and promising future demand growth. Primarily, TGMS is employed to assess and monitor the geometric parameters of railway tracks, including track gauge, alignment, curvature, and cross-level. By continuously monitoring these parameters, TGMS helps railway authorities identify deviations from optimal track geometry, enabling timely maintenance interventions to prevent accidents and ensure smooth train operations.

- Its ability to provide real-time data on track conditions, allowing for proactive maintenance planning and optimization of resources. By detecting track defects early and accurately, TGMS helps minimize downtime and maintenance costs while maximizing the operational lifespan of railway infrastructure. Additionally, TGMS facilitates data-driven decision-making by providing comprehensive insights into track condition trends and performance metrics, enabling railway authorities to prioritize maintenance activities based on criticality and impact on safety and service reliability.

- The future demand growth for TGMS is expected to be driven by several factors. With the increasing emphasis on safety and efficiency in rail transportation, there is a growing recognition of the importance of proactive track maintenance and monitoring. As railway networks expand and modernize globally, the demand for advanced TGMS solutions capable of capturing and analyzing a wide range of track parameters is projected to surge. Furthermore, technological advancements, such as the integration of artificial intelligence and machine learning algorithms into TGMS platforms, are expected to enhance the accuracy and efficiency of track inspection processes, further driving the adoption of TGMS in the railway industry.

Track Geometry Measurement System (TGMS) Market Trend Analysis:

Growing Adoption of High-Speed Railways and Urban Rail Systems

- The rising uptake of high-speed railways and urban rail systems stands as a key catalyst driving the expansion of the Track Geometry Measurement System (TGMS) Market. Across the globe, governments are channeling investments into upgrading railway infrastructure to meet the surging demand for sustainable and efficient transportation solutions. This heightened emphasis underscores the imperative of ensuring the safety and dependability of rail networks, particularly amidst the unique challenges posed by high-speed and urban rail operations, characterized by elevated speeds and frequent service schedules. Consequently, there arises an escalating necessity for advanced track inspection technologies like TGMS to accurately assess and uphold track geometry parameters.

- Furthermore, the stringent safety regulations and performance criteria inherent in high-speed railways and urban rail systems necessitate robust track monitoring solutions. TGMS empowers railway authorities with continuous monitoring capabilities, facilitating the detection of deviations from optimal track geometry and the prioritization of maintenance endeavors to uphold safe and reliable operations. By furnishing real-time insights into track health and performance, TGMS plays a pivotal role in mitigating the risks of derailments, service disruptions, and accidents, thereby augmenting passenger safety and bolstering service reliability.

- Moreover, the expanding footprint of high-speed railways and urban rail systems on a global scale presents lucrative prospects for TGMS providers. With governments and railway operators investing substantially in infrastructure enhancements to bolster connectivity and mobility, the demand for advanced track inspection technologies is poised to surge. Additionally, ongoing technological advancements in TGMS, including the integration of remote monitoring functionalities and predictive maintenance algorithms, further propel market growth by enhancing operational efficiency and performance in track maintenance endeavors. the rising adoption of high-speed railways and urban rail systems is anticipated to propel the demand for TGMS, fostering innovation and reshaping the landscape of railway track maintenance practices.

Integration with Cloud-Based Platforms and IoT Solutions

- The integration with cloud-based platforms and IoT solutions stands out as a significant opportunity propelling the expansion of the Track Geometry Measurement System (TGMS) Market. In an era marked by rapid technological advancement, there is an increasing demand for interconnected and intelligent solutions aimed at streamlining operations and boosting efficiency in rail infrastructure management. By integrating with cloud-based platforms, TGMS can effectively leverage the scalability, accessibility, and robust data storage capabilities offered by cloud computing, facilitating seamless data management and analysis.

- Additionally, integration with IoT solutions empowers TGMS to capitalize on real-time data collection and analysis capabilities. Through the utilization of IoT sensors and devices deployed along railway tracks, TGMS can collect comprehensive data on various track geometry parameters, track conditions, and environmental factors in real-time. This capability enables proactive maintenance measures and empowers railway authorities to swiftly identify and address potential issues, thereby enhancing safety and reliability in rail operations.

- Furthermore, integration with cloud-based platforms and IoT solutions brings forth supplementary benefits such as predictive analytics and remote monitoring. By conducting an in-depth analysis of the vast volumes of data gathered from TGMS and other IoT sensors, railway authorities can derive valuable insights into track health, anticipate maintenance requirements, and optimize maintenance schedules. Moreover, the remote monitoring capabilities provided enable railway operators to oversee track conditions from any location, facilitating prompt decision-making and response to potential issues. Overall, integration with cloud-based platforms and IoT solutions represents a significant opportunity for fostering innovation and growth in the TGMS Market, empowering railway authorities to refine track maintenance practices and elevate rail network performance.

Track Geometry Measurement System (TGMS) Market Segment Analysis:

Track Geometry Measurement System (TGMS) Market Segmented on the basis of Type Operation Type, Railway Type, and Component

By Railway Type, Mass Transit Railways segment is expected to dominate the market during the forecast period

- The Mass Transit Railways segment is expected to spearhead the growth of the Track Geometry Measurement System (TGMS) Market, establishing a dominant position within the industry. With the widespread proliferation of mass transit systems in urban areas across the globe, there is an escalating need for advanced technological solutions to uphold the safety, reliability, and efficiency of rail networks. TGMS fulfills a pivotal role in this regard by furnishing precise and timely data concerning track geometry parameters, enabling railway operators to effectively monitor and upkeep track conditions.

- Furthermore, mass transit railways operate within densely populated urban landscapes where safety and operational efficacy hold paramount importance. By adopting TGMS solutions, railway authorities can systematically conduct routine track inspections, pinpoint potential issues, and proactively tackle maintenance requirements to mitigate disruptions and ensure passenger safety. Additionally, TGMS systems offer real-time monitoring capabilities, facilitating swift identification and response to track irregularities or faults. As mass transit railways continue expanding globally to cater to the surging demand for urban mobility, the Mass Transit Railways segment is primed to dominate the TGMS Market, catalyzing innovation and augmenting rail network performance.

By Operation Type, Contactless segment held the largest share of 57.3 % in 2022

- The Contactless segment is positioned to spearhead the expansion of the Track Geometry Measurement System (TGMS) Market, asserting its dominance in the industry. As safety and efficiency become increasingly paramount in rail operations, there's a rising demand for innovative solutions that reduce physical contact and enhance automation in track inspection processes. Contactless TGMS systems utilize advanced technologies like LiDAR (Light Detection and Ranging) and radar to remotely gather precise data on track geometry parameters, eliminating the need for direct physical contact with the rails.

- Furthermore, contactless TGMS solutions offer numerous advantages over traditional contact-based systems, including heightened accuracy, decreased maintenance downtime, and enhanced safety for personnel. By eradicating the necessity for physical contact with the track, contactless TGMS systems mitigate the risk of accidents and injuries associated with manual track inspections. Additionally, these systems can operate at greater speeds and cover larger track sections in less time, facilitating more efficient and thorough monitoring of rail infrastructure. the Contactless segment is poised to dominate the TGMS Market, propelling innovation and reshaping the landscape of track inspection technologies.

Track Geometry Measurement System (TGMS) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to emerge as the primary driver of growth in the Track Geometry Measurement System (TGMS) market. The region experiences rapid urbanization, heightened population density, and extensive infrastructure development initiatives, leading to a surge in demand for efficient and dependable rail transport systems. As nations in Asia Pacific allocate substantial investments to expand and modernize their railway networks to cater to escalating transportation requirements, the adoption of TGMS technologies is expected to gain significant momentum.

- Additionally, Asia Pacific's diverse geographical terrain and variable climatic conditions pose distinct challenges for rail infrastructure upkeep. TGMS solutions offer precise and automated track inspection capabilities, empowering railway operators to efficiently monitor and manage track conditions across different environments. Furthermore, the region's emphasis on elevating safety standards and operational efficiency in rail transport further propels the need for advanced track inspection technologies like TGMS. With escalating investments in rail infrastructure and persistent urbanization trends, Asia Pacific is positioned to lead the TGMS market, exerting a pivotal influence on the future of rail transportation systems in the area.

Track Geometry Measurement System (TGMS) Market Top Key Players:

- Ensco, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Bentley Systems (U.S.)

- Harsco Corporation (U.S.)

- Siemens Mobility GmbH (Germany)

- Goldschmidt Thermit Group (Germany)

- ERTMS Solutions (France)

- Fugro (Netherlands)

- Amberg Technologies AG (Switzerland)

- Egis (France)

- Plasser & Theurer (Austria)

- MERMEC Group (Italy)

- Balfour Beatty plc (UK)

- Hitachi Rail (Japan)

- Alstom (France)

- Bombardier Transportation (Canada)

- China Railway Construction Corporation Limited (China)

- Ansaldo STS (Italy)

- R. Bance & Co (UK), and Other Major Players

Key Industry Developments in the Track Geometry Measurement System (TGMS) Market:

- In November 2022, In November 2022, Ensco and Fugro formed a strategic alliance to pool their respective strengths in geotechnical services and railway inspection. The goal of this partnership is to offer more thorough track evaluation solutions.

- In April 2023, an innovative Rail Infrastructure Measuring System was introduced by Siemens Mobility. This cutting-edge device measures track geometry with extreme accuracy and efficiency using LiDAR technology.

|

Global Track Geometry Measurement System (TGMS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.36% |

Market Size in 2032: |

USD 5.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Operation Type |

|

||

|

By Railway Type |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY TYPE (2017-2032)

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GAUGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TWIST

- CANT AND CANT DEFICIENCY

- VERTICAL PROFILE

- CURVATURE

- OTHERS

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY OPERATION TYPE (2017-2032)

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONTACTLESS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONTACT

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY RAILWAY TYPE (2017-2032)

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HIGH-SPEED RAILWAYS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MASS TRANSIT RAILWAYS

- HAUL RAILWAYS

- LIGHT RAILWAYS

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY COMPONENT (2017-2032)

- TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIGHTING EQUIPMENT

- NAVIGATION EQUIPMENT

- COMMUNICATION EQUIPMENT

- COMPUTER

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Track Geometry Measurement System (TGMS) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ENSCO, INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TRIMBLE INC. (U.S.)

- BENTLEY SYSTEMS (U.S.)

- HARSCO CORPORATION (U.S.)

- SIEMENS MOBILITY GMBH (GERMANY)

- GOLDSCHMIDT THERMIT GROUP (GERMANY)

- ERTMS SOLUTIONS (FRANCE)

- FUGRO (NETHERLANDS)

- AMBERG TECHNOLOGIES AG (SWITZERLAND)

- EGIS (FRANCE)

- PLASSER & THEURER (AUSTRIA)

- MERMEC GROUP (ITALY)

- BALFOUR BEATTY PLC (UK)

- R. BANCE & CO (UK)

- COMPETITIVE LANDSCAPE

- GLOBAL TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Operation Type

- Historic And Forecasted Market Size By Railway Type

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Track Geometry Measurement System (TGMS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.36% |

Market Size in 2032: |

USD 5.38 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Operation Type |

|

||

|

By Railway Type |

|

||

|

By Component |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET COMPETITIVE RIVALRY

TABLE 005. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET THREAT OF SUBSTITUTES

TABLE 007. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY TYPE

TABLE 008. NO CONTACT BASED MARKET OVERVIEW (2016-2028)

TABLE 009. CONTACT BASED MARKET OVERVIEW (2016-2028)

TABLE 010. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET BY APPLICATION

TABLE 011. HIGH-SPEED RAILWAYS MARKET OVERVIEW (2016-2028)

TABLE 012. MASS TRANSIT RAILWAYS MARKET OVERVIEW (2016-2028)

TABLE 013. HEAVY HAUL RAILWAYS MARKET OVERVIEW (2016-2028)

TABLE 014. LIGHT RAILWAYS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY APPLICATION (2016-2028)

TABLE 017. N TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY APPLICATION (2016-2028)

TABLE 020. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY APPLICATION (2016-2028)

TABLE 023. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY APPLICATION (2016-2028)

TABLE 026. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY APPLICATION (2016-2028)

TABLE 029. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET, BY COUNTRY (2016-2028)

TABLE 030. ENSCO INC.: SNAPSHOT

TABLE 031. ENSCO INC.: BUSINESS PERFORMANCE

TABLE 032. ENSCO INC.: PRODUCT PORTFOLIO

TABLE 033. ENSCO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. FUGRO: SNAPSHOT

TABLE 034. FUGRO: BUSINESS PERFORMANCE

TABLE 035. FUGRO: PRODUCT PORTFOLIO

TABLE 036. FUGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. MER MEC S.P.A.: SNAPSHOT

TABLE 037. MER MEC S.P.A.: BUSINESS PERFORMANCE

TABLE 038. MER MEC S.P.A.: PRODUCT PORTFOLIO

TABLE 039. MER MEC S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. BALFOUR BEATTY: SNAPSHOT

TABLE 040. BALFOUR BEATTY: BUSINESS PERFORMANCE

TABLE 041. BALFOUR BEATTY: PRODUCT PORTFOLIO

TABLE 042. BALFOUR BEATTY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. PLASSER & THEURER: SNAPSHOT

TABLE 043. PLASSER & THEURER: BUSINESS PERFORMANCE

TABLE 044. PLASSER & THEURER: PRODUCT PORTFOLIO

TABLE 045. PLASSER & THEURER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. EGIS: SNAPSHOT

TABLE 046. EGIS: BUSINESS PERFORMANCE

TABLE 047. EGIS: PRODUCT PORTFOLIO

TABLE 048. EGIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MRX TECHNOLOGIES: SNAPSHOT

TABLE 049. MRX TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 050. MRX TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 051. MRX TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. R. BANCE & CO.LTD.: SNAPSHOT

TABLE 052. R. BANCE & CO.LTD.: BUSINESS PERFORMANCE

TABLE 053. R. BANCE & CO.LTD.: PRODUCT PORTFOLIO

TABLE 054. R. BANCE & CO.LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BENTLEY SYSTEMS INC.: SNAPSHOT

TABLE 055. BENTLEY SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 056. BENTLEY SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 057. BENTLEY SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY TYPE

FIGURE 012. NO CONTACT BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. CONTACT BASED MARKET OVERVIEW (2016-2028)

FIGURE 014. TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY APPLICATION

FIGURE 015. HIGH-SPEED RAILWAYS MARKET OVERVIEW (2016-2028)

FIGURE 016. MASS TRANSIT RAILWAYS MARKET OVERVIEW (2016-2028)

FIGURE 017. HEAVY HAUL RAILWAYS MARKET OVERVIEW (2016-2028)

FIGURE 018. LIGHT RAILWAYS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA TRACK GEOMETRY MEASUREMENT SYSTEM (TGMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Track Geometry Measurement System (TGMS) Market research report is 2024-2032.

Ensco, Inc. (U.S.), Trimble Inc. (U.S.), Bentley Systems (U.S.), Harsco Corporation (U.S.), Siemens Mobility GmbH (Germany), Goldschmidt Thermit Group (Germany), ERTMS Solutions (France), Fugro (Netherlands), Amberg Technologies AG (Switzerland), Egis (France), Plasser & Theurer (Austria), MERMEC Group (Italy), Balfour Beatty plc (UK), R. Bance & Co (UK), and Other Major Players.

The Track Geometry Measurement System (TGMS) Market is segmented into Type, Operation Type, Railway Type, Component, and Region. By Type, the market is categorized into Gauge, Twist, Cant and Cant Deficiency, Vertical Profile, Curvature Others. By Operation Type, the market is categorized into Contactless and Contact. By Railway Type, the market is categorized into High-Speed Railways, Mass Transit Railways, Heavy Haul Railways, and Light Railways. By Component, the market is categorized into Software, Lighting Equipment, Navigation Equipment, Communication Equipment, and Computers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Track Geometry Measurement System (TGMS) is utilized in rail infrastructure management for evaluating the geometric attributes of railway tracks. It utilizes a range of sensors and measurement tools to precisely gather information on parameters like track gauge, alignment, curvature, and cross-level.

Global Track Geometry Measurement System (TGMS) Market Size Was Valued at USD 3.54 Billion in 2023 and is Projected to Reach USD 5.38 Billion by 2030, Growing at a CAGR of 5.36 % From 2024-2032.