Thermal Camera Market Synopsis:

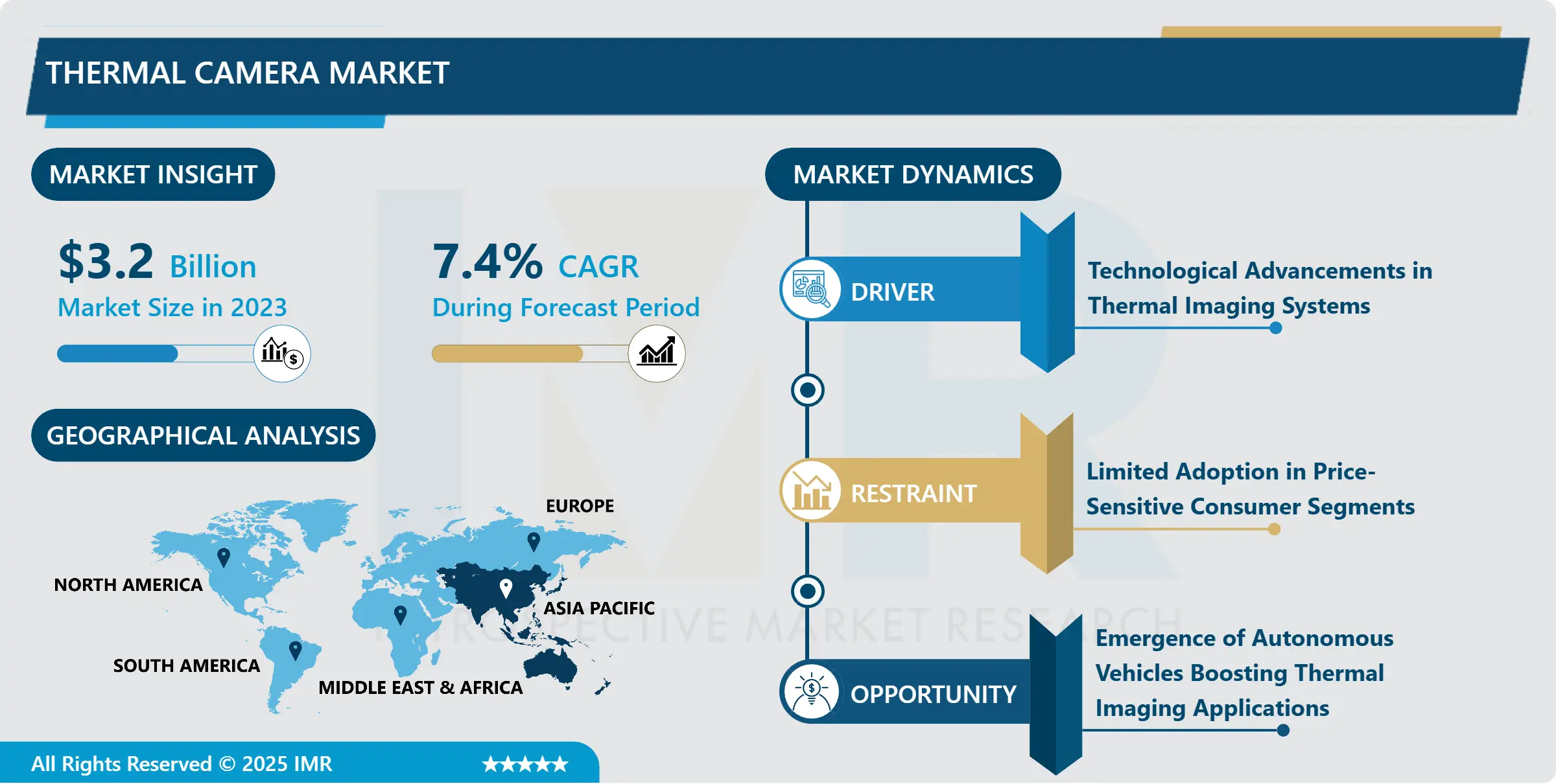

Thermal Camera Market Size Was Valued at USD 3.20 Billion in 2023, and is Projected to Reach USD 6.08 Billion by 2032, Growing at a CAGR of 7.40 % From 2024-2032.

Thermal camera industry can be defined as the commercial domain that produces, designs and sells systems that allow for the identification and visualization of thermal frequencies released by objects. And these cameras record the infrared radiation and translate it into picture so that users can easily detect temperature difference or abnormalities. Thermal cameras are applied in the sectors like industrial, commercial, military, healthcare, automobile and consumer electronics for security reasons, predictive analysis, surveillance, medical purpose and others.

From the analysis, one of the most vital contributors to the thermal camera market is the use of surveillance and security systems. Thermal cameras have object detection abilities in low light or pitch darkness; they are widely used in military and defense, as well as those related to public safety. Specifically, the overall growth in security needs globally is coupled with the need for high-performance thermal camera in the existing security systems. In addition, the development of better resolutions, frequently in combination with an extended detection distance, increase the application number of thermal cameras.

Another ingredient is growing usage of thermal cameras in industrial segments for predictive upkeep and apparatus surveillance. Manufacturing companies, power and utilities, companies all have their equipment and components being monitored by thermal cameras to prevent failure due to overheating which increases productivity while reducing on time off. The intensification of automation in industries, including the IoT technologies solidifies the role of the thermal cameras in monitoring and diagnostics.

Thermal Camera Market Trend Analysis:

Tendency of size reduction of thermal sensors and thermal cameras

- One key trend within the thermal camera market area is a tendency of size reduction of thermal sensors and thermal cameras. That is why thermal imaging technology still progresses, and producers make thinner and smaller thermal cameras, which are incorporated into portable and wearable devices. This trend is improving the applicability of thermal cameras extending their use in several fields, such as consumer electronics, including smart phones and wearable health monitoring systems.

- Still, the rising adoption of thermal cameras is observable in automotive applications, such as self-driving cars and human-supporting tools – ADAS. Night vision cameras are serving as safety devices for identifying pedestrians, animals, and obstacles on the roads during conditions like fog, rain, or during night time. This trend is projected to increase in future as car makers shift their attention into improving safety elements and creating autonomous vehicles.

The increasing size of health-care systems

- The increasing size of health-care systems should act as an incentive for the thermal camera markets. Security thermal cameras are rapidly becoming incorporated into the diagnostic medical tools especially in detection of fevers and monitoring body temperatures. They are not invasive, precise and as such give prompt diagnoses hence can be used in routine screening and differentiation of diseases during an outbreak in large populations. In healthcare, the call for thermal cameras is expected to increase due to development in technology hence embracing preventive measures.

- The increasing smart homes as well as smart buildings is another area where thermal cameras can be applied. Smart applications of these devices can be employed in smart building management systems, for tracking energy and heat losses or for the safety of building occupants. Incorporated in the dynamics of smart building with circulation of IoT and growing popularity of buildings’ automation, thermal cameras became not only important addition for enhancement of energy management but also boost opportunity for developing enhanced security systems.

Thermal Camera Market Segment Analysis:

Thermal Camera Market Segmented on the basis of Technology, Application, End User, and Region.

By Technology, Cooled segment is expected to dominate the market during the forecast period

- Cryco cooled thermal cameras employ cryogenic cooling system that removes heat from the infrared sensor thus improving its performance. These cameras preset higher resolutions and better thermal sensitivity thus can be used for military, defense industrial purposes. Uncooled thermal cameras on the other hand have no cooling system, meaning they work at the surrounding temperatures. Although their sensitivity and resolving power are generally inferior to those of their cooled counterparts, they are smaller, cheaper, and more suitable for use in commercial and consumer markets.

By Application, Industrial segment expected to held the largest share

- A thermal camera is an invaluable tool across different applications. They are indispensable in industries because facilitate predictive maintenance, equipment surveillance, and safety, due to temperature changes in the machinery and electric equipment, or power concerns. In commercial applications, they assist construction and structural inspection of buildings, assessment of thermal performance for energy evaluation and safety secutiry by pointing out areas of heat loss or gain and also potential security risks. Defense departments and military forces use thermal cameras for surveillance; for detecting targets in low light require information from thermal cameras. Such applications include, but are not limited to, fever screening, body temperature screening, inflammation-related, or circulatory problems. In the ADAS, the automotive industry employs them to improve safety from pedestrians, animals, and objects when visibility is low. Consumers electronics employing thermal cameras in Smartphones and Drones for heat detection, Thermal Imaging and Security Surveillance.

Thermal Camera Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- As seen in the figure below, Asia Pacific region is the largest market for thermal camera mainly because of higher industrial growth rate, higher rate of technology adoption, and growing spending on security and defence from emerging economies such as China, India and Japan. It is due to the robust manufacturing industry in the region in addition to rising applications in the automotive, consumer electronics, healthcare segment that drives the market ahead.

- The rising application of thermal imaging gadgets in new applications such as industrial uses, surveillance, and healthcare; and favourable outlook for the market in countries like China and India in Asia Pacific is further driving the market. Also, the increased investment across the defense and military modernization across the region provides substantial demand for the enhanced thermal camera.

Active Key Players in the Thermal Camera Market

- Axis Communications (Sweden)

- BAE Systems (UK)

- Dali Technology (China)

- FLIR Systems (USA)

- Honeywell International (USA)

- Leonardo (Italy)

- Lockheed Martin (USA)

- Opgal (Israel)

- Teledyne Technologies (USA)

- Thermoteknix Systems (UK)

- Other Active Players

|

Global Thermal Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.20 Billion |

|

Forecast Period 2024-32 CAGR: |

7.40 % |

Market Size in 2032: |

USD 6.08 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Thermal Camera Market by Application

4.1 Thermal Camera Market Snapshot and Growth Engine

4.2 Thermal Camera Market Overview

4.3 Oil & Gas

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Oil & Gas: Geographic Segmentation Analysis

4.4 Water & Wastewater

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Water & Wastewater: Geographic Segmentation Analysis

4.5 Mining & Dredging

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Mining & Dredging: Geographic Segmentation Analysis

4.6 Utilities & Renewables

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Utilities & Renewables: Geographic Segmentation Analysis

4.7 Chemicals

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Chemicals: Geographic Segmentation Analysis

Chapter 5: Thermal Camera Market by End-User

5.1 Thermal Camera Market Snapshot and Growth Engine

5.2 Thermal Camera Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Industrial: Geographic Segmentation Analysis

5.4 Commercial

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial: Geographic Segmentation Analysis

5.5 Residential

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Residential: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Thermal Camera Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 FLIR SYSTEMS (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HONEYWELL INTERNATIONAL (USA)

6.4 TELEDYNE TECHNOLOGIES (USA)

6.5 AXIS COMMUNICATIONS (SWEDEN)

6.6 LOCKHEED MARTIN (USA)

6.7 BAE SYSTEMS (UK)

6.8 THERMOTEKNIX SYSTEMS (UK)

6.9 DALI TECHNOLOGY (CHINA)

6.10 OPGAL (ISRAEL)

6.11 LEONARDO (ITALY)

6.12 OTHER ACTIVE PLAYERS

Chapter 7: Global Thermal Camera Market By Region

7.1 Overview

7.2. North America Thermal Camera Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Application

7.2.4.1 Oil & Gas

7.2.4.2 Water & Wastewater

7.2.4.3 Mining & Dredging

7.2.4.4 Utilities & Renewables

7.2.4.5 Chemicals

7.2.5 Historic and Forecasted Market Size By End-User

7.2.5.1 Industrial

7.2.5.2 Commercial

7.2.5.3 Residential

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Thermal Camera Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Application

7.3.4.1 Oil & Gas

7.3.4.2 Water & Wastewater

7.3.4.3 Mining & Dredging

7.3.4.4 Utilities & Renewables

7.3.4.5 Chemicals

7.3.5 Historic and Forecasted Market Size By End-User

7.3.5.1 Industrial

7.3.5.2 Commercial

7.3.5.3 Residential

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Thermal Camera Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Application

7.4.4.1 Oil & Gas

7.4.4.2 Water & Wastewater

7.4.4.3 Mining & Dredging

7.4.4.4 Utilities & Renewables

7.4.4.5 Chemicals

7.4.5 Historic and Forecasted Market Size By End-User

7.4.5.1 Industrial

7.4.5.2 Commercial

7.4.5.3 Residential

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Thermal Camera Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Application

7.5.4.1 Oil & Gas

7.5.4.2 Water & Wastewater

7.5.4.3 Mining & Dredging

7.5.4.4 Utilities & Renewables

7.5.4.5 Chemicals

7.5.5 Historic and Forecasted Market Size By End-User

7.5.5.1 Industrial

7.5.5.2 Commercial

7.5.5.3 Residential

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Thermal Camera Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Application

7.6.4.1 Oil & Gas

7.6.4.2 Water & Wastewater

7.6.4.3 Mining & Dredging

7.6.4.4 Utilities & Renewables

7.6.4.5 Chemicals

7.6.5 Historic and Forecasted Market Size By End-User

7.6.5.1 Industrial

7.6.5.2 Commercial

7.6.5.3 Residential

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Thermal Camera Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Application

7.7.4.1 Oil & Gas

7.7.4.2 Water & Wastewater

7.7.4.3 Mining & Dredging

7.7.4.4 Utilities & Renewables

7.7.4.5 Chemicals

7.7.5 Historic and Forecasted Market Size By End-User

7.7.5.1 Industrial

7.7.5.2 Commercial

7.7.5.3 Residential

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Thermal Camera Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.20 Billion |

|

Forecast Period 2024-32 CAGR: |

7.40 % |

Market Size in 2032: |

USD 6.08 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||