Suture Needles Market Synopsis

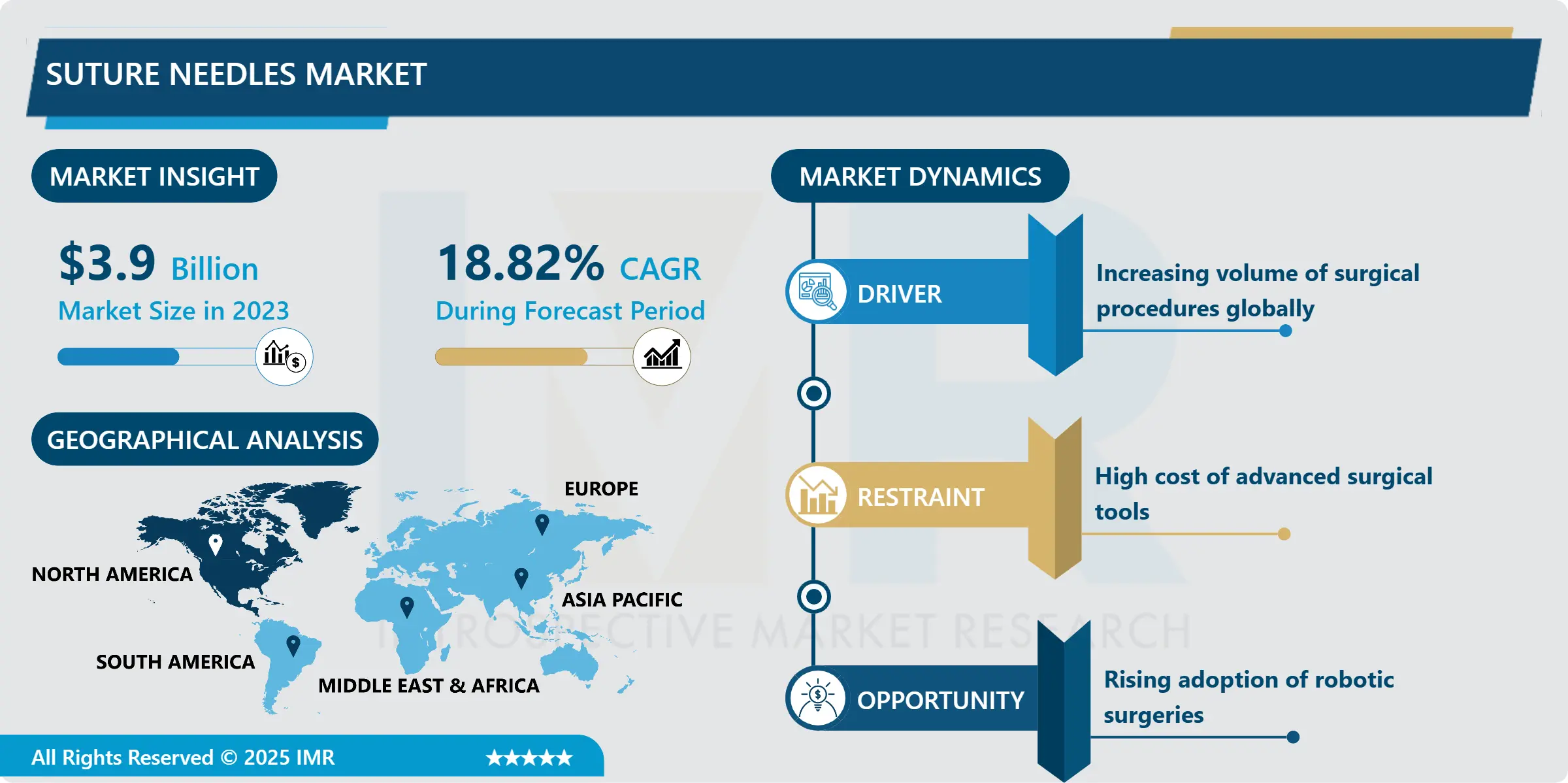

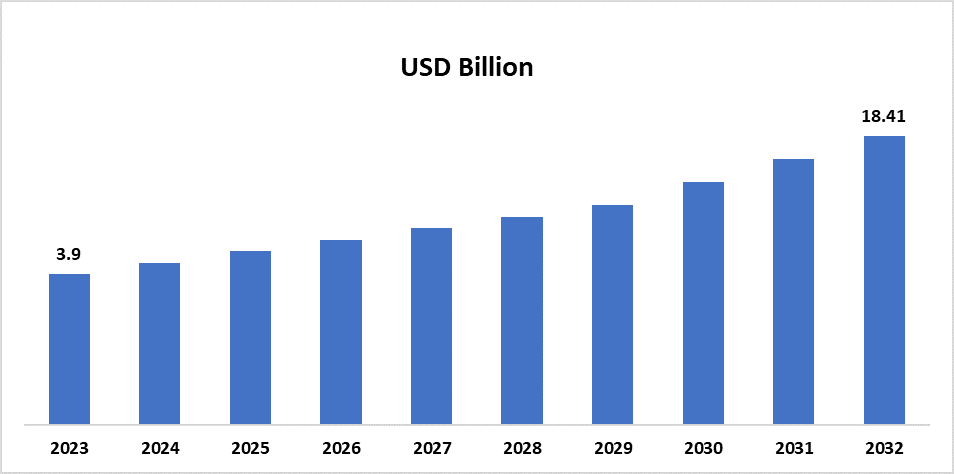

Suture Needles Market Size Was Valued at USD 3.9 Billion in 2023, and is Projected to Reach USD 18.41 Billion by 2032, Growing at a CAGR of 18.82 % From 2024-2032.

The Suture Needles Market refers to the manufacturing and sales industry of suture needles designed to perform surgical procedures of joining wounds or tissues. These needles are used in surgical procedures to make closures, approximation of tissues or ligation, with the required level of safety and effective healing.

The suture needles market has grown at a speedy pace over the years because of the growing number of surgeries across the world. New chapter topics include increasing tendencies towards trauma cases, chronic and age-related diseases and conditions requiring surgery increase the demand for improved suture technologies. A rise in the demand for minimally invasive and robotic procedures, which are typically performed using suture needles, is expected to boosts market growth. Also, advancement in surgical solutions such as outpatient surgeries and growing understanding of post-operation care by patients has boosted market growth.

Incremental investment by developed players to enhance health care structures in EMs along with availability of high end surgical tools and techniques is opening up opportunities for new players as well as incumbents. Market also get technological advancement related to the suture needle that is coat and needle cutting edge to get minimize tissue drag and increase its working life. An increasing application of bioabsorbable sutures and needles in particular surgical processes meets the market’s trend towards patient comfort and the speed of surgery.

Suture Needles Market Trend Analysis

Innovations in Needle Coatings and Materials

-

Over several years, the suture needles have experienced tremendous innovations with regard to the coating techniques of the needles as well as the raw materials used. Coated needles and those coated with silicon or other lubricants are becoming popular because of less tissue drag and time spent on surgery. The following are already in use to enhance strength and flexibility of needles: stainless steel, alloys, and novel biocompatible metals. They can provide improved patient health as well, increase surgeon productivity, and decrease patient risks; thus, making them the centerfold of product development in the market.

Rising Demand in Emerging Economies

-

Developing countries account for a significant portion of the suture needles market growth rate due to the progressive expansion of the quality and availability of surgical services. The corresponding governments are venturing into healthcare management reforms where they help in implementing more sophisticated surgical instruments as well as techniques. An increase in the prevalence of life style diseases combined with a continuously rising geriatric population will lead to a higher number of surgeries and in turn, the use of suture needles. Market penetration in such high-growth regions can also be improved by support from international manufacturers and local distribution outlets.

Suture Needles Market Outlook, 2023 and 2032: Future Outlook

Suture Needles Market Segment Analysis:

Suture Needles Market Segmented on the basis of type, application, and end user.

By Type, Taper cut segment is expected to dominate the market during the forecast period

-

This segment is expected to retain the largest market share throughout the forecast period owing to the length of application of the Taper Cut suture needles in various soft tissue procedures. Taper cut needles have both sharpness for ease of penetration and sustaining tissue cohesiveness which makes them appropriate for use in vascular and general surgery. The market is also experiencing growth in segments due to the development in needle technology that is appropriate for specific operations in surgeries based on accuracy and safety.

By Application, the Cardiovascular segment is expected to hold the largest share

-

Cardiovascular suture needles will likely dominate this market due to the global increase in cardiovascular disease and the higher frequency of cardiovascular surgery procedures. Suture needles, as pointed out earlier, are crucial in operations such as bypass operations, valve reconstruction, and arterial bypass operations. The trend towards less invasive processes in cardiac treatment also boosted the demand for suture needles specialized for this purpose which only accentuates this segment’s significance.

Suture Needles Market Regional Insights:

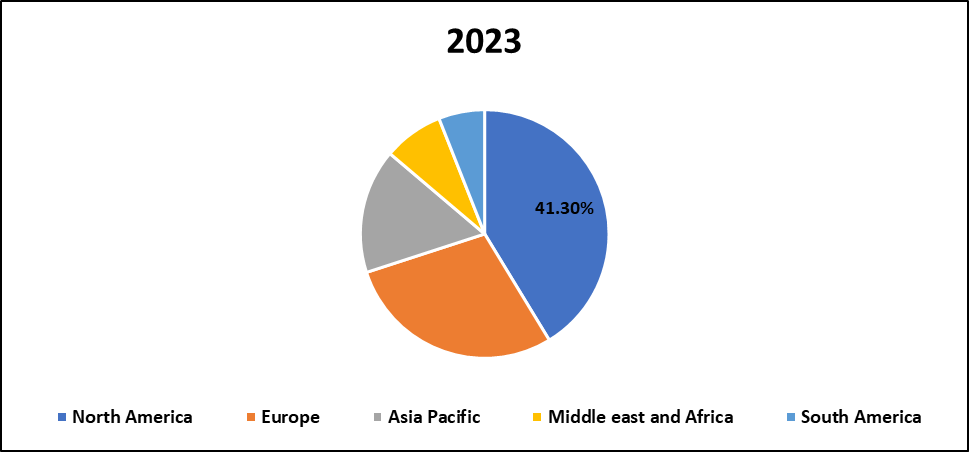

North America is Expected to Dominate the Market Over the Forecast period

-

North America market to dominate the global suture needles market during the forecast period backed by a strong healthcare structure, a high number of surgeries, and enhanced technological developments. The United States market is the largest contributor and shows much potential in demand for technologically advanced suture products due to rise in chronic diseases, increasing geriatric population, and enhanced surgical techniques. The existence of market leaders as well as high levels of investment on research and innovation also support the region’s supremacy.

- In Canada too, the opportunity is expected to rise because of increasing health care expenditure, and raising awareness about the latest technology surgical instruments. This is why there is a shift noted in the focus of enhancing patients outcomes through precise and less invasive procedures, thus the call to adopt on higher quality suture needles is gaining ground among the stakeholders. Safety regulated environment is in favour of innovation and market expansion in the region, hence readiness by various stakeholders. In addition, strategies such as joint venture between healthcare providers and manufacturers to incorporate inexpensive products into the market are likely to improve market activity in North America.

Suture Needles Market Share, by Geography, 2023 (%)

Active Key Players in the Suture Needles Market

-

B. Braun Melsungen AG (Germany)

- Boston Scientific Corporation (USA)

- Demetech Corporation (USA)

- EndoEvolution LLC (USA)

- Ethicon, Inc. (USA)

- Fukuda Denshi (Japan)

- Hu-Friedy Mfg. Co., LLC (USA)

- Medtronic Plc (Ireland)

- Péters Surgical (France)

- Smith & Nephew Plc (UK)

- Sutures India Pvt. Ltd. (India)

- Teleflex Incorporated (USA)

- Thermo Fisher Scientific Inc. (USA)

- Wego Group (China)

- Zimmer Biomet (USA)

- Other Key Players

|

Global Suture Needles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Billion |

|

Forecast Period 2024-32 CAGR: |

18.82 % |

Market Size in 2032: |

USD 18.41 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Suture Needles Market by Type

4.1 Suture Needles Market Snapshot and Growth Engine

4.2 Suture Needles Market Overview

4.3 Cotton Tipped

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cotton Tipped: Geographic Segmentation Analysis

4.4 Foam Tipped

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Foam Tipped: Geographic Segmentation Analysis

4.5 Non-woven

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Non-woven: Geographic Segmentation Analysis

4.6 and Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 and Others: Geographic Segmentation Analysis

Chapter 5: Suture Needles Market by Application

5.1 Suture Needles Market Snapshot and Growth Engine

5.2 Suture Needles Market Overview

5.3 Specimen Collection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Specimen Collection: Geographic Segmentation Analysis

5.4 Disinfection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Disinfection: Geographic Segmentation Analysis

5.5 and Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 and Others: Geographic Segmentation Analysis

Chapter 6: Suture Needles Market by End User

6.1 Suture Needles Market Snapshot and Growth Engine

6.2 Suture Needles Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Laboratories & Diagnostic Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Laboratories & Diagnostic Centers: Geographic Segmentation Analysis

6.5 and Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 and Research Institutes: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Suture Needles Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 B. BRAUN MELSUNGEN AG (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOSTON SCIENTIFIC CORPORATION (USA)

7.4 DEMETECH CORPORATION (USA)

7.5 ENDOEVOLUTION LLC (USA)

7.6 ETHICON INC. (USA)

7.7 FUKUDA DENSHI (JAPAN)

7.8 HU-FRIEDY MFG. CO. LLC (USA)

7.9 MEDTRONIC PLC (IRELAND)

7.10 PÉTERS SURGICAL (FRANCE)

7.11 SMITH & NEPHEW PLC (UK)

7.12 SUTURES INDIA PVT. LTD. (INDIA)

7.13 TELEFLEX INCORPORATED (USA)

7.14 THERMO FISHER SCIENTIFIC INC. (USA)

7.15 WEGO GROUP (CHINA)

7.16 ZIMMER BIOMET (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Suture Needles Market By Region

8.1 Overview

8.2. North America Suture Needles Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Cotton Tipped

8.2.4.2 Foam Tipped

8.2.4.3 Non-woven

8.2.4.4 and Others

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Specimen Collection

8.2.5.2 Disinfection

8.2.5.3 and Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Laboratories & Diagnostic Centers

8.2.6.3 and Research Institutes

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Suture Needles Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Cotton Tipped

8.3.4.2 Foam Tipped

8.3.4.3 Non-woven

8.3.4.4 and Others

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Specimen Collection

8.3.5.2 Disinfection

8.3.5.3 and Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Laboratories & Diagnostic Centers

8.3.6.3 and Research Institutes

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Suture Needles Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Cotton Tipped

8.4.4.2 Foam Tipped

8.4.4.3 Non-woven

8.4.4.4 and Others

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Specimen Collection

8.4.5.2 Disinfection

8.4.5.3 and Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Laboratories & Diagnostic Centers

8.4.6.3 and Research Institutes

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Suture Needles Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Cotton Tipped

8.5.4.2 Foam Tipped

8.5.4.3 Non-woven

8.5.4.4 and Others

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Specimen Collection

8.5.5.2 Disinfection

8.5.5.3 and Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Laboratories & Diagnostic Centers

8.5.6.3 and Research Institutes

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Suture Needles Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Cotton Tipped

8.6.4.2 Foam Tipped

8.6.4.3 Non-woven

8.6.4.4 and Others

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Specimen Collection

8.6.5.2 Disinfection

8.6.5.3 and Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Laboratories & Diagnostic Centers

8.6.6.3 and Research Institutes

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Suture Needles Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Cotton Tipped

8.7.4.2 Foam Tipped

8.7.4.3 Non-woven

8.7.4.4 and Others

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Specimen Collection

8.7.5.2 Disinfection

8.7.5.3 and Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Laboratories & Diagnostic Centers

8.7.6.3 and Research Institutes

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Suture Needles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Billion |

|

Forecast Period 2024-32 CAGR: |

18.82 % |

Market Size in 2032: |

USD 18.41 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||