Suspension Parts of Excavators Market Synopsis

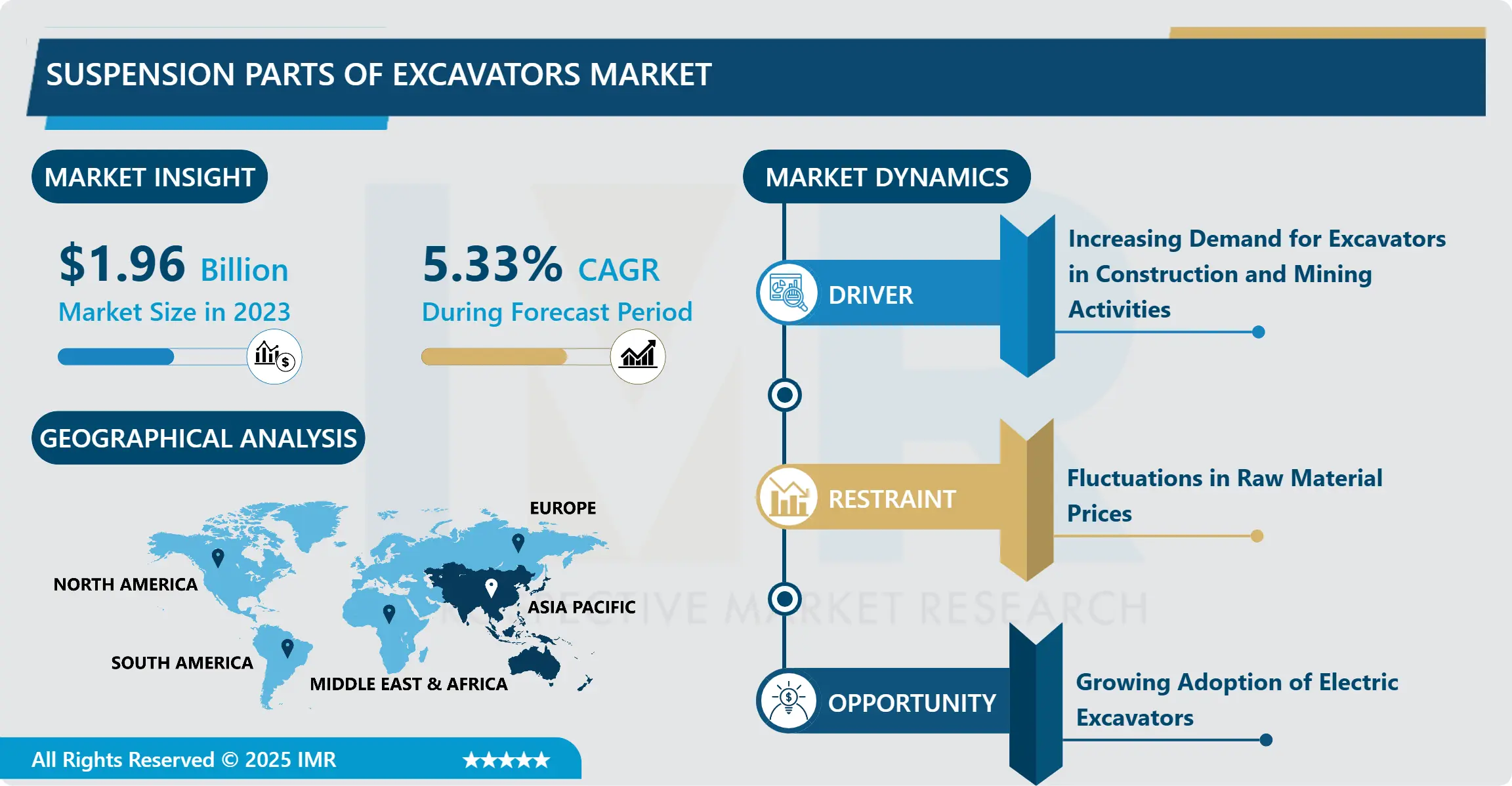

Suspension Parts of Excavators Market Size Was Valued at USD 1.96 Billion In 2023 And Is Projected to Reach USD 3.13 Billion By 2032, Growing at A CAGR of 5.33 % From 2024-2032.

Suspension parts of excavators are essential components that support and stabilize the machine during operation. These include components such as shock absorbers, springs, linkages, and stabilizer bars. Their primary function is to absorb shocks and vibrations generated during digging and movement, ensuring smooth operation and minimizing wear and tear on the machine. Proper maintenance and functioning of suspension parts are crucial for the overall performance and longevity of excavators.

The suspension parts market for excavators is a segment within the broader construction equipment industry. Excavators, vital for earthmoving and construction tasks, rely on suspension parts to ensure smooth operation, stability, and safety. These parts include but are not limited to track frames, undercarriages, hydraulic cylinders, and various linkage components.

Market dynamics for suspension parts in excavators are influenced by factors such as construction activity levels, infrastructure development, technological advancements, and regulatory standards. Increasing urbanization, coupled with growing investments in infrastructure projects globally, drives the demand for excavators and, consequently, their suspension parts.

The market is characterized by a mix of original equipment manufacturers (OEMs) and aftermarket suppliers. OEMs provide suspension parts as part of new excavator sales, while aftermarket suppliers offer replacement parts and components to support maintenance and repair activities.

Innovation plays a significant role in this market, with a focus on enhancing durability, performance, and efficiency. Materials advancements, such as the use of high-strength alloys and composites, contribute to lighter yet more robust suspension components. Additionally, integration of smart technologies for predictive maintenance and remote monitoring is gaining traction, offering efficiency gains for excavator operators.

Geographically, the market's landscape varies, with regions experiencing different levels of construction activity and infrastructure development. Emerging economies, particularly in Asia-Pacific and Latin America, present lucrative opportunities due to extensive infrastructure projects.

Overall, the suspension parts market for excavators is poised for steady growth, driven by ongoing construction activities, technological advancements, and the need for efficient and reliable earthmoving equipment. Collaboration between OEMs and aftermarket suppliers, along with a focus on innovation, will be crucial for sustaining competitiveness in this dynamic market.

Suspension Parts of Excavators Market Trend Analysis

Increasing Demand for Excavators in Construction and Mining Activities

- In construction, excavators are indispensable for various tasks including digging foundations, trenching, demolition, and material handling. With the global construction industry witnessing robust growth, particularly in emerging markets, the demand for excavators and consequently their suspension parts has surged significantly.

- Similarly, in mining activities, excavators are pivotal for tasks such as ore extraction, earthmoving, and infrastructure development within mining sites. The expansion of mining operations, driven by the growing demand for minerals and metals worldwide, has led to an increased requirement for excavators and their associated suspension parts.

- Moreover, technological advancements in excavator designs have further propelled market growth, with suspension parts becoming increasingly sophisticated and durable to meet the demands of modern construction and mining operations.

- In essence, the growing demand for excavators in construction and mining activities serves as a major driving force behind the robust growth of the Suspension Parts of Excavators Market, indicating promising opportunities for market players in the foreseeable future..

Growing Adoption of Electric Excavators

- There growing adoption towards sustainable practices and reducing carbon emissions, industries are increasingly turning to electric alternatives. Electric excavators offer numerous advantages over their traditional counterparts, including lower operating costs, reduced environmental impact, and quieter operation. This shift towards electric excavators necessitates the development and integration of specialized suspension parts to support their unique requirements. Suspension components play a crucial role in ensuring the smooth and efficient operation of excavators, particularly in electric models where precision and reliability are paramount.

- Moreover, the adoption of electric excavators is not only driven by environmental concerns but also by government regulations and incentives favoring cleaner technologies. This creates a conducive market environment for manufacturers of suspension parts to capitalize on the rising demand for electric excavators. Overall, the growing adoption of electric excavators represents a lucrative opportunity for companies in the suspension parts segment to innovate and cater to the evolving needs of the market, driving growth and profitability in the excavator industry.

Suspension Parts of Excavators Market Segment Analysis:

Suspension Parts of Excavators Market Segmented on the Excavator Type, End-user, and Distribution Channel.

By Excavator Type, Mini excavators segment is expected to dominate the market during the forecast period

- The mini excavators are increasingly preferred for their versatility, compact size, and maneuverability, making them suitable for various applications in construction, landscaping, and agriculture. Due to their smaller size, they often undergo more frequent and diverse movements, leading to increased wear and tear on suspension parts, thereby driving demand. Additionally, the growing trend towards urbanization and infrastructure development in congested areas further fuels the demand for mini excavators, as they can operate efficiently in confined spaces. Moreover, advancements in technology have led to the development of more robust and durable suspension systems for mini excavators, enhancing their performance and reliability. Consequently, the mini excavators segment emerges as the dominant force in the suspension parts of the excavators market, catering to the evolving needs of diverse industries.

By End-User, Mining segment held the largest share of xx% in 2022

- The demanding nature of mining operations necessitates robust and durable suspension parts to withstand harsh conditions, such as constant vibration, heavy loads, and rough terrain. Therefore, mining companies prioritize high-quality suspension parts to ensure the longevity and efficiency of their excavators. Additionally, the scale of mining operations often requires a large fleet of excavators, leading to substantial demand for suspension parts.

- Moreover, the profitability of the mining sector allows for significant investment in equipment maintenance and upgrades, further driving the demand for suspension parts. Overall, the combination of rigorous operational requirements, scale, and financial capacity makes the mining segment the dominant consumer of suspension parts in the excavators market.

Suspension Parts of Excavators Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations have led to increased construction activities, thereby driving the demand for excavators and their components, including suspension parts. The Asia Pacific has witnessed significant investments in infrastructure development projects, such as roads, bridges, and railways, which necessitate the use of excavators. This steady flow of infrastructure projects creates a continuous demand for suspension parts in the region. The presence of a well-established manufacturing base for excavators and related components in countries like Japan and South Korea further strengthens Asia Pacific's position in the market. These countries cater to domestic demand and serve as key suppliers to other regions, contributing to the region's dominance.

- Furthermore, favorable government policies and initiatives aimed at boosting construction activities and infrastructure development provide further impetus to the market growth. Subsidies, tax incentives, and infrastructure projects funded by governments drive the demand for excavators and their parts in Asia Pacific. The growing focus on technological advancements and innovation in the construction equipment sector in Asia Pacific fosters the development of advanced suspension systems, attracting customers looking for efficient and reliable solutions. The combination of rapid urbanization, infrastructure investments, manufacturing capabilities, government support, and technological innovation positions Asia Pacific as a dominant player in the suspension parts of excavators market.

Suspension Parts of Excavators Market Top Key Players:

- Caterpillar (United States)

- Liebherr (Switzerland)

- Volvo (Sweden)

- ZF (Germany)

- Hitachi (Japan)

- Hyundai (South Korea)

- Doosan Group (South Korea)

- Komatsu (Japan), and other major players.

Key Industry Developments in the Suspension Parts of Excavators Market:

- In June 2024, Caterpillar launched its new facelift excavators: Cat 323D3, 320D3, and 320D3 GC. Mukul Dixit, Director of Sales and Marketing in Caterpillar’s Global Construction and Infrastructure Division, emphasized the variety of products designed to meet the demand for higher productivity, tighter project completion schedules, competitive operating costs, and safety. The Cat 323D3 and 320D3 models featured an advanced electrohydraulic system, which reduced fuel consumption and maintenance costs while enhancing operational controllability and efficiency. This system minimized leaks and energy waste by providing flow on demand, resulting in significant fuel savings.

|

Global Suspension Parts of Excavators Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.96 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.33% |

Market Size in 2032: |

USD 3.13 Bn. |

|

Segments Covered: |

By Excavator Type |

|

|

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Suspension Parts of Excavators Market by Excavator Type (2018-2032)

4.1 Suspension Parts of Excavators Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mini excavators

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Crawler excavators

4.5 Wheeled excavators

Chapter 5: Suspension Parts of Excavators Market by End-user (2018-2032)

5.1 Suspension Parts of Excavators Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mining

5.5 Forestry

5.6 Agriculture

Chapter 6: Suspension Parts of Excavators Market by Distribution Channel (2018-2032)

6.1 Suspension Parts of Excavators Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Original equipment manufacturers (OEMs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aftermarket

6.5 Online retailers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Suspension Parts of Excavators Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INGERSOLL RAND INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CHART INDUSTRIES INC. (USA)

7.4 ARIEL CORPORATION (USA)

7.5 FLUITRON INC. (USA)

7.6 SUNDYNE (USA)

7.7 IDEX CORPORATION (USA)

7.8 ATLAS COPCO AB (SWEDEN)

7.9 BURCKHARDT COMPRESSION HOLDING AG (SWITZERLAND)

7.10 NEL ASA (NORWAY)

7.11 HAUG SAUER KOMPRESSOREN AG (GERMANY)

7.12 HITACHI LTD. (JAPAN)

7.13

Chapter 8: Global Suspension Parts of Excavators Market By Region

8.1 Overview

8.2. North America Suspension Parts of Excavators Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Excavator Type

8.2.4.1 Mini excavators

8.2.4.2 Crawler excavators

8.2.4.3 Wheeled excavators

8.2.5 Historic and Forecasted Market Size by End-user

8.2.5.1 Construction

8.2.5.2 Mining

8.2.5.3 Forestry

8.2.5.4 Agriculture

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Original equipment manufacturers (OEMs)

8.2.6.2 Aftermarket

8.2.6.3 Online retailers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Suspension Parts of Excavators Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Excavator Type

8.3.4.1 Mini excavators

8.3.4.2 Crawler excavators

8.3.4.3 Wheeled excavators

8.3.5 Historic and Forecasted Market Size by End-user

8.3.5.1 Construction

8.3.5.2 Mining

8.3.5.3 Forestry

8.3.5.4 Agriculture

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Original equipment manufacturers (OEMs)

8.3.6.2 Aftermarket

8.3.6.3 Online retailers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Suspension Parts of Excavators Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Excavator Type

8.4.4.1 Mini excavators

8.4.4.2 Crawler excavators

8.4.4.3 Wheeled excavators

8.4.5 Historic and Forecasted Market Size by End-user

8.4.5.1 Construction

8.4.5.2 Mining

8.4.5.3 Forestry

8.4.5.4 Agriculture

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Original equipment manufacturers (OEMs)

8.4.6.2 Aftermarket

8.4.6.3 Online retailers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Suspension Parts of Excavators Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Excavator Type

8.5.4.1 Mini excavators

8.5.4.2 Crawler excavators

8.5.4.3 Wheeled excavators

8.5.5 Historic and Forecasted Market Size by End-user

8.5.5.1 Construction

8.5.5.2 Mining

8.5.5.3 Forestry

8.5.5.4 Agriculture

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Original equipment manufacturers (OEMs)

8.5.6.2 Aftermarket

8.5.6.3 Online retailers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Suspension Parts of Excavators Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Excavator Type

8.6.4.1 Mini excavators

8.6.4.2 Crawler excavators

8.6.4.3 Wheeled excavators

8.6.5 Historic and Forecasted Market Size by End-user

8.6.5.1 Construction

8.6.5.2 Mining

8.6.5.3 Forestry

8.6.5.4 Agriculture

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Original equipment manufacturers (OEMs)

8.6.6.2 Aftermarket

8.6.6.3 Online retailers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Suspension Parts of Excavators Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Excavator Type

8.7.4.1 Mini excavators

8.7.4.2 Crawler excavators

8.7.4.3 Wheeled excavators

8.7.5 Historic and Forecasted Market Size by End-user

8.7.5.1 Construction

8.7.5.2 Mining

8.7.5.3 Forestry

8.7.5.4 Agriculture

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Original equipment manufacturers (OEMs)

8.7.6.2 Aftermarket

8.7.6.3 Online retailers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Suspension Parts of Excavators Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.96 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.33% |

Market Size in 2032: |

USD 3.13 Bn. |

|

Segments Covered: |

By Excavator Type |

|

|

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||