Surgical Scalpels Market Synopsis

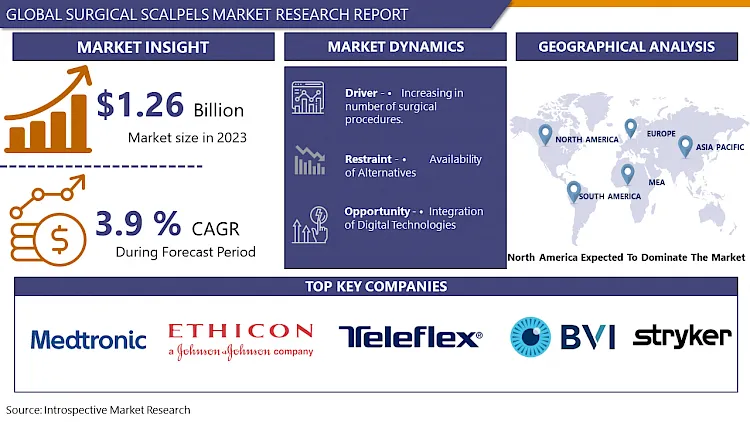

Surgical Scalpels Market Size Was Valued at USD 1.31 Billion in 2024 and is Projected to Reach USD 1.78 Billion by 2032, Growing at a CAGR of 3.9% From 2025-2032.

A scalpel, lancet, or bistoury is a small and extremely sharp-bladed instrument used by healthcare professionals for medical treatment like surgery, anatomical dissection, podiatry, and various handicrafts. Surgical blades are widely used for skin and tissue incisions while doing surgical procedures. The most common type of scalpel blade used in surgery is the non-attached, replaceable blade.

Scalpel blades are usually made up of hardened and tempered steel, stainless steel, or high-carbon steel. titanium, ceramic, diamond, and even obsidian knives are commonly used materials for scalpel. For example, when performing surgery under MRI guidance, steel blades are unusable (the blades would be drawn to the magnets and would also cause image artifacts).

Historically, the preferred material for surgical scalpels was silver. Scalpel blades are also offered by some manufacturers with a zirconium nitride-coated edge to improve sharpness and edge retention. Others manufacture blades that are polymer-coated to enhance lubricity during a cut.

the rapid expansion of the Medical Device & Healthcare industry, the increasing number of surgical procedures and innovations in the healthcare industry, and the rising popularity of cosmetic surgeries, plastic surgeries, accident cases, and Neurological - cardiovascular disorders mainly across developing economies estimated to boost the surgical scalpels market.

Surgical Scalpels Market Trend Analysis

Surgical Scalpels Market Drivers- Increasing in number of surgical procedures.

- More than 18,100 major plastic and cosmetic surgery actions, such as Botox and rhinoplasty, were conducted in Canada, followed by more than 9,900 internet explorations for the procedure.

- As technological advancements make procedures more appealing, the increased rate of demand has resulted in an increased interest in plastic surgery. Also, the cosmetic surgery industry booms due to advanced technological innovations that have been made to improve the quality of procedures. This is seen in the growing use of technological tools in cosmetic procedures, such as ultrasonic saws which making a rise in the surgery market.

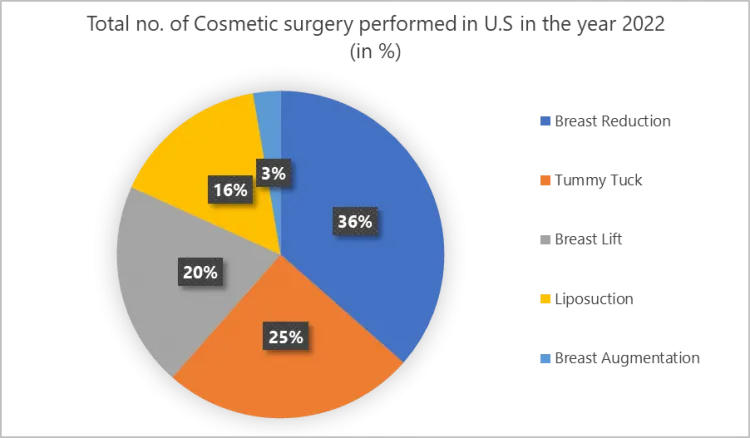

- As per the 2022 Plastic Surgery Report of the American Society of Plastic Surgeons, the number of cosmetic surgery procedures has increased significantly which is 19% in 2022 as compared to 2019.

- Body procedures which include liposuction, abdominoplasty (tummy tucks), and Arm and lower body lifts showed the way to account for 25% growth in 2022 and a total of 576,485.

Surgical Scalpels Market Opportunities- Integration of Digital Technologies

- Over the recent years, there has been noteworthy technical development in the healthcare industry and medical device industry. The growing number of surgery procedures is responsible for the rise in surgery Scalpels. Due to rising demand, the advancement in the scalpel also increases as many medical device companies and researchers making innovations.

- In the year 2023, Nano Surgical, LLC announced the use of AI (Artificial Intelligence) in scalpels to increase safety. The scalpel uses technology in a way parallel to how a tablet senses the position of a stylus, producing its electromagnetic resonant signal which can be digitally mapped to precise anatomic locations using a grid and multiple planes.

- This electromagnetic resonant scalpel allows a surgical method to be replicated remotely. It not only allows surgeons to see the precise incisions of prior surgeries but likely improves surgical care for patients in underdeveloped countries.

Surgical Scalpels Market Segment Analysis:

Surgical Scalpels Market is Segmented based on material, type, product type, and end-users.

By Type, Stainless Steel segment is expected to dominate the market during the forecast period

- The stainless-steel blade has well anti-corrosion properties, which makes it more suitable for a disposable scalpel because it is assembled and frequently used in less controlled environments or for procedures that use a lot of saline solution, which would immediately cause rusting.

- Stainless steel is used widely for Surgical scalpels due to its easy maintenance and resistant corrosion nature.

- It has a lot of advantages compared to other materials. It is tough to break because of its sturdy nature and corrosion-resistant properties.

- Thus, allowing the knife to be of reduced thickness, making the blade more economical. They are tremendously strong and durable. Surgical stainless steel is widely used for orthopedic procedures and operations.

By Type, Disposable segment held the largest share in 2024

- disposable blades are the type of scalpels that are discarded after just one use in surgery. Reusable scalpels have fixed blades that can be sharpened or removable single-use blades that are permanently attached.

- Disposable scalpels typically have a plastic handle with an extensible blade and it can only be used once before becoming outdated. In most cases, scalpel blades are packaged in sterile pouches.

- Disposable scalpels are the type of scalpel that is pre-sterilized and has a fixed blade that is attached to a plastic handle of the scalpel. Disposable scalpels are sterilized with the help of Gamma radiation to a minimum dose of 25 kGy.

- They are frequently applied as they aid in preventing cross-contamination infection.

- These blades come in various shapes and sizes, including retractable razors, and safety switch scalpels.

Surgical Scalpels Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America dominates the scalpel market because of the increase in Breast Surgeries, Cardiovascular surgeries, Neurological surgeries, trauma conditions, and accident cases. The number of cardiac surgeries surpasses 90,000 procedures every year in the United States.

- Heart disease is the main cause of death in men as well as in women in the U.S. There are about 5000,000 open heart surgeries performed each year. Also, favorable reimbursement policies by governmental bodies within the region.

Active Key Players in the Surgical Scalpels Market

- Hill-Rom Holdings, Inc. (U.S.)

- Boston Scientific (U.S.)

- Medtronic (U.S.)

- Ethicon (U.S.)

- Teleflex (U.S.)

- Beaver-Visitec International (BVI) Medical (U.S.)

- Stryker (U.S.)

- Aspen Surgical (U.S.)

- Surgical Specialties Corporation (U.S.)

- MYCO Medical (U.S.)

- Cincinnati Surgical Company (U.S.)

- PL Medical Co., LLC. (U.S.)

- Hu-Friedy Mfg. Co., LLC (U.S.)

- Integra Life Sciences Corporation (United States)

- SouthMedic (Canada)

- Swann-Morton Limited (U.K)

- VOGT Medical (Germany)

- Erbe Elektromedizin GmbH (Germany)

- Braun Melsungen (Germany)

- VOGT Medical Vertrieb GmbH (Germany)

- Olympus Corporation (Japan)

- Kai Industries Co., Ltd. (Japan)

- Qingdao Sinoland Medical Technology Co. (China)

- Anhui Intrag Medical Techs Co. (China)

- Shanghai Sun-Shore Medical Instruments Co. (China)

- Other Active Players

Key Industry Developments in the Surgical Scalpels Market:

- In December 2023, Stryker announced that it intends to acquire SERF SAS, enhancing its global joint replacement leadership. Stryker (NYSE: SYK), one of the world’s leading medical technology companies, announced today that it has executed a binding offer to Menix to acquire SERF SAS, a France-based joint replacement company.

- In August 2022, Teleflex will complete the Acquisition of Palette Life Sciences. Teleflex Incorporated (NYSE: TFX), a leading global provider of medical technologies, today announced it has entered into a definitive agreement to acquire Standard Bariatrics, Inc.

|

Global Surgical Scalpels Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 1.78 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product Type

|

(Scalpel blade) (Scalpel Handle)

(Scalpel blade) (Scalpel Handle)

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Scalpels Market by Type (2018-2032)

4.1 Surgical Scalpels Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Disposable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Reusable

Chapter 5: Surgical Scalpels Market by Material (2018-2032)

5.1 Surgical Scalpels Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Stainless Steel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 High-Grade Carbon Steel

5.5 Ceramic Scalpels

Chapter 6: Surgical Scalpels Market by Product Type (2018-2032)

6.1 Surgical Scalpels Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Safety Surgical Scalpel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 (Scalpel blade)

6.5 (Scalpel Handle)

6.6 Standard Surgical Scalpels

6.7 (Scalpel blade)

6.8 (Scalpel Handle)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Scalpels Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NOVO SURGICAL INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 EUROTEK SURGICAL CO. (US)

7.4 MILLENNIUM SURGICAL CORP. (US)

7.5 INTEGRA LIFE SCIENCES CORPORATION (US)

7.6 VITAL SURGICAL TECHNOLOGIES INC. (US)

7.7 KEY SURGICAL (US)

7.8 KARL SCHUMACHER (US)

7.9 SKLAR SURGICAL INSTRUMENTS (US)

7.10 ZIMMER BIOMET (US)

7.11 SMITH & NEPHEW (US)

7.12 JOHNSON & JOHNSON SERVICES INC (US)

7.13 BECTON

7.14 DICKINSON AND COMPANY (US)

7.15 COOPER SURGICAL INC. (US)

7.16 THOMPSON SURGICAL INSTRUMENTS INC. (US)

7.17 ASPEN SURGICAL (US)

7.18 INTEGRA LIFE SCIENCES CORPORATION (US)

7.19 STRYKER (US)

7.20 GSOURCE

7.21 LLC. (NEW JERSEY)

7.22 FINE SCIENCE TOOLS INC. (CALIFORNIA)

7.23 TREWAVIS SURGICAL (AUSTRALIA)

7.24 B. BRAUN MELSUNGEN AG (GERMANY)

7.25 MEDTRONIC

7.26 PLC (IRELAND)

7.27 SHANGHAI BOJIN MEDICAL INSTRUMENT CO. LTD (CHINA)

7.28 KLS MARTIN GROUP (GERMANY)

7.29 COUSIN-BIOTECH (FRANCE)

7.30 AND

Chapter 8: Global Surgical Scalpels Market By Region

8.1 Overview

8.2. North America Surgical Scalpels Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Disposable

8.2.4.2 Reusable

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Stainless Steel

8.2.5.2 High-Grade Carbon Steel

8.2.5.3 Ceramic Scalpels

8.2.6 Historic and Forecasted Market Size by Product Type

8.2.6.1 Safety Surgical Scalpel

8.2.6.2 (Scalpel blade)

8.2.6.3 (Scalpel Handle)

8.2.6.4 Standard Surgical Scalpels

8.2.6.5 (Scalpel blade)

8.2.6.6 (Scalpel Handle)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surgical Scalpels Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Disposable

8.3.4.2 Reusable

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Stainless Steel

8.3.5.2 High-Grade Carbon Steel

8.3.5.3 Ceramic Scalpels

8.3.6 Historic and Forecasted Market Size by Product Type

8.3.6.1 Safety Surgical Scalpel

8.3.6.2 (Scalpel blade)

8.3.6.3 (Scalpel Handle)

8.3.6.4 Standard Surgical Scalpels

8.3.6.5 (Scalpel blade)

8.3.6.6 (Scalpel Handle)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surgical Scalpels Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Disposable

8.4.4.2 Reusable

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Stainless Steel

8.4.5.2 High-Grade Carbon Steel

8.4.5.3 Ceramic Scalpels

8.4.6 Historic and Forecasted Market Size by Product Type

8.4.6.1 Safety Surgical Scalpel

8.4.6.2 (Scalpel blade)

8.4.6.3 (Scalpel Handle)

8.4.6.4 Standard Surgical Scalpels

8.4.6.5 (Scalpel blade)

8.4.6.6 (Scalpel Handle)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surgical Scalpels Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Disposable

8.5.4.2 Reusable

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Stainless Steel

8.5.5.2 High-Grade Carbon Steel

8.5.5.3 Ceramic Scalpels

8.5.6 Historic and Forecasted Market Size by Product Type

8.5.6.1 Safety Surgical Scalpel

8.5.6.2 (Scalpel blade)

8.5.6.3 (Scalpel Handle)

8.5.6.4 Standard Surgical Scalpels

8.5.6.5 (Scalpel blade)

8.5.6.6 (Scalpel Handle)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surgical Scalpels Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Disposable

8.6.4.2 Reusable

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Stainless Steel

8.6.5.2 High-Grade Carbon Steel

8.6.5.3 Ceramic Scalpels

8.6.6 Historic and Forecasted Market Size by Product Type

8.6.6.1 Safety Surgical Scalpel

8.6.6.2 (Scalpel blade)

8.6.6.3 (Scalpel Handle)

8.6.6.4 Standard Surgical Scalpels

8.6.6.5 (Scalpel blade)

8.6.6.6 (Scalpel Handle)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surgical Scalpels Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Disposable

8.7.4.2 Reusable

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Stainless Steel

8.7.5.2 High-Grade Carbon Steel

8.7.5.3 Ceramic Scalpels

8.7.6 Historic and Forecasted Market Size by Product Type

8.7.6.1 Safety Surgical Scalpel

8.7.6.2 (Scalpel blade)

8.7.6.3 (Scalpel Handle)

8.7.6.4 Standard Surgical Scalpels

8.7.6.5 (Scalpel blade)

8.7.6.6 (Scalpel Handle)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Surgical Scalpels Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.9 % |

Market Size in 2032: |

USD 1.78 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product Type

|

(Scalpel blade) (Scalpel Handle)

(Scalpel blade) (Scalpel Handle)

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||