Surgical Rasps Market Synopsis

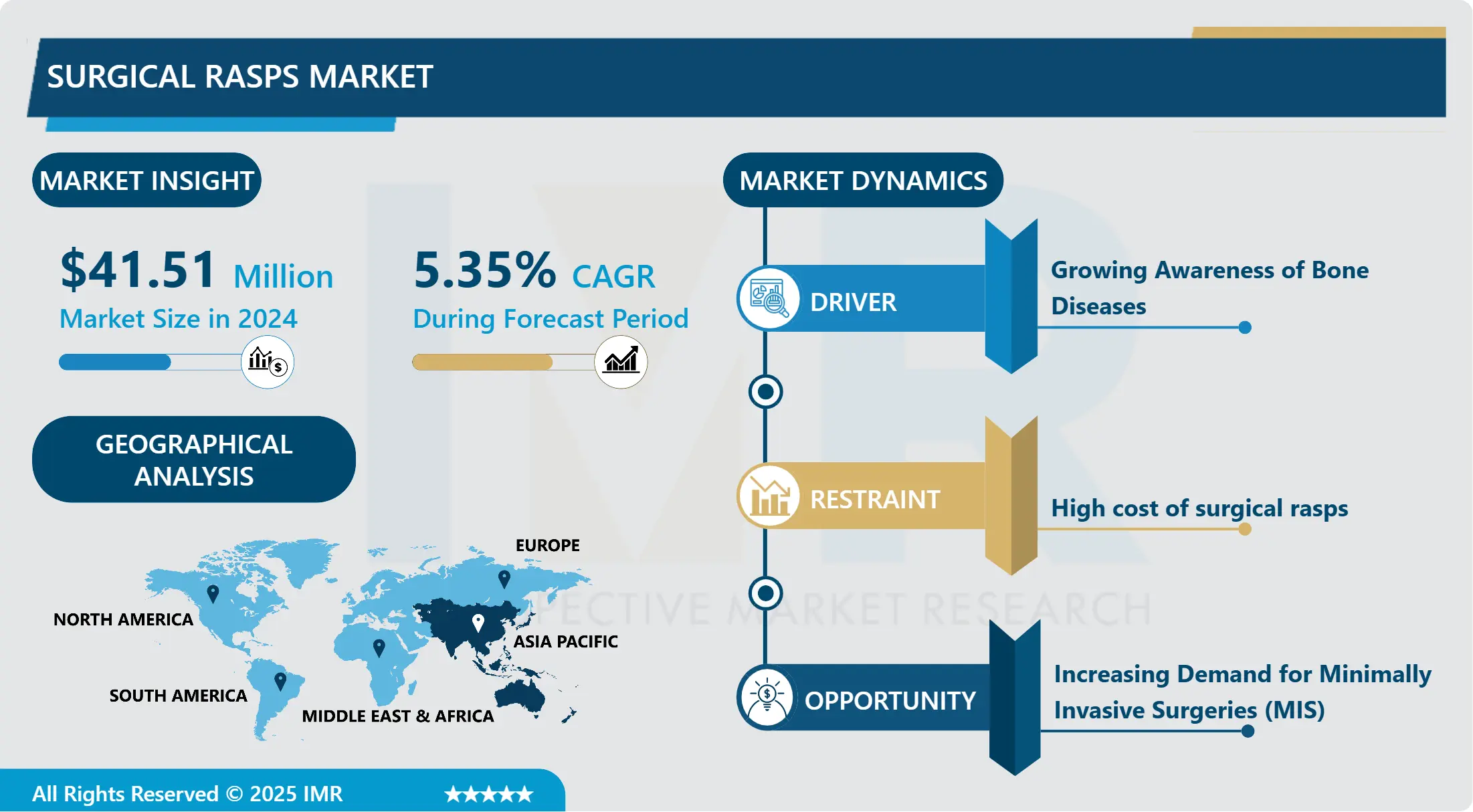

Surgical Rasps Market Size Was Valued at USD 41.51 Million in 2024 and is Projected to Reach USD 62.98 Million by 2032, Growing at a CAGR of 5.35 % From 2025-2032.

Surgical rasps are specialist devices used during surgical operations to remove bone or tissue. They are naturally cylindrical or conical in form, with a rough surface made up of tiny, sharp points. Rasps are used to smooth and shape bone surfaces, particularly during orthopedic and reconstructive treatments. They give control and enable the removal of undesired tissue while minimizing harm to surrounding tissues, enhancing surgical precision and efficacy.

Surgical Rasps are commonly employed in orthopedic, neurosurgery, and plastic surgery procedures. The rise in orthopedic operations has raised the incidence of musculoskeletal injuries and illnesses is one of the major factors propelling the market.

Orthopedic procedures are becoming progressively popular as the population ages and the prevalence of diseases such as osteoarthritis and osteoporosis rise. The efficiency and precision of these instruments are also being enhanced as surgical procedures and materials advance, which is propelling the industry forward.

The growing popularity of less invasive surgical techniques is another trend influencing the market for surgical rasps. Because procedures that are minimally invasive provide benefits including less post-operative pain, shortened hospital stays, and expedited recovery periods, more and more specialists are choosing to do them. Innovation in the market is being fueled by the need for specific rasps created for minimally invasive treatments. there is a tendency in surgical rasp design toward the development of ergonomically and user-friendly devices. To reduce strain and enhance surgical, manufacturers are developing devices with better tactile input, grip, and movement. The market for medical rasps is anticipated to rise as long as surgeries remain in demand and medical technology keeps making develop. All of these variables lead to the market's growth and expansion.

Surgical Rasps Market Trend Analysis

Growing Awareness of Bone Diseases

- The need for innovative surgical techniques for effectively treating bone diseases like osteoporosis, osteoarthritis, and bone malignancies is becoming more widely accepted. To be able to eliminate diseased or damaged bone tissue accurately while providing the least amount of stress to healthy tissue, surgical rasps are essential to bone processes. An increase in bone-related problems has been linked to global aging. People living longer have a greater likelihood to have degenerative bone diseases, be treated or controlled with surgery. By increasing surgical outcomes and reducing procedure-related problems, advancements in surgical rasp design, such as ergonomic handles, quicker cutting edges, and compatibility with minimally invasive procedures, have contributed to the market's growth. The market is projected to expand of orthopedic surgeons' and other medical professionals' growing adoption of surgical rasps and increasing infrastructure spending, particularly in developing nations.

- Growing awareness of bone disorders has increased the demand for new surgical devices and procedures that may meet the changing demands of patients all over the world. Growing investments in healthcare infrastructure, particularly in emerging markets, and increased use of surgical rasps by orthopedic surgeons and other medical professionals all contributes to market expansion.

Increasing Demand for Minimally Invasive Surgeries (MIS)

- Compared to typical open operations, MIS methods have smaller incisions, which lessen the stress on surrounding tissues, minimize postoperative discomfort, and hasten patients' recuperation. Patients as well as healthcare providers are beginning to favour MIS operations.

- Specialized equipment that provides accuracy and agility in limited locations are often necessary for MIS treatments. During these operations, surgical rasps are essential instruments in microsurgical implant surgery (MIS) because they smooth the surfaces of bones, remove tissue, and shape bone

- Technological innovations have empowered the creation of novel rasps that improve surgical efficiency and results. Ergonomic designs and materials with better strength and durability, have increased precision. The growing aging population worldwide contributes to the demand for MIS procedures as older adults pursue less invasive treatment options that minimize risks and promote faster recovery.

- The increasing demand for MIS surgeries is creating growth opportunities in the Surgical Rasps Market by specialized instruments with unique requirements of minimally invasive procedures in the healthcare industry.

Rasps Market Segment Analysis:

Surgical Rasps Market is Segmented based on Type, Material, Application, End-User, Distribution Channel, and Region.

By Type, Double-ended rasps segment is expected to dominate the market during the forecast period

- Double-ended rasps offer versatility and efficiency in surgical procedures. These rasps offer dual functionality, allowing surgeons to perform multiple tasks with a single tool, thereby reorganizing procedures and saving time.

- The design allows for accurate and controlled bone shaping and extraction during orthopedic and reconstructive procedures. These surgical rasps are made from high-quality materials, including medical-grade stainless steel, to guarantee durability and sterility in healthcare organizations. The ergonomic design enhances user comfort and reduces hand fatigue throughout long procedures. Therefore, surgeons support these rasps for their dependability, efficacy, and cost-effectiveness, resulting in their dominance in the surgical rasps industry.

By Material, Stainless Steel Rasps segment held the largest sharein 2024

-

Stainless steel offers excellent durability, resistance to corrosion, and ease of sterilization, crucial factors in surgical instrument selection. These rasps retain their integrity even after several sterilizing cycles, assuring longevity and dependability throughout surgical procedures. Moreover, stainless steel provides superior strength and hardness, enabling precise shaping and smoothing of bone and tissue surfaces during surgeries.

- The durability and precision make stainless steel rasps highly versatile across various surgical specialties, including orthopedics, neurosurgery, and plastic surgery. Stainless steel's non-reactive characteristics restrict the possibility of adverse reactions or contamination, consequently enhancing patient safety. The material's vast availability and low cost propelled it to the top of the stainless steel rasp market among surgeons and hospitals worldwide.

Surgical Rasps Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The rapidly growing healthcare infrastructure and growing investments in medical amenities across countries like China, India, and Japan are driving the demand for surgical instruments including rasps. Urbanization and rising expendable incomes have emphasized the region's healthcare services and the use of advanced medical technology. The Asia Pacific region has seen an increase in the prevalence of orthopedic diseases such as osteoarthritis and osteoporosis as people age and lifestyles change. Surgical rasps are vital tools in orthopedic treatments, especially for joint replacement procedures, creating demand in the region.

- Furthermore, technological advancements and innovations in surgical rasp designs are enhancing their efficacy attracting healthcare providers in the Asia Pacific region. These innovations include the development of ergonomic designs, better materials, and enhanced sterilization techniques, which contribute to improved surgical outcomes and patient satisfaction.

- The presence of key players established operations and distribution networks in the Asia Pacific helping the grow of the market. Asia Pacific is expected to dominate the surgical rasps market due to promising demographic trends, increasing healthcare spending, increased occurrence of orthopedic illnesses, technical developments, and market growth activities by key companies.

Active Key Players in the Surgical Rasps Market

- Cousin Surgery LLC (United States)

- Johnson & Johnson (United States)

- Boston Scientific Corporation (United States)

- Integra LifeSciences Holdings Corporation (United States)

- ConMed Corporation (United States)

- KLS Martin Group (Germany)

- Fuhrmann GmbH (Germany)

- Entrhal Medical GmbH (Germany)

- Medtronic plc (Ireland)

- B. Braun SE (Germany)

- Other Active Players.

Key Industry Developments in the Surgical Rasps Market:

- In March 2024, Johnson & Johnson finalized its acquisition of Ambrx Biopharma, Inc., valued at approximately $2.0 Million. With this merger, Johnson & Johnson gains access to Ambrx's synthetic biology platform for developing antibody-drug conjugates (ADCs). The move underscores Johnson & Johnson's commitment to advancing oncology treatments, particularly ARX517, a potential breakthrough for metastatic castration-resistant prostate cancer. Yusri Elsayed, MD, MHSc, PhD, expressed optimism about improving patient care through innovative therapies.

- In March 2023, Surgical Holdings introduced the NuTrace laser marking system to enhance the traceability of surgical instruments, including surgical rasps, within the sterile supply workflow. This technology uniquely marks instruments for easy identification and tracking throughout their lifecycle, bolstering the company's portfolio of surgical solutions.

|

Global Surgical Rasps Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.51 Mn. |

|

Forecast Period 2025-32 CAGR: |

5.35 % |

Market Size in 2032: |

USD 62.98 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Rasps Market by Type (2018-2032)

4.1 Surgical Rasps Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Double-ended rasps

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Single-ended rasps

Chapter 5: Surgical Rasps Market by Material (2018-2032)

5.1 Surgical Rasps Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Stainless Steel Rasps

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Tungsten Carbide Rasps

5.5 Diamond-Coated Rasps

Chapter 6: Surgical Rasps Market by Application (2018-2032)

6.1 Surgical Rasps Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Sculpting to Bone

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Misshapen Bones

Chapter 7: Surgical Rasps Market by End-User (2018-2032)

7.1 Surgical Rasps Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals and clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ambulatory surgical centers (ASCs)

7.5 Specialty clinics

Chapter 8: Surgical Rasps Market by Distribution Channel (2018-2032)

8.1 Surgical Rasps Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Direct Sales

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Distributors/Wholesalers

8.5 Online Retailers

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Surgical Rasps Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BECTON

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 DICKINSON AND COMPANY (US)

9.4 MEDTRONIC PLC (US)

9.5 TELEFLEX CORPORATION (US)

9.6 BAXTER INTERNATIONAL INC. (US)

9.7 B. BRAUN MELSUNGEN AG (GERMANY)

9.8 STRYKER CORPORATION (US)

9.9 CURAMEDICAL BV (NETHERLANDS)

9.10 GELITA MEDICAL GMBH (GERMANY)

9.11 INTEGRA LIFESCIENCES (US)

9.12 MARINE POLYMER TECHNOLOGIES INC

9.13 HEMOSTASIS LLC (US)

9.14 ARTIVION INC. (U.S.)

9.15 BIOM'UP (U.S.)

9.16 MEDTRONIC (IRELAND)

9.17 JOHNSON & JOHNSON SERVICES INC. (U.S.)

9.18 PFIZER INC. (U.S.)

9.19 Z-MEDICA LLC (UNITED STATES)

9.20 ANIKA THERAPEUTICS INC. (US)

9.21 ETHICON INC. (US)

Chapter 10: Global Surgical Rasps Market By Region

10.1 Overview

10.2. North America Surgical Rasps Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Double-ended rasps

10.2.4.2 Single-ended rasps

10.2.5 Historic and Forecasted Market Size by Material

10.2.5.1 Stainless Steel Rasps

10.2.5.2 Tungsten Carbide Rasps

10.2.5.3 Diamond-Coated Rasps

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Sculpting to Bone

10.2.6.2 Misshapen Bones

10.2.7 Historic and Forecasted Market Size by End-User

10.2.7.1 Hospitals and clinics

10.2.7.2 Ambulatory surgical centers (ASCs)

10.2.7.3 Specialty clinics

10.2.8 Historic and Forecasted Market Size by Distribution Channel

10.2.8.1 Direct Sales

10.2.8.2 Distributors/Wholesalers

10.2.8.3 Online Retailers

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Surgical Rasps Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Double-ended rasps

10.3.4.2 Single-ended rasps

10.3.5 Historic and Forecasted Market Size by Material

10.3.5.1 Stainless Steel Rasps

10.3.5.2 Tungsten Carbide Rasps

10.3.5.3 Diamond-Coated Rasps

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Sculpting to Bone

10.3.6.2 Misshapen Bones

10.3.7 Historic and Forecasted Market Size by End-User

10.3.7.1 Hospitals and clinics

10.3.7.2 Ambulatory surgical centers (ASCs)

10.3.7.3 Specialty clinics

10.3.8 Historic and Forecasted Market Size by Distribution Channel

10.3.8.1 Direct Sales

10.3.8.2 Distributors/Wholesalers

10.3.8.3 Online Retailers

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Surgical Rasps Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Double-ended rasps

10.4.4.2 Single-ended rasps

10.4.5 Historic and Forecasted Market Size by Material

10.4.5.1 Stainless Steel Rasps

10.4.5.2 Tungsten Carbide Rasps

10.4.5.3 Diamond-Coated Rasps

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Sculpting to Bone

10.4.6.2 Misshapen Bones

10.4.7 Historic and Forecasted Market Size by End-User

10.4.7.1 Hospitals and clinics

10.4.7.2 Ambulatory surgical centers (ASCs)

10.4.7.3 Specialty clinics

10.4.8 Historic and Forecasted Market Size by Distribution Channel

10.4.8.1 Direct Sales

10.4.8.2 Distributors/Wholesalers

10.4.8.3 Online Retailers

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Surgical Rasps Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Double-ended rasps

10.5.4.2 Single-ended rasps

10.5.5 Historic and Forecasted Market Size by Material

10.5.5.1 Stainless Steel Rasps

10.5.5.2 Tungsten Carbide Rasps

10.5.5.3 Diamond-Coated Rasps

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Sculpting to Bone

10.5.6.2 Misshapen Bones

10.5.7 Historic and Forecasted Market Size by End-User

10.5.7.1 Hospitals and clinics

10.5.7.2 Ambulatory surgical centers (ASCs)

10.5.7.3 Specialty clinics

10.5.8 Historic and Forecasted Market Size by Distribution Channel

10.5.8.1 Direct Sales

10.5.8.2 Distributors/Wholesalers

10.5.8.3 Online Retailers

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Surgical Rasps Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Double-ended rasps

10.6.4.2 Single-ended rasps

10.6.5 Historic and Forecasted Market Size by Material

10.6.5.1 Stainless Steel Rasps

10.6.5.2 Tungsten Carbide Rasps

10.6.5.3 Diamond-Coated Rasps

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Sculpting to Bone

10.6.6.2 Misshapen Bones

10.6.7 Historic and Forecasted Market Size by End-User

10.6.7.1 Hospitals and clinics

10.6.7.2 Ambulatory surgical centers (ASCs)

10.6.7.3 Specialty clinics

10.6.8 Historic and Forecasted Market Size by Distribution Channel

10.6.8.1 Direct Sales

10.6.8.2 Distributors/Wholesalers

10.6.8.3 Online Retailers

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Surgical Rasps Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Double-ended rasps

10.7.4.2 Single-ended rasps

10.7.5 Historic and Forecasted Market Size by Material

10.7.5.1 Stainless Steel Rasps

10.7.5.2 Tungsten Carbide Rasps

10.7.5.3 Diamond-Coated Rasps

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Sculpting to Bone

10.7.6.2 Misshapen Bones

10.7.7 Historic and Forecasted Market Size by End-User

10.7.7.1 Hospitals and clinics

10.7.7.2 Ambulatory surgical centers (ASCs)

10.7.7.3 Specialty clinics

10.7.8 Historic and Forecasted Market Size by Distribution Channel

10.7.8.1 Direct Sales

10.7.8.2 Distributors/Wholesalers

10.7.8.3 Online Retailers

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Surgical Rasps Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 41.51 Mn. |

|

Forecast Period 2025-32 CAGR: |

5.35 % |

Market Size in 2032: |

USD 62.98 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||