Surgical Instruments Packaging Market Synopsis

Surgical Instruments Packaging Market Size Was Valued at USD 30.16 Billion in 2023 and is Projected to Reach USD 51.56 Billion by 2032, Growing at a CAGR of 5.51% From 2024-2032.

The term surgical instruments packaging" describes the specialized packaging options made to transport, store, and safeguard surgical tools used in medical procedures safely and cleanly. Until they are required for surgery, these containers are crucial for preserving the sterility and integrity of surgical instruments, guaranteeing their freedom from contamination and harm. Surgical instrument packaging is often made of materials that can be sterilized using techniques like autoclaving. It may also have features like labels for simple identification, sterilization indications, and tamper-evident seals. These packing options guarantee that surgical instruments are prepared for usage in aseptic circumstances, which is essential for upholding the strictest standards of patient safety and infection control in healthcare environments.

Surgical instrument packaging should ensure the safe handling of instruments. The instruments are often made from a variety of materials, including stainless steel, tungsten carbide, titanium, plastic, and aluminium. There are several types of STs, including paper, foil, and plastic. Each one has its own unique properties and requires a specific method for packaging. The instruments must be properly packaged. The packaging should also ensure the safety of the patient and the health of the surgeon.

In a hospital, every item contains the potential for germs. The staff must ensure that each item is sterile and clean to avoid mistakes during surgical procedures. Surgical instrument packaging should help the hospital maintain this level of hygiene, reducing the chances of malfunctions in the operating room. It should include a tracking system for all instrument packages.

Surgical Instruments Packaging Market Trend Analysis

Growing Adoption of Minimally Invasive Surgery (MIS)

- Minimally invasive surgery (MIS) provides so many advantages over traditional surgical methods, its use has increased dramatically all across the world. This strategy reduces stress, expedites recovery, and leaves patients with fewer scars by performing difficult surgeries through tiny incisions using cutting-edge surgical tools and techniques. Because of this, medical professionals are choosing MIS more frequently to provide better patient outcomes and elevate surgical experiences in general. The market for surgical instrument packaging has grown as a result of the increasing use of MIS. The necessity for customized packaging solutions catered to the particular needs of these fragile devices is growing along with the need for MIS procedures. From the point of manufacture to the end-user facilities, which include hospitals and ambulatory surgery centers, the packaging is essential to maintaining the sterility, integrity, and safety of surgical instruments wherever along the supply chain.

- The market for surgical instrument packaging has the necessity for customized packaging solutions catered to the particular needs of these fragile devices is growing along with the need for MIS procedures. From the point of manufacture to the end-user facilities, include hospitals and ambulatory surgery centers, packaging is essential to maintaining the sterility, integrity, and safety of surgical instruments wherever along the supply chain.

Smart Packaging Solutions

- Surgical equipment packaging that incorporates smart technology like NFC and RFID has the potential to completely transform the healthcare supply chain. Real-time monitoring capabilities provided by RFID tags and NFC chips enable hospitals and healthcare facilities to keep an eye on the flow of surgical instruments from point of manufacture to point of use. By giving precise stock levels, lowering the possibility of stockouts or overstocking, and guaranteeing that essential equipment are available when needed, this degree of insight improves inventory management.

- By making surgical equipment more traceable and authentic, smart packaging solutions improve patient safety. Healthcare professionals may confirm the legitimacy of equipment and make sure it satisfies quality requirements and has passed the correct sterilizing processes by using RFID and NFC-enabled packaging. This lessens the possibility of utilizing tainted or fake tools throughout surgery. Packaging that is RFID and NFC-enabled makes it easier to automate the procedures of receiving, storing, and dispensing instruments. This lowers the risk of human error and manual handling. This automation increases overall operational productivity by increasing efficiency and giving healthcare personnel more time to concentrate on providing high-quality patient care.

Surgical Instruments Packaging Market Segment Analysis:

Surgical Instruments Packaging Market Segmented on the basis of type, Material, Sterilization Methods and end-users.

By Type, thermoform trays segment is expected to dominate the market during the forecast period

- Thermoform trays dominating the market due to they can be formed in various shapes and sizes to accommodate a wide range of surgical instruments, from delicate sutures to bulky implants. Trays can be designed with multiple compartments to keep instruments organized and prevent them from touching during transport and storage. Thermoform materials can be rigid enough to protect instruments during handling and sterilization processes. They are generally less expensive compared to other packaging options like glass vials or ampoules.

By Material, Metal segment held the largest share of 13% in 2023

- Metal instruments can withstand the rigors of surgery, withstanding repeated sterilization and manipulation without breaking. Many surgical procedures require precise cutting, and metals can be honed to a very sharp edge. Certain metals like stainless steel have excellent biocompatibility, meaning they don't cause adverse reactions in the body.

Surgical Instruments Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The surgical instruments packaging market in North America is ruled by the United States. The United States of America is renowned for its sophisticated healthcare system and state-of-the-art medical equipment. Its extensive network of medical facilities includes clinics, hospitals, and ambulatory surgical centers. With the nation's enormous healthcare system and the large number of surgical procedures conducted every year, there is a huge demand for surgical instrument packaging.

- There are many top surgical instrument packaging producers in the United States. For them fulfill the stringent requirements of healthcare professionals and guarantee the security and sterility of surgical instruments throughout storage and transit, these businesses make use of cutting-edge materials and creative designs. Committed on efficiency, quality, and regulatory compliance, American companies continue to enjoy a significant market share, offering packaging solutions that are customized to suit the different demands of healthcare facilities across the country.

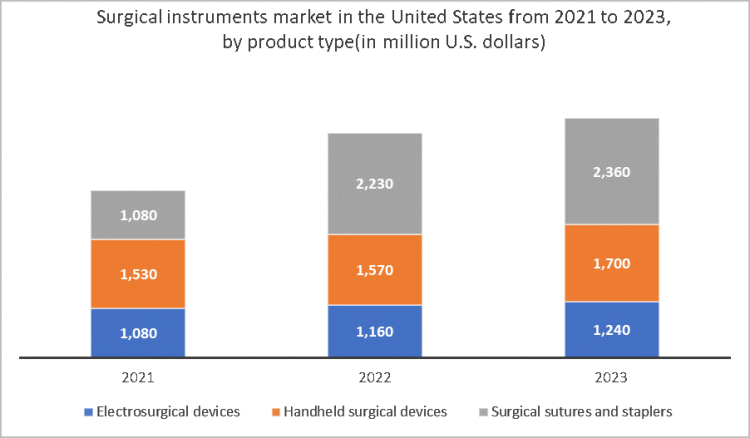

From 2021 and 2023, the surgical tools packaging market in the US had substantial growth, with differing patterns for various product categories. Scalpels, forceps, retractors, scissors, and other equipment necessary for a variety of surgical operations are among the many items available on the market. Several variables, including an aging population, technological improvements, and the rise in the prevalence of chronic diseases requiring surgical intervention, contributed to the spike in demand for surgical equipment during this time. Consequently, the market grew steadily and reached multimillion-dollar levels in a variety of product categories

Surgical Instruments Packaging Market Top Key Players:

- 3M (U.S.)

- Bemis Company, Inc. (U.S.)

- SHOTT AG (Germany)

- West Pharmaceutical Services, inc. (U.S.)

- DuPont (U.S.)

- Gerresheimer AG (Germany)

- CooperSurgical, Inc. (U.S.)

- Tekni-Plex (U.S.)

- Placon (U.S.)

- Sonoco Products Company (U.S.)

- Janco, Inc. (U.S.)

- Teleflex Incorporated (U.S.)

- Medtronic (U.S.)

- Coloplast (Denmark)

- Riverside Medical Packaging Company Ltd (U.K.)

- Shanghai Medical Instruments (Group) Ltd., Corp. (China)

- Steripack Contract Manufacturing (Ireland)

- Amcor plc (Switzerland), and Other Major Players.

Key Industry Developments in the Surgical Instruments Packaging Market:

- In August 2023, DuPont de Nemours, Inc. completed the acquisition of Spectrum Plastics Group (US), a recognized leader in specialty medical devices and components markets.

- In July 2023, Berry Global Group, Inc., collaborated with Deaconess Midtown Hospital, Nexus Circular, and Evansville Packaging Supply (US) to recycle non-hazardous, sterile, plastic packaging, and nonwoven fabric from the hospital’s surgical suite, pharmaceutical packaging, laboratory, and warehouse.

- In January 2023, Amcor plc announced an agreement to acquire Shanghai-based MDK Medical Packing Co., Ltd. (China).

|

Global Surgical Instruments Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.51 % |

Market Size in 2032: |

USD 51.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SURGICAL INSTRUMENTS PACKAGING MARKET BY TYPE (2017-2032)

- SURGICAL INSTRUMENTS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- THERMOFORM TRAYS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOTTLES

- VIALS

- AMPOULES

- SURGICAL INSTRUMENTS PACKAGING MARKET BY MATERIAL (2017-2032)

- SURGICAL INSTRUMENTS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GLASS

- METAL

- SURGICAL INSTRUMENTS PACKAGING MARKET BY END USERS (2017-2032)

- SURGICAL INSTRUMENTS PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORTHOPEDICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OPHTHALMIC

- DENTAL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Surgical Instruments Packaging Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BEMIS COMPANY, INC. (U.S.)

- SHOTT AG (GERMANY)

- WEST PHARMACEUTICAL SERVICES, INC. (U.S.)

- DUPONT (U.S.)

- GERRESHEIMER AG (GERMANY)

- COOPERSURGICAL, INC. (U.S.)

- TEKNI-PLEX (U.S.)

- PLACON (U.S.)

- SONOCO PRODUCTS COMPANY (U.S.)

- JANCO, INC. (U.S.)

- TELEFLEX INCORPORATED (U.S.)

- MEDTRONIC (U.S.)

- COLOPLAST (DENMARK)

- RIVERSIDE MEDICAL PACKAGING COMPANY LTD (U.K.)

- SHANGHAI MEDICAL INSTRUMENTS (GROUP) LTD., CORP. (CHINA)

- STERIPACK CONTRACT MANUFACTURING (IRELAND)

- AMCOR PLC (SWITZERLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL SURGICAL INSTRUMENTS PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Surgical Instruments Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.51 % |

Market Size in 2032: |

USD 51.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SURGICAL INSTRUMENTS PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SURGICAL INSTRUMENTS PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SURGICAL INSTRUMENTS PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. SURGICAL INSTRUMENTS PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. SURGICAL INSTRUMENTS PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. SURGICAL INSTRUMENTS PACKAGING MARKET BY PRODUCT TYPES

TABLE 008. BASIC SURGICAL MASK MARKET OVERVIEW (2016-2028)

TABLE 009. ANTI-FOG SURGICAL MASK MARKET OVERVIEW (2016-2028)

TABLE 010. FLUID/SPLASH-RESISTANT SURGICAL MASK MARKET OVERVIEW (2016-2028)

TABLE 011. N95 MASKS MARKET OVERVIEW (2016-2028)

TABLE 012. SURGICAL INSTRUMENTS PACKAGING MARKET BY DISTRIBUTION CHANNELS

TABLE 013. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 014. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY PRODUCT TYPES (2016-2028)

TABLE 016. NORTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 017. N SURGICAL INSTRUMENTS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE SURGICAL INSTRUMENTS PACKAGING MARKET, BY PRODUCT TYPES (2016-2028)

TABLE 019. EUROPE SURGICAL INSTRUMENTS PACKAGING MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 020. SURGICAL INSTRUMENTS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC SURGICAL INSTRUMENTS PACKAGING MARKET, BY PRODUCT TYPES (2016-2028)

TABLE 022. ASIA PACIFIC SURGICAL INSTRUMENTS PACKAGING MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 023. SURGICAL INSTRUMENTS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY PRODUCT TYPES (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 026. SURGICAL INSTRUMENTS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY PRODUCT TYPES (2016-2028)

TABLE 028. SOUTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 029. SURGICAL INSTRUMENTS PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 030. AMCOR PLC: SNAPSHOT

TABLE 031. AMCOR PLC: BUSINESS PERFORMANCE

TABLE 032. AMCOR PLC: PRODUCT PORTFOLIO

TABLE 033. AMCOR PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. PLACON: SNAPSHOT

TABLE 034. PLACON: BUSINESS PERFORMANCE

TABLE 035. PLACON: PRODUCT PORTFOLIO

TABLE 036. PLACON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. DUPONT: SNAPSHOT

TABLE 037. DUPONT: BUSINESS PERFORMANCE

TABLE 038. DUPONT: PRODUCT PORTFOLIO

TABLE 039. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. STERIPACK LTD: SNAPSHOT

TABLE 040. STERIPACK LTD: BUSINESS PERFORMANCE

TABLE 041. STERIPACK LTD: PRODUCT PORTFOLIO

TABLE 042. STERIPACK LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. WIPAK GROUP: SNAPSHOT

TABLE 043. WIPAK GROUP: BUSINESS PERFORMANCE

TABLE 044. WIPAK GROUP: PRODUCT PORTFOLIO

TABLE 045. WIPAK GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SONOCO: SNAPSHOT

TABLE 046. SONOCO: BUSINESS PERFORMANCE

TABLE 047. SONOCO: PRODUCT PORTFOLIO

TABLE 048. SONOCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PROAMPAC: SNAPSHOT

TABLE 049. PROAMPAC: BUSINESS PERFORMANCE

TABLE 050. PROAMPAC: PRODUCT PORTFOLIO

TABLE 051. PROAMPAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. TEKNI – PLEX: SNAPSHOT

TABLE 052. TEKNI – PLEX: BUSINESS PERFORMANCE

TABLE 053. TEKNI – PLEX: PRODUCT PORTFOLIO

TABLE 054. TEKNI – PLEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. NELIPAK HEALTHCARE: SNAPSHOT

TABLE 055. NELIPAK HEALTHCARE: BUSINESS PERFORMANCE

TABLE 056. NELIPAK HEALTHCARE: PRODUCT PORTFOLIO

TABLE 057. NELIPAK HEALTHCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TEHNIPAQ INC.: SNAPSHOT

TABLE 058. TEHNIPAQ INC.: BUSINESS PERFORMANCE

TABLE 059. TEHNIPAQ INC.: PRODUCT PORTFOLIO

TABLE 060. TEHNIPAQ INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ORCHID: SNAPSHOT

TABLE 061. ORCHID: BUSINESS PERFORMANCE

TABLE 062. ORCHID: PRODUCT PORTFOLIO

TABLE 063. ORCHID: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY PRODUCT TYPES

FIGURE 012. BASIC SURGICAL MASK MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTI-FOG SURGICAL MASK MARKET OVERVIEW (2016-2028)

FIGURE 014. FLUID/SPLASH-RESISTANT SURGICAL MASK MARKET OVERVIEW (2016-2028)

FIGURE 015. N95 MASKS MARKET OVERVIEW (2016-2028)

FIGURE 016. SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 017. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 018. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA SURGICAL INSTRUMENTS PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Surgical Instruments Packaging Market research report is 2024-2032.

3M (U.S.), Bemis Company, Inc. (U.S.), SHOTT AG (Germany), West Pharmaceutical Services, inc. (U.S.), DuPont (U.S.), Gerresheimer AG (Germany), Cooper Surgical, Inc. (U.S.), Tekni-Plex (U.S.), Placon (U.S.), Sonoco Products Company (U.S.), Janco, Inc. (U.S.), Teleflex Incorporated (U.S.), Medtronic (U.S.), Coloplast (Denmark), Riverside Medical Packaging Company Ltd (U.K.), Shanghai Medical Instruments (Group) Ltd., Corp. (China), Steripack Contract Manufacturing (Ireland), Amcor plc (Switzerland)and Other Major Players.

The Surgical Instruments Packaging Market is segmented into Type, Material, End-User, and region. By Type, the market is categorized into Thermoform Trays, Bottles, Vials, and Ampoules. By Material, the market is categorized into Plastic, Glass, and Metal. By End-User, the market is categorized into Orthopedics, Ophthalmic, Dental, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The term "surgical instruments packaging" describes the specialized packaging options made to transport, store, and safeguard surgical tools used in medical procedures in a safe and clean manner. Until they are required for surgery, these containers are crucial for preserving the sterility and integrity of surgical instruments, guaranteeing their freedom from contamination and harm.

Surgical Instruments Packaging Market Size Was Valued at USD 30.16 Billion in 2023, and is Projected to Reach USD 51.56 Billion by 2032, Growing at a CAGR of 5.51% From 2024-2032.