Sugar Based Excipient Market Synopsis:

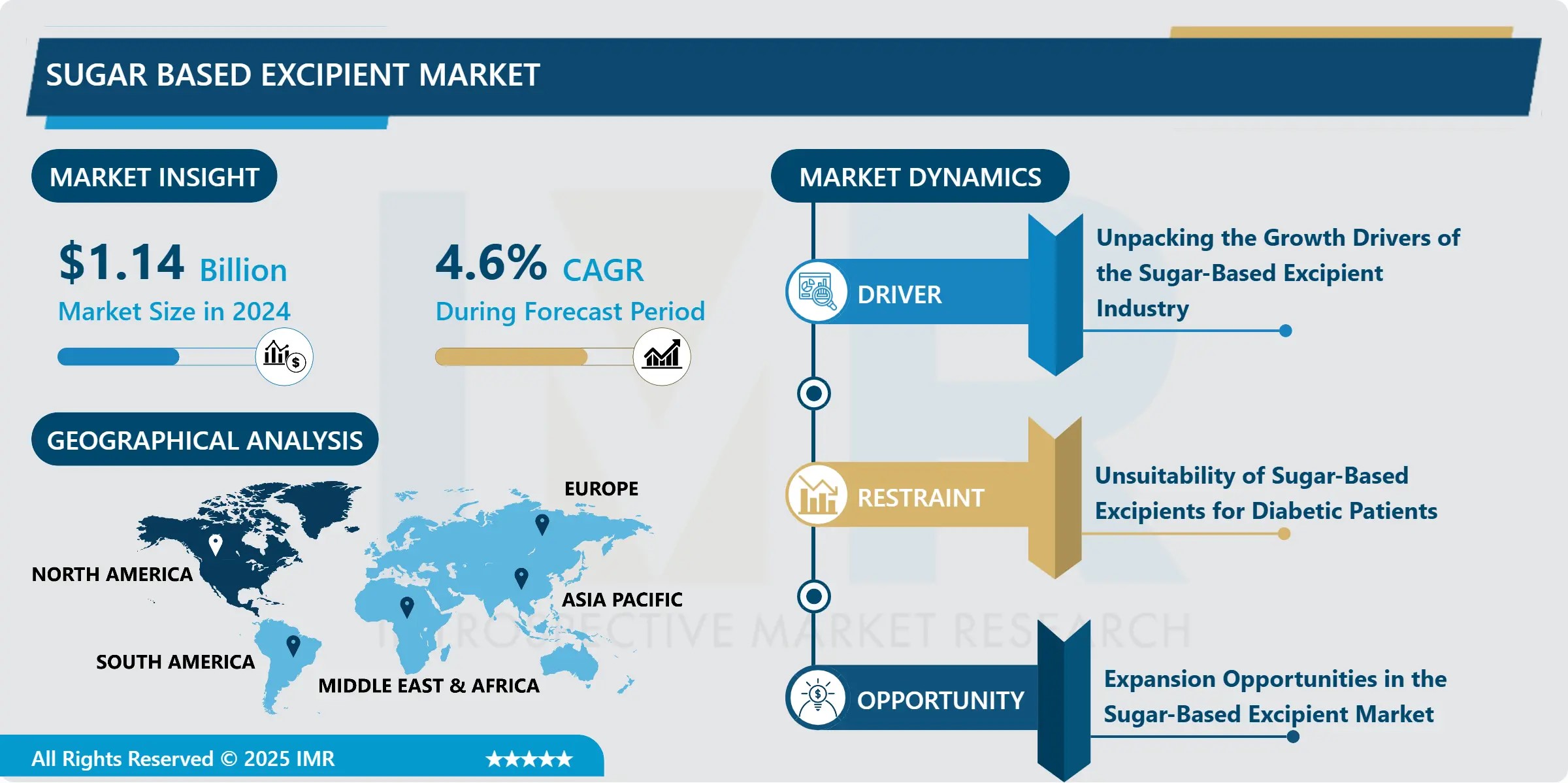

The Sugar-Based Excipient Market size was valued at USD 1.14 billion in 2024, and is projected to reach USD 1.87 billion by 2035, growing at a CAGR of 4.6% from 2025 to 2035.

The sugar-based excipient market is a specialized segment within the pharmaceutical excipient industry, focused on ingredients derived from sugar such as sucrose, sorbitol, mannitol, and dextrose. These excipients are widely used in oral dosage forms to improve taste, texture, and patient compliance, especially in paediatric and geriatric medications. Their natural origin, non-toxicity, and high solubility make them essential in formulating syrups, chewable tablets, lozenges, and orally disintegrating tablets.

Market growth is being driven by the increasing demand for patient-centric drug delivery systems, particularly in the form of palatable and easy-to-administer oral medications. Technological advancements in formulation science and the growing global pharmaceutical industry are further boosting demand. North America and Europe currently lead the market due to well-established pharmaceutical sectors, while Asia-Pacific is expected to witness the fastest growth owing to rising healthcare investments and generic drug production.

Despite the advantages, the market faces some challenges such as limitations in diabetic formulations and moisture sensitivity. However, ongoing research and development of innovative sugar-based and co-processed excipients are addressing these concerns. Overall, the sugar-based excipient market is poised for steady growth, supported by innovation, regulatory acceptance, and the need for improved drug delivery experiences.

Sugar Based Excipient Market Growth and Trend Analysis:

Sugar Based Excipient Market Growth Driver - Unpacking the Growth Drivers of the Sugar-Based Excipient Industry

- The sugar-based excipient market is growing steadily. Excipients are inactive ingredients used in pharmaceutical products to help with the delivery and stability of the active drug. Sugar-based excipients like sucrose, mannitol, sorbitol, and dextrose are popular choices because they are safe, taste sweet, and dissolve easily in water.

- One of the main growth drivers is the increasing demand for oral medicines, especially those designed for children and the elderly. These groups often need medicines that taste good and are easy to swallow. Sugar-based excipients are perfect for making tablets, syrups, and chewable or dissolvable medicines more pleasant to take. This has led to a rise in their use in orally disintegrating tablets (ODTs), which dissolve quickly in the mouth without water.

- Another major driver is the overall growth of the pharmaceutical and nutraceutical industries. As more people around the world seek medical treatments and supplements, the demand for effective and user-friendly formulations is increasing. Sugar-based excipients help manufacturers meet this need.

- In addition, the focus on patient-friendly drug delivery systems is encouraging pharmaceutical companies to improve product taste and mouthfeel, especially for over-the-counter (OTC) drugs. Finally, advancements in formulation technologies and innovations like co-processed sugar-based excipients are allowing for better stability and performance, further expanding their applications. Overall, rising health awareness, better drug delivery technologies, and patient comfort are the main factors fuelling the growth of the sugar-based excipient market.

Sugar Based Excipient Market Limiting Factor - Unsuitability of Sugar-Based Excipients for Diabetic Patients

- One of the main challenges in the sugar-based excipient market is that these ingredients are not suitable for people with diabetes. Sugar-based excipients like sucrose, dextrose, and even some sugar alcohols can raise blood sugar levels because they have a high glycaemic index. This means they are absorbed quickly by the body and can cause a rapid increase in blood sugar.

- As the number of diabetic patients continues to rise globally, this becomes a major concern. Many medications, especially for chronic conditions, need to be taken regularly. If these medications contain sugar-based excipients, they may not be safe for diabetic patients. As a result, pharmaceutical companies are often forced to look for alternative excipients when developing drugs for this group.

- This limitation reduces the overall demand for sugar-based excipients, especially in markets with high rates of diabetes. It also increases the need for research and development of sugar-free or low-glycaemic substitutes.

- In summary, while sugar-based excipients offer many benefits for taste and solubility, their use is restricted in diabetic populations, which is a significant barrier to market growth. Finding safer alternatives is key to meeting the needs of all patients.

Sugar Based Excipient Market Expansion Opportunity - Expansion Opportunities in the Sugar-Based Excipient Market

- The sugar-based excipient market holds strong potential for future expansion, driven by several emerging opportunities across the pharmaceutical and healthcare sectors. One key area of growth is the rising demand for orally disintegrating tablets (ODTs) and other patient-friendly drug delivery systems. Sugar-based excipients improve taste, mouthfeel, and solubility, making them ideal for these formulations especially for children, elderly patients, and people with swallowing difficulties.

- Another promising opportunity lies in the growing nutraceutical and over-the-counter (OTC) product segments. Consumers are increasingly seeking vitamins, supplements, and health products that are pleasant to consume. Sugar-based excipients help enhance taste and appearance, encouraging regular use and brand loyalty.

- The expansion of pharmaceutical manufacturing in emerging markets, particularly in Asia-Pacific and Latin America, also creates room for market growth. As healthcare access improves in these regions, the demand for affordable and high-quality medicines is increasing, boosting the need for excipients that are cost-effective and safe like sugar-based options.

- In addition, ongoing innovations in co-processed and low-glycaemic sugar-based excipients are expanding their applications, including use in diabetic-friendly formulations. These advancements can help overcome current limitations and open up new markets. In summary, the sugar-based excipient market can expand by tapping into new drug delivery formats, emerging economies, and innovative formulations that meet evolving patient needs.

Sugar Based Excipient Market Challenge and Risk - Dental Health Concerns

- One important challenge facing the sugar-based excipient market is the risk of dental problems, particularly in medications designed for children or for long-term use. Sugar-based excipients like sucrose and dextrose are commonly used to improve the taste of medicines, making them easier for patients to take. However, when these medicines are taken frequently, especially by children, they can increase the risk of tooth decay and cavities.

- Children are more likely to consume flavoured syrups, chewable tablets, and dissolvable medications, which often rely on sugar-based excipients to mask bitter tastes. Over time, this regular exposure to sugar can harm their dental health. Similarly, adults taking chronic medications may also face increased risk if their drugs contain sugar-based ingredients.

- As awareness of oral health grows among consumers and healthcare providers, there is a growing demand for sugar-free or low-sugar alternatives in pharmaceutical formulations. Parents, in particular, are cautious about exposing children to excess sugar through medicine.

- This concern is pushing pharmaceutical companies to innovate and invest in non-cariogenic (tooth-friendly) excipients, such as sugar alcohols or artificial sweeteners. Addressing this challenge is essential for ensuring long-term growth and patient trust in sugar-based excipient products.

Sugar Based Excipient Market Segment Analysis:

Sugar Based Excipient Market is segmented based on Type, Application, End-Users, and Region

By Type, Sugar Based Excipient Segment is Expected to Dominate the Market During the Forecast Period

- Sugar alcohols, such as sorbitol, mannitol, and xylitol, are becoming more popular in the pharmaceutical and nutraceutical industries. These ingredients are used as excipients, which are inactive substances added to medicines to help with taste, texture, and stability. Unlike regular sugars such as sucrose or dextrose, sugar alcohols offer a sweet taste without causing a sharp increase in blood sugar levels. This makes them especially useful in medications made for people with diabetes, a growing health concern around the world.

- Another big benefit of sugar alcohols is that they do not lead to tooth decay, unlike traditional sugars. This makes them ideal for use in paediatric medicines and for people who need to take medication regularly over a long period. Many children's medicines, chewable tablets, and mouth-dissolving tablets now use sugar alcohols because they are sweet, safe, and help improve the overall taste and feel of the product.

- Sugar alcohols also act as binders and stabilizers, helping to hold tablets together and keep medicines effective during storage. With the rising demand for sugar-free, pleasant-tasting, and easy-to-use medications, sugar alcohols are expected to remain a key ingredient in future pharmaceutical formulations, especially in health-conscious and diabetic-friendly markets.

By Application, Sugar Based Excipient Segment Held the Largest Share in 2024

- Flavouring agents are especially important in oral medicines, such as syrups, chewable tablets, and orally disintegrating tablets (ODTs). Many active pharmaceutical ingredients (APIs) have a bitter or unpleasant taste, which can make it hard for patients especially children and elderly individuals to take their medicines regularly. Sugar-based excipients like sucrose, sorbitol, and mannitol act as flavouring agents to mask the bitter taste and make medications more palatable.

- Improving the taste of medicine helps increase patient adherence, which is essential for effective treatment, particularly in chronic illnesses. This is why pharmaceutical companies are focusing on developing better-tasting drugs using sweet and natural flavouring excipients.

- In addition to pharmaceuticals, flavouring agents are widely used in nutraceuticals and over-the-counter (OTC) health supplements, where consumer experience plays a big role in product preference.

- With the growing demand for patient-friendly and taste-enhanced drug formulations, especially in paediatric and geriatric segments, the use of sugar-based flavouring agents is expected to grow further. Their ability to improve taste while also acting as sweeteners and stabilizers makes them a critical application area in the sugar-based excipient market.

Sugar Based Excipient Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, especially the United States, is a leading region in the sugar-based excipient market due to its strong focus on innovation and product quality. The region is home to many top pharmaceutical companies that invest heavily in research and development. These companies are constantly working to improve drug formulations by using high-quality sugar-based excipients like sorbitol, mannitol, and sucrose.

- One of the key strengths of North America is its advanced healthcare system and regulatory support. Organizations such as the U.S. Food and Drug Administration (FDA) have strict rules to ensure the safety and effectiveness of pharmaceutical ingredients. This encourages companies to develop excipients that meet high standards, making them safe for all age groups, including children and people with special health needs.

- North American consumers also demand sugar-free and diabetic-friendly medicines, which has led to the development of better-tasting and safer sugar substitutes like sugar alcohols. In addition, the popularity of orally disintegrating tablets (ODTs) and flavoured liquid medicines in the region supports the growth of sugar-based excipients. Overall, North America continues to lead in this market by combining innovation, strict quality control, and patient-focused solutions, setting an example for other regions.

Sugar Based Excipient Market Active Players:

- Archer Daniels Midland (ADM) (USA)

- Ashland Inc. (USA)

- Associated British Foods plc (UK)

- BASF SE (Germany)

- Biogrund GmbH (Germany)

- Cargill, Inc. (USA)

- Colorcon Inc. (USA)

- DFE Pharma (Netherlands)

- DFE Pharma GmbH & Co KG (Germany)

- DuPont de Nemours, Inc. (USA)

- Evonik Industries AG (Germany)

- FMC Corporation (now IFF Health) (USA)

- Hunan Er-Kang Pharmaceutical Co., Ltd. (China)

- Ingredion Incorporated (USA)

- JRS Pharma LP (J. Rettenmaier & Söhne Group) (Germany)

- Kerry Group plc (Ireland)

- MEGGLE GmbH & Co. KG (Germany)

- Merck KGaA (Germany)

- Pfanstiehl, Inc. (USA)

- Pfizer Centre One (Pfizer Inc.) (USA)

- Prayag Polytech Pvt.Ltd. (India)

- Qingdao Bright Moon Seaweed Group Co., Ltd. (China)

- Roquette Frères (France)

- Sanofi (Contract Manufacturing) (France)

- SEPPIC (Air Liquide Healthcare) (France)

- Shandong Baisheng Biotechnology Co., Ltd. (China)

- SPI Pharma Inc. (USA)

- Sumitomo Pharma Co., Ltd. (Japan)

- Tate & Lyle PLC (UK)

- The Lubrizol Corporation (USA)

- Other Active Players

Key Industry Developments in the Sugar Based Excipient Market:

- In 2025, pharmaceutical and nutraceutical manufacturers intensified efforts to switch to non-GMO, naturally sourced sugar-based excipients especially sugar alcohols like sorbitol and mannitol. This trend reflects rising consumer demand for clean-label products, pushing companies to reformulate medicines and supplements omitting synthetic additives

- Between 2024 and 2025, there has been increased adoption of sugar-based excipients in orally disintegrating tablets (ODTs) formulations designed to dissolve quickly on the tongue. Sugar alcohols and related sugars enhance taste, solubility, and patient experience, particularly among paediatric and geriatric segments

|

Sugar Based Excipient Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.14 billion |

|

Forecast Period 2025-35 CAGR: |

4.6 % |

Market Size in 2035: |

USD 1.87 billion |

|

Segments Covered: |

By Type |

|

|

|

By Dosage Form |

|

||

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Sugar Based Excipient Market by Product (2018-2035)

4.1 Sugar Based Excipient Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Actual Sugar

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Artificial Sweeteners

4.5 Sugar Alcohol

Chapter 5: Sugar Based Excipient Market by Dosage Form (2018-2035)

5.1 Sugar Based Excipient Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Liquid Dosage Forms

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Semi-Solid Dosage Forms

5.5 Solid Dosage Forms

Chapter 6: Sugar Based Excipient Market by Application (2018-2035)

6.1 Sugar Based Excipient Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diluents

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Fillers

6.5 Tonicity Agents

6.6 Flavouring Agents

Chapter 7: Sugar Based Excipient Market by End User (2018-2035)

7.1 Sugar Based Excipient Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Food and Beverage Industry

7.5 Cosmetics and Personal Care Industry

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Sugar Based Excipient Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ARCHER DANIELS MIDLAND (ADM) (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 ASHLAND INC. (USA)

8.4 ASSOCIATED BRITISH FOODS PLC (UK)

8.5 BASF SE (GERMANY)

8.6 BIOGRUND GMBH (GERMANY)

8.7 CARGILL

8.8 INC. (USA)

8.9 COLORCON INC. (USA)

8.10 DFE PHARMA (NETHERLANDS)

8.11 DFE PHARMA GMBH & CO KG (GERMANY)

8.12 DUPONT DE NEMOURS

8.13 INC. (USA)

8.14 EVONIK INDUSTRIES AG (GERMANY)

8.15 FMC CORPORATION (NOW IFF HEALTH) (USA)

8.16 HUNAN ER-KANG PHARMACEUTICAL CO.

8.17 LTD. (CHINA)

8.18 INGREDION INCORPORATED (USA)

8.19 JRS PHARMA LP (J. RETTENMAIER & SÖHNE GROUP) (GERMANY)

8.20 KERRY GROUP PLC (IRELAND)

8.21 MEGGLE GMBH & CO. KG (GERMANY)

8.22 MERCK KGAA (GERMANY)

8.23 PFANSTIEHL

8.24 INC. (USA)

8.25 PFIZER CENTRE ONE (PFIZER INC.) (USA)

8.26 PRAYAG POLYTECH PVT. LTD. (INDIA)

8.27 QINGDAO BRIGHT MOON SEAWEED GROUP CO.

8.28 LTD. (CHINA)

8.29 ROQUETTE FRÈRES (FRANCE)

8.30 SANOFI (CONTRACT MANUFACTURING) (FRANCE)

8.31 SEPPIC (AIR LIQUIDE HEALTHCARE) (FRANCE)

8.32 SHANDONG BAISHENG BIOTECHNOLOGY CO.

8.33 LTD. (CHINA)

8.34 SPI PHARMA INC. (USA)

8.35 SUMITOMO PHARMA CO.

8.36 LTD. (JAPAN)

8.37 TATE & LYLE PLC (UK)

8.38 THE LUBRIZOL CORPORATION (USA)

8.39 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Sugar Based Excipient Market By Region

9.1 Overview

9.2. North America Sugar Based Excipient Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Sugar Based Excipient Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Sugar Based Excipient Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Sugar Based Excipient Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Sugar Based Excipient Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Sugar Based Excipient Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Sugar Based Excipient Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.14 billion |

|

Forecast Period 2025-35 CAGR: |

4.6 % |

Market Size in 2035: |

USD 1.87 billion |

|

Segments Covered: |

By Type |

|

|

|

By Dosage Form |

|

||

|

By Application

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||