Sterilization Services Market Synopsis:

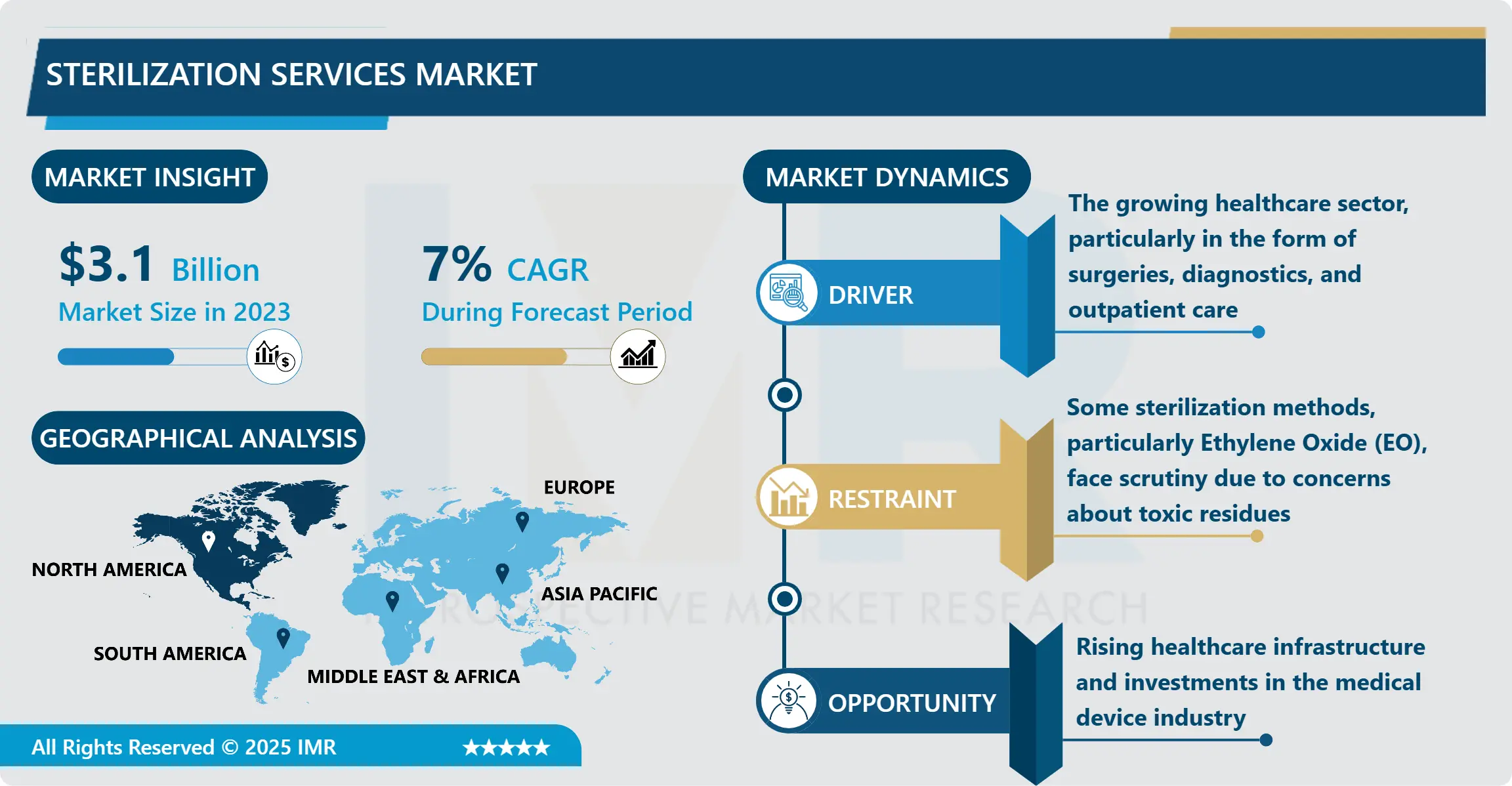

Sterilization Services Market Size Was Valued at USD 3.1 Billion in 2023, and is Projected to Reach USD 9.2 Billion by 2032, Growing at a CAGR of 7% From 2024-2032.

The Sterilization Services Market is an important sector in the health care and manufacturing vertical, which deals with sterilization procedures for medical devices, instruments, equipment and products for eliminating microorganisms, which are capable of causing diseases. These services play an important role of anticipating and reducing cases of Health care acquired infection otherwise known as HAIs while promoting patient safety in facilities such as hospitals, clinic and other healthcare institution. Heat sterilization of instruments and equipment’s is done with the use of steam while the use of gas mainly ethylene and Oxide is referred to as the gas sterilization while the use of radiation in form of gamma and X-ray is called radiation sterilization and plasma sterilization which uses hydrogen peroxide gas plasma depending on the material to be sterilized. The market exists mostly due to the rise in chronic diseases, the appeal to patient lives, and the implementation of strict norms on sterilization in medical organizations.

The Sterilization Services Market holds tremendous importance in the industry pertaining to several sectors that can support the medical devices, pharmaceutical products & consumables and hygiene business. Sterilization is a process used to remove all microorganisms including bacteria, viruses, fungi, and spores from medical instruments to save patient lives from HAIs and provide safety to hospital, clinic and outpatient settings. The main driving factor include growth in the need for infection control in wards, hospitals and other health organizations, growth in surgical operations among others and enforcing legislation and rules to keep manufacturing healthcare products and equipment sterile.

Also, the market has increased considerably because new sterilization technologies are more efficient, reusable, and affordable. Biological indicators, hydrogen peroxide gas plasma, and ozone sterilization methods are rising in sensibility due to their low-temperature sterilization execution for heat-sensitive medical instruments and medications. Third party sterilization service providers are also emerging as a center of significance, as manufacturers and healthcare service providers may have required specialized skills and facility for sterilizing products. There is even higher demand for sterility in medical devices and elevated standards of sterilization in all contexts connected to health care industry from the side of regulators, mainly in medical and pharmaceutical markets. On regional basis, North America and Europe are the largest markets for sterilization services due to the stringent regulatory environment and developed healthcare industry in the regions.

Sterilization Services Market Trend Analysis:

The Rise of Low-Temperature Sterilization Technologies in Healthcare

-

The marked increase in the use of low temperature sterilization technologies in healthcare applications is developing into one of the most prominent trends in the sterilization services industry. Hydrogen Peroxide Gas Plasma, Ozone Sterilization and Vaporized hydrogen Peroxide are good example of these methods which are ideal for use when sterilizing heat sensitive articles like Endoscopes, the surgical instruments and even Electronics, among others. When the medical field develops, they use more delicate complicated apparatus in surgeries and diagnostic hence the need for sterilization techniques that can kill all microorganisms without damaging the apparatus. Low temperature sterilization technologies are especially appealing because they are indeed less invasive on easily damaged instruments but also very effective at eradicating pathogens on equipment. This is also triggered by the increasing demand for improved safer and faster solutions that can replace the ethylene oxide (EO) gas sterilization that has been associated with health hazards and environmental concerns.

Expanding Reach: Emerging Markets Fuel Growth in Sterilization Services

-

Emerging markets account for a huge growth in Sterilization Services Market due to increased health care access, health and medical innovations and growing investment on health care facilities. Meanwhile, the Asia-Pacific, Latin America, and the Middle East & Africa are emerging markets for sterilization services providers as they aim to address growing need of health care entities for effective prevention of infections across the operating rooms and other healthcare facilities. With economic development of these regions, an increase in number of healthcare facilities together with the enhanced and increased access to healthcare, there is need to adopt effective sterilization techniques that do not pose any harm to patients and are cost-effective but can meet the international standards on health care sterilization to control healthcare associated infections (HAIs). Surgical procedures, outpatient treatments and healthcare services have increased tremendously in these areas due to rising prevalence of diseases and increased consciousness hence creating a good market segment that I believe any player in this business would wish to penetrate these new markets.

Sterilization Services Market Segment Analysis:

Sterilization Services Market Segmented on the basis of type, application, end user and region.

By Type, Gas Sterilization (Ethylene Oxide - EO) and Radiation Sterilization (Gamma and X-ray segment is expected to dominate the market during the forecast period

-

Gas sterilization, particularly ethylene oxide and radiation sterilization by gamma and X-ray is expected to dominate the sterilization market over the forecast period because of their efficacy in sterilizing delicate and intricate products. The second is ethylene oxide (EO), which is used in different medical applications including med-tech and pharmaceuticals, and in manufacturing of materials that cannot undergo high-temperature sterilization, including plastics, implants, electronic equipment, etc. As the number of single-use medical devices increased and stringent regulatory measures followed, EO sterilization still remains most ideal. In the same way, radiation sterilization particularly gamma and X-ray is crucial in sterilization of disposable utensils used in health facilities such as syringes, gloves, and catheters among others, medicated products such as drugs and biological products. Gamma radiation being able to penetrate through sealed packaging and sterilize items makes the process to be very important particularly for the medical and drug production companies which require their products to have very long shelf lives.

By Application, Medical Device Sterilization segment expected to held the largest share

-

Medical Device Sterilization account for the largest market share of the bio CEP industry due to increased usage of sterilized equipment in the healthcare facilities and growth in the in the global medical device industry. With increasing establishment of health care having need for its services extended, and with the increasing need for the medical procedures consequently comes the need for instruments that have been put through a sterile process such as the surgical instruments, diagnostic tools, and implants. Any medical device to be used must be sterile and this poses some challenges of sterilization to meet set standards. This need is especially apparent with single-use devices and implants that are created from thermally sensitive materials that cannot survive autoclave sterilization but may use EO or Gamma radiation. Also, due to rising outpatient surgeries and less invasive procedures involving a significantly higher number of sterile medical devices, market demand and need for reliable sterilization methods also increases.

Sterilization Services Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America has been estimated to lead the sterilization services market during the forecast period due to its well-developed healthcare sector along with the compulsory regulatory standards and the increasing requirement for sterilized medicated products. The United States specifically has a high percentage of healthcare facilities, medical device manufacturing industries and companies dealing with pharmaceuticals all of which need efficient sterilization solutions. High usage of EO and radiation as technologies in medical centres, facilities for research, and pharmaceutical production companies in North America also buttresses the dominion of this region. Also, the strong regulatory requirements across the medical industries such as FDA and other health authority bodies across the region require proper sterilization process in the medical products hence the need for professional medical sterilization services.

Active Key Players in the Sterilization Services Market

- 3M Company (United States)

- Advanced Sterilization Products (ASP) (United States)

- Andersen Products (United States)

- Becton Dickinson and Company (BD) (United States)

- BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

- Bioquell (a part of Ecolab) (United Kingdom)

- Cosmed Group (Italy)

- E-Beam Services, Inc. (United States)

- Getinge AB (Sweden)

- Ionisos (France)

- Linde Group (Germany)

- Mesa Laboratories, Inc. (United States)

- MilliporeSigma (United States)

- Noxilizer, Inc. (United States)

- STERIS Applied Sterilization Technologies (United States)

- Steris Corporation (United States)

- Tuttnauer (Israel)

- VWR International LLC (United States)

- Other Active Players

|

Sterilization Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.1 Billion |

|

Forecast Period 2024-32 CAGR: |

7 % |

Market Size in 2032: |

USD 9.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sterilization Services Market by Type

4.1 Sterilization Services Market Snapshot and Growth Engine

4.2 Sterilization Services Market Overview

4.3 Heat Sterilization (Steam)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Heat Sterilization (Steam): Geographic Segmentation Analysis

4.4 Gas Sterilization (Ethylene Oxide - EO)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Gas Sterilization (Ethylene Oxide - EO): Geographic Segmentation Analysis

4.5 Radiation Sterilization (Gamma and X-ray)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Radiation Sterilization (Gamma and X-ray): Geographic Segmentation Analysis

4.6 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma)): Geographic Segmentation Analysis

4.7

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 : Geographic Segmentation Analysis

Chapter 5: Sterilization Services Market by Application

5.1 Sterilization Services Market Snapshot and Growth Engine

5.2 Sterilization Services Market Overview

5.3 Medical Device Sterilization

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Medical Device Sterilization: Geographic Segmentation Analysis

5.4 Pharmaceutical Sterilization

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pharmaceutical Sterilization: Geographic Segmentation Analysis

5.5 Food and Beverage Sterilization

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Food and Beverage Sterilization: Geographic Segmentation Analysis

5.6 Laboratory Sterilization)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Laboratory Sterilization): Geographic Segmentation Analysis

5.7

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 : Geographic Segmentation Analysis

Chapter 6: Sterilization Services Market by End User

6.1 Sterilization Services Market Snapshot and Growth Engine

6.2 Sterilization Services Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers (ASCs)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Ambulatory Surgical Centers (ASCs): Geographic Segmentation Analysis

6.5 Pharmaceutical & Biotechnology Companies

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Pharmaceutical & Biotechnology Companies: Geographic Segmentation Analysis

6.6 Contract Sterilization Service Providers)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Contract Sterilization Service Providers) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sterilization Services Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M COMPANY (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADVANCED STERILIZATION PRODUCTS (ASP) (UNITED STATES)

7.4 ANDERSEN PRODUCTS (UNITED STATES)

7.5 BECTON DICKINSON AND COMPANY (BD) (UNITED STATES)

7.6 BGS BETA-GAMMA-SERVICE GMBH & CO. KG (GERMANY)

7.7 BIOQUELL (A PART OF ECOLAB) (UNITED KINGDOM)

7.8 COSMED GROUP (ITALY)

7.9 E-BEAM SERVICES INC. (UNITED STATES)

7.10 GETINGE AB (SWEDEN)

7.11 IONISOS (FRANCE)

7.12 LINDE GROUP (GERMANY)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Sterilization Services Market By Region

8.1 Overview

8.2. North America Sterilization Services Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Heat Sterilization (Steam)

8.2.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.2.4.3 Radiation Sterilization (Gamma and X-ray)

8.2.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.2.4.5

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Medical Device Sterilization

8.2.5.2 Pharmaceutical Sterilization

8.2.5.3 Food and Beverage Sterilization

8.2.5.4 Laboratory Sterilization)

8.2.5.5

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Ambulatory Surgical Centers (ASCs)

8.2.6.3 Pharmaceutical & Biotechnology Companies

8.2.6.4 Contract Sterilization Service Providers)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sterilization Services Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Heat Sterilization (Steam)

8.3.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.3.4.3 Radiation Sterilization (Gamma and X-ray)

8.3.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.3.4.5

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Medical Device Sterilization

8.3.5.2 Pharmaceutical Sterilization

8.3.5.3 Food and Beverage Sterilization

8.3.5.4 Laboratory Sterilization)

8.3.5.5

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Ambulatory Surgical Centers (ASCs)

8.3.6.3 Pharmaceutical & Biotechnology Companies

8.3.6.4 Contract Sterilization Service Providers)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sterilization Services Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Heat Sterilization (Steam)

8.4.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.4.4.3 Radiation Sterilization (Gamma and X-ray)

8.4.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.4.4.5

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Medical Device Sterilization

8.4.5.2 Pharmaceutical Sterilization

8.4.5.3 Food and Beverage Sterilization

8.4.5.4 Laboratory Sterilization)

8.4.5.5

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Ambulatory Surgical Centers (ASCs)

8.4.6.3 Pharmaceutical & Biotechnology Companies

8.4.6.4 Contract Sterilization Service Providers)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sterilization Services Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Heat Sterilization (Steam)

8.5.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.5.4.3 Radiation Sterilization (Gamma and X-ray)

8.5.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.5.4.5

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Medical Device Sterilization

8.5.5.2 Pharmaceutical Sterilization

8.5.5.3 Food and Beverage Sterilization

8.5.5.4 Laboratory Sterilization)

8.5.5.5

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Ambulatory Surgical Centers (ASCs)

8.5.6.3 Pharmaceutical & Biotechnology Companies

8.5.6.4 Contract Sterilization Service Providers)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sterilization Services Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Heat Sterilization (Steam)

8.6.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.6.4.3 Radiation Sterilization (Gamma and X-ray)

8.6.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.6.4.5

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Medical Device Sterilization

8.6.5.2 Pharmaceutical Sterilization

8.6.5.3 Food and Beverage Sterilization

8.6.5.4 Laboratory Sterilization)

8.6.5.5

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Ambulatory Surgical Centers (ASCs)

8.6.6.3 Pharmaceutical & Biotechnology Companies

8.6.6.4 Contract Sterilization Service Providers)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sterilization Services Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Heat Sterilization (Steam)

8.7.4.2 Gas Sterilization (Ethylene Oxide - EO)

8.7.4.3 Radiation Sterilization (Gamma and X-ray)

8.7.4.4 Plasma Sterilization (Hydrogen Peroxide Gas Plasma))

8.7.4.5

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Medical Device Sterilization

8.7.5.2 Pharmaceutical Sterilization

8.7.5.3 Food and Beverage Sterilization

8.7.5.4 Laboratory Sterilization)

8.7.5.5

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Ambulatory Surgical Centers (ASCs)

8.7.6.3 Pharmaceutical & Biotechnology Companies

8.7.6.4 Contract Sterilization Service Providers)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Sterilization Services Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.1 Billion |

|

Forecast Period 2024-32 CAGR: |

7 % |

Market Size in 2032: |

USD 9.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||