Global Sound Masking Market Overview

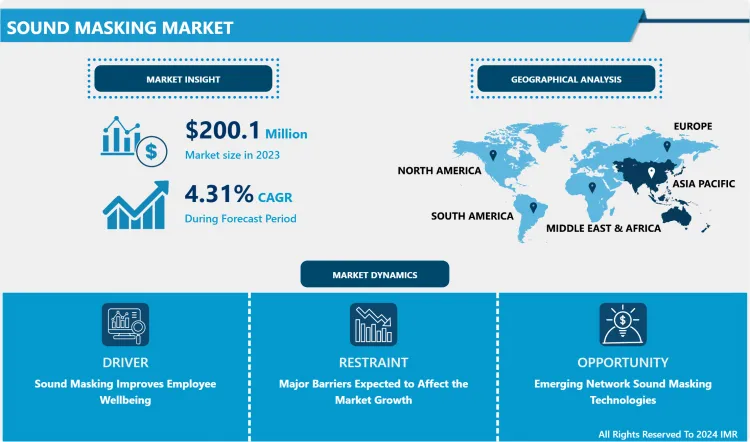

Sound Masking Market Size Was Valued at USD 200.1 Million In 2023 And Is Projected to Reach USD 284.8 Million By 2032, Growing at A CAGR of 4% From 2024-2032.

An ambient background noise that resembles the frequency of human speech is known as sound masking. Sound masking, mimics airflow, lessens distracting noises, safeguards speech privacy, and improves employee comfort at work. Even though it seems contradictory, increasing sound in a room makes human speech less understandable. You are less prone to become sidetracked when you are unable to grasp what someone is saying. Sound cancellation or total voice eradication is not achieved via sound masking. It lessens the distance at which conversations may still be heard and understood by others. Let's take the scenario where you are washing dishes while conversing with someone across the kitchen. You can hear the other person when the water isn't running. When the water is running, the sound of their speech is "masked" by the sound of the water.

The effect is emulated in a more sophisticated way by sound masking. You can help disguise other sounds and lessen their disruptiveness by adding ambient sound to a space (such as the sound of airflow or water flowing). Small speakers mounted in or above the ceiling are used for sound masking. The speakers are arranged in a grid arrangement and are connected to the control equipment by cables. Direct and indirect sound masking are the two main types. The demand for silence in most public buildings and public areas, as well as the ongoing development of sound masking systems, have both contributed to the growth of the global sound masking market.

Market Dynamics And Factors For Sound Masking Market

Drivers:

Sound Masking Improves Employee Wellbeing

- People grumbled about loudness in the workplace even before the pandemic without comprehending how hazardous it was. According to Steelcase, background noise harms cardiovascular illness, hypertension, tinnitus, hearing loss, and sleep difficulties. It's the ideal opportunity to address any ignored workplace sound concerns that harm people's physical, emotional, and cognitive well-being as workers leave their home offices and report to work in a post-COVID environment. Sound masking aids in creating a peaceful, effective workplace where employees can concentrate without being distracted by loud noises that stimulate the nervous system, raise blood pressure, and promote the release of stress hormones. According to Cambridge Sound Management, employees may lose as much as 86 minutes each day owing to noise disruptions. This lapse in concentration will probably result in a decrease in output, but it could also seriously adversely affect safety. Errors and mishaps are more likely to happen to distracted personnel. Additionally, they might not hear crucial vocal instructions, notifications, or cautions. Any workplace that has excessive noise should be concerned because it can have several detrimental consequences on workers. According to OSHA, loud noise can make it harder to hear warning signals, which increases workplace accidents and injuries. It can also cause physical and mental stress, decrease productivity, disrupt communication and focus, and increase workplace accidents and injuries. As a result, the use of sound masking is required to address these concerns, which is likely to drive market growth over the forecast period.

Restraints:

Major Barriers Expected to Affect the Market Growth

- The installation costs and complicated settings of sound masking systems are their major drawbacks. Additionally, it needs employees with the necessary skills to implement these systems correctly. A quieter, less obtrusive workspace environment is produced by the direct field technology utilized in sound masking systems. This technology produces a sound that readily blends into the background noise. Moreover, it is projected that a lack of knowledge about sound masking among people and commercial organizations will have a detrimental impact on the growth of the global sound masking market.

Opportunity:

Emerging Network Sound Masking Technologies

- The IT/Electrical Integration Community continues to generate additional revenue for the project by providing sound masking solutions. To date, these systems have been primarily analog with limited networking capabilities with limited controllability. The installation of loudspeaker systems and similar infrastructure remains the same using known and practiced technologies every day. Virtually all audio transmissions today rely on timing networks, which means they deploy on “flat” networks. (OSI Layer 2 Technology). This network topology, combined with limited switching steps, allows audio packets to arrive with precise delay. One possible deployment strategy is to favor virtual LANs (VLANs) for the implementation of sound masking and sound signatures. Some standard audio/video transmissions are based on software licenses issued by network switch manufacturers. Restricting access through role-based security policies is a good first line of defense for system security. (Unique username and password for each person). In addition, technologies such as 802.1x (port authentication) can identify trusted devices on the network from unauthorized ones. Encryption via an updateable security certificate is a method used by IT to ensure that only trusted devices can communicate with each other. As the implementation of sound masking systems becomes more and more encapsulated in IT technologies, the importance of training employees on specific platforms/technology becomes more important than ever. Leveraging sound masking and computer networking-specific training will provide lucrative opportunities in the years to come.

Segmentation Analysis Of the Sound Masking Market

- By Type, the manual segment had the largest market share in 2021, while the automatic segment is expected to register a significant market share owing to rising innovation and technologies by the major companies during the forecast period.

- By Type of Technology, QT100 sound masking technology is likely to dominate in this area. Currently, QT100 holds the maximum market and is anticipated to grow at a substantial rate over the forecasted period. The Qt 100 sound masking is ideal for single-zone spaces of up to 12,000 square feet (1,115 m2). The Qt 100 is easily controlled from the module's front panel, making volume adjustments quick and easy. Qt 100 uses sound masking, often misunderstood as white noise. Sound masking is at a frequency range more tuned to the frequency of human speech and is more acoustically pleasant than white noise.

- By End User, the offices' segment is expected to have the maximum market during the forecast period. This is due to workplaces increasingly demanding speech privacy, especially from coworkers. According to a survey, office noise and chatty coworkers are the two biggest distractions at work, cited by almost 80% of respondents. Employees are no longer required to be each other's primary sources of distraction thanks to sound masking. Furthermore, by reducing the audibility of human voices, sound masking tools can create a more comfortable working environment for staff. These are some of the factors that have grown the market share of the office segment in the sound masking system market. Hospitals and healthcare were the second-largest markets in contrast, and they are anticipated to grow at the quickest rate during the forecast period.

Regional Analysis Of the Sound Masking Market

- The Asia Pacific region is expected to hold the largest market share owing to the back of growing investment in sound masking technology to enhance the productivity and efficiency of employees. The need for smart buildings is growing quickly in the Asia-Pacific region as domestic income rises, which is opening up opportunities for the sound masking market to expand quickly. These are the buildings that have a lot of amenities, and the people who live there are willing to pay for them, therefore as the number of smart buildings rises across the nation, it is anticipated that the market share of sound masking systems will as well. China is considered to be the largest market for sound masking systems because it contains a large number of commercial buildings and hospitals, where the need for these systems is growing quickly. The number of commercial buildings is also increasing quickly in India, which is also thought to have the fastest-growing economy in the Asia-Pacific area due to the country's rapid globalization. Additionally, the nation features one of the most important healthcare systems in the Asia-Pacific area, which is assisting the market for sound masking in the region to grow.

- The market in the Europe region is expected to observe the fastest growth during the forecast period due to the augmenting growth of the hotel business. More than 200 thousand hotels were operating in the European Union in 2019. The most significant markets for sound masking systems are thought to be Germany and the UK. Since it is a manufacturing hub, there are numerous business buildings, especially in Germany and the UK, which are two of the most technologically advanced nations. The nation also has a strong health infrastructure, which creates a market opportunity for sound masking technology to expand. Additionally, the hotel business is well-established in Europe, which provides a lot of opportunities for the sound masking system to develop there. Furthermore, it is anticipated that the market share of sound masking systems would expand as France develops and becomes more commercialized.

- In North America, The United States has the largest market with a significant value of the market and it is anticipated to grow in the next years. The market's growth may be ascribed to SMEs using sound masking equipment more frequently and to the nation's important technological advancements in the healthcare, BSFI, and educational sectors. Additionally, the nation is recognized for being technologically advanced, and with increased privacy concerns, noise problems in many commercial institutions, and an increase in the adoption of sound masking systems. In addition, Canada's banking sector is expanding quickly, and commercialization is expanding quickly, both of which are fueling the market's demand for sound masking systems.

Top Key Players Covered In Sound Masking Market

- Yamaha Unified Communications, Inc

- MPS LLC

- Vibra-Sonic Control

- Cambridge sound management of QT

- GSA Sound Masking

- Communication Service Corporation

- Logison

- Strategic Connections Sound Masking

- Biamp Systems

- Lencore Sounds Corp.

- DUKANE AV

- Pro Sounds LLC

- K.R. Moeller Associates Ltd.

- Soundmask Global Pty. Ltd.

- ARCAT

- Speech Privacy Systems

- Soft DB

- Vibra Sonic

- Hermanmiller

- Pro Circuit Incorporated and other major players.

Key Industry Development In The Sound Masking Market

- In January 2022, Yamaha's research and expertise in audio systems for corporate environments, with extensive practical testing in Japan, Yamaha introduced the new VSP-2 Speech Privacy System. This ready-to-deploy system supports productive and confidential conferences and meetings in the office with a compact, high-performance, and customizable solution that comfortably masks conversation and can be easily integrated into existing facilities.

- In June 2021, Oneida Consumer LLC was acquired by Lenox Corporation. All existing Oneida consumer-branded tabletop items, including dinnerware, flatware, and cutlery, are included in the transaction. Lenox has expanded its brand portfolio with this purchase, concentrating on improving its visibility and overall retail channels. With a diverse product provider, the firm hopes to reach existing and new clients while also enhancing its global distribution channels.

- In August 2019, Soft DB declared that it has introduced a Chicago Plenum variety of one of its sound masking speaker products, the SMS-SURF4, which complies with the regulations of the City of Chicago Environmental Air (CCEA).

|

Sound Masking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 200.1 Mn. |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 284.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Type of Technology |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sound Masking Market by Type (2018-2032)

4.1 Sound Masking Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Automatic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Manual

Chapter 5: Sound Masking Market by Type of Technology (2018-2032)

5.1 Sound Masking Market Snapshot and Growth Engine

5.2 Market Overview

5.3 QT100

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 QT200

5.5 QT600

Chapter 6: Sound Masking Market by End Users (2018-2032)

6.1 Sound Masking Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hotels

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospitals

6.5 Recording Studios

6.6 Offices

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sound Masking Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SHIN-ETSU CHEMICAL COLTD (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SENSATA TECHNOLOGIES INC. (USA)

7.4 LITTELFUSE INC. (USA)

7.5 EXCELITAS TECHNOLOGIES CORP. (USA)

7.6 BROADCOM (USA)

7.7 THORLABS INC. (USA)

7.8 OPTICAL FIBER PACKAGING LTD (UNITED KINGDOM)

7.9 FARADAY PHOTONICS (UNITED KINGDOM)

7.10 TOPTICA PHOTONICS AG (GERMANY)

7.11 SHENZHEN OPTICO COMMUNICATION COLTD (CHINA)

7.12 OZ OPTICS LTD. (CANADA)

7.13 OF-LINK COMMUNICATIONS COLTD (CHINA)

7.14 NEWPORT CORPORATION (USA)

7.15 INNOVATION PHOTONICS (USA)

7.16 GEZHI PHOTONICS COLTD (CHINA)

7.17 AC PHOTONICS INC. (USA)

7.18 FUJIAN ULTRA PHOTONICS COLTD (CHINA)

7.19 DELTRONIC CRYSTAL INDUSTRIES INC. (USA)

7.20 NEPTEC OPTICAL SOLUTIONS (CANADA)

7.21 INNOLUME (GERMANY)

Chapter 8: Global Sound Masking Market By Region

8.1 Overview

8.2. North America Sound Masking Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Automatic

8.2.4.2 Manual

8.2.5 Historic and Forecasted Market Size by Type of Technology

8.2.5.1 QT100

8.2.5.2 QT200

8.2.5.3 QT600

8.2.6 Historic and Forecasted Market Size by End Users

8.2.6.1 Hotels

8.2.6.2 Hospitals

8.2.6.3 Recording Studios

8.2.6.4 Offices

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sound Masking Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Automatic

8.3.4.2 Manual

8.3.5 Historic and Forecasted Market Size by Type of Technology

8.3.5.1 QT100

8.3.5.2 QT200

8.3.5.3 QT600

8.3.6 Historic and Forecasted Market Size by End Users

8.3.6.1 Hotels

8.3.6.2 Hospitals

8.3.6.3 Recording Studios

8.3.6.4 Offices

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sound Masking Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Automatic

8.4.4.2 Manual

8.4.5 Historic and Forecasted Market Size by Type of Technology

8.4.5.1 QT100

8.4.5.2 QT200

8.4.5.3 QT600

8.4.6 Historic and Forecasted Market Size by End Users

8.4.6.1 Hotels

8.4.6.2 Hospitals

8.4.6.3 Recording Studios

8.4.6.4 Offices

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sound Masking Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Automatic

8.5.4.2 Manual

8.5.5 Historic and Forecasted Market Size by Type of Technology

8.5.5.1 QT100

8.5.5.2 QT200

8.5.5.3 QT600

8.5.6 Historic and Forecasted Market Size by End Users

8.5.6.1 Hotels

8.5.6.2 Hospitals

8.5.6.3 Recording Studios

8.5.6.4 Offices

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sound Masking Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Automatic

8.6.4.2 Manual

8.6.5 Historic and Forecasted Market Size by Type of Technology

8.6.5.1 QT100

8.6.5.2 QT200

8.6.5.3 QT600

8.6.6 Historic and Forecasted Market Size by End Users

8.6.6.1 Hotels

8.6.6.2 Hospitals

8.6.6.3 Recording Studios

8.6.6.4 Offices

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sound Masking Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Automatic

8.7.4.2 Manual

8.7.5 Historic and Forecasted Market Size by Type of Technology

8.7.5.1 QT100

8.7.5.2 QT200

8.7.5.3 QT600

8.7.6 Historic and Forecasted Market Size by End Users

8.7.6.1 Hotels

8.7.6.2 Hospitals

8.7.6.3 Recording Studios

8.7.6.4 Offices

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Sound Masking Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 200.1 Mn. |

|

Forecast Period 2024-32 CAGR: |

4% |

Market Size in 2032: |

USD 284.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Type of Technology |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||