Software Asset Management Market Synopsis

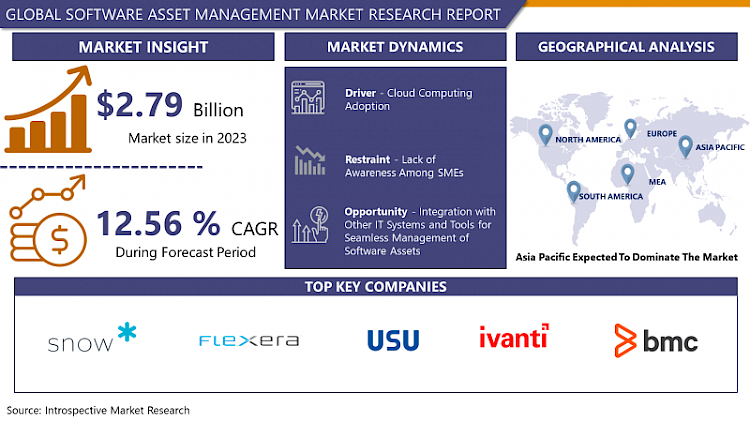

Software Asset Management Market Size Was Valued at USD 2.79 Billion in 2023 and is Projected to Reach USD 12.56 Billion by 2032, Growing at a CAGR of 18.19% From 2024-2032

Software Asset Management (SAM) refers to the process of managing and optimizing an organization's software assets throughout their lifecycle. This includes the procurement, deployment, utilization, and retirement of software to maximize value, minimize risks, and ensure compliance with licensing agreements. SAM involves tracking software licenses, usage, and entitlements to enhance cost efficiency, security, and governance. Key objectives of SAM include reducing software spending by identifying unused or underutilized licenses, ensuring compliance with vendor agreements and regulatory requirements, and mitigating security risks associated with unauthorized or outdated software installations. Effective SAM practices enable organizations to make informed decisions regarding software investments, streamline operations, and maintain a comprehensive view of their software landscape for improved governance and strategic planning. The SAM market encompasses a range of solutions and services aimed at supporting organizations in these efforts, providing tools for inventory management, license optimization, compliance reporting, and software lifecycle management.

- The Software Asset Management (SAM) market is experiencing robust growth driven by increasing demand for optimizing software usage and reducing compliance risks. SAM solutions enable organizations to effectively manage software licenses, track usage, and ensure compliance with licensing agreements. As businesses increasingly rely on a diverse range of software applications, SAM tools provide critical insights into license utilization, helping companies optimize costs and streamline operations.

- Key drivers fueling the expansion of the SAM market include stringent regulatory requirements, such as GDPR and HIPAA, which emphasize the need for accurate software inventory and compliance. Additionally, the rise of cloud computing and virtualization has further complicated license management, making SAM solutions essential for maintaining governance and controlling software expenditures.

- Large enterprises are the primary adopters of SAM solutions due to their complex IT environments and extensive software portfolios. However, small and medium-sized enterprises (SMEs) are increasingly recognizing the benefits of SAM in controlling costs and ensuring legal compliance. As a result, vendors are developing tailored solutions to cater to the unique needs of SMEs, driving further market growth.

- The SAM market is characterized by intense competition, with major players investing in innovative technologies such as artificial intelligence (AI) and machine learning (ML) to enhance SAM capabilities. These advancements enable real-time monitoring, predictive analytics, and automated compliance reporting, empowering organizations to proactively manage software assets.

- Geographically, North America and Europe lead the SAM market, owing to stringent compliance regulations and high IT spending. However, rapid digitization in emerging economies like Asia-Pacific is fueling SAM adoption, presenting lucrative growth opportunities for market players.

- In summary, the SAM market is poised for continued expansion as organizations prioritize cost optimization, compliance, and operational efficiency in an increasingly complex software landscape. Vendors are expected to focus on enhancing product capabilities and expanding their global footprint to capitalize on growing demand for robust software asset management solutions.

Software Asset Management Market Trend Analysis

Evolving Challenges and Opportunities in Cloud-Based Software Asset Management

- Cloud computing and subscription models have significantly transformed the landscape of Software Asset Management (SAM) by introducing new challenges and opportunities for organizations. As cloud technologies continue to dominate IT infrastructure, businesses are increasingly adopting multi-cloud environments, utilizing various cloud platforms for different applications and services. This diversity presents SAM with the complex task of managing software assets across these disparate cloud environments efficiently. SAM strategies now need to accommodate different licensing models and billing structures from different cloud providers, ensuring compliance and cost optimization across the board.

- Moreover, the proliferation of Software as a Service (SaaS) applications has led to a phenomenon known as SaaS sprawl, where organizations accumulate numerous subscriptions across departments. This widespread adoption of SaaS solutions introduces challenges related to subscription management, cost control, and compliance monitoring. SAM tools are evolving to address these challenges by providing robust capabilities for software discovery, optimization, and metering in SaaS environments. Organizations are prioritizing the optimization of subscriptions, identifying redundant or underutilized licenses, and ensuring license portability between on-premises and cloud infrastructures. SAM is becoming a critical component in managing the lifecycle of software assets in a cloud-centric IT ecosystem, enabling organizations to maximize value from their software investments while maintaining compliance and efficiency.

- In summary, cloud computing and subscription models are reshaping SAM practices by necessitating a comprehensive approach to managing software assets across diverse cloud platforms. This shift requires organizations to invest in SAM solutions that can seamlessly handle the complexities of SaaS sprawl, optimize subscription usage, and ensure license portability between on-premises and cloud environments. By leveraging advanced SAM strategies and tools, businesses can navigate the challenges of modern cloud-based IT environments effectively, enabling cost savings, compliance assurance, and enhanced operational efficiency across their software assets.

Cybersecurity Integration

- In the realm of Software Asset Management (SAM), the integration with cybersecurity strategies has become essential to mitigate risks associated with outdated or unauthorized software. SAM plays a critical role in identifying potential security vulnerabilities within software assets by conducting continuous monitoring and discovery across an organization's IT infrastructure. By maintaining an up-to-date inventory of software applications and versions, SAM tools can swiftly detect outdated or unpatched software components that may pose security risks. This proactive approach allows organizations to prioritize patching and updates based on criticality, reducing the window of exposure to potential threats and enhancing overall cybersecurity posture.

- Moreover, SAM is instrumental in automating patching and vulnerability scanning processes, further strengthening cybersecurity defenses. Automated patch management capabilities enable SAM tools to deploy security patches promptly across the organization's software assets, reducing the risk of exploitation by cyber attackers. Additionally, vulnerability scanning functionalities integrated into SAM solutions enable organizations to proactively identify and address software vulnerabilities before they can be exploited. By leveraging SAM for automated patching and vulnerability management, organizations can streamline security operations, improve incident response readiness, and mitigate the impact of cybersecurity threats on their IT environments.

- In summary, the integration of SAM with cybersecurity strategies represents a proactive approach to software asset management, focusing on identifying and mitigating security risks associated with software assets. By automating patching and vulnerability scanning processes, SAM empowers organizations to enhance their cybersecurity posture, reduce security vulnerabilities, and strengthen overall resilience against cyber threats. This integration underscores the importance of SAM as a strategic component of comprehensive cybersecurity frameworks, enabling organizations to maintain software compliance, minimize security risks, and safeguard critical IT assets effectively.

Software Asset Management Market Segment Analysis:

Market Name Market Segmented based on By Component, By deployment model, By organization size and By Vertical.

By Component, Solutions segment is expected to dominate the market during the forecast period

- Endpoint security and SIEM (Security Information and Event Management) solutions stand out as critical components within the cybersecurity landscape. Endpoint security focuses on protecting individual devices such as desktops, laptops, smartphones, and other endpoints from various cyber threats. With the proliferation of remote work and the growing number of devices connected to corporate networks, the demand for robust endpoint security solutions has soared. These solutions typically include antivirus software, firewalls, intrusion detection systems, and endpoint detection and response (EDR) tools, all aimed at safeguarding endpoints against malware, ransomware, and unauthorized access.

- On the other hand, SIEM solutions play a pivotal role in monitoring and analyzing security events and incidents across an organization's IT infrastructure. They aggregate and correlate data from various sources like network logs, system logs, and application logs to detect suspicious activities and potential security breaches. SIEM platforms provide real-time visibility into security events, enabling rapid incident response and threat mitigation. They are especially crucial for large enterprises with complex IT environments, where managing and interpreting security logs and alerts manually would be challenging. Due to their effectiveness in threat detection and compliance management, SIEM solutions hold a significant share of the cybersecurity market, driven by the continuous need to strengthen security postures and comply with regulatory requirements.

- In addition to solutions, managed security services (MSS) have become increasingly popular among organizations seeking to enhance their cybersecurity capabilities. Managed security services encompass a range of outsourced security offerings, including continuous monitoring, threat intelligence, incident response, and vulnerability management. MSS providers leverage specialized expertise and advanced tools to detect, analyze, and respond to cyber threats on behalf of their clients. This approach enables organizations to offload the complexities of cybersecurity operations to dedicated security professionals, allowing internal teams to focus on core business activities. The MSS market is expanding rapidly as businesses recognize the benefits of partnering with experienced security providers to mitigate risks and stay ahead of cyber adversaries in today's dynamic threat landscape.

By Vertical, IT and ITeS segment held the largest share in 2023

- The Information Technology and IT-enabled Services (ITeS) sector stands as a cornerstone of modern industry, wielding substantial influence and market impact globally. This sector's significance lies in its ability to catalyze digital transformation across various domains, from finance and healthcare to manufacturing and retail. IT and ITeS encompass a vast array of services, including software development, cybersecurity, cloud computing, and IT consulting. Businesses rely on these services to optimize processes, leverage data analytics for informed decision-making, and enhance customer experiences through digital platforms. As technology continues to evolve, the demand for IT solutions grows unabated, fueling innovation and driving efficiency across the business landscape.

- A defining characteristic of the IT and ITeS sector is its dynamic nature, characterized by rapid innovation and adaptation to emerging technologies. Artificial intelligence (AI), blockchain, Internet of Things (IoT), and machine learning are reshaping industry paradigms, with IT companies at the forefront of these advancements. Moreover, major global players in the IT sector serve as catalysts for technological progress, fostering collaborations with other industries and driving economic growth. The sector's resilience is evident in its ability to navigate disruptions such as the COVID-19 pandemic, where remote work and digital solutions became indispensable overnight. Moving forward, IT and ITeS will continue to play a pivotal role in shaping the future of work, commerce, and society as a whole, driving innovation and enabling businesses to thrive in an increasingly digital world.

Software Asset Management Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is experiencing a significant surge in IT investments, particularly in countries like China, India, Japan, and South Korea. This increased investment is playing a crucial role in propelling the Software Asset Management (SAM) market forward. As organizations allocate more resources to enhance their digital infrastructure and IT capabilities, the need to efficiently manage software assets becomes paramount.

- One of the primary drivers behind the growing adoption of SAM solutions in the region is the increasing awareness of compliance and cost management among enterprises. Companies are becoming more cognizant of the risks associated with non-compliance, such as legal penalties and reputational damage. Therefore, there's a heightened emphasis on ensuring that software licenses are used in accordance with vendor agreements and regulatory requirements.

- Moreover, cost management is a key consideration for businesses in the Asia Pacific region. SAM solutions enable organizations to optimize their software usage, identify redundant licenses, and streamline procurement processes. By implementing SAM practices, enterprises can achieve substantial cost savings by eliminating unnecessary expenditures on software licenses and reducing the risk of overspending on IT resources.

- Furthermore, the complexities associated with managing software assets in large enterprises are driving the demand for SAM solutions. As businesses scale up their operations and adopt a diverse range of software applications, the need for centralized control and visibility over software assets becomes imperative. SAM tools provide organizations with the capability to efficiently track and manage their software inventory, ensuring that resources are utilized effectively and compliance obligations are met.

- In summary, the Asia Pacific region is witnessing a robust growth in IT investments, which in turn is fueling the demand for SAM solutions. The convergence of factors such as compliance awareness, cost management, and the need for efficient software asset management is driving enterprises to adopt comprehensive SAM strategies to optimize their IT operations and mitigate risks. This trend is expected to continue as businesses in the region prioritize digital transformation and seek to leverage technology to enhance operational efficiency and competitiveness.

Active Key Players in the Software Asset Management Market

- 1E

- Belarc

- BMC Software

- Broadcom

- Certero

- Eracent

- Flexera

- IBM

- InvGate

- Ivanti

- ManageEngine

- Matrix42

- Micro Focus

- Microsoft

- Open iT

- Scalable Software

- ServiceNow

- Snow Software

- Symphony SummitAI

- USU Software AG

- Xensam

- Other Key Players

Key Industry Developments in the Software Asset Management Market:

- In July 2021, Snow Software introduced Snow Atlas, the first integrated platform built to help organizations discover, monitor, and optimize their technology investments both on-premises and in the cloud. The first solutions available on the new cloud-native platform are SAM, SaaS management, and ITSM integrations which were earlier delivered as a service, are now in early access.

- In March 2021- Ivanti acquired Cherwell Software, a provider of service management solutions to enterprises. With the help of this acquisition, Ivanti aims to enlarge the range of its Neurons platform, that provides asset management and end-to-end service to IT businesses.

- In October 2020- ServiceNow partnered with IBM Corporation to help companies reduce operational risk at an affordable cost by applying artificial intelligence (AI) technology to automate IT operations.

|

Global Software Asset Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.19% |

Market Size in 2032: |

USD 12.56 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Snow Software (Sweden), Flexera (US), USU Software AG (Germany), Ivanti (US), BMC Software (US), ServiceNow (US), Certero (UK), Matrix42 (Germany), Broadcom (US), Eracent (US), Scalable Software (US), Belarc (US), IBM (US), Micro Focus (UK), Microsoft (US), ManageEngine (US), Xensam (Sweden), InvGate (Argentina), Symphony SummitAI (US), 1E (UK), Open iT (US), Lansweeper (Belgium), and License Dashboard (UK) and Other Major Players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SOFTWARE ASSET MANAGEMENT MARKET BY COMPONENT (2017-2032)

- SOFTWARE ASSET MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- SOFTWARE ASSET MANAGEMENT MARKET BY DEPLOYMENT MODEL (2017-2032)

- SOFTWARE ASSET MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- SOFTWARE ASSET MANAGEMENT MARKET BY ORGANIZATION SIZE (2017-2032)

- SOFTWARE ASSET MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMEs

- SOFTWARE ASSET MANAGEMENT MARKET BY VERTICAL (2017-2032)

- SOFTWARE ASSET MANAGEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IT AND ITES

- TELECOM

- MANUFACTURING

- RETAIL AND ECOMMERCE

- GOVERNMENT

- HEALTHCARE AND LIFE SCIENCES

- EDUCATION

- MEDIA AND ENTERTAINMENT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Software Asset Management Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 1E

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BELARC

- BMC SOFTWARE

- BROADCOM

- CERTERO

- ERACENT

- FLEXERA

- IBM

- INVGATE

- IVANTI

- MANAGEENGINE

- MATRIX42

- MICRO FOCUS

- MICROSOFT

- OPEN IT

- SCALABLE SOFTWARE

- SERVICENOW

- SNOW SOFTWARE

- SYMPHONY SUMMITAI

- USU SOFTWARE AG

- XENSAM

- COMPETITIVE LANDSCAPE

- GLOBAL SOFTWARE ASSET MANAGEMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Software Asset Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.79 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.19% |

Market Size in 2032: |

USD 12.56 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment Model |

|

||

|

By Organization Size |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Snow Software (Sweden), Flexera (US), USU Software AG (Germany), Ivanti (US), BMC Software (US), ServiceNow (US), Certero (UK), Matrix42 (Germany), Broadcom (US), Eracent (US), Scalable Software (US), Belarc (US), IBM (US), Micro Focus (UK), Microsoft (US), ManageEngine (US), Xensam (Sweden), InvGate (Argentina), Symphony SummitAI (US), 1E (UK), Open iT (US), Lansweeper (Belgium), and License Dashboard (UK) and Other Major Players. |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SOFTWARE ASSET MANAGEMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SOFTWARE ASSET MANAGEMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SOFTWARE ASSET MANAGEMENT MARKET COMPETITIVE RIVALRY

TABLE 005. SOFTWARE ASSET MANAGEMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. SOFTWARE ASSET MANAGEMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. SOFTWARE ASSET MANAGEMENT MARKET BY TYPE

TABLE 008. ON-PREMISES MARKET OVERVIEW (2016-2028)

TABLE 009. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 010. SOFTWARE ASSET MANAGEMENT MARKET BY APPLICATION

TABLE 011. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 012. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 014. NORTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET, BY TYPE (2016-2028)

TABLE 015. NORTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET, BY APPLICATION (2016-2028)

TABLE 016. N SOFTWARE ASSET MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 017. EUROPE SOFTWARE ASSET MANAGEMENT MARKET, BY TYPE (2016-2028)

TABLE 018. EUROPE SOFTWARE ASSET MANAGEMENT MARKET, BY APPLICATION (2016-2028)

TABLE 019. SOFTWARE ASSET MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 020. ASIA PACIFIC SOFTWARE ASSET MANAGEMENT MARKET, BY TYPE (2016-2028)

TABLE 021. ASIA PACIFIC SOFTWARE ASSET MANAGEMENT MARKET, BY APPLICATION (2016-2028)

TABLE 022. SOFTWARE ASSET MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA SOFTWARE ASSET MANAGEMENT MARKET, BY TYPE (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SOFTWARE ASSET MANAGEMENT MARKET, BY APPLICATION (2016-2028)

TABLE 025. SOFTWARE ASSET MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 026. SOUTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET, BY TYPE (2016-2028)

TABLE 027. SOUTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET, BY APPLICATION (2016-2028)

TABLE 028. SOFTWARE ASSET MANAGEMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. SNOW SOFTWARE: SNAPSHOT

TABLE 030. SNOW SOFTWARE: BUSINESS PERFORMANCE

TABLE 031. SNOW SOFTWARE: PRODUCT PORTFOLIO

TABLE 032. SNOW SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. FLEXERA: SNAPSHOT

TABLE 033. FLEXERA: BUSINESS PERFORMANCE

TABLE 034. FLEXERA: PRODUCT PORTFOLIO

TABLE 035. FLEXERA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BMC SOFTWARE: SNAPSHOT

TABLE 036. BMC SOFTWARE: BUSINESS PERFORMANCE

TABLE 037. BMC SOFTWARE: PRODUCT PORTFOLIO

TABLE 038. BMC SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. IVANTI: SNAPSHOT

TABLE 039. IVANTI: BUSINESS PERFORMANCE

TABLE 040. IVANTI: PRODUCT PORTFOLIO

TABLE 041. IVANTI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CERTERO: SNAPSHOT

TABLE 042. CERTERO: BUSINESS PERFORMANCE

TABLE 043. CERTERO: PRODUCT PORTFOLIO

TABLE 044. CERTERO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SERVICENOW: SNAPSHOT

TABLE 045. SERVICENOW: BUSINESS PERFORMANCE

TABLE 046. SERVICENOW: PRODUCT PORTFOLIO

TABLE 047. SERVICENOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ASPERA TECHNOLOGIES: SNAPSHOT

TABLE 048. ASPERA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 049. ASPERA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 050. ASPERA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CHERWELL SOFTWARE: SNAPSHOT

TABLE 051. CHERWELL SOFTWARE: BUSINESS PERFORMANCE

TABLE 052. CHERWELL SOFTWARE: PRODUCT PORTFOLIO

TABLE 053. CHERWELL SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SCALABLE SOFTWARE: SNAPSHOT

TABLE 054. SCALABLE SOFTWARE: BUSINESS PERFORMANCE

TABLE 055. SCALABLE SOFTWARE: PRODUCT PORTFOLIO

TABLE 056. SCALABLE SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. CA TECHNOLOGIES: SNAPSHOT

TABLE 057. CA TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 058. CA TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 059. CA TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. SYMANTEC: SNAPSHOT

TABLE 060. SYMANTEC: BUSINESS PERFORMANCE

TABLE 061. SYMANTEC: PRODUCT PORTFOLIO

TABLE 062. SYMANTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. IBM: SNAPSHOT

TABLE 063. IBM: BUSINESS PERFORMANCE

TABLE 064. IBM: PRODUCT PORTFOLIO

TABLE 065. IBM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MICRO FOCUS: SNAPSHOT

TABLE 066. MICRO FOCUS: BUSINESS PERFORMANCE

TABLE 067. MICRO FOCUS: PRODUCT PORTFOLIO

TABLE 068. MICRO FOCUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MICROSOFT: SNAPSHOT

TABLE 069. MICROSOFT: BUSINESS PERFORMANCE

TABLE 070. MICROSOFT: PRODUCT PORTFOLIO

TABLE 071. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY TYPE

FIGURE 012. ON-PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 013. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 014. SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY APPLICATION

FIGURE 015. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 018. NORTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. EUROPE SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. ASIA PACIFIC SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. MIDDLE EAST & AFRICA SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. SOUTH AMERICA SOFTWARE ASSET MANAGEMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Software Asset Management Market research report is 2024-2032.

Snow Software (Sweden), Flexera (US), USU Software AG (Germany), Ivanti (US), BMC Software (US), ServiceNow (US), Certero (UK), Matrix42 (Germany), Broadcom (US), Eracent (US), Scalable Software (US), Belarc (US), IBM (US), Micro Focus (UK), Microsoft (US), ManageEngine (US), Xensam (Sweden), InvGate (Argentina), Symphony SummitAI (US), 1E (UK), Open iT (US), Lansweeper (Belgium), and License Dashboard (UK) and Other Major Players.

The Software Asset Management Market is segmented into By Component, By deployment model, By organization size , By Vertical and region. By Component, the market is categorized into Solutions and Services. By deployment model, the market is categorized into On-premises and Cloud. By organization size, the market is categorized into Large Enterprises and SMEs. By Vertical, the market is categorized into BFSI, IT and ITeS, Telecom, Manufacturing, Retail and eCommerce, Government, Healthcare and Life Sciences, Education, Media and Entertainment and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Software Asset Management (SAM) refers to the process of managing and optimizing an organization's software assets throughout their lifecycle. This includes the procurement, deployment, utilization, and retirement of software to maximize value, minimize risks, and ensure compliance with licensing agreements. SAM involves tracking software licenses, usage, and entitlements to enhance cost efficiency, security, and governance. Key objectives of SAM include reducing software spending by identifying unused or underutilized licenses, ensuring compliance with vendor agreements and regulatory requirements, and mitigating security risks associated with unauthorized or outdated software installations. Effective SAM practices enable organizations to make informed decisions regarding software investments, streamline operations, and maintain a comprehensive view of their software landscape for improved governance and strategic planning. The SAM market encompasses a range of solutions and services aimed at supporting organizations in these efforts, providing tools for inventory management, license optimization, compliance reporting, and software lifecycle management.

Software Asset Management Market Size Was Valued at USD 2.79 Billion in 2023 and is Projected to Reach USD 12.56 Billion by 2032, Growing at a CAGR of 18.19% From 2024-2032