Global Geographic Information System (GIS) Tools Market Overview

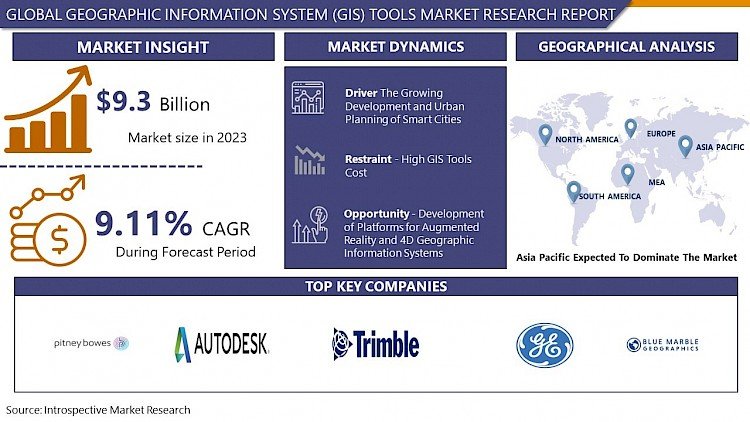

Global Geographic Information System (GIS) Tools Market size is expected to grow from USD 9.3 Billion in 2023 to USD 20.38 Billion by 2032, at a CAGR of 9.11% during the forecast period (2024-2032).

Geographic Information System (GIS) Tools The market is currently supplying a comprehensive analysis of many things that are liable for economic growth and factors that could play an important part in the increase of the marketplace in the prediction period. The record of the Geographic Information System (GIS) Tools Industry provides a thorough study on the grounds of market revenue, production, and price. The report also provides an overview of the segmentation on the basis of area, contemplating the particulars of earnings and sales pertaining to the marketplace.

An extensive analysis of this Geographic Information System (GIS) Tools Market is completed to recognize the many applications of the qualities of merchandise and utilization. The report involves an explanation regarding the numerous facets linked to market involving data and market increase concerning technological advancements, production and the firm's revenue. Additionally, market risk factors inventions, market setting, economy restraints, and challenges on the market have been explored within the accounts..

Scope of the Geographic Information System (GIS) Tools Market

Global Geographic Information System (GIS) Tools market research report obtained from sources such as websites, annual reports of many other folks, journals, and also those businesses and was evaluated and encouraged by the industry experts. The details and information are represented in the accounts with graphs, diagrams, pie graphs, as well as other pictorial representations. The visual image is enhanced by this and helps in comprehending the truth much better.

Geographic Information System (GIS) Tools Market Trend Analysis

The Growing Development and Urban Planning of Smart Cities

A significant amount of geographic information is required for smart city planning in order to determine the current state of market potential data, both during the planning stage and throughout plan execution. Keeping track of zoning and associated building and occupancy data would require the use of GIS land use management technologies in a smart city. GIS offers accurate, logical, and trustworthy data for smart city administration and planning. Although GIS interfaces with building information modeling (BIM) readily, it is being utilized more and more in the development of green buildings and smart infrastructure planning. Using GIS in smart city development may be applied in a number of sectors, such as smart public works, smart utilities, and smart urban planning. GIS spatial analytical technologies are utilized in the construction of smart cities to facilitate efficient decision-making about urban growth management. Specialists apply GIS in urban planning for analysis, modeling, and visualization. By processing geospatial data from satellite imaging, aerial photography, and remote sensors, users gain a detailed perspective on land and infrastructure. These benefits of GIS are driving the growth of the GIS software market.

Development of platforms for augmented reality and 4D geographic information systems

A growing amount of geographical geographic data as well as space analysis and time-series visualization are being included into GIS technology. Time change, 3D, and 2D GIS data are all included in 4D data. Generating 4D data requires an integrated database with real-time monitoring. Information gathered from diverse data sources, both geographical and nonspatial, is integrated, managed, and analyzed using 4D GIS. When forecasting dimensions over time requires the use of GIS, 4D GIS is becoming more and more common. For instance, knowing where and when infrastructure vulnerabilities could appear is necessary for infrastructure monitoring.

Geographic Information System (GIS) Tools Market Segmentation Analysis

Geographic Information System (GIS) Tools Market Segmented on the basis of Component , Function, and End-User

By Component, Software segment is expected to dominate the market during the forecast period

The GIS Software segment is estimated to dominate the GIS market, increasing GIS applications in urban planning, transport management, disaster management, and innovative city development. Combining GIS with enterprise resource planning (ERP) and customer relationship management (CRM) has increased GIS usage in business intelligence and marketing. Furthermore, advancements in artificial technology and cloud computing are fueling the growth of this segment in the GIS market.

By End-User, Transportation segment is expected to dominate the market during the forecast period

Transportation-related uses including route planning, traffic modeling, accident analysis, highway maintenance, and transportation planning are seeing an increase in the use of GIS. The mapping of transportation characteristics with a base map and the storage and analysis of geospatial data are made easier for transportation planners by GIS. The administration of transportation infrastructure and the planning of new roads, bridges, and railroad lines are greatly aided by GIS. Businesses are concentrating on creating GIS solutions specifically for the transportation industry as a result of the expanding use of GIS in this domain. For instance, TransCAD, a GIS program, is available from Caliper Corporation (US) and is specifically made for transportation-related applications, including transportation planning and traffic modeling

Competitive Landscape and Geographic Information System (GIS) Tools Market Share Analysis

Global Geographic Information System (GIS) Tools Market Research report comprises of Porter's five forces analysis to do the detail study about its each segmentation like Product segmentation, End user/application segment analysis and Major key players analysis mentioned as below;

Players Covered in Geographic Information System (GIS) Tools market are :

- Environmental Systems Research Institute, Inc. (ESRI) (US)

- Pitney Bowes Inc. (US)

- Autodesk, Inc. (US)

- Trimble Inc. (US)

- Bentley Systems, Incorporated (US)

- General Electric Co. (US)

- Blue Marble Geographics (US)

- Maxar Technologies Inc. (US)

- Topcon Positioning Systems (US)

- Caliper Corporation (US)

- Asset Essentials (US)

- Axxerion CMMS (US)

- UpKeep (US)

- Maintenance Connection (US)

- ServiceChannel (US)

- IBM TRIRIGA (US)

- Samsara (US)

- Geosoft Inc. (Canada)

- Hexagon AB (Sweden)

- Computer Aided Development Corporation Limited (UK)

- ABACO Group (Italy)

- Spatialworks (Malaysia), and other Major Players

Geographic Information System (GIS) Tools Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The APAC geographic information system market is expanding due to the rising need for geographic information system solutions for government applications in emerging nations like China and India. The Indian government has launched the "Digital India" project, under which more investments in expanding the nation's infrastructure for location-based services and internet connection are anticipated from both the public and commercial sectors.China is anticipated to occupy the largest portion of the Asia Pacific GIS market because of the country's extensive use of GIS technology in utilities, construction, transportation, and agriculture. In India, government initiatives have pushed the use of GIS in environmental monitoring, smart city development, and urban planning. Throughout the projection period, the demand for GIS in this area is anticipated to be driven by the usage of GIS-integrated solutions, such as BIM, for construction planning.

Key Industry Development: -

- In June 2023, Bentley Systems Announced ITwin Activate to boost early-stage startups in infrastructure engineering software.

- In June 2023, The national road business of Israel began a program for digitizing the entire network. Kav Medidia received the contract to map the northern state of the network using novel software, UAVs, and full-angle mobile mapping cameras.

|

Global Geographic Information System (GIS) Tools Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.3 Bn. |

|

|

CAGR (2024-2032): |

9.8% |

Market Size in 2032: |

USD 20.38 Bn. |

|

|

Segments Covered: |

By Component |

|

|

|

|

By Function |

|

|

||

|

By End-User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY COMPONENT (2016-2030)

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY FUNCTION (2016-2030)

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MAPPING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SURVEYING

- TELEMATICS AND NAVIGATION

- LOCATION-BASED SERVICES

- FUNCTIONE

- FUNCTIONF

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY END-USER (2016-2030)

- GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AGRICULTURE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION

- GOVERNMENT

- HEALTHCARE

- MINING

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Geographic Information System (GIS) Tools Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ENVIRONMENTAL SYSTEMS RESEARCH INSTITUTE, INC. (ESRI) (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PITNEY BOWES INC. (US)

- AUTODESK, INC. (US)

- TRIMBLE INC. (US)

- BENTLEY SYSTEMS, INCORPORATED (US)

- GENERAL ELECTRIC CO. (US)

- BLUE MARBLE GEOGRAPHICS (US)

- MAXAR TECHNOLOGIES INC. (US)

- TOPCON POSITIONING SYSTEMS (US)

- CALIPER CORPORATION (US)

- ASSET ESSENTIALS (US)

- AXXERION CMMS (US)

- UPKEEP (US)

- MAINTENANCE CONNECTION (US)

- SERVICECHANNEL (US)

- IBM TRIRIGA (US)

- SAMSARA (US)

- GEOSOFT INC. (CANADA)

- HEXAGON AB (SWEDEN)

- COMPUTER AIDED DEVELOPMENT CORPORATION LIMITED (UK)

- ABACO GROUP (ITALY)

- SPATIALWORKS (MALAYSIA)

- COMPETITIVE LANDSCAPE

- GLOBAL GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Function

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Geographic Information System (GIS) Tools Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.3 Bn. |

|

|

CAGR (2024-2032): |

9.8% |

Market Size in 2032: |

USD 20.38 Bn. |

|

|

Segments Covered: |

By Component |

|

|

|

|

By Function |

|

|

||

|

By End-User |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET COMPETITIVE RIVALRY

TABLE 005. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET THREAT OF NEW ENTRANTS

TABLE 006. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET THREAT OF SUBSTITUTES

TABLE 007. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY CATEGORY

TABLE 008. DESKTOP MARKET OVERVIEW (2016-2028)

TABLE 009. WEB MARKET OVERVIEW (2016-2028)

TABLE 010. SERVER MARKET OVERVIEW (2016-2028)

TABLE 011. SPECIALIZED MARKET OVERVIEW (2016-2028)

TABLE 012. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET BY APPLICATION

TABLE 013. SMES MARKET OVERVIEW (2016-2028)

TABLE 014. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY CATEGORY (2016-2028)

TABLE 016. NORTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY APPLICATION (2016-2028)

TABLE 017. N GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY CATEGORY (2016-2028)

TABLE 019. EUROPE GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY APPLICATION (2016-2028)

TABLE 020. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY CATEGORY (2016-2028)

TABLE 022. ASIA PACIFIC GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY APPLICATION (2016-2028)

TABLE 023. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY CATEGORY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY APPLICATION (2016-2028)

TABLE 026. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY CATEGORY (2016-2028)

TABLE 028. SOUTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY APPLICATION (2016-2028)

TABLE 029. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 030. UPKEEP: SNAPSHOT

TABLE 031. UPKEEP: BUSINESS PERFORMANCE

TABLE 032. UPKEEP: PRODUCT PORTFOLIO

TABLE 033. UPKEEP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. MAINTENANCE CONNECTION: SNAPSHOT

TABLE 034. MAINTENANCE CONNECTION: BUSINESS PERFORMANCE

TABLE 035. MAINTENANCE CONNECTION: PRODUCT PORTFOLIO

TABLE 036. MAINTENANCE CONNECTION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. CURO: SNAPSHOT

TABLE 037. CURO: BUSINESS PERFORMANCE

TABLE 038. CURO: PRODUCT PORTFOLIO

TABLE 039. CURO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. AXXERION CMMS: SNAPSHOT

TABLE 040. AXXERION CMMS: BUSINESS PERFORMANCE

TABLE 041. AXXERION CMMS: PRODUCT PORTFOLIO

TABLE 042. AXXERION CMMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ASSET ESSENTIALS: SNAPSHOT

TABLE 043. ASSET ESSENTIALS: BUSINESS PERFORMANCE

TABLE 044. ASSET ESSENTIALS: PRODUCT PORTFOLIO

TABLE 045. ASSET ESSENTIALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SERVICECHANNEL: SNAPSHOT

TABLE 046. SERVICECHANNEL: BUSINESS PERFORMANCE

TABLE 047. SERVICECHANNEL: PRODUCT PORTFOLIO

TABLE 048. SERVICECHANNEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. IBM TRIRIGA: SNAPSHOT

TABLE 049. IBM TRIRIGA: BUSINESS PERFORMANCE

TABLE 050. IBM TRIRIGA: PRODUCT PORTFOLIO

TABLE 051. IBM TRIRIGA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. SAMSARA: SNAPSHOT

TABLE 052. SAMSARA: BUSINESS PERFORMANCE

TABLE 053. SAMSARA: PRODUCT PORTFOLIO

TABLE 054. SAMSARA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INFOR EAM: SNAPSHOT

TABLE 055. INFOR EAM: BUSINESS PERFORMANCE

TABLE 056. INFOR EAM: PRODUCT PORTFOLIO

TABLE 057. INFOR EAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. AVANTIS: SNAPSHOT

TABLE 058. AVANTIS: BUSINESS PERFORMANCE

TABLE 059. AVANTIS: PRODUCT PORTFOLIO

TABLE 060. AVANTIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 061. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 062. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 063. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY CATEGORY

FIGURE 012. DESKTOP MARKET OVERVIEW (2016-2028)

FIGURE 013. WEB MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVER MARKET OVERVIEW (2016-2028)

FIGURE 015. SPECIALIZED MARKET OVERVIEW (2016-2028)

FIGURE 016. GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY APPLICATION

FIGURE 017. SMES MARKET OVERVIEW (2016-2028)

FIGURE 018. LARGE ENTERPRISES MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA GEOGRAPHIC INFORMATION SYSTEM (GIS) TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Geographic Information System Tools Market research report is 2024-2032.

Environmental Systems Research Institute, Inc. (ESRI) (US),Pitney Bowes Inc. (US),Autodesk, Inc. (US),Trimble Inc. (US),Bentley Systems, Incorporated (US),General Electric Co. (US),Blue Marble Geographics (US),Maxar Technologies Inc. (US),Topcon Positioning Systems (US),Caliper Corporation (US),Asset Essentials (US),Axxerion CMMS (US),UpKeep (US),Maintenance Connection (US),ServiceChannel (US),IBM TRIRIGA (US),Samsara (US),Geosoft Inc. (Canada),Hexagon AB (Sweden),Computer Aided Development Corporation Limited (UK),ABACO Group (Italy),Spatialworks (Malaysia), and other major players

The Geographic Information System Tools Market is segmented into Component , Function,End-User and region. By Component, the market is categorized into Hardware,and Software Web, Server, and Specialized. By Function, the market is categorized as Mapping, Surveying,Telematics and Navigation, and Location -Based Services.By End-User, the market is categorized as Agriculture,Transporation,Government,Healthcare,and Mining. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A software application called geographic information is used to evaluate, produce, maintain, and map various sorts of data. By combining location data with various descriptive data types, such as demographic data, it also connects to the map. Analyzing, interpreting, and visualizing geographic data to identify trends, patterns, and relevant investments is now possible thanks to technology. Users can better understand relationships, trends, and spatial context via GIS. Recently, mapping has become this technology's most significant role.

Global Geographic Information System (GIS) Tools Market size is expected to grow from USD 9.3 Billion in 2023 to USD 20.38 Billion by 2032, at a CAGR of 9.11% during the forecast period (2024-2032).