Global Data Warehouse as a Service Market Overview

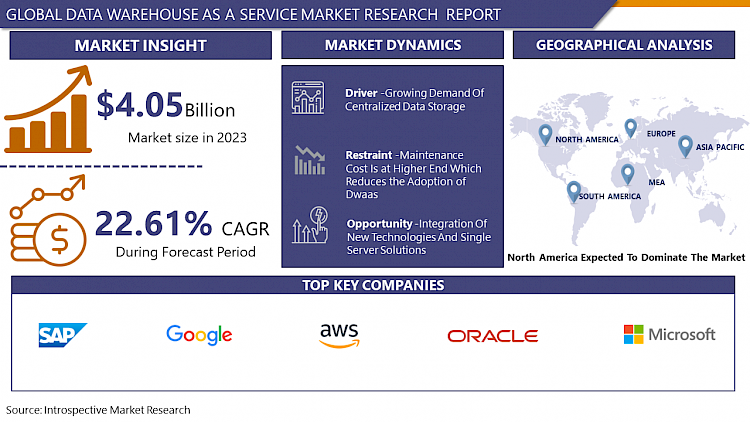

Data Warehouse as a Service Market Size Was Valued at USD 4.05 Billion In 2023, And Is Projected to Reach USD 25.36 Billion By 2032, Growing at A CAGR Of 22.61% From 2024-2032.

A subject-oriented, integrated, time-variant, and non-volatile data warehouse is a collection of information used to assist management in making decisions. A copy of transaction data that has been specially organised for query and analysis is called a data warehouse.

DWaaS stands for Data Warehouse as a Service, a method in which the customer provides data and pays for its management, while the provider handles the setup and maintenance of the necessary hardware and software resources for the data management system. The increase in the industry's profitability is due to the increased need for fast analytics and minimal delays, as well as the expanding importance of business intelligence in enterprise management. The increasing amount of organized and unorganized data produced in different sectors like BFSI, government, manufacturing, and more.

The development of different cutting-edge technologies like AI, cloud, and IoT is expected to provide significant growth prospects for these services. Having a data warehouse is essential for operating a business of any scale to make informed choices. It allows for a competitive edge. Data warehousing primarily focuses on data and its relationships, serving as the basis for Business Intelligence (BI). Cloud Computing has surfaced as a fresh approach for hosting and providing these services instantly via the internet. The market for data warehouse services has expanded dramatically over the years as crucial data storage has turned into a crucial component for big businesses that deal with a lot of data that needs to be accessible by the organisation. During the projected period, the market is anticipated to grow in key regions.

Market Dynamics And Factors For Data Warehouse as a Service Market

Drivers:

Growing Demand Of Centralized Data Storage

As DWaaS deployments offer flexibility and lower upfront costs when compared to classic data warehouses, they are expected to increase in the coming years. The expansion of the worldwide data warehouse-as-a-service market is predicted to be fuelled by the expanding importance of data analytics and business intelligence throughout enterprise management. For significant insights to be derived from the exponential development of statistics, best-in-class data analytics are required. Information wrangling, data analysis, and information storage are the three main components of business intelligence. The popularity of BI solutions is increasing as cloud technology is being embraced by more and more businesses. Many IT companies are inclined to provide data warehousing services considering the need of the market. For Instance, the most recent version of Yellowbrick Data's cloud data warehouse is introduced in the open market. Yellowbrick Data is a pioneer in distributed data cloud architecture for data warehousing. The elastic cloud-native data warehouse from Yellowbrick scales to meet the expanding organizational data needs which work both on-premises and in the cloud and provide a straightforward pricing structure with predictable prices. Moreover, data analytics and visualization are among the primary purposes of BI solutions. Global demand for DWaaS is predicted to be driven by the increased use of these BI solutions. Additionally, businesses are attempting to concentrate more on business operations than IT infrastructure due to the lucrative growth in data volumes and rising degrees of IT infrastructure complexity. DWaaS (Data warehouse as a service) demand will rise as a result of the increased attention on IT infrastructure. Additionally, the global industry is anticipated to benefit greatly from the rapid adoption of cloud data warehousing during the forecasted period.

Restraints:

Maintenance cost is at the higher end which reduces the adoption of DWaaS

A data warehouse may put additional work on departments, depending on the size of the organization. Typically, the IT teams in each business division must produce each sort of data that is required in the warehouse. This can be as easy as copying data from an existing database, but other times it requires obtaining new information from consumers or workers.

The cost/benefit analysis is one of data warehousing's frequently highlighted drawbacks. A data warehouse is a large IT project, and like many large IT projects, it can use a lot of IT man-hours and financial resources to provide a technology that isn't used frequently enough to be worthwhile. The cost of upkeep and updating the data warehouse as the company expands extracts additional costs which hamper the market growth.

Opportunity:

Integration Of New Technologies And Single Server Solutions

The user interface of a competent LCNC data integration platform is essentially graphical (GUI). By employing a drag and drop actions to connect smaller routines, the user can construct complex logic without having to laboriously type hundreds of lines of code. For instance, deduplication is created by combining a Rank component with a Filter component. The required code is produced by the LCNC platform itself. This significantly lowers the entry hurdle for non-technical data users. Citizen developers from all areas of the organization can start contributing right now. They can serve themselves and create the business logic in which they are the authorities. The "self-build" option is once more a choice rather than being forced to pick between outsourcing or purchasing expert assistance.

The big trend in Data is making all of the data available in one service. There are many ways to achieve this outcome. Data consolidation at a single point and large-scale serverless data warehouse technologies like Google’s BigQuery are capable of storing and serving an enterprise’s data needs as a single endpoint. Most likely users may already have so many data warehouses that consolidation is not an option and organizations have to explore the next generation of emerging data virtualization technologies that can present a single data service view into multiple data warehouses whether on-premise, in the cloud or any combination of the two.

Segmentation Analysis Of Data Warehouse as a Service Market

By Type, Enterprise Data Warehouse (EDW) segment dominates in the Data Warehouse as a Service Market. The amount of data that an organization will store will quickly increase as it expands. There may be circumstances when the data model needs to be modified in addition to the volume increase to account for various other attributes that need to be documented. Without having to completely rework the system, Enterprise Data Warehouses (EDW) are renowned for their flexibility and ability to easily handle any change in needs, such as the amount of data being stored or the data model. The majority of contemporary Enterprise Data Warehouses (EDW) enable simple connecting to a preferred Business Intelligence application. With the help of this seamless connectivity, businesses can quickly build and monitor a variety of Key Performance Indicators (KPIs) that can be used to assess how well they are accomplishing their main goals.

By Deployment, the public cloud is expected to dominate the Data Warehouse as a Service Market. The continual strategic actions of eminent firms, such as mergers and collaborations, can be responsible for this enormous market share. Additionally, it is projected that increasing expenditures in new remote working infrastructure will propel the segment's growth. Because it has the potential to increase business continuity and scalability while lowering operating costs, the hybrid cloud segment is anticipated to have rapid expansion in the global market over the forecast period. Over the next few years, it is anticipated that these advantages will fuel the segment's expansion.

By Application, Business Intelligence is expected to dominate the Data Warehouse as a Service Market. In business intelligence, data warehouses serve as the backbone of data storage. Business intelligence relies on complex queries and comparing multiple sets of data to inform everything from everyday decisions to organization-wide shifts in focus. To facilitate this, business intelligence is comprised of three overarching activities: data wrangling, data storage, and data analysis. Data wrangling is usually facilitated by extract, transform, and load (ETL) technologies. Amazon Web Services, Inc, company announced the general availability of three new serverless analytics offerings that make it even easier for customers to analyze vast amounts of data without having to configure, scale or manage the underlying infrastructure. In addition to other AWS serverless analytics services like AWS Glue for data integration and Amazon QuickSight for business intelligence.

Regional Analysis Of Data Warehouse as a Service Market

North America dominates the Data Warehouse as a Service Market. It is projected that the use of cutting-edge technologies like cloud data warehouse solutions, as well as mergers and acquisitions amongst illustrious organizations in the region, will propel the expansion of these services in the area. For instance, Snowflake and Next Pathway entered into a collaborative alliance in October 2019 to quicken the migration of old data warehouses to Snowflake. Additionally, the availability of cutting-edge data warehousing infrastructure in the area is anticipated to increase demand. Analytics solutions are quickly being adopted by businesses nationwide, especially in industries like retail, BFSI, healthcare, and others. The region's market is anticipated to increase as a result of the introduction of cloud solution providers and the rising demand for managing operational information.

The Asia Pacific is expected to grow significantly in the Data Warehouse as a Service Market. It is projected that the category would grow as a result of the expanding technology developments and investments across several verticals in developing nations like China and India. Furthermore, several significant participants in the worldwide market are expected to have serious worries due to the lower operational costs and improved productivity provided by businesses in the region. Businesses in the Asia Pacific area are putting more effort into enhancing customer service, which increases client retention. Also, The substantial adoption of data warehousing services by small and medium-sized organizations (SMEs) in an emerging market is one of the main drivers of market growth.

Top Key Players Covered In Data Warehouse as a Service Market

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- Action Corporation

- Amazon Web Services

- AtScale

- Hortonworks

- Mark Logic Corporation

- Micro Focus

- Netavis GmbH

- Teradata Corporation

- Veeva Systems Inc

Key Industry Development In The Data Warehouse as a Service Market

- In May 2023, Oracle announced new innovations to Oracle Autonomous Data Warehouse, the industry's first and only autonomous database powered by machine learning and optimized for analytics workloads. The innovations break through the propristaty and closed nature of traditional data warehouses and data lakes.

- In March 2023,SAP SE has announced key data innovations and partnerships that give customers access to mission-critical data, enabling faster time to insights and better business decision-making.

|

Global Data Warehouse as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.05 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.61% |

Market Size in 2032: |

USD 25.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Deployment

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Data Warehouse as a Service Market by Type

5.1 Data Warehouse as a Service Market Overview Snapshot and Growth Engine

5.2 Data Warehouse as a Service Market Overview

5.3 Enterprise Data Warehouse (EDW)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Enterprise Data Warehouse (EDW): Geographic Segmentation

5.4 Operational Data Store (ODS)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Operational Data Store (ODS): Geographic Segmentation

5.5 Data Mart

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Data Mart: Geographic Segmentation

Chapter 6: Data Warehouse as a Service Market by Deployment

6.1 Data Warehouse as a Service Market Overview Snapshot and Growth Engine

6.2 Data Warehouse as a Service Market Overview

6.3 Public

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Public: Geographic Segmentation

6.4 Private

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Private: Geographic Segmentation

6.5 Hybrid

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Hybrid: Geographic Segmentation

Chapter 7: Data Warehouse as a Service Market by Application

7.1 Data Warehouse as a Service Market Overview Snapshot and Growth Engine

7.2 Data Warehouse as a Service Market Overview

7.3 Business Intelligence

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Business Intelligence: Geographic Segmentation

7.4 Customer Analytics

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Customer Analytics: Geographic Segmentation

7.5 Data Modernization

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Data Modernization: Geographic Segmentation

7.6 Operational Analytics

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Operational Analytics: Geographic Segmentation

7.7 Predictive Analytics

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Predictive Analytics: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Data Warehouse as a Service Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Data Warehouse as a Service Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Data Warehouse as a Service Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ORACLE CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 SAP SE

8.4 GOOGLE

8.5 MICROSOFT CORPORATION

8.6 ACTIAN CORPORATION

8.7 AMAZON WEB SERVICES

8.8 ATSCALE

8.9 HORTONWORKS

8.10 MARK LOGIC CORPORATION

8.11 MICRO FOCUS

8.12 NETAVIS GMBH

8.13 TERADATA CORPORATION

8.14 VEEVA SYSTEMS INC

8.15 OTHER MAJOR PLAYERS

Chapter 9: Global Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Enterprise Data Warehouse (EDW)

9.2.2 Operational Data Store (ODS)

9.2.3 Data Mart

9.3 Historic and Forecasted Market Size By Deployment

9.3.1 Public

9.3.2 Private

9.3.3 Hybrid

9.4 Historic and Forecasted Market Size By Application

9.4.1 Business Intelligence

9.4.2 Customer Analytics

9.4.3 Data Modernization

9.4.4 Operational Analytics

9.4.5 Predictive Analytics

Chapter 10: North America Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Enterprise Data Warehouse (EDW)

10.4.2 Operational Data Store (ODS)

10.4.3 Data Mart

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 Public

10.5.2 Private

10.5.3 Hybrid

10.6 Historic and Forecasted Market Size By Application

10.6.1 Business Intelligence

10.6.2 Customer Analytics

10.6.3 Data Modernization

10.6.4 Operational Analytics

10.6.5 Predictive Analytics

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Enterprise Data Warehouse (EDW)

11.4.2 Operational Data Store (ODS)

11.4.3 Data Mart

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 Public

11.5.2 Private

11.5.3 Hybrid

11.6 Historic and Forecasted Market Size By Application

11.6.1 Business Intelligence

11.6.2 Customer Analytics

11.6.3 Data Modernization

11.6.4 Operational Analytics

11.6.5 Predictive Analytics

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Enterprise Data Warehouse (EDW)

12.4.2 Operational Data Store (ODS)

12.4.3 Data Mart

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 Public

12.5.2 Private

12.5.3 Hybrid

12.6 Historic and Forecasted Market Size By Application

12.6.1 Business Intelligence

12.6.2 Customer Analytics

12.6.3 Data Modernization

12.6.4 Operational Analytics

12.6.5 Predictive Analytics

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Enterprise Data Warehouse (EDW)

13.4.2 Operational Data Store (ODS)

13.4.3 Data Mart

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 Public

13.5.2 Private

13.5.3 Hybrid

13.6 Historic and Forecasted Market Size By Application

13.6.1 Business Intelligence

13.6.2 Customer Analytics

13.6.3 Data Modernization

13.6.4 Operational Analytics

13.6.5 Predictive Analytics

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Data Warehouse as a Service Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Enterprise Data Warehouse (EDW)

14.4.2 Operational Data Store (ODS)

14.4.3 Data Mart

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 Public

14.5.2 Private

14.5.3 Hybrid

14.6 Historic and Forecasted Market Size By Application

14.6.1 Business Intelligence

14.6.2 Customer Analytics

14.6.3 Data Modernization

14.6.4 Operational Analytics

14.6.5 Predictive Analytics

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Data Warehouse as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.05 Bn. |

|

Forecast Period 2024-32 CAGR: |

22.61% |

Market Size in 2032: |

USD 25.36 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DATA WAREHOUSE AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DATA WAREHOUSE AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DATA WAREHOUSE AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. DATA WAREHOUSE AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. DATA WAREHOUSE AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. DATA WAREHOUSE AS A SERVICE MARKET BY TYPE

TABLE 008. ENTERPRISE DATA WAREHOUSE (EDW) MARKET OVERVIEW (2016-2028)

TABLE 009. OPERATIONAL DATA STORE (ODS) MARKET OVERVIEW (2016-2028)

TABLE 010. DATA MART MARKET OVERVIEW (2016-2028)

TABLE 011. DATA WAREHOUSE AS A SERVICE MARKET BY DEPLOYMENT

TABLE 012. PUBLIC MARKET OVERVIEW (2016-2028)

TABLE 013. PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 014. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 015. DATA WAREHOUSE AS A SERVICE MARKET BY APPLICATION

TABLE 016. BUSINESS INTELLIGENCE MARKET OVERVIEW (2016-2028)

TABLE 017. CUSTOMER ANALYTICS MARKET OVERVIEW (2016-2028)

TABLE 018. DATA MODERNIZATION MARKET OVERVIEW (2016-2028)

TABLE 019. OPERATIONAL ANALYTICS MARKET OVERVIEW (2016-2028)

TABLE 020. PREDICTIVE ANALYTICS MARKET OVERVIEW (2016-2028)

TABLE 021. NORTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 022. NORTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 023. NORTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 024. N DATA WAREHOUSE AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 025. EUROPE DATA WAREHOUSE AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 026. EUROPE DATA WAREHOUSE AS A SERVICE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 027. EUROPE DATA WAREHOUSE AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 028. DATA WAREHOUSE AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC DATA WAREHOUSE AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 030. ASIA PACIFIC DATA WAREHOUSE AS A SERVICE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 031. ASIA PACIFIC DATA WAREHOUSE AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 032. DATA WAREHOUSE AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA DATA WAREHOUSE AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA DATA WAREHOUSE AS A SERVICE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA DATA WAREHOUSE AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 036. DATA WAREHOUSE AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 037. SOUTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 038. SOUTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY DEPLOYMENT (2016-2028)

TABLE 039. SOUTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 040. DATA WAREHOUSE AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 041. ORACLE CORPORATION: SNAPSHOT

TABLE 042. ORACLE CORPORATION: BUSINESS PERFORMANCE

TABLE 043. ORACLE CORPORATION: PRODUCT PORTFOLIO

TABLE 044. ORACLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. SAP SE: SNAPSHOT

TABLE 045. SAP SE: BUSINESS PERFORMANCE

TABLE 046. SAP SE: PRODUCT PORTFOLIO

TABLE 047. SAP SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. GOOGLE: SNAPSHOT

TABLE 048. GOOGLE: BUSINESS PERFORMANCE

TABLE 049. GOOGLE: PRODUCT PORTFOLIO

TABLE 050. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. MICROSOFT CORPORATION: SNAPSHOT

TABLE 051. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 052. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 053. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ACTIAN CORPORATION: SNAPSHOT

TABLE 054. ACTIAN CORPORATION: BUSINESS PERFORMANCE

TABLE 055. ACTIAN CORPORATION: PRODUCT PORTFOLIO

TABLE 056. ACTIAN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AMAZON WEB SERVICES: SNAPSHOT

TABLE 057. AMAZON WEB SERVICES: BUSINESS PERFORMANCE

TABLE 058. AMAZON WEB SERVICES: PRODUCT PORTFOLIO

TABLE 059. AMAZON WEB SERVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ATSCALE: SNAPSHOT

TABLE 060. ATSCALE: BUSINESS PERFORMANCE

TABLE 061. ATSCALE: PRODUCT PORTFOLIO

TABLE 062. ATSCALE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. HORTONWORKS: SNAPSHOT

TABLE 063. HORTONWORKS: BUSINESS PERFORMANCE

TABLE 064. HORTONWORKS: PRODUCT PORTFOLIO

TABLE 065. HORTONWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. MARK LOGIC CORPORATION: SNAPSHOT

TABLE 066. MARK LOGIC CORPORATION: BUSINESS PERFORMANCE

TABLE 067. MARK LOGIC CORPORATION: PRODUCT PORTFOLIO

TABLE 068. MARK LOGIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. MICRO FOCUS: SNAPSHOT

TABLE 069. MICRO FOCUS: BUSINESS PERFORMANCE

TABLE 070. MICRO FOCUS: PRODUCT PORTFOLIO

TABLE 071. MICRO FOCUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. NETAVIS GMBH: SNAPSHOT

TABLE 072. NETAVIS GMBH: BUSINESS PERFORMANCE

TABLE 073. NETAVIS GMBH: PRODUCT PORTFOLIO

TABLE 074. NETAVIS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. TERADATA CORPORATION: SNAPSHOT

TABLE 075. TERADATA CORPORATION: BUSINESS PERFORMANCE

TABLE 076. TERADATA CORPORATION: PRODUCT PORTFOLIO

TABLE 077. TERADATA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. VEEVA SYSTEMS INC: SNAPSHOT

TABLE 078. VEEVA SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 079. VEEVA SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 080. VEEVA SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 081. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 082. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 083. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. ENTERPRISE DATA WAREHOUSE (EDW) MARKET OVERVIEW (2016-2028)

FIGURE 013. OPERATIONAL DATA STORE (ODS) MARKET OVERVIEW (2016-2028)

FIGURE 014. DATA MART MARKET OVERVIEW (2016-2028)

FIGURE 015. DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY DEPLOYMENT

FIGURE 016. PUBLIC MARKET OVERVIEW (2016-2028)

FIGURE 017. PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 018. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 019. DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 020. BUSINESS INTELLIGENCE MARKET OVERVIEW (2016-2028)

FIGURE 021. CUSTOMER ANALYTICS MARKET OVERVIEW (2016-2028)

FIGURE 022. DATA MODERNIZATION MARKET OVERVIEW (2016-2028)

FIGURE 023. OPERATIONAL ANALYTICS MARKET OVERVIEW (2016-2028)

FIGURE 024. PREDICTIVE ANALYTICS MARKET OVERVIEW (2016-2028)

FIGURE 025. NORTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. EUROPE DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. ASIA PACIFIC DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. MIDDLE EAST & AFRICA DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. SOUTH AMERICA DATA WAREHOUSE AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Data Warehouse as a Service Market research report is 2023-2032.

Oracle Corporation, SAP SE, Google, Microsoft Corporation, Actian Corporation, Amazon Web Services, AtScale, Hortonworks, Mark Logic Corporation, Micro Focus, Netavis GmbH, Teradata Corporation, Veeva Systems Inc. and other major players.

The Data Warehouse as a Service Market is segmented into Type, Deployment, Application, and region. By Type, the market is categorized into Enterprise Data Warehouse (EDW), Operational Data Store (ODS), Data Mart. By Deployment, the market is categorized into Public, Private, Hybrid. By Application, the market is categorized into Business Intelligence, Customer Analytics, Data Modernization, Operational Analytics, Predictive Analytics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

In an outsourcing model known as data warehouse as a service (DWaaS), the customer supplies the data and pays for the managed service while a cloud service provider configures and manages the hardware and software resources needed for a data warehouse.

Data Warehouse as a Service Market Size Was Valued at USD 4.05 Billion In 2023, And Is Projected to Reach USD 25.36 Billion By 2032, Growing at A CAGR Of 22.61% From 2024-2032.