Hotel PMS Market Synopsis

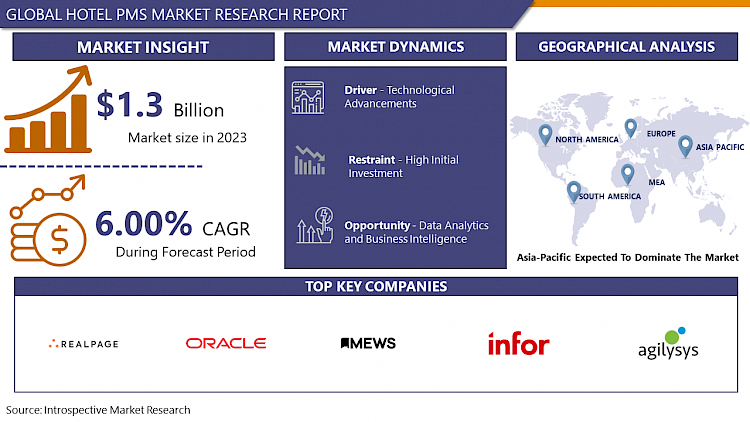

Hotel PMS Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 2.2 Billion by 2032, Growing at a CAGR of 6.00% From 2024-2032.

The Hotel Property Management System (PMS) market refers to the industry focused on software solutions designed to streamline and optimize the management of hotel operations. These systems typically encompass a range of functionalities, including reservation management, guest check-in and check-out, housekeeping coordination, billing, and invoicing, and often integrate with other hotel systems such as point-of-sale (POS) and customer relationship management (CRM). The PMS market caters to hotels of various sizes, from small boutique establishments to large chain resorts, offering customizable solutions tailored to meet the specific needs and preferences of each property. As technology continues to advance, the PMS market evolves to incorporate new features such as mobile accessibility, data analytics, and integration with emerging technologies like artificial intelligence and Internet of Things (IoT) devices, aiming to enhance operational efficiency and elevate the guest experience.

- The Hotel Property Management System (PMS) market is experiencing significant growth, driven by the increasing adoption of technology in the hospitality industry and the growing demand for streamlined operations.

- PMS solutions are becoming indispensable tools for hoteliers, enabling them to efficiently manage reservations, check-ins, check-outs, billing, and other essential tasks. Cloud-based PMS platforms are particularly gaining traction due to their flexibility, scalability, and cost-effectiveness.

- Moreover, the COVID-19 pandemic has accelerated the digital transformation in the hotel sector, as establishments seek contactless solutions to enhance guest safety and streamline operations.

- As a result, there is a surge in demand for PMS solutions that offer mobile check-in/out, online booking capabilities, and integration with other hotel systems. Key players in the market are continuously innovating to offer advanced features such as predictive analytics, artificial intelligence-driven automation, and personalized guest experiences.

- Overall, the Hotel PMS market is poised for continued growth as hotels increasingly recognize the strategic importance of technology in optimizing efficiency, enhancing guest satisfaction, and driving profitability.

Hotel PMS Market Trend Analysis

The Rise of Cloud-Based PMS Solutions in the Hospitality Industry

- The transition towards cloud-based Property Management Systems (PMS) within the hotel industry represents a fundamental shift driven by the pursuit of efficiency, adaptability, and guest satisfaction. Cloud technology offers an array of advantages over traditional on-premises systems, notably in terms of flexibility. Unlike legacy systems that require substantial hardware investments and manual updates, cloud-based PMS solutions operate on a subscription model, providing hoteliers with the flexibility to scale resources up or down according to demand.

- This scalability is particularly valuable in the hospitality sector, where seasonal fluctuations and unexpected events can significantly impact operational requirements. Moreover, cloud-based PMS platforms are designed to seamlessly integrate with other hotel technologies, enabling a cohesive ecosystem that enhances operational efficiency and guest experiences.

- Furthermore, the COVID-19 pandemic has accelerated the adoption of cloud-based PMS solutions by highlighting the importance of remote access and contactless interactions. With travel restrictions and safety concerns prompting changes in guest expectations and operational procedures, hoteliers have turned to cloud-based PMS platforms to adapt swiftly to evolving circumstances.

- Remote access capabilities allow hotel staff to manage reservations, check-ins, and other essential functions from any location with internet connectivity, minimizing physical contact and reducing the risk of virus transmission. This flexibility not only enhances safety protocols but also ensures business continuity during periods of uncertainty. As the hospitality industry continues to navigate the challenges posed by the pandemic and beyond, cloud-based PMS solutions are poised to remain a cornerstone of operational resilience and guest satisfaction.

The Impact of Advanced Analytics and AI in Hospitality Property Management Systems

- The integration of advanced analytics and AI-driven capabilities into Property Management Systems (PMS) marks a transformative shift in how hoteliers leverage data to enhance guest experiences and drive operational efficiency. By harnessing the wealth of information generated through guest interactions, booking patterns, and revenue streams, hoteliers can gain valuable insights into customer preferences and behaviors. Embedded data analytics tools within PMS platforms enable hoteliers to segment guests based on various criteria, such as demographics, booking history, and spending patterns, allowing for targeted marketing campaigns and personalized service offerings.

- Moreover, the incorporation of AI and machine learning algorithms into PMS platforms empowers hoteliers to optimize pricing strategies and revenue management tactics in real time. By analyzing historical data, market trends, and competitor pricing, AI-driven PMS solutions can dynamically adjust room rates and inventory availability to maximize revenue potential. Additionally, AI-powered recommendation engines can suggest upselling opportunities, such as room upgrades or ancillary services, based on individual guest profiles and preferences. This level of personalization not only enhances guest satisfaction but also drives incremental revenue for hoteliers.

- Furthermore, AI-driven PMS platforms streamline operational processes by automating routine tasks and identifying areas for improvement. Predictive analytics capabilities enable proactive maintenance of hotel facilities and equipment, reducing downtime and enhancing overall guest satisfaction. Additionally, AI-powered chatbots integrated into PMS platforms can handle routine guest inquiries and requests, freeing up staff to focus on delivering exceptional service. As hoteliers continue to prioritize data-driven decision-making and personalized guest experiences, the integration of advanced analytics and AI-driven capabilities into PMS platforms will play a pivotal role in shaping the future of the hospitality industry.

Hotel PMS Market Segment Analysis:

Hotel PMS Market Segmented based on Property Type, Property Size, and Deployment.

By Property Size, Large Enterprises segment is expected to dominate the market during the forecast period

- Large enterprises in the hospitality industry, particularly hotel chains and conglomerates, wield significant influence due to their vast resources, extensive networks, and established brand identities. These enterprises often operate multiple properties across various locations, allowing them to cater to a wide range of customer preferences and demographics. Their extensive reach enables them to penetrate both domestic and international markets, leveraging economies of scale to optimize operations and offer competitive pricing.

- Moreover, large enterprises benefit from their brand recognition, which fosters trust and loyalty among consumers. Travelers often gravitate towards familiar hotel chains or conglomerates due to the assurance of consistent quality standards, service excellence, and loyalty programs. This brand equity translates into a higher dominance share in the market as these enterprises attract a substantial portion of the customer base, capturing repeat business and attracting new customers through their marketing efforts and partnerships.

- Furthermore, the ability of large enterprises to invest in innovation and technology sets them apart from smaller competitors. They can afford to implement cutting-edge solutions for customer relationship management, revenue management, and operational efficiency. By leveraging advanced analytics and digital platforms, large enterprises can tailor personalized experiences for guests, optimize pricing strategies, and streamline processes to enhance overall guest satisfaction. This strategic advantage allows them to maintain and expand their dominance share in the hospitality industry, solidifying their position as market leaders.

By Property Type, Hotels and Resorts segment held the largest share in 2023

- Hotels and resorts represent the epitome of luxury and comfort in the hospitality industry, offering travelers a premium experience that transcends mere accommodation. These establishments are characterized by their exquisite design, opulent amenities, and impeccable service standards, catering to the discerning needs of affluent guests seeking a memorable stay. From lavish suites with panoramic views to world-class dining options and indulgent spa facilities, hotels and resorts spare no expense in providing an unparalleled level of luxury and sophistication.

- In popular tourist destinations or bustling urban centers, hotels and resorts often reign supreme, capturing the lion's share of the hospitality market. Their prime locations, coupled with extensive marketing efforts and renowned brand reputation, make them the preferred choice for travelers seeking a lavish getaway or a sophisticated city escape.

- Moreover, hotels and resorts play a pivotal role in driving tourism and economic growth in these regions, attracting visitors from far and wide and contributing significantly to local employment opportunities and revenue generation. As hubs of luxury and leisure, hotels and resorts stand as iconic landmarks, showcasing the epitome of hospitality excellence and serving as beacons of indulgence for travelers worldwide.

Hotel PMS Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region stands at the forefront of the global Hotel Property Management System (PMS) market, wielding its influence as a dominant force driven by several key factors. Chief among these is the unprecedented wave of urbanization sweeping across the region, leading to the rapid expansion of cities and the proliferation of commercial hubs. As urban centers burgeon, there emerges a parallel surge in tourism, fueled by both domestic and international travelers seeking diverse cultural experiences, business opportunities, and leisure pursuits.

- This burgeoning tourism sector acts as a catalyst for the exponential growth of the hospitality industry, propelling the construction of hotels, resorts, and accommodation facilities at a remarkable pace. The hospitality infrastructure landscape in countries like China, India, and various Southeast Asian nations is undergoing a dynamic transformation, with new properties springing up to meet the escalating demand for lodging options. This surge in hotel construction, coupled with the modernization of existing properties, underscores the pressing need for efficient and innovative management solutions, thus amplifying the demand for Hotel PMS systems.

- Cloud-based PMS solutions have emerged as the frontrunners in this dynamic landscape, gaining widespread acceptance and adoption across Asia-Pacific. The inherent advantages of cloud technology, including cost-effectiveness, scalability, and accessibility, resonate strongly with hospitality operators seeking to streamline their operations and enhance guest experiences. Furthermore, the flexibility offered by cloud-based PMS platforms enables hotels of all sizes to adapt and scale their technology infrastructure in response to fluctuating demand patterns and evolving market dynamics.

- As Asia-Pacific solidifies its position as a dominant force in the Hotel PMS market, fueled by rapid urbanization, burgeoning tourism, and technological advancements, the region presents a wealth of opportunities for PMS providers and hospitality stakeholders alike. By embracing innovation, customization, and scalability, the Asia-Pacific hospitality industry is poised to harness the transformative power of PMS solutions to drive operational efficiency, optimize revenue streams, and deliver unparalleled guest satisfaction in the years to come.

Active Key Players in the Hotel PMS Market

- Oracle Corporation

- Agilysys, Inc.

- Infor Equity Holdings LLC

- Mews Systems B.V.

- RealPage, Inc., and Other Key Players.

Key Industry Developments in the Hotel PMS Market:

- June 2023: saw the installation of Infor property management software at the Monaco Hotel in Dubai World Islands' Heart of Europe. The Monaco Hotel collects and makes use of integrated and comprehensive data through several touchpoints using Infor HMS. To improve the experience for guests staying at the 198-room hotel, Infor SCS sales and event management solutions as well as the Infor hospitality management solution (HMS) were implemented.

- June 2023: Oracle Hospitality Cloud and Worldline's Hospitality Suite have achieved Oracle Validated Integration, according to the announcement made by the global payments provider. With its new services, Worldline aims to enhance both the traveler and hotelier experience. The worldwide payment provider's decision makes it possible for Oracle OPERA Cloud PMS to incorporate several cloud-based payment methods.

|

Global Hotel PMS Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.00% |

Market Size in 2032: |

USD 2.2 Bn. |

|

Segments Covered: |

By Property Type |

|

|

|

By Property Size |

|

||

|

By Deployment |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HOTEL PMS MARKET BY PROPERTY TYPE (2017-2032)

- HOTEL PMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOTELS AND RESORTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOTELS AND LODGES

- HOMESTAY ACCOMMODATIONS

- SERVICE APARTMENTS

- OTHERS

- HOTEL PMS MARKET BY PROPERTY SIZE (2017-2032)

- HOTEL PMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL AND MEDIUM ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- HOTEL PMS MARKET BY DEPLOYMENT (2017-2032)

- HOTEL PMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- HOTEL PMS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ORACLE CORPORATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AGILYSYS, INC.

- INFOR EQUITY HOLDINGS LLC

- MEWS SYSTEMS B.V.

- REALPAGE, INC.

- COMPETITIVE LANDSCAPE

- GLOBAL HOTEL PMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Property Type

- Historic And Forecasted Market Size By Property Size

- Historic And Forecasted Market Size By Deployment

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Hotel PMS Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.00% |

Market Size in 2032: |

USD 2.2 Bn. |

|

Segments Covered: |

By Property Type |

|

|

|

By Property Size |

|

||

|

By Deployment |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HOTEL PMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HOTEL PMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HOTEL PMS MARKET COMPETITIVE RIVALRY

TABLE 005. HOTEL PMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HOTEL PMS MARKET THREAT OF SUBSTITUTES

TABLE 007. HOTEL PMS MARKET BY TYPE

TABLE 008. MOBILE AND CLOUD BASED MARKET OVERVIEW (2016-2028)

TABLE 009. ON PREMISE MARKET OVERVIEW (2016-2028)

TABLE 010. HOTEL PMS MARKET BY APPLICATION

TABLE 011. SMES MARKET OVERVIEW (2016-2028)

TABLE 012. LARGE ENTERPRISE MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA HOTEL PMS MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA HOTEL PMS MARKET, BY APPLICATION (2016-2028)

TABLE 015. N HOTEL PMS MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE HOTEL PMS MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE HOTEL PMS MARKET, BY APPLICATION (2016-2028)

TABLE 018. HOTEL PMS MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC HOTEL PMS MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC HOTEL PMS MARKET, BY APPLICATION (2016-2028)

TABLE 021. HOTEL PMS MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA HOTEL PMS MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA HOTEL PMS MARKET, BY APPLICATION (2016-2028)

TABLE 024. HOTEL PMS MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA HOTEL PMS MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA HOTEL PMS MARKET, BY APPLICATION (2016-2028)

TABLE 027. HOTEL PMS MARKET, BY COUNTRY (2016-2028)

TABLE 028. CLOUDBEDS: SNAPSHOT

TABLE 029. CLOUDBEDS: BUSINESS PERFORMANCE

TABLE 030. CLOUDBEDS: PRODUCT PORTFOLIO

TABLE 031. CLOUDBEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. GUESTY: SNAPSHOT

TABLE 032. GUESTY: BUSINESS PERFORMANCE

TABLE 033. GUESTY: PRODUCT PORTFOLIO

TABLE 034. GUESTY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. WEBREZPRO: SNAPSHOT

TABLE 035. WEBREZPRO: BUSINESS PERFORMANCE

TABLE 036. WEBREZPRO: PRODUCT PORTFOLIO

TABLE 037. WEBREZPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. NEWBOOK: SNAPSHOT

TABLE 038. NEWBOOK: BUSINESS PERFORMANCE

TABLE 039. NEWBOOK: PRODUCT PORTFOLIO

TABLE 040. NEWBOOK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. FRONTDESK ANYWHERE: SNAPSHOT

TABLE 041. FRONTDESK ANYWHERE: BUSINESS PERFORMANCE

TABLE 042. FRONTDESK ANYWHERE: PRODUCT PORTFOLIO

TABLE 043. FRONTDESK ANYWHERE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. FANTASTICSTAY: SNAPSHOT

TABLE 044. FANTASTICSTAY: BUSINESS PERFORMANCE

TABLE 045. FANTASTICSTAY: PRODUCT PORTFOLIO

TABLE 046. FANTASTICSTAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SEEKOM IBEX: SNAPSHOT

TABLE 047. SEEKOM IBEX: BUSINESS PERFORMANCE

TABLE 048. SEEKOM IBEX: PRODUCT PORTFOLIO

TABLE 049. SEEKOM IBEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KLOUDHOTELS: SNAPSHOT

TABLE 050. KLOUDHOTELS: BUSINESS PERFORMANCE

TABLE 051. KLOUDHOTELS: PRODUCT PORTFOLIO

TABLE 052. KLOUDHOTELS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. DJUBO: SNAPSHOT

TABLE 053. DJUBO: BUSINESS PERFORMANCE

TABLE 054. DJUBO: PRODUCT PORTFOLIO

TABLE 055. DJUBO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. REZWARE XP7: SNAPSHOT

TABLE 056. REZWARE XP7: BUSINESS PERFORMANCE

TABLE 057. REZWARE XP7: PRODUCT PORTFOLIO

TABLE 058. REZWARE XP7: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. FCS COSMOPMS: SNAPSHOT

TABLE 059. FCS COSMOPMS: BUSINESS PERFORMANCE

TABLE 060. FCS COSMOPMS: PRODUCT PORTFOLIO

TABLE 061. FCS COSMOPMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VREASY: SNAPSHOT

TABLE 062. VREASY: BUSINESS PERFORMANCE

TABLE 063. VREASY: PRODUCT PORTFOLIO

TABLE 064. VREASY: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HOTEL PMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HOTEL PMS MARKET OVERVIEW BY TYPE

FIGURE 012. MOBILE AND CLOUD BASED MARKET OVERVIEW (2016-2028)

FIGURE 013. ON PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 014. HOTEL PMS MARKET OVERVIEW BY APPLICATION

FIGURE 015. SMES MARKET OVERVIEW (2016-2028)

FIGURE 016. LARGE ENTERPRISE MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA HOTEL PMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE HOTEL PMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC HOTEL PMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA HOTEL PMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA HOTEL PMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Hotel PMS Market research report is 2024-2032.

Johnson Controls, Jonas Software, NEC Corporation, Protel hotel-software GmbH., Schneider Electric, Siemens AG, Oracle Corporation, Agilysys, Inc., Infor Equity Holdings LLC, Mews Systems B.V. and RealPage, Inc., and Other Major Players.

The Hotel PMS Market is segmented into By Property Type, By Property Size, By Deployment, and region. By Property Type, the market is categorized into Hotels and Resorts, Motels and Lodges, Homestay Accommodations, Service Apartments, and Others. By Property Size, the market is categorized into Small and Medium Enterprises and Large Enterprises. By Deployment, the market is categorized into On-premise and Cloud. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Hotel Property Management System (PMS) market refers to the industry focused on software solutions designed to streamline and optimize the management of hotel operations. These systems typically encompass a range of functionalities, including reservation management, guest check-in and check-out, housekeeping coordination, billing, and invoicing, and often integrate with other hotel systems such as point-of-sale (POS) and customer relationship management (CRM). The PMS market caters to hotels of various sizes, from small boutique establishments to large chain resorts, offering customizable solutions tailored to meet the specific needs and preferences of each property. As technology continues to advance, the PMS market evolves to incorporate new features such as mobile accessibility, data analytics, and integration with emerging technologies like artificial intelligence and Internet of Things (IoT) devices, aiming to enhance operational efficiency and elevate the guest experience.

Hotel PMS Market Size Was Valued at USD 1.3 Billion in 2023, and is Projected to Reach USD 2.2 Billion by 2032, Growing at a CAGR of 6.00% From 2024-2032.