Soft Starter Market Synopsis:

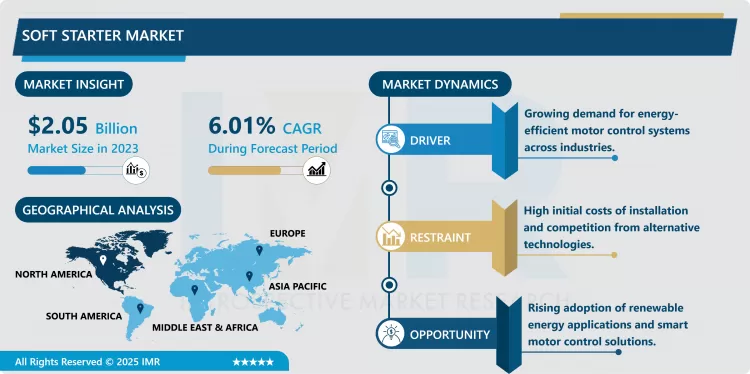

Soft Starter Market Size Was Valued at USD 2.05 Billion in 2023, and is Projected to Reach USD 3.47 Billion by 2032, Growing at a CAGR of 6.01 % From 2024-2032.

Soft Starter Market includes products used for measuring and managing the starting of electrical motors in order to minimize the surge current and mechanical forces. These devices afford a step-by-step increase in voltage that leads to easier motor control at start-up. Soft starters have found extensive application in industrial, commercial, and residential installations to minimize energy consumption, maximize product durability, and reduce fatigue in subject equipment.

soft starter market has progressed remarkably mainly because of growing industrial automation and demand for efficient motor control. Soft starters are increasingly being used in applications including oil & gas, manufacturing, mining, and water treatment because they allow precise control of motor activity and can lower costs. This has made them even more popular for enhancing system dependability and for cutting down on maintenance needs across various end-using sectors.

Moreover, increased levels of technology for Internet of Things and remote monitoring options have offered new sophisticated versions of the earlier standard soft starters, which has evolved the traditional soft starters into smart motor control systems. This has led to improved detection and prognosis of faults, prevention of downtime and direct integration into industrial system architectures. Nevertheless, the high initial cost charged to installation and the market competition prevailed by other technologies such as variable frequency drives (VFDs) act as constraints to the growth of the market. Nevertheless, the market is expanding year by year due to consumers’ continued interest in energy-saving and environmentally friendly materials.

Soft Starter Market Trend Analysis:

Increasing Integration of IoT in Soft Starters

- Another development that is emerging in the soft starter market is the connectivity of IoT with soft starters. With IoT integration, soft starters provide motors performance information in real-time, remote analysis, and schedule maintenance to improve efficiency and minimize failure incidences. These additional features are useful for getting practical information about the condition of a system and making early decisions about improvements for the sake of cost reduction.Original equipment manufacturers are working on creating smart soft starters integrated with mobile and even cloud solutions, in response to that Industry 4.0 trend. Technology based solutions have features that facilitate this trend, particularly within industrial environments, where performance and dependability matter.

Expanding Use in Renewable Energy Applications

- The increasing use of renewable power sources is the most compelling trend driving the soft starter market. Soft starters are very useful in wind and solar power where the control of motor performance as well as maintaining a smooth operation of the systems is very important. In the future, social development towards the application of clean energy will be even more concerned, thus promoting the application of soft starters in renewable energy industry.Various governments and organizations are increasing spending on renewable energy facilities resulting in a right climate for soft starter manufacturers.

Soft Starter Market Segment Analysis:

Soft Starter Market Segmented on the basis of voltage, application end user, and region.

By Voltage, Low Voltage segment is expected to dominate the market during the forecast period

- LV segment is expected to hold the largest market share in the soft starter market during the forecast period since they are commonly used in the commercial and industrial settings. Low voltage soft starters are also suitable for applications in small and medium-sized motors for the control of their electrical power requirements at lower costs.Their portable size, instant integration, and their capability to cut down energy usage makes them popular with different sectors. Driven by demand for HVAC, manufacturing, and water treatment industry, the low voltage segment is expected to have a high growth in the coming years.

By Application, Industrial segment expected to held the largest share

- The industrial segment is likely to hold the maximum market share in the soft starter market since it can be driven by the rising requirements of automation and motor control in manufacturing, oil & gas, mining, and power generation sectors. Soft starters are very essential in industries to enhance motor efficiency, to cut maintenance expenses and provide consistent operations.The use of electronic equipment to manage the flow of electricity demand is also on the rise, and this is pushing businesses to go for soft starters. Furthermore, the motor control systems required in sophisticated and durable industrial applications are driving the demand for the industrial segment.

Soft Starter Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to be the largest consumer of soft starter in the global market as a result of enhanced industrialization and increased use of efficient energy solutions. The region has involved modernization of old industrial equipment and installation of new superior motor control systems that increases demand for soft starter. AMENTOF of the United States of America is a leading company in this growth having the broad application across many industries including manufacturing, industrial gas and water industries.

- North American countries have embraced technology and R&D and thus the region stands out among competitors in the production of soft starters. Future growth of this regional market could be attributed to advancements that relate the ‘Internet of Things’ in conjunction with smart features of soft starters.

Active Key Players in the Soft Starter Market:

- ABB Ltd. (Switzerland)

- Carlo Gavazzi Holding AG (Switzerland)

- Danfoss A/S (Denmark)

- Eaton Corporation (USA)

- Fairford Electronics Ltd. (UK)

- Fuji Electric Co., Ltd. (Japan)

- General Electric Company (USA)

- Larsen & Toubro Limited (India)

- Mitsubishi Electric Corporation (Japan)

- Rockwell Automation, Inc. (USA)

- Schneider Electric SE (France)

- Siemens AG (Germany)

- Toshiba Corporation (Japan)

- Weg SA (Brazil)

- Yaskawa Electric Corporation (Japan)

- Other Active Players

|

Soft Starter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.05 Billion |

|

Forecast Period 2024-32 CAGR: |

6.01 % |

Market Size in 2032: |

USD 3.47 Billion |

|

Segments Covered: |

By Voltage |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Soft Starter Market by Voltage (2018-2032)

4.1 Soft Starter Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Low Voltage (up to 1000V)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Medium Voltage (1000-33000V)

4.5 High Voltage (over 33000V)

Chapter 5: Soft Starter Market by Application (2018-2032)

5.1 Soft Starter Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Residential

Chapter 6: Soft Starter Market by End User (2018-2032)

6.1 Soft Starter Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mining & Metal

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Food & Beverages

6.5 Energy & Power

6.6 Oil & Gas

6.7 Other

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Soft Starter Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANGELALIGN TECHNOLOGY INC. (CHINA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARRAIL GROUP (CHINA)

7.4 BEIJING BYBO DENTAL GROUP (CHINA)

7.5 CARESTREAM DENTAL (USA)

7.6 COLGATE-PALMOLIVE COMPANY (USA)

7.7 DANAHER CORPORATION (USA)

7.8 DENTSPLY SIRONA (USA)

7.9 FOSHAN ANLE DENTAL MATERIAL CO. LTD. (CHINA)

7.10 GC CORPORATION (JAPAN)

7.11 HENRY SCHEIN INC. (USA)

7.12 IVOCLAR VIVADENT AG (LIECHTENSTEIN)

7.13 NEW TOM (ITALY)

7.14 OSSTEM IMPLANT (SOUTH KOREA)

7.15 STRAUMANN GROUP (SWITZERLAND)

7.16 W&H DENTALWERK BÜRMOOS GMBH (AUSTRIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Soft Starter Market By Region

8.1 Overview

8.2. North America Soft Starter Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Voltage

8.2.4.1 Low Voltage (up to 1000V)

8.2.4.2 Medium Voltage (1000-33000V)

8.2.4.3 High Voltage (over 33000V)

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Industrial

8.2.5.2 Commercial

8.2.5.3 Residential

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Mining & Metal

8.2.6.2 Food & Beverages

8.2.6.3 Energy & Power

8.2.6.4 Oil & Gas

8.2.6.5 Other

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Soft Starter Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Voltage

8.3.4.1 Low Voltage (up to 1000V)

8.3.4.2 Medium Voltage (1000-33000V)

8.3.4.3 High Voltage (over 33000V)

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Industrial

8.3.5.2 Commercial

8.3.5.3 Residential

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Mining & Metal

8.3.6.2 Food & Beverages

8.3.6.3 Energy & Power

8.3.6.4 Oil & Gas

8.3.6.5 Other

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Soft Starter Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Voltage

8.4.4.1 Low Voltage (up to 1000V)

8.4.4.2 Medium Voltage (1000-33000V)

8.4.4.3 High Voltage (over 33000V)

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Industrial

8.4.5.2 Commercial

8.4.5.3 Residential

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Mining & Metal

8.4.6.2 Food & Beverages

8.4.6.3 Energy & Power

8.4.6.4 Oil & Gas

8.4.6.5 Other

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Soft Starter Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Voltage

8.5.4.1 Low Voltage (up to 1000V)

8.5.4.2 Medium Voltage (1000-33000V)

8.5.4.3 High Voltage (over 33000V)

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Industrial

8.5.5.2 Commercial

8.5.5.3 Residential

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Mining & Metal

8.5.6.2 Food & Beverages

8.5.6.3 Energy & Power

8.5.6.4 Oil & Gas

8.5.6.5 Other

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Soft Starter Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Voltage

8.6.4.1 Low Voltage (up to 1000V)

8.6.4.2 Medium Voltage (1000-33000V)

8.6.4.3 High Voltage (over 33000V)

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Industrial

8.6.5.2 Commercial

8.6.5.3 Residential

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Mining & Metal

8.6.6.2 Food & Beverages

8.6.6.3 Energy & Power

8.6.6.4 Oil & Gas

8.6.6.5 Other

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Soft Starter Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Voltage

8.7.4.1 Low Voltage (up to 1000V)

8.7.4.2 Medium Voltage (1000-33000V)

8.7.4.3 High Voltage (over 33000V)

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Industrial

8.7.5.2 Commercial

8.7.5.3 Residential

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Mining & Metal

8.7.6.2 Food & Beverages

8.7.6.3 Energy & Power

8.7.6.4 Oil & Gas

8.7.6.5 Other

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Soft Starter Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.05 Billion |

|

Forecast Period 2024-32 CAGR: |

6.01 % |

Market Size in 2032: |

USD 3.47 Billion |

|

Segments Covered: |

By Voltage |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||