Smart Water Management Market Synopsis

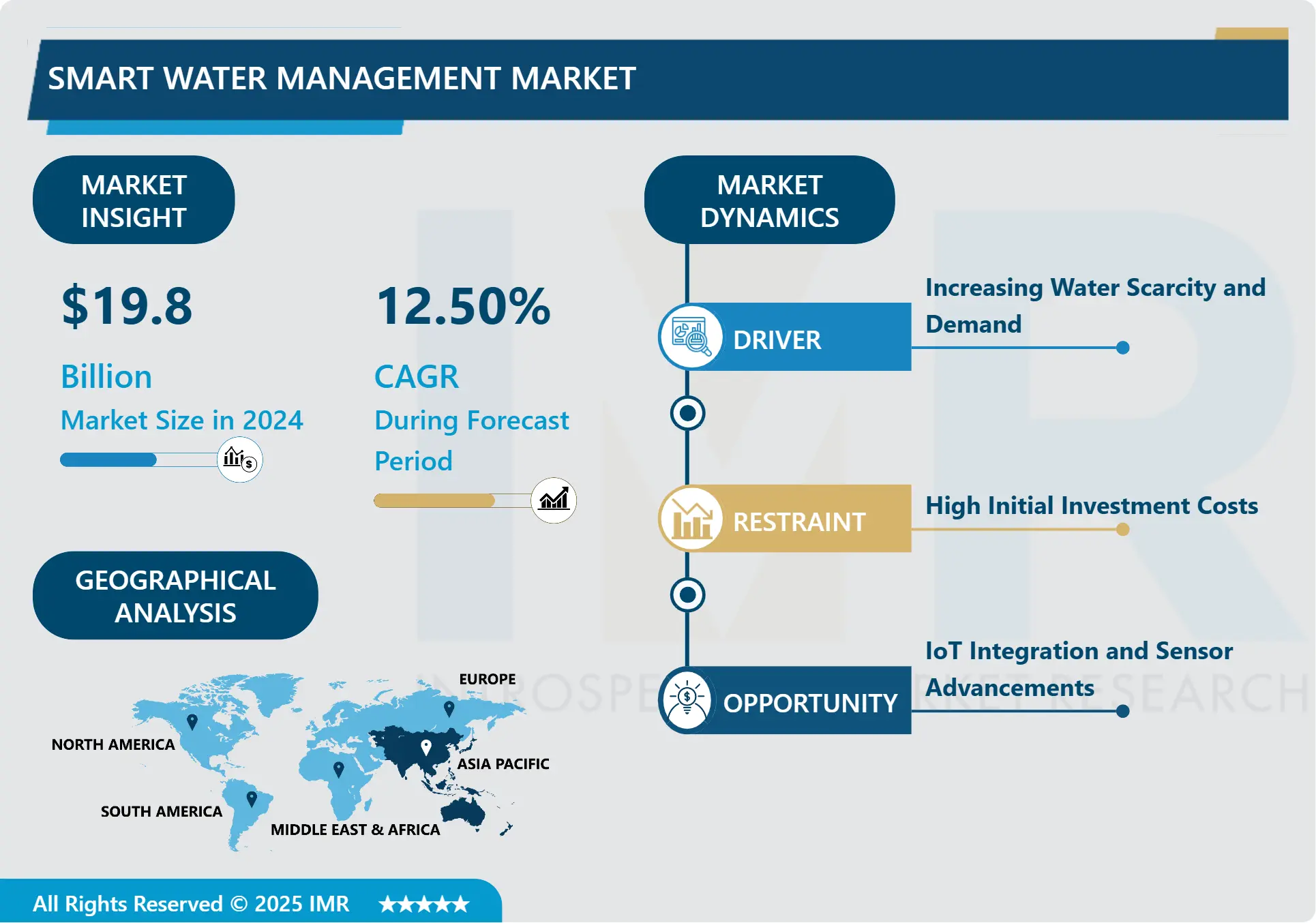

Smart Water Management Market Size Was Valued at USD 19.8 Billion in 2024 and is Projected to Reach USD 50.80 Billion by 2032, Growing at a CAGR of 12.50% From 2025-2032.

SWM is the process of optimizing and controlling the consumption of water using state-of-art technologies including the IoT and big data. It seeks to manage the usage of water with an emphasis on the efficient use of water along with the management of water supply and utilization in a manner that does not compromise its supply in the future. SWM contributes to issues affecting water supply, pipe age, and its effect on managing, offering a solution to, and improving the water supply situation.

The market for smart water management is steadily advancing due to growing problems with water shortage, deteriorating pipelines, and shifting towards water efficiency. Smart water management can be defined as the process of applying innovative technologies based on data to control water supply and demand and improve the efficiency of water usage. Development of this market is envisaged to help solve challenges facing the world’s water supply while covering areas such as residential, commercial, industrial, and municipal needs.

Among the key factors that help to define the outlook for the smart water management market, the most significant is the concern with the water resources and their demanded scarcity. The United Nations has estimated that around 2. Over 2 billion consumers today do not have access to basic water supply services which are safely managed and therefore the need to enhancing better systems of water management. Also, climate change and increasing population density in mega cities have led to increased levels of water stress, making the governments and organizations to register their interest in smart water technologies.

Advancements in technology is also considered as one of the drivers for the growth in smart water management market. Smart technologies like IoT devices, AMI, and data analytics are empowering the management of water networks in real-time at lower costs. These technologies help the utilities in leak identification, pressure control, and primary pipeline assessment, which in return helps in minimizing the water wastage and operating expenses. For example, smart meters offers accurate and timely information on the use of water to both the utilities and customers to enhance rational use of water.

There are many cases of smart water management being implemented in different fields to solve particular issues. In the municipal sector, SCW are applied with purpose to assist the utilities in better management of the water distribution network. The efficient detection of leaks as well as other incidences that may lead to NRW can help municipalities to address issues of lost water and propel service delivery for the dwelling units. In industries, the smart water management solutions help in the efficient managing of water usage in production activities and hence the minimization of water use and wastage.

There is also a huge investment in smart water management technologies being carried out in the residential sector. It is well-known that many smart home systems come incorporated with IoT product s which allow the identification of water usage patterns as well as leakage, which makes it possible to avoid insufficient water bills and other related inconveniences. Also with rising conscious consumption, water consumers are seeking to lead a more sustainable lifestyle by opting for efficient water consumption thus a call for smart water solutions.

Nonetheless the smart water management is experiencing a high growth potential it is faced with several challenges. Therefore, high initial expense and financial difficulties remain as barriers to the implementation of modern water management solutions, especially in areas of the third world. Furthermore, getting new technologies standardised also means integrating this new infrastructure with the existing one, thus often demanding special technical services. Data protection issues are also an issue because the smart water systems yield large volume of data that require protection.

But in fact all these difficulties are the starting point for the creation of new solutions and partnerships. Concerned governments and other players in the private markets need to come up with financing strategies and motivation for the use of smart water technologies. Also, new inventions in the field of artificial intelligence (AI) and machine learning allow improving the functions of smart water management systems and their effectiveness. Strategic partnership between the technology suppliers, utilities, and the research establishments can help to facilitate the evolution of new technologies and knowledge on how to integrate the SMWT effectively.

Smart water management market has a great potential as more technological developments are expected to be made in the near future, thus, people’s consciousness on water shortages and their effects. Expectations regarding governments across the globe put pressure on them to introduce measures that would help manage the water resource optimally. New investment in smart water infrastructure may grow due to the necessity improving the current water networks and to face the water scarcity problems.

Therefore, the smart water management market is expected to step up to the agenda of water sustainability and efficient management. Smart water management is one of the respectful progressive technologies which may contribute into solving the global water issues, optimization of the water supply and demand, and SD. Thus, the market will remain rather portentous for advancement and partnership, which will help develop the concept of a water-secure world in the future.

Smart Water Management Market Trend Analysis

Smart Water Management Market Growth Driver- Growing Focus on Sustainable Water Solutions

- The smart water management market is thus experiencing quite a rapid growth especially due to a global push towards finding better sustainable water solutions. This increased attention is mainly attributable to increased concerns specifically; water shortage, aspects of water age and the requirements for optimum utilization and preservation of water. The governments and organizations across the globe are spending a significantly high amount of money and effort in developing the IoT, AI, and data analytics for efficient distribution of water, minimizing wastage, and the conservation of water. A variety of smart equipments including smart meters, sensors, and automation systems are being installed into homes and facilities for timely read and manage water usage, identify leakage and enhance the quality of water supply. These technologies also help in carrying out predictive maintenance as well as making data-driven decisions to increase efficiency by a large extent thereby cutting down operation costs.

- Besides, legal requirements and initiatives toward sustainable use of resources are making utilities and industries implement smart water management solutions. There are other market drivers which include; awareness of the public and the shift towards green infrastructure and smart cities. Therefore, the smart water management is expected to grow at a rapid pace because the stakeholders have started focusing on effective, efficient, and sustainable solutions for water problems.

Smart Water Management Market Opportunity- IoT Integration and Sensor Advancements

- The smart water management is rapidly growing due to IoT developments and sensors’ usage in this field. IoT is all about bringing in coordination across different devices and systems and getting real time assessment of water resources. Sensors are very useful as they help in surveying the usage pattern of water, detecting leakage, quality of the water, and even the prevailing environmental conditions. It is then used to predict and therefore control water supply, minimize wastewater, and also improve its utilization.

- Some trends are related to cloud computing and AI in data processing, which enhances decision-making and operations as well. Local and central administrations are focusing more and more on the development of smart water infrastructure to deal with water deficit and to meet strict benchmarks. Due to the increasing need for efficient water management all over the world, market for smart water management is expected to grow further with the support of continuous incorporation of new technologies in this area..

Smart Water Management Market Segment Analysis:

Smart Water Management Market Segmented based on Technology ,Offering,Application and End-User.

By Technology, Smart Irrigation Management Systemssegment is expected to dominate the market during the forecast period

- The knowledge concerning the market of Smart Water Management is progressive due to several initiatives in the shape of key technologies.Supervisory Control and Data Acquisition (SCADA), . AMI gives more capacities to water utility through the metering data of water consumed by the consumers at their door steps in real time. GIS is indeed useful in spatial and asset management and assists in the effective identification of water distribution network and some of the necessary maintenance activities. The Application of Enterprise Resource Planning (ERP) acts as a driving force that unites organizational elements where utilities of water work from billing to the inventory.

- Through the use of technology that includes computerised equipment monitoring, Efficient Agricultural Water Use through well timed and optimal watering saves water. A Mobile Workforce Management enables the field teams to access relevant information and tools on matters regarding work and tasks in real time, facilitating better operational productivity and response. All together these technologies advance innovation in the Smart Water Management sector in a sustainable, resilient, and cost-effective manner in the management of water resources internationally.

By Application , Water Quality Management segment held the largest share in 2024

- Smart Water Management Market is categorized by its applications such as; water resources management, water distribution, water meters management, water quality, leak detection, advanced pressure management and others. Every of the applications is significant in managing water and making the utilization of water to be efficient and sustainable in cities and the industries. In water resource management application, solutions are aimed at the further monitoring of the given water supplies and their proper utilization. Smart technologies are wired into water distribution systems around the world to ensure that the flow of water is regulated in a way that leads to minimal loss as well as enhanced distribution. You are briefly describing water meter management where smart meters are used for billing and consumption, along with the identification of leakage, making revenues more manageable and customers happier.

- The water quality entails management of water through sensors and data that checks on the water’s quality to reach set standards for safe use. IOT and AI based leak detection systems are used to automatically identify the leak areas and losses and prevent damage to infrastructure. Some of the latest technologies applied savings pressure management systems control the pressure at any point in water distribution networks and hence saves energy and imposes more durability to the water systems. Some other applications are in the flood measurement, wastewaters and environment measurement and hence facilitating complete water management solutions. These applications of IoT, AI, and cloud computing are the key factors that are propelling the smart water management market as they offer efficient solutions for water and scarcity, problems related to ageing water infrastructures, and compliance to regulations across the world.

Smart Water Management Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Smart Water Management market is expected to have healthy growth in future, meanwhile, Asia Pacific will play a decisive role in it throughout the forecast period. The following factors might be used in explaining this region’s projected dominance: * Rapid urbanization coupled with the rising industrialization and population pressure which exerts pressure on water resources for this region. Currently, there has been an upsurge of governments and municipalities especially in the Asia Pacific Region incorporating smart technologies in endeavors that relate to water such as supply and water quality, and irrigation.

- Due to large-scale infrastructural development and projects envisaged for improving water system management, countries like China, India, and Japan are at the frontier. Also, IoT and cloud solutions for real-time monitoring and analytics have been a key factor in the growth of this market in the region. Owing to the increasing water shortage, smart water management is likely to emerge as one of the most crucial fields, and Asia Pacific is expected to be in the driver’s seat in adopting new technologies for efficient water use.

Active Key Players in the Smart Water Management Market

- IBM Corporation (USA)

- Neptune Technology (USA)

- Siemens AG (Germany)

- Itron (USA)

- Schneider Electric SE (France)

- ABB Ltd (Switzerland)

- Suez (France)

- Ketos (USA)

- Oracle Corporation (USA)

- Honeywell International Inc. (USA)

- Trimble Inc. (USA)

- Xenius (USA)

- Badger Meter (USA)

- Hydropoint (USA)

- Landis+Gyr (Switzerland)

- Takadu (Israel)

- Ayyeka (Israel), Other Active Players

|

Global Smart Water Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.80 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.50% |

Market Size in 2032: |

USD 50.80 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Offering |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Water Management Market by Technology (2018-2032)

4.1 Smart Water Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Supervisory Control and Data Acquisition (SCADA)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Advanced Metering Infrastructure (AMI)

4.5 Geographic Information System (GIS)

4.6 Enterprise Resource Planning (ERP)

4.7 Smart Irrigation Management Systems

4.8 Mobile Workforce Management

4.9 Others

Chapter 5: Smart Water Management Market by Offering (2018-2032)

5.1 Smart Water Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

5.5 Services

Chapter 6: Smart Water Management Market by Application (2018-2032)

6.1 Smart Water Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Water Resource Management

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Water Distribution

6.5 Water Meter Management

6.6 Water Quality Management

6.7 Leak Detection

6.8 Advanced Pressure Management

6.9 Others

Chapter 7: Smart Water Management Market by End-User (2018-2032)

7.1 Smart Water Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

7.6 Agriculture

7.7 Utility

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smart Water Management Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM CORPORATION (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NEPTUNE TECHNOLOGY (USA)

8.4 SIEMENS AG (GERMANY)

8.5 ITRON (USA)

8.6 SCHNEIDER ELECTRIC SE (FRANCE)

8.7 ABB LTD (SWITZERLAND)

8.8 SUEZ (FRANCE)

8.9 KETOS (USA)

8.10 ORACLE CORPORATION (USA)

8.11 HONEYWELL INTERNATIONAL INC. (USA)

8.12 TRIMBLE INC. (USA)

8.13 XENIUS (USA)

8.14 BADGER METER (USA)

8.15 HYDROPOINT (USA)

8.16 LANDIS+GYR (SWITZERLAND)

8.17 TAKADU (ISRAEL)

8.18 AYYEKA (ISRAEL)

8.19 OTHER KEY PLAYERS

Chapter 9: Global Smart Water Management Market By Region

9.1 Overview

9.2. North America Smart Water Management Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Technology

9.2.4.1 Supervisory Control and Data Acquisition (SCADA)

9.2.4.2 Advanced Metering Infrastructure (AMI)

9.2.4.3 Geographic Information System (GIS)

9.2.4.4 Enterprise Resource Planning (ERP)

9.2.4.5 Smart Irrigation Management Systems

9.2.4.6 Mobile Workforce Management

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size by Offering

9.2.5.1 Hardware

9.2.5.2 Software

9.2.5.3 Services

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Water Resource Management

9.2.6.2 Water Distribution

9.2.6.3 Water Meter Management

9.2.6.4 Water Quality Management

9.2.6.5 Leak Detection

9.2.6.6 Advanced Pressure Management

9.2.6.7 Others

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.7.4 Agriculture

9.2.7.5 Utility

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Smart Water Management Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Technology

9.3.4.1 Supervisory Control and Data Acquisition (SCADA)

9.3.4.2 Advanced Metering Infrastructure (AMI)

9.3.4.3 Geographic Information System (GIS)

9.3.4.4 Enterprise Resource Planning (ERP)

9.3.4.5 Smart Irrigation Management Systems

9.3.4.6 Mobile Workforce Management

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size by Offering

9.3.5.1 Hardware

9.3.5.2 Software

9.3.5.3 Services

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Water Resource Management

9.3.6.2 Water Distribution

9.3.6.3 Water Meter Management

9.3.6.4 Water Quality Management

9.3.6.5 Leak Detection

9.3.6.6 Advanced Pressure Management

9.3.6.7 Others

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.7.4 Agriculture

9.3.7.5 Utility

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Smart Water Management Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Technology

9.4.4.1 Supervisory Control and Data Acquisition (SCADA)

9.4.4.2 Advanced Metering Infrastructure (AMI)

9.4.4.3 Geographic Information System (GIS)

9.4.4.4 Enterprise Resource Planning (ERP)

9.4.4.5 Smart Irrigation Management Systems

9.4.4.6 Mobile Workforce Management

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size by Offering

9.4.5.1 Hardware

9.4.5.2 Software

9.4.5.3 Services

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Water Resource Management

9.4.6.2 Water Distribution

9.4.6.3 Water Meter Management

9.4.6.4 Water Quality Management

9.4.6.5 Leak Detection

9.4.6.6 Advanced Pressure Management

9.4.6.7 Others

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.7.4 Agriculture

9.4.7.5 Utility

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Smart Water Management Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Technology

9.5.4.1 Supervisory Control and Data Acquisition (SCADA)

9.5.4.2 Advanced Metering Infrastructure (AMI)

9.5.4.3 Geographic Information System (GIS)

9.5.4.4 Enterprise Resource Planning (ERP)

9.5.4.5 Smart Irrigation Management Systems

9.5.4.6 Mobile Workforce Management

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size by Offering

9.5.5.1 Hardware

9.5.5.2 Software

9.5.5.3 Services

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Water Resource Management

9.5.6.2 Water Distribution

9.5.6.3 Water Meter Management

9.5.6.4 Water Quality Management

9.5.6.5 Leak Detection

9.5.6.6 Advanced Pressure Management

9.5.6.7 Others

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.7.4 Agriculture

9.5.7.5 Utility

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Smart Water Management Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Technology

9.6.4.1 Supervisory Control and Data Acquisition (SCADA)

9.6.4.2 Advanced Metering Infrastructure (AMI)

9.6.4.3 Geographic Information System (GIS)

9.6.4.4 Enterprise Resource Planning (ERP)

9.6.4.5 Smart Irrigation Management Systems

9.6.4.6 Mobile Workforce Management

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size by Offering

9.6.5.1 Hardware

9.6.5.2 Software

9.6.5.3 Services

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Water Resource Management

9.6.6.2 Water Distribution

9.6.6.3 Water Meter Management

9.6.6.4 Water Quality Management

9.6.6.5 Leak Detection

9.6.6.6 Advanced Pressure Management

9.6.6.7 Others

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.7.4 Agriculture

9.6.7.5 Utility

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Smart Water Management Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Technology

9.7.4.1 Supervisory Control and Data Acquisition (SCADA)

9.7.4.2 Advanced Metering Infrastructure (AMI)

9.7.4.3 Geographic Information System (GIS)

9.7.4.4 Enterprise Resource Planning (ERP)

9.7.4.5 Smart Irrigation Management Systems

9.7.4.6 Mobile Workforce Management

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size by Offering

9.7.5.1 Hardware

9.7.5.2 Software

9.7.5.3 Services

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Water Resource Management

9.7.6.2 Water Distribution

9.7.6.3 Water Meter Management

9.7.6.4 Water Quality Management

9.7.6.5 Leak Detection

9.7.6.6 Advanced Pressure Management

9.7.6.7 Others

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.7.4 Agriculture

9.7.7.5 Utility

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Smart Water Management Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 19.80 Bn. |

|

Forecast Period 2025-32 CAGR: |

12.50% |

Market Size in 2032: |

USD 50.80 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Offering |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||