Smart Elevator Market Synopsis

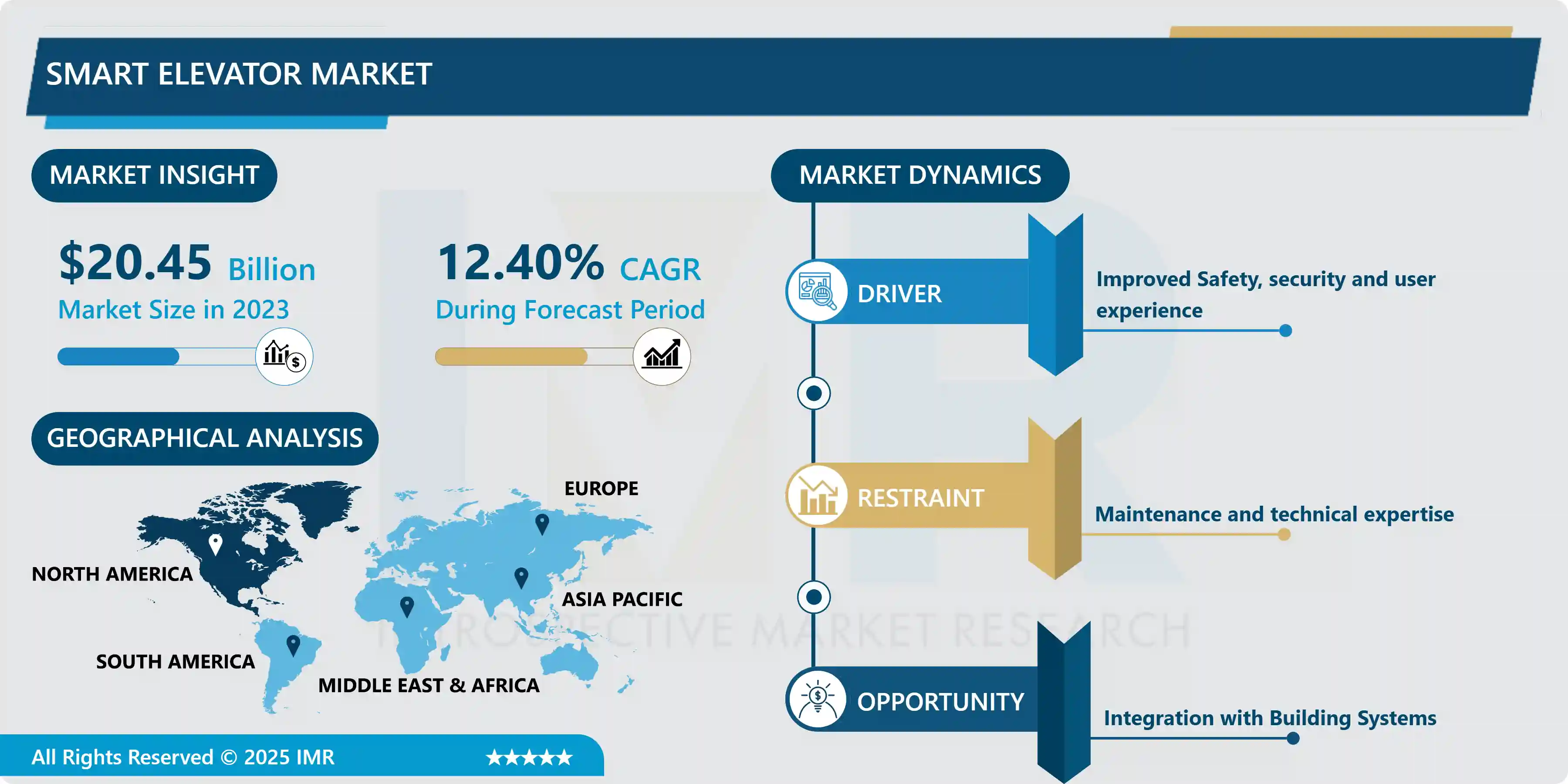

Smart Elevator Market Size Was Valued at USD 20.45 Billion in 2023, and is Projected to Reach USD 58.56 Billion by 2032, Growing at a CAGR of 12.40% From 2024-2032.

A smart elevator is an elevator equipped with advanced technologies such as sensors, connectivity, and automation to improve efficiency, safety, and user experience. These elevators can optimize operations, reduce energy consumption, enhance security, and provide personalized services through features like predictive maintenance, destination dispatching, and touchless controls.

Smart elevators, also known as intelligent elevators, are designed to optimize efficiency, convenience, and safety. They use algorithms to optimize routes based on user demand, time of day, and building traffic patterns, reducing wait times. They also have destination control systems that allow users to input their destination floor before entering the elevator, assigning them to the most appropriate car. Smart elevators also incorporate energy-saving features like regenerative drives and sensors to conserve energy. They can schedule maintenance proactively, minimizing downtime and reducing the risk of unexpected breakdowns.

Access control features like card readers or biometric scanners restrict access to authorized individuals, and they can integrate with building security systems for enhanced safety. They can communicate with building management systems, allowing for centralized control and optimization of operations. They also enhance tenant experience with personalized greetings, destination settings, and real-time updates. They also provide data analytics for building owners and managers, ensuring safety during evacuation procedures or power outages. Building managers can remotely monitor and control smart elevators using dedicated software platforms or mobile apps.

Smart elevators utilize advanced algorithms and sensors to optimize elevator operation, reducing wait times and energy consumption. They improve efficiency in high-traffic buildings by managing traffic flow intelligently. Safety features like emergency communication systems, fire detection sensors, and predictive maintenance capabilities ensure passenger safety. User experience is enhanced with destination control systems, touchless interfaces, and personalized services.

Smart elevators contribute to sustainability by optimizing energy usage and reducing carbon emissions. Data analytics help optimize performance, predict maintenance needs, and identify usage trends. Integration with building systems like access control, security, and automation systems enhances operational efficiency and security. Smart elevators are future-proof, adapting to evolving needs and requirements with upgradable software and connectivity features.

Smart Elevator Market Trend Analysis

Improved Safety, Security and User Experience

- Smart elevators are innovative elevator systems that use advanced safety features to enhance passenger protection and reduce the risk of accidents. These include real-time monitoring, emergency response systems, predictive maintenance, access control, surveillance systems, and integration with building security systems. Real-time data allows for early detection of potential malfunctions or hazards, while emergency communication systems enable passengers to quickly summon help in case of emergencies.

- Smart elevators also use data analytics and predictive algorithms to anticipate maintenance needs before they lead to safety issues, reducing the risk of unexpected breakdowns and accidents. Access control restricts access to specific floors or areas based on user credentials, while surveillance systems monitor passenger activity to deter vandalism, theft, or other criminal activities. Smart elevators offer a more efficient and user-friendly solution for enhancing passenger safety and convenience.

- Integrated with building security systems allows for centralized monitoring and control of access points, alarms, and emergency response procedures. The overall passenger experience is improved by faster and more efficient transportation, personalized services based on passenger preferences, and enhanced comfort and convenience. By incorporating advanced safety features, enhancing user experience, and integrating with building security systems, smart elevators provide a safer and more efficient way for passengers to travel.

Restraint

Maintenance and technical expertise

- Smart elevators are a technology that has been gaining popularity due to their advanced features and advanced technology. However, there are several factors that may hinder their adoption, implementation, or performance. These include the high initial investment required, the complexity of the technology, compatibility issues, potential cyber threats, and regulatory compliance.

- To ensure optimal performance and reliability, smart elevators require regular maintenance, technical support, training, remote monitoring, and continuous improvement. Regular inspections, testing, and preventive maintenance are essential to identify potential issues before they escalate into costly problems or downtime. Access to skilled technicians or engineers is also necessary for troubleshooting and optimizing system performance.

- Training is also crucial for elevator maintenance personnel and building staff to effectively operate and maintain smart elevator systems. Remote monitoring, often enabled by IoT sensors and connectivity, allows for proactive maintenance and real-time problem resolution, minimizing downtime and improving efficiency.

Opportunity

Integration with Building Systems

- Smart elevators offer numerous benefits for building systems, including energy efficiency, traffic management, maintenance optimization, security enhancement, user experience enhancement, emergency response, and data analytics.

- By integrating with building management systems, they can optimize energy consumption based on occupancy, time of day, and other factors, reducing energy waste and operating costs. They can also anticipate and manage traffic flow, reducing wait times and improving overall efficiency.

- Furthermore, they can monitor performance in real-time, identifying potential issues before they occur, reducing downtime and maintenance costs. Integration with building access control systems restricts access to sensitive areas based on user credentials, enhancing security.

- Smart elevators can provide real-time updates on weather and traffic conditions, ensuring a safe and orderly evacuation. Data analytics from smart elevators can inform decision-making processes, leading to more efficient operations and improved tenant satisfaction.

Challenge

Power Outages and Backup Systems

- Smart elevators face challenges due to power outages, as they rely heavily on electricity for efficient operation. These disruptions can cause inconvenience for passengers and safety concerns. However, the failure of electronic components, sensors, and communication systems during a power outage can lead to elevator downtime.

- In emergency situations, such as fires or earthquakes, timely evacuation is critical. To address these issues, smart elevator systems often incorporate backup power solutions such as Uninterruptible Power Supply (UPS), Emergency Rescue Systems, and Energy Storage Systems. UPS systems provide temporary power, while emergency rescue systems activate during power outages.

- Energy storage systems store energy during normal operation and provide backup power during outages. Implementing robust backup systems ensures continuity of service and enhances passenger safety, but their effectiveness depends on factors like maintenance, monitoring, and the duration of the outage.

Smart Elevator Market Segment Analysis:

Smart Elevator Market Segmented based on type, component, and application.

By Type, Passenger segment is expected to dominate the market during the forecast period

- Rapid urbanization worldwide is increasing the demand for high-rise buildings, making smart elevators essential for efficient transport. These elevators focus on safety, efficiency, and user experience, integrating advanced technologies like destination control systems, predictive maintenance, and real-time monitoring. They also offer enhanced user experiences through touchscreen interfaces, destination dispatch systems, and personalized settings.

- Energy-efficient technologies like regenerative drives, LED lighting, and standby modes are in high demand, reducing energy consumption and environmental impact. Smart elevators can integrate with smart building systems, enabling remote monitoring, data analytics, and predictive maintenance. The demand for smart elevators is growing in emerging economies, where modernizing infrastructure is essential for urban populations.

- Technological advancements like machine learning algorithms, artificial intelligence, and IoT sensors drive innovation in the passenger elevator segment. Government regulations and industry standards mandate safe and efficient elevator systems, making smart elevators preferred by building developers and owners.

By Application, Commercial segment held the largest share of 48.9% in 2023

- Smart elevator systems are increasingly being adopted in commercial buildings due to their potential to improve efficiency, reduce waiting times, and enhance user experience. These systems offer features like predictive maintenance, destination dispatching, and energy optimization, reducing operating costs and ensuring safety and security.

- They can be customized to meet specific needs, such as high-speed elevators for skyscrapers or wheelchair-accessible elevators for healthcare facilities. They are also scalable, allowing owners to expand or upgrade their systems as needed. Smart elevators can integrate seamlessly with other building management systems, enhancing overall building efficiency, sustainability, and tenant comfort.

- The growing trend towards smart buildings and IoT solutions has led to increased adoption of smart elevator systems in commercial properties, as building owners and developers recognize the benefits of integrating smart technologies to optimize performance, enhance tenant satisfaction, and future-proof their investments.

Smart Elevator Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, known for its technological advancements, is at the forefront of the smart elevator market. The region's densely populated urban centers with high-rise buildings drive the adoption of smart elevator systems to improve traffic flow, enhance user experience, and optimize building operations. North America's stringent building regulations and safety standards make smart elevator systems attractive for building owners and developers.

- The growing emphasis on energy efficiency and sustainability in North America, driven by environmental concerns and regulatory initiatives, drives the adoption of smart elevator systems. Urbanization and infrastructure development projects in North America create opportunities for smart elevator systems in new construction and retrofit projects. The robust construction industry in North America supports the construction of new commercial, residential, and institutional buildings, driving demand for efficient vertical transportation solutions.

- North America is an early adopter of smart building technologies, including IoT solutions, building automation systems, and integrated building management platforms. This combination of technological leadership, urbanization trends, regulatory requirements, sustainability initiatives, and strong construction activity positions North America as a key market for smart elevators, driving its dominance in the global market.

Smart Elevator Market Top Key Players:

- Otis Elevator Company (USA)

- Savaria Corporation (Canada)

- Delta Elevator Co. Ltd. (Canada)

- Thyssenkrupp Elevator AG (Germany)

- Schmersal Group (Germany)

- Wittur Group (Italy)

- Aritco Group (Sweden)

- Schindler Group (Switzerland)

- KONE Corporation (Finland)

- Shanghai Mitsubishi Elevator Co., Ltd. (China)

- Canny Elevator Co., Ltd. (China)

- SJEC Corporation (China)

- Express Lift Co., Ltd. (China)

- Suzhou Shenlong Elevator Co., Ltd. (China)

- Ningbo Xinda Group Co., Ltd. (China)

- Shenyang Brilliant Elevator Co., Ltd. (China)

- GiantKONE Elevator Co., Ltd. (China)

- Guangzhou Guangri Elevator Industry Co., Ltd. (China)

- Hyundai Elevator (China) Co., Ltd. (China)

- Hitachi Elevator (China) Co., Ltd. (China)

- Mitsubishi Electric Corporation (Japan)

- Fujitec Co., Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Elevator and Building Systems Corporation (Japan)

- Hyundai Elevator Co., Ltd. (South Korea), and other major players

Key Industry Developments in the Smart Elevator Market

- In September 2024, Otis Elevator Company (Taiwan) Limited announced the completion of its acquisition of Jardine Schindler Lifts Limited in Taiwan from the Jardine Schindler Group. As a subsidiary of Otis Worldwide Corporation, the world’s leading company in elevator and escalator manufacturing, installation, and service, Otis Taiwan acquired Jardine Schindler’s elevator and escalator business, which employed approximately 200 individuals across its four branches in Taiwan.

- In August 2024, Schindler Olayan secured the contract for The Avenues – Riyadh project in Saudi Arabia. The company was set to provide a total of 293 elevators, escalators, and moving walks for phase one of the new multi-purpose development, which covered an area of over 1.8 million square meters in the Saudi Arabian capital.

|

Global Smart Elevator Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

20.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.40% |

Market Size in 2032: |

58.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Elevators Market by Type (2018-2032)

4.1 Smart Elevators Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passenger

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Freight

4.5 Fire-proof

Chapter 5: Smart Elevators Market by Component (2018-2032)

5.1 Smart Elevators Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Maintenance System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 ControlSystem

5.5 CommunicationSystem

Chapter 6: Smart Elevators Market by Application (2018-2032)

6.1 Smart Elevators Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial

6.5 Industrial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Smart Elevators Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMAZON (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 WHOLE FOODS MARKET (US)

7.4 MEIJER (US)

7.5 WALMART (US)

7.6 INSTACART (US)

7.7 SHIPT (US)

7.8 FRESHDIRECT (US)

7.9 KROGER (US)

7.10 LIDL (GERMANY)

7.11 EDEKA GROUP (GERMANY)

7.12 REWE GROUP (GERMANY)

7.13 TESCO PLC (UK)

7.14 OCADO GROUP (UK)

7.15 SAINSBURY'S (UK)

7.16 ASDA (UK)

7.17 CARREFOUR (FRANCE)

7.18 AHOLD DELHAIZE (NETHERLANDS)

7.19 ALIBABA GROUP (CHINA)

7.20 JD.COM (CHINA)

7.21 BIGBASKET (INDIA)

7.22 RELIANCE RETAIL (INDIA)

7.23 RAKUTEN (JAPAN)

7.24 COLES GROUP (AUSTRALIA)

7.25 WOOLWORTHS GROUP (AUSTRALIA)

7.26

Chapter 8: Global Smart Elevators Market By Region

8.1 Overview

8.2. North America Smart Elevators Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Passenger

8.2.4.2 Freight

8.2.4.3 Fire-proof

8.2.5 Historic and Forecasted Market Size by Component

8.2.5.1 Maintenance System

8.2.5.2 ControlSystem

8.2.5.3 CommunicationSystem

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Residential

8.2.6.2 Commercial

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Smart Elevators Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Passenger

8.3.4.2 Freight

8.3.4.3 Fire-proof

8.3.5 Historic and Forecasted Market Size by Component

8.3.5.1 Maintenance System

8.3.5.2 ControlSystem

8.3.5.3 CommunicationSystem

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Residential

8.3.6.2 Commercial

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Smart Elevators Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Passenger

8.4.4.2 Freight

8.4.4.3 Fire-proof

8.4.5 Historic and Forecasted Market Size by Component

8.4.5.1 Maintenance System

8.4.5.2 ControlSystem

8.4.5.3 CommunicationSystem

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Residential

8.4.6.2 Commercial

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Smart Elevators Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Passenger

8.5.4.2 Freight

8.5.4.3 Fire-proof

8.5.5 Historic and Forecasted Market Size by Component

8.5.5.1 Maintenance System

8.5.5.2 ControlSystem

8.5.5.3 CommunicationSystem

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Residential

8.5.6.2 Commercial

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Smart Elevators Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Passenger

8.6.4.2 Freight

8.6.4.3 Fire-proof

8.6.5 Historic and Forecasted Market Size by Component

8.6.5.1 Maintenance System

8.6.5.2 ControlSystem

8.6.5.3 CommunicationSystem

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Residential

8.6.6.2 Commercial

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Smart Elevators Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Passenger

8.7.4.2 Freight

8.7.4.3 Fire-proof

8.7.5 Historic and Forecasted Market Size by Component

8.7.5.1 Maintenance System

8.7.5.2 ControlSystem

8.7.5.3 CommunicationSystem

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Residential

8.7.6.2 Commercial

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Smart Elevator Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

20.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.40% |

Market Size in 2032: |

58.56 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||