Small Molecule Drug Discovery Market Synopsis:

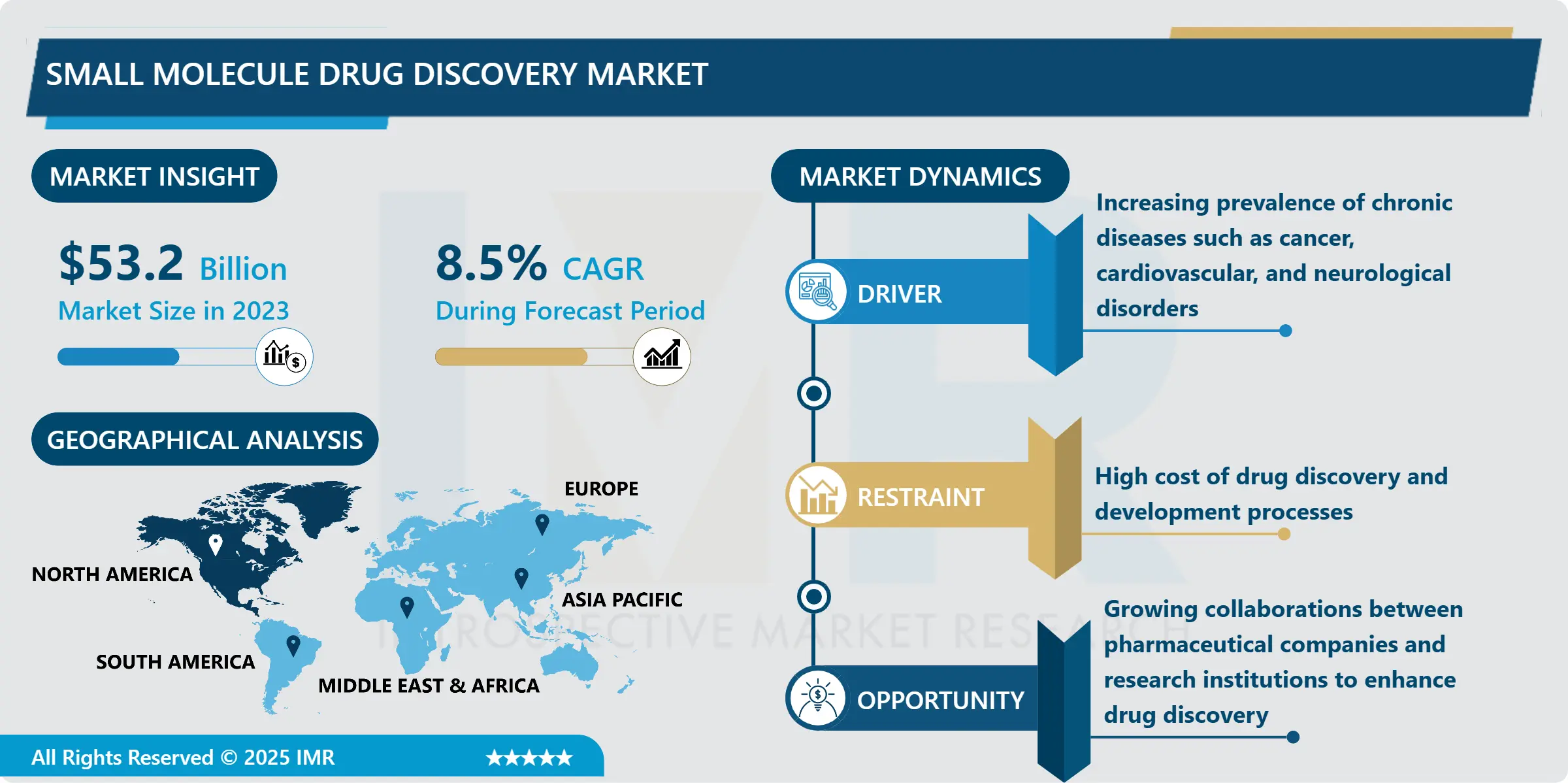

Small Molecule Drug Discovery Market Size Was Valued at USD 53.2 Billion in 2023, and is Projected to Reach USD 110.9 Billion by 2032, Growing at a CAGR of 8.5% From 2024-2032.

Small Molecule Drug Discovery Market is looked as the synthesis and marketing of small molecules, that are, chemical compounds having molecular weight lesser than 900 Daltons. These molecules can readily cross cell membranes to get to intracellular objectives and are therefore ideal for use with regard to certain proteins or enzymes within a body. Small molecules can be built for virtually all diseases such as cancer, cardiovascular diseases, neurological disorders, and others that are infectious in nature. In the market it shift to the discovery process, which entails identification, optimization and preclinical evaluation of these drugs in order to assess their safety and effectiveness prior to commencement of actual clinical trials.

The small molecule drug discovery is growing at rapid pace with the rise in the need for drugs for various diseases. Smaller molecular drugs remain important to the modern pharmacology because, despite the emerging importance of biologics, they are usually smaller use range, cost-effective to produce and can interact with an array of targets. Innovations in the field of genomics, proteomics and molecular biology have improved the ability to taste various new small thicken agents to cure those diseases in which there are no cure. Additionally, this culture of precision medicine in the pharmaceutical industry is improving the generation of small molecules that are selective for certain pathways reducing adverse effects and improving on patient outcomes.

Furthermore, a rise in long-term illnesses including cancer and diabetes, and neurological disorders has increased the demand for new small molecule drugs. Multinational firms and research organizations are putting tremendous efforts to look for new compounds targeting the new molecular action sites. There is a growing demand for this mainly because the government and the relevant regulatory bodies are encouraging developers to fast-track drug approval for therapies that cater for unmet patient needs. Therefore, the market is expected to register considerable future growth especially with several potential contenders already in the final stage of the clinical process.

Small Molecule Drug Discovery Market Trend Analysis:

Precision Medicine Driving Small Molecule Drug Discovery

- Precision medicine is one of the emerging trends that played a significant role in changing the Small Molecule Drug Discovery Market. Precision medicine aims at individualized treatments based on features of patient’s genetic profile and disease biomarkers. Small molecules are appropriate for precision medicine because they can be designed to hit a protein or a process linked to a disease when used. Other factors that are helping to arrive at more accurate small molecule drugs include the progress in computational drug design, structure-based drug discovery and the use of AI and ML. This is due to anticipate that the above trend will greatly transform drug discovery process and bring about well-effective therapeutic solution with minimal side effects and greatly enhanced patient benefits.

Increasing Collaborations and Partnerships

- Strategic partnerships between leading solid molecule producers, research universities and bio technology enterprises are proven to offer a massive growth potential for the Small Molecule Drug Discovery Market. These collaborations allow one to share resources, knowledge and exclusive technologies that make the process of drug discovery to be fast. Also, the contract research organizations (CROs) are coming up with an important role of outsourcing R & D services and enabling specialty pharmaceuticals to optimize the smaller molecule screen and resultant optimization methods. As different organizations have acknowledged open innovation models along with cross-industry partnerships, they are able to decrease development expenses and threats as well as launch new drugs faster. This situation leads to the best of both worlds for all parties that engage in drug discovery.

Small Molecule Drug Discovery Market Segment Analysis:

Small Molecule Drug Discovery Market is Segmented on the basis of Drug Type, Technology, end user, and region.

By Drug Type, Small Molecule Drugs segment is expected to dominate the market during the forecast period

- Depending on the drugs, the small molecule drugs segment is expected to maintain its position in the leading one during the given period due to high effectiveness and applicability for the treatment of various diseases. Small molecules share significant advantages with other drugs in terms of production costs and manner of administration, making it possible to deliver therapies that can reach the target patients. There are many small molecule drugs today and new breakthroughs in medicinal chemistry are still pushing through new drug candidates ranging across many diseases of significant medical need. Small molecules have a specific edge over biologics owing to them being able to enter the cells and modulate intracellular signals while most biologics target outside the cell. Epidemiological trends toward more cases of cancers and cardiac diseases will continue to propel small molecule drug sales and market share.

By Technology, High Throughput Screening segment expected to held the largest share

- Based on technology, High Throughput Screening (HTS) is identified to dominate the Small Molecule Drug Discovery market. Schroeder and both posit that in terms of speed and efficiency, HTS is a significant tool in the initial stages of drug discovery even though it is a potent technology for screening firm libraries of compounds. By employing HTS, initial compounds that are able to bind to particular biological interactants can be quickly determined, thus increasing the speed with which a target drug can be found. It also progresses in automation, robotics, and data analysis have improved the prospects of HTS, where millions of compounds can be screened in a short time. It not only saves valuable time and money in early ADME/TOX drug discovery, and also improves the chances of finding more drug leads.

Small Molecule Drug Discovery Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America accounted for the largest share in Small Molecule Drug Discovery Market, because of its well-developed pharmaceutical industry, solid research capabilities and favourable policies. Among these regions the United States holds the largest market share due to its profound improve technology, large number of clinical trials, and investment on biotechnology. The dominance of the region can also be explained by reference to the presence of leading players in the pharmaceutical industry, government encouragement for innovation, and high consumption on health services. Furthermore, with the emerging technologies like the AI-based drug discovery and precision medicine or theranostics, North America has cemented its position as a world leader in this segment.

Active Key Players in the Small Molecule Drug Discovery Market:

- AbbVie (USA)

- Amgen (USA)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Boehringer Ingelheim (Germany)

- Bristol-Myers Squibb (USA)

- Eli Lilly (USA)

- GlaxoSmithKline (UK)

- Johnson & Johnson (USA)

- Merck & Co. (USA)

- Novartis (Switzerland)

- Pfizer (USA)

- Roche (Switzerland)

- Sanofi (France)

- Takeda Pharmaceutical (Japan)

- Other Active Players

|

Small Molecule Drug Discovery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 110.9 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Small Molecule Drug Discovery Market by Drug Type

4.1 Small Molecule Drug Discovery Market Snapshot and Growth Engine

4.2 Small Molecule Drug Discovery Market Overview

4.3 Small Molecule Drugs

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Small Molecule Drugs: Geographic Segmentation Analysis

4.4 Biologic Drugs

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Biologic Drugs: Geographic Segmentation Analysis

Chapter 5: Small Molecule Drug Discovery Market by Technology

5.1 Small Molecule Drug Discovery Market Snapshot and Growth Engine

5.2 Small Molecule Drug Discovery Market Overview

5.3 High Throughput Screening

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 High Throughput Screening: Geographic Segmentation Analysis

5.4 Pharmacogenomics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Pharmacogenomics: Geographic Segmentation Analysis

5.5 Combinatorial Chemistry

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Combinatorial Chemistry: Geographic Segmentation Analysis

5.6 Nanotechnology

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Nanotechnology: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Small Molecule Drug Discovery Market by End User

6.1 Small Molecule Drug Discovery Market Snapshot and Growth Engine

6.2 Small Molecule Drug Discovery Market Overview

6.3 High Throughput Pharmaceutical Companies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 High Throughput Pharmaceutical Companies: Geographic Segmentation Analysis

6.4 Contract Research Organizations

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Contract Research Organizations: Geographic Segmentation Analysis

6.5 Others)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Small Molecule Drug Discovery Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PFIZER

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NOVARTIS

7.4 ROCHE

7.5 BRISTOL-MYERS SQUIBB

7.6 AND MERCK & CO

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Small Molecule Drug Discovery Market By Region

8.1 Overview

8.2. North America Small Molecule Drug Discovery Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Drug Type

8.2.4.1 Small Molecule Drugs

8.2.4.2 Biologic Drugs

8.2.5 Historic and Forecasted Market Size By Technology

8.2.5.1 High Throughput Screening

8.2.5.2 Pharmacogenomics

8.2.5.3 Combinatorial Chemistry

8.2.5.4 Nanotechnology

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 High Throughput Pharmaceutical Companies

8.2.6.2 Contract Research Organizations

8.2.6.3 Others)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Small Molecule Drug Discovery Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Drug Type

8.3.4.1 Small Molecule Drugs

8.3.4.2 Biologic Drugs

8.3.5 Historic and Forecasted Market Size By Technology

8.3.5.1 High Throughput Screening

8.3.5.2 Pharmacogenomics

8.3.5.3 Combinatorial Chemistry

8.3.5.4 Nanotechnology

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 High Throughput Pharmaceutical Companies

8.3.6.2 Contract Research Organizations

8.3.6.3 Others)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Small Molecule Drug Discovery Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Drug Type

8.4.4.1 Small Molecule Drugs

8.4.4.2 Biologic Drugs

8.4.5 Historic and Forecasted Market Size By Technology

8.4.5.1 High Throughput Screening

8.4.5.2 Pharmacogenomics

8.4.5.3 Combinatorial Chemistry

8.4.5.4 Nanotechnology

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 High Throughput Pharmaceutical Companies

8.4.6.2 Contract Research Organizations

8.4.6.3 Others)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Small Molecule Drug Discovery Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Drug Type

8.5.4.1 Small Molecule Drugs

8.5.4.2 Biologic Drugs

8.5.5 Historic and Forecasted Market Size By Technology

8.5.5.1 High Throughput Screening

8.5.5.2 Pharmacogenomics

8.5.5.3 Combinatorial Chemistry

8.5.5.4 Nanotechnology

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 High Throughput Pharmaceutical Companies

8.5.6.2 Contract Research Organizations

8.5.6.3 Others)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Small Molecule Drug Discovery Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Drug Type

8.6.4.1 Small Molecule Drugs

8.6.4.2 Biologic Drugs

8.6.5 Historic and Forecasted Market Size By Technology

8.6.5.1 High Throughput Screening

8.6.5.2 Pharmacogenomics

8.6.5.3 Combinatorial Chemistry

8.6.5.4 Nanotechnology

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 High Throughput Pharmaceutical Companies

8.6.6.2 Contract Research Organizations

8.6.6.3 Others)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Small Molecule Drug Discovery Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Drug Type

8.7.4.1 Small Molecule Drugs

8.7.4.2 Biologic Drugs

8.7.5 Historic and Forecasted Market Size By Technology

8.7.5.1 High Throughput Screening

8.7.5.2 Pharmacogenomics

8.7.5.3 Combinatorial Chemistry

8.7.5.4 Nanotechnology

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 High Throughput Pharmaceutical Companies

8.7.6.2 Contract Research Organizations

8.7.6.3 Others)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Small Molecule Drug Discovery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.2 Billion |

|

Forecast Period 2024-32 CAGR: |

8.5% |

Market Size in 2032: |

USD 110.9 Billion |

|

Segments Covered: |

By Drug Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||