Secure Logistics Market Synopsis:

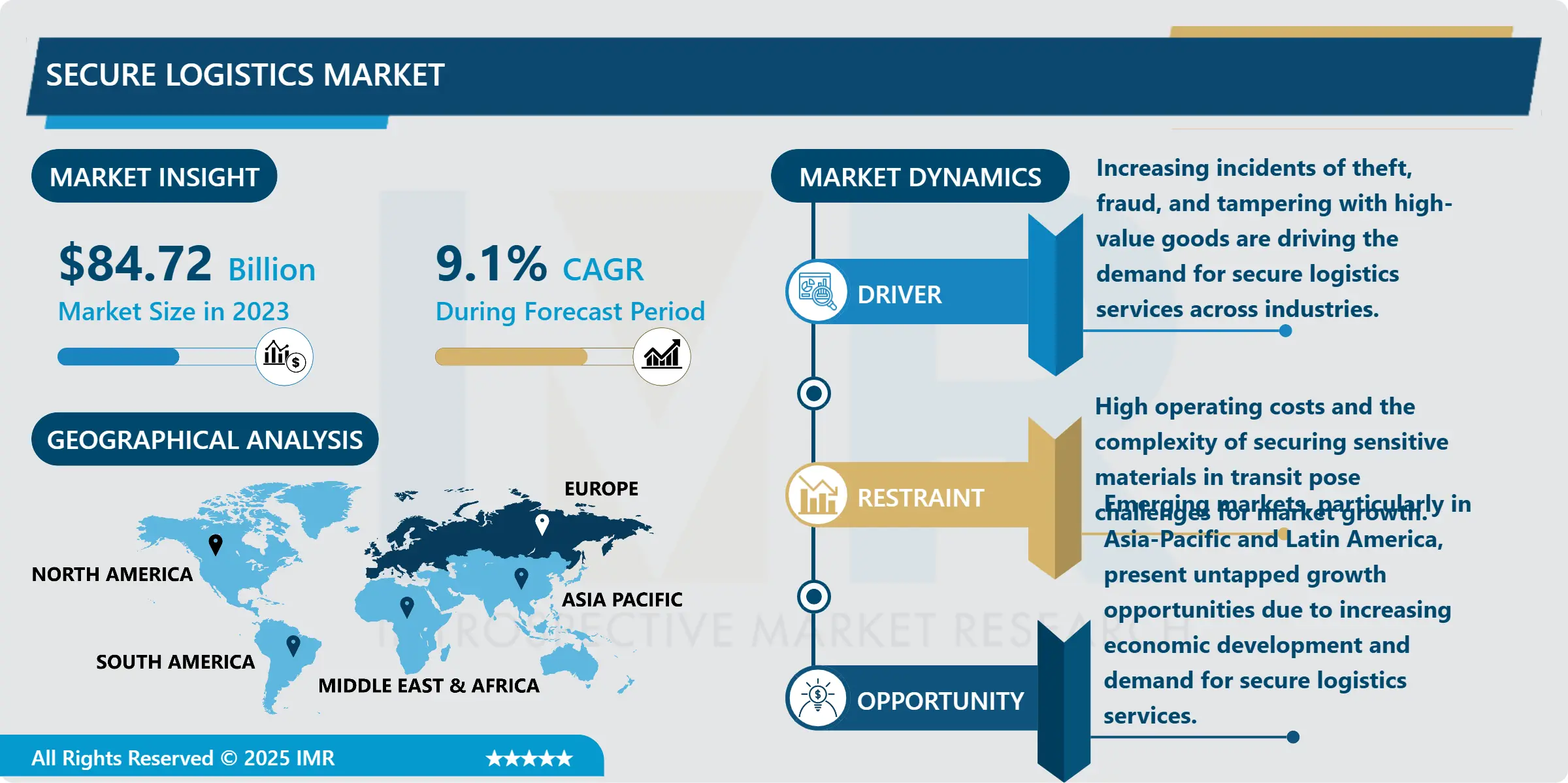

Secure Logistics Market Size Was Valued at USD 84.72 Billion in 2023, and is Projected to Reach USD 185.53 Billion by 2032, Growing at a CAGR of 9.1 % From 2024-2032.

The Secure Logistics market can be defined as the segment that deals with the transport, storage, and delivery of valuable goods, Cash, sensitive material in a secure manner. This market covers a spectrum of different services, ranging from armored car transportation, cash handling and secure storage services all the way to services designed to ensure that no tampering or theft occurs with valuables or other items that are easily damaged. As the demand for safety and security in supply chain services grows around the world will require more secure solutions to logistics services across the fields of banking, retail and e-commerce, as well as various government departments. The market is backed up by sophisticated technologies including GPS tracking services, surveillance cameras and very reliable financial services that guarantee safe transport of products.

Secure Logistics is an emerging market that has gained momentum in the world market due to increasing risks such as theft, fraud and tampering especially during transportation of cash, metals, electronics, and other high value goods. As more and more firms realized the need for secure supply chains, supply protection services to protect their goods and also gain customer trust is gaining popularity. The factors such as the growth in e- commerce industry, improvement in cash flow in the developing nations, and the globalization of trade have led to requirement of advance security systems during transportation. The transition from physical financial systems to online transactions, though, also puts pressure on cash handling – which is an essential aspect of safe supply chain solutions.

Similarly, technological changes are central in the improvement of the security of the logistic services. Entering in facility automation, real time GPS tracking in vehicles, use of drones for delivery and security systems, have increase security and effectiveness in the market. Such technologies assist in deterring intrusion, addressing and containing risks during transit, and enhancing efficiency to enhance peoples’ confidence in secure logistics companies. Banking and pharma industries along with e-commerce sectors are the many key growth drivers as many organizations in these sectors seek more security products due to demand in security compliance in the coming years.

Secure Logistics Market Trend Analysis:

Rise of Cash Management Solutions

-

One of the most important factors contributing to the development of the Secure Logistics market is the growth of the need for highly specialized services for cash transportation. This trend has been most apparent in companies in sectors that handle highly liquid forms of money, including retail, banking as well as e-commerce. Today, due to the tendency to minimize the use of cash in the performance of economic transactions, quite an effort is placed on the efficient processing, transportation and storage and management of money, checks, valuable documents and coins. Products involving cash management services include; cash processing, cash vailing, CIT services and cash recycling. These solutions are also effective in prevention and control of theft and fraud but are equally efficient in managing cash more efficiently, freeing up business time

Expansion of Secure Logistics in Emerging Markets

-

The Secure Logistics market is expected to grow most in the emerging markets that are situated in Asia-Pacific, Latin America, and the Middle East. These markets are experiencing dynamic economic change, higher disposable income, growing retail and e-commerce markets. Due to the continued use of cash in these regions the transport of money and high value goods hence must be secure. Moreover, there also has been emerging a great concern among governments and private enterprises to invest in secure logistical infrastructure for safe keeping of sensitive items. Being more bothered to enhance the standards of monetary persuasions and correctiveness these regions are potentially virgin to safe logistics service providers, signifying that these regions are potential markets for the long haul.

Secure Logistics Market Segment Analysis:

Secure Logistics Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Static segment is expected to dominate the market during the forecast period

-

The physical segment of the Secure Logistics market, mainly pertaining to the protection of goods in secure locations such as ware house and vaults is expected to remain the largest market for the prediction period. This segment includes such services like outsourcing of, secure warehousing and inventory management, secured and intelligent vaults for cash and other valuables, among others. With increased number of products that require storage and transportation the demand for safe and stationary storage techniques also rises. Valuable substances including metals, drugs and electrical products call for secure area with sophisticated monitors, alarm, and access controls. The static segment will also enjoy steady growth because of rising demands for security with the protection of assets as well as the augmenting role of security in the supply chain network around the world.

By Application, Cash management segment expected to held the largest share

-

The cash management segment of the Secure Logistics market is anticipated to dominate the market as a result of the continued use of physical cash in many global economies. Although most people, customers, and consumers today adopt the use of digital payment methods, most companies, especially those doing retail businesses, banking, and the hospitality industry, handle cash every day. Operations delicacies like CIT, cash vault, and automated cash operation add up to efficiencies in transport and storing of the cash and minimizing on chances of embezzlement or misappropriation of the cash. The need for high-level cash management services is expected to grow in parallel to the development of e-commerce and growing popularity of various types of businesses that process large amounts of cash.

Secure Logistics Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

-

It is predicted that Europe will remain the largest consumer of Secure Logistics for the duration of the forecast period of the report owing to various factors. There is a concentration of many major players in the logistics and security industries and is boast of sound legal systems that enforce the safety and legal compliance of secured logistic solutions. Given that European countries remain concerned with their monetary and commerce susceptibilities, the market for safe transporting of product should increase in demand. The growing existing infrastructure such as transportation networks and secure markets constitutes to the market growth in the region.

-

European consumers and businesses also have continued to require secure logistics services because of evolving technologies in the region. By integration of automation and real-time monitoring tools, digital cash management in logistics has become more effective and secured. As more industries request security worldwide especially across the Europe’s financial, retail and healthcare sectors, more companies will invest in next generation technologies to support the needs of the clients.

Active Key Players in the Secure Logistics Market

- Adecco Group (Switzerland)

- Brinks Company (USA)

- Cargo Services (Germany)

- G4S (UK)

- GardaWorld (Canada)

- Loomis (Sweden)

- Malca-Amit (Israel)

- Prosegur (Spain)

- Samsung S1 Corporation (South Korea)

- Securitas AB (Sweden)

- Transguard Group (UAE)

- Tyco Integrated Security (USA)

- United Parcel Service (UPS) (USA)

- Vale S.A. (Brazil)

- Wells Fargo & Company (USA)

- Other Active Players.

|

Global Secure Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 84.72 Billion |

|

Forecast Period 2024-32 CAGR: |

9.1 % |

Market Size in 2032: |

USD 185.53 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Secure Logistics Market by Type

4.1 Secure Logistics Market Snapshot and Growth Engine

4.2 Secure Logistics Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Hardware: Geographic Segmentation Analysis

4.4 Software

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Software: Geographic Segmentation Analysis

Chapter 5: Secure Logistics Market by Vehicle Type

5.1 Secure Logistics Market Snapshot and Growth Engine

5.2 Secure Logistics Market Overview

5.3 Passenger Vehicles

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Passenger Vehicles: Geographic Segmentation Analysis

5.4 Commercial Vehicles

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Commercial Vehicles: Geographic Segmentation Analysis

Chapter 6: Secure Logistics Market by Application

6.1 Secure Logistics Market Snapshot and Growth Engine

6.2 Secure Logistics Market Overview

6.3 In-Vehicle Applications

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 In-Vehicle Applications: Geographic Segmentation Analysis

6.4 Charging Stations

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Charging Stations: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Secure Logistics Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ADECCO GROUP (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BRINKS COMPANY (USA)

7.4 CARGO SERVICES (GERMANY)

7.5 G4S (UK)

7.6 GARDAWORLD (CANADA)

7.7 LOOMIS (SWEDEN)

7.8 MALCA-AMIT (ISRAEL)

7.9 PROSEGUR (SPAIN)

7.10 SAMSUNG S1 CORPORATION (SOUTH KOREA)

7.11 SECURITAS AB (SWEDEN)

7.12 TRANSGUARD GROUP (UAE)

7.13 TYCO INTEGRATED SECURITY (USA)

7.14 UNITED PARCEL SERVICE (UPS) (USA)

7.15 VALE S.A. (BRAZIL)

7.16 WELLS FARGO & COMPANY (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Secure Logistics Market By Region

8.1 Overview

8.2. North America Secure Logistics Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Hardware

8.2.4.2 Software

8.2.5 Historic and Forecasted Market Size By Vehicle Type

8.2.5.1 Passenger Vehicles

8.2.5.2 Commercial Vehicles

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 In-Vehicle Applications

8.2.6.2 Charging Stations

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Secure Logistics Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Hardware

8.3.4.2 Software

8.3.5 Historic and Forecasted Market Size By Vehicle Type

8.3.5.1 Passenger Vehicles

8.3.5.2 Commercial Vehicles

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 In-Vehicle Applications

8.3.6.2 Charging Stations

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Secure Logistics Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Hardware

8.4.4.2 Software

8.4.5 Historic and Forecasted Market Size By Vehicle Type

8.4.5.1 Passenger Vehicles

8.4.5.2 Commercial Vehicles

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 In-Vehicle Applications

8.4.6.2 Charging Stations

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Secure Logistics Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Hardware

8.5.4.2 Software

8.5.5 Historic and Forecasted Market Size By Vehicle Type

8.5.5.1 Passenger Vehicles

8.5.5.2 Commercial Vehicles

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 In-Vehicle Applications

8.5.6.2 Charging Stations

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Secure Logistics Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Hardware

8.6.4.2 Software

8.6.5 Historic and Forecasted Market Size By Vehicle Type

8.6.5.1 Passenger Vehicles

8.6.5.2 Commercial Vehicles

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 In-Vehicle Applications

8.6.6.2 Charging Stations

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Secure Logistics Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Hardware

8.7.4.2 Software

8.7.5 Historic and Forecasted Market Size By Vehicle Type

8.7.5.1 Passenger Vehicles

8.7.5.2 Commercial Vehicles

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 In-Vehicle Applications

8.7.6.2 Charging Stations

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Secure Logistics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 84.72 Billion |

|

Forecast Period 2024-32 CAGR: |

9.1 % |

Market Size in 2032: |

USD 185.53 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||