Scooter Rental Market Synopsis:

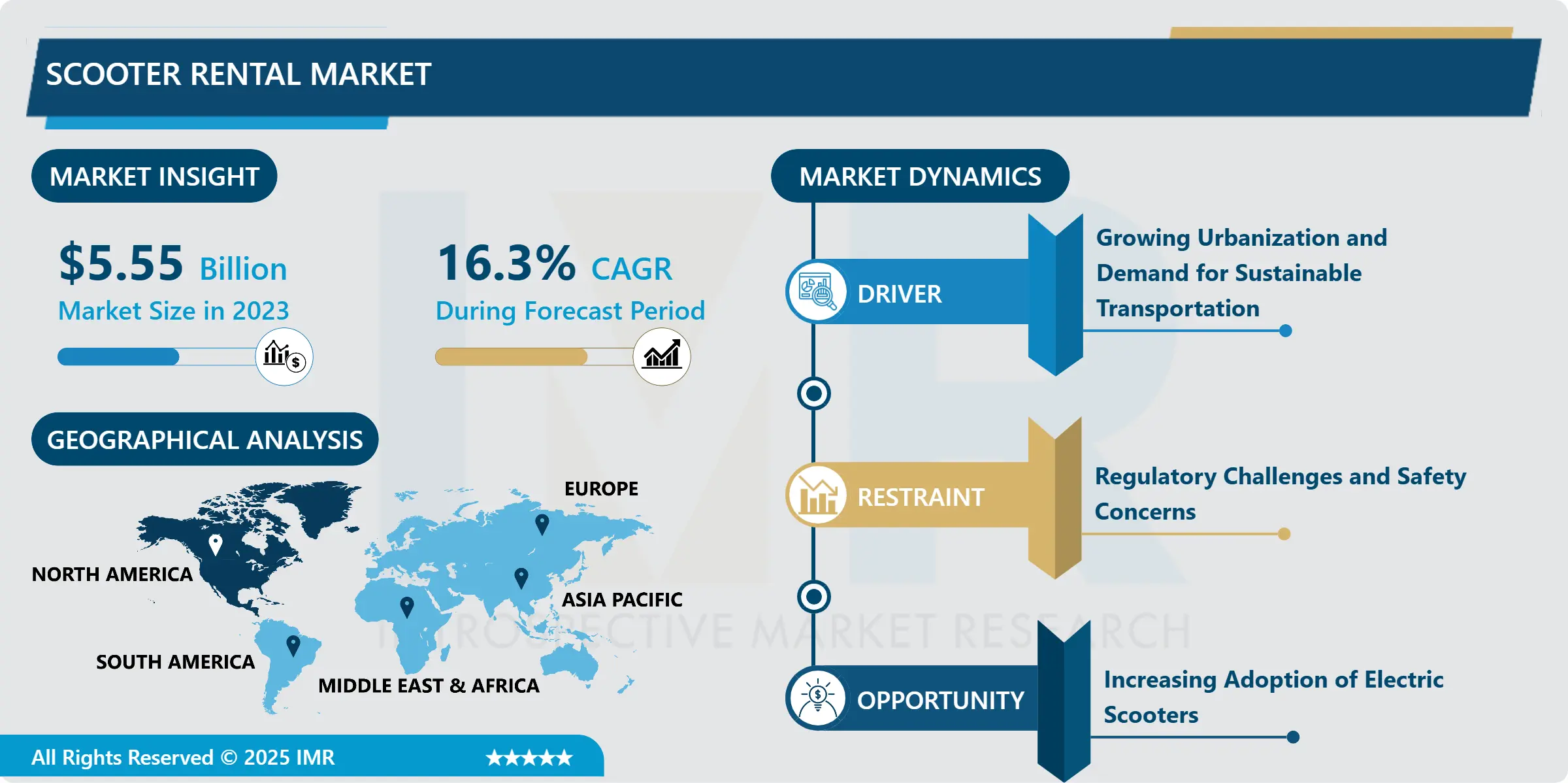

Scooter Rental Market Size Was Valued at USD 5.55 Billion in 2023, and is Projected to Reach USD 21.60 Billion by 2032, Growing at a CAGR of 16.3 % From 2024-2032.

All are rental service businesses, who provide scooters for use by the public for a particular period and may be physically or through an app. Such include cost, flexibility and environmental factors as a viable mode of transport for citizens, visitors and firms. These subcategories include electric scooters, kick scooters and motor scooters and the pricing reflect the consumer tastes and needs.

Scooters are being rented in the last few years mainly because of growing urbanization, skyrocketing fuel prices and a shift towards more environmentally friendly vehicles. Amid growing traffic and emission problems in cities around the world, the scooters can offer a viable option for first and last mile transport and short distance trips. This market has been a prerequisite of the urban transport system and the rental services companies have embraced technology, such as GPS, IoT and mobile application for the swift services.

Furthermore, change of the geographic location of consumers’ preference market has equally contributed to growth of the market mainly volatile young generation consumers especially the millennial and Gen-z consumers than ever before, scooter rentals are portable, cheap and eco-friendly modes of transport for diverse groups. This segment has also informed this year’s acceleration in the growth of this segment depending on the general global tendencies towards decarbonization and energy efficiency. The market will continue to be attractive due to increased approval of micromobility services and solutions by regulatory authorities and continuous development of the products.

Scooter Rental Market Trend Analysis:

Rising Integration of IoT and Smart Technologies

-

Scooter rental market is now following a trend of IoT and smart solutions that are being integrated into scooter rental market significantly improving the user experience and usability. Scooters integrated with internet with GPS, diagnostic and real time data management offer the same together with the users’ safety to the owners of scooters. Operators and end customers can describe available vehicles, unlock, and make payment within the application whereas application processing gives operators a means to estimate the position of their vehicles and maintain them appropriately. For this reason, as cities become smart urban mobility systems, the utilization of such technologies will stay a key model that shapes the development of scooter rental services.

Expanding Electric Scooter Infrastructure

-

How companies have begun shifting more of their attention towards developing the necessary infrastructure for electric scooter is a big shot in the arm for the scooter rental business. Cities and automakers are providing incentives for the installation of charging points and battery exchange points and dedicated bike lanes that afford good opportunities for electric vehicles. They at the same time offer their share not only toward enhancing the utility of a transport service from the users’ perspective but also toward implementing the concept of sustainable mobility in urban contexts. Thus with the move of cities around the world seeking to employ the use of electric transportation systems as a way of driving carbon neutrality, there is expected to be increased uptake of electric scooter rental services hence presenting good business prospects for the service providers.

Scooter Rental Market Segment Analysis:

Scooter Rental Market is Segmented on the basis of Type, Application, Power, and Region.

By Type, Electric Scooter segment is expected to dominate the market during the forecast period

-

Out of all the categories of the scooter rental business, the electric scooter type is expected to be the largest segment in the market for the forecast period since it is environmentally friendly, cheap, and gaining popularity with customers. Electric scooters are an environment-friendly mode of transport that when used can operate within the current international environmental standards as well as policies formulated to combat climate change, pollution, global warming, and carbon emissions. In addition, the enhancements in a battery system, for which the range is longer and charging time is shorter than in other conventional battery technologies, make electric scooters more suitable for availability for renting services. When deciding on electric mobile operators are acting to meet the existing need for green solutions and thereby strengthening the dominance of the segment.

By Application, Tourism segment expected to held the largest share

-

Out of the mentioned segments, tourism segment is expected to maintain the highest market share throughout the rental scooter market this can be attributed by the enlarging usage of tourist on scooter as a entertaining way of moving within town. Scooter rentals are an opportunity to quickly and easily rent a scooter for getting around the city, and the possibility of getting to places that are difficult to reach by car, train, or bus. Other places such as beaches, and historical centers have also been other areas that have been registering a lot of demands for scooter rental businesses. The following trend is also evidenced by the contracts that scooters’ rental companies make with local tourist offices, which generally offer and often impose packaged, and rented, scooters to tourists.

Scooter Rental Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

Out of all the regions across the world, North America is likely to have largest market of scooter rental business in the coming years. The first is attributed to the focus of the essential market players on the area, relatively higher rates of urbanization, and appropriate technology foundations for shared mobility services. Today, the clients from many cities, for example Los Angeles, San Francisco, and Austin, use scooter rental services because of the services oriented to green mobility solutions

- Furthermore, governmental support, and private funding for public transportation are trying to make scooter-sharing service more popular in North America. Measures that governments have taken towards traffic control and reduction of congestion and carbon emission have argued cities to adopt micromobility systems to address mobility issues. North America continues to be an active market for scooter rental since the focus on innovation and the consumers’ readiness for new mobility solutions give a competitive edge.

Active Key Players in the Scooter Rental Market

- Bird Rides, Inc. (United States)

- Bolt (Estonia)

- Felyx (Netherlands)

- Grin Scooters (Mexico)

- Lime (United States)

- Mobike (China)

- Muving (Spain)

- Razor USA LLC (United States)

- Scoot Networks (United States)

- Spin (United States)

- Tier Mobility (Germany)

- Vogo Automotive (India)

- VOI Technology AB (Sweden)

- Wind Mobility (Germany)

- Yulu Bikes (India)

- Other Active Players.

|

Global Scooter Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.55 Billion |

|

Forecast Period 2024-32 CAGR: |

16.3 % |

Market Size in 2032: |

USD 21.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Power |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Scooter Rental Market by Product Type

4.1 Scooter Rental Market Snapshot and Growth Engine

4.2 Scooter Rental Market Overview

4.3 Free Standing Beverage Cooler

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Free Standing Beverage Cooler: Geographic Segmentation Analysis

4.4 Built in Beverage Counter top

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Built in Beverage Counter top: Geographic Segmentation Analysis

Chapter 5: Scooter Rental Market by Capacity

5.1 Scooter Rental Market Snapshot and Growth Engine

5.2 Scooter Rental Market Overview

5.3 Below 100 lts

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Below 100 lts: Geographic Segmentation Analysis

5.4 100-200 lts

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 100-200 lts: Geographic Segmentation Analysis

5.5 200-300 lts

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 200-300 lts: Geographic Segmentation Analysis

5.6 above 400 lts

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 above 400 lts: Geographic Segmentation Analysis

Chapter 6: Scooter Rental Market by Distribution Channel

6.1 Scooter Rental Market Snapshot and Growth Engine

6.2 Scooter Rental Market Overview

6.3 Residential and Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential and Commercial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Scooter Rental Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BIRD RIDES INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOLT (ESTONIA)

7.4 FELYX (NETHERLANDS)

7.5 GRIN SCOOTERS (MEXICO)

7.6 LIME (UNITED STATES)

7.7 MOBIKE (CHINA)

7.8 MUVING (SPAIN)

7.9 RAZOR USA LLC (UNITED STATES)

7.10 SCOOT NETWORKS (UNITED STATES)

7.11 SPIN (UNITED STATES)

7.12 TIER MOBILITY (GERMANY)

7.13 VOGO AUTOMOTIVE (INDIA)

7.14 VOI TECHNOLOGY AB (SWEDEN)

7.15 WIND MOBILITY (GERMANY)

7.16 YULU BIKES (INDIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Scooter Rental Market By Region

8.1 Overview

8.2. North America Scooter Rental Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Free Standing Beverage Cooler

8.2.4.2 Built in Beverage Counter top

8.2.5 Historic and Forecasted Market Size By Capacity

8.2.5.1 Below 100 lts

8.2.5.2 100-200 lts

8.2.5.3 200-300 lts

8.2.5.4 above 400 lts

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Residential and Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Scooter Rental Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Free Standing Beverage Cooler

8.3.4.2 Built in Beverage Counter top

8.3.5 Historic and Forecasted Market Size By Capacity

8.3.5.1 Below 100 lts

8.3.5.2 100-200 lts

8.3.5.3 200-300 lts

8.3.5.4 above 400 lts

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Residential and Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Scooter Rental Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Free Standing Beverage Cooler

8.4.4.2 Built in Beverage Counter top

8.4.5 Historic and Forecasted Market Size By Capacity

8.4.5.1 Below 100 lts

8.4.5.2 100-200 lts

8.4.5.3 200-300 lts

8.4.5.4 above 400 lts

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Residential and Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Scooter Rental Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Free Standing Beverage Cooler

8.5.4.2 Built in Beverage Counter top

8.5.5 Historic and Forecasted Market Size By Capacity

8.5.5.1 Below 100 lts

8.5.5.2 100-200 lts

8.5.5.3 200-300 lts

8.5.5.4 above 400 lts

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Residential and Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Scooter Rental Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Free Standing Beverage Cooler

8.6.4.2 Built in Beverage Counter top

8.6.5 Historic and Forecasted Market Size By Capacity

8.6.5.1 Below 100 lts

8.6.5.2 100-200 lts

8.6.5.3 200-300 lts

8.6.5.4 above 400 lts

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Residential and Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Scooter Rental Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Free Standing Beverage Cooler

8.7.4.2 Built in Beverage Counter top

8.7.5 Historic and Forecasted Market Size By Capacity

8.7.5.1 Below 100 lts

8.7.5.2 100-200 lts

8.7.5.3 200-300 lts

8.7.5.4 above 400 lts

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Residential and Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Scooter Rental Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.55 Billion |

|

Forecast Period 2024-32 CAGR: |

16.3 % |

Market Size in 2032: |

USD 21.60 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Power |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||