Roasted Coffee Market Synopsis

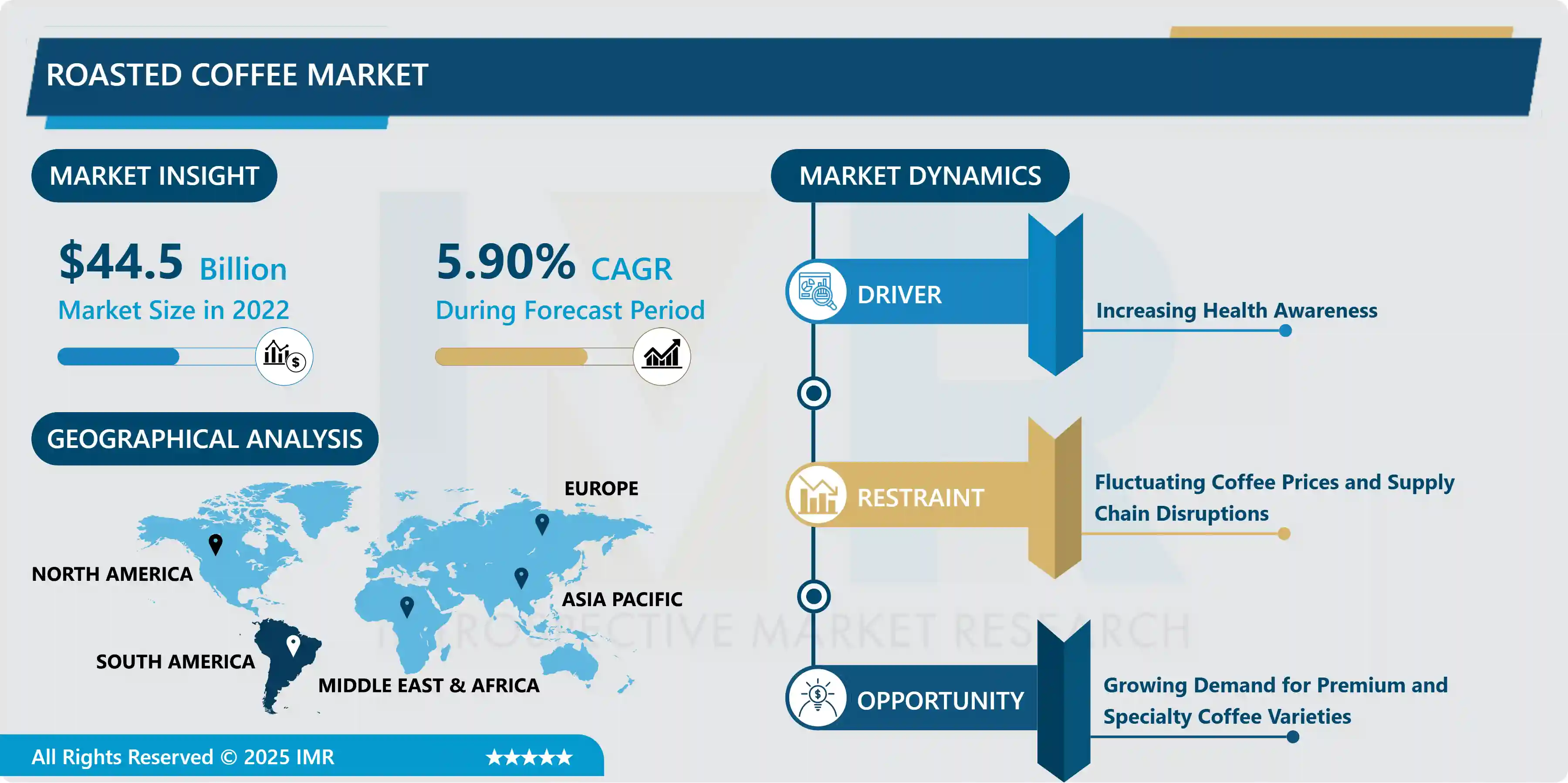

Roasted Coffee Market Size is Valued at USD 44.5 Billion in 2023, and is Projected to Reach USD 70.5 Billion by 2032, Growing at a CAGR of 5.90% From 2024-2032.

The roasted coffee market is expanding at a rapid pace, primarily due to the growing popularity of premium and specialty coffee varieties among consumers. As global coffee culture continues to develop, the demand for a variety of high-quality roasts is on the rise, leading to the growth of specialty retailers and coffee businesses. Furthermore, the market benefits from advancements in sustainable sourcing practices and roasting techniques. Furthermore, the proliferation of single-serve coffee systems and the expansion of the coffee subscription model are further stimulating the market. We expect the roasted coffee market to continue its upward trajectory, supported by the development of consumer preferences and the advancement of coffee preparation technologies.

In recent years, the roasted coffee market has experienced substantial development as a result of the growing demand for premium and specialty coffee products among consumers. A diverse array of offerings, including artisanal roasts and mass-produced blends, are available in this market, catering to the preferences of a wide spectrum of consumers. As coffee culture continues to develop, there is an increasing emphasis on sustainable procurement practices, single-origin beans, and distinctive flavor profiles. Specialty roasters and boutique coffee shops are increasingly prevalent, facilitating the market's expansion. This trend is evident.

North America and Europe are the dominant regions in the roasted coffee market, owing to their well-established coffee cultures and high consumption rates. However, a burgeoning middle class with a growing taste for coffee, urbanization, and increasing disposable incomes are driving significant development in the Asia-Pacific and Latin American emerging markets. Specifically, consumption of coffee is increasing in countries such as China and India, which presents new opportunities for market participants to investigate.

Competitive dynamics distinguish the roasted coffee market, with key actors constantly innovating to adapt to changing consumer preferences. In order to distinguish their products, organizations are investing in state-of-the-art roasting technologies and investigating novel combinations. Furthermore, there is an increasing emphasis on sustainability, as numerous brands are implementing eco-friendly practices and transparent supply chains to attract environmentally conscious consumers. We anticipate that this focus on sustainability and quality will drive further growth and shape the future of the roasted coffee market.

Roasted Coffee Market Trend Analysis

Increasing Health Awareness

- Growing health consciousness has become one of the main factors driving the demand for roasted coffee. The possible health advantages of coffee intake have become an important element influencing consumer decisions as they grow more health conscious. Research and studies indicating coffee may help lower the incidence of diabetes, Parkinson's disease, and Alzheimer's disease have struck a chord with people who are concerned about their health, leading many to choose coffee as part of their daily routine.

- The antioxidants present in coffee are believed to have protective effects on the body, contributing to its overall health-promoting image. Furthermore, the association of coffee consumption with liver and stomach health has garnered attention, particularly among those seeking preventive measures for maintaining well-being. This heightened awareness of the positive aspects of coffee has led to a shift in consumer perception, positioning coffee as more than just a beverage but also as a potential contributor to a healthier lifestyle.

- Consumers, particularly in younger demographics, are actively seeking functional foods and beverages that offer both enjoyment and health benefits. The alignment of roasted coffee with these evolving consumer preferences has driven market growth, with individuals increasingly viewing their coffee consumption as a conscious choice for well-being. As health awareness continues to be a focal point in consumer decision-making, the roasted coffee market is expected to thrive, catering to those who value both the sensory pleasures and potential health advantages associated with their daily cup of coffee.

Growing Demand for Premium and Specialty Coffee Varieties

- The roasted coffee market is witnessing a significant opportunity with the growing demand for premium and specialty coffee varieties. This surge is fueled by a confluence of factors, including shifting consumer preferences, a heightened focus on sustainability, and the influential role played by millennials, who exhibit a strong penchant for coffee consumption. Recent trends in the global specialty coffee market underscore this opportunity, with an increasing number of coffee shops, a rising popularity of Ready-To-Drink (RTD) specialty coffee, and the emergence of cold brew and nitro coffee as sought-after options.

- Market vendors are capitalizing on this trend by concentrating on product diversification, introducing new and unique flavors, and extending their brands to cater to a discerning consumer base. An illustrative example is the innovative approach adopted by CoffeeB, a Swiss coffee brand, which introduced compressed coffee balls as the "next generation of single-serve coffee." Remarkably, they utilized seaweed-based material wrappers, a sustainable alternative to traditional aluminum or plastic capsules, emphasizing the industry's commitment to environmental responsibility.

- The consumption of specialty coffee is not limited to established coffee markets, as developing countries such as China, India, and Brazil are experiencing a significant uptick in coffee consumption. In the United States, a National Coffee Association report highlighted a substantial increase in specialty coffee consumption, reaching a five-year high. Furthermore, Europe, boasting the largest global specialty coffee market share at around 46.2%, contributes significantly to this trend.

- As evidenced by the National Coffee Association's data, the world's coffee consumption is projected to grow by 1.7% to 178.5 million 60kg bags in 2022/23. This growth is mirrored in the United States, where daily coffee consumption has reached its highest level in 20 years, with approximately 60% of the population indulging in coffee every day. The robust demand for premium and specialty coffee varieties presents a major opportunity for the roasted coffee market, encouraging continued innovation and market expansion.

Roasted Coffee Market Segment Analysis:

Roasted Coffee Market Segmented based on Type and Distribution Channel.

By Type, Arabica segment is expected to dominate the market during the forecast period

- The Arabica segment is poised to maintain its dominance in the roasted coffee market during the forecast period. Renowned for its smooth and premium flavor profile, Arabica beans continue to be the preferred choice for discerning consumers who prioritize a sophisticated coffee experience. With lower acidity and a diverse array of intricate flavors, ranging from fruity and floral to nutty and chocolaty notes, Arabica stands out in delivering a nuanced taste that aligns with the evolving preferences of coffee enthusiasts.

- The segment's leading position is further solidified by a 1.8% increase in Arabica production during the 2022/23 coffee year, reaching 94.0 million bags. South America, the primary regional producer, contributed significantly to this growth, with a 2.6% increase in output to 57.4 million bags. As the global demand for specialty coffees rises and consumers increasingly emphasize quality, Arabica's market prominence is expected to persist, accounting for 55.9% of total coffee production.

By Application, the B2C (Hypermarkets & Supermarkets, Convenience Stores, Online) segment held the largest share of 53.6% in 2022

- The B2C segment, encompassing Hypermarkets & Supermarkets, and Convenience Stores and Online, is anticipated to assert its dominance as the primary driver in the Roasted Coffee Market, holding the largest share. This heightened market presence is attributed to the widespread consumer accessibility of roasted coffee products through hypermarkets, supermarkets, and convenience stores. These retail outlets offer a diverse range of roasted coffee options, catering to the evolving preferences of discerning consumers.

- The convenience of one-stop shopping in hypermarkets and the accessibility of on-the-go choices in convenience stores contribute significantly to the segment's robust market position. The online segment continues to witness significant growth, driven by the increasing trend of e-commerce and the convenience of doorstep delivery. As consumers increasingly seek quality and convenience in their coffee choices, the B2C segment is poised to maintain its dominance, reflecting the market's responsiveness to evolving consumer preferences and retail dynamics.

Roasted Coffee Market Regional Insights:

South America is Expected to Dominate the Market Over the Forecast Period

- South America is poised to assert its dominance in the global coffee market over the forecast period, buoyed by significant growth trends in both Arabica and Robusta production. In the coffee year 2022/23, Brazil, the leading Arabica producer globally, witnessed a remarkable 7.3% surge in output to 41.8 million bags, marking an "on-year" for Arabica production. Meanwhile, South America, recognized as the world's largest Arabica-producing region, recorded a substantial 10.4% growth in Robusta output, reaching 23.9 million bags. Brazil further contributed to this momentum with a noteworthy 10.6% increase in Robusta production, totaling 23.7 million bags, attributable to favorable weather conditions and expanded cultivation areas.

- The Brazilian Institute of Geography and Statistics reported a 4.2% rise in the Robusta area harvested for coffee year 2022/23, reaching 408,719 hectares. This expansion, encompassing 16,648 additional hectares, underscores the region's commitment to meeting the growing global demand for coffee. As South America, particularly Brazil, continues to exhibit robust production figures and adaptability to market dynamics, it is poised to dominate the coffee market landscape over the forecast period, solidifying its position as a key player in the global coffee industry.

Roasted Coffee Market Top Key Players:

- Starbucks Corporation (USA)

- Nestlé SA (Switzerland)

- JAB Holding Company (Luxembourg)

- The JM Smucker Company (USA)

- Keurig Dr Pepper Inc. (USA)

- Dunkin' Brands Group, Inc. (USA)

- Lavazza Group (Italy)

- Tchibo GmbH (Germany)

- Illycaffè S.p.A. (Italy)

- Peet's Coffee (USA)

- Strauss Group Ltd. (Israel)

- Eight O'Clock Coffee Company (USA)

- Melitta Group (Germany)

- Segafredo Zanetti (Italy)

- Luigi Lavazza S.p.A. (Italy)

- Stumptown Coffee Roasters (USA)

- Coffee Bean & Tea Leaf (USA)

- Bulletproof 360, Inc. (USA)

- Keen Coffee B.V. (Netherlands)

- Blue Bottle Coffee Company (USA)

- PJ's Coffee of New Orleans (USA)

- D.E Master Blenders 1753 (Netherlands)

- Intelligentsia Coffee (USA)

- Allegro Coffee Company (USA) and Other Major Players

Key Industry Developments in the Roasted Coffee Market:

- In July 2023, Lavazza, a coffee company based in Italy, launched Tales of Italy. Tales of Italy is a collection of locally roasted coffees designed to promote Italy’s rich cultural heritage and storytelling traditions. It comes in three distinct flavors such as Alluring Napoli, made from Conilon Robusta, Eternal Roma, which is a premium blend of hand-picked Colombian Arabica, and Refined Milano, which is a 100% premium blend of late-harvested Arabica. Tales of Italy comes packaged in resealable packaging with a bright, vibrant color palette.

- In March 2023, Westrock Coffee, a U.S.-based coffee roasting company, acquired Bixby Roasting Co for an undisclosed amount. Through this acquisition, Westrock Coffee aims to capitalize on growing consumer trends and create new impactful brands that are especially appealing to younger consumers. Bixby Roasting Co is a US-based company that specializes in providing roasted coffee beans.

|

Roasted Coffee Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 44.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90 % |

Market Size in 2032: |

USD 70.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Roasted Coffee Market by Type (2018-2032)

4.1 Roasted Coffee Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Arabica

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Robusta

Chapter 5: Roasted Coffee Market by Distribution Channel (2018-2032)

5.1 Roasted Coffee Market Snapshot and Growth Engine

5.2 Market Overview

5.3 B2B

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 B2C

5.5 Hypermarkets & Supermarkets

5.6 Convenience Stores

5.7 Online

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Roasted Coffee Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DYNACAST INTERNATIONAL (U.S)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARC GROUP WORLDWIDE (U.S.)

6.4 PHILLIPS-MEDISIZE (U.S.)

6.5 SMITH METAL PRODUCTS (U.S.)

6.6 NETSHAPE TECHNOLOGIES (U.S.)

6.7 PARMATECH CORPORATION (U.S.)

6.8 TRITECH TITANIUM PARTS (U.S.)

6.9 CYPRESS INDUSTRIES (U.S.)

6.10 ATW COMPANIES (U.S.)

6.11 BRITT MANUFACTURING (U.S.)

6.12 CMG TECHNOLOGIES (UK)

6.13 DEAN GROUP INTERNATIONAL (UK)

6.14 GKN PLC (UK)

6.15 REAL TECHNIK AG (AUSTRIA)

6.16 PARMACO METAL INJECTION MOLDING AG (SWITZERLAND)

6.17 CERATIZIT S.A.(LUXEMBOURG)

6.18 SINTEX (CHINA)

6.19 FUTURE HIGH-TECH (CHINA)

6.20 TEKNA. (CHINA)

6.21 EPSON ATMIX CORPORATION (JAPAN)

6.22 HITACHI METALS LTD. (JAPAN)

6.23 INDO-MIM PVT (INDIA)

6.24

Chapter 7: Global Roasted Coffee Market By Region

7.1 Overview

7.2. North America Roasted Coffee Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Arabica

7.2.4.2 Robusta

7.2.5 Historic and Forecasted Market Size by Distribution Channel

7.2.5.1 B2B

7.2.5.2 B2C

7.2.5.3 Hypermarkets & Supermarkets

7.2.5.4 Convenience Stores

7.2.5.5 Online

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Roasted Coffee Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Arabica

7.3.4.2 Robusta

7.3.5 Historic and Forecasted Market Size by Distribution Channel

7.3.5.1 B2B

7.3.5.2 B2C

7.3.5.3 Hypermarkets & Supermarkets

7.3.5.4 Convenience Stores

7.3.5.5 Online

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Roasted Coffee Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Arabica

7.4.4.2 Robusta

7.4.5 Historic and Forecasted Market Size by Distribution Channel

7.4.5.1 B2B

7.4.5.2 B2C

7.4.5.3 Hypermarkets & Supermarkets

7.4.5.4 Convenience Stores

7.4.5.5 Online

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Roasted Coffee Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Arabica

7.5.4.2 Robusta

7.5.5 Historic and Forecasted Market Size by Distribution Channel

7.5.5.1 B2B

7.5.5.2 B2C

7.5.5.3 Hypermarkets & Supermarkets

7.5.5.4 Convenience Stores

7.5.5.5 Online

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Roasted Coffee Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Arabica

7.6.4.2 Robusta

7.6.5 Historic and Forecasted Market Size by Distribution Channel

7.6.5.1 B2B

7.6.5.2 B2C

7.6.5.3 Hypermarkets & Supermarkets

7.6.5.4 Convenience Stores

7.6.5.5 Online

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Roasted Coffee Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Arabica

7.7.4.2 Robusta

7.7.5 Historic and Forecasted Market Size by Distribution Channel

7.7.5.1 B2B

7.7.5.2 B2C

7.7.5.3 Hypermarkets & Supermarkets

7.7.5.4 Convenience Stores

7.7.5.5 Online

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Roasted Coffee Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 44.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90 % |

Market Size in 2032: |

USD 70.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||