Retail Bags Market Synopsis

Retail Bags Market Size Was Valued at USD 16.39 Billion in 2022, and is Projected to Reach USD 24.96 Billion by 2030, Growing at a CAGR of 5.4% From 2023-2030.

A single-use bag provided to customers to retain their goods from a Retail Establishment is referred to as a retail bag and includes both plastic and biodegradable plastic bags. The retail bag sector is in flux, influenced by bigger causes such as the rise of e-commerce and restaurant curbside pickup and delivery, and by shifting legislation and consumer preferences, as well as store responses to these shifts.

- While the rapid growth of e-commerce has reduced foot traffic in many bricks and mortar retail establishments, affecting the number of bags leaving the door, the rise in restaurant curbside pickup and delivery options is pushing in the opposite direction, with consumers preferring these options to dine in or preparing a meal at home.

- Consumer awareness of the massive volume of plastic garbage produced and eventually dumped in the ocean has prompted many businesses to embrace and promote sustainability measures to improve their brand image and sales. Local administrations have also reacted quickly. Hundreds of communities in the United States (and several states) have implemented retail bag rules in the recent decade, with the majority outlawing single-use plastic bags and some imposing fees on paper bags. The definition of a reusable bag, on the other hand, is still up for debate, making it impossible for manufacturers to forecast future capacity needs.

Retail Bags Market Trend Analysis

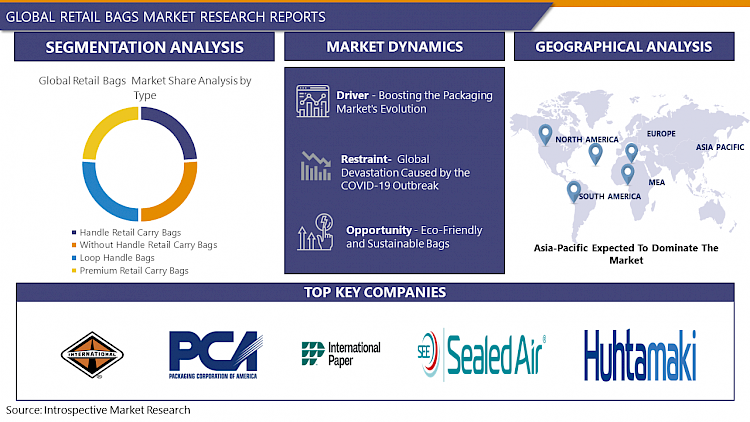

Boosting the Packaging Market's Evolution

- Brands have one last chance to sell their products and leave a lasting impression with the package, which includes both the physical structure and the design or artwork. The key to sticking out is to deliver something unique and relevant to a customer's needs. Finally, having a product that stands out enhances the likelihood of it being added to a shopper's cart. The physical structure is one of the primary trends we're seeing as a differentiator in packaging today. Consumers are increasingly seeking items that match their lifestyles, and physical packaging can help meet those needs.

- The retail bag market is expected to rise throughout the forecast period. Furthermore, as the demand for packaging grows across all end-user industries, so does the amount of packaging waste generate. Packaging generates nearly 77.9 metric tons of municipal solid garbage each year, according to the United States Environmental Protection Agency (EPA). Almost 30% of overall waste is packaging, which accounts for a whopping 65 percent of all home garbage.

Eco-Friendly and Sustainable Bags Create an Opportunity for Retail Bags Market

- The retail bags market is witnessing a significant shift towards eco-friendly and sustainable options, presenting abundant opportunities for growth and innovation. With increasing awareness of environmental issues and a growing emphasis on sustainable living, consumers are actively seeking alternatives to traditional plastic bags. This shift in consumer preferences aligns with a global commitment to reduce plastic waste and promote eco-friendly practices.

- Retailers have a unique opportunity to capitalize on this trend by offering eco-friendly bags as a part of their packaging solutions. Biodegradable materials, reusable bags, and recycled content are gaining traction as consumers prioritize environmentally conscious choices. Brands that adopt sustainable practices not only contribute to environmental conservation but also enhance their corporate social responsibility image, fostering customer loyalty.

- Governments and regulatory bodies are also pushing for sustainable alternatives, imposing restrictions on single-use plastics. This further opens up avenues for retailers to invest in eco-friendly packaging solutions. As the demand for green alternatives continues to rise, businesses that embrace sustainable bags are likely to experience increased sales, positive brand perception, and a competitive edge in the evolving retail landscape. The transition to eco-friendly retail bags represents not only an environmental responsibility but also a strategic business opportunity in a market driven by conscious consumer choices.

Retail Bags Market Segment Analysis:

Retail Bags Market Segmented on the basis of type, Material, and end-users.

By Material, Paper segment is expected to dominate the market during the forecast period

- The retail bags market is poised for significant growth, with the paper segment anticipated to dominate based on various factors contributing to its popularity. Paper bags have gained traction due to their eco-friendly nature, aligning with the global shift towards sustainable and environmentally conscious practices. Consumers, retailers, and governments are increasingly prioritizing products that minimize environmental impact, making paper bags a preferred choice.

- The dominance of the paper segment can be attributed to several key advantages. First and foremost, paper is a renewable resource, making it a sustainable alternative to plastic bags. Paper bags are biodegradable and easily recyclable, addressing concerns about plastic pollution. Additionally, the growing awareness of deforestation issues has led to the adoption of responsibly sourced paper, further enhancing the environmental credentials of paper bags.

By Type, Premium Retail Carry Bags segment held the largest share of 43% in 2022

- The Premium Retail Carry Bags segment is poised to exert significant dominance in the retail bags market. This market trend is primarily attributed to the escalating demand for high-quality, aesthetically pleasing, and durable packaging solutions across various retail sectors. Premium retail carry bags are characterized by their superior material quality, innovative designs, and added features that enhance the overall shopping experience for consumers.

- Consumers today place a premium on sustainable and visually appealing packaging, driving the preference for premium retail carry bags over conventional options. The increasing awareness and consciousness regarding environmental issues have prompted retailers to opt for premium bags that are not only visually appealing but also eco-friendly. Many premium carry bags are made from sustainable materials, aligning with the growing global emphasis on environmentally responsible practices.

- Moreover, the Premium Retail Carry Bags segment often caters to the luxury and high-end markets, where branding and presentation play a pivotal role. Retailers in these segments prioritize packaging that reflects the exclusivity and premium nature of their products.

Retail Bags Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to exert significant dominance in the retail bags market, reflecting a robust and expanding consumer landscape. Several factors contribute to this projected dominance. The region's burgeoning population, coupled with rising disposable incomes and urbanization, fuels a growing demand for retail bags. As consumers increasingly adopt modern retail practices, the need for convenient and eco-friendly packaging solutions becomes more pronounced.

- The retail sector in Asia Pacific is experiencing dynamic transformations, with the e-commerce boom playing a pivotal role. The surge in online shopping, driven by technological advancements and changing consumer preferences, necessitates efficient packaging solutions for shipping and delivery. Retail bags, serving as a crucial component of this packaging ecosystem, witness heightened demand.

- Governments and consumers in the Asia Pacific region are also placing greater emphasis on sustainable practices. This has led to an increased preference for eco-friendly and reusable retail bags, aligning with global efforts to reduce environmental impact. Manufacturers and retailers are adapting to these changing preferences, contributing to the region's anticipated dominance in the retail bags market. Overall, the Asia Pacific region stands as a key player in shaping the future trajectory of the retail bags industry, driven by a confluence of demographic, economic, and environmental factors.

Retail Bags Market Top Key Players:

-

Berry Global Inc. (Usa)

- Huamei Group Co., Ltd. (China)

- Weigang Group Co., Ltd. (China)

- Shanghai Bluelion Intelligent Technology Co., Ltd. (China)

- Suzhou Jingang Packaging Co., Ltd. (China)

- Amcor Limited (Australia)

- Sonoco Products Company (Usa)

- Proampac Llc (Usa)

- Dow Chemical Company (USA)

- Bemis Company Inc. (USA)

- Westrock Company (USA)

- Graphic Packaging International, Inc. (USA)

- Packaging Corporation Of America (Pca) (USA)

- International Paper Company (USA)

- Sealed Air Corporation (USA)

- Huhtamaki Group Oyj (Finland)

- Wipak Oy (Finland)

- Stora Enso Oyj (Finland)

- Huhtamaki Oyj (Finland)

- Smurfit Kappa Group Plc (Ireland)

- Ds Smith (UK)

- Greiner Packaging (Austria)

- Mondi Group (Austria)

- Nippon Paper Industries Co., Ltd. (Japan)

- Uflex Limited (India)

Key Industry Developments in the Retail Bags Market:

- In November 2023, Papira a company that specializes in making paper from stone, introduced its stone paper shopping bags. These bags are tear-resistant, water-resistant, and recyclable, making them a sustainable alternative to traditional plastic bags.

- In May 2022, Mondi introduced Eco Vantage, a range of recyclable and repulpable paper bags for e-commerce deliveries. This helps reduce reliance on plastic packaging and aligns with consumer preferences for sustainable options.

|

Global Retail Bags Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.39 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.4% |

Market Size in 2030: |

USD 24.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- RETAIL BAGS MARKET BY TYPE (2016-2030)

- RETAIL BAGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HANDLE RETAIL CARRY BAGS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WITHOUT HANDLE RETAIL CARRY BAGS

- LOOP HANDLE BAGS

- PREMIUM RETAIL CARRY BAGS

- RETAIL BAGS MARKET BY MATERIAL (2016-2030)

- RETAIL BAGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAPER

- NATURAL MATERIAL

- RETAIL BAGS MARKET BY END USER (2016-2030)

- RETAIL BAGS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS & HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- E-COMMERCE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- RETAIL BAGS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BERRY GLOBAL INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPANYB SONOCO PRODUCTS COMPANY (USA)

- PROAMPAC LLC (USA)

- DOW CHEMICAL COMPANY (USA)

- BEMIS COMPANY INC. (USA)

- WESTROCK COMPANY (USA)

- GRAPHIC PACKAGING INTERNATIONAL, INC. (USA)

- PACKAGING CORPORATION OF AMERICA (PCA) (USA)

- INTERNATIONAL PAPER COMPANY (USA)

- SEALED AIR CORPORATION (USA)

- HUHTAMAKI GROUP OYJ (FINLAND)

- WIPAK OY (FINLAND)

- STORA ENSO OYJ (FINLAND)

- HUHTAMAKI OYJ (FINLAND)

- SMURFIT KAPPA GROUP PLC (IRELAND)

- DS SMITH (UK)

- GREINER PACKAGING (AUSTRIA)

- MONDI GROUP (AUSTRIA)

- NIPPON PAPER INDUSTRIES CO., LTD. (JAPAN)

- UFLEX LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL RETAIL BAGS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Retail Bags Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.39 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.4% |

Market Size in 2030: |

USD 24.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RETAIL BAGS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RETAIL BAGS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RETAIL BAGS MARKET COMPETITIVE RIVALRY

TABLE 005. RETAIL BAGS MARKET THREAT OF NEW ENTRANTS

TABLE 006. RETAIL BAGS MARKET THREAT OF SUBSTITUTES

TABLE 007. RETAIL BAGS MARKET BY TYPE

TABLE 008. HANDLE RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

TABLE 009. WITHOUT HANDLE RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

TABLE 010. LOOP HANDLE BAGS MARKET OVERVIEW (2016-2028)

TABLE 011. PREMIUM RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. RETAIL BAGS MARKET BY MATERIAL

TABLE 014. PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 015. PAPER MARKET OVERVIEW (2016-2028)

TABLE 016. NATURAL MATERIAL {JUTE MARKET OVERVIEW (2016-2028)

TABLE 017. COTTON & CANVAS MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS} MARKET OVERVIEW (2016-2028)

TABLE 019. RETAIL BAGS MARKET BY END USE

TABLE 020. ONLINE RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 021. OFFLINE RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA RETAIL BAGS MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA RETAIL BAGS MARKET, BY MATERIAL (2016-2028)

TABLE 024. NORTH AMERICA RETAIL BAGS MARKET, BY END USE (2016-2028)

TABLE 025. N RETAIL BAGS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE RETAIL BAGS MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE RETAIL BAGS MARKET, BY MATERIAL (2016-2028)

TABLE 028. EUROPE RETAIL BAGS MARKET, BY END USE (2016-2028)

TABLE 029. RETAIL BAGS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC RETAIL BAGS MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC RETAIL BAGS MARKET, BY MATERIAL (2016-2028)

TABLE 032. ASIA PACIFIC RETAIL BAGS MARKET, BY END USE (2016-2028)

TABLE 033. RETAIL BAGS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA RETAIL BAGS MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA RETAIL BAGS MARKET, BY MATERIAL (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA RETAIL BAGS MARKET, BY END USE (2016-2028)

TABLE 037. RETAIL BAGS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA RETAIL BAGS MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA RETAIL BAGS MARKET, BY MATERIAL (2016-2028)

TABLE 040. SOUTH AMERICA RETAIL BAGS MARKET, BY END USE (2016-2028)

TABLE 041. RETAIL BAGS MARKET, BY COUNTRY (2016-2028)

TABLE 042. ATLANTIC POLY INC.: SNAPSHOT

TABLE 043. ATLANTIC POLY INC.: BUSINESS PERFORMANCE

TABLE 044. ATLANTIC POLY INC.: PRODUCT PORTFOLIO

TABLE 045. ATLANTIC POLY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SMURFIT KAPPA GROUP PLC: SNAPSHOT

TABLE 046. SMURFIT KAPPA GROUP PLC: BUSINESS PERFORMANCE

TABLE 047. SMURFIT KAPPA GROUP PLC: PRODUCT PORTFOLIO

TABLE 048. SMURFIT KAPPA GROUP PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SPP POLY PACK PVT. LTD.: SNAPSHOT

TABLE 049. SPP POLY PACK PVT. LTD.: BUSINESS PERFORMANCE

TABLE 050. SPP POLY PACK PVT. LTD.: PRODUCT PORTFOLIO

TABLE 051. SPP POLY PACK PVT. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MONDI GROUP PLC: SNAPSHOT

TABLE 052. MONDI GROUP PLC: BUSINESS PERFORMANCE

TABLE 053. MONDI GROUP PLC: PRODUCT PORTFOLIO

TABLE 054. MONDI GROUP PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. EI DORADO PACKAGING INC.: SNAPSHOT

TABLE 055. EI DORADO PACKAGING INC.: BUSINESS PERFORMANCE

TABLE 056. EI DORADO PACKAGING INC.: PRODUCT PORTFOLIO

TABLE 057. EI DORADO PACKAGING INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. THE CARRY BAG COMPANY: SNAPSHOT

TABLE 058. THE CARRY BAG COMPANY: BUSINESS PERFORMANCE

TABLE 059. THE CARRY BAG COMPANY: PRODUCT PORTFOLIO

TABLE 060. THE CARRY BAG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ATTWOODS PACKAGING COMPANY: SNAPSHOT

TABLE 061. ATTWOODS PACKAGING COMPANY: BUSINESS PERFORMANCE

TABLE 062. ATTWOODS PACKAGING COMPANY: PRODUCT PORTFOLIO

TABLE 063. ATTWOODS PACKAGING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GLOBAL-PAK INC.: SNAPSHOT

TABLE 064. GLOBAL-PAK INC.: BUSINESS PERFORMANCE

TABLE 065. GLOBAL-PAK INC.: PRODUCT PORTFOLIO

TABLE 066. GLOBAL-PAK INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. BURBERRY GROUP PLC.: SNAPSHOT

TABLE 067. BURBERRY GROUP PLC.: BUSINESS PERFORMANCE

TABLE 068. BURBERRY GROUP PLC.: PRODUCT PORTFOLIO

TABLE 069. BURBERRY GROUP PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. WELTON BIBBY & BARON LIMITED: SNAPSHOT

TABLE 070. WELTON BIBBY & BARON LIMITED: BUSINESS PERFORMANCE

TABLE 071. WELTON BIBBY & BARON LIMITED: PRODUCT PORTFOLIO

TABLE 072. WELTON BIBBY & BARON LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. INITIAL PACKAGING LTD: SNAPSHOT

TABLE 073. INITIAL PACKAGING LTD: BUSINESS PERFORMANCE

TABLE 074. INITIAL PACKAGING LTD: PRODUCT PORTFOLIO

TABLE 075. INITIAL PACKAGING LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. RAINBOW PACKAGING INC.: SNAPSHOT

TABLE 076. RAINBOW PACKAGING INC.: BUSINESS PERFORMANCE

TABLE 077. RAINBOW PACKAGING INC.: PRODUCT PORTFOLIO

TABLE 078. RAINBOW PACKAGING INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. RUTAN POLY INDUSTRIES: SNAPSHOT

TABLE 079. RUTAN POLY INDUSTRIES: BUSINESS PERFORMANCE

TABLE 080. RUTAN POLY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 081. RUTAN POLY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. COVERIS HOLDINGS S.A.: SNAPSHOT

TABLE 082. COVERIS HOLDINGS S.A.: BUSINESS PERFORMANCE

TABLE 083. COVERIS HOLDINGS S.A.: PRODUCT PORTFOLIO

TABLE 084. COVERIS HOLDINGS S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. PARDA HOLDING B. V.: SNAPSHOT

TABLE 085. PARDA HOLDING B. V.: BUSINESS PERFORMANCE

TABLE 086. PARDA HOLDING B. V.: PRODUCT PORTFOLIO

TABLE 087. PARDA HOLDING B. V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. NOVOLEX HOLDINGS INC.: SNAPSHOT

TABLE 088. NOVOLEX HOLDINGS INC.: BUSINESS PERFORMANCE

TABLE 089. NOVOLEX HOLDINGS INC.: PRODUCT PORTFOLIO

TABLE 090. NOVOLEX HOLDINGS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. INTERNATIONAL PAPER COMPANY: SNAPSHOT

TABLE 091. INTERNATIONAL PAPER COMPANY: BUSINESS PERFORMANCE

TABLE 092. INTERNATIONAL PAPER COMPANY: PRODUCT PORTFOLIO

TABLE 093. INTERNATIONAL PAPER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 094. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 095. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 096. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RETAIL BAGS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RETAIL BAGS MARKET OVERVIEW BY TYPE

FIGURE 012. HANDLE RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

FIGURE 013. WITHOUT HANDLE RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

FIGURE 014. LOOP HANDLE BAGS MARKET OVERVIEW (2016-2028)

FIGURE 015. PREMIUM RETAIL CARRY BAGS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. RETAIL BAGS MARKET OVERVIEW BY MATERIAL

FIGURE 018. PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 019. PAPER MARKET OVERVIEW (2016-2028)

FIGURE 020. NATURAL MATERIAL {JUTE MARKET OVERVIEW (2016-2028)

FIGURE 021. COTTON & CANVAS MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS} MARKET OVERVIEW (2016-2028)

FIGURE 023. RETAIL BAGS MARKET OVERVIEW BY END USE

FIGURE 024. ONLINE RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 025. OFFLINE RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA RETAIL BAGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE RETAIL BAGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC RETAIL BAGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA RETAIL BAGS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA RETAIL BAGS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Retail Bags Market research report is 2023-2030.

Berry Global Inc. (USA),Sonoco Products Company (USA),ProAmpac LLC (USA),Dow Chemical Company (USA),Bemis Company Inc. (USA),Westrock Company (USA),Graphic Packaging International, Inc. (USA), Packaging Corporation of America (PCA) (USA), International Paper Company (USA),Sealed Air Corporation (USA), Huhtamaki Group Oyj (Finland), Wipak Oy (Finland), Stora Enso Oyj (Finland), Huhtamaki Oyj (Finland),Smurfit Kappa Group Plc (Ireland), DS Smith (UK), Greiner Packaging (Austria), Mondi Group (Austria), Nippon Paper Industries Co., Ltd. (Japan), UFlex Limited (India), Huamei Group Co., Ltd. (China), Weigang Group Co., Ltd. (China), Shanghai Bluelion Intelligent Technology Co., Ltd. (China), Suzhou Jingang Packaging Co., Ltd. (China), Amcor Limited (Australia) and Other Major Players.

The Retail Bags Market is segmented into Type, Material, End Use, and region. By Type, the market is categorized into Handle Retail Carry Bags, Without Handle Retail Carry Bags, Loop Handle Bags, Premium Retail Carry Bags. By Material, the market is categorized into Plastic, Paper, Natural Material {Jute, Cotton & Canvas}. By End Use, the market is categorized into Supermarkets & Hypermarkets, Specialty Stores, E-Commerce. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A single-use bag provided to customers to retain their goods from a Retail Establishment is referred to as a retail bag and includes both plastic and biodegradable plastic bags. The retail bag sector is in flux, influenced by bigger causes such as the rise of e-commerce and restaurant curbside pickup and delivery, and by shifting legislation and consumer preferences, as well as store responses to these shifts.

Retail Bags Market Size Was Valued at USD 16.39 Billion in 2022, and is Projected to Reach USD 24.96 Billion by 2030, Growing at a CAGR of 5.4% From 2023-2030.