Global Biodegradable Plastics Market Overview

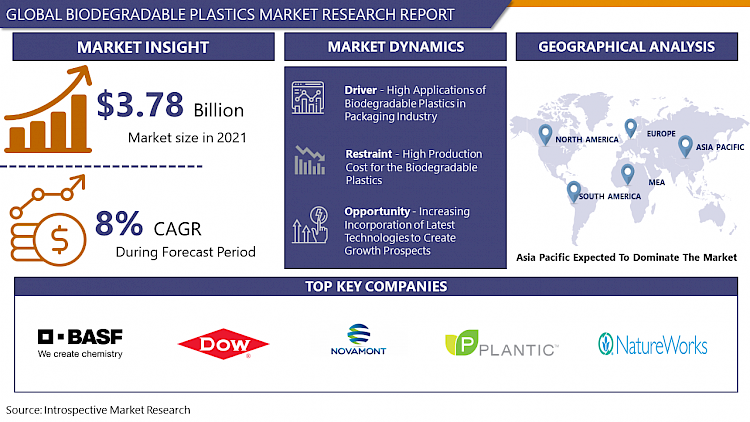

Global Biodegradable Plastics Market was valued at USD 3.78 billion in 2021 and is expected to reach USD 6.48 billion by the year 2028, at a CAGR of 8%.

Biodegradation is the property of a material that can be completely converted into water, CO2, and biomass by the action of microorganisms such as fungi and bacteria. Biodegradable plastics can be decomposed by microorganisms present in the environment by penetrating the microbial food chain. Biodegradable plastics can be decomposed by the action of living organisms, usual microbes, carbon dioxide, into the water, and biomass. Biodegradable plastics are produced with microorganisms, renewable raw materials, and petrochemicals. Additionally, the potential of biodegradable plastics and more particularly that of polymers obtained from renewable resources such as polysaccharides (e.g., starch) have long been acknowledged. Nevertheless, these biodegradable plastics have been extensively utilized in some and have not found massive applications in the packaging industries to put back conventional plastic materials, although they could be an interesting way to reduce the limitation of the petrochemical resources in the future. Furthermore, fossil fuel and gas could be partially replaced by greener agricultural sources, which should add to the reduction of CO2 emissions. Bio-based and biodegradable plastics can form the basis for environmentally acceptable, sustainable substitutes to current materials based exclusively on petroleum feedstocks. These bio-based materials offer value in the sustainability/life-cycle equation by being a part of the biological carbon cycle, particularly as it associates with carbon-based polymeric materials such as plastics, water-soluble polymers, and other carbon-based products such as biodiesel, lubricants, and detergents. Moreover, identification and specification of biobased content use radioactive C-14 signature. Biopolymers are generally able to be utilized by living matter (biodegraded), and so can be prepared in safe and ecologically sound ways through disposal processes (waste management) such as soil application, composting, and biological wastewater treatment. Single-use, short-life, disposable products can be prepared or developed to be bio-based and biodegradable. Additionally, plastic and its massive waste have become a major environmental issue globally also with growing issues related to petroleum-based plastics such as disposal management motivate growth in the biodegradable plastics market.

Market Dynamics and Factors for the Biodegradable Plastics Market:

Drivers:

High Applications of Biodegradable Plastics in Packaging Industry

Growing usages of biodegradable plastics majorly in food packaging is a key driver for the growth of the biodegradable plastics market in the projected period. This development is majorly due to biodegradable polyesters being the best alternatives to plastics. Therefore, an increase in the applications of bottles, food packaging, and disposable tableware and government support for biodegradable materials with stringent regulations on plastics utilization to overcome environmental pollution are factors anticipated to improve the biodegradable plastics market growth in the forecast time. For instance, in 2020, the German government declared a prohibition on the sale of single-use plastic products such as food containers, cutlery, straws, and other similar products from July 2021 to reduce plastic waste over the nation. As per, The German Association of Local Utility estimates, every year there is an increase of common plastic items waste by 10% to 20%, which is majorly from single-use plastic products. Furthermore, the government is preferring initiatives to develop awareness regarding biodegradable items and helping producers to offer high-quality products. Such factors are anticipated to demand the biodegradable plastics market growth, during the forecast period.

Switching Consumer Preference Toward Eco-Friendly Plastic

Developing consumer consciousness about sustainable plastic solutions and rising efforts to eliminate the use of non-biodegradable conventional plastics contribute to the market growth of biodegradable plastics. Regular used petroleum-based plastics take decades to break down or decompose and lay in the landfills for a long period. Biodegradable plastics break down rapidly when they are dropped and are absorbed back into the natural system. Additionally, the rate of decomposition of biodegradable plastics by the activities of microorganisms is much faster than that of traditional plastics. Biodegradable plastics seize up 60% and more within 180 days or less as compared with traditional plastics, which take about 1,000 years to break down. Rising landfills and waste piles have developed as serious environmental hazards and resulted in various poor effects on the flora and fauna of the ecosystem. The increasing consumer consciousness about these poor effects is motivating the utilization of biodegradable plastics. Hence, the change in consumer inclination toward the use of eco-friendly plastic products is driving the market for biodegradable plastics.

Restraints:

High Production Cost for the Biodegradable Plastics

Higher cost of the biodegradable plastic products owing to huge raw material cost as well as limited accessibility of raw materials. Moreover, the manufacturing cost of biodegradable plastics is 20-80% higher than that of conventional plastics. This is majorly owing to the high polymerization cost of biodegradable plastics as most of the processes are still in the emergence stage and hence, have not achieved economies of scale are expected to be a major obstacle for the biodegradable plastics market growth, throughout the projected period.

Opportunities:

Increasing Incorporation of Latest Technologies to Create Growth Prospects

Constant incorporation of the latest technologies in biodegradable plastics production is estimated to create huge investment opportunities for the market in the upcoming years. For instance, there has been the incorporation of antimicrobial technology in biodegradable materials producing to develop materials with longer shelf life and to expand preservation of the packaged products primarily food items. Additionally, antimicrobial packaging is used to defend against deterioration and ensure microbiological & chemical food safety by preventing microbial growth.

Furthermore, with the rising focus on sustainability and favorable government regulations for green procurement policies, biodegradable plastic producers have lucrative opportunities in the new end-use industries such as medical, electronics, and automotive. The biodegradable plastic manufacturers are investing heavily in R&D activities for the application of biodegradable plastics in various applications in the medical industry, such as screws, repaired materials, and implants. Biodegradable plastics such as PLA and bio-PBS are used for the production of medical devices & equipment. Biodegradable plastics are also utilized in tires with starch-based materials in the automotive industry to reduce fuel consumption which helps to increase the growth of the biodegradable plastic market in the upcoming years.

Market Segmentation

Players Covered in Biodegradable Plastics market are :

- BASF SE

- Dow Inc.

- Novamont S.p.A.

- Plantic

- Natureworks

- Corbion N.V.

- Biome Technologies plc

- Mitsubishi Chemical Holdings

- Eastman Chemical Company

- Danimer Scientific and other major players.

Regional Analysis of the Biodegradable Plastics Market:

The Asia Pacific region is expected to dominate the biodegradable plastic market during the forecast period. This dominance is majorly accredited to healthy economic developments for biodegradable plastics applications in the packaging sector and rising consumer positive outlook towards its utilization to reduce plastic pollution. Developing countries such as China and India have implemented severe regulations on conventional plastics utilization and major biodegradable plastic manufacturers in these countries are launching sustainable packaging solutions such as bio-based products, which is expected to drive the market growth in the review time. China is the global second highest economy, is forecast to gain a projected market size of US$1 Billion by the year 2027 the analysis period 2020 to 2027. Furthermore, the development of the biodegradable plastics market in APAC is attributed to the easy accessibility of raw materials used to manufacture biodegradable plastics. The future growth of biodegradable plastics in APAC highly depends on the awareness regarding the application of biodegradable plastics as a viable substitute to traditional plastics and price reduction.

North America is the significant share of the biodegradable plastics market owing to the governmental and regulatory bodies making decisions based on the aims to protect the planet. The conscious population and the high disposable income in the region favor the development of the biodegradable plastics market.

The European region is expected to be the fastest-growing biodegradable plastics market. Stringent regulations implemented by the European Union on fossil fuel-based plastics to overcome carbon footprint in the environment are expected to accelerate the biodegradable plastics market growth in the review time. The European region planned to reduce the consumption of plastic bags in the region by 80%, which has resulted in the extensive application of biodegradable flexible and rigid packaging in the region.

Key Industry Developments in the Biodegradable Plastics Market:

- In October 2021, Biodegradable Future has joined forces with Ocean Plastics Charter of Canada, the Canadian Government, and Biodegradable Future are executed to taking strong actions that dispose with a greener future and share similar goals & objectives. Making a difference in the sustainability arena is of the highest significance and this collaborate will ensure a positive sustainable impact in the fight against plastic pollution.

- In April 2021, NatureWorks declared a new strategic collaboration with IMA Coffee, which is a market leader in coffee handling processing and packaging. This collaboration focuses on growing the market reach for high-performing compostable K-cup in North America.

- In February 2020, BASF and Fabbri Group (Italy) formed a partnership to produce a sustainable solution for cling film used in fresh-food packaging. The film will be utilized in wrapping meat, seafood, and fresh fruits & vegetables. It will be developed by the Fabbri group with BASF's Ecovio bioplastic and will enhance the demand for biodegradable plastics in packaging applications.

- In September 2020, Danimer Scientific, a top designer and producer of biodegradable materials, and Plastic Suppliers, Inc. (PSI), a global producer of biopolymer EarthFirst PLA hurdle and non-barrier sealant films, on this day declared that they will develop bio-based, home compostable films. PSI will use material supplied by Danimer Scientific to create packaging films that will reliably degrade without leaving behind harmful microplastics.

COVID-19 Impact on the Biodegradable Plastics Market:

Owing to the global COVI-19 pandemic, the industries had been affected across the world. Biodegradable plastics are used in various industries, such as agriculture & horticulture, consumer goods, packaging, and textiles. Workforce scarcity, lack of material, logistical restrictions, and other restrictions had slowed the growth of the industry during the previous year. Owing to the spread of the Covid-19 pandemic and its rapid spread, industries of essential requirements such as getting foods and needed supplies safely to the consumers are growingly influenced. The global impact has helped to a sharp decline in demand for some types of packaging which are lost as non-essential. In addition, the demand for essential packaging such as e-commerce shipment has seen huge growth. These changes are creating packaging companies with a new set of challenges. The influence of the Covid-19 pandemic on the packaging industry will be mixed owing to these reasons. The Covid-19 pandemic has influenced the normal functioning of companies in the consumer goods sector. The successful marketing model has been influenced by the pandemic, which has stimulated the proper functioning of the business model. Owing to the supply chain interruptions across the world, 76% of the businesses had to overcome revenue targets by an average of 23%, according to the Institute for Supply Management Research. The sector has mixed market feelings as some industries such as household cleaning and frozen foods have seen a rise in consumer demands whereas others have seen a fall in sales and a significant reduction in food traffic in retail stores. The companies had to become pliable with the change in consumer demand towards e-commerce. This has required the entire consumer goods industry into the digital age.

|

Global Biodegradable Plastics Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 3.78 Bn. |

|

Forecast Period 2022-28 CAGR: |

8% |

Market Size in 2028: |

USD 6.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Biodegradable Plastics Market by Type

5.1 Biodegradable Plastics Market Overview Snapshot and Growth Engine

5.2 Biodegradable Plastics Market Overview

5.3 Polylactic Acid [PLA]

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Polylactic Acid [PLA]: Grographic Segmentation

5.4 Polybutylene Adipate Terephthalate [PBAT]

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Polybutylene Adipate Terephthalate [PBAT]: Grographic Segmentation

5.5 Polybutylene Succinate [PBS]

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Polybutylene Succinate [PBS]: Grographic Segmentation

5.6 Polyhydroxyalkanoates [PHA]

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Polyhydroxyalkanoates [PHA]: Grographic Segmentation

5.7 Starch Blends

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Starch Blends: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Biodegradable Plastics Market by Application

6.1 Biodegradable Plastics Market Overview Snapshot and Growth Engine

6.2 Biodegradable Plastics Market Overview

6.3 Packaging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Packaging: Grographic Segmentation

6.4 Agriculture

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Agriculture: Grographic Segmentation

6.5 Consumer Durable

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Consumer Durable: Grographic Segmentation

6.6 Textile

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Textile: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Biodegradable Plastics Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Biodegradable Plastics Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Biodegradable Plastics Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 BASF SE

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 DOW INC.

7.4 NOVAMONT S.P.A.

7.5 PLANTIC

7.6 NATUREWORKS

7.7 CORBION N.V.

7.8 BIOME TECHNOLOGIES PLC

7.9 MITSUBISHI CHEMICAL HOLDINGS

7.10 EASTMAN CHEMICAL COMPANY

7.11 DANIMER SCIENTIFIC

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Polylactic Acid [PLA]

8.2.2 Polybutylene Adipate Terephthalate [PBAT]

8.2.3 Polybutylene Succinate [PBS]

8.2.4 Polyhydroxyalkanoates [PHA]

8.2.5 Starch Blends

8.2.6 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Packaging

8.3.2 Agriculture

8.3.3 Consumer Durable

8.3.4 Textile

8.3.5 Others

Chapter 9: North America Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Polylactic Acid [PLA]

9.4.2 Polybutylene Adipate Terephthalate [PBAT]

9.4.3 Polybutylene Succinate [PBS]

9.4.4 Polyhydroxyalkanoates [PHA]

9.4.5 Starch Blends

9.4.6 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Packaging

9.5.2 Agriculture

9.5.3 Consumer Durable

9.5.4 Textile

9.5.5 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Polylactic Acid [PLA]

10.4.2 Polybutylene Adipate Terephthalate [PBAT]

10.4.3 Polybutylene Succinate [PBS]

10.4.4 Polyhydroxyalkanoates [PHA]

10.4.5 Starch Blends

10.4.6 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Packaging

10.5.2 Agriculture

10.5.3 Consumer Durable

10.5.4 Textile

10.5.5 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Polylactic Acid [PLA]

11.4.2 Polybutylene Adipate Terephthalate [PBAT]

11.4.3 Polybutylene Succinate [PBS]

11.4.4 Polyhydroxyalkanoates [PHA]

11.4.5 Starch Blends

11.4.6 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Packaging

11.5.2 Agriculture

11.5.3 Consumer Durable

11.5.4 Textile

11.5.5 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Polylactic Acid [PLA]

12.4.2 Polybutylene Adipate Terephthalate [PBAT]

12.4.3 Polybutylene Succinate [PBS]

12.4.4 Polyhydroxyalkanoates [PHA]

12.4.5 Starch Blends

12.4.6 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Packaging

12.5.2 Agriculture

12.5.3 Consumer Durable

12.5.4 Textile

12.5.5 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Biodegradable Plastics Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Polylactic Acid [PLA]

13.4.2 Polybutylene Adipate Terephthalate [PBAT]

13.4.3 Polybutylene Succinate [PBS]

13.4.4 Polyhydroxyalkanoates [PHA]

13.4.5 Starch Blends

13.4.6 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Packaging

13.5.2 Agriculture

13.5.3 Consumer Durable

13.5.4 Textile

13.5.5 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Biodegradable Plastics Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 3.78 Bn. |

|

Forecast Period 2022-28 CAGR: |

8% |

Market Size in 2028: |

USD 6.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIODEGRADABLE PLASTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIODEGRADABLE PLASTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIODEGRADABLE PLASTICS MARKET COMPETITIVE RIVALRY

TABLE 005. BIODEGRADABLE PLASTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIODEGRADABLE PLASTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. BIODEGRADABLE PLASTICS MARKET BY TYPE

TABLE 008. POLYLACTIC ACID [PLA] MARKET OVERVIEW (2016-2028)

TABLE 009. POLYBUTYLENE ADIPATE TEREPHTHALATE [PBAT] MARKET OVERVIEW (2016-2028)

TABLE 010. POLYBUTYLENE SUCCINATE [PBS] MARKET OVERVIEW (2016-2028)

TABLE 011. POLYHYDROXYALKANOATES [PHA] MARKET OVERVIEW (2016-2028)

TABLE 012. STARCH BLENDS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. BIODEGRADABLE PLASTICS MARKET BY APPLICATION

TABLE 015. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 016. AGRICULTURE MARKET OVERVIEW (2016-2028)

TABLE 017. CONSUMER DURABLE MARKET OVERVIEW (2016-2028)

TABLE 018. TEXTILE MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA BIODEGRADABLE PLASTICS MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA BIODEGRADABLE PLASTICS MARKET, BY APPLICATION (2016-2028)

TABLE 022. N BIODEGRADABLE PLASTICS MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE BIODEGRADABLE PLASTICS MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE BIODEGRADABLE PLASTICS MARKET, BY APPLICATION (2016-2028)

TABLE 025. BIODEGRADABLE PLASTICS MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC BIODEGRADABLE PLASTICS MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC BIODEGRADABLE PLASTICS MARKET, BY APPLICATION (2016-2028)

TABLE 028. BIODEGRADABLE PLASTICS MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA BIODEGRADABLE PLASTICS MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA BIODEGRADABLE PLASTICS MARKET, BY APPLICATION (2016-2028)

TABLE 031. BIODEGRADABLE PLASTICS MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA BIODEGRADABLE PLASTICS MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA BIODEGRADABLE PLASTICS MARKET, BY APPLICATION (2016-2028)

TABLE 034. BIODEGRADABLE PLASTICS MARKET, BY COUNTRY (2016-2028)

TABLE 035. BASF SE: SNAPSHOT

TABLE 036. BASF SE: BUSINESS PERFORMANCE

TABLE 037. BASF SE: PRODUCT PORTFOLIO

TABLE 038. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. DOW INC.: SNAPSHOT

TABLE 039. DOW INC.: BUSINESS PERFORMANCE

TABLE 040. DOW INC.: PRODUCT PORTFOLIO

TABLE 041. DOW INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. NOVAMONT S.P.A.: SNAPSHOT

TABLE 042. NOVAMONT S.P.A.: BUSINESS PERFORMANCE

TABLE 043. NOVAMONT S.P.A.: PRODUCT PORTFOLIO

TABLE 044. NOVAMONT S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. PLANTIC: SNAPSHOT

TABLE 045. PLANTIC: BUSINESS PERFORMANCE

TABLE 046. PLANTIC: PRODUCT PORTFOLIO

TABLE 047. PLANTIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. NATUREWORKS: SNAPSHOT

TABLE 048. NATUREWORKS: BUSINESS PERFORMANCE

TABLE 049. NATUREWORKS: PRODUCT PORTFOLIO

TABLE 050. NATUREWORKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. CORBION N.V.: SNAPSHOT

TABLE 051. CORBION N.V.: BUSINESS PERFORMANCE

TABLE 052. CORBION N.V.: PRODUCT PORTFOLIO

TABLE 053. CORBION N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. BIOME TECHNOLOGIES PLC: SNAPSHOT

TABLE 054. BIOME TECHNOLOGIES PLC: BUSINESS PERFORMANCE

TABLE 055. BIOME TECHNOLOGIES PLC: PRODUCT PORTFOLIO

TABLE 056. BIOME TECHNOLOGIES PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MITSUBISHI CHEMICAL HOLDINGS: SNAPSHOT

TABLE 057. MITSUBISHI CHEMICAL HOLDINGS: BUSINESS PERFORMANCE

TABLE 058. MITSUBISHI CHEMICAL HOLDINGS: PRODUCT PORTFOLIO

TABLE 059. MITSUBISHI CHEMICAL HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. EASTMAN CHEMICAL COMPANY: SNAPSHOT

TABLE 060. EASTMAN CHEMICAL COMPANY: BUSINESS PERFORMANCE

TABLE 061. EASTMAN CHEMICAL COMPANY: PRODUCT PORTFOLIO

TABLE 062. EASTMAN CHEMICAL COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DANIMER SCIENTIFIC: SNAPSHOT

TABLE 063. DANIMER SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 064. DANIMER SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 065. DANIMER SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 066. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 067. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 068. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIODEGRADABLE PLASTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIODEGRADABLE PLASTICS MARKET OVERVIEW BY TYPE

FIGURE 012. POLYLACTIC ACID [PLA] MARKET OVERVIEW (2016-2028)

FIGURE 013. POLYBUTYLENE ADIPATE TEREPHTHALATE [PBAT] MARKET OVERVIEW (2016-2028)

FIGURE 014. POLYBUTYLENE SUCCINATE [PBS] MARKET OVERVIEW (2016-2028)

FIGURE 015. POLYHYDROXYALKANOATES [PHA] MARKET OVERVIEW (2016-2028)

FIGURE 016. STARCH BLENDS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. BIODEGRADABLE PLASTICS MARKET OVERVIEW BY APPLICATION

FIGURE 019. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 020. AGRICULTURE MARKET OVERVIEW (2016-2028)

FIGURE 021. CONSUMER DURABLE MARKET OVERVIEW (2016-2028)

FIGURE 022. TEXTILE MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA BIODEGRADABLE PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE BIODEGRADABLE PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC BIODEGRADABLE PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA BIODEGRADABLE PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA BIODEGRADABLE PLASTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Biodegradable Plastics Market research report is 2022-2028.

BASF SE, Dow Inc., Novamont S.p.A., Plantic, Natureworks, Corbion N.V., Biome Technologies plc, Mitsubishi Chemical Holdings, Eastman Chemical Company, Danimer Scientific, and other major players.

The Biodegradable Plastics Market is segmented into Type, Application, and region. By Type, the market is categorized into Polylactic Acid [PLA], Polybutylene Adipate Terephthalate [PBAT], Polybutylene Succinate [PBS], Polyhydroxyalkanoates [PHA], Starch Blends, and Others. By Application, the market is categorized into Packaging, Agriculture, Consumer Durable, Textile, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biodegradable plastics are produced with microorganisms, renewable raw materials, and petrochemicals. Additionally, the potential of biodegradable plastics and more particularly that of polymers obtained from renewable resources such as polysaccharides (e.g., starch) have long been acknowledged.

The Biodegradable Plastics Market was valued at USD 3.78 Billion in 2021 and is projected to reach USD 6.48 Billion by 2028, growing at a CAGR of 8% from 2022 to 2028.