Chub Packaging Market Overview

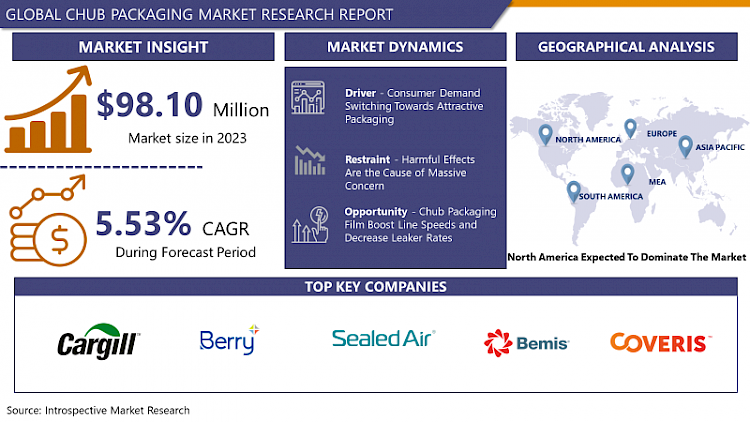

Chub Packaging Market Size Was Valued at USD 98.10 Million in 2023 and is Projected to Reach USD 159.24 Million by 2032, Growing at a CAGR of 5.53% From 2024-2032

Chub packaging is referred to as the chub packs, chub wrap, or simply chubs which is a cylindrical sausage-shaped form of packaging often used for ground meats. As chub packaging has become more familiar to consumers over the past several years, along with other vacuum-sealed products with meat that blooms when opened and exposed to oxygen, its advantages have been acknowledged by those seeking certain aspects from ground meat products. The interest in chub packaging by consumers continues to grow which helps to growth of the market over the forecast period. Moreover, chub packaging is utilized in retail and foodservice operations as a cost-effective way to defend pet foods, fresh and cooked ground meats, and substitute proteins. Furthermore, chub packaging manufacturers offer packaging solutions that are characterized by smoother packaging for slippage, consistent packaging material for a wide temperature range, and films that are resistant to puncture. Chub packaging incorporates co-extruded multi-layer barrier films which have transparent, white, or painted surfaces. The films are manufactured to deliver high-performance storage of ground meat to extend shelf-life. Packaging film producers support the demand by continually integrating technology into packaging materials. In addition, chub packaging helps to control the respirational functionality of the packaging and maintain equilibrium between the temperature of the product packed within and the atmospheric temperature outside. Chub packages are impassable to oxygen, which gives the product an enlarged shelf-life.

Market Dynamics and Factors for the Chub Packaging Market:

Drivers:

Driving forces include a demand in ground beef utilization owing to it enable quick preparation of protein-rich meals. Demand for chubs also is increasing owing to the format's ability to deliver extended shelf life. Switching lifestyles are another influencer, particularly in emerging countries where incomes are growing. Additionally, chub packaging costs less than tray packaging, and its lighter weight means lower supply chain costs and sustainability significance. The latest designs of chub packaging machines also improve sustainability and decrease costs. For instance, positioning clips in the shortest space possible conserve film and manufactures an attractive package. Forming clips online from roll stock cuts costs versus preformed clips. Filling speeds range from 15 to approximately 150 chubs per minute. Many models offer a choice of sealing options: heated air, radiofrequency, or extrusion. Common chub sizes include one, two, three, five, and 10-pound, but heavier weights are accessible.

The consumer demand switching towards attractive packaging, up to the extent that the look and feel of the product's packaging are nowadays considered a unique selling point. The multi-layer protection & transparency provided by chub packaging is expected to accelerate the market demand. Furthermore, the printed and tailored options in chub packaging along with rising engineered solutions focused to augment the shelf-life of the products packed inside are the added growth indicators. In addition, the atmospheric temperature outside the package is the same as the inside temperature, which makes it a more ideal option for packaging grounded meat and meat products. The advanced chub packaging producers create it a cost-efficient option and the advent of the latest technology in machinery enables them to create it using less material and less energy compared to other packaging options. From a retailer's point of view, chub packaging offers them easy to freeze packaging option, with the additional advantage of shelf-ready packaging for their product offerings. The demand for sustainability is also accomplished by chub packaging, as it is made mostly out of recycled material and helps to establish a cycle of recyclable packaging material.

Restraints:

Cheap manufacturing costs and easy availability make plastic very useful, but it has many inadequacies and its harmful effects are the cause of massive concern for us to save the earth and ourselves. Food processors are challenged with the rising requirements to overcome plastic and produce packs that are strong enough to protect food in various food channels and long distribution chains. Nevertheless, an increase in the prices of meat products can decline the utilization of meat by people, which hampering the growth of the chub packaging market during the forecast period.

Opportunities:

Chub Packaging Film Boost Line Speeds and Decrease Leaker Rates

Torpedo chub film for ground beef, pork, and poultry offers fresh meat processors enhanced productivity by faster line speeds and reduced leaker rates. Developed structural technology yields better film tracking and overall machinability, as well as wider seal temperature tolerances for high-performance packaging that benefits the bottom line. Produced by Alcan Packaging Food Americas, Torpedo chub film is available in clear or white, plain or printed in high-impact 10-color graphics. Multi-layer Torpedo combats puncture and perform well in cold temperatures. With its high-barrier properties, the inventive film helps to increase shelf life, providing significant advantages compared to conventional overwrapped trays.

Market Segmentation

Based on the material, the Polypropylene segment is expected to register the maximum chub packaging market share during the forecast period. The major raw materials utilized for the production of bags are High-Density Polyethylene or PP granules, which can hold heavy materials. High-Density Polyethylene, which has replaced the ancient tradition of using jute bags. All polythene bags are fully recyclable and of food-grade quality, which is completely secure to use with consumable products. Polythene packing solutions provide a comprehensive choice of bags designed for medium, light, and heavy-duty use, in a wide variety of sizes.

Based on the application, the food application segment is expected to register the maximum chub packaging market share during the forecast period. Food application includes various sub-application for chub packaging such as cream cheese, processed meat, pet foods, ground meat, liverwurst, ice cream, vegetables, cookie dough, processed cheese, pork sausage, butter, stuffing, shortening, marzipan, polenta, marmalade/jams. Owing to the highly stretchable sleeves ease high-speed packaging with a superior seal over a wide range of temperatures. Puncture-resistant chub films resist production, shipping, and handling. Its flap-less seal fully exposes print and graphics all over the package with excellent gloss and slipping properties. Many customers have found that chub-packaged product is generally fresher and more hygienic than in-store processed ground beef.

Players Covered in Chub Packaging Market are :

- Cargill Corporation

- Berry Plastics Corporation

- Henry & Sons and Qingdao Haide Packaging Co. Ltd.

- Plastopil Hazorea Co. Ltd.

- Alcan Packaging Food Americas Plastopil BV

- Kendall Packaging Corporation

- R.A Jones Group Ltd

- Sealed Air Corporation

- Inteplast Group

- Coveris Holdings SA

- Bemis Company

- Flexopack S.A.

- HOVUS Incorporated and other major players.

Regional Analysis for the Chub Packaging Market:

- North America is a major market for chub packaging not only in terms of application but also leading in technological developments for chub packaging. With the rising demand for flexible packaging, players are making a significant investment in product innovation, thereby increasing market growth in the region. Moreover, the demand for chub packaging products is generally driven by millennial customers in the region, as they have an eager preference for single-serving and on-the-go style food and beverage foodstuffs. These products are generally developed to be portable, long-lasting, and lightweight; flexible packaging stands to be a famous option to pack such products. The rising demand for chub packaging for foods applications, both in terms of processed foods and fresh items and others is anticipated to govern the demand for flexible packaging from the region's food and beverage industry.

- The Asia-pacific region is set to perform well over the estimated period to come as the chub packaging type is currently in the growing stage for the whole Asian market. The increase in the flexible packaging industry in India is mainly turned by the food and pharmaceutical packaging sectors. The large and rising Indian middle class, along with the growth in organized retailing in the country are accelerating growth in the chub packaging industry.

- The European region is expected to grow at a significant growth rate for the chub packaging market owing to its key economies countries have recorded a rise in demand for easy and flexibly packed products. The development of modified atmosphere packaging has raised massive traction in the last few years. These types of packaging control the in-pack gas atmosphere, improving freshness and improving shelf life for fresh food products.

- Middle-Eastern economies have shown a sharp surge in demand for packaging which is flexible along with longer shelf-lives. As meat utilization in the region increases owing to the result of growth in disposable income of consumers and rising expenditure on food products. Latin America is anticipated to create a lucrative market for chub packaging as growth in demand along with utilization for meat products are healthy signs from their region.

Key Industry Developments in the Chub Packaging Market:

- In January 2024, SEE developed the first biobased, industrial compostable tray for protein packaging, the CRYOVAC® brand compostable overwrap tray. The tray is made from biobased, food-contact grade resin, certified by USDA for 54% biobased content. It breaks into organic material without leaving toxic residue, offering an alternative to expanded polystyrene (EPS), which is not biodegradable or recyclable. The tray is designed to meet the demands of existing food processing equipment.

|

Global Chub Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 98.10 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.53% |

Market Size in 2032: |

USD 159.24 Bn. |

|

Segments Covered:

|

By Material |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Material

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Chub Packaging Market by Material

5.1 Chub Packaging Market Overview Snapshot and Growth Engine

5.2 Chub Packaging Market Overview

5.3 Polyethylene (PE)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Polyethylene (PE): Grographic Segmentation

5.4 Polyvinylidene Chloride (PVC)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Polyvinylidene Chloride (PVC): Grographic Segmentation

5.5 Multilayer Nylon

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Multilayer Nylon: Grographic Segmentation

5.6 Polyethylene Terephthalate (PET)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Polyethylene Terephthalate (PET): Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Chub Packaging Market by Application

6.1 Chub Packaging Market Overview Snapshot and Growth Engine

6.2 Chub Packaging Market Overview

6.3 Food Applications

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Food Applications: Grographic Segmentation

6.4 Institutional Applications

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Institutional Applications: Grographic Segmentation

6.5 Industrial Applications

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial Applications: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Chub Packaging Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Chub Packaging Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Chub Packaging Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 CARGILL CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BERRY PLASTICS CORPORATION

7.4 HENRY & SONS AND QINGDAO HAIDE PACKAGING CO. LTD.

7.5 PLASTOPIL HAZOREA CO. LTD.

7.6 ALCAN PACKAGING FOOD AMERICAS PLASTOPIL BV

7.7 KENDALL PACKAGING CORPORATION

7.8 R.A JONES GROUP LTD

7.9 SEALED AIR CORPORATION

7.10 INTEPLAST GROUP

7.11 COVERIS HOLDINGS SA

7.12 BEMIS COMPANY

7.13 FLEXOPACK S.A.

7.14 HOVUS INCORPORATED

7.15 OTHER MAJOR PLAYERS

Chapter 8: Global Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Material

8.2.1 Polyethylene (PE)

8.2.2 Polyvinylidene Chloride (PVC)

8.2.3 Multilayer Nylon

8.2.4 Polyethylene Terephthalate (PET)

8.2.5 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Food Applications

8.3.2 Institutional Applications

8.3.3 Industrial Applications

Chapter 9: North America Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Material

9.4.1 Polyethylene (PE)

9.4.2 Polyvinylidene Chloride (PVC)

9.4.3 Multilayer Nylon

9.4.4 Polyethylene Terephthalate (PET)

9.4.5 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Food Applications

9.5.2 Institutional Applications

9.5.3 Industrial Applications

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Material

10.4.1 Polyethylene (PE)

10.4.2 Polyvinylidene Chloride (PVC)

10.4.3 Multilayer Nylon

10.4.4 Polyethylene Terephthalate (PET)

10.4.5 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Food Applications

10.5.2 Institutional Applications

10.5.3 Industrial Applications

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Material

11.4.1 Polyethylene (PE)

11.4.2 Polyvinylidene Chloride (PVC)

11.4.3 Multilayer Nylon

11.4.4 Polyethylene Terephthalate (PET)

11.4.5 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Food Applications

11.5.2 Institutional Applications

11.5.3 Industrial Applications

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Material

12.4.1 Polyethylene (PE)

12.4.2 Polyvinylidene Chloride (PVC)

12.4.3 Multilayer Nylon

12.4.4 Polyethylene Terephthalate (PET)

12.4.5 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Food Applications

12.5.2 Institutional Applications

12.5.3 Industrial Applications

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Chub Packaging Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Material

13.4.1 Polyethylene (PE)

13.4.2 Polyvinylidene Chloride (PVC)

13.4.3 Multilayer Nylon

13.4.4 Polyethylene Terephthalate (PET)

13.4.5 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Food Applications

13.5.2 Institutional Applications

13.5.3 Industrial Applications

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Chub Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2016 to 2022 |

Market Size in 2023: |

USD 98.10 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.53% |

Market Size in 2032: |

USD 159.24 Bn. |

|

Segments Covered:

|

By Material |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. CHUB PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. CHUB PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. CHUB PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. CHUB PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. CHUB PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. CHUB PACKAGING MARKET BY MATERIAL

TABLE 008. POLYETHYLENE (PE) MARKET OVERVIEW (2016-2028)

TABLE 009. POLYVINYLIDENE CHLORIDE (PVC) MARKET OVERVIEW (2016-2028)

TABLE 010. MULTILAYER NYLON MARKET OVERVIEW (2016-2028)

TABLE 011. POLYETHYLENE TEREPHTHALATE (PET) MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. CHUB PACKAGING MARKET BY APPLICATION

TABLE 014. FOOD APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 015. INSTITUTIONAL APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 016. INDUSTRIAL APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA CHUB PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 018. NORTH AMERICA CHUB PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 019. N CHUB PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE CHUB PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 021. EUROPE CHUB PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 022. CHUB PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC CHUB PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 024. ASIA PACIFIC CHUB PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 025. CHUB PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA CHUB PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA CHUB PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 028. CHUB PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA CHUB PACKAGING MARKET, BY MATERIAL (2016-2028)

TABLE 030. SOUTH AMERICA CHUB PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 031. CHUB PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 032. CARGILL CORPORATION: SNAPSHOT

TABLE 033. CARGILL CORPORATION: BUSINESS PERFORMANCE

TABLE 034. CARGILL CORPORATION: PRODUCT PORTFOLIO

TABLE 035. CARGILL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. BERRY PLASTICS CORPORATION: SNAPSHOT

TABLE 036. BERRY PLASTICS CORPORATION: BUSINESS PERFORMANCE

TABLE 037. BERRY PLASTICS CORPORATION: PRODUCT PORTFOLIO

TABLE 038. BERRY PLASTICS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. HENRY & SONS AND QINGDAO HAIDE PACKAGING CO. LTD.: SNAPSHOT

TABLE 039. HENRY & SONS AND QINGDAO HAIDE PACKAGING CO. LTD.: BUSINESS PERFORMANCE

TABLE 040. HENRY & SONS AND QINGDAO HAIDE PACKAGING CO. LTD.: PRODUCT PORTFOLIO

TABLE 041. HENRY & SONS AND QINGDAO HAIDE PACKAGING CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PLASTOPIL HAZOREA CO. LTD.: SNAPSHOT

TABLE 042. PLASTOPIL HAZOREA CO. LTD.: BUSINESS PERFORMANCE

TABLE 043. PLASTOPIL HAZOREA CO. LTD.: PRODUCT PORTFOLIO

TABLE 044. PLASTOPIL HAZOREA CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ALCAN PACKAGING FOOD AMERICAS PLASTOPIL BV: SNAPSHOT

TABLE 045. ALCAN PACKAGING FOOD AMERICAS PLASTOPIL BV: BUSINESS PERFORMANCE

TABLE 046. ALCAN PACKAGING FOOD AMERICAS PLASTOPIL BV: PRODUCT PORTFOLIO

TABLE 047. ALCAN PACKAGING FOOD AMERICAS PLASTOPIL BV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. KENDALL PACKAGING CORPORATION: SNAPSHOT

TABLE 048. KENDALL PACKAGING CORPORATION: BUSINESS PERFORMANCE

TABLE 049. KENDALL PACKAGING CORPORATION: PRODUCT PORTFOLIO

TABLE 050. KENDALL PACKAGING CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. R.A JONES GROUP LTD: SNAPSHOT

TABLE 051. R.A JONES GROUP LTD: BUSINESS PERFORMANCE

TABLE 052. R.A JONES GROUP LTD: PRODUCT PORTFOLIO

TABLE 053. R.A JONES GROUP LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SEALED AIR CORPORATION: SNAPSHOT

TABLE 054. SEALED AIR CORPORATION: BUSINESS PERFORMANCE

TABLE 055. SEALED AIR CORPORATION: PRODUCT PORTFOLIO

TABLE 056. SEALED AIR CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. INTEPLAST GROUP: SNAPSHOT

TABLE 057. INTEPLAST GROUP: BUSINESS PERFORMANCE

TABLE 058. INTEPLAST GROUP: PRODUCT PORTFOLIO

TABLE 059. INTEPLAST GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. COVERIS HOLDINGS SA: SNAPSHOT

TABLE 060. COVERIS HOLDINGS SA: BUSINESS PERFORMANCE

TABLE 061. COVERIS HOLDINGS SA: PRODUCT PORTFOLIO

TABLE 062. COVERIS HOLDINGS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. BEMIS COMPANY: SNAPSHOT

TABLE 063. BEMIS COMPANY: BUSINESS PERFORMANCE

TABLE 064. BEMIS COMPANY: PRODUCT PORTFOLIO

TABLE 065. BEMIS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. FLEXOPACK S.A.: SNAPSHOT

TABLE 066. FLEXOPACK S.A.: BUSINESS PERFORMANCE

TABLE 067. FLEXOPACK S.A.: PRODUCT PORTFOLIO

TABLE 068. FLEXOPACK S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. HOVUS INCORPORATED: SNAPSHOT

TABLE 069. HOVUS INCORPORATED: BUSINESS PERFORMANCE

TABLE 070. HOVUS INCORPORATED: PRODUCT PORTFOLIO

TABLE 071. HOVUS INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 072. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 073. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 074. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. CHUB PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. CHUB PACKAGING MARKET OVERVIEW BY MATERIAL

FIGURE 012. POLYETHYLENE (PE) MARKET OVERVIEW (2016-2028)

FIGURE 013. POLYVINYLIDENE CHLORIDE (PVC) MARKET OVERVIEW (2016-2028)

FIGURE 014. MULTILAYER NYLON MARKET OVERVIEW (2016-2028)

FIGURE 015. POLYETHYLENE TEREPHTHALATE (PET) MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. CHUB PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 018. FOOD APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 019. INSTITUTIONAL APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 020. INDUSTRIAL APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA CHUB PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE CHUB PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC CHUB PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA CHUB PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA CHUB PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Chub Packaging Market research report is 2024-2032.

Cargill Corporation, Berry Plastics Corporation, Henry & Sons and Qingdao Haide Packaging Co. Ltd., Plastopil Hazorea Co. Ltd., Alcan Packaging Food Americas Plastopil BV, Kendall Packaging Corporation, R.A Jones Group Ltd, Sealed Air Corporation, Inteplast Group, Coveris Holdings SA, Bemis Company, Flexopack S.A., HOVUS Incorporated and other major players.

The Chub Packaging Market is segmented into Material, Application, and region. By Material, the market is categorized into Polyethylene (PE), Polyvinylidene Chloride (PVC), Multilayer Nylon, Polyethylene Terephthalate (PET), Others. By Application, the market is categorized into Food Applications, Institutional Applications, Industrial Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Chub packaging is referred to as the chub packs, chub wrap, or simply chubs which is a cylindrical sausage-shaped form of packaging often used for ground meats.

Chub Packaging Market Size Was Valued at USD 98.10 Million in 2023 and is Projected to Reach USD 159.24 Million by 2032, Growing at a CAGR of 5.53% From 2024-2032