Micro-perforated Food Packaging Market Synopsis

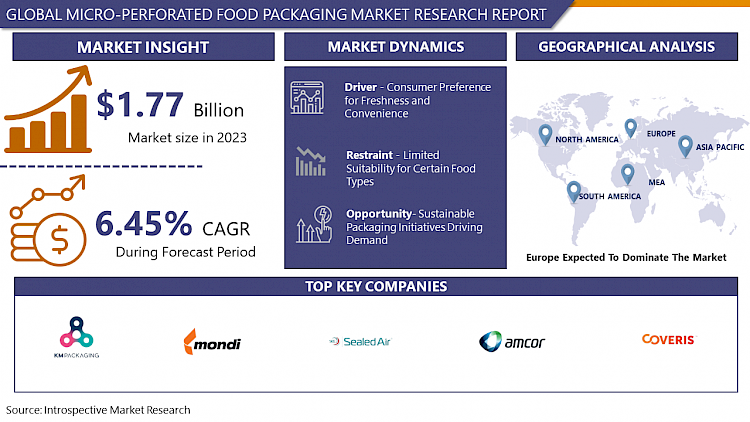

Micro-perforated Food Packaging Market Size Was Valued at USD 1.77 Billion in 2023, and is Projected to Reach USD 3.11 Billion by 2032, Growing at a CAGR of 6.45 % From 2024-2032.

Micro-perforated food packaging refers to packaging materials, typically films or bags, that are punctured with tiny holes. These holes allow for a controlled exchange of gases such as oxygen and carbon dioxide between the packaged food and its environment. This controlled gas exchange helps maintain freshness and extends the shelf life of perishable foods by slowing down spoilage and preserving quality.

- The micro-perforated food packaging market has experienced significant growth in recent years, driven by the rising demand for convenience and extended shelf life of perishable food items. These packaging solutions are designed with tiny perforations that allow for controlled airflow, maintaining the freshness of the contents while preventing moisture buildup that could lead to spoilage. With consumers increasingly prioritizing food safety and sustainability, manufacturers are focusing on developing eco-friendly materials for micro-perforated packaging, further driving market expansion.

- The adoption of advanced technologies, such as modified atmosphere packaging, enhances the efficacy of micro-perforated solutions in preserving food quality. As the food industry continues to evolve, the micro-perforated packaging market is poised for continued growth, catering to the needs of both consumers and producers alike.

- The core needs of food freshness and sustainability, the micro-perforated food packaging market is witnessing further expansion fueled by technological advancements and shifting consumer preferences. Innovations such as active packaging incorporating antimicrobial agents or oxygen scavengers are enhancing the preservation capabilities of micro-perforated materials, extending the shelf life of products even further. Moreover, the trend towards convenient, on-the-go consumption is driving the demand for single-serve and portion-controlled packaging formats, where micro-perforated solutions play a crucial role in maintaining product quality without compromising convenience. Furthermore, regulatory initiatives promoting food safety standards and reducing food waste are bolstering the adoption of micro-perforated packaging across various segments of the food industry.

- The global push towards sustainable practices and environmental consciousness is significantly influencing the micro-perforated food packaging market. Consumers are increasingly drawn to packaging solutions that minimize waste and utilize recyclable or biodegradable materials. This has prompted packaging manufacturers to explore innovative eco-friendly alternatives, such as compostable films and bio-based polymers, for micro-perforated packaging applications. initiatives aimed at reducing plastic usage, coupled with government regulations mandating eco-friendly packaging practices, are driving the adoption of sustainable micro-perforated solutions across the food industry.

Micro-perforated Food Packaging Market Trend Analysis

Enhanced Shelf-life Extension Technologies

- Enhanced shelf-life extension technologies, particularly micro-perforated food packaging, are rapidly gaining traction in the food industry due to their ability to prolong the freshness and quality of perishable products. These packaging solutions incorporate tiny perforations that allow controlled amounts of oxygen to enter the package while releasing excess moisture, thus creating an optimal environment for maintaining the product's freshness. This technology helps to slow down the growth of spoilage microorganisms and preserve the sensory attributes of the food, such as taste, texture, and aroma. As consumers increasingly demand convenience and longer shelf life for their food purchases, the micro-perforated food packaging market is witnessing significant growth. Additionally, advancements in material science and manufacturing processes are driving innovation in this sector, leading to the development of more efficient and sustainable packaging solutions.

- The adoption of micro-perforated food packaging aligns with the industry's growing emphasis on sustainability and reducing food waste. By extending the shelf life of perishable products, these technologies help minimize the need for excessive preservatives and additives, contributing to cleaner labels and healthier food options. Additionally, by reducing food spoilage and the frequency of product recalls due to compromised freshness, micro-perforated packaging supports efforts to lower the environmental impact associated with food production and distribution. As regulatory agencies and consumers alike prioritize sustainability and food safety, the demand for innovative packaging solutions like micro-perforated technology is expected to continue rising, driving further market expansion and technological advancements.

Sustainable Packaging Initiatives Driving Demand

- The micro-perforated food packaging market is experiencing a surge in demand, primarily propelled by the growing emphasis on sustainable packaging initiatives. As consumers become increasingly aware of environmental concerns, there's a palpable shift towards eco-friendly packaging solutions. Micro-perforated packaging stands out as a viable option due to its ability to extend the shelf life of perishable goods while reducing food waste. These packages incorporate tiny perforations that facilitate controlled airflow, thereby regulating moisture levels and preventing condensation buildup, which can lead to spoilage.

- The micro-perforated packaging allows for the exchange of gases, such as oxygen and carbon dioxide, which is crucial for preserving the freshness of fruits, vegetables, and baked goods. This combination of enhanced product preservation and reduced environmental impact aligns with the goals of sustainable packaging initiatives, driving the heightened demand for micro-perforated food packaging solutions in the market.

Micro-perforated Food Packaging Market Segment Analysis:

Micro-perforated Food Packaging Market Segmented Based on Product Type and Application.

By Product Type, the Polyethylene (PE) segment is expected to dominate the market during the forecast period

- Polyethylene (PE): PE is likely a prominent material in micro-perforated food packaging due to its versatility, durability, and cost-effectiveness. It offers excellent moisture resistance, making it suitable for various food products. Micro-perforated PE packaging may be preferred for items such as fresh produce, bakery goods, and snacks, where controlled airflow is necessary to maintain freshness.

- Polypropylene (PP): PP is another common material in micro-perforated food packaging, known for its high heat resistance and ability to withstand repeated use. Micro-perforated PP packaging may be used for items requiring high clarity and presentation, such as deli meats, cheeses, and pre-packaged salads.

- PET (Polyethylene Terephthalate): PET is a widely used material in the food packaging industry due to its transparency, lightweight nature, and recyclability. Micro-perforated PET packaging is likely utilized for products requiring visibility and protection from external contaminants, such as fresh fruits, vegetables, and ready-to-eat meals.

- Others: This category encompasses various materials not specified as PE, PP, or PET, including compostable plastics, bio-based materials, and specialty films. Micro-perforated packaging made from alternative materials may cater to niche markets or specific sustainability requirements, offering unique properties such as compostability or enhanced barrier protection.

By Application, Fruits & Vegetables segment held the largest share in 2023

- Fruits & Vegetables: Micro-perforated packaging is commonly used for fresh produce like fruits and vegetables. It allows for controlled respiration and moisture retention, preventing the build-up of condensation which can lead to spoilage. By regulating oxygen and carbon dioxide levels, it helps in prolonging the freshness of fruits and vegetables, thereby reducing food waste.

- Bakery & Confectionery: In the bakery and confectionery sector, micro-perforated packaging plays a crucial role in preserving the texture and taste of baked goods and confectionery items. It helps in maintaining the ideal balance of moisture and air inside the package, preventing products from becoming stale or losing their crispiness.

- Ready-to-Eat: Micro-perforated packaging is also utilized for ready-to-eat food items such as salads, sandwiches, and deli meats. It ensures that these products remain fresh and appetizing by allowing for proper airflow while preventing moisture buildup that could lead to sogginess or microbial growth.

- Others: This category may encompass a range of miscellaneous food items that benefit from micro-perforated packaging. It could include items such as cheese, snacks, herbs, or even pre-cut meats. The primary goal across all these applications is to maintain product quality and extend shelf life.

Micro-perforated Food Packaging Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is anticipated to maintain dominance in the micro-perforated food packaging market. This is primarily attributed to several factors such as stringent regulations regarding food safety and sustainability, coupled with increasing consumer demand for convenient and eco-friendly packaging solutions. Additionally, the growing emphasis on extending the shelf life of perishable food products is driving the adoption of micro-perforated packaging technology, as it helps in maintaining product freshness and quality. Moreover, the presence of established players in the region investing in research and development activities to enhance packaging efficiency and sustainability further contributes to the market's growth trajectory.

- Europe's robust infrastructure for food processing and packaging industries, combined with a well-developed retail sector, provides a conducive environment for the widespread adoption of micro-perforated food packaging solutions. The region's focus on reducing food wastage and promoting sustainable practices aligns with the benefits offered by micro-perforated packaging, such as extended shelf life and reduced spoilage. Additionally, the increasing consumer preference for fresh and minimally processed food products amplifies the demand for packaging solutions that maintain product quality and freshness throughout the supply chain. With innovations in materials and manufacturing processes, European companies are continuously enhancing the functionality and sustainability of micro-perforated packaging, thereby solidifying their position as leaders in the global market.

Active Key Players in the Micro-perforated Food Packaging Market

- Sealed Air (US)

- COVERIS (UK)

- Amcor Limited (Australia)

- Mondi plc (UK)

- Ultraperf Technologies (US)

- KM Packaging Services Ltd (UK)

- Amerplast (Finland)

- Uflex Ltd (India), and Other Key Players

Key Industry Developments in the Micro-perforated Food Packaging Market

- In January 2023, the Burgo Group's Duino mill, located close to Trieste (Italy), was successfully acquired by Mondi plc ('Mondi') for a total price of US$42.95 million.

- In October 2022, for the relaunch of its premium Appetitt brand, Mondi cooperated with renowned Norwegian pet food company Felleskjpet to shift to recyclable high-barrier packaging. Dry cat and dog food will be packaged and protected using Mondi's FlexiBag Recyclable. The single-material bags support a circular economy and are biodegradable in Norwegian plastic recycling systems.

|

Global Micro-perforated Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 3.11 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICRO-PERFORATED FOOD PACKAGING MARKET BY PRODUCT TYPE (2017-2032)

- MICRO-PERFORATED FOOD PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYETHYLENE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POLYPROPYLENE

- PET

- OTHERS

- MICRO-PERFORATED FOOD PACKAGING MARKET BY APPLICATION (2017-2032)

- MICRO-PERFORATED FOOD PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUITS & VEGETABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BAKERY & CONFECTIONERY

- READY-TO-EAT

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Micro-Perforated Food Packaging Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SEALED AIR (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COVERIS (UK)

- AMCOR LIMITED (AUSTRALIA)

- MONDI PLC (UK)

- ULTRAPERF TECHNOLOGIES (US)

- KM PACKAGING SERVICES LTD (UK)

- AMERPLAST (FINLAND)

- UFLEX LTD (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL MICRO-PERFORATED FOOD PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Micro-perforated Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.77 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.45 % |

Market Size in 2032: |

USD 3.11 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MICRO-PERFORATED FOOD PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MICRO-PERFORATED FOOD PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MICRO-PERFORATED FOOD PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. MICRO-PERFORATED FOOD PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. MICRO-PERFORATED FOOD PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. MICRO-PERFORATED FOOD PACKAGING MARKET BY TYPE

TABLE 008. POLYETHYLENE MARKET OVERVIEW (2016-2028)

TABLE 009. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

TABLE 010. PET MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. MICRO-PERFORATED FOOD PACKAGING MARKET BY APPLICATION

TABLE 013. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 014. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 015. READY-TO-EAT MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 019. N MICRO-PERFORATED FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE MICRO-PERFORATED FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE MICRO-PERFORATED FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 022. MICRO-PERFORATED FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC MICRO-PERFORATED FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC MICRO-PERFORATED FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 025. MICRO-PERFORATED FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 028. MICRO-PERFORATED FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET, BY APPLICATION (2016-2028)

TABLE 031. MICRO-PERFORATED FOOD PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 032. SEALED AIR: SNAPSHOT

TABLE 033. SEALED AIR: BUSINESS PERFORMANCE

TABLE 034. SEALED AIR: PRODUCT PORTFOLIO

TABLE 035. SEALED AIR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. COVERIS: SNAPSHOT

TABLE 036. COVERIS: BUSINESS PERFORMANCE

TABLE 037. COVERIS: PRODUCT PORTFOLIO

TABLE 038. COVERIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. AMCOR LIMITED: SNAPSHOT

TABLE 039. AMCOR LIMITED: BUSINESS PERFORMANCE

TABLE 040. AMCOR LIMITED: PRODUCT PORTFOLIO

TABLE 041. AMCOR LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. MONDI PLC: SNAPSHOT

TABLE 042. MONDI PLC: BUSINESS PERFORMANCE

TABLE 043. MONDI PLC: PRODUCT PORTFOLIO

TABLE 044. MONDI PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ULTRAPERF TECHNOLOGIES: SNAPSHOT

TABLE 045. ULTRAPERF TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 046. ULTRAPERF TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 047. ULTRAPERF TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. KM PACKAGING SERVICES LTD: SNAPSHOT

TABLE 048. KM PACKAGING SERVICES LTD: BUSINESS PERFORMANCE

TABLE 049. KM PACKAGING SERVICES LTD: PRODUCT PORTFOLIO

TABLE 050. KM PACKAGING SERVICES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BOLLORÉ GROUP: SNAPSHOT

TABLE 051. BOLLORÉ GROUP: BUSINESS PERFORMANCE

TABLE 052. BOLLORÉ GROUP: PRODUCT PORTFOLIO

TABLE 053. BOLLORÉ GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. AMERPLAST: SNAPSHOT

TABLE 054. AMERPLAST: BUSINESS PERFORMANCE

TABLE 055. AMERPLAST: PRODUCT PORTFOLIO

TABLE 056. AMERPLAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. UFLEX LTD: SNAPSHOT

TABLE 057. UFLEX LTD: BUSINESS PERFORMANCE

TABLE 058. UFLEX LTD: PRODUCT PORTFOLIO

TABLE 059. UFLEX LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY TYPE

FIGURE 012. POLYETHYLENE MARKET OVERVIEW (2016-2028)

FIGURE 013. POLYPROPYLENE MARKET OVERVIEW (2016-2028)

FIGURE 014. PET MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY APPLICATION

FIGURE 017. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 018. BAKERY & CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 019. READY-TO-EAT MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA MICRO-PERFORATED FOOD PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Micro-perforated Food Packaging Market research report is 2024-2032.

Sealed Air (US), COVERIS (UK), Amcor Limited (Australia), Mondi plc (UK), Ultraperf Technologies (US), KM Packaging Services Ltd (UK), and Other Major Players.

The Micro-perforated Food Packaging Market is segmented into Product Type, Application, and Region. By Product Type, the market is categorized into Polyethylene, Polypropylene, PET, and Others. By Application, the market is categorized into Fruits & vegetables, Bakery & confectionery, Ready-to-eat, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Micro-perforated food packaging refers to packaging materials, typically films or bags, that are punctured with tiny holes. These holes allow for a controlled exchange of gases such as oxygen and carbon dioxide between the packaged food and its environment. This controlled gas exchange helps maintain freshness and extends the shelf life of perishable foods by slowing down spoilage and preserving quality.

Micro-perforated Food Packaging Market Size Was Valued at USD 1.77 Billion in 2023, and is Projected to Reach USD 3.11 Billion by 2032, Growing at a CAGR of 6.45 % From 2024-2032.