Home Care Packaging Market Synopsis

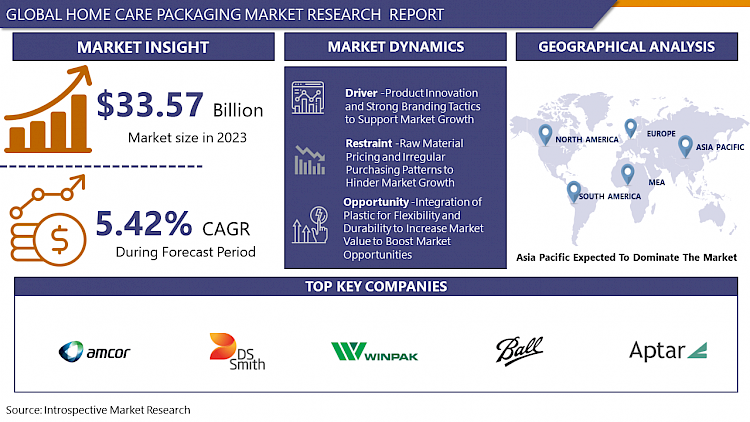

Home Care Packaging Market Size Was Valued at USD 33.57 Billion in 2023, and is Projected to Reach USD 53.98 Billion by 2032, Growing at a CAGR of 5.42% From 2024-2032.

The home care packaging market refers to the industry segment focused on the design, production, and distribution of packaging solutions specifically tailored for household care products such as detergents, cleaners, air fresheners, and personal care items used within homes. These packaging solutions are designed to ensure product protection, convenience in handling and storage, and often incorporate features that enhance sustainability and consumer safety. The market encompasses a wide range of packaging materials, formats, and technologies aimed at meeting the varied needs of consumers while aligning with regulatory requirements and environmental considerations.

- A number of important reasons are propelling the rapid growth of the worldwide home care packaging market. Growing consumer awareness of cleanliness and hygiene, especially in the wake of the COVID-19 pandemic, is driving an increase in the need for practical and environmentally friendly packaging solutions. Effective packaging is necessary for home care goods including detergents, cleaners, and disinfectants to guarantee product safety, user-friendliness, and environmental sustainability.

- To satisfy these expectations, producers in the home care packaging sector are putting more of an emphasis on innovation. The use of recyclable and biodegradable materials is one notable trend that is a response to consumer demand for eco-friendly products as well as governmental pressures. In addition to environmental concerns, the need to improve company reputation and win over environmentally sensitive customers is what is driving this trend towards sustainability.

- An additional noteworthy advancement in the industry is the arrival of intelligent packaging options. NFC (Near Field Communication) tags for interactive experiences, QR codes for product information, and intelligent sensors for tracking product consumption and freshness are a few examples of these advances. These technologies seek to raise consumer satisfaction, improve product safety, and give businesses useful information to help them better manage their supply chains and advertising campaigns.

- Additionally, the importance of ergonomic and user-friendly designs in home care packaging is growing. In order to improve consumer convenience and set their products apart on store shelves, manufacturers are concentrating on creating designs that are simple to handle, store, and dispense. Additionally important factors to take into account are visual attractiveness and branding, with packaging being a key component in communicating to customers the quality and worth of a product.

- The home care packaging industry shows different characteristics at the regional level. When it comes to the adoption of cutting-edge technologies and sustainable packaging methods, developed regions like North America and Europe are setting the standard. Meanwhile, growing urbanization, rising disposable incomes, and shifting consumer lifestyles are propelling the fast expansion of emerging economies in Latin America and Asia-Pacific.

- With developments in material science, packaging technology, and customer tastes, it is anticipated that the home care packaging market will continue to change in the future. Along with advancements in intelligent packaging and improved user experience, sustainable packaging solutions will probably continue to be a major area of interest. Industry strategies will be shaped by regulatory advancements pertaining to packaging waste and recycling, which will encourage additional innovation and cooperation throughout the home care packaging value chain.

Home Care Packaging Market Trend Analysis

Sustainable Home Care Packaging

- The home care industry's growing need for environmentally friendly packaging options is indicative of a larger worldwide movement towards environmental consciousness. Today's consumers are increasingly aware of the effects of their purchases on the environment and are making more educated judgments. Growing consumer preference for items packed in environmentally friendly materials like bioplastics, recycled plastics, and paper-based packaging is the result of this understanding. In response to this need, producers are allocating resources to research and development in order to create novel, environmentally friendly packaging solutions that reduce their impact on the environment over the course of the product's lifecycle.

- Furthermore, the adoption of sustainable packaging strategies is being mostly driven by legislative forces. Globally, governments and regulatory agencies are enforcing more stringent policies and directives with the objective of curbing plastic waste and encouraging recycling endeavors. These rules force producers to reconsider their packaging approaches and motivate them to create goods that are not only aesthetically pleasing and useful but also ecologically friendly. Consequently, the industry is working together to provide packaging solutions that satisfy customer demands for sustainability as well as legal requirements related to waste minimization and recyclable materials. Home care packaging will become more environmentally conscious and sustainable in the future as a result of this simultaneous focus on consumer demand and legal compliance.

Convenience and Usability Trends in Home Care Packaging

- Convenience and usability have become key factors in the home care packaging business, impacting both consumer choices and industry advances. Due to their increasingly hectic lifestyles, consumers today place a higher value on products that are useful and simple to use. Manufacturers have been forced to reconsider their packaging designs in response, incorporating elements such as ergonomic shapes for comfort, dispensing systems for regulated and mess-free product application, and resealable closures for product freshness and spill prevention.

- Moreover, adaptable packaging options have become more popular as households' demands and tastes diversify. Packaging that is designed to be easily stored in different locations, including closets or under sinks, is greatly appreciated. Furthermore, designs that support effective dosage monitoring and dispensing satisfy customers who want accurate consumption with minimal waste. These factors highlight a trend toward packaging that is more user-centric, which improves ease while also encouraging favorable customer experiences and brand loyalty.

- Moreover, the trend toward convenience in home care packaging goes beyond usefulness to include product distinctiveness and sustainability. Companies are using innovative packaging more and more to draw attention to themselves on store shelves in addition to satisfying utilitarian needs. Packaging that blends environmental responsibility, beauty, and usability becomes a competitive advantage as the market gets more intense. The future of home care packaging is being shaped by a holistic approach that integrates customer convenience, environmental conscience, and brand identification.

Home Care Packaging Market Segment Analysis:

Home Care Packaging Market Segmented based on By Material, By Type, By Packaging Type and By Products.

By Material, Plastic segment is expected to dominate the market during the forecast period

- Across all consumer product categories, plastic packaging stands out for its unmatched convenience and versatility. Plastic is used extensively in toiletry packaging, including lotion and shampoo bottles, because of its flexibility and durability. Plastic is the material of choice for manufacturers because it can survive knocks and falls during handling and transportation, guaranteeing that products arrive undamaged to customers. Furthermore, complex forms and shapes that improve brand visibility and customer appeal are made possible by the moldability of plastic. Beyond just being aesthetically pleasing, this personalization allows for ergonomic designs that suit users' hands comfortably and guarantee easy dispensing and storage.

- Plastic bags and pouches have transformed packaging in the food and detergent industries in addition to toiletries. These formats provide portable, lightweight, and adaptable solutions that are simple to store and move. Plastic pouches are perfect for products like chips, candy, and nuts in the snack industry since they maintain flavor and freshness. Their resealable features increase consumer convenience by encouraging portion management and preventing spoiling. Comparably, plastic packaging offers strong defenses against chemicals and moisture in detergents and household cleansers, preserving product integrity and extending shelf life. Because of their dependability, plastic bags and pouches are now essential in contemporary packaging techniques, satisfying customer demands for sustainability and usability.

By Packaging Type, Bottles segment held the largest share in 2023

- Bottles and containers play a vital role in the preservation and presentation of products, making them crucial packaging solutions in a variety of consumer goods markets. These containers, which are mostly composed of plastic, glass, or metal, serve a variety of purposes in the food and toiletry industries. Plastic bottles are used for containing liquids like shampoos, conditioners, and lotions because of their durability and capacity to endure the rigors of regular use. They give producers the freedom to include ergonomic features, such easy-grip forms and practical dispensing systems, that improve user experience.

- In the food packaging sector, containers and bottles are essential for preserving the safety and freshness of the product. Because glass jars are airtight and moisture-tight, they are the best option for storing sauces, jams, and pickles because they preserve textures and flavors. Because they have airtight seals that prolong shelf life and guarantee product quality, metal cans are frequently used to store beverages and tinned products. On the other hand, thanks to recyclable materials, plastic containers satisfy consumer demands for convenience and sustainability by providing robust and lightweight solutions for a variety of products, including dairy products and condiments.

- In addition to providing product protection, bottles and containers are useful marketing tools because they offer options for branding and customisable labeling that convey product quality and appeal to customers. Their flexibility to a variety of product kinds and their versatility highlight their crucial role in contemporary packaging strategies, which balance aesthetic appeal with practicality to suit changing customer expectations across a range of markets.

Home Care Packaging Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- With a predicted value of USD 14.19 billion in 2021, the home care packaging market in Asia-Pacific is anticipated to grow at a compound annual growth rate (CAGR) of 5.44%. China's highly educated customer base allowed them to donate the most, accounting for the majority of the total. The rapid changes in living conditions in China will also help the industry grow. India is expected to hold a significant share of the market in terms of value, owing to the increase in literate parents and the availability of clear information that promotes the development of natural products. The market's demand for fewer or no chemical preservatives is forcing dominant corporations to manufacture their products in the same manner.

- North America retained the second-largest market share for the duration of the projection period. Its estimated value in 2021 was USD 8.13 billion, with a compound annual growth rate of 3.92%. Leading beauty brands in the area, such as Dove, Toni & Guy, Tresemme, and Unilever, will offer a creative opportunity for the market to grow rapidly. Because more and more people are using e-commerce platforms to directly give home care to their consumers, the US made a substantial contribution. Growing premium brand integration and environmental concerns will also drive up market volume.

Active Key Players in the Home Care Packaging Market

- Amcor PLC,

- Ball Corporation,

- RPC Group,

- Winpak Ltd,

- AptarGroup Inc.,

- Sonoco Products Company,

- Silgan Holdings,

- Constantia Flexibles Group GmbH,

- DS Smith PLC,

- Can-Pack SA,

- ProAmpac LLC

- Other Key Players

Key Industry Developments in the Home Care Packaging Market:

- May 2021 – Unilever announced their use of post-consumer recycled plastic, with 11% of their total plastic packaging volume of recycled plastic.

Global Home Care Packaging Market Scope:

|

Global Home Care Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.42 % |

Market Size in 2032: |

USD 53.98 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Packaging Type |

|

||

|

By Products |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HOME CARE PACKAGING MARKET BY MATERIAL (2017-2032)

- HOME CARE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLASTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- PAPER

- METAL

- GLASS

- HOME CARE PACKAGING MARKET BY TYPE (2017-2032)

- HOME CARE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTTLE AND CONTAINERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- METAL CANS

- CARONS AND CORRUGATED BOXES

- POUCHES BAGS

- HOME CARE PACKAGING MARKET BY PACKAGING TYPE (2017-2032)

- HOME CARE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BOTTLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- JARS & CONTAINERS

- BAGS & POUCHES

- BOXES

- CANS

- HOME CARE PACKAGING MARKET BY PRODUCTS (2017-2032)

- HOME CARE PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DISHWASHING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INSECTICIDES

- LAUNDRY CARE

- TOILETRIES

- POLISHES

- AIR CARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Home Care Packaging Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMCOR PLC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BALL CORPORATION,

- RPC GROUP,

- WINPAK LTD,

- APTARGROUP INC.,

- SONOCO PRODUCTS COMPANY,

- SILGAN HOLDINGS,

- CONSTANTIA FLEXIBLES GROUP GMBH,

- DS SMITH PLC,

- CAN-PACK SA,

- PROAMPAC LLC

- COMPETITIVE LANDSCAPE

- GLOBAL HOME CARE PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By Packaging Type

- Historic And Forecasted Market Size By Products

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Home Care Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 33.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.42 % |

Market Size in 2032: |

USD 53.98 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Packaging Type |

|

||

|

By Products |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HOME CARE PACKAGING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HOME CARE PACKAGING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HOME CARE PACKAGING MARKET COMPETITIVE RIVALRY

TABLE 005. HOME CARE PACKAGING MARKET THREAT OF NEW ENTRANTS

TABLE 006. HOME CARE PACKAGING MARKET THREAT OF SUBSTITUTES

TABLE 007. HOME CARE PACKAGING MARKET BY MATERIALS

TABLE 008. PLASTIC MARKET OVERVIEW (2016-2028)

TABLE 009. PAPER MARKET OVERVIEW (2016-2028)

TABLE 010. METAL MARKET OVERVIEW (2016-2028)

TABLE 011. GLASS MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. HOME CARE PACKAGING MARKET BY PRODUCT TYPE

TABLE 014. DISHWASHING MARKET OVERVIEW (2016-2028)

TABLE 015. INSECTICIDES MARKET OVERVIEW (2016-2028)

TABLE 016. LAUNDRY CARE MARKET OVERVIEW (2016-2028)

TABLE 017. TOILETRIES MARKET OVERVIEW (2016-2028)

TABLE 018. POLISHES MARKET OVERVIEW (2016-2028)

TABLE 019. AIR CARE MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. HOME CARE PACKAGING MARKET BY PACKAGING TYPE

TABLE 022. BOTTLES MARKET OVERVIEW (2016-2028)

TABLE 023. CANS MARKET OVERVIEW (2016-2028)

TABLE 024. CARTONS MARKET OVERVIEW (2016-2028)

TABLE 025. JARS MARKET OVERVIEW (2016-2028)

TABLE 026. POUCHES MARKET OVERVIEW (2016-2028)

TABLE 027. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA HOME CARE PACKAGING MARKET, BY MATERIALS (2016-2028)

TABLE 029. NORTH AMERICA HOME CARE PACKAGING MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 030. NORTH AMERICA HOME CARE PACKAGING MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 031. N HOME CARE PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 032. EUROPE HOME CARE PACKAGING MARKET, BY MATERIALS (2016-2028)

TABLE 033. EUROPE HOME CARE PACKAGING MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 034. EUROPE HOME CARE PACKAGING MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 035. HOME CARE PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC HOME CARE PACKAGING MARKET, BY MATERIALS (2016-2028)

TABLE 037. ASIA PACIFIC HOME CARE PACKAGING MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 038. ASIA PACIFIC HOME CARE PACKAGING MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 039. HOME CARE PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA HOME CARE PACKAGING MARKET, BY MATERIALS (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA HOME CARE PACKAGING MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA HOME CARE PACKAGING MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 043. HOME CARE PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA HOME CARE PACKAGING MARKET, BY MATERIALS (2016-2028)

TABLE 045. SOUTH AMERICA HOME CARE PACKAGING MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 046. SOUTH AMERICA HOME CARE PACKAGING MARKET, BY PACKAGING TYPE (2016-2028)

TABLE 047. HOME CARE PACKAGING MARKET, BY COUNTRY (2016-2028)

TABLE 048. AMCOR PLC: SNAPSHOT

TABLE 049. AMCOR PLC: BUSINESS PERFORMANCE

TABLE 050. AMCOR PLC: PRODUCT PORTFOLIO

TABLE 051. AMCOR PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BALL CORPORATION: SNAPSHOT

TABLE 052. BALL CORPORATION: BUSINESS PERFORMANCE

TABLE 053. BALL CORPORATION: PRODUCT PORTFOLIO

TABLE 054. BALL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. RPC GROUP: SNAPSHOT

TABLE 055. RPC GROUP: BUSINESS PERFORMANCE

TABLE 056. RPC GROUP: PRODUCT PORTFOLIO

TABLE 057. RPC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. WINPAK LTD: SNAPSHOT

TABLE 058. WINPAK LTD: BUSINESS PERFORMANCE

TABLE 059. WINPAK LTD: PRODUCT PORTFOLIO

TABLE 060. WINPAK LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. APTAR GROUP INC: SNAPSHOT

TABLE 061. APTAR GROUP INC: BUSINESS PERFORMANCE

TABLE 062. APTAR GROUP INC: PRODUCT PORTFOLIO

TABLE 063. APTAR GROUP INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SONOCO PRODUCTS COMPANY: SNAPSHOT

TABLE 064. SONOCO PRODUCTS COMPANY: BUSINESS PERFORMANCE

TABLE 065. SONOCO PRODUCTS COMPANY: PRODUCT PORTFOLIO

TABLE 066. SONOCO PRODUCTS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. SILGAN HOLDINGS: SNAPSHOT

TABLE 067. SILGAN HOLDINGS: BUSINESS PERFORMANCE

TABLE 068. SILGAN HOLDINGS: PRODUCT PORTFOLIO

TABLE 069. SILGAN HOLDINGS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. TETRA LAVAL INTERNATIONAL SA: SNAPSHOT

TABLE 070. TETRA LAVAL INTERNATIONAL SA: BUSINESS PERFORMANCE

TABLE 071. TETRA LAVAL INTERNATIONAL SA: PRODUCT PORTFOLIO

TABLE 072. TETRA LAVAL INTERNATIONAL SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. DS SMITH PLC: SNAPSHOT

TABLE 073. DS SMITH PLC: BUSINESS PERFORMANCE

TABLE 074. DS SMITH PLC: PRODUCT PORTFOLIO

TABLE 075. DS SMITH PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. 10 CAN-PACK SA: SNAPSHOT

TABLE 076. 10 CAN-PACK SA: BUSINESS PERFORMANCE

TABLE 077. 10 CAN-PACK SA: PRODUCT PORTFOLIO

TABLE 078. 10 CAN-PACK SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. PROAMPAC: SNAPSHOT

TABLE 079. PROAMPAC: BUSINESS PERFORMANCE

TABLE 080. PROAMPAC: PRODUCT PORTFOLIO

TABLE 081. PROAMPAC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HOME CARE PACKAGING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HOME CARE PACKAGING MARKET OVERVIEW BY MATERIALS

FIGURE 012. PLASTIC MARKET OVERVIEW (2016-2028)

FIGURE 013. PAPER MARKET OVERVIEW (2016-2028)

FIGURE 014. METAL MARKET OVERVIEW (2016-2028)

FIGURE 015. GLASS MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. HOME CARE PACKAGING MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 018. DISHWASHING MARKET OVERVIEW (2016-2028)

FIGURE 019. INSECTICIDES MARKET OVERVIEW (2016-2028)

FIGURE 020. LAUNDRY CARE MARKET OVERVIEW (2016-2028)

FIGURE 021. TOILETRIES MARKET OVERVIEW (2016-2028)

FIGURE 022. POLISHES MARKET OVERVIEW (2016-2028)

FIGURE 023. AIR CARE MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. HOME CARE PACKAGING MARKET OVERVIEW BY PACKAGING TYPE

FIGURE 026. BOTTLES MARKET OVERVIEW (2016-2028)

FIGURE 027. CANS MARKET OVERVIEW (2016-2028)

FIGURE 028. CARTONS MARKET OVERVIEW (2016-2028)

FIGURE 029. JARS MARKET OVERVIEW (2016-2028)

FIGURE 030. POUCHES MARKET OVERVIEW (2016-2028)

FIGURE 031. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA HOME CARE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE HOME CARE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC HOME CARE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA HOME CARE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA HOME CARE PACKAGING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Home Care Packaging Market research report is 2024-2032.

Amcor PLC Ball Corporation RPC Group Winpak Ltd AptarGroup Inc. Sonoco Products Company Silgan Holdings Constantia Flexibles Group GmbH DS Smith PLC Can-Pack SA ProAmpac LLC and Other Major Players.

The Home Care Packaging Market is segmented into By Material, By Type, By Packaging Type, By Products and region.By Material, the market is categorized into Plastic, Paper, Metal and Glass. By Type, the market is categorized into Bottle and Containers, Metal Cans, Carons and Corrugated Boxes, Pouches Bags and Others Types. By Packaging Type, the market is categorized into Bottles, Jars & Containers, Bags & Pouches, Boxes, Cans and Others. By Products, the market is categorized into Dishwashing, Insecticides, Laundry Care, Toiletries, Polishes, Air Care and Other Products. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The home care packaging market refers to the industry segment focused on the design, production, and distribution of packaging solutions specifically tailored for household care products such as detergents, cleaners, air fresheners, and personal care items used within homes. These packaging solutions are designed to ensure product protection, convenience in handling and storage, and often incorporate features that enhance sustainability and consumer safety. The market encompasses a wide range of packaging materials, formats, and technologies aimed at meeting the varied needs of consumers while aligning with regulatory requirements and environmental considerations.

Home Care Packaging Market Size Was Valued at USD 33.57 Billion in 2023, and is Projected to Reach USD 53.98 Billion by 2032, Growing at a CAGR of 5.42% From 2024-2032.